Hamak Gold Limited Drill Targets Identified by Geophysical Survey (8462Y)

10 May 2023 - 4:00PM

UK Regulatory

TIDMHAMA

RNS Number : 8462Y

Hamak Gold Limited

10 May 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN,

THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES, ANY TERRITORY OR

POSSESSION THEREOF OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

10 May 2023

Hamak Gold Limited

(" Hamak Gold " or the " Company ")

High Priority Drill Targets Identified by Geophysical Survey

Hamak Gold Limited (LSE: HAMA) is pleased to announce that it

has received the report and interpretation of the geophysical

Induced Polarisation ("IP") survey conducted over the high-grade

Ziatoyah gold discovery on the Company's Nimba licence in northern

Liberia.

Highlights

-- Consulting group GeoFocus conducted the detailed Induced

Polarisation ("IP") geophysical survey

-- 21 line kilometres of survey successfully completed over the

high-grade Ziatoyah gold discovery and northern gold insoil

anomaly

-- The survey has identified strong geophysical anomalies which

are coincident with the high-grade Ziatoyah gold discovery and gold

in soil anomalies

-- Priority drill targets have been identified to test these

geophysical anomalies and to identify extensions of the gold

mineralisation encountered in the first drill hole at Ziatoyah

which intersected 20m @7g/t Au

Karl Smithson, Executive Director of Hamak Gold commented:

"We are extremely encouraged with the results the geophysical

survey which has generated strong IP anomalies that are believed to

be associated with the high-grade gold discovery at Ziatoyah and

with the gold in soil anomalies. After detailed review of the

results, we have identified several high priority drill targets to

test these anomalies and determine whether they represent

extensions of the gold mineralization intersected at Ziatoyah."

Geophysical Survey and Results

South African based geophysical consultancy group GeoFocus (Pty)

Ltd. conducted the IP survey. A total of 21 line kilometers ("km")

of survey were run along traverses varying from 800 metres ("m") to

1,200m with line spacings of 100m and 200m. These lines were chosen

to cover the Ziatoyah gold discovery in the vicinity of the

significant drill intersection of 20m at 7 grammes per tonne

("g/t") Au as well as the northern part of the 3km x 1km strong

gold in soil anomaly. An initial IP Orientation/Pilot survey block

was surveyed (at 25m and 50m dipole-dipole spacing) directly over

the Ziatoyah discovery outcrop and Drill Holes 1 and 2 to get the

"finger print" of the gold discovery and establish the optimal

survey parameters to be applied and conducted over the wider

discovery area and northern soil anomaly during the IP Follow Up

survey (Figure 1).

Figure 1: Geophysical Survey Blocks

GeoFocus reported that the data quality generated from the

survey was very good, particularly on the 50m dipole-dipole

transmitter spacing, which provides data to depths of 100m below

surface. Processing and interpretation of the data has resulted in

the identification of a number of strong IP chargeability and

resistivity anomalies that can be correlated to the Ziatoyah

discovery and the gold in soil anomalies further to the north.

Figure 2 shows a strong chargeability anomaly at 75m depth that

runs from the Ziatoyah discovery site and Drill Hole 1, to the

north and then curves to the northwest. This arcuate, strong

chargeability anomaly (30 - 40 mSecs) is possibly related to a fold

or shear/fault structure. A further two strong chargeability

anomalies were identified to the north (circled in black) which

correlate well with peak values of gold in soil anomalies.

Figure 2: 75m Depth Slice Chargeability Anomaly and Gold in Soil

Values

As previously reported, the gold mineralization intersected at

Ziatoyah in drilling and observed in outcrop of the mineralized

metadolerite unit suggests that the gold occurs as free grains

within disseminated crystalline and aggregates of pyrite attaining

levels of between 1% and 10% of the rock mass. The resistivity

anomaly at Ziatoyah likely indicates alteration associated with

sulphide mineralization and shows a strong correlation between gold

in soil anomalies and high resistivity readings. This is also the

case for the two northern anomalies (Figure 3).

Figure 3: 75m Depth Slice Resistivity Anomaly and Gold in Soil

Values

Summary

Rock chip sampling and limited initial drilling at the Ziatoyah

outcrop returned very encouraging results, in particular Drill Hole

1 which intersected 20m @7g/t Au. The geophysical survey has

successfully identified a very strong chargeability anomaly

trending north and then northwest from the vicinity of the Ziatoyah

outcrop which will be drill tested to determine whether it

represents an extension of the high-grade gold mineralization

discovered at the Ziatoyah outcrop and in Drill Hole 1 (see Figure

2). Additionally, the survey has generated several new high

priority drill targets to test both the chargeability and

resistivity anomalies coincident with gold in soil anomalies in the

northern part of the survey area. A drilling programme is being

designed to test these anomalies during the next phase of

exploration.

For further information you are invited to view the company's

website at www.hamakgold.com or please contact:

Hamak Gold Limited

Amara Kamara +231 (0) 77 005 0005

Karl Smithson +44 (0) 77 837 07971

Peterhouse Capital Limited (Broker)

Lucy Williams

Guy Miller +44 (0) 20 7469 0930

Yellow Jersey PR

Sarah Hollins

Annabelle Wills +44 (0) 20 3004 9512

About Hamak Gold Limited

Hamak Gold Limited (LSE: HAMA) is a UK listed company focussed

on gold exploration of a portfolio of licences in highly

prospective areas of Liberia, where significant drilling results

have identified a new high-grade gold discovery with the discovery

hole returning 20m @ 7g/t Au near surface.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFLFEEEAIAIIV

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

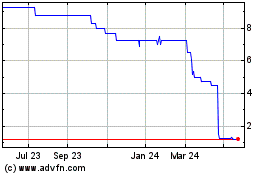

Hamak Gold (LSE:HAMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

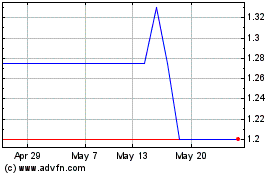

Hamak Gold (LSE:HAMA)

Historical Stock Chart

From Dec 2023 to Dec 2024