TIDMHLMA

RNS Number : 7077G

Halma PLC

19 March 2020

Halma today releases its scheduled trading update, for the

period from 1 October 2019 to date.

The Group has made good progress during the period, although

given the COVID-19 outbreak in the fourth quarter now expects

adjusted profit before tax for the year ending 31 March 2020 to be

in a range of approximately GBP265 million to GBP270 million. This

compares to an average of current market forecasts of GBP275.5

million (see notes 1 and 2). Risks remain given the evolving and

uncertain situation; the Board will continue to monitor the impact

of the COVID-19 outbreak closely and take mitigating actions as

appropriate.

The Group's financial position remains robust, with committed

facilities totalling approximately GBP750 million (at current

exchange rates), of which around 60% are drawn. The earliest

maturity in these facilities is for GBP77 million (at current

exchange rates) in January 2021, with the remaining maturities from

2023 onwards.

Order intake is currently ahead of revenue and ahead of the same

period last year. We have continued to benefit in the period from

the long-term growth drivers in our markets, the breadth of our

portfolio and the resilience of our business model.

To date, the Group has delivered revenue growth in all four

major regions and all sectors:

- The USA grew strongly and benefited from positive

contributions from recent acquisitions. There was good growth in

the UK and more moderate growth in Mainland Europe, while strong

growth in Asia Pacific was driven by recent acquisitions.

- The Environmental & Analysis sector delivered strong

organic growth in the period, with Infrastructure Safety delivering

a strong performance, driven by positive contributions from recent

acquisitions and solid organic growth. The Medical sector delivered

solid revenue growth, although profit growth was lower. Although

Process Safety's performance in the second half was affected by

weaker oil and gas markets, the sector is expected to deliver a

satisfactory performance for the full year.

The currency translation effect on the Group's results in the

second half of the year is expected to be broadly neutral,

resulting in a positive impact for the year ending 31 March 2020 as

a whole (see note 3).

This has been a strong year for M&A activity, with ten

acquisitions completed across all four sectors, for a total initial

consideration of GBP227 million. We made seven acquisitions in the

second half (see note 4 to this announcement, and our website

www.halma.com ). The integration of all acquisitions made during

the year is currently progressing well.

The Group's next scheduled update on trading will be the

announcement of its results for the year ending 31 March 2020,

which will be released on 11 June 2020.

For further information, please

contact:

Halma plc

Andrew Williams, Chief Executive Switchboard: +44 (0)1494 721111

Marc Ronchetti, Chief Financial

Officer

Charles King, Head of Investor Mobile: +44 (0)7776 685948

Relations

MHP Communications

Rachel Hirst/ Andrew Jaques +44 (0)20 3128 8100

About Halma

Halma is a global group of life-saving technology companies,

focused on growing a safer, cleaner and healthier future for people

worldwide. Our innovative products and solutions address many of

the key issues facing the world today. We operate in four sectors:

Process Safety, Infrastructure Safety, Medical and Environmental

& Analysis. We employ over 6,000 people in more than 20

countries, with major operations in Europe, the USA and

Asia-Pacific. We target global niche markets where sustainable

growth and high returns are supported by long-term drivers. Halma

is listed on the London Stock Exchange and has been a member of the

FTSE 100 index since December 2017.

Notes

1. Adjusted profit before tax is before amortisation and

impairment of acquired intangible assets, acquisition items,

restructuring costs and profit or loss on disposal of

businesses.

2. The Board believes that current market forecasts for adjusted

profit before tax for the year ending 31 March 2020 are in the

range of GBP272.0 million to GBP278.3 million, with an average of

GBP275.5 million.

3. Sterling has weakened in the financial year relative to many

currencies, including the US Dollar and Euro and the currency

translation impact on the Group's results for the financial year

ending 31 March 2020 is expected to be positive. Based on the mix

of currency denominated revenue and profit for the 2020 financial

year, a 1% movement in the US Dollar changes full year revenue by

GBP6.3 million and profit by GBP1.4 million. Similarly, a 1%

movement in the Euro changes full year revenue by GBP1.6 million

and profit by GBP0.3 million. The weighted average exchange rates

relative to Sterling used to translate revenue and profit for the

year ended 31 March 2019 were: US Dollar 1.31, Euro 1.14.

4. We made seven acquisitions in the second half of the current financial year.

In October 2019, we acquired the Trabectome and Goniotome

product platforms from NeoMedix Inc., to enter the fast-growing

minimally-invasive glaucoma surgery market. The initial cash

consideration was US$8.1 million (GBP6.6 million) on a cash- and

debt-free basis. Further earn-out considerations, capped at a total

of US$17 million (GBP14.0 million) are payable in cash, dependent

on performance in the three years to October 2022. In the same

month, we also acquired Infowave Solutions Inc., a location sensing

and software solutions provider, for CenTrak, to further expand its

addressable market and enhance its technological and data

capabilities. The initial consideration for Infowave was US$8.3

million (GBP6.8 million) with further earn-out considerations,

payable in cash, of up to US$4 million (GBP3.3 million) in total,

payable dependent on performance in each of the financial years

ended March 2021 and March 2022.

In January 2020, we acquired NovaBone Products, LLC, a designer

and manufacturer of US FDA-approved synthetic bone graft products,

for US$97.0 million (GBP74.0 million). We also purchased a 70 per

cent holding in FireMate Software Pty. Ltd, which provides

cloud-based fire protection maintenance software to fire

contractors, for an initial consideration of A$11.8 million (GBP6.2

million) and a further A$6.4 million (GBP3.3 million) contingent on

performance to 30 June 2022. We have an option to purchase the

remaining 30% of FireMate, exercisable in the six months from 31

March 2025.

In February 2020, we acquired Sensit Technologies, LLC, a gas

leak detection company, for US$51.5 million (GBP39.6 million);

Maxtec, LLC, a leader in the design, manufacture and distribution

of oxygen analysis and delivery products, for US$20.0 million

(GBP15.3 million); and Spreo, an indoor positioning and mapping

platform company, to further enhance CenTrak's capabilities, for an

initial consideration of US$0.6 million (GBP0.4 million) and

contingent consideration of US$2.0 million (GBP1.5 million).

5. This Trading Update is based upon current management accounts

information. Forward-looking statements have been made by the

Directors in good faith using information available up until the

date that they approved this statement. Forward-looking statements

should be regarded with caution because of the inherent

uncertainties in economic trends and business risks, including the

effects of the current COVID-19 outbreak.

6. A copy of this announcement, together with other information

about Halma, may be viewed on our website www.halma.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBIGDXISBDGGI

(END) Dow Jones Newswires

March 19, 2020 03:00 ET (07:00 GMT)

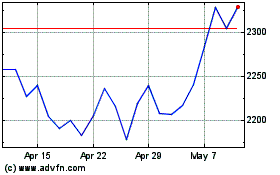

Halma (LSE:HLMA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Halma (LSE:HLMA)

Historical Stock Chart

From Mar 2024 to Mar 2025