TIDMDTG

RNS Number : 3833W

Dart Group PLC

18 November 2010

DART GROUP PLC

Interim Results

Dart Group PLC (the "Group"), the aviation and distribution group, announces its

interim results for the half year ended 30 September 2010. These results are

presented under International Financial Reporting Standards (IFRS).

Highlights

· Turnover up 25% to GBP340.4m (2009: GBP272.7m)

· Pre-tax profits up 38% to GBP38.7m (2009: GBP28.1m)

· Underlying pre-tax profits up 50% to GBP38.5m (2009: GBP25.7m)

· Jet2.com load factors increased to 87.5% (2009: 81.3%)

· Fowler Welch-Coolchain revenue up 23% to GBP70.4m (2009: GBP57.3m)

· GBP31.0m net cash generated from operating activities, before capex (2009:

GBP12.2m)

· Interim dividend declared at 0.40p per share (2009: 0.36p)

· Full year results anticipated to be ahead of market expectations, despite

increased losses forecast in the second half due to business growth

Chairman's Statement

I am pleased to report on the Group's trading for the six months ended 30

September 2010. The Group's profit before tax was GBP38.7m, an increase of 38%

on last year (2009: GBP28.1m).

On an underlying basis (excluding the specific IAS39 mark to market

adjustments), profit before tax amounted to GBP38.5m (2009: GBP25.7m),

reflecting a stronger performance in the aviation business. Jet2.com, the

Group's leisure airline, achieved both higher load factors and increased overall

yield per passenger. Underlying EBITDA increased by 60% to GBP64.0m (2009:

GBP40.0m).

Net cash flow from operations of GBP31.0m was generated in the period (2009:

GBP12.2m), before total capital expenditure amounting to GBP35.0m (2009:

GBP6.5m). The significant increase in capital expenditure reflected further

investment in the business with the acquisition of a freehold distribution

centre in Heywood, Greater Manchester, together with a higher number of aircraft

engine overhauls than the previous year. After capital expenditure, the Group

has reported an overall cash outflow of GBP4.2m in the period (2009: cash inflow

GBP4.7m). Net cash at the end of the period amounted to GBP47.7m, a GBP31.6m

improvement on September 2009, with Jet2.com customer advance payments of circa

GBP40m at 30 September 2010.

The Board has decided to pay an increased interim dividend of 0.40p per share,

in recognition of the Group's trading performance in the period. The dividend

will be paid on 28 January 2011 to shareholders on the register at 7 January

2011.

Aviation

Jet2.com, the Group's leisure airline, has continued to focus on its core

leisure routes from its seven Northern bases (Belfast, Blackpool, East Midlands,

Edinburgh, Leeds Bradford, Manchester and Newcastle), and increased its services

to Eastern Mediterranean destinations. The company operates 34 aircraft of

which 30 (21 Boeing 737-300s and 9 Boeing 757-200s) are owned by the Group.

In total, Aviation revenues rose by 25% to GBP270m, as a result of increased

passenger volumes, higher average revenues per passenger and continued growth in

Jet2holidays, the Group's ATOL bonded tour operator. This revenue growth was

achieved despite the disruption to Jet2.com's flying programme caused by volcano

Eyjafjallaj?kull, which resulted in the cancellation of over 400 flights. The

overall profit impact as a result of this disruption is estimated to have

amounted to GBP3m, comprising refunded flight revenues, compensation claims and

the repatriation of customers who were stranded overseas, together with an

estimate of lost revenues, offset by variable operating cost savings on

cancelled flights.

In the six months to 30 September 2010 we flew 2.4m scheduled passengers (2009:

2.2m) with the total number of routes served from all bases rising to 117 (2009:

94). We were able to increase load factors in Summer 2010 through a combination

of increased customer demand, the introduction of further enhancements to our

yield management systems, additional sales of allocations to third party tour

operators, the growth of Jet2holidays, and by focusing on flying popular leisure

routes at departure times convenient to our customers. Ticket yields increased

8% year on year partly as a result of the change in mix towards longer haul

destinations. We provide our customers with the unique proposition of "great

flight times", "22kg baggage allowance", "allocated seating" and "loyalty points

for free flights" as they start their holidays with us.

Jet2.com has opened a base at Glasgow airport (its eighth UK location) from

which services to nine sun destinations will be operated from March 2011 (which

are also on sale as package holiday destinations with Jet2holidays). We have

expanded our operations at East Midlands, Newcastle and Manchester Airports for

Summer 2011 with more flights to proven Jet2.com leisure destinations. Overall,

we have planned a 26% increase in scheduled seat capacity; new destinations for

next summer include Bodrum, Dordogne Valley (Brive) and Hurghada in Egypt, and

we have increased capacity to the Balearics, Portugal and Spain.

For Winter 2010/11, Jet2.com has increased its overall seat capacity by 29%,

driven by the first winter of services from East Midlands, the introduction of

services supported by tour operators including to Hurghada, and increased flying

to Salzburg and Geneva. A number of successful summer services will be flown

with increased winter frequencies, including Manchester routes to Budapest,

Murcia, Prague and Rome where competitors have either reduced or withdrawn

capacity.

Jet2holidays, our ATOL protected tour operator, carried over 71,000 customers on

package holidays in the half year to 30 September 2010, a 51% increase over the

same period last year. We offer holiday packages encompassing flights,

transfers, and accommodation ranging from budget self catering to five star

luxury hotels. We intend that Jet2holidays will grow through providing our

leisure customers with great holidays from their local airports, flying with

Jet2.com.

Retail revenues are continuously being developed, with revenue per passenger

increasing to GBP25.93 during this half year (2009: GBP20.70). This increase is

principally driven by sales made possible by our proprietary reservation system.

Pre-ordered meals, advanced seat assignment, and extra leg room seats lend

themselves well to the leisure profile of our customers and have all proved

successful. We will grow our retail revenues with new features such as targeted

discounted bundles, offering our customers more travel related products in one

easy purchase e.g. tailored travel insurance, great value car hire, and

hand-held entertainment devices.

Our passenger charter operation has operated 369 flights in the six months to 30

September 2010 (2009: 315) and forward bookings for the winter are encouraging.

We are proud to fly our 18 nightly services for the Royal Mail ensuring that the

first class post arrives on time, in line with demanding service levels. In

total, charter revenues were up 5% in the first half of the year.

Distribution

The Group's logistics company, Fowler Welch-Coolchain, provides an integrated

supply chain solution for retailers, food manufacturers, growers and importers.

Services provided from its distribution centres in Spalding (Lincolnshire),

Teynham (Kent), Washington (Tyne & Wear), Heywood (Greater Manchester) and

Portsmouth (Hampshire) include both chilled and ambient storage and

distribution, together with value adding pick-to-order warehousing operations.

The company also has port operations in Felixstowe, Sheerness and Southampton

which provide transport services for imported container traffic.

Our new 50,000 pallet capacity Heywood distribution centre, "The Hub",

strategically located for Manchester and just two minutes from the M62,

purchased in May 2010, has now been commissioned following completion of the

initial investment in the site infrastructure. Improvements include enlarged

and upgraded office space, loading and yard areas, enabling The Hub to become

the focal point for our ambient business. It will replace our previous 19,000

pallet, leasehold, ambient site in Stockport prior to Christmas 2010 as planned.

Year-on-year there has been an 18% increase in ambient business volumes, with

several new customer wins and significant further growth from our supermarket

customers. The much greater capacity of The Hub will facilitate growth in our

ambient business. Encouragingly, the ambient sales pipeline is strong and there

are also good prospects for new chilled distribution business, which will be

operated from The Hub as it is developed.

In the North East, Washington has continued to grow with a year-on-year sales

increase of 47% for the first six months. Developments are underway to

replicate our North East Tesco store delivery operation in other regions in the

near future. The company's European, Kent and Portsmouth sites have also traded

strongly, each seeing sales growth in excess of 20%. Similarly, our new ambient

contract in Desborough (Northamptonshire) has traded ahead of expected volumes

in the first six months and we hope to see further growth here early in 2011.

Our Spalding distribution centre, the location of the Company's head office,

remains the largest site in the network with substantial temperature controlled

and ambient facilities, and is the principal consolidation point for many

deliveries across the Fowler Welch-Coolchain network. An additional ten acres

of land previously purchased immediately adjacent to the Spalding site is now

under development, initially for vehicle parking, but with the expectation of

additional warehouse space in the future.

Elsewhere, Bawdsey Haulage Limited, located in Felixstowe, has been renamed

Fowler Welch (Containers) Limited and has been restructured to include the

Sheerness port operations team, which will continue to be integrated into the

Fowler Welch-Coolchain network in the remainder of this financial year.

Our IT infrastructure is being developed across the business. The Manhattan

Warehouse Management System has been implemented across the company, yielding

significant operating efficiencies. The next step in the systems evolution for

Fowler Welch-Coolchain will be to upgrade the Transport Management System in

2011, enhancing the service offered to customers and giving greater transparency

for managing fleet resources. Investment in fleet telemetry and engine

diagnostics, together with a continued expansion of our double-deck trailer

fleet, will not only generate fuel savings and operating efficiencies, but

further reduce our carbon footprint.

Overall, revenues grew by 23% year-on-year as a result of both new business wins

and additional volumes with existing customers, although operating margins have

suffered due to higher short term vehicle lease costs and further investment in

our own fleet to maintain our high standard of customer service levels. The

acquisition and commissioning of The Hub has also resulted in short term dual

running costs.

Whilst the marketplace remains extremely competitive, the outlook for Fowler

Welch-Coolchain is encouraging. The company's focused commitment to operational

excellence, its national network coverage, and its growing presence in the

ambient arena positions it well for future growth.

Outlook

Performance in the Group's stronger six-month trading period has outperformed

our expectations, despite the Icelandic volcano. However, the Group expects to

report increased losses in the second half of the financial year as a result of

our ongoing investment for continued growth. This reflects expansion of the

Aviation business's cost base, which is being carried through the traditionally

loss making winter months, and Fowler Welch-Coolchain's growth related operating

cost increases including the development of The Hub.

Nevertheless, I am pleased to report that Jet2.com's overall forward booking

levels are encouraging and we expect that Fowler Welch-Coolchain will see

continued revenue growth next year.

As a result of the Group's strong trading performance in the first half of the

year, we expect full year results to be ahead of current market expectations.

Philip Meeson

Chairman

18 November 2010

www.dartgroup.co.uk

Enquiries:

+-----------------------------------+-----------------------------------+

| Philip Meeson, Chairman | Mobile: 07785 258666 |

+-----------------------------------+-----------------------------------+

| Andrew Merrick, Group Finance | Mobile: 07788 565358 |

| Director | |

+-----------------------------------+-----------------------------------+

| Andy Pedrette / Charles Combe, | |

| Smith & Williamson Corporate | 020 7131 4000 |

| Finance Limited | |

+-----------------------------------+-----------------------------------+

Dart Group PLC

Consolidated Group Income Statement (unaudited)

For the half year ended 30 September 2010

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | Half year ended 30 | | Half year ended 30 | | Year ended 31 March |

| | | September 2010 | | September 2009 | | 2010 - Audited |

+------------------------+------+---------------------------------+----------+---------------------------------+----------+---------------------------------+

| | | Results | | | | Results | | | | Results | | |

| | | before | Specific | | | before | Specific | | | before | Specific | |

| | | specific | fair | Results | | specific | fair | Results | | specific | fair | Results |

| | | fair | value | for the | | fair | value | for the | | fair | value | for the |

| | | value | movements | period | | value | movements | period | | value | movements | year |

| | | movements | [1] | | | movements | [1] | | | movements | [1] | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Continuing operations |Note | GBPm | GBPm | GBPm | | GBPm | GBPm | GBPm | | GBPm | GBPm | GBPm |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Turnover | 4 | 340.4 | - | 340.4 | | 272.7 | - | 272.7 | | 434.5 | - | 434.5 |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Net operating expenses | | (301.7) | 0.2 | (301.5) | | (247.4) | 2.4 | (245.0) | | (415.1) | 3.1 | (412.0) |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Operating profit | | 38.7 | 0.2 | 38.9 | | 25.3 | 2.4 | 27.7 | | 19.4 | 3.1 | 22.5 |

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Finance income | | 1.2 | - | 1.2 | | 2.2 | - | 2.2 | | 1.9 | - | 1.9 |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Finance costs | | (1.4) | - | (1.4) | | (1.8) | - | (1.8) | | (2.4) | - | (2.4) |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Net financing costs | | (0.2) | - | (0.2) | | 0.4 | - | 0.4 | | (0.5) | - | (0.5) |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Profit on disposal of | | - | - | - | | - | - | - | | 0.2 | - | 0.2 |

| fixed assets | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Profit before taxation | 38.5 | 0.2 | 38.7 | | 25.7 | 2.4 | 28.1 | | 19.1 | 3.1 | 22.2 |

+-------------------------------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Taxation | 7 | (10.7) | - | (10.7) | | (7.2) | (0.7) | (7.9) | | (5.6) | (1.0) | (6.6) |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Profit for the period | | 27.8 | 0.2 | 28.0 | | 18.5 | 1.7 | 20.2 | | 13.5 | 2.1 | 15.6 |

| (all attributable to | | | | | | | | | | | | |

| equity shareholders of | | | | | | | | | | | | |

| the Parent) | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Earnings per share - | 5 | | | | | | | | | | | |

| total [2] | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| - basic | | | | 19.72p | | | | 14.31p | | | | 11.06p |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| - diluted | | | | 18.87p | | | | 13.83p | | | | 10.62p |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| Non - GAAP measures | | | | | | | | | | | |

| Underlying earnings per | | | | | | | | | | | |

| share [3] | | | | | | | | | | | |

+-------------------------------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| - basic | | 19.63p | | | | 13.10p | | | | 9.54p | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| - diluted | | 18.79p | | | | 12.67p | | | | 9.17p | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

| | | | | | | | | | | | | |

+------------------------+------+-----------+-----------+---------+----------+-----------+-----------+---------+----------+-----------+-----------+---------+

[1] In order to assist the reader to understand the underlying business

performance, the Group discloses separately within the income statement specific

IAS 39 fair value movements (refer to note 2 accounting policies - basis of

preparation of the interim report).

[2] Earnings per share is calculated in accordance with IAS 33, "Earnings per

share".

[3] Underlying earnings per share excludes specific fair value movements [1].

Dart Group PLC

Consolidated Group Statement of Comprehensive Income (unaudited)

For the half year ended 30 September 2010

+-----------------------------+----+------------+----------+-----------+----------+---------+

| | | Half year | | Half year | | Year |

| | | ended 30 | | ended 30 | | ended |

| | | September | | September | | 31 |

| | | 2010 | | 2009 | | March |

| | | | | | | 2010 |

| | | GBPm | | GBPm | | Audited |

| | | | | | | |

| | | | | | | GBPm |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| Profit for the period | | 28.0 | | 20.2 | | 15.6 |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| Effective portion of | | (21.5) | | (0.5) | | 10.6 |

| changes in fair value | | | | | | |

| movements in cash flow | | | | | | |

| hedges | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| Net change in fair value of | | - | | - | | 0.1 |

| effective cash flow hedges | | | | | | |

| transferred to profit | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| Taxation on components of | | 6.0 | | 0.1 | | (3.0) |

| other comprehensive income | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| Other comprehensive income | | (15.5) | | (0.4) | | 7.7 |

| & expense for the period, | | | | | | |

| net of taxation | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| Total comprehensive income | | 12.5 | | 19.8 | | 23.3 |

| for the period, all | | | | | | |

| attributable to owners of | | | | | | |

| the parent | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

| | | | | | | |

+-----------------------------+----+------------+----------+-----------+----------+---------+

Dart Group PLC

Consolidated Group Balance Sheet (unaudited)

As at 30 September 2010

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | 30 | | 30 | | 31 March |

| | | September | | September | | 2010 |

| | | 2010 | | 2009 | | Audited |

| | | | | | | |

| | | GBPm | | GBPm | | GBPm |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Non-current assets | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Goodwill | | 7.0 | | 7.0 | | 7.0 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Property, plant and | | 201.3 | | 183.4 | | 191.4 |

| equipment | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Derivative financial | | 1.2 | | 5.0 | | 2.9 |

| instruments | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | 209.5 | | 195.4 | | 201.3 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Current assets | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Inventories | | 0.4 | | 1.0 | | 0.3 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Trade and other | | 68.9 | | 45.4 | | 66.8 |

| receivables | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Derivative financial | | 6.3 | | 6.3 | | 18.8 |

| instruments | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Cash and cash | | 48.0 | | 16.5 | | 52.2 |

| equivalents | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | 123.6 | | 69.2 | | 138.1 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Total assets | | 333.1 | | 264.6 | | 339.4 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Current liabilities | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Trade and other | | 163.0 | | 114.5 | | 181.9 |

| payables | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Borrowings | | 0.3 | | 0.4 | | 0.3 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Derivative financial | | 12.0 | | 2.0 | | 9.4 |

| instruments | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | 175.3 | | 116.9 | | 191.6 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Non-current | | | | | | |

| liabilities | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Other non-current | | 8.6 | | 6.1 | | 6.6 |

| liabilities | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Borrowings | | - | | - | | 0.3 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Derivative financial | | 4.0 | | 7.3 | | 0.3 |

| instruments | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Deferred tax | | 16.8 | | 20.9 | | 25.1 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | 29.4 | | 34.3 | | 32.3 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Total liabilities | | 204.7 | | 151.2 | | 223.9 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Net assets | | 128.4 | | 113.4 | | 115.5 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Shareholders' equity | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Called up share | | 1.8 | | 1.8 | | 1.8 |

| capital | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Share premium | | 9.5 | | 9.3 | | 9.3 |

| account | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Cash flow hedging | | (5.9) | | 1.5 | | 9.6 |

| reserve | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Retained earnings | | 123.0 | | 100.8 | | 94.8 |

+----------------------+--+-----------+----------+-----------+-+-----------+

| Total shareholders' | | 128.4 | | 113.4 | | 115.5 |

| equity | | | | | | |

+----------------------+--+-----------+----------+-----------+-+-----------+

Dart Group PLC

Consolidated Group Cash Flow Statement (unaudited)

For the half year ended 30 September 2010

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | Half | | Half | | Year |

| | | year | | year | | ended |

| | | ended | | ended | | 31 March |

| | | 30 | | 30 | | 2010 |

| | | September | | September | | Audited |

| | | 2010 | | 2009 | | |

| | | | | | | |

| | | GBPm | | GBPm | | GBPm |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Cash flows from operating | | | | | | |

| activities | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Profit before taxation from | 38.7 | | 28.1 | | 22.2 |

| continuing operations | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Adjustments for: | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Finance income | | (1.2) | | (2.2) | | (1.9) |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Finance costs | | 1.4 | | 1.8 | | 2.4 |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Profit on disposal of | | - | | - | | (0.2) |

| property, plant and | | | | | | |

| equipment | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Depreciation | | 25.1 | | 14.7 | | 33.0 |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Net financial derivative | | (1.8) | | 7.4 | | 6.0 |

| close out (gain) / cost | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Equity settled share based | | 0.2 | | - | | 0.3 |

| payments | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Specific fair value | | - | | (2.4) | | (2.8) |

| movements | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Operating cash flows before | | 62.4 | | 47.4 | | 59.0 |

| movements in working capital | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| (Increase) / decrease in | | (0.1) | | (0.6) | | 0.1 |

| inventories | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| (Increase) / decrease in trade | (3.1) | | 0.6 | | (21.8) |

| and other receivables | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| (Decrease) / increase in trade | (27.3) | | (33.4) | | 40.0 |

| and other payables | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Cash generated from | | 31.9 | | 14.0 | | 77.3 |

| operations | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Interest paid | | (0.5) | | (1.8) | | (2.4) |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Income taxes paid | | (0.4) | | - | | (1.7) |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Net cash from operating | 31.0 | | 12.2 | | 73.2 |

| activities | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Cash flows from investing | | | | | | |

| activities | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Purchase of property, plant and | (35.0) | | (5.8) | | (32.1) |

| equipment | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| Business acquisitions | | - | | (0.7) | | (0.5) |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Proceeds from sale of | | - | | - | | 0.3 |

| property, plant and | | | | | | |

| equipment | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Net cash used in investing | | (35.0) | | (6.5) | | (32.3) |

| activities | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Cash flows from financing | | | | | | |

| activities | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Repayment of borrowings | (0.3) | | - | | (0.4) |

+---------------------------------+-----------+----------+-----------+----------+----------+

| Proceeds on issue of shares | | 0.2 | | - | | - |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Equity dividends paid | | - | | (1.0) | | (1.5) |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Net cash used in financing | (0.1) | | (1.0) | | (1.9) |

| activities | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Effect of foreign exchange | | (0.1) | | - | | 1.4 |

| rate changes | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Net (decrease) / increase in | (4.2) | | 4.7 | | 40.4 |

| cash in the period | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Cash and cash equivalents at | 52.2 | | 11.8 | | 11.8 |

| beginning of period | | | | | |

+---------------------------------+-----------+----------+-----------+----------+----------+

| | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

| Cash and cash equivalents at | | 48.0 | | 16.5 | | 52.2 |

| end of period | | | | | | |

+------------------------------+--+-----------+----------+-----------+----------+----------+

Dart Group PLC

Consolidated Group Statement of Changes in Equity (unaudited)

For the half year ended 30 September 2010

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | Share | | Share | | Cash flow | | Retained | | | Total |

| | | capital | | premium | | hedging | | earnings | | | reserves |

| | | | | | | reserve | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | GBPm | | GBPm | | GBPm | | GBPm | | | GBPm |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Balance at 1 April 2009 | | 1.8 | | 9.3 | | 1.9 | | 80.4 | | | 93.4 |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Total comprehensive | | - | | - | | (0.4) | | 20.2 | | | 19.8 |

| income for the period | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Share based payments | | - | | - | | - | | 0.2 | | | 0.2 |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Balance at 30 September | | 1.8 | | 9.3 | | 1.5 | | 100.8 | | | 113.4 |

| 2009 | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Total comprehensive | | - | | - | | 8.1 | | (4.6) | | | 3.5 |

| income for the period | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Dividends paid in the | | - | | - | | - | | (1.5) | | | (1.5) |

| period | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Share based payments | | - | | - | | - | | 0.1 | | | 0.1 |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Balance at 31 March 2010 | | 1.8 | | 9.3 | | 9.6 | | 94.8 | | | 115.5 |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Total comprehensive | | - | | - | | (15.5) | | 28.0 | | | 12.5 |

| income for the period | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Share based payments | | - | | - | | - | | 0.2 | | | 0.2 |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Issue of share capital | | - | | 0.2 | | - | | - | | | 0.2 |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

| Balance at 30 September | | 1.8 | | 9.5 | | (5.9) | | 123.0 | | | 128.4 |

| 2010 | | | | | | | | | | | |

+--------------------------+--+----------+----------+---------+----------+-----------+----------+----------+----------+----------+----------+

Dart Group PLC

Notes to the consolidated financial statements

For the half year ended 30 September 2010 (unaudited)

1. General information

The accounts for Dart Group PLC (the "Group") have been prepared and approved by

the Directors in accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union ("Adopted IFRS"). The Group's accounts

consolidate the accounts of Dart Group PLC and its subsidiaries.

The interim report for the six months ended 30 September 2010 was approved by

the Board of Directors on 17 November 2010.

2. Accounting policies

Basis of preparation of the interim report

The financial statements have been prepared under the historical cost convention

except for all derivative financial instruments that have been measured at fair

value and disposal groups held for sale that have been measured at the lower of

fair value, less costs to sell, and their carrying amounts prior to the decision

to treat them as held for sale.

In order to allow a better understanding of the financial information presented,

and specifically the Group's underlying business performance, the Group presents

its income statement in three columns such that it identifies: (i) results

before specific IAS 39 fair value movements; (ii) the effect of specific IAS 39

fair value movements; and (iii) results for the period. For the purpose of

clarity, in the explanation of the basis of preparation applied to these

consolidated financial statements, we describe these columns as the "left hand

column", the "middle column" and the "right hand column" respectively.

The Group uses forward foreign currency contracts, currency option products and

aviation fuel swaps to hedge exposure to foreign exchange rates and aviation

fuel price volatility. Such derivative financial instruments are stated at fair

value.

Ineffectiveness in qualifying cash flow hedges under IAS 39 can arise as a

result of the difference between the contractual profile of a hedge and the

profile of transactions defined as the hedged item. IAS 39 requires

ineffectiveness in qualifying cash flow hedges to be recorded in the income

statement, and therefore the Group records this ineffectiveness in the left hand

column when it relates to a cash flow hedge, reflecting underlying performance.

IFRS compliant hedge documentation was not in place prior to 1 April 2007.

Movements in the fair value of derivatives in existence at this time, along with

subsequent fair value movements on these cash flow hedges that would have

qualified for hedge accounting had the documentation requirement been met, are

separately presented in the middle column to assist the reader's understanding

of underlying business performance and to provide a more meaningful

presentation.

The right hand column presents the results for the period showing all gains and

losses recorded in the consolidated Group income statement.

The Group's accounts are presented in pounds sterling and all values are rounded

to the nearest GBP100,000 except where indicated otherwise.

Going Concern

The Directors have prepared financial forecasts for the Group, comprising

operating profit, balance sheet and cash flows through to 31 March 2013.

For the purposes of their assessment of the appropriateness of the preparation

of the Group's unaudited interim accounts on a going concern basis, the

Directors have considered the current cash position, the availability of bank

facilities and forecasts of future trading. The Directors have assessed the

underlying assumptions and principal areas of uncertainty within these

forecasts, in particular those related to market and customer risks, cost

management, working capital management and treasury risks. A number of these are

subject to market uncertainty and impact financial covenants. Recognising the

potential uncertainty, the Directors have considered a range of actions

available to mitigate the impact of these potential risks should they

crystallise and have also reviewed the key strategies which underpin the

forecast and the Group's ability to implement them successfully.

On the basis of the current liquidity position, the forecasts and these

considerations, the Directors have assessed future covenant compliance and

headroom for the foreseeable future and conclude that it is appropriate for the

unaudited financial statements for the period ended 30 September 2010 to be

prepared on a going concern basis.

3. Adoption of new and revised standards

The following new or revised IFRS standards and IFRIC interpretations will be

adopted for purposes of the preparation of future financial statements, where

applicable. We do not anticipate that the adoption of these new or revised

standards and interpretations will have a material impact on our financial

position or results from operations.

· IAS 24 (revised 2009), "Related Party Disclosures" (effective for fiscal

periods beginning on or after January 1, 2011).

· Amendments to IFRIC 14, "IAS 19 - The Limit on a Defined Benefit Assets,

Minimum Funding Requirements and their Interaction" (effective for fiscal

periods beginning on or after January 1, 2011).

· IFRIC 19, "Extinguishing Financial Liabilities with Equity Instruments"

(effective for fiscal periods beginning on or after July 1, 2010).

· IFRS 9, "Financial Instruments" (effective for fiscal periods beginning on

or after January 1, 2013).

· The IASB's third annual improvements project, "Improvements to

International Financial Reporting Standards 2010", published on May 6, 2010

(effective dates are dealt with on a standard-by-standard basis).

4. Segmental information

Business Segments

The Group's businesses are organised into two operating segments:

· Aviation, comprising the Group's scheduled leisure airline and tour

operations, trading under the Jet2.com and Jet2holidays.com brands; and

· Distribution, comprising the Group's logistic operations.

These divisions are the basis on which the Group reports its primary segmental

information in the day-to-day management of the business. The following is an

analysis of the Group's revenue by operating segment.

Revenue from reportable segments is measured on a basis consistent with the

income statement. All segment revenue is derived wholly from external customers

hence intersegment revenue is nil. Revenue is principally generated from within

the UK, the Group's country of domicile.

+----------------------------+-----------+----------+-----------+----------+---------+

| Segmental Revenues | Half | | Half | | Year to |

| | year to | | year to | | |

| | 30 | | 30 | | 31 |

| | September | | September | | March |

| | 2010 | | 2009 | | 2010 |

| | | | | | Audited |

| | | | | | |

| | GBPm | | GBPm | | GBPm |

+----------------------------+-----------+----------+-----------+----------+---------+

| | | | | | |

+----------------------------+-----------+----------+-----------+----------+---------+

| Aviation | 270.0 | | 215.4 | | 312.0 |

+----------------------------+-----------+----------+-----------+----------+---------+

| Distribution | 70.4 | | 57.3 | | 122.5 |

+----------------------------+-----------+----------+-----------+----------+---------+

| | 340.4 | | 272.7 | | 434.5 |

+----------------------------+-----------+----------+-----------+----------+---------+

5. Earnings per share

The calculation of earnings per share is based on the following:

+-----------------------------+-------------+----------+-------------+----------+-------------+

| | Half | | Half | | Year to |

| | year to | | year to | | 31 |

| | 30 | | 30 | | March |

| | September | | September | | 2010 |

| | 2010 | | 2009 | | Audited |

| | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

| | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

| Profit for the period | 28.0 | | 20.2 | | 15.6 |

| (GBPm) | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

| | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

| Weighted average number of | 141,349,326 | | 141,089,854 | | 141,117,098 |

| ordinary shares in issue | | | | | |

| during the period used to | | | | | |

| calculate basic earnings | | | | | |

| per share | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

| | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

| Weighted average number of | 147,718,753 | | 145,906,222 | | 146,856,883 |

| ordinary shares in issue | | | | | |

| during the period used to | | | | | |

| calculate diluted earnings | | | | | |

| per share | | | | | |

+-----------------------------+-------------+----------+-------------+----------+-------------+

6. Dividends

An interim dividend has been proposed during the six month period to 30

September 2010 of 0.40p per share (2009: 0.36p).

7. Taxation

The tax charge for the period of GBP10.7m is calculated by applying an estimated

effective tax rate of 28% to the profit for the period (2009: 28%). It was

announced in the 2010 Budget that a corporation tax rate of 27% will apply from

1 April 2011. As a result the Group's reported deferred tax liability of

GBP16.8m would reduce by GBP0.6m to GBP16.2m.

8. Reconciliation of net cash flow to movement in net cash

+---------------------------------------------------------------------------------+----------+----------+----------+----------+----------+

| Half Half Year | | | | | |

| year year to | | | | | |

| to to 30 | | | | | |

| 30 30 March | | | | | |

| September September 2010 | | | | | |

| 2010 2009 Audited | | | | | |

| | | | | | |

| GBPm GBPm GBPm | | | | | |

| (Decrease) / increase (4.2) 4.7 40.4 | | | | | |

| in cash in the period | | | | | |

| Movement in net debt 0.3 (0.4) 0.4 | | | | | |

| in the period | | | | | |

| Change in net cash | | | | | |

| resulting from cash (3.9) 4.3 40.8 | | | | | |

| flows in the period | | | | | |

| Other non cash changes - - (1.0) | | | | | |

| Net cash at beginning 51.6 11.8 11.8 | | | | | |

| of period | | | | | |

| Net cash at end of 47.7 16.1 51.6 | | | | | |

| period | | | | | |

| | | | | | |

+---------------------------------------------------------------------------------+----------+----------+----------+----------+----------+

9. Contingent liabilities

The Group has issued various guarantees in the ordinary course of business, none

of which are expected to lead to a financial gain or loss.

The Group is currently involved in litigation proceedings in the US against

Sutra Inc and Novak Niketic, who provided use of the reservation system operated

by Jet2.com until February 2008, in relation to the termination of the use of

this system. An unspecified counterclaim has been lodged which is being

vigorously defended by the Group in respect of which the Directors estimate

approximately $2.5m liability in the unlikely event that the counterclaim is

successful.

10. Other matters

This report will be posted on the Company's website, www.dartgroup.co.uk and

copies are available from the Company Secretary at the registered office of the

Company, Low Fare Finder House, Leeds Bradford International Airport, Leeds,

LS19 7TU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KKODQOBDDPDD

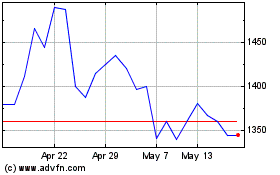

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

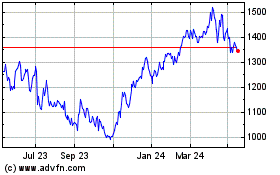

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024