TIDMHVT

RNS Number : 7519B

Heavitree Brewery PLC

15 February 2022

The Heavitree Brewery PLC

Trood Lane

Matford

Exeter EX2 8YP

Date: 15 February 2022

Contact: Graham Crocker - Managing Director - 01392 217733

Nicola McLean - Company Secretary - 01392 217733

Patrick Castle /Anita Ghanekar - Shore Capital - 0207 408

4052

Following a Board Meeting held today, 15 February 2022, the

Directors announce the preliminary statement of results for the

year ended 31 October 2021.

ISIN: GB0004182720 for 'A' Limited Voting Ordinary Shares

ISIN: GB0004182506 for Ordinary Shares

Chairman's statement

The results reported at the half-year showed that this Company,

like most in the hospitality sector, inevitably would be reporting

at the year-end numbers that had been detrimentally affected by the

ongoing Covid-19 pandemic. At the beginning of the year under

review, during November 2020, our pubs were under lockdown. This

was followed by trading under restrictions in December until Boxing

Day when the Government implemented another lockdown which

continued until 12th April. Following this our pubs were permitted

to trade with restrictions until 19th July when social distancing

measures were eased. As in the previous year, the Board has

remained determined to support and protect our Tenants and

Leaseholders as best we can during the periods of lockdown and the

periods of restricted trading by waiving and discounting rents as

appropriate. Consequently, only three months of the year had rents

collected at the full rate. This has had an increased impact on

turnover against the previous year and revenue for the year under

review has decreased by 7.98% to GBP4,618,000 (2020: GBP5,019,000).

The Group returned a small operating loss of GBP59,000. Profit

before taxation was GBP1,114,000 (2020: GBP414,000).

The IFRS 16 Lease Accounting calculation which apportions rental

income to each year of the full term of the lease and which I

referred to in last year's statement, has once again skewed the

position by causing the inclusion of significant rental income that

was not actually collected, nor charged, in the year.

Also, in April 2021, The Jolly Sailor in East Ogwell was

destroyed by a devastating fire. Thankfully, and most importantly,

our Tenants John Turner and Amanda Bearne and their customers were

not harmed, nor any members of the local emergency services who

bravely attended the scene and prevented any spread to other

properties in the village. At the time of writing, the site has

been made secure while we await the decision, following the

recommendation of the conservation officer, of a demolition

application of the damaged, unstable gable end. Included in the

operating loss for the year is the impairment loss GBP119,000 for

The Jolly Sailor, in order to write off the book 'historical cost'

carrying value.

The Company has continued the programme of selling some non-core

assets and this has realised a book profit of GBP1,318,000 (2020:

GBP293,000) in this respect. This policy is in line with the

Board's decision to reduce the Company's level of borrowing.

Dividend

At the half-year, I reported that the Directors would not

consider the payment of a dividend for the financial year

2020/2021. When trading does return to some sort of normality, the

Board will be able to review future dividend payments.

Sale of Property

The properties that were sold during the year are listed as

follows:

The Maltsters Arms in Harbertonford, which had been closed since

September 2018. The adjacent cottage Bridge house. The garage

opposite the pub.

The Castle Inn in Holcombe.

The Toby Jug Inn in Bickington which had been closed since May

2003.

Rose Cottage in Strete.

Two flats at the Old St.Loye's Hotel site.

Land at the rear of the Globe Inn in Chudleigh.

Two garden plots in Abbotskerswell.

Within the financial year, the Company made a reduction in

borrowings of GBP661,000. Early in the new year following the

completion of further sales of The Victoria Inn in Ashburton with a

small adjoining cottage and the Maltster's Arms site in Clyst St

Mary, a prepayment on the term loan of GBP750,000 was made.

Heavitree Inc.

The final piece of land held by our American subsidiary in

Houston has been sold for $45,000 (GBP33,000). This is a post

balance sheet event which will end our involvement in Houston. This

started in 1982 with our investment in a company operating an

English style pub and restaurant in the city called The Bear and

Ragged Staff. The collapse of the oil price and, in turn, the

collapse of the Houston economy led to the demise of the operating

company and this Company taking direct control of the site in 1983.

In 1986 the original site was swapped for a parcel of undeveloped

land. Over the years, a series of land sales has distributed cash

to the parent Company.

Pension Scheme

In January 2022 the trustees of the Final Salary Pension Scheme

and the Company formally gave notice to trigger the wind-up of the

Scheme. The Scheme was closed to new members in July 2002, with no

future accrual since April 2006 and the last deferred members

transferred out in June 2018. Wind-up must be completed within a

two-year period. As part of the wind-up, retired members who had

annuities purchased on their behalf in the Scheme's name will, in

due course, have those annuities transferred into their own

names.

Personnel

I am very sad to report that Joan Ballman who was the landlady

of our Locomotive Inn in Exeter since 1988 and who held the tenancy

of The Mitre in Exeter before that, passed away in December 2021.

Joan commanded the utmost respect and affection from all of us at

head office during her long time at The Locomotive and the huge

number of attendees at her funeral showed how she was held in the

highest esteem by the many who visited her pub. We will all miss

Joan.

A similarly huge figure from the Exeter licencing trade was

Derek Elson who we also sadly lost early in 2022. Derek (with his

wife Adrienne) was probably ahead of his time in terms of being a

multi pub operator and started as our very first Manager when

taking on The Gardeners' Arms in Exeter in 1965. He was then

appointed as our Manager at The Upton Vale in Torquay in 1968 and

after that held tenancies or leases with us at The St. Loye's Hotel

in Exeter, The George in Babbacombe and most famously at The Kings

Arms in Exeter, which he took on in 1976. Our Managing Director

even managed to persuade him to come out of retirement to help us

by taking The Royal Oak in Exeter, for a short period, while a new

tenant was being sought. We will always be grateful to Derek for a

long, happy and highly respected association with this Company and

again, he will be greatly missed by many.

Prospects

The trading environment remains testing; although there was no

actual lockdown, Christmas trading was hindered as customers became

unsettled by the recent infection rate peak caused by the Omicron

variant. Staff shortages and increasing costs are also a continual

concern.

However, the success of the vaccination programme has clearly

helped in encouraging customers to support pubs and enjoy

everything they have to offer and some comfort for the future was

drawn from the strong trade during late Summer and Autumn. Also,

the houses I visited during the variant affected build up to

Christmas and in the early new year showed not only how

professional and robust our operators are but also how determined

our customers are to enjoy the offer provided by our great

pubs.

N H P TUCKER

Chairman

15 February 2022

Group income statement

for the year ended 31 October 2021

Notes Total Total

2021 2020

GBP000 GBP000

Revenue 4,618 5,019

--------- ---------

Other operating income 310 317

Purchase of inventories (1,909) (2,065)

Staff costs (1,349) (1,310)

Depreciation of property,

plant and equipment (177) (177)

Other operating charges (1,552) (1,245)

--------- ---------

(4,677) (4,480)

--------- ---------

Group operating (loss)/profit (59) 539

Profit on sale of property

plant and equipment 1,318 293

Impairment of fixed

assets - (279)

Group profit before

finance costs and taxation 1,259 553

Finance income - 2

Finance costs (145) (141)

Other finance costs - -

- pensions

--------- ---------

(145) (139

Profit before taxation 1,114 414

Tax expense (313) (300)

Profit for the year

attributable to equity

holders of the parent 801 114

--------- ---------

Basic earnings per

share 2 16.6p 2.4p

--------- ---------

Diluted earnings per

share 2 16.6p 2.4p

--------- ---------

Group statement of comprehensive income

for the year ended 31 October 2021

2021 2020

GBP000 GBP000

Profit for the year 801 114

-------- --------

Items that will not be reclassified

to profit or loss

Fair value adjustment on investment

in equity 5 (12)

5 (12)

Items that may be reclassified to

profit or loss

Exchange rate differences on translation

of subsidiary undertaking - (4)

- (4)

Other comprehensive income for the

year, net of tax 806 98

-------- --------

Total comprehensive income attributable

to:

Equity holders of the parent 806 98

Group balance sheet

at 31 October 2021

2021 2020

GBP000 GBP000

Non-current assets

Property, plant and equipment 16,436 16,615

Investment property 1,490 2,130

Right of use asset 71 -

17,997 18,745

Financial assets 34 30

Deferred tax asset 16 16

--------- ---------

18,047 18,791

--------- ---------

Current assets

Inventories 10 10

Trade and other receivables 1,936 1,277

Cash and cash equivalents 52 49

--------- ---------

1,998 1,336

--------- ---------

Assets held for sale 883 219

--------- ---------

Total assets 20,928 20,346

--------- ---------

Current liabilities

Trade and other payables (984) (666)

Financial liabilities (1,158) (1,520)

Income tax payable (108) (237)

--------- ---------

(2,250) (2,423)

--------- ---------

Non-current liabilities

Other payables (318) (274)

Financial liabilities (4,069) (4,322)

Deferred tax liabilities (734) (536)

Defined benefit pension plan deficit (92) (92)

--------- ---------

(5,213) (5,224)

--------- ---------

Total liabilities (7,463) (7,647)

--------- ---------

Net assets 13,465 12,699

--------- ---------

Capital and reserves

Equity share capital 264 264

Capital redemption reserve 673 673

Treasury shares (1,529) (1,522)

Fair value adjustments reserve 10 5

Currency translation 13 13

Retained earnings 14,034 13,266

--------- ---------

Total equity 13,465 12,699

--------- ---------

Group statement of cash flows

for the year ended 31 October 2021

2021 2020

GBP000 GBP000

Operating activities

Profit for the year 801 114

Tax expense 313 301

Net finance costs 145 139

Profit on disposal of non-current assets

and assets held for sale (1,200) (293)

Depreciation and impairment of property,

plant and equipment 177 177

(Increase)/decrease in trade and other

receivables (442) 220

Increase/(decrease) in trade and other

payables 353 (274)

Impairment of fixed assets - 279

---------- --- ---------

Cash generated from operations 147 663

Income taxes paid (245) (151)

Interest paid (145) (141)

Net cash(outflow)/ inflow from operating

activities (243) 371

---------- --- ---------

Investing activities

Interest received - 2

Proceeds from sale of property, plant

and equipment and assets held for sale 1,411 186

Payments to acquire property, plant

and equipment (473) (315)

Net cash inflow/(outflow) from investing

activities 938 (127)

---------- --- ---------

Financing activities

Preference dividend paid (1) (1)

Equity dividends paid - -

Consideration received by EBT on sale

of shares 41 62

Consideration paid by EBT on purchase

of shares (81) (25)

Capital element of finance lease rental

payments (25) (9)

Loan repayment (187) (1,500)

Mortgage receipts received 35 -

Net cash outflow from financing activities (218) (1,473)

---------- --- ---------

Increase/(decrease) in cash and cash

equivalents 477 (1,229)

Cash and cash equivalents at the beginning

of the year (1,232) (3)

---------- --- ---------

Cash and cash equivalents at the year

end (755) (1,232)

---------- --- ---------

Group statement of changes in equity

for the year ended 31 October 2021

Equity Capital Fair

share redemption Treasury value Currency Retained Total

capital reserve shares adjustment translation earnings equity

GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

At 1 November

2019 264 673 (1,562) 17 17 13,152 12,561

Profit for the

year - - - - - 114 114

Other comprehensive

income for the

year

net of income

tax - - - (12) (4) - (16)

--------- ------------ ----------- ------------ -------------- ----------- ---------

Total comprehensive

income for the

year - - - (12) (4) 114 98

--------- ------------ ----------- ------------ -------------- ----------- ---------

Consideration

received

by EBT on sale

of

shares - - 62 - - - 62

Consideration

paid by

EBT on purchase

of shares - - (24) - - - (24)

Loss by EBT on

sale

of shares - - 2 - - - 2

Equity dividends - - - - - - -

paid

--------- ------------ ----------- ------------ -------------- ----------- ---------

At 31 October

2020 264 673 (1,522) 5 13 13,266 12,699

--------- ------------ ----------- ------------ -------------- ----------- ---------

Equity Capital Fair

share redemption Treasury value Currency Retained Total

capital reserve shares adjustment translation earnings equity

GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

At 1 November

2020 264 673 (1,522) 5 13 13,266 12,699

Profit for the

year - - - - - 801 801

Other comprehensive

income for the

year

net of income

tax - - - 5 - - 5

--------- ------------ ----------- ------------ -------------- ----------- ---------

Total comprehensive

income for the

year - - - 5 - 801 806

--------- ------------ ----------- ------------ -------------- ----------- ---------

Consideration

received

by EBT on sale

of

shares - - 41 - - - 41

Consideration

paid by

EBT on purchase

of shares - - (81) - - - (81)

Loss by EBT on

sale

of shares - - 33 - - (33) -

Equity dividends - - - - - - -

paid

--------- ------------ ----------- ------------ -------------- ----------- ---------

At 31 October

2021 264 673 (1,529) 10 13 14,034 13,465

--------- ------------ ----------- ------------ -------------- ----------- ---------

Equity share capital

The balance classified as share capital includes the total net

proceeds (nominal amount only) arising or deemed to arise on the

issue of the Company's equity share capital, comprising Ordinary

Shares of 5p each and 'A' Limited Voting Ordinary Shares of 5p

each.

Capital redemption reserve

The capital redemption reserve arises on the re-purchase and

cancellation by the Company of Ordinary Shares .

Treasury shares

Treasury shares represent the cost of The Heavitree Brewery PLC

shares purchased in the market and held by The Heavitree Brewery

PLC Employee Benefits Trust and Employee Share Option Scheme

('EBT').

At 31 October 2021 the Group held 193,053 Ordinary Shares and

238,310 'A' Limited Voting Ordinary Shares (2020: 183,719 Ordinary

Shares and 254,153 'A' Limited Voting Ordinary Shares) of its own

shares. During the year there were purchases of 9,334 Ordinary

Shares and 17,204 'A 'Limited Voting ordinary Shares and sales of

33,147 'A; Limited Voting Ordinary Shares.

Fair value adjustments reserve

The fair value adjustments reserve is used to record differences

in the year on year fair value of the investment classified as fair

value through other comprehensive income.

Foreign currency translation reserve

The foreign currency translation reserve is used to record

exchange differences arising from the translation of the financial

statements of foreign subsidiaries.

Notes to the preliminary announcement

1. Basis of preparation

These figures do not constitute full accounts within the meaning

of Section 396 of the Companies Act 2006. They have been extracted

from the statutory financial statements for the year ended 31

October 2021. The statutory financial statements have not yet been

delivered to the Registrar of Companies.

The auditors, PKF Francis Clark, have reported on the accounts

for the years ended 31 October 2021 and 31 October 2020. Their

audit reports in both years were unqualified, did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and did not contain

a statement under Section 498 (2) or (3) of the Companies Act 2006

in respect of those accounts.

The financial information in this statement has been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted for use in the United Kingdom. The accounting policies

have been consistently applied and are described in full in the

statutory financial statements for the year ended 31 October 2021,

which are expected to be mailed to shareholders on 11 March 2022.

The financial statements will also be available on the Group's

website www.heavitreebrewery.co.uk .

Going concern

With the continued uncertain nature of the pandemic and further

lockdowns and restrictions being in place during this financial

year, the Directors have considered the Group's financial

resources. This had included a further review of the medium-term

financial plan, along with a range of cash flow forecasts for 12

months from the date of approval of these financial statements. The

Group has positive cash generation from its operations before tax

and interest and the gearing remains low. These forecasts include a

reduction in trade in the financial year to October 2022 due to an

anticipated decrease in footfall and assume that there will be no

further lockdown or significant trading restrictions. The

mitigation measures which are in place in order to protect the cash

position of the business have been incorporated into the forecasts

for future cash positions. The forecast for capital receipts in

2022 includes non-core asset sales of GBP2m of which GBP880,000 has

been received. These forecasts leave the Group with headroom of

over GBP1.4m on an overdraft facility of GBP3m. The Board will

continue to review cashflows as guidance from Government

changes.

The Board took the decision last year to accelerate the paying

down of its GBP4.5m term loan by the selling of non-core assets to

secure its current position and the long term trading position of

the Group. The Board identified up to 15 non-core assets with a

value of between GBP5m and GBP7m to be realised over a period of 2

to 3 years. These include unlicensed properties and developments

with permissions which are already within the Estate. This year the

Group has sold 9 of the non-core assets resulting in profits of

GBP1,318,000 being realised from these sales, with a further

property completing early in the new financial year this has

enabled the Group post year end to make a further prepayment on the

term loan of GBP750,000, meaning that by the 31 December 2021 the

Group has paid down GBP992,000 on the loan.

The Board has continued to engage with the bank regarding its

facilities and forward trading, it has in place a waiver of

covenant testing until April 2022 along with the agreement on

paying down of loan facilities, projections show that there is a

good level of headroom in the debt service cover covenant both to

April 2022 and October 2022. However one covenant will fail the

April 2022 testing but will have headroom in October 2022. A

further waiver has been received from the bank in respect of the

April 2022 covenant test. The Directors are satisfied that the

Group's forecasts and projections, which take account the

anticipated changes which will come about as a direct result of the

Covid-19 pandemic and shows that the Group will be able to operate

within its facilities. The current trading performance of the Group

also shows that it will be able to operate within the level of its

facilities for the 12 months from date of approval. With value in

the Estate being realised over time and with the support from the

bank there are no material uncertainties in relation to going

concern. For this reason, the Group continues to adopt the going

concern basis in preparing its financial statements.

2. Earnings per share

Basic earnings per share amounts are calculated by dividing

profit for the year attributable to ordinary equity holders of the

parent by the weighted average number of Ordinary shares and 'A'

Limited Voting Ordinary shares outstanding during the year.

The following reflects the income and shares data used in the

basic and diluted earnings per share

Computation:

2021 2020

GBP000 GBP000

Profit for the year 801 114

-------- --------

2021 2020

N(o) . N(o) .

(000) (000)

-------- --------

Basic weighted average number of shares

(excluding treasury shares) 4,824 4,801

-------- --------

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of completion of these financial statements.

3. Dividends paid and proposed

2021 2020

GBP000 GBP000

Declared and paid during the year:

Equity dividends on ordinary shares:

Final dividend for 2020: nil (2019: nil) - -

First dividend for 2021: nil (2020: nil) - -

Less dividend on shares held within employee - -

share schemes

Dividends paid - -

-------- --------

Proposed for approval at AGM

(not recognised as a liability as at 31

October)

- -

Final dividend for 2021 nil (2020: nil)

Cumulative preference dividends 1 1

-------- --------

4. Segment information

Primary reporting format - business segments

During the year the Group operated in one business segment -

leased estate.

Leased estate represents properties which are leased to tenants

to operate independently from the Group, under tied and free of tie

tenancies.

Secondary reporting format - geographical segments

The following tables present revenue, expenditure and certain

asset information regarding the Group's geographical segments for

the years ended 31 October 2021 and 2020. Revenue is based on the

geographical location of customers and assets are based on the

geographical location of the asset.

Segment information

Year ended 31 October 2020 UK United Total

GBP000 States GBP000

GBP000

Revenue

Sales to external customers 5,019 - 5,019

Other segment information

Segment assets 20,304 42 20,346

-------- -------- --------

Total Assets 20,304 42 20,346

-------- -------- --------

Capital expenditure

Property, plant and equipment 355 - 355

-------- -------- --------

Year ended 31 October 2021 UK United Total

GBP000 States GBP000

GBP000

Revenue

Sales to external customers 4,618 - 4,618

Other segment information

Segment assets

21,382 42 21,424

-------- -------- --------

Total Assets 21,382 42 21,424

-------- -------- --------

Capital expenditure

Property, plant and equipment 473 - 473

Right of use asset 71 71

5. General information

The 2021 Annual Report and Financial Statements will be

published and posted to shareholders on 11th March 2022 Further

copies may be obtained by contacting the Company Secretary at The

Heavitree Brewery PLC, Trood Lane, Matford, Exeter EX2 8YP. The

2021 Annual Report and Financial Statements will also be available

on the Company's website at

http://www.heavitreebrewery.co.uk/financial/

The Annual General Meeting will be held at the Registered Office

on 13 April 2022 at 11.30am.

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAFASFDAAEFA

(END) Dow Jones Newswires

February 15, 2022 09:59 ET (14:59 GMT)

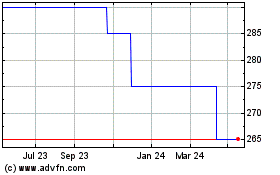

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Mar 2024 to Mar 2025