TIDMDTG

RNS Number : 5310W

Dart Group PLC

30 July 2009

DART GROUP PLC

PRELIMINARY UNAUDITED RESULTS FOR YEAR ENDED 31 MARCH 2009

Dart Group PLC (the "Group"), the aviation and distribution group, announces its

preliminary results for the year ended 31 March 2009. These results are

presented under International Financial Reporting Standards (IFRS).

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the year ended 31 March 2009 -

a successful year for the Group. Although turnover grew only slightly to GBP439m

(2008: GBP429m), profitability was improved, principally through stronger

trading performance in Jet2.com. Profit before tax amounted to GBP33.5m (2008:

GBP11.8m) with earnings per share of 19.3p (2008: 6.2p). Underlying profit

before tax, before specific IAS 39 fair value movements, would have been

GBP28.8m (2008: GBP3.9m). In the light of Summer 2009 trading, the Board has

concluded that it is appropriate to resume payment of a dividend at a level of

0.71p per share.

Capital expenditure for the year ended 31 March 2009 was GBP27.9m (2008:

GBP38.5m), with the reduction principally related to the phasing of long term

maintenance spend on engines and airframes. As at 31 March 2009, the Group's net

cash position amounted to GBP11.8m, which represents a significant improvement

from 31 March 2008, at which time the Group had net debt of GBP17.2m.

All of Jet2.com's expected fuel requirements for its passenger operations have

been hedged for the year ending 31 March 2010, as have nearly all of the Group's

forecast US$ and Euro requirements. Neither Jet2.com's freight operations nor

Fowler Welch-Coolchain currently have any material exposure to oil price risk as

this is substantially covered in their commercial contracts.

Aviation

Jet2.com, the Group's leisure airline, focused its development in 2008/9 on a

wider range of leisure sun routes. New leisure routes were added, principally

from Leeds and Manchester. In order to match supply with expected market

demand, Jet2.com managed down overall capacity both in Summer 2008 and in Winter

2008/9.Summer seat capacity was reduced by 21% with some city routes being

discontinued, and Winter capacity was reduced by 49% in recognition of the

economic downturn, principally through reduction in flight frequencies to

Western Mediterranean destinations. Encouragingly, the business continues to win

awards - a recent customer satisfaction survey conducted by Which? identified

Jet2.com as having the highest level of satisfaction amongst UK short haul

carriers.

The Group's tour operator, Jet2holidays.com, grew more slowly than hoped for,

with 36,128 passengers in the year (2007/8: 34,339), booked through internet

sales, telephone sales via our UK based call centre and via travel agencies. We

are working to grow this segment of our aviation business, packaging attractive

hotels with Jet2.com scheduled flights and offering flexible holidays to a wide

range of destinations.

The Jet2.com in-house developed reservation system, which went live in February

2008, was further developed during the year, with the introduction of a number

of enhancements including on-line seat assignment, a "shopping basket" facility

for multiple purchases and a specific travel agency portal. The introduction of

our own reservation system allows us to tailor the system constantly to meet

customer needs quickly and effectively, improving the shopping experience and

consequently generating additional non-ticket revenues.

Our passenger charter airline operations had a very strong year, as a result of

both increased market demand and additional aircraft availability. The Group's

freight operations continue to deliver a significant revenue stream; in

particular the night flights for Royal Mail on "Quick Change" aircraft allow us

to maximise the use of the Group's aircraft through day and night time

operations.

Looking forward, Jet2.com will continue to focus its growth in the leisure

sector of the airline market. The continuing development of its in-house IT

capabilities is recognised as being particularly important to ensure that both

its scheduled flights and holiday offerings meet the evolving demands of its

growing customer base. The Group also intends to continue to work closely with

the travel trade in making its flight and holiday offerings more accessible to

all forms of distribution.

Distribution

The Group's logistics operation, Fowler Welch-Coolchain, primarily provides an

integrated supply chain solution to supermarkets and their suppliers as well as

food manufacturers, growers and importers. Its capabilities include both chilled

and ambient distribution together with warehousing and pick-to-order services.

It offers national coverage from a network of eight distribution and storage

operations.

Revenues for the year ended 31 March 2009 decreased by 6%, principally as a

result of customer losses at the beginning of the year. Whilst the cost base was

reduced, reflecting both the flexible nature of the business and action taken

during the year to improve efficiency, profitability was impacted. "Manhattan",

the company's new warehouse management system was introduced at our Spalding

site in the year, providing real-time online visibility of stock levels as well

as inbound and outbound movements.

During the year, Fowler Welch-Coolchain continued to ensure that it operated the

optimum mix of own and sub-contractor vehicles and drivers. Fowler

Welch-Coolchain continues to invest in new technology with the introduction of

further dual fuel vehicles and double deck trailers into the fleet, together

with further investment in its driver training initiative. These investments are

expected to continue to deliver a reduction in both operating costs and carbon

emissions.

It is our intention to continue to grow this operation both organically and by

selective acquisition, should any attractive opportunities arise to add skills

or scale.

Our Staff

I am sad to report that Jim Welch, President of Fowler Welch-Coolchain, passed

away in January of this year. Jim was the founder of Fowler Welch Limited. Jim

retired from active involvement in Fowler Welch, but retained a passion for and

real interest in the business, being a source of both inspiration and valuable

advice. His former business partner, Maurice Fowler, sadly also passed away in

January this year. On behalf of all our colleagues, we send sincere condolences

to the families and are hugely grateful for the vision and hard work that led to

the creation and success of Fowler Welch.

All our businesses have earned a reputation for high quality customer service

from their customers. This can only be achieved through the dedication and hard

work of all of the Group's operational and administrative staff in Fowler

Welch-Coolchain, Jet2.com and Jet2holidays.com.Our businesses are

customer-focused and operationally demanding at all hours of the day. We are

grateful to all and look forward to continuing to grow our business together.

Outlook

We expect to grow both our businesses cautiously in the year ahead given current

market conditions. In Fowler Welch-Coolchain, we will also evaluate acquisition

opportunities as these arise and continue to develop the business

infrastructure.

We will invest in the development of the aviation business, through a growing

focus on leisure flights and package holidays, increasingly to longer haul

destinations. In the current trading environment, the key to success will

continue to focus on matching flight schedules and frequencies to market demand.

With our expected fuel requirements fully hedged and a carefully tailored flying

programme, we are well placed to deliver satisfactory financial performance in

this financial year in difficult trading conditions.

Philip Meeson

Chairman

29 July 2009

For further information about Dart Group PLC and its subsidiary companies please

visit our website, www.dartgroup.co.uk

BUSINESS AND FINANCIAL REVIEW

The Group is comprised of two principal operating businesses, Aviation and

Distribution, which trade in separate market segments.

2008/9 Performance

Dart Group PLC's financial performance for the year to 31 March 2009 is reported

in line with International Financial Reporting Standards (IFRS), as adopted by

the EU, which were effective at the year end. Under IFRS, the Group was not able

to adopt hedge accounting in restating its 2006/7 results, since IFRS compliant

hedge documentation was not in place prior to April 2007.To be consistent with

previous announcements, these results are also presented as if hedge accounting

had been available to the Group in 2006/7 under IFRS across all of these

periods.

Although Group turnover increased by 2.3%, EBITDA increased by 77.2% and

underlying Group profit before tax increased from GBP3.9m to GBP28.8m,

reflecting a focus on profitability rather than growth in Jet2.com, our leisure

airline operation. The Group's effective tax rate for the year of 19% was lower

than last year (2008: 26%), principally reflecting the recognition of deferred

tax assets from tax losses arising in prior years.

After careful consideration, the Group has decided to pay a final dividend of

0.71p for the year ended 31 March 2009.

The Group's cash position improved by GBP29.0m in the year, with a positive net

cash position as at 31 March 2009 of GBP11.8m (2008: GBP17.2m net debt). The

Group's improved cash generation was driven by a combination of improved EBITDA

and lower capital expenditure, in part offset by an increase in working capital

requirements.

With improved profitability in the year and considerable positive cash

generation, the Group's balance sheet strengthened in the year. The resultant

increase in shareholders' equity and the positive net cash position are the

principal changes in the shape of the balance sheet from the previous year end.

Segmental Performance

Aviation

The Aviation division comprises the Group's passenger and freight charter

operations, scheduled leisure airline and associated tour operator activities

trading under the Jet2.com and Jet2holidays.com brands. It operates 21 Boeing

737-300 aircraft, including eight "Quick-Change" aircraft, and nine Boeing

757-200 aircraft from its home base of Leeds Bradford International Airport and

five other northern bases.

During 2008/9, Jet2.com increased the focus of its scheduled airline activities

on leisure routes, adding a number of additional routes, particularly out of

Leeds Bradford International Airport, with a number of city routes being

discontinued out of Manchester. Overall scheduled airline seat capacity was

reduced by 21% for Summer 2008 and by 49% for Winter 2008/9. The Winter

reductions centred on lower frequency on Western Mediterranean routes.

This successful route and capacity management resulted in a significant increase

in load factor to 78% (2007/8: 72%), at improved yields. The Group added an

additional, leased, Boeing 757 aircraft to the fleet in May 2008 to support its

increased focus on longer haul leisure destinations.

Retail revenues are a very important source of income for the scheduled airline

business, allowing low fares to be maintained. Retail revenue per passenger

increased from GBP9.10 to GBP14.93 in 2008/9, generated from a number of sources

including hold baggage charges and online seat assignment.

Jet2.com switched over to its own in-house developed reservation system in

February 2008. The introduction of our own reservation system allows us to

tailor our offering more quickly and effectively to meet customer needs, and

improve the online shopping experience. Retail revenues, in particular online

seat assignment and extra leg room, have increased significantly as a result of

the introduction of this system. A trade portal into this system has been

developed to improve access to Jet2.com for the travel trade. Jet2.com also

introduced a loyalty scheme in November 2008 to reward regular fliers.

Jet2.com's charter activities were further expanded in the year. The Royal Mail

contract, under which night mail flights are undertaken from six UK airports,

continues to be serviced well, with industry leading punctuality, to enable the

Royal Mail to meet its service obligations. The passenger charter operation

provides flights for tour operators, specialist holiday providers and in support

of promotional and sporting events. Increasingly we are working with tour

operators on a part aircraft basis, to supplement load factor on our scheduled

services, as well as using charter activity to improve utilisation of aircraft

outside peak periods. Passenger charter revenues grew significantly in 2008/9 as

a result of greater aircraft availability and strong market demand, partly

influenced by the market exit of some competitors.

In its second full year of operation, Jet2holidays.com sold over 36,000

holidays, all on Jet2.com flights. Holidays are packaged dynamically by linking

flights with accommodation provided by our bed supplier and a range of airport

transfer options. During the year, the holidays call centre was repatriated to

the UK to ensure that direct customers calling us obtained the best possible

advice. A trade portal was also developed during the year to improve travel

agency access to Jet2holidays.com.

Having fully hedged its fuel costs in advance of the relevant season, the

business was not subject to the very significant fuel price increases which

impacted the industry during the financial year.

The business has fully hedged its anticipated fuel requirement for the year

ending March 2010.

We continue to benefit from the long term agreement with Pratt & Whitney for the

fixed price maintenance of the CFM56-3 series engines, which power our Boeing

737-300 aircraft. Pratt & Whitney have also started to manufacture and supply a

range of parts for these engines at attractive pricing under their Global

Material Solutions Programme. This agreement delivers increased engine

efficiency, cost certainty and price reductions for the business.

Reducing fuel burn and consequent emissions is a high profile project within

Jet2.com. The company has a significant checklist of actions which include

efficient aircraft loading, lower aircraft flying speeds made possible by the

introduction of a newly implemented flight planning system. Two Boeing 757s have

had fuel efficient winglets fitted and a further two aircraft are to be fitted

with winglets this Autumn. Overall year on year fuel savings and consequent

emission reductions in excess of 3.5% were achieved.

Jet2.com's financial performance was significantly improved by the focus on

leisure routes and tailoring of seat capacity to demand, leading to increased

load factors and yield. Total aviation revenues grew by 6% despite the overall

28% reduction in scheduled seat capacity.

Jet2.com reduced its cost base in 2008/9. The reduction in seat capacity allowed

the business to eliminate the need for short term wet leased aircraft which had

been required in Summer 2007 to supplement the owned fleet.

Distribution

The Group's Distribution business, Fowler Welch-Coolchain, is one of the UK's

leading logistics providers serving UK retailers, importers and manufacturers.

Focusing on food and drink, the business operates from eight strategic locations

and offers a range of logistics solutions including storage, case pick-to-order

and national distribution of both temperature controlled and ambient products.

The company's origins are built around consolidating numerous suppliers'

products into specific temperature groups for onward "on time" delivery to end

destination. These complex and time-sensitive operations offer the ideal

solution for clients serving the "Just in Time" supply chains demanded by UK

retailers. Typically Fowler Welch-Coolchain picks and delivers approximately

1.25 million cases of prepared meats, ready meals, citrus juice and pasta on a

weekly basis.

Trailer load fill is an important KPI for the business and the introduction of

additional double deck trailers further enhanced efficiencies through increased

load fill, whilst also contributing to the company's carbon footprint reduction

programme.

Revenues reduced by 6% in the year, principally as a result of two customer

losses sustained in the early part of the year, following very aggressive

competitor pricing. By the end of the year, this business volume had been

replaced through a combination of new business wins, in particular a significant

contract for a chilled meats supplier, and additional activity undertaken for

existing customers.

Given the flexible nature of the operation, Fowler Welch-Coolchain was able to

manage its costs down largely in line with reduced business volumes, to minimise

the profit impact of reduced revenues. Action was also taken to improve

efficiency by optimising the own driver to contractor mix, particularly in

Spalding and Washington. This has put the business in a stronger position for

the current financial year. The Company has focused heavily on fleet

utilisation, both at individual depot level and also through optimising national

network synergies.

This has delivered both efficiencies and environmental benefits through fleet

reductions and fewer empty miles. We believe this trend will continue into the

year ahead.

During the year, the company successfully introduced a new warehouse management

system for a number of customers, allowing real-time online visibility of stock

levels as well as inbound and outbound movements. This will be fully rolled out

during the current financial year.

Over the last 12 months, the company has made substantial progress in reducing

the environmental impact of its operations and has identified four key elements

in its aim to reduce its carbon footprint. By increasing both payload

utilisation and reducing empty running, the net carbon impact per unit of

product delivered is reduced. Fowler Welch-Coolchain has made further

investments in training, management processes and technology in order to achieve

these goals. This investment includes an enhanced telematics system currently

being deployed across the entire fleet. This will permit real-time vehicle,

driver, route and consignment management. Linked to the company's existing

transport management system and with further interfaces to key client systems,

we hope to further reduce empty running, the impact of congestion, poor driving

behaviour and, consequently, the net carbon footprint per unit delivered.

We continue to work closely with commercial vehicle manufacturers to identify

potential fuel saving initiatives. We are currently undertaking initial trials

with hydrogen injection systems for diesel engines, as well as long term testing

of liquid petroleum gas powered vehicles. All of our newly acquired tractor

units comply with the latest EURO V emissions standard and our latest

refrigerated trailers are the most fuel efficient in the market place.

For our warehouse operations, we are in the process of replacing the refrigerant

in our chillers with the latest environmentally friendly alternatives in

accordance with European Directives. We have also invested in some upgrades to

both sealed dock-levelers and internal structures in order to minimise heat

ingress. We continue to work with the Carbon Trust in order to progress our

agenda in this key area.

Investment in driver training continues and will remain ongoing. Continuing

fleet evaluation enables the Company to make critical decisions with fleet

replacement programmes, thus ensuring that the most fuel efficient vehicles are

purchased.

Despite the economic slowdown, the company increased its portside activities

handling more imported containers. This activity complements fleet utilisation

and extends the service offering to provide true end-to-end logistics

capabilities.

Not surprisingly, the sector has seen considerable consolidation and this has

provided the company with both organic and targeted acquisitive growth

opportunities.

As cost pressures continue, the requirement of sustainable lean supply chains

will grow. The company is well established and renowned for its ability to

service short order lead times with FMCG and through its strategically situated

locations is well placed to secure additional volumes.

The ongoing need to be cost competitive remains a key driver of the business,

and the company anticipates it will be competitively placed to take full

advantage of further opportunities in this sector.

For further information contact:

+--------------------------------------------+----------+---------------+

| Dart Group PLC | Tel: | 0113 238 7444 |

+--------------------------------------------+----------+---------------+

| Philip Meeson | Mobile: | 07785 258666 |

| Group Chairman and Chief Executive | | |

+--------------------------------------------+----------+---------------+

| Andrew Merrick | Mobile: | 07788 565358 |

| Group Finance Director | | |

+--------------------------------------------+----------+---------------+

| Andy Pedrette | Tel: | 020 7131 4000 |

| Smith & Williamson Corporate Finance | | |

| Limited | | |

+--------------------------------------------+----------+---------------+

Consolidated Group Income Statement

for the year ended 31 March 2009

+----------------------+-----------+-----------+---------+-------------------+-----------+------+--------+

| | Unaudited | Audited |

| | Year ended 31 March 2009 | Year ended 31 March 2008 |

+----------------------+---------------------------------+--------------------------------------+

| | Results | Specific | Results | Results before | Specific | Results for |

| | before | fair | for the | specific IAS 39 | | the year |

| | specific | value | year | fair value | fair | |

| | IAS 39 | movements | | movements | value | |

| | fair | (1) | | | movements | |

| | value | | | | (1) | |

| | movements | | | | | |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Revenue | 439.3 | - | 439.3 | 429.3 | - | 429.3 |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Net operating | (404.1) | 4.7 | (399.4) | (423.7) | 7.9 | (415.8) |

| expenses | | | | | | |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Operating profit | 35.2 | 4.7 | 39.9 | 5.6 | 7.9 | 13.5 |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Finance income | 0.9 | - | 0.9 | 2.7 | - | 2.7 |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Finance costs | (7.3) | - | (7.3) | (5.7) | - | (5.7) |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Net financing costs | (6.4) | - | (6.4) | (3.0) | - | (3.0) |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Profit on disposal | - | - | - | 1.3 | - | 1.3 |

| of property, plant | | | | | | |

| and equipment | | | | | | |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Profit before | 28.8 | 4.7 | 33.5 | 3.9 | 7.9 | 11.8 |

| taxation | | | | | | |

+----------------------+-----------+-----------+---------+-------------------+-----------+------+

| Taxation | (5.1) | (1.3) | (6.4) | (0.8) | (2.3) | (3.1) |

+----------------------+-----------+-----------+---------+-------------------+-----------+---------------+

| Profit for the year | 23.7 | 3.4 | 27.1 | 3.1 | 5.6 | 8.7 |

| (all attributable to | | | | | | |

| equity shareholders | | | | | | |

| of the parent) | | | | | | |

+----------------------+-----------+-----------+---------+-------------------+-----------+------+--------+

Earnings per share

+----------------------+-----------+-----------+---------+-------------------+----------+-------+

| - basic | 16.87p | | 19.27p | 2.15p | | 6.18p |

+----------------------+-----------+-----------+---------+-------------------+----------+-------+

| - diluted | 16.46p | | 18.80p | 2.12p | | 6.13p |

+----------------------+-----------+-----------+---------+-------------------+----------+-------+

Notes

(1) In order to assist the reader to understand the underlying business

performance, the Group discloses separately within the income statement specific

IAS 39 fair value movements.

Consolidated Group Balance Sheet

at 31 March 2009

+-----------------------------------------------------+---------------+-------------+

| | Unaudited | Audited |

| | 2009 | 2008 |

+-----------------------------------------------------+---------------+-------------+

| | GBPm | GBPm |

+-----------------------------------------------------+---------------+-------------+

| Non-current assets | | |

+-----------------------------------------------------+---------------+-------------+

| Goodwill | 6.8 | 6.8 |

+-----------------------------------------------------+---------------+-------------+

| Property, plant and equipment | 190.5 | 193.4 |

+-----------------------------------------------------+---------------+-------------+

| Derivative financial instruments | 2.4 | 1.6 |

+-----------------------------------------------------+---------------+-------------+

| Deferred Tax Assets | - | 2.8 |

+-----------------------------------------------------+---------------+-------------+

| | 199.7 | 204.6 |

+-----------------------------------------------------+---------------+-------------+

| Current assets | | |

+-----------------------------------------------------+---------------+-------------+

| Inventories | 0.4 | 0.3 |

+-----------------------------------------------------+---------------+-------------+

| Trade and other receivables | 45.1 | 50.0 |

+-----------------------------------------------------+---------------+-------------+

| Derivative financial instruments | 32.7 | 13.7 |

+-----------------------------------------------------+---------------+-------------+

| Cash and cash equivalents | 11.8 | 4.0 |

+-----------------------------------------------------+---------------+-------------+

| | 90.0 | 68.0 |

+-----------------------------------------------------+---------------+-------------+

| Total assets | 289.7 | 272.6 |

+-----------------------------------------------------+---------------+-------------+

| Current liabilities | | |

+-----------------------------------------------------+---------------+-------------+

| Trade and other payables | 139.9 | 147.1 |

+-----------------------------------------------------+---------------+-------------+

| Derivative financial instruments | 30.8 | 5.9 |

+-----------------------------------------------------+---------------+-------------+

| | 170.7 | 153.0 |

+-----------------------------------------------------+---------------+-------------+

| Non-current liabilities | | |

+-----------------------------------------------------+---------------+-------------+

| Other non current liabilities | 6.4 | 2.9 |

+-----------------------------------------------------+---------------+-------------+

| Borrowings | - | 21.2 |

+-----------------------------------------------------+---------------+-------------+

| Derivative financial instruments | 0.2 | 2.5 |

+-----------------------------------------------------+---------------+-------------+

| Deferred tax liabilities | 19.0 | 18.5 |

+-----------------------------------------------------+---------------+-------------+

| | 25.6 | 42.4 |

+-----------------------------------------------------+---------------+-------------+

| Total liabilities | 196.3 | 198.2 |

+-----------------------------------------------------+---------------+-------------+

| Net assets | 93.4 | 74.4 |

+-----------------------------------------------------+---------------+-------------+

| Shareholders' equity | | |

+-----------------------------------------------------+---------------+-------------+

| Share capital | 1.8 | 1.8 |

+-----------------------------------------------------+---------------+-------------+

| Share premium | 9.3 | 9.3 |

+-----------------------------------------------------+---------------+-------------+

| Cash flow hedging reserve | 1.9 | 10.0 |

+-----------------------------------------------------+---------------+-------------+

| Retained earnings | 80.4 | 53.1 |

+-----------------------------------------------------+---------------+-------------+

| Other reserves | - | 0.2 |

+-----------------------------------------------------+---------------+-------------+

| Total Shareholders' equity | 93.4 | 74.4 |

+-----------------------------------------------------+---------------+-------------+

Consolidated Group Cash Flow Statement

for the year ended 31 March 2009

+----------------------------------------------------+---------------+-------------+

| | Unaudited | Audited |

| | 2009 | 2008 |

+----------------------------------------------------+---------------+-------------+

| | GBPm | GBPm |

+----------------------------------------------------+---------------+-------------+

| | | |

+----------------------------------------------------+---------------+-------------+

| Cash flows from operating activities | | |

+----------------------------------------------------+---------------+-------------+

| Profit for the year | 27.1 | 8.7 |

+----------------------------------------------------+---------------+-------------+

| Adjustments for: | | |

+----------------------------------------------------+---------------+-------------+

| Tax charge | 6.4 | 3.1 |

+----------------------------------------------------+---------------+-------------+

| Finance income | (0.9) | (2.7) |

+----------------------------------------------------+---------------+-------------+

| Finance costs | 7.3 | 5.7 |

+----------------------------------------------------+---------------+-------------+

| Profit on disposal of property, plant | - | (1.3) |

| and equipment | | |

+----------------------------------------------------+---------------+-------------+

| Depreciation | 30.7 | 30.3 |

+----------------------------------------------------+---------------+-------------+

| Equity settled share based payments | 0.2 | 0.2 |

+----------------------------------------------------+---------------+-------------+

| Specific fair value adjustments | (4.7) | (7.9) |

+----------------------------------------------------+---------------+-------------+

| Operating cash flows before movements in working | 66.1 | 36.1 |

| capital | | |

+----------------------------------------------------+---------------+-------------+

| Increase in inventories | (0.1) | (0.1) |

+----------------------------------------------------+---------------+-------------+

| Increase in trade and other | (5.3) | (6.5) |

| receivables | | |

+----------------------------------------------------+---------------+-------------+

| Increase in trade and other payables | 7.3 | 12.9 |

+----------------------------------------------------+---------------+-------------+

| Increase in financial instruments | (6.5) | - |

+----------------------------------------------------+---------------+-------------+

| Cash generated from operations | 61.5 | 42.4 |

+----------------------------------------------------+---------------+-------------+

| Interest received | 0.1 | 0.1 |

+----------------------------------------------------+---------------+-------------+

| Interest paid | (2.8) | (4.4) |

+----------------------------------------------------+---------------+-------------+

| Income taxes paid | (0.4) | (0.5) |

+----------------------------------------------------+---------------+-------------+

| Net cash from operating activities | 58.4 | 37.6 |

+----------------------------------------------------+---------------+-------------+

| Cash flows from investing activities | | |

+----------------------------------------------------+---------------+-------------+

| Purchase of property, plant and | (27.9) | (38.5) |

| equipment | | |

+----------------------------------------------------+---------------+-------------+

| Proceeds from sale of property, plant | 0.1 | 1.5 |

| and equipment | | |

+----------------------------------------------------+---------------+-------------+

| Net cash used in investing activities | (27.8) | (37.0) |

+----------------------------------------------------+---------------+-------------+

| Cash flows from financing activities | | |

+----------------------------------------------------+---------------+-------------+

| Proceeds from issue of share capital | - | 0.1 |

+----------------------------------------------------+---------------+-------------+

| Net draw down of credit facilities | - | 3.2 |

+----------------------------------------------------+---------------+-------------+

| Repayment of borrowings | (22.0) | - |

+----------------------------------------------------+---------------+-------------+

| Transaction costs paid | (0.9) | - |

+----------------------------------------------------+---------------+-------------+

| Equity dividends paid | - | (2.9) |

+----------------------------------------------------+---------------+-------------+

| Net cash (used in) / generated from financing | (22.9) | 0.4 |

| activities | | |

+----------------------------------------------------+---------------+-------------+

| Effect of foreign exchange rate changes | 0.1 | (0.9) |

+----------------------------------------------------+---------------+-------------+

| Net increase in cash in the year | 7.8 | 0.1 |

+----------------------------------------------------+---------------+-------------+

| Cash and cash equivalents at beginning of year | 4.0 | 3.9 |

+----------------------------------------------------+---------------+-------------+

| Cash and cash equivalents at end of year | 11.8 | 4.0 |

+----------------------------------------------------+---------------+-------------+

Consolidated Statement of Recognised Income and Expense

for the year ended 31 March 2009

+-----------------------------------------------------+--------------+---------------+

| | Unaudited | Audited |

| | 2009 | 2008 |

+-----------------------------------------------------+--------------+---------------+

| | GBPm | GBPm |

+-----------------------------------------------------+--------------+---------------+

| Fair value (losses)/gains, gross of tax: | | |

+-----------------------------------------------------+--------------+---------------+

| On cash flow hedges: | | |

+-----------------------------------------------------+--------------+---------------+

| Transfers to profit and loss on maturity of cash | 2.3 | (0.9) |

| flow hedges | | |

+-----------------------------------------------------+--------------+---------------+

| Changes in fair value of cash flow hedges | (14.1) | 13.9 |

+-----------------------------------------------------+--------------+---------------+

| Taxation on items taken directly to equity | 3.7 | (3.9) |

+-----------------------------------------------------+--------------+---------------+

| Exchange differences on translation of foreign | (0.2) | 0.2 |

| operations | | |

+-----------------------------------------------------+--------------+---------------+

| Net Income and expense recognised directly in | (8.3) | 9.3 |

| equity | | |

+-----------------------------------------------------+--------------+---------------+

| Profit for the year | 27.1 | 8.7 |

+-----------------------------------------------------+--------------+---------------+

| Total recognised income and expense for the year | 18.8 | 18.0 |

| (all attributable to equity holders of the parent) | | |

+-----------------------------------------------------+--------------+---------------+

NOTES TO THE GROUP FINANCIAL STATEMENTS

1. General information

The Group's Financial Statements consolidate the Financial Statements of Dart

Group PLC and its subsidiaries. The Group's Financial Statements have been

prepared and approved by the Directors in accordance with International

Financial Reporting Standards ("IFRSs") as adopted by the European Union

("Adopted IFRSs").

2. Basis of preparation

The financial statements have been prepared under the historical cost convention

except for all derivative financial instruments that have been measured at fair

value and disposal groups held for sale that have been measured at the lower of

fair value less costs to sell and their carrying amounts prior to the decision

to treat them as held for sale.

In order to allow a better understanding of the financial information presented,

and specifically the Group's underlying business performance, the Group presents

its income statement in three columns such that it identifies: (i) results

excluding specific IAS 39 fair value movements; (ii) the effect of specific IAS

39 fair value movements; and (iii) results for the year. For the purpose of

clarity, in the explanation of the basis of preparation applied in these

consolidated financial statements, we describe these columns as the "left hand

column", the "middle column" and the "right hand column" respectively.

The Group uses forward foreign currency contracts, currency option products and

aviation fuel swaps to hedge exposure to foreign exchange rates and aviation

fuel price volatility. Such derivative financial instruments are stated at fair

value.

Ineffectiveness in qualifying cash flow hedges under IAS 39 can arise as a

result of the difference between the contractual profile of a hedge and the

profile of transactions defined as the hedged item. IAS 39 requires

ineffectiveness in qualifying cash flow hedges to be recorded in the income

statement, and therefore the Group records this ineffectiveness in the left hand

column when it relates to a cash flow hedge.

IFRS compliant hedge documentation was not in place prior to 1 April 2007.

Movements in the fair value of derivatives in existence at this time, along with

subsequent fair value movements on these cash flow hedges that would have

qualified for hedge accounting had the documentation requirement been met, are

separately presented in the middle column to assist the readers understanding of

underlying business performance and to provide a more meaningful presentation.

For the avoidance of doubt, references to underlying performance refer to the

left hand column.

The right hand column presents the results for the year showing all gains and

losses recorded in the Consolidated Group Income Statement.

The financial information in this announcement is presented in pounds sterling

and all values are rounded to the nearest GBP100,000, except where indicated

otherwise.

The accounting policies adopted are consistent with those described in the

Annual Report and Accounts for the year ended 31 March 2008 with the exception

of the following:

Revenue

The Group operates a loyalty programme. The programme operates through the

airline's 'myJet2' loyalty scheme and allows members of the scheme to accumulate

points that entitle them to primarily free travel. Revenue is recorded at the

amount of consideration received or receivable, less the fair value of the

points awarded. The full fair value of the points is deducted from the

consideration, and carried forward as a liability.

3. Earnings per share

Earnings per share is presented both before specific IAS 39 fair value movements

and after specific IAS 39 fair value movements in order to allow a better

understanding of the financial information presented, and specifically the

Group's underlying business performance.

+-------------------------------------------------------------+------------------------+--------------------------+

| | Unaudited | Audited |

| | 2009 | 2008 |

+-------------------------------------------------------------+------------------------+--------------------------+

| | No. | No. |

+-------------------------------------------------------------+------------------------+--------------------------+

| Basic weighted average number of shares in | 141,065,694 | 141,029,664 |

| issue | | |

+-------------------------------------------------------------+------------------------+--------------------------+

| Dilutive potential ordinary shares: | | |

+-------------------------------------------------------------+------------------------+--------------------------+

| Employee share options | 3,524 ,964 | 2,062,732 |

+-------------------------------------------------------------+------------------------+--------------------------+

| | | |

+-------------------------------------------------------------+------------------------+--------------------------+

| Diluted weighted average number of shares in | 144,590,658 | 143,092,396 |

| issue | | |

+-------------------------------------------------------------+------------------------+--------------------------+

+---------------------------------------------+----------------------------+-------------------+

| Basis of calculation - earnings (basic and | GBPm | GBPm |

| diluted) | | |

+---------------------------------------------+----------------------------+-------------------+

| Profit before specific IAS 39 fair value | 23.7 | 3.1 |

| movements | | |

+---------------------------------------------+----------------------------+-------------------+

| Specific IAS 39 fair value movements | 3.4 | 5.6 |

+---------------------------------------------+----------------------------+-------------------+

| Profit after specific IAS 39 fair value | 27.1 | 8.7 |

| movements for the purposes of calculating | | |

| basic and diluted earnings | | |

+---------------------------------------------+----------------------------+-------------------+

+---------------------+--+------------------------+------------------------+--+------------------------+------------------------+

| | | Year to 31 | | Year to 31 March |

| | | March 2009 | | 2008 |

+---------------------+--+-------------------------------------------------+--+-------------------------------------------------+

| | | Before | After | | Before | After |

| | | specific | specific | | specific | specific |

| | | IAS 39 | IAS 39 | | IAS 39 | IAS 39 |

| | | fair | fair | | fair | fair |

| | | value | value | | value | value |

| | | movements | movements | | movements | movements |

+---------------------+--+------------------------+------------------------+--+------------------------+------------------------+

| Earnings per share - | | | | |

| Total | | | | |

+-------------------------------------------------+------------------------+--+------------------------+------------------------+

| - basic | | 16.87p | 19.27p | | 2.15p | 6.18p |

+---------------------+--+------------------------+------------------------+--+------------------------+------------------------+

| - diluted | | 16.46p | 18.80p | | 2.12p | 6.13p |

+---------------------+--+------------------------+------------------------+--+------------------------+------------------------+

4. Segmental Reporting

Business segments

The primary reporting segment format is business segments as the Group's risk

and rates of return are affected predominantly by the different services

provided. Secondary segmental information is reported geographically.

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Unaudited | Distribution | Aviation | Un-allocated | Total |

| Year ended 31 March 2009 | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| | GBPm | GBPm | GBPm | GBPm |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Revenue | 112.9 | 326.4 | - | 439.3 |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Operating profit before | 4.1 | 31.1 | - | 35.2 |

| specific fair value | | | | |

| movements | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Specific fair value movements | - | 4.7 | - | 4.7 |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Operating profit after | 4.1 | 35.8 | - | 39.9 |

| specific fair value | | | | |

| movements | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Finance income | - | 0.8 | 0.1 | 0.9 |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Finance costs | - | (2.8) | (4.5) | (7.3) |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Profit/(loss) before | 4.1 | 33.8 | (4.4) | 33.5 |

| taxation | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Taxation | - | - | (6.4) | (6.4) |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Profit/(loss) for the year | 4.1 | 33.8 | (10.8) | 27.1 |

| after taxation | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Audited | Distribution | Aviation | Un-allocated | Total |

| Year ended 31 March 2008 | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| | GBPm | GBPm | GBPm | GBPm |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Revenue | 120.5 | 308.8 | - | 429.3 |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Operating profit before | 5.3 | 0.3 | - | 5.6 |

| specific fair value | | | | |

| movements | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Specific fair value movements | - | 7.9 | - | 7.9 |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Operating profit after fair | 5.3 | 8.2 | - | 13.5 |

| value movements | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Profit on disposal of | - | 1.3 | - | 1.3 |

| property, plant and | | | | |

| equipment | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Finance income | - | 2.6 | 0.1 | 2.7 |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Finance costs | - | (1.3) | (4.4) | (5.7) |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Profit/(loss) before | 5.3 | 10.8 | (4.3) | 11.8 |

| taxation | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Taxation | - | - | (3.1) | (3.1) |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| Profit/(loss) for the year | 5.3 | 10.8 | (7.4) | 8.7 |

| after taxation | | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

| | | | |

+---------------------------------+---------------------------+-----------------------+---------------------------+--------------------+

5. The financial information set out above does not constitute the company's

statutory accounts for the years ended 31 March 2009 or 2008. The financial

information for 2008 is derived from the statutory accounts for 2008 which have

been delivered to the registrar of companies. The auditors have reported on the

2008 accounts; their report was (i) unqualified, (ii) did not include a

reference to any matters to which the auditors drew attention by way of emphasis

without qualifying their report and (iii) did not contain a statement under

section 237(2) or (3) of the Companies Act 1985. The statutory accounts for 2009

will be finalised on the basis of the financial information presented by the

directors in this preliminary announcement and will be delivered to the

registrar of companies in due course.

6. The 2009 Annual Report and Accounts (together with the Auditor's Report) will

be posted to shareholders no later than 11 August 2009. The Annual General

Meeting will be held on 9 September 2009.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DGGDRSUDGGCC

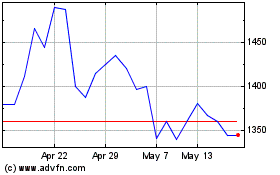

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

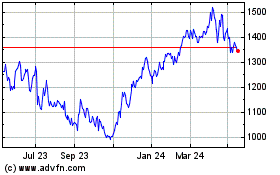

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024