HgCapital Trust PLC HgCapital announces sale of Zenith to Bridgepoint (4206V)

30 January 2017 - 6:01PM

UK Regulatory

TIDMHGT

RNS Number : 4206V

HgCapital Trust PLC

30 January 2017

30 January 2017

HgCapital, the Manager of HgCapital Trust plc ("The Trust"), has

announced that it has agreed the sale of Zenith, the largest

independent vehicle leasing business in the UK, to Bridgepoint in a

transaction totalling GBP750 million. The sale of Zenith delivers a

2.9x investment multiple and a 46% gross IRR over the investment

period.

The Trust, the listed investment trust which participates in all

HgCapital's investments alongside its institutional clients, will

realise cash proceeds of approximately GBP59.0 million on

completion of the transaction. This represents an uplift of GBP15.4

million (35%) or 41 pence per share over the carrying value of

GBP43.6 million in the Net Asset Value ("NAV") of the Trust at 30

November 2016 which was based on the Directors' valuation as at 30

June 2016.

Based on the 30 November 2016 reported NAV (including the impact

of the revaluation of the carried interest provision) the pro-forma

NAV of the Trust is expected to increase to GBP601.5 million (or

1,611 pence per share). The Trust's liquid resources available for

future deployment are estimated to be GBP105 million (17% of the

pro-forma 30 November 2016 NAV). In addition, the Trust has access

to a GBP80 million standby facility, which is currently

undrawn.

The investments within the Trust portfolio were last valued at

30 June 2016. The Trust's 2016 annual results, including the

re-valuation of the portfolio as at 31 December 2016 will be

announced on 6 March 2017.

HgCapital announces sale of Zenith to Bridgepoint

30 January 2017: HgCapital is pleased to announce that it has

agreed the sale of Zenith, the largest independent vehicle leasing

business in the UK, to Bridgepoint in a transaction totalling

GBP750 million.

Headquartered in Leeds, with full-service operations in both

Solihull and Wokingham, Zenith has over 500 employees and provides

end-to-end automotive solutions focused on contract hire, salary

sacrifice, fleet management and short-term hire services to

customers across the UK. The company operates a fleet of c.85,000

vehicles and focuses on serving blue-chip customers, principally as

sole supplier. Zenith was recently ranked 7th in the FN50's list of

the UK's top 50 contract hire companies.

HgCapital initially invested in Leasedrive in December 2013

(with LDC retaining a minority stake in the business), subsequently

completing the merger with Zenith in February 2014, and the

business has operated as a single entity since March 2014. The

merger of Zenith and Leasedrive was driven by the highly

complementary nature of the two businesses and the potential to

create economies of scale.

A substantial part of the value created during HgCapital's

investment period has been driven by the close collaboration of

Zenith's management and the HgCapital team. Zenith has continued to

deliver strong double-digit revenue and EBITDA growth over the past

year (19% p.a. CAGR since March 2014) and the contracted nature of

its business model means that a significant proportion of future

growth is already underpinned by existing customer contracts.

Andrew Land, Partner, HgCapital, said: "We have had a very

successful partnership with the Zenith management team and are

proud to have been part of the Company's success. The business

model has been a great fit with Hg's investment strategy, providing

mission-critical services to customers through long-term

relationships and the use of proprietary technology. We have no

doubt that Tim, Mark and the rest of the team will have continued

success working with Bridgepoint."

Tim Buchan, CEO at Zenith commented "We thank HgCapital for

their contribution and are pleased to welcome Bridgepoint as our

new partner. We look forward to working together on our long-term

strategy of continued investment in product and system

developments."

Emma Watford, partner at Bridgepoint and head of its business

services sector team, commented: "Zenith is already best-in-class

with a proven business model that has had an unbroken track record

of growth over a long period. It benefits from an exceptional

management team and, with them, we believe that the business can

continue its impressive growth trajectory through its continued

focus on customer service, technology and targeted acquisition

activity."

HgCapital were supported by Evercore, Deloitte, OC&C, KPMG,

Weil Gotshal & Manges and Sidley Austin on the sale.

For further details:

HgCapital +44 (0)20 7089 7888

Laura Dixon

Maitland

Tom Eckersley +44 (0)20 7379 5151

About HgCapital Trust plc

HgCapital Trust plc is an investment trust whose shares are

listed on the London Stock Exchange (ticker: HGT.L). The Trust is a

client of HgCapital, giving investors exposure to a portfolio of

high-growth private companies, through a liquid vehicle. New

investments and existing portfolio companies are managed by

HgCapital, an experienced and well-resourced private equity firm

with a long-term track record of delivering superior risk-adjusted

returns for its investors. For further details, please see

www.hgcapitaltrust.com.

Neither the contents of HgCapital Trust's, HgCapital's,

Zenith's, nor Bridgepoint's websites nor the contents of any

website accessible from hyperlinks on the websites (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAKFEDFLXEEF

(END) Dow Jones Newswires

January 30, 2017 02:01 ET (07:01 GMT)

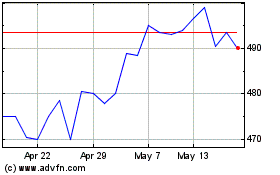

Hg Capital (LSE:HGT)

Historical Stock Chart

From Apr 2024 to May 2024

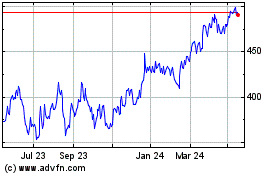

Hg Capital (LSE:HGT)

Historical Stock Chart

From May 2023 to May 2024