TIDMLWI

RNS Number : 2592W

Lowland Investment Co PLC

09 December 2019

HERSON INVESTMENT FUNDS LIMITED

LOWLAND INVESTMENT COMPANY PLC

LEGAL ENTITY IDENTIFIER: 2138008RHG5363FEHV19

LOWLAND INVESTMENT COMPANY PLC

ANNUAL FINANCIAL RESULTS FOR THE YEARED 30 SEPTEMBER 2019

This announcement contains regulated information

INVESTMENT OBJECTIVE

The Company aims to give shareholders a higher than average

return with growth of both capital and income over the medium to

long-term by investing in a broad spread of predominantly UK

companies. The Company measures its performance against the FTSE

All-Share Index Total Return.

INVESTMENT POLICY

Asset Allocation

The Company will invest in a combination of large, medium and

smaller companies listed in the UK. We are not constrained by the

weightings of any index; we focus instead on controlling absolute

risk by diversifying on the basis of underlying company

characteristics such as size, industry, economic sensitivity,

clients and management. In normal circumstances up to half the

portfolio will be invested in FTSE 100 companies; the remainder

will be divided between small and medium-sized companies. On

occasions the Manager will buy shares listed overseas. The Manager

may also invest a maximum of 15% in other listed trusts.

Dividend

The Company aims to provide shareholders with

better-than-average dividend growth.

Gearing

The Board believes that debt in a closed-end fund is a valuable

source of long-term outperformance, therefore the Company will

usually be geared. At the point of drawing down debt, gearing will

never exceed 29.99% of the portfolio valuation. Borrowing will be a

mixture of short and long-dated debt, depending on relative

attractiveness of rates.

Key Data as at 30 September 2019

-- Net Asset Value ('NAV') Total Return(1) of -9.6%

-- Benchmark Total Return of 2.7%(2)

-- Dividend growth of 10.2%

-- Dividend for the Year(3) of 59.5p

Year ended Year ended

30 September 30 September

2019 2018

---------------------------------------------- -------------- --------------

NAV per share at year end 1,428p 1,625p

Share price at year end(4) 1,280p 1,515p

Market capitalisation GBP346m GBP409m

Dividend per share 59.5p(3) 54.0p

Ongoing charge including performance fee 0.63% 0.57%

Ongoing charge excluding performance fee 0.63% 0.57%

Dividend yield(5) 4.6% 3.6%

Gearing at year end 12.8% 12.2%

Discount at year end(6) 9.1% 6.5%

AIC UK Equity Income sector average discount 4.5% 1.4%

(1) NAV per share total return (including dividends reinvested)

in the prior year was 2.7%

(2) The benchmark is the FTSE All-Share Index. The amount

includes dividends reinvested

(3) Includes the final dividend of 15.0p per ordinary share for

the year ended 30 September 2019 that will be put to shareholders

for approval at the Annual General Meeting on Tuesday 28 January

2020

(4) Mid-market closing price

(5) Based on dividends paid in respect of the previous 12 months

and the share price at the year-end

(6) Calculated using year-end audited NAVs including current

year revenue

Sources: Morningstar for the AIC, Janus Henderson, Refinitiv

Datastream

Historical Performance

Share

Net revenue Net asset price

Dividend Total return/(loss) return Total value per per ordinary

Year ended per ordinary per ordinary per ordinary net assets ordinary share

30 September share (pence) share (pence) share (pence) (GBP'000) share (pence) (pence)

2009 26.5 8.4 22.7 173,633 657.3 610.0

--------------- -------------------- --------------- ------------ --------------- --------------

2010 27.0 139.5 22.5 203,484 770.3 699.5

--------------- -------------------- --------------- ------------ --------------- --------------

2011 28.0 68.3 28.8 214,251 811.0 762.5

--------------- -------------------- --------------- ------------ --------------- --------------

2012 30.5 229.9 31.1 266,401 1,008.4 991.5

--------------- -------------------- --------------- ------------ --------------- --------------

2013 34.0 330.1 36.7 347,202 1,306.9 1,325.0

--------------- -------------------- --------------- ------------ --------------- --------------

2014 37.0 73.3 39.4 361,856 1,345.6 1,355.0

--------------- -------------------- --------------- ------------ --------------- --------------

2015 41.0 11.8 46.4 354,563 1,318.4 1,287.0

--------------- -------------------- --------------- ------------ --------------- --------------

2016 45.0 156.4 47.7 386,910 1,432.0 1,336.5

--------------- -------------------- --------------- ------------ --------------- --------------

2017 49.0 243.2 49.1 439,896 1,628.1 1,504.0

--------------- -------------------- --------------- ------------ --------------- --------------

2018 54.0 47.4 58.6 438,934 1,624.6 1,515.0

--------------- -------------------- --------------- ------------ --------------- --------------

2019 59.5(1) (138.7) 68.0 385,904 1,428.3 1,280.0

--------------- -------------------- --------------- ------------ --------------- --------------

(1) Includes the final dividend of 15.0p per ordinary share for

the year ended 30 September 2019 that will be put to the

shareholders for approval at the Annual General Meeting on Tuesday

28 January 2020

CHAIRMAN'S STATEMENT

Performance

Lowland has two objectives: to grow capital and to grow income

over the medium to long term. In recent years it has fallen short

on the first and overshot on the second. In terms of capital, this

was a disappointing year for Lowland. Not only did NAV underperform

the FTSE All-Share Index, which rose 2.7%, but it declined in

absolute terms, by 9.6%. The reasons for the underperformance are

set out clearly in the Fund Managers' Report. They are

predominantly three-fold. Firstly, Lowland runs a multi-cap

portfolio. Its relatively high weighting in small and medium-sized

companies, which has served it well over the long-term, has not

done so recently, these companies being more exposed to the

uncertainties of the UK. Secondly, Lowland's sectoral bias towards

Industrials served it poorly. Finally, the focus on investment in

shares perceived to be undervalued, as opposed to growth stocks,

has been out of favour.

Lowland has now underperformed the benchmark over five years,

whilst over ten and twenty years, performance remains robust. The

strategy and positioning of the portfolio is always subject to

Board discussion and review, but it is fair to say that this

discussion is more robust during a period of prolonged difficulty.

The Board is firmly of the view that it is important to stick to

the investment style which has served shareholders well over the

long term. We believe that inconsistency of approach is the enemy

of long-term value creation. We also note that the growth in income

which the Company has experienced points to fundamental value in

the portfolio.

Dividends

The growth in our earnings is in marked contrast with the

capital performance. Earnings grew by 16.0% (9.4 pence) to 68

pence, including special dividends received, and by 11.6% (or 6.3

pence) to 61.8 pence excluding them. It should be noted that 6.1

pence of the increase is as a result of the decision to capitalise

50% of management fees and finance costs, in line with our

competitors, from the beginning of the financial year.

If shareholders vote at the AGM in favour of the proposed final

dividend of 15p, total dividends for the year will amount to 59.5p,

10.2% above the previous year. Dividends will have grown at a

compound rate of 10% over seven years. In 2013 we responded to

shareholder feedback by introducing a progressive quarterly

dividend policy. So far it has been possible to declare dividends

exceeding those for the corresponding quarter in the previous

year.

Shareholders have benefited from a regular, and thus far,

growing source of income. The dividend is well covered by earnings,

with GBP2.3m being transferred to the Revenue Reserve, which at the

year end stood at GBP18.4m.

Barring really adverse circumstances, we are committed to a

progressive dividend policy, with each quarterly declaration being

no less than the previous equivalent. We aspire to each quarterly

dividend exceeding the previous equivalent.

It is noteworthy that our dividend yield, 4.6% based on this

year's dividend, has now risen to a level only seen on one previous

occasion over the 29 years of James Henderson's involvement with

the Company. There may be some comfort in the fact that, on the

previous occasion, the spike in yield was followed by significant

outperformance in Lowland's share price. Whether or not that

history will be repeated, we conclude from the revenue position

that there is real value in the portfolio.

Investment Review and Gearing

The level of gearing averaged around 12% during the year, ending

at 12.8%. The Board has regarded this a reasonable level as the

Fund Managers see considerable value in the underlying portfolio.

Gearing has enhanced earnings, the underlying dividend yield of the

portfolio being 4.7% compared with a blended cost of borrowing of

2.6%. This year gearing has detracted from capital performance; we

expect gearing to enhance capital performance over the

long-term.

The weighting of the portfolio in the FTSE 100 component stocks

has continued to rise modestly, and was 44% as at the year end

(versus 39% at the end of 2018). This has come about predominantly

due to purchases that the Fund Managers judge to be good value, the

largest of which are RBS and GlaxoSmithKline. There is more detail

on both purchases in the Fund Managers' report.

The sector positioning of the portfolio has remained relatively

constant; Industrials and Financials are the two largest sectors.

In an environment where global economic growth is slowing and bond

yields have fallen, the large position in both sectors has

detracted from performance this year. If economic conditions

stabilise, for example on a resolution to Brexit or to the US/China

trade war, the Fund Managers consider the valuation of both sectors

to be low and the shares well poised to recover.

Our Fund Managers have long acted as responsible managers,

paying attention to environmental, social and governance issues in

performing their duties. Reflecting the growing prominence of these

issues, our Fund Managers have increased their focus on them as set

out for the first time in their report.

Ongoing Charge

The ongoing charge was 0.63% compared with the previous year's

0.57%. The Management Fee amounts to 0.5% on Net Chargeable assets

up to GBP375m and 0.4% thereafter. No performance fee was paid in

the year under review.

Share Price Discount

During the year the discount to NAV fluctuated between 1.7% and

9.2% ending the year at 9.1%. The policy on discount is set out in

the Annual Report.

Corporate Governance

'Overboarding' is a term and concern which has achieved

prominence in the last year or two, and has influenced voting

patterns at AGMs. It has long been our practice to ensure that we

only recruit directors who are able to devote sufficient time to

the job. Directors who have a breadth of activity can bring more to

the table than those who do not, but they clearly must have the

time to do so.

While there is welcome evidence of some movement in the right

direction, I believe that some of the approaches to the

'overboarding' issue are still over-simplistic. Some shareholders

and agencies measure commitments to investment companies as if they

were operating companies, while at the same time ignoring

commitments to private companies and charities, either of which can

be very onerous. Ours is a more pragmatic approach. Each Director,

actual or prospective, is required to provide to the Nominations

Committee an account of time commitments to all his or her

professional activities. This procedure is repeated if a Director

seeks the Chairman's approval to take up an additional post.

I am quite sure that all Directors have the capacity and

inclination to devote such time as may be necessary to Lowland,

whether in normal or exceptional circumstances. Equally, the broad

range of other activities undertaken by your Directors enriches the

contributions each makes.

Tenure of office is also a matter of some concern to

shareholders. Lowland has always valued a mix of continuity and

refreshment. Over the last few years we have brought more

discipline to the process of succession planning. Clearly

individual circumstances change and flexibility is required, but we

now have a framework within which Directors have an expectation of

their likely retirement dates, and when we expect new Directors to

be recruited. This aims to provide for one Director to be replaced

on average every three years. This brings the benefit of, on the

one hand, experience of past vicissitudes and, on the other, fresh

thought. It should also facilitate a pool of internal candidates

from which the Chair may be chosen. I would add that it would be

abundantly clear to anyone who attended one of our board meetings

that all Directors are entirely independent.

The Board

As mentioned at the half year stage, we were delighted to

welcome Tom Walker to the Board on 1 July. He stands for election

at the AGM.

Contact with Shareholders

We are always keen to hear shareholders' views and so I would

invite anyone who wishes to contact me to do so at:

itsecretariat@janushenderson.com

Annual General Meeting

The AGM of the Company will be held at the offices of Janus

Henderson on 28 January 2020 at 12.30 pm. Full details of the

business to be conducted at the meeting are set out in the Notice

of Meeting.

As usual our Fund Managers will be making a presentation. This

is an important opportunity for shareholders to meet the Board and

Fund Managers and to ask them questions. We would encourage as many

shareholders as possible to attend; we welcome your questions and

observations. The AGM will be broadcast live on the internet, so if

you are unable to attend the AGM in person you will be able to log

on to watch as it happens, by visiting

http://www.janushenderson.com/en-gb/investor/investment-trusts-live/.

Outlook

It seems likely that political uncertainty will prevail in the

UK for some time to come, whatever the outcome of the General

Election. None of the foreseeable results is likely to result in a

speedy resolution of the relationship between the UK and the EU.

However UK companies continue to show resilience, and are modestly

valued by most yardsticks. We see potential for capital growth,

with the current level of yield on the UK market unlikely to

prevail for long. On balance we feel it will be an increase in

valuations rather than reduction in dividends which brings yields

towards historic norms.

Robert Robertson

Chairman

9 December 2019

FUND MANAGER'S REPORT

Background

Economic growth slowed during the period, just managing to avoid

a quarter of contraction. This happened in spite of very low

interest rates and weak sterling. The stimulus of low rates and

cheap currency would normally cause growth to accelerate. The

domestic impact was offset by the global economy: world growth

slowed down as the trade war between the US and China intensified.

At home, the looming possibility of a disorderly Brexit and

political uncertainty compounded the scarcity of global growth.

These factors combined to make companies more risk-averse: they

have cut costs, and reduced capital expenditure, which in turn led

to a stagnation in productivity growth.

It has been a difficult economic backdrop for many companies

with predominantly UK operations. However, company results have

been generally satisfactory. This is a testament to those companies

who have excellent, differentiated products, a solid business model

and good management discipline. When the UK economy picks up, we

believe that the companies we hold in the portfolio will be well

placed to benefit.

In particular, the cash generation of many of our portfolio

companies has been strong despite the economic headwinds. This is

evidenced by the decent level of dividend growth our companies have

delivered, with investment income growing 4.5% year on year.

Performance Attribution

It was a disappointing year for performance. There are a number

of factors which contributed to this underperformance: the

positioning of the portfolio in different sizes of companies; our

bias in sector exposures; the investment approach; and some

company-specific challenges.

The portfolio has always been a blend of large, medium and small

companies. Over the long term the best performers have often been

small and medium-sized companies. Even in a bad year, as last year

was for smaller companies, all of the top five performers at the

stock level are listed outside the FTSE 100. While there have been

small and medium-sized companies that have performed well this

year, in aggregate there has been a pronounced underperformance of

small companies relative to large companies and, to a lesser

degree, medium-sized companies relative to large companies. Over

the financial year to the end of September, the FTSE 100 rose 3.2%

while the FTSE Small Cap fell 7.8% and the AIM All-Share Index fell

19.4%. The FTSE Small Cap Index made up 13% of the portfolio, and

the AIM All-Share 15% of the portfolio as at the year end. Our

weighting to these smaller companies is more than 8x greater than

the exposure in the index.

There are two main reasons for the underperformance of smaller

companies. Firstly, smaller companies are on average more exposed

to the domestic economy. They are at an earlier stage in their

lifecycle and tend to address their home market before expanding

overseas. For Lowland's portfolio as a whole, approximately 47% of

sales derive from the UK versus 27% of the benchmark. Over the long

term, companies more exposed to the domestic economy have traded at

approximately the same valuation as those more exposed to overseas

earnings. This is not currently the case; those more exposed to the

UK are trading at a material valuation discount. This 'domestic

discount' has therefore damaged smaller companies' share prices

more than larger companies' valuations.

Secondly, there is an increasing desire for liquidity when

positions are held within open-ended funds; this is particularly

pronounced for companies below a market valuation of GBP250m. This

is causing pressure on share prices where some fund managers are,

in effect, becoming forced sellers. While this technical factor

will gradually pass and shares will find appropriate long-term

holders, in the interim stage there is dislocation in share

prices.

The portfolio's sector allocation was also a detractor from

performance. Our portfolio is particularly overweight in

Industrials. It is industrial companies that have suffered most

from the trade war between the USA and China, and it makes

forecasting even more perilous than usual.

The resulting reduction in visibility in industrial company

earnings has led to a de-rating of industrial company valuations.

Eventually clarity on sales and earnings growth will emerge, from a

low valuation base.

It is important at times of an economic slowdown to reassess the

Industrials weighting in the portfolio and decide whether it is

appropriate against the current backdrop. The Industrials we own

are not producing commoditised components; they are specialist

engineers, producing components that are often exported globally,

and that would be difficult to substitute for another supplier. The

clearest examples would be the aerospace components suppliers we

hold, such as Rolls-Royce and Senior, but this would equally apply

to companies such as XP Power, which makes components designed for

medical equipment, or Avon Rubber, which is producing specialist

equipment for use by the US Department of Defense. Industrials are

not a homogeneous block of companies that move with the broad

economic cycle. They are exposed to a wide variety of end-markets

all at different stages in their cycles. For example Somero

Enterprises is predominantly exposed to the US construction cycle,

while XP Power is exposed to the semiconductor cycle. We have to

assess the overall Industrials exposure by considering the

exposures to multiple end-markets.

In addition to concerns over a broad economic slowdown, there

was also a one-off factor for aerospace components supplier Senior,

which is the largest industrial position and made up 2.2% of the

portfolio as at the end of September. Senior's largest individual

aerospace programme is the Boeing 737 Max where they make, for

example, structures for the wing. Their components are unrelated to

the two crashes and subsequent grounding of the aircraft but until

the aircraft is re-certified, earnings forecasts have been reduced

in the short term. Longer term, Senior remains well positioned on

new aerospace programmes for both Airbus and Boeing. If the Boeing

aircraft were to remain grounded, while it would be temporarily

disruptive, over time orders would shift to Airbus where Senior is

also well positioned. We have maintained our holding, as the

valuation is low relative to the company's potential to grow sales

and earnings.

The final factor contributing to underperformance has been our

preference for companies with a low valuation (relative to peers or

relative to history) where we can see a clear path to earnings

recovery. This moderately 'contrarian' or 'value' approach has

worked well for the Company historically. However, in recent years

the best performers in the market have been more highly valued

companies that have delivered consistent earnings growth. As this

trend has persisted, valuation levels have become increasingly

polarised. This can be seen clearly in the performance of the FTSE

All-Share split by valuation bands, with the high valuation

sections of the market materially outperforming over the past year.

This has been detrimental to portfolio performance, where the

average valuation of the portfolio at year end was 11.4x forward

earnings.

The top five active contributors to performance (relative to the

benchmark), that we own, were:

1. Greene King (a pub and brewer). Cash bid from CK Asset

Holdings at a substantial premium to the undisturbed share

price.

2. Anexo Group (credit hire and legal services). Encouraging

results and strong cash collections coming through.

3. Johnson Service Group (laundry services across hotels,

restaurants and workwear). Excellent organic growth being delivered

and substantial new hotel linen capacity soon to come on stream in

Leeds.

4. Churchill China (crockery for the restaurant industry).

Strong organic growth coming from sales to the restaurant industry

globally.

5. Avon Rubber (defence and dairy equipment). Excellent

acquisition of a division from 3M to expand their defence

division.

An encouraging theme this year has been the re-emergence of

corporate activity in the portfolio: Greene King has agreed a cash

bid from Hong Kong conglomerate CK Asset Holdings, while earlier in

the year Manx Telecom agreed a cash bid from private equity and

A&J Mucklow agreed to a bid from listed peer LondonMetric.

The top five active detractors from performance (relative to the

benchmark), that we own, were:

1. Senior (engineer predominantly for the aerospace industry).

Grounding of the Boeing 737 Max has reduced earnings forecasts.

2. Carclo (specialist plastics for medical devices and LED

lighting for premium cars). Manufacturing issues in their car

lighting division has caused an already stretched balance sheet to

become very difficult. The holding has been written down to

zero.

3. International Personal Finance (door to door and digital

lending in emerging markets). Changing regulatory environment in

Poland means there is a lack of earnings visibility.

4. Royal Mail (UK and European letter and parcel delivery).

Difficulty reducing costs against a challenging UK backdrop for

letters.

5. Stobart Group (a conglomerate; the majority of their earnings

are Southend airport and biomass delivery). Corporate governance

has been poor and has been discussed with the company and the

balance sheet has been highly indebted.

Were there to be a common theme among the detractors from

performance, it would be that they have become too highly indebted.

This would be the case for Carclo and Stobart, and is to a lesser

degree the case for International Personal Finance. There is an

increasing aversion to high levels of debt among equity investors

given the current uncertain economic outlook. This is causing

substantial valuation discounts among those companies that have a

high level of debt versus peers. In our view this aversion to debt

in the market is a valuation opportunity, as the potential for debt

reduction is not being fully appreciated in cash generative

companies. However, there is of course a need to be selective and

to recognise that we have made mistakes in the past in not fully

appreciating the scale of additional debt such as pension

deficits.

We have adjusted our investment process to take account of these

past mistakes; we shall never stop taking lessons from the judge

and jury of share prices.

Portfolio Positioning

The largest sector within the portfolio remains Financials. It

is worth noting that while the weighting in the financial sector is

high, it is to a degree a 'catch-all' sector. For example real

estate investments (such as Land Securities, Hammerson and Helical)

fall within financials, as do other investment trusts held (such as

Herald).

Within Financials the largest sub-sector remains insurance

(13.0% of the portfolio versus 15.0% of the portfolio as at the

previous year end). While the overall portfolio weight in insurance

has remained broadly flat, the holdings in Sabre Insurance, Direct

Line and FBD Holdings have been increased, all of which pay an

attractive dividend to shareholders and look good value relative to

the returns they are generating. In contrast, the position in

Hiscox was modestly reduced on valuation grounds. It continues to

grow its retail business successfully and generate strong returns;

therefore, we remain happy with the position on a long-term

basis.

The portfolio remains more heavily weighted in large companies

than the long-term average positioning, which is approximately

one-third in large companies, one-third in medium-sized companies

and one-third in small companies. This bias in the portfolio has

come about primarily from stock-level decisions, as there are

valuation opportunities in companies such as RBS and

GlaxoSmithKline (both described in more detail in the portfolio

activity section). As stated above, many investors have short-term

concerns around smaller companies, and we felt it prudent to reduce

exposure slightly.

Portfolio Activity

The largest purchase during the year was RBS, which was 1.0% of

the portfolio at the year end. As an income portfolio manager, RBS

had for a number of years been a relatively easy share to ignore as

a result of its historic conduct issues (such as PPI) and lack of

dividend. However, PPI claims have this year come to an end and a

regular dividend to shareholders has been reinstated, backed by a

strong balance sheet versus peers. The key remaining overhang is

the government stake, which is still a majority holding. In our

view this is more than factored into the current valuation, which

at just over half book value implies low returns being generated

into perpetuity. Even absent a re-valuation of the shares on the

back of, for example, the government reducing their stake or better

sentiment towards the domestic UK economy, the shares pay an

attractive high-single-digit dividend yield (including recurring

special dividends).

We added to the existing position in GlaxoSmithKline following

an encouraging meeting with the relatively new Head of

Pharmaceuticals, who has joined from AstraZeneca. Back in 2012

under the leadership of the then-new CEO, Pascal Soriot,

AstraZeneca dramatically improved its pipeline of drugs with a

renewed focus on innovative medicines. It is our view that under a

new management team (new CEO, new Head of R&D and new Head of

Pharmaceuticals), a similar process is currently underway at

GlaxoSmithKline. This will, in all likelihood, be a slow process of

reinvigorating research and development at such a large company,

but it is not in our view factored into the valuation.

Another sizeable purchase included a new position in XP Power.

XP Power makes power converters across a range of industries, the

most material of which are healthcare and semiconductors. As the

power converters are 'designed in' at an early stage in the product

life cycle, and form a very small part of the overall product cost,

the margins that XP Power generates are good (over 20% operating

margin). Recently the valuation had come down considerably as a

result of severe weakness in the semiconductor market and concerns

that as a result, XP Power earnings would need to be re-based (a

concern that has, at the time of writing, not come to fruition and

orders have continued to grow). We purchased the position on the

view that it is rare to see a company with good margins, a

respected management team and a strong balance sheet trading on a

low teens earnings multiple (as at the time of purchase). On any

further weakness we will look to add to the position.

Our largest sale was Royal Dutch Shell, which we reduced to 5.6%

as at the year end primarily for portfolio balance reasons

following a period of strong performance. As at the beginning of

December 2018 the position in Shell was 8% of the portfolio before

it was reduced.

The largest sale outside of the FTSE 100 was paving stone

company Marshalls, which has been sold in its entirety. This had

been in the portfolio since 2008, when we purchased the shares

between GBP0.96 and GBP1.66. The final sales this year were between

GBP4.20 and GBP6.32. The management have done an excellent job, and

the performance of the shares has been driven by both good organic

growth and sensible bolt-on acquisitions. The sale of the position

was not as a result of concerns around the fundamentals of the

business but rather a concern regarding valuation, versus both the

building materials peer group and its history.

Also among the largest divestments during the year were the

positions in industrial property company A&J Mucklow and Isle

of Man telecoms operator Manx Telecom, in both cases following a

takeover offer. During the year there has been a notable uptick in

bid activity, including Greene King (see performance attribution

section), a failed takeover of Provident Financial and two

approaches (but deemed by the board to be at an insufficient

premium) for office property company, Helical. In our view, this

increase in takeover interest shows that UK companies (and it is

notable that all the companies mentioned are domestically focused

UK companies) are valued too low relative to global peers.

Therefore, while there is uncertainty regarding the domestic

outlook, the valuation opportunity is such that some companies

(whether operating or private equity) are willing to take the risk

on exposure to the UK economy.

Lowland responsible investment strategy

Responsible Investment is the term used at Janus Henderson to

cover the Manager's work on environmental, social and corporate

governance ('ESG') issues in the Company's investee companies.

These issues are important not only as a standalone objective in

order to allocate the capital of the Company to the companies with

the most responsible practices, but are also an integral part of

the investment process.

As data quality and availability on ESG is in some cases poor,

potential or current investments are not rigidly excluded on

quantitative metrics. However, each new position in the portfolio

is reviewed for ESG issues and any concerns that the Managers view

as material are discussed with company management. In addition the

existing portfolio is screened for 'red flags', which are then

discussed with management and monitored.

Substantial progress has been made in the governance area in

recent years, where information is more easily accessible. As the

data on environmental and social issues improves we will expand our

engagement in these areas. Engagement takes place at both the Fund

Manager level and at the level of the Governance and Responsible

Investing team (an independent team within Janus Henderson who work

closely alongside the Fund Managers).

For Lowland, responsible investing incorporates:

1. A focus on companies' long-term plans. We are a long-term

investor and therefore we should invest in companies that are

cognisant of changing standards with regards to, for example,

single-use plastic or renewable energy (even before these changing

societal standards are fully recognised in legislation). These

changing expectations need to be viewed within the context of the

investment proposition - for example what valuation multiple should

be given to a plastic packaging company?

2. Reacting to evidence of poor corporate governance where

identified (whether by screening, external research or internal

meetings), engaging with the company involved, and monitoring

improvement.

3. Engaging thoughtfully on corporate remuneration. A company's

board and senior executive remuneration policy needs to be

appropriate relative to both its peers and (increasingly) relative

to its broader employee base. There needs to be a defensible logic

to how corporate remuneration levels have been set.

We always vote at company AGMs. Where possible, we will seek to

engage with companies beforehand, but if agreement cannot be

reasonably reached, we will vote against resolutions. The approach

to voting is pragmatic - we subscribe to proxy voting agencies such

as ISS (Institutional Shareholder Services) and we will carefully

study their recommendations; however we do not necessarily follow

all recommendations.

Outlook

Companies in aggregate, are reporting results in line with

modestly reduced expectations. This suggests the current slowdown

in global economic activity is, at least to a degree, reflected in

earnings forecasts. The low valuation for much of the portfolio

means that where companies are only meeting expectations (rather

than surpassing them), shares are broadly responding positively.

This backdrop of modest valuations and realistic earnings

expectations within the portfolio is encouraging for the year

ahead.

The last year has been strong for dividend growth but

disappointing for capital growth. This means the dividend yield on

the underlying portfolio has reached levels not seen in many years.

This dividend yield (currently just under 5%) is particularly stark

when viewed in the context of low government bond yields (at the

time of writing the UK 10 year gilt yield is 0.75%). This would

suggest one of two things is likely to occur: either the dividends

being paid by companies are unsustainable and need to be reduced,

or there will be a period of valuation 'catch up' (in other words

yield compression) in the portfolio. We have begun forecasting

dividends for the current financial year ending 30 September 2020

and based on current expectations think a healthy level of dividend

growth will be achieved. There will always be isolated dividend

cuts, but in aggregate dividend pay-out ratios are modest and

balance sheets are conservative. This attractive, and in our view

sustainable, dividend yield, in combination with the level of bid

interest seen this year, are the clearest indicators to us of the

underlying value within the portfolio.

James Henderson and Laura Foll

Fund Managers

9 December 2019

Twenty Largest Holdings as at 30 September 2019

The stocks in the portfolio are a diverse mix of businesses

operating in a wide range of end markets.

Rank Company % of Approx. Valuation

2019 (2018) portfolio market 2019

cap GBP'000

Royal Dutch Shell

The company explores, produces and refines

oil; it produces fuels, chemicals and

lubricants as well as operating filling

stations worldwide. The company has

attacked its cost base and has very

high-class assets, which positions it

1 (1) well for the future. 5.6 GBP186bn 24,475

------------------------------------------------- ----------- ---------- ----------

2 (7) GlaxoSmithKline 3.5 GBP85bn 15,265

A global pharmaceutical, vaccine and

consumer healthcare company. The consumer

healthcare and vaccine businesses should

be steady growers over time, while the

pharmaceutical division under a new

leadership team could turn around what

has been a mixed R&D track record.

------------------------------------------------- ----------- ---------- ----------

3 (6) Phoenix 2.7 GBP5.2bn 11,561

The company operates primarily in the

UK and specialises in taking over and

managing closed life insurance and pension

funds.

------------------------------------------------- ----------- ---------- ----------

4 (3) Hiscox 2.6 GBP4.1bn 11,311

The international insurance company

manages underwriting syndicates and

underwrites a range of personal and

commercial insurance. The company is

very disciplined and has over the long-term

achieved a high return on capital.

------------------------------------------------- ----------- ---------- ----------

HSBC

The global bank provides international

banking and financial services. The

diversity of the countries it operates

in as well as its exposure to faster

5 (4) growing economies make it well placed. 2.5 GBP121bn 11,117

------------------------------------------------- ----------- ---------- ----------

6 (5) Prudential 2.2 GBP36bn 9,588

The company provides an assortment of

insurance and investment products around

the world. The business in the Far East

has grown impressively in recent years.

------------------------------------------------- ----------- ---------- ----------

7 (2) Senior 2.2 GBP800m 9,380

The company manufactures specialist

engineering products for the automotive

and aerospace sectors. Having come under

margin pressure in recent years, the

company is well positioned to grow margins

as end markets recover and new aerospace

programs ramp up production.

------------------------------------------------- ----------- ---------- ----------

8 (16) Severn Trent 2.1 GBP5.3bn 9,201

A UK water utility. Due to concerns

regarding possible renationalisation

under Labour and an upcoming regulatory

review, shares have performed poorly

and are trading at a lower discount

to regulated asset base than in recent

years. There is also a good dividend

yield with scope to grow.

------------------------------------------------- ----------- ---------- ----------

9 (11) Standard Chartered 2.1 GBP24bn 9,092

The international banking group operates

principally in Asia, Africa and the

Middle East. The new management team

has focussed the bank back to areas

of relative strength in its growing

markets.

------------------------------------------------- ----------- ---------- ----------

10 (13) Relx 1.8 GBP36bn 7,730

The company publishes information for

the scientific, medical, legal and business

sectors, serving customers worldwide.

The company is a consistent, high quality

growth business.

------------------------------------------------- ----------- ---------- ----------

Greene King

A UK pub and brewer. Since financial

year end it has been acquired by Hong

Kong based investment company CK Asset

11 (*) Holdings. 1.7 GBP2.6bn 7,623

------------------------------------------------- ----------- ---------- ----------

12 (9) BP 1.7 GBP105bn 7,479

A producer and refiner of oil. Following

the fall in the oil price they have

successfully focused on cost reduction.

------------------------------------------------- ----------- ---------- ----------

13 (17) Johnson Service(1) 1.7 GBP650m 7,289

A textile rental company that provides

linens for use across workwear, hotels

and restaurants. In recent years the

management team has successfully de-geared

the balance sheet and grown operating

margins.

------------------------------------------------- ----------- ---------- ----------

14 (*) National Grid 1.7 GBP31bn 7,202

A regulated utility (electricity and

gas distribution) operating in the US

and UK. Due to concerns regarding possible

renationalisation under Labour, shares

are trading at an attractive valuation

relative to global regulated utility

peers. There is also an attractive dividend

yield.

------------------------------------------------- ----------- ---------- ----------

15 (*) Avon Rubber 1.6 GBP570m 7,147

A supplier of defence equipment for

predominantly the US Department of Defense

as well as law enforcement. Their revenues

and earnings are forecast to grow substantially

following an acquisition of a personal

protection business from 3M.

------------------------------------------------- ----------- ---------- ----------

16 (8) Irish Continental(2) 1.6 GBP720m 6,967

The group provides passenger transport,

roll-on and roll-off freight transport

and container services between Ireland,

the United Kingdom and Continental Europe.

It is a very cash generative well-run

company.

------------------------------------------------- ----------- ---------- ----------

17 (18) Vodafone 1.5 GBP44bn 6,591

A global telecoms company. The company

has invested in their network quality

and are now better placed to grow revenue

per customer as people use more mobile

data.

------------------------------------------------- ----------- ---------- ----------

18 (10) Rolls-Royce 1.5 GBP15.2bn 6,537

The company designs and manufactures

engines as well as providing aftermarket

services for use across aerospace and

industry. The company has successfully

won market share across many of the

large new civil aerospace programmes

and under a new management team has

a renewed focus on removing duplicate

costs.

------------------------------------------------- ----------- ---------- ----------

19 (19) Direct Line 1.5 GBP3.8bn 6,454

A UK provider of car and home insurance.

The company has well-known brands which

will allow them to grow policies well,

while maintaining underwriting discipline.

A strong balance sheet allows them to

pay an attractive dividend yield to

shareholders.

------------------------------------------------- ----------- ---------- ----------

Aviva

This company provides a wide range of

insurance and financial services. The

management team has done a good job

of simplifying the business, exiting

peripheral and low return areas. The

company pays an attractive yield that

20 (12) has good scope to grow. 1.4 GBP16.9bn 6,189

------------------------------------------------- ----------- ---------- ----------

188,198

------------------------------------------------- ----------- ---------- ----------

At 30 September 2019 these investments totalled GBP188,198,000,

or 43.2% of the portfolio.

* Not in the twenty largest investments last year

1 AIM stocks

2 Overseas listed stocks (Ireland)

PRINCIPAL RISKS AND UNCERTAINTIES

The Board, with the assistance of the Manager, has carried out a

robust assessment of the principal risks, and uncertainties, facing

the Company that would threaten its business model, future

performance, solvency and liquidity. A matrix of these risks has

been drawn up and steps taken to mitigate these. The principal

risks and mitigating actions are as follows:

Investment Activity and Strategy Risk

An inappropriate investment strategy or poor execution, for

example, in terms of asset allocation or level of gearing, may

result in underperformance against the Company's benchmark index

and the companies in its peer group, and also in the Company's

shares trading on a wider discount to the net asset value per

share.

The Board manages these risks by ensuring a diversification of

investments and a regular review of the extent of borrowings. Janus

Henderson operates in accordance with investment limits and

restrictions and policy determined by the Board, which includes

limits on the extent to which borrowings may be employed.

The Board reviews the investment limits and restrictions on a

regular basis and the Manager confirms adherence to them every

month. Janus Henderson provides the Board with management

information, including performance data and reports and shareholder

analyses.

The Board monitors the implementation and results of the

investment process with the Fund Managers at each Board meeting and

monitor risk factors in respect of the portfolio.

Investment strategy is reviewed at each meeting.

Portfolio and Market Price Risk

Market risk arises from uncertainty about the future prices of

the Company's investments. Although the Company invests almost

entirely in securities that are listed on recognised markets, share

prices may move rapidly. The companies in which investments are

made may operate unsuccessfully, or fail entirely.

The Fund Managers seek to maintain a diversified portfolio to

mitigate against this risk. The Board regularly reviews the

portfolio, activities and performance.

Financial Risk

The financial risks faced by the Company include market price

risk, interest rate risk, liquidity risk, currency risk and credit

and counterparty risk.

The Company minimises the risk of a counterparty failing to

deliver securities or cash by dealing through organisations that

have undergone rigorous due diligence by Janus Henderson. The

Company holds its liquid funds almost entirely in interest bearing

bank accounts in the UK or on short-term deposit. This, together

with a diversified portfolio which comprises mainly investments in

large and medium-sized companies mitigates the Company's exposure

to liquidity risk. Currency risk is mitigated by the low exposure

to overseas stocks.

Gearing Risk

At the point of drawing down debt, gearing will never exceed

29.99% of the portfolio valuation. In the event of a significant or

prolonged fall in equity markets gearing would exacerbate the

effect of the falling market on the Company's NAV per share and,

consequently, its share price.

The Company minimises the risk by the regular monitoring of the

levels of the Company's borrowings in accordance with the agreed

limits. The Company confirms adherence to the covenants of the loan

facilities on a monthly basis.

Operational Risk

Disruption to, or the failure of, Janus Henderson's accounting,

dealing or payment systems or the custodian's records could prevent

the accurate reporting or monitoring of the Company's financial

position.

Janus Henderson contracts some of the operational functions

(principally those relating to trade processing, investment

administration and accounting), to BNP Paribas Securities

Services.

Details of how the Board monitors the services provided by Janus

Henderson and its other suppliers, including cyber risk, and the

key elements designed to provide effective internal control, are

explained further in the Internal Controls section of the Corporate

Governance Statement in the Annual Report.

Accounting, Legal and Regulatory Risk

In order to qualify as an investment trust, the Company must

comply with Section 1158 of the Corporation Tax Act 2010. A breach

of Section 1158 could result in the Company losing investment trust

status and, as a consequence, capital gains realised within the

Company's portfolio would be subject to corporation tax.

Compliance with the requirements of Section 1158 is monitored by

Janus Henderson and the results are reported at each Board meeting.

The Company must comply with the provisions of the Companies Act

2006 and, since its shares are listed on the London Stock Exchange,

the FCA's Listing and Disclosure Guidance and Transparency Rules

and the Prospectus Rules ('FCA Rules').

A breach of the Companies Act 2006 could result in the Company

and/or the Directors being fined or the subject of criminal

proceedings. A breach of the Listing Rules could result in the

suspension of the Company's shares; which in turn would breach

Section 1158.

The Board relies on its Company Secretary and its professional

advisers to ensure compliance with the Companies Act 2006 and FCA

Rules.

The Board receives internal control reports produced by Janus

Henderson on a quarterly basis, which confirm regulatory

compliance.

The Board considers these risks to have remained unchanged

throughout the year under review.

VIABILITY STATEMENT

The Company is a long-term investor; the Board believes it is

appropriate to assess the Company's viability over a five-year

period in recognition of our long-term horizon and what we believe

to be investors' horizons, taking account of the Company's current

position and the potential impact of the principal risks and

uncertainties as documented above.

The assessment has considered the impact of the likelihood of

the principal risks and uncertainties facing the Company, in

particular investment strategy and performance against benchmark,

whether from asset allocation or the level of gearing, and market

risk, materialising in severe but plausible scenarios, and the

effectiveness of any mitigating controls in place.

The Board has taken into account the liquidity of the portfolio

and the gearing in place when considering the viability of the

Company over the next five years and its ability to meet

liabilities as they fall due. This included consideration of the

duration of the Company's loan facilities and how a breach of the

loan facility covenants could impact on the Company's liquidity,

net asset value and share price.

The Board does not expect there to be any significant change in

the current principal risks and adequacy of the mitigating controls

in place. The Directors do not envisage any change in strategy or

objectives or any events that would prevent the Company from

continuing to operate over that period as the Company's assets are

liquid, its commitments are limited and the Company intends to

continue to operate as an investment trust. Only a substantial

financial crisis affecting the global economy could have an impact

on this assessment.

Based on this assessment, the Directors have a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the next five-year

period.

RELATED PARTY TRANSACTIONS

The Company's current related parties are its Directors and

Janus Henderson. There have been no material transactions between

the Company and its Directors during the year. The fees and

expenses paid to Directors are set in the Annual Report. There were

no outstanding amounts payable at the year end.

In relation to the provision of services by Janus Henderson,

other than fees payable by the Company in the ordinary course of

business and the provision of sales and marketing services, there

have been no material transactions with Janus Henderson affecting

the financial position of the Company during the year under review.

More details on transactions with Janus Henderson, including

amounts outstanding at the year end, are given in the Annual

Report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

In accordance with Disclosure Guidance and Transparency Rule

4.1.12, each of the Directors confirms that, to the best of his or

her knowledge:

-- the Company's financial statements, which have been prepared

in accordance with UK Accounting Standards and applicable law give

a true and fair view of the assets, liabilities, financial position

and loss of the Company; and

-- the Strategic Report, Report of the Directors and financial

statements include a fair review of the development and performance

of the business and the position of the Company, together with a

description of the principal risks and uncertainties that it

faces.

The directors consider that the Annual Report, taken as a whole,

is fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

For and on behalf of the Board

Robert Robertson

Chairman

9 December 2019

INCOME STATEMENT

Year ended 30 September Year ended 30 September

2019 2018

Revenue Capital Revenue Capital

return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- -------- --------- -------- -------- ---------

Losses on investments

held at fair value through

profit or loss - (54,206) (54,206) - (3,032) (3,032)

Income from investments

(note 2) 20,640 - 20,640 19,757 - 19,757

Other interest receivable

and similar income (note

4) 121 - 121 190 - 190

Gross revenue and capital

losses 20,761 (54,206) (33,445) 19,947 (3,032) 16,915

Management fee (983) (983) (1,966) (2,048) - (2,048)

Administrative expenses (539) - (539) (520) - (520)

Net return/(loss) before

finance costs and taxation 19,239 (55,189) (35,950) 17,379 (3,032) 14,347

Finance costs (669) (670) (1,339) (1,347) - (1,347)

Net return/(loss) before

taxation 18,570 (55,589) (37,289) 16,032 (3,032) 13,000

Taxation on net return (205) - (205) (183) - (183)

Net return/(loss) after

taxation 18,365 (55,859) (37,494) 15,849 (3,032) 12,817

Return/(loss) per ordinary

share

- basic and diluted (note

5) 68.0p (206.7p) (138.7p) 58.6p (11.2p) 47.4p

===== ===== ===== ===== ===== =====

The total columns of this statement represent the Profit and

Loss Account of the Company. The revenue return and capital return

columns are supplementary to this and are prepared under guidance

published by the Association of Investment Companies. All revenue

and capital items in the above statement derive from continuing

operations. The Company had no other comprehensive income other

than those disclosed in the Income Statement. The net return is

both the profit for the year and the total comprehensive

income.

STATEMENT OF CHANGES IN EQUITY

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

30 September 2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ---------- ----------- ------------ ------------ ----------- ------------

At 1 October 2018 6,755 61,619 1,007 353,998 15,555 438,934

Net (loss)/return after

taxation - - - (55,859) 18,365 (37,494)

Third interim dividend

(14.0p) for the year

ended 30 September 2018

paid 31 October 2018 - - - - (3,783) (3,783)

Final dividend (14.0p)

for the year ended

30 September 2018 paid

31 January 2019 - - - - (3,782) (3,782)

First interim dividend

(14.5p) for the year

ended 30 September 2019

paid 30 April 2019 - - - - (3,918) (3,918)

Second interim dividend

(15.0p) for the year

ended 30 September 2019

paid 31 July 2019 - - - - (4,053) (4,053)

--------- ---------- ---------- ----------- ---------- -----------

At 30 September 2019 6,755 61,619 1,007 298,139 18,384 385,904

===== ===== ===== ====== ===== ======

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

30 September 2018 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ---------- ----------- ------------ ------------ ----------- ------------

At 1 October 2017 6,755 61,619 1,007 357,030 13,485 439,896

Net (loss)/return after

taxation - - - (3,032) 15,849 12,817

Third interim dividend

(12.0p) for the year

ended 30 September 2017

paid 31 October 2017 - - - - (3,242) (3,242)

Final dividend (13.0p)

for the year ended 30

September 2017 paid 31

January 2018 - - - - (3,512) (3,512)

First interim dividend

(13.0p) for the year

ended 30 September 2018

paid 30 April 2018 - - - - (3,512) (3,512)

Second interim dividend

(13.0p) for the year

ended 30 September 2018

paid 31 July 2018 - - - - (3,513) (3,513)

--------- ---------- ---------- ----------- ---------- -----------

At 30 September 2018 6,755 61,619 1,007 353,998 15,555 438,934

===== ===== ===== ====== ===== ======

STATEMENT OF FINANCIAL POSITION

As at 30 September As at 30 September

2019 2018

GBP'000 GBP'000

---------------------------------------- ------------------- -------------------

Fixed assets

Investments held at fair value through

profit or loss:

Listed at market value in the United

Kingdom (main market) 351,431 390,951

Listed at market value on AIM 65,428 73,811

Listed at market value overseas 15,906 25,641

Unlisted 2,422 2,256

----------- -----------

435,187 492,659

----------- -----------

Current assets

Debtors 1,710 2,018

Cash at bank 2,008 1,445

----------- -----------

3,718 3,463

----------- -----------

Creditors: amounts falling due within

one year (23,222) (27,421)

----------- -----------

Net current liabilities (19,504) (23,958)

----------- -----------

Total assets less current liabilities 415,683 468,701

Creditors: amounts falling due after

one year (29,779) (29,767)

----------- -----------

Net assets 385,904 438,934

======= =======

Capital and reserves

Called up share capital 6,755 6,755

Share premium account 61,619 61,619

Capital redemption reserve 1,007 1,007

Other capital reserves 298,139 353,998

Revenue reserve 18,384 15,555

----------- -----------

Total shareholders' funds 385,904 438,934

======= =======

Net asset value per ordinary share

- basic and diluted 1,428.3p 1,624.6p

======= =======

STATEMENT OF CASH FLOWS

Year ended Year ended

30 September 30 September

2019 2018

GBP'000 GBP'000

------------------------------------------- -------------- --------------

Cash flows from operating activities

Net (loss)/return before taxation (37,289) 13,000

Add back: finance costs 1,339 1,347

Add: losses on investments held at

fair value through profit or loss 54,206 3,032

Withholding tax on dividends deducted

at source (282) (228)

Decrease in other debtors 386 89

Increase/(decrease) in other creditors 1,159 (371)

----------- -----------

Net cash inflow from operating activities 19,519 16,869

Cash flows from investing activities

Purchase of investments (51,677) (76,383)

Sale of investments 54,923 48,182

----------- -----------

Net cash inflow/(outflow) from investing

activities 3,246 (28,201)

Cash flows from financing activities

Equity dividends paid (net of refund

of unclaimed distributions and reclaimed

distributions) (15,536) (13,779)

Net loans (repaid)/drawn down (5,342) 16,507

Interest paid (1,344) (1,310)

----------- -----------

Net cash (outflow)/inflow from financing

activities (22,222) 1,418

Net increase/(decrease) in cash and

cash equivalents 543 (9,914)

Cash and cash equivalents at start

of year 1,445 11,362

Effect of foreign exchange rates 20 (3)

----------- -----------

Cash and cash equivalents at end

of year 2,008 1,445

======= =======

Comprising:

Cash at bank 2,008 1,445

----------- -----------

2,008 1,445

======= =======

Cash inflow from dividends net of taxation was GBP20,564,000

(2018: GBP19,665,000).

NOTES TO THE FINANCIAL STATEMENTS

1. Accounting Policies

a) Basis of Preparation

The Company is a registered investment company as defined in section

833 of the Companies Act 2006 and is incorporated in the United

Kingdom. It operates in the United Kingdom and is registered at

201 Bishopsgate, London, EC2M 3AE.

The financial statements have been prepared in accordance with the

Companies Act 2006, FRS 102 - The Financial Reporting Standard applicable

in the UK and Republic of Ireland and with the Statement of Recommended

Practice: Financial Statements of Investment Trust Companies and

Venture Capital Trusts (the 'SORP') issued in November 2014 and

updated in February 2018 with consequential amendments.

The principal accounting policies applied in the presentation of

these financial statements are set out below. These policies have

been consistently applied to all the years presented.

The financial statements have been prepared under the historical

cost basis except for the measurement of fair value of investments.

In applying FRS102, financial instruments have been accounted for

in accordance with Section 11 and 12 of the standard. All of the

Company's operations are of a continuing nature.

The preparation of the Company's financial statements on occasion

requires the Directors to make judgements, estimates and assumptions

that affect the reported amounts in the primary financial statements

and the accompanying disclosures. These assumptions and estimates

could result in outcomes that require a material adjustment to the

carrying amount of assets or liabilities affected in the current

and future periods, depending on circumstance.

The Directors do not believe that any accounting judgements or estimates

have been applied to this set of financial statements that have

a significant risk of causing a material adjustment to the carrying

amount of assets and liabilities within the next financial year.

b) Going Concern

The assets of the Company consist of securities that are readily

realisable and, accordingly, the Directors believe that the Company

has adequate resources to continue in operational existence for

at least twelve months from the date of approval of the financial

statements. Having assessed these factors, the principal risks and

other matters discussed in connection with the viability statement,

the Directors considered it appropriate to adopt the going concern

basis of accounting in the financial statements.

Losses on Investments held at fair value through 2019 2018

2. profit or loss GBP'000 GBP'000

---- -------------------------------------------------------- ------------ ------------

Gains on the sale of investments based on historical

cost 13,452 18,056

Less: revaluation gains recognised in previous

years (11,057) (16,524)

----------- -----------

Gains on investments sold in the year based on

carrying value at previous Statement of Financial

Position date 2,395 1,532

Revaluation losses on investments held at 30 September (56,621) (4,561)

Exchange gains/(losses) 20 (3)

---------- ----------

(54,206) (3,032)

====== ======

2019 2018

3. Income from Investments GBP'000 GBP'000

---- --------------------------- ---------- ----------

UK dividends:

Listed investments 16,682 15,205

Unlisted 69 50

Property income dividends 442 391

--------- ---------

17,193 15,646

--------- ---------

Non-UK dividends:

Overseas dividend income 3,447 4,111

--------- ---------

3,447 4,111

--------- ---------

20,640 19,757

===== =====

2019 2018

4. Other Interest Receivable and Similar Income GBP'000 GBP'000

-------- -------------------------------------------------------- ----------- -----------

Stock lending commission 112 112

Income from underwriting 5 76

Bank interest 4 2

--------- ---------

121 190

===== =====

At 30 September 2019 the total value of securities on loan by the

Company for stock lending purposes was GBP74,715,000 (2018: GBP50,426,000).

The maximum aggregate value of securities on loan at any time during

the year ended 30 September 2019 was GBP118,213,000 (2018: GBP53,415,000).

The Company's agent holds collateral comprising FTSE 100 stocks,

gilts, overseas equities and overseas government bonds with a collateral

value of GBP78,772,000 (2018: GBP54,285,000) amounting to a minimum

of 105% (2018: minimum 105%) of the market value of any securities

on loan. Stock lending commission has been shown net of brokerage

fees of GBP28,000 (2018: GBP28,000).

5. Return per Ordinary Share - Basic and Diluted

The (loss)/return per ordinary share is based on the net loss attributable

to the ordinary shares of GBP37,494,000 (2018: GBP12,817,000) and

on 27,018,565 ordinary shares (2018: 27,018,565) being the weighted

average number of ordinary shares in issue during the year. The (loss)/return

per ordinary share can be further analysed between revenue and capital,

as below.

2019 2018

GBP'000 GBP'000

---- ----------------------------------------------------------- ------------------ ---------------------------

Net revenue return 18,365 15,849

Net capital loss) (55,859) (3,032)

--------- ---------

Net total (loss)/return (37,494) 12,817

===== =====

Weighted average number of ordinary shares

in issue during the year 27,018,565 27,018,565

2019 2018

Pence Pence

Revenue return per ordinary share 68.0 58.6

Capital loss per ordinary share (206.7) (11.2)

---------- ----------

Total (loss)/return per ordinary share (138.7) 47.4

====== ======

The Company does not have any dilutive securities, therefore the

basic and diluted returns per share are the same.

6. Dividends Paid and Payable on the Ordinary Shares

2019 2018

Dividends on ordinary shares Record date Payment date GBP'000 GBP'000

----------------------------------- --------------------- ------------------- ---------- -------------

Third interim dividend (12.0p)

for the year ended 30 September 6 October 31 October

2017 2017 2017 - 3,242

Final dividend (13.0p) for the

year ended 5 January 31 January

30 September 2017 2018 2018 - 3,512

First interim dividend (13.0p)

for the year ended 30 September 30 April

2018 6 April 2018 2018 - 3,512

Second interim dividend (13.0p)

for the year ended 30 September

2018 6 July 2018 31 July 2018 - 3,513

Third interim dividend (14.0p)

for the year ended 30 September 5 October 31 October

2018 2018 2018 3,783 -

Final dividend (14.0p) for the

year ended 4 January 31 January

30 September 2018 2019 2019 3,782 -

First interim dividend (14.5p)

for the year ended 30 September 30 April

2019 5 April 2019 2019 3,918 -

Second interim dividend (15.0p)

for the year ended 30 September 4,053 -

2019 5 July 2019 31 July 2019

--------- ---------

15,536 13,779

===== =====

The third interim dividend and the final dividend for the year ended 30

September 2019 have not been included as a liability in these financial

statements. The total dividends payable in respect of the financial year,

which form the basis of the retention test under Section 1158 of the Corporation

Tax Act 2010, are set out below.

2019

GBP'000

------------------------------------------------------------------------ -----------

Revenue available for distribution by way of dividend for

the year 18,365

First interim dividend (14.5p) for the year ended 30 September

2019 (3,918)

Second interim dividend (15.0p) for the year ended 30 September

2019 (4,053)

Third interim dividend (15.0p) for the year ended 30 September

2019 (4,053)

Final dividend (15.0p) for the year ended 30 September 2019

(based on 27,018,565 ordinary shares in issue at 9 December

2019) (4,053)

---------

Revenue surplus 2,288

=====

For Section 1158 purposes, the Company's undistributed revenue represents

11.1% of the income from investments.

7. Called up Share Capital

Number of Nominal value

shares entitled Total number of shares

to dividend of shares GBP'000

----------------------- ----------------- ------------- --------------

At 30 September 2018 27,018,565 27,018,565 6,755

----------- ----------- -----------

At 30 September 2019 27,018,565 27,018,565 6,755

The Company issued no ordinary shares during the year (2018: nil).

8. Net Asset Value per Ordinary Share

The net asset value per ordinary share of 1,428.3p (2018: 1,624.6p)

is based on the net assets attributable to the ordinary shares of

GBP385,904,000 (2018: GBP438,934,000) and on 27,018,565 (2018: 27,018,565)

shares in issue on 30 September 2019.

The movements during the year of the assets attributable to the ordinary

shares were as follows:

2019 2018

GBP'000 GBP'000

---- ---------------------------------------------------- ------------- ------------

Total net assets at 1 October 438,934 439,896

Total net return after taxation (37,494) 12,817

Net dividends paid in the year:

Ordinary shares (15,536) (13,779)

----------- -----------

Net assets attributable to the ordinary shares

at 30 September 385,904 438,934

====== ======

9. 2019 Financial Information

The figures and financial information for the year ended 30 September

2019 are extracted from the Company's annual financial statements

for that period and do not constitute statutory accounts. The Company's

annual financial statements for the year to 30 September 2019 have

been audited but have not yet been delivered to the Registrar of Companies.

The Independent Auditor's Report on the 2019 annual financial statements

was unqualified, did not include reference to any matter to which

the Auditor drew attention without qualifying the report, and did

not contain any statements under sections 498(2) or 498(3) of the

Companies Act 2006.

10. 2018 Financial Information

The figures and financial information for the year ended 30 September

2018 are compiled from an extract of the published financial statements

for that year and do not constitute statutory accounts. Those financial

statements have been delivered to the Registrar of Companies and included

the Independent Auditor's Report, which was unqualified, did not include

reference to any matter to which the Auditor drew attention without

qualifying the report, and did not contain any statements under sections

498(2) or 498(3) of the Companies Act 2006.

11. Dividend

The final dividend, if approved by the shareholders at the Annual

General Meeting, of 15.0p per ordinary share will be paid on 31 January

2020 to shareholders on the register of members at the close of business

on 3 January 2020. This will take the total dividends for the year

to 59.5p (2018: 54.0p). The Company's shares will be traded ex-dividend

on 2 January 2020.

12. Annual Report

The Annual Report will be posted to shareholders in December 2019

and will be available on the Company's website (www.lowlandinvestment.com)

or in hard copy format from the Company's Registered Office, 201 Bishopsgate,

London EC2M 3AE.

13. Annual General Meeting

The Annual General Meeting will be held on Tuesday, 28 January 2020

at 12.30 pm at 201 Bishopsgate, London, EC2M 3AE. The Notice of Meeting

will be sent to shareholders with the Annual Report.

For further information please

contact:

James Henderson Laura Foll

Fund Manager Fund Manager

Lowland Investment Company plc Lowland Investment Company plc

Telephone: 020 7818 4370 Telephone: 020 7818 6364

Laura Thomas James de Sausmarez

Investment Trust PR Manager Head of Investment Trusts

Janus Henderson Investors Janus Henderson Investors

Telephone: 020 7818 2636 Telephone: 020 7818 3349

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) are incorporated into, or form part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR TLBFTMBBMBBL

(END) Dow Jones Newswires

December 09, 2019 11:15 ET (16:15 GMT)

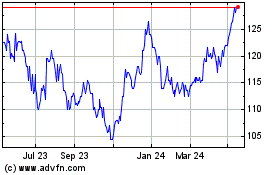

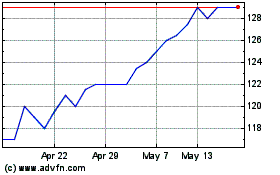

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jul 2023 to Jul 2024