TIDMLWI

RNS Number : 5810B

Lowland Investment Co PLC

07 June 2019

Legal Entity Identifier: 2138008RHG5363FEHV19

LOWLAND INVESTMENT COMPANY PLC

Unaudited results for the half-year ended 31 March 2019

This announcement contains regulated information.

Investment objective

The Company aims to give shareholders a higher than average

return with growth of both capital and income over the medium to

long-term, by investing in a broad spread of predominantly UK

Companies. The Company measures its performance against the FTSE

All-Share Index Total Return.

Key data for the six months to 31 March 2019

Net Asset Value Total Return -10.6%

Benchmark(1) Total Return -1.8%

Growth in Dividend 13.5%

Dividend 29.5p

(1) FTSE All-Share Index

Half-Year Ended Half-Year Ended Year Ended

Financial highlights 31 Mar 2019 31 Mar 2018 30 Sept 2018

-------------------------------------- ---------------- ---------------- --------------

NAV Per Ordinary Share(1) 1,431p 1,553p 1,625p

Share Price(2) 1,340p 1,485p 1,515p

Market Capitalisation GBP362m GBP401m GBP409m

Dividend Per Share 29.5p 26.0p 54.0p

Ongoing Charge Including Performance

Fee 0.6% 0.6% 0.6%

Ongoing Charge Excluding Performance

Fee 0.6% 0.6% 0.6%

Dividend Yield(3) 4.3% 3.4% 3.6%

Gearing 11.9% 14.2% 12.2%

Discount 6.4% 4.4% 6.8%

(1) NAV (Net Asset Value total return) with debt at par

value

(2) Using mid-market closing price

(3) Based on dividends paid and declared in respect of the

previous twelve months

Total return performance (including dividends reinvested and

excluding transaction costs)

6 months 1 year 3 years 5 years 10 years

% % % % %

----------------- --------- ------- -------- -------- ---------

Net Asset Value -10.6 -4.8 17.7 18.5 379.8

Share Price(1) -9.8 -6.3 15.3 10.6 372.3

Benchmark(2) -1.8 6.4 31.3 34.5 186.8

(1) Using mid-market closing price

(2) FTSE All-Share Index

Sources: Morningstar, Funddata, Datastream and Janus

Henderson

Historical record - Year to 30 September

As at

31 Mar

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

----------- ------- ------- ------- ------- ------- ------- ------- ------- ------- ------- -----------

Net

Assets(1)

(GBPm) 174 204 214 266 347 362 355 387 440 439 387

Per Ordinary Share

Net Asset

Value(2) 657p 770p 811p 1,008p 1,307p 1,346p 1,318p 1,432p 1,628p 1,625p 1,431p

Share

Price 610p 700p 763p 992p 1,325p 1,355p 1,287p 1,337p 1,504p 1,515p 1,340p

Net

Revenue 22.7p 22.5p 28.8p 31.1p 36.7p 39.4p 46.4p 47.7p 49.1p 58.6p 22.2p

Net

Dividends

Paid 26.5p 27.0p 28.0p 30.5p 34.0p 37.0p 41.0p 45.0p 49.0p 54.0p 29.5p(3)

(1) Attributable to Ordinary Shares

(2) NAV with debt at par value

(3) First interim dividend of 14.5p per ordinary share paid on

30 April 2019 and second interim dividend of 15.0p per ordinary

share that will be paid on 31 July 2019

INTERIM MANAGEMENT REPORT

CHAIRMAN'S STATEMENT

Overview

Lowland's Net Asset Value ("NAV") fell 10.6%, compared with a

decline of 1.8% in our benchmark, the FTSE All-Share Index. This

disappointing performance is analysed by the Fund Managers in their

report, which also covers activity in the portfolio.

Lowland has always been characterised by periods of

outperformance and underperformance. Over the longer term,

performance has been strong, with an increase in NAV (total return)

of 380% over the last ten years, against 187% in our benchmark. The

Company's investment style, with a distinct bias away from the

largest stocks in the index, gives rise both to the periods of

underperformance and the long-term outperformance.

Small companies have added substantial value to the portfolio

over the long-term and they will again. The portfolio also has a

bias to industrial companies, which over the six months were weak

overall, as uncertainty over trade wars dominated investor

sentiment.

Dividend

Underlying earnings have performed well and, helped by the

change in accounting policy announced last year, earnings per share

rose to 22.2p from 18.4p. The first interim dividend was 14.5p and

the Board has today declared a second interim dividend of 15.0p.

The total distribution at the half-year stage therefore amounts to

29.5p, compared with 26.0p at this time last year. Lowland started

paying quarterly dividends in 2013 and since then each quarter's

dividend has been greater than that paid in the same quarter in the

previous year. It is the ambition to maintain this practice.

Barring unforeseen circumstances, the Board intends to pay total

dividends of 59.5p this year, extending to seven years the period

in which our annual dividends have grown at 10%.

Year ended 30 September 1st Interim 2nd Interim 3rd Interim Final

------------------------- ------------ ------------ ------------ -------

2015 10.0p 10.0p 10.0p 11.0p

2016 11.0p 11.0p 11.0p 12.0p

2017 12.0p 12.0p 12.0p 13.0p

2018 13.0p 13.0p 14.0p 14.0p

2019 14.5p 15.0p 15.0p* 15.0p*

* Intention barring unforeseen circumstances

Gearing

During the half-year, gearing was fairly constant at around 12%.

It has increased to 13% on 4 June 2019 (the latest practicable date

prior to publication of this report) and we would expect it to

increase moderately from this level.

Share price discount

During the period the share price discount (on a total return

basis) fluctuated between 2.2% and 6.4%. At the period-end it was

6.4% and it stood at 4.6% as at 4 June 2019. The Board does not

operate a formal discount control mechanism. The policy with regard

to discount is set out in last year's Chairman's Statement.

Board

I advised at the year-end that Kevin Carter had indicated his

desire to retire, and this he will do at the end of this month. The

Board's thanks to Kevin for his first-class service to the Company

bear repeating. I am delighted to advise that following a search

and selection process, the Board has agreed that Tom Walker be

appointed to the Board with effect from 1 July 2019. Tom was

formerly a Fund Manager with Martin Currie Investment Management,

and brings valuable experience from his career. He is a director of

EP Global Opportunities Trust plc and will be appointed as a

director of JPMorgan Japan Smaller Companies Trust plc with effect

from 29 July 2019.

Outlook

In times of uncertainty, opportunities for profitable investment

occur. The Fund Managers are becoming increasingly confident that

stock prices are discounting most of the problems facing the

economy. Value is evident and therefore borrowings are being

increased. We are net buyers of equities, utilising current

uncertainties to refresh the portfolio with good-quality companies

on reasonable valuations.

On a final note, we value contact with our shareholders and I

would be delighted to be contacted at the Company Secretary's email

address (as shown at the end of this report) should you have any

matters you wish to raise with me.

Robert Robertson

Chairman

7 June 2019

Performance as at 31 March 2019

The tables below show the top contributors to and detractors

from the Company's total return performance over the six months

under review.

Top 5 Contributors

Company Sector Contribution %

----------------- ------------------------------------- ---------------

Greene King Travel & Leisure 0.39

Marshalls Construction & Materials 0.37

Churchill China Household Goods & Home Construction 0.34

Shoe Zone General Retailers 0.33

Hill & Smith Industrial Engineering 0.23

Top 5 Detractors

Company Sector Contribution %

------------- --------------------------- ---------------

Senior Aerospace & Defence -1.01

Royal Mail Industrial Transportation -0.65

Carclo Chemicals -0.51

Stobart Industrial Transportation -0.49

Low & Bonar General Industrials -0.44

Sector Analysis % as at 31 March 2019 % as at 30 September 2018

Company Benchmark(1) Company Benchmark(1)

-------------------- --------- ------------- ---------- ----------------

Financials 34.9 25.7 32.0 25.3

Industrials 25.0 11.0 27.6 11.3

Consumer Services 9.7 11.5 9.4 12.1

Oil & Gas 9.5 14.2 10.5 14.5

Health Care 5.2 8.3 4.8 9.3

Utilities 5.1 2.8 4.2 2.5

Basic Materials 4.6 8.1 5.2 7.5

Consumer Goods 4.2 14.6 3.7 13.8

Telecommunications 1.3 2.7 2.1 2.8

Technology 0.5 1.1 0.5 0.9

-------------------- --------- ------------- ---------- ----------------

Total 100.0 100.0 100.0 100.0

-------------------- --------- ------------- ---------- ----------------

(1) FTSE All-Share Index

FUND MANAGERS' STATEMENT

Performance review

Lowland's performance in the six months to the end of March was

disappointing. The NAV fell 10.6% relative to a 1.8% fall in the

FTSE All-Share (both figures on a total return basis). The fall in

NAV was concentrated in the fourth quarter of 2018, when the NAV

fell 14.9%. The NAV has recovered by 3.5% calendar year to

date.

There are two key elements to the underperformance. The first is

size, as small and medium-sized companies underperformed during the

six month period:

Total return for the

Index 6 months to 31 March 2019

(%)

-------------------- ---------------------------

FTSE All-Share -1.8

FTSE 100 -1.0

FTSE 250 -4.9

FTSE AIM All-Share -16.0

Lowland continues to invest in small and medium-sized companies,

with 55% of the portfolio invested outside of the FTSE 100 as at

the end of March. The best sales and earnings growth will, over

time, come from this portion of the portfolio and it has been the

largest source of outperformance for the Company over the long

term. Small and medium-sized companies are, however, more tied into

the domestic economic cycle and therefore they are more vulnerable

to underperformance at times when there are concerns about the UK

economy.

The second element of the underperformance was sector

allocation, specifically the industrials weighting, which as at the

end of March was 25% of the portfolio. In the fourth quarter of

2018, US economic data showed signs of weakening at a time when

Europe and China were already exhibiting signs of a slowdown. This

led to reduced (although still positive) expectations for 2019

global economic growth. For the industrials sector this resulted in

sharp and fairly indiscriminate underperformance which, in our

view, did not adequately reflect the diversity of end markets to

which the industrials held in the portfolio are exposed.

As an example, the largest industrial company held is Senior, an

engineering company that produces predominantly aerospace

components. The civil aerospace market continues to grow well.

Passenger miles flown per year are growing considerably above

global economic growth, driven by emerging market demand. This

trend is unlikely to change, leading to greater demand for new

planes to which Senior is well exposed. Senior is winning

considerable amounts of new civil aerospace work which is

pressuring short-term margins. We see this work being won as a

positive - it will lead to higher sales and earnings growth in

future. The market, however, is sceptical that they will make a

good return on this investment and as a result the shares fell 30%

on a total return basis during the six months to the end of March,

making it the largest individual detractor from performance. We

continue to hold the position as in our view the shares are not

reflecting the potential for future sales and earnings growth.

The top five active contributors to performance relative to the

benchmark were:

1. Greene King - a UK pub and brewery. Shares recovered well

from a low valuation as sales growth proved encouraging and a peer

(Fuller's) sold their brewery asset at a high valuation.

2. Marshalls - a building materials company, primarily paving

stones. Shares have performed well as a result of ongoing good

organic growth. We have reduced the position on valuation

grounds.

3. Churchill China - a crockery company based in Stoke-on-Trent.

Management have done well to position the company as selling

primarily to the restaurant industry where repeat sales are of

greater importance and they have successfully grown market

share.

4. Shoe Zone - a UK shoe retailer positioned at the 'value' end

of the market. The management team have done an excellent job of

reducing costs (such as rent) and we think the company can begin to

grow sales via their website and a new, larger store format.

5. Hill & Smith - an industrial company that makes products

including road crash barriers and messaging signs for roads. The

shares recovered well following a difficult first half of 2018 as

extremely cold weather delayed road building programmes.

The top five active detractors from performance relative to the

benchmark were:

1. Senior - a predominantly aerospace components supplier.

Earnings are under short-term pressure but they have good prospects

to grow sales and earnings over the longer term.

2. Royal Mail - the largest deliverer of letters and parcels in

the UK. Letter volumes have declined more steeply than anticipated

as spending by businesses on direct marketing mail has decreased in

the face of economic uncertainty. It is difficult to offset this

reduced volume in the short term via cost reductions, as

simplistically it means that each postman is delivering less volume

but still has to do the same daily route. The position continues to

be held as, in our view, the shares are factoring in a permanent

deterioration in margins which we think is unlikely to

materialise.

3. Carclo - a manufacturer of technical plastics for use in

medical devices and LED lighting for high-end cars. Production

problems in their LED lighting division have led to material cost

increases and the balance sheet is heavily indebted. This position

has been a mistake. It is a small position in the overall portfolio

(0.3% as at 31 March 2019).

4. Stobart Group - a conglomerate which owns Southend airport

and supplies biomass facilities in the UK. During the period the

dividend was cut in order to reinvest in the business and this

caused the shares to perform poorly. The position continues to be

held as the company has excellent potential for earnings growth

driven by more passengers travelling through Southend airport.

5. Low & Bonar - a buildings material manufacturer that had

a high level of indebtedness and as a result needed to raise money

from shareholders in order to strengthen the balance sheet (we

participated in the equity raise). Under a new management team the

business is becoming more focused on its core product areas, where

they continue to make good operating margins.

Activity

The largest purchase during the period was a new position in

Royal Bank of Scotland. Its legacy issues (such as PPI) are largely

resolved and it has retreated to its core competency of commercial

and personal lending in the UK. The primary reason for the purchase

is their potential to return capital to shareholders via dividends

and share buy-backs, which we think is underappreciated by the

market.

The largest individual sale during the period was a reduction in

the holding in Royal Dutch Shell. This continues to be the largest

position in the portfolio (5.7% as at the end of March 2019). The

position was added to in 2015 and 2016 during a period of severe

oil price weakness. At the trough in the share price, the dividend

yield rose to over 8% due to question marks about the dividend's

sustainability. The company has since done an excellent job of

reducing capital expenditure and operating costs and as a result

their ability to generate enough cash flow to cover the dividend

has greatly improved. As a result the shares have re-rated and as

at the time of writing are yielding below 6%. As and when we find

more exciting value opportunities elsewhere we expect to reduce the

position further.

The outlook for the global economy remains uncertain, with a

much greater divergence than usual among economic growth forecasts.

This is partly as a result of the US and Chinese trade war, in

which there is no clarity regarding the level or duration of

tariffs. Aside from economic uncertainty, there is ongoing

political uncertainty, with the result of Brexit still unclear and

the possibility of a general election. However, the most likely

outcome is that the global economy will continue to grow (albeit at

a reduced pace) and domestically focused equities are already

trading at a considerable valuation discount.

In the context of very low bond yields, equities continue to

look excellent value - the forecast yield on the portfolio over the

next twelve months is currently 4.8% with scope for dividends to

grow modestly while the 10-year gilt yield is under 1%. While there

is considerable uncertainty, it is the cash returns available to

shareholders that give us confidence in the outlook for equities

and for this reason we expect to be net investors over the upcoming

period.

James Henderson and Laura Foll

Fund Managers

7 June 2019

Related party transactions

The Company's current related parties are its Directors and

Janus Henderson. There have been no material transactions between

the Company and its Directors during the year and the only amounts

paid to them were in respect of Directors' remuneration and

expenses incurred on the Company's business, for which there were

no outstanding amounts payable at the period end.

In relation to the provision of services by Janus Henderson,

other than fees payable by the Company in the ordinary course of

business and the provision of sales and marketing services, there

have been no material transactions with Janus Henderson affecting

the financial position of the Company during the year under

review.

Principal risks and uncertainties

The principal risks and uncertainties associated with the

Company's business can be divided into various areas:

-- Investment Activity and Strategy;

-- Portfolio and Market Price;

-- Financial;

-- Gearing;

-- Operational; and

-- Accounting, Legal and Regulatory.

Information on these risks is given in the Annual Report for the

year ended 30 September 2018. In the view of the Board, these

principal risks and uncertainties are as applicable to the

remaining six months of the financial year as they were to the six

months under review.

Statement of Directors' Responsibilities

The Directors confirm that, to the best of their knowledge:

(a) the set of financial statements for the half-year to 31

March 2019 has been prepared in accordance with "FRS 104 Interim

Financial Reporting";

(b) the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months

and description of principal risks and uncertainties for the

remaining six months of the year); and

(c) the Interim Management Report includes a fair review of the

information required by the Disclosure Guidance and Transparency

Rule 4.2.8R (disclosure of related party transactions and changes

therein).

For and on behalf of the Board

Robert Robertson

Chairman

7 June 2019

PORTFOLIO INFORMATION

As at 31 March 2019

Market value % of

Company Sector GBP'000 portfolio

Royal Dutch Shell Oil & Gas Producers 24,786 5.7

HSBC Banks 11,874 2.8

Phoenix Life Insurance 11,330 2.6

Senior Aerospace & Defence 10,910 2.5

Hiscox Non-Life Insurance 10,629 2.5

Prudential Life Insurance 9,994 2.3

GlaxoSmithKline Pharmaceuticals & Biotechnology 9,980 2.3

Severn Trent Gas Water & Multiutilities 8,398 1.9

BP Oil & Gas Producers 8,098 1.9

Irish Continental (Ireland) Travel & Leisure 7,890 1.8

----------------------------- ------------------------------------- ------------- -----------

10 Largest 113,889 26.3

-------------------------------------------------------------------- ------------- -----------

Standard Chartered Banks 7,857 1.8

Rolls-Royce Aerospace & Defence 7,451 1.7

Relx Media 7,387 1.7

Direct Line Insurance Non-Life Insurance 7,237 1.7

Johnson Service (1) Support Services 7,011 1.6

National Grid Gas Water & Multiutilities 6,948 1.6

Aviva Life Insurance 6,392 1.5

International Personal

Finance Financial Services 6,160 1.5

Churchill China (1) Household Goods & Home Construction 6,089 1.4

Greene King Travel & Leisure 5,989 1.4

20 Largest 182,410 42.2

-------------------------------------------------------------------- ------------- -----------

Avon Rubber Aerospace & Defence 5,980 1.4

Rio Tinto Mining 5,806 1.3

Henderson Opportunities

Trust Equity Investment Instruments 5,742 1.3

Vodafone Mobile Telecommunications 5,687 1.3

Land Securities Real Estate Investment Trusts 5,480 1.3

Ten Entertainment Travel & Leisure 5,395 1.2

Randall & Quilter (1) Non-Life Insurance 5,146 1.2

Croda Chemicals 5,038 1.2

Headlam Household Goods & Home Construction 5,017 1.2

Somero Enterprises (1)

(USA) Industrial Engineering 4,860 1.1

----------------------------- ------------------------------------- ------------- -----------

30 Largest 236,561 54.7

-------------------------------------------------------------------- ------------- -----------

Shoe Zone (1) General Retailers 4,733 1.1

St Modwen Properties Real Estate Investment Services 4,728 1.1

FBD (Ireland) Non-Life Insurance 4,591 1.0

Royal Bank of Scotland Banks 4,446 1.0

Hill & Smith Industrial Engineering 4,369 1.0

BAE Systems Aerospace & Defence 4,342 1.0

Mondi Forestry & Paper 4,245 1.0

Standard Life Aberdeen Financial Services 4,199 1.0

Park (1) Financial Services 4,163 1.0

Provident Financial Financial Services 4,014 0.9

----------------------------- ------------------------------------- ------------- -----------

40 Largest 280,391 64.8

-------------------------------------------------------------------- ------------- -----------

Morgan Advanced Materials Electronic & Electrical Equipment 4,010 0.9

Babcock Support Services 3,948 0.9

AstraZeneca Pharmaceuticals & Biotechnology 3,926 0.9

DS Smith General Industrials 3,909 0.9

Consort Medical Health Care Equipment & Services 3,860 0.9

Clarkson Industrial Transportation 3,832 0.9

TT Electronics Electronic & Electrical Equipment 3,806 0.9

Castings Industrial Engineering 3,749 0.9

Pennon Gas Water & Multiutilities 3,718 0.9

Royal Mail Industrial Transportation 3,694 0.9

----------------------------- ------------------------------------- ------------- -----------

50 Largest 318,843 73.8

-------------------------------------------------------------------- ------------- -----------

Market value % of

Company Sector GBP'000 portfolio

---------------------------- ------------------------------------- --------------- ------------

Balfour Beatty Construction & Materials 3,688 0.9

H&T (1) Financial Services 3,688 0.9

Sabre Insurance Non-Life Insurance 3,642 0.8

Chesnara Life Insurance 3,618 0.8

International Consolidated

Airlines Travel & Leisure 3,584 0.8

Stobart Industrial Transportation 3,572 0.8

Anexo (1) Support Services 3,510 0.8

Redde (1) Financial Services 3,391 0.8

Gibson Energy (Canada) Oil & Gas Producers 3,216 0.7

Palace Capital Real Estate Investment Services 3,179 0.7

---------------------------- ------------------------------------- --------------- ------------

60 Largest 353,931 81.8

------------------------------------------------------------------- --------------- ------------

Elementis Chemicals 3,169 0.7

IMI Industrial Engineering 3,148 0.7

Centrica Gas Water & Multiutilities 3,140 0.7

XP Power Electronic & Electrical Equipment 3,125 0.7

HICL Infrastructure Equity Investment Instruments 3,118 0.7

Daily Mail & General

Trust Media 3,068 0.7

Epwin (1) Construction & Materials 3,066 0.7

Marshalls Construction & Materials 2,969 0.7

Numis (1) Financial Services 2,937 0.7

K3 Capital (1) Financial Services 2,683 0.7

---------------------------- ------------------------------------- --------------- ------------

70 Largest 384,354 88.8

------------------------------------------------------------------- --------------- ------------

Airea (1) Personal Goods 2,681 0.6

Renold Industrial Engineering 2,661 0.6

Low & Bonar General Industrials 2,626 0.6

A & J Mucklow Real Estate Investment Trusts 2,620 0.6

Gordon Dadds (1) Support Services 2,567 0.6

Helical Real Estate Investment Services 2,479 0.6

Findel General Retailers 2,366 0.6

Elecosoft (1) Technology 2,365 0.6

Herald Investment Trust Equity Investment Instruments 2,242 0.5

Ibstock Construction & Materials 2,225 0.5

---------------------------- ------------------------------------- --------------- ------------

80 Largest 409,186 94.6

------------------------------------------------------------------- --------------- ------------

4D Pharma (1) Pharmaceuticals & Biotechnology 2,207 0.5

IP Group Financial Services 2,067 0.5

Oxford Sciences Innovation

(2) Pharmaceuticals & Biotechnology 1,548 0.4

Bellway Household Goods & Home Construction 1,523 0.3

Ilika (1) Alternative Energy 1,406 0.3

Carr's Group Food Producers 1,365 0.3

Indus Gas (1) Oil & Gas Producers 1,257 0.3

Taylor Wimpey Household Goods & Home Construction 1,228 0.3

Hammerson Real Estate Investment Trusts 1,175 0.3

Premier Oil Oil & Gas Producers 1,174 0.3

---------------------------- ------------------------------------- --------------- ------------

90 Largest 424,136 98.1

------------------------------------------------------------------- --------------- ------------

Carclo Chemicals 1,165 0.3

Renewi Support Services 1,116 0.2

Wadworth - ordinary shares

(2) Travel & Leisure 723 0.2

Horizon Discovery (1) Pharmaceuticals & Biotechnology 721 0.2

SIMEC Atlantis Energy

(1) Alternative Energy 689 0.1

Moss Bros General Retailers 573 0.1

Flowtech Fluidpower (1) Industrial Engineering 512 0.1

Modern Water (1) Gas Water & Multiutilities 424 0.1

Providence Resources

(1) (Ireland) Oil & Gas Producers 386 0.1

Velocys (1) Chemicals 371 0.1

---------------------------- ------------------------------------- --------------- ------------

100 Largest 430,816 99.6

------------------------------------------------------------------- --------------- ------------

(1) AIM Stocks

(2) Unlisted Investments

Source: Janus Henderson

CONDENSED INCOME STATEMENT

(Unaudited) (Unaudited) (Audited)

Half-year ended Half-year ended Year ended

31 March 2019 31 March 2018 30 September 2018

Revenue Capital Revenue Capital Revenue Capital

return return Total return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ---------- --------- ---------- ---------- --------- ---------- ---------- ---------- ----------

Losses on

investments

held at fair

value through

profit or loss - (49,907) (49,907) - (18,550) (18,550) - (3,032) (3,032)

Income from

investments 7,117 - 7,117 6,888 - 6,888 19,757 - 19,757

Other interest

receivable and

similar income 51 - 51 93 - 93 190 - 190

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Gross revenue

and capital

losses 7,168 (49,907) (42,739) 6,981 (18,550) (11,569) 19,947 (3,032) 16,915

Management fee

and

performance

fee (note 2) (488) (488) (976) (1,009) - (1,009) (2,048) - (2,048)

Other

administrative

expenses (note

2) (271) - (271) (296) - (296) (520) - (520)

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Net

return/(loss)

before finance

costs and

taxation 6,409 (50,395) (43,986) 5,676 (18,550) (12,874) 17,379 (3,032) 14,347

Finance costs (324) (324) (648) (606) - (606) (1,347) - (1,347)

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Net

return/(loss)

before

taxation 6,085 (50,719) (44,634) 5,070 (18,550) (13,480) 16,032 (3,032) 13,000

Taxation on net

return (82) - (82) (95) - (95) (183) - (183)

--------- -------- --------- --------- -------- --------- --------- --------- ---------

Net

return/(loss)

after taxation 6,003 (50,719) (44,716) 4,975 (18,550) (13,575) 15,849 (3,032) 12,817

====== ====== ====== ====== ====== ====== ===== ====== =====

Return/(loss)

per ordinary

share - basic

and diluted

(note 3) 22.2p (187.7p) (165.5p) 18.4p (68.7p) (50.3p) 58.6p (11.2p) 47.4p

====== ====== ====== ====== ====== ====== ===== ====== ======

The total columns of this statement represent the Income

Statement of the Company, prepared in accordance with FRS 104. The

revenue and capital columns are supplementary to this and are

published under guidance from the Association of Investment

Companies.

The Company has no recognised gains or losses other than those

disclosed in the Income Statement and Statement of Changes in

Equity.

All items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the

period.

The accompanying notes are an integral part of the condensed

financial statements.

CONDENSED STATEMENT OF CHANGES IN EQUITY

(Unaudited)

Half-year ended 31 March 2019

Called Share premium Capital Other

up share account redemption capital Revenue

capital GBP'000 reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------------- -------------- ------------ ------------ ------------ ------------

At 1 October 2018 6,755 61,619 1,007 353,998 15,555 438,934

Net (loss)/return after

taxation - - - (50,719) 6,003 (44,716)

Third interim dividend

(14.0p) for

the year ended 30 September

2018 - - - - (3,783) (3,783)

Final dividend (14.0p)

for

the year ended 30 September

2018 - - - - (3,782) (3,782)

------------ ------------ ----------- ----------- ----------- -----------

At 31 March 2019 6,755 61,619 1,007 303,279 13,993 386,653

======= ======= ======= ====== ======= =======

(Unaudited)

Half-year ended 31 March 2018

Share premium Capital Other

Called account redemption capital Revenue

up share GBP'000 reserve reserves reserve Total

capital GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ ------------- -------------- ------------ ------------ ------------ ------------

At 1 October 2017 6,755 61,619 1,007 357,030 13,485 439,896

Net (loss)/return after

taxation - - - (18,550) 4,975 (13,575)

Third interim dividend

(12.0p) for

the year ended 30 September

2017 - - - - (3,242) (3,242)

Final dividend (13.0p)

for

the year ended 30 September

2017 - - - - (3,512) (3,512)

------------ ------------ ----------- ----------- ----------- -----------

At 31 March 2018 6,755 61,619 1,007 338,480 11,706 419,567

======= ======= ======= ======= ======= =======

(Audited)

Year ended 30 September 2018

Share Capital Other

Called premium redemption capital

up share account reserve reserves Revenue

capital GBP'000 GBP'000 GBP'000 reserve Total

GBP'000 GBP'000 GBP'000

------------ ------------ ------------ ------------ ------------- ------------

At 1 October 2017 6,755 61,619 1,007 357,030 13,485 439,896

Net (loss)/return after

taxation - - - (3,032) 15,849 12,817

Third interim dividend

(12.0p) for

the year ended 30 September

2017 - - - - (3,242) (3,242)

Final dividend (13.0p)

for

the year ended 30 September

2017 - - - - (3,512) (3,512)

First interim dividend

(13.0p) for the

year ended 30 September

2018 - - - - (3,512) (3,512)

Second interim dividend

(13.0p) for the

year ended 30 September

2018 - - - - (3,513) (3,513)

----------- ----------- ----------- ----------- ------------ -----------

At 30 September 2018 6,755 61,619 1,007 353,998 15,555 438,934

======= ======= ======= ======= ======= =======

The accompanying notes form an integral part of these condensed

financial statements.

CONDENSED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Unaudited) (Audited)

Half-year ended Half-year ended Year ended

31 March 2019 31 March 2018 30 September

GBP'000 GBP'000 2018

GBP'000

Fixed assets

Investments held at fair value

through profit or loss (note

4) 432,493 479,143 492,659

----------- ----------- -----------

Current assets

Debtors 2,263 2,479 2,018

Cash at bank 1,983 1,115 1,445

----------- ----------- -----------

4,246 3,594 3,463

Creditors: amounts falling due

within one year (20,312) (33,409) (27,421)

----------- ----------- -----------

Net current liabilities (16,066) (29,815) (23,958)

----------- ----------- -----------

Total assets less current liabilities 416,427 449,328 468,701

----------- ----------- -----------

Creditors: amounts falling due

after more than one year (29,774) (29,761) (29,767)

----------- ----------- -----------

Net assets 386,653 419,567 438,934

====== ====== =======

Capital and reserves

Called up share capital 6,755 6,755 6,755

Share premium account 61,619 61,619 61,619

Capital redemption reserve 1,007 1,007 1,007

Other capital reserves 303,279 338,480 353,998

Revenue reserve 13,993 11,706 15,555

----------- ----------- -----------

Total shareholders' funds 386,653 419,567 438,934

====== ====== =======

Net asset value per ordinary

share - basic and diluted (note

7) 1,431.1p 1,552.9p 1,624.6p

======= ======= =======

The accompanying notes form an integral part of these condensed

financial statements.

CONDENSED STATEMENT OF CASH FLOWS

(Unaudited) (Audited)

(Unaudited) Half-year Year ended

Half-year ended ended 31 30 September

31 March 2019 March 2018 2018

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------------ -------------- ---------------

Cash flows from operating activities

Net (loss)/return before taxation (44,634) (13,480) 13,000

Add back: finance costs 648 606 1,347

Add: losses on investments held

at fair value through profit or

loss 49,907 18,550 3,032

Withholding tax on dividends deducted

at source (107) (109) (228)

(Increase)/decrease in debtors (220) (404) 89

Increase/(decrease) in creditors 523 (410) (371)

----------- ----------- -----------

Net cash inflow from operating

activities 6,117 4,753 16,869

====== ====== ======

Cash flows from investing activities

Purchase of investments (28,240) (50,043) (76,383)

Sale of investments 38,776 24,862 48,182

----------- ----------- -----------

Net cash inflow/(outflow) from

investing activities 10,536 (25,181) (28,201)

Cash flows from financing activities

Equity dividends paid (net of refund

of unclaimed distributions and

reclaimed distributions) (7,565) (6,754) (13,779)

Net loans (repaid)/drawn down (7,885) 17,540 16,507

Interest paid (665) (600) (1,310)

----------- ----------- -----------

Net cash (outflow)/inflow from

financing activities (16,115) 10,186 1,418

Net increase/(decrease) in cash

and cash equivalents 538 (10,242) (9,914)

Cash and cash equivalents at start

of year 1,445 11,362 11,362

Effect of foreign exchange rates - (5) (3)

----------- ----------- -----------

Cash and cash equivalents at end

of year 1,983 1,115 1,445

====== ====== ======

Comprising:

Cash at bank 1,983 1,115 1,445

====== ====== ======

The accompanying notes are an integral part of these condensed

financial statements.

NOTES TO THE FINANCIAL STATEMENTS

The half-year financial statements cover the period from 1

October 2018 to 31 March 2019 and have not been audited or reviewed

by the Company's auditors.

1. Accounting policies - basis of preparation

The condensed set of financial statements has been prepared

in accordance with FRS 104, Interim Financial Reporting, FRS

102, the Financial Reporting Standard applicable in the UK and

Republic of Ireland, and the Statement of Recommended Practice

for "Financial Statements of Investment Trust Companies and

Venture Capital Trusts", which was updated by the Association

of Investment Companies in February 2018 with consequential

amendments.

For the period under review, the Company's accounting policies

have not varied from those described in the annual report for

the year ended 30 September 2018.

2. Expenses

All expenses with the exception of the performance fee, management

fee and finance costs are charged wholly to revenue. Performance

fees are charged wholly to capital. With effect from 1 October

2018, management fees and finance costs are charged 50% to revenue

and 50% to capital (previously 100% to revenue). Expenses which

are incidental to the purchase or sale of an investment are

included in the cost or deducted from the proceeds of sale of

the investment. No provision has been made for a performance

fee based on the Company's performance relative to the FTSE

All-Share Index (the benchmark) over the thirty months to 31

March 2019 (31 March 2018 and 30 September 2018: GBPnil). Any

performance fee payable will be calculated based on the actual

relative performance for the thirty-six months to 30 September

2019 and will be equal to 15% of any outperformance (on a total

return basis) of the FTSE All-Share Index by more than 10% (the

'hurdle rate'). The performance fee is capped at 0.25% of average

net chargeable assets for the year.

No performance fee will be payable if the net asset value per

share on the last day of the relevant calculation period is

lower than the net asset value per share on the first day of

the calculation period.

3. Return per ordinary share - basic and diluted

(Unaudited) (Audited)

Half-year ended (Unaudited) Year ended

31 March 2019 Half-year ended 30 September

GBP'000 31 March 2018 2018

GBP'000 GBP'000

---------------------------- ----------------- ----------------- --------------

The return/(loss)

per ordinary share

is based on the following

figures:

Net revenue return 6,003 4,975 15,849

Net capital loss (50,719) (18,550) (3,032)

---------- ---------- ----------

Net total(loss)/return (44,716) (13,575) 12,817

====== ====== ======

Weighted average number

of ordinary shares

in issue for each

period 27,018,565 27,018,565 27,018,565

Revenue return per

ordinary share 22.2p 18.4p 58.6p

Capital loss per ordinary

share (187.7p) (68.7p) (11.2p)

---------- ---------- ----------

Total (loss)/return

per ordinary share (165.5p) (50.3p) 47.4p

====== ====== ======

The Company does not have any dilutive securities; therefore,

basic and diluted returns per share are the same.

4. Fair value of financial assets and liabilities

The table below analyses fair value measurements for investments

held at fair value through profit or loss. These fair value measurements

are categorised into different levels in the fair value hierarchy

based on the valuation techniques used and are defined as follows:

Level 1: valued using quoted prices in active markets for identical

assets

Level 2: valued by reference to valuation techniques using observable

inputs other than quoted prices included in Level 1

Level 3: valued by reference to valuation techniques using inputs

that are not based on observable market data

Investments held at fair value through Level Level Level Total

profit or loss at 31 March 2019 (unaudited) 1 2 3 GBP'000

GBP'000 GBP'000 GBP'000

-------------------------------------------------- ---------- --------- --------- ---------

Investments 430,012 - 2,481 432,493

Investments held at fair value through Level Level Level Total

profit or loss at 1 2 3 GBP'000

31 March 2018 (unaudited) GBP'000 GBP'000 GBP'000

-------------------------------------------------- ---------- --------- --------- ---------

Investments 476,874 - 2,269 479,143

Investments held at fair value through Level Level Level Total

profit or loss at 1 2 3 GBP'000

30 September 2018 (audited) GBP'000 GBP'000 GBP'000

-------------------------------------------------- ---------- --------- --------- ---------

Investments 490,403 - 2,256 492,659

A reconciliation of movements within Level 3 is set out below:

2019

GBP'000

------------------------------------------------------------------------- --------- ---------

Opening balance 2,256

Transfers in 84

Total gain included in the Income Statement

- on investments held 141

Closing balance 2,481

---------

The transfer in relates to the Company's holding in ACHP, which

has been delisted from AIM.

The valuation techniques used by the Company are explained in the

accounting policies note in the Company's Annual Report for the

year ended 30 September 2018.

The fair value of the senior unsecured loan notes at 31 March 2019

has been estimated to be GBP32,451,000 (31 March 2018: GBP31,679,000;

30 September 2018: GBP31,056,000). The fair value of the senior

unsecured loan notes is calculated using a discount rate which reflects

the yield on a UK Gilt of similar maturity plus a suitable credit

spread.

The senior unsecured loan notes are categorised as level 3 in the

fair value hierarchy.

5. Share Capital

At 31 March 2019 there were 27,018,565 ordinary shares of 25p each

in issue (31 March 2018: 27,018,565; 30 September 2018: 27,018,565).

During the half-year ended 31 March 2019 no shares were issued or

bought back (31 March 2018 and 30 September 2018: no shares issued

or bought back).

6. Transaction costs

Purchase transaction costs for the half-year ended 31 March 2019

were GBP121,000 (31 March 2018: GBP277,000; 30 September 2018: GBP328,000).

Sale transaction costs for the half-year ended 31 March 2019 were

GBP15,000 (31 March 2018: GBP12,000; 30 September 2018: GBP23,000).

These comprise mainly stamp duty and commission.

7. Net asset value per ordinary share - basic and diluted

The net asset value per ordinary share of 1,431.1p (31 March

2018: 1,552.9p; 30 September 2018: 1,624.6p) is based on the

net assets attributable to the ordinary shares of GBP386,653,000

(31 March 2018: GBP419,567,000; 30 September 2018: GBP438,934,000)

and on 27,018,565 ordinary shares (31 March 2018 and 30 September

2018: 27,018,565), being the number of ordinary shares in issue

at the end of each period.

8. Dividend

On 30 April 2019, a first interim dividend of 14.5p per ordinary

share was paid in respect of the year ending 30 September 2019.

A second interim dividend of 15.0p per ordinary share has been

declared and will be paid on 31 July 2019 to shareholders on

the register of members at the close of business on 5 July 2019.

The ex-dividend date is 4 July 2019. Based on the number of

shares in issue on 4 June 2019 of 27,018,565, the cost of the

dividend will be GBP4,053,000 (second interim dividend for the

year ended 30 September 2018: GBP3,513,000).

9. Going concern

The assets of the Company consist of securities that are readily

realisable and, accordingly, the Directors believe that the

Company has adequate resources to continue in operational existence

for at least twelve months from the date of approval of the

financial statements. Having assessed these factors and the

principal risks, the Board has determined that it is appropriate

for the financial statements to be prepared on a going concern

basis.

10. Comparative Information

The financial information contained in this half-year report

does not constitute statutory accounts as defined in section

434 of the Companies Act 2006. The financial information for

the half-years ended 31 March 2019 and 31 March 2018 has not

been audited nor reviewed by the Company's auditor.

The figures and financial information for the year ended 30

September 2018 are extracted from the latest published accounts

and do not constitute the statutory accounts for that year.

Those accounts have been delivered to the Registrar of Companies

and included the report of the independent auditors, which was

unqualified and did not include a statement under either section

498(2) or 498(3) of the Companies Act 2006.

11. Manager

Henderson Investment Funds Limited ('HIFL') is appointed to

act as the Company's Alternative Investment Fund Manager. HIFL

delegates investment management services to Henderson Global

Investors Limited. References to Janus Henderson within these

results refer to the services provided by both entities.

12. General information

Company Status

The Company is a UK-domiciled investment trust company. The

registered number is 670489.

The London Stock Exchange Daily Official List SEDOL number is

0536806

The ISIN number is GB0005368062.

The London Stock Exchange (TIDM) Code is LWI.

The Global Intermediary Identification Number (GIIN) is 2KBHLK.99999.SL.826.

The Legal Entity Identifier Number (LEI) is 2138008RHG5363FEHV19

Directors

The Directors of the Company are Robert Robertson (Chairman),

Gaynor Coley (Audit Committee Chairman), Duncan Budge, Kevin

Carter, and Karl Sternberg.

Corporate Secretary

Henderson Secretarial Services Limited, represented by Helena

Harvey ACIS.

Email: ITSecretariat@janushenderson.com

Registered Office

201 Bishopsgate, London EC2M 3AE.

Website

Details of the Company's share price and net asset value, together

with general information about the Company, monthly factsheets

and data, copies of announcements, reports and details of general

meetings can be found at www.lowlandinvestment.com.

13. Half-year report

An abbreviated version of the half-year report, the 'Update',

will be posted will be posted to shareholders in June 2019.

The Update will also be available on the Company's website,

and hard copies will be available at the Company's registered

office, 201 Bishopsgate, London EC2M 3AE.

For further information, please contact:

James Henderson / Laura Foll

Fund Managers

Lowland Investment Company plc

Tel: 020 7818 4370 / 020 7818 6364

James de Sausmarez

Director and Head of Investment Trusts

Janus Henderson Investors

Tel: 020 7818 3349

Laura Thomas

Investment Trust PR Manager

Janus Henderson Investors

Tel: 020 7818 2636

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SSIFIWFUSEFM

(END) Dow Jones Newswires

June 07, 2019 11:20 ET (15:20 GMT)

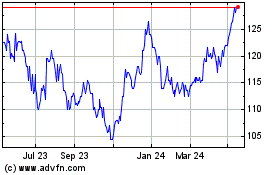

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jun 2024 to Jul 2024

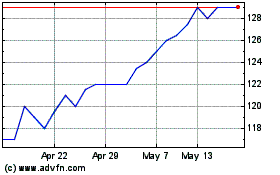

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jul 2023 to Jul 2024