TIDMMNRG

MetalNRG PLC

29 June 2022

29 June 2022

MetalNRG plc

("MetalNRG" or the "Company")

Request for a General Meeting

MetalNRG takes the opportunity to inform the market that, on 16

June 2022, MetalNRG received a letter at its registered office

address, requesting that a general meeting be convened for the

purpose of considering the instruction by the Company of an

independent professional advisor to conduct an impartial

investigation of: (i) the transactions carried out by the Company

between 1 January 2021 and 2 February 2022, including the issuance

of up to GBP200,000 of secured Convertible Loan Notes to Global

Investment Strategy ("GIS") ; and (ii) the use of the aggregate

GBP1,800,000 net placing proceeds, raised in the placing in May

2021, including the financing of BritNRG Limited and the Sunswept

Acquisition.

The Company considered the requisition notice carefully (not

least in light of its general wish not to deny any qualifying

shareholder their rights under section 303(1) Companies Act) and

rejected it on the grounds that it had not been executed by

"members" (within the meaning of the Companies Act 2006) holding

the requisite percentage of shares required to make a valid

request. The Company's rejection of the requisition notice came

after due and careful enquiry of its registrar and after scrutiny

of reports prepared for it by third party register analysts to

determine the validity of the requisition notice. In any event, the

request would also have to be balanced against due and proper

process and the prudent use of shareholder resources.

In order to avoid the need to requisition a general meeting, and

the costs associated therewith, to obtain information which is

already readily available to shareholders, the Company has decided

to provide the information voluntarily and transparently. The

Company would also like to point out that the Contract of the

Convertible Loan Notes entered into with GIS has been available for

all to scrutinise since January 2022 on the Company's website.

The Company outlines below the use of proceeds from the May 2021

placing referred to in the requisition notice:

Use of Proceeds

Investments

BritNRG LLP 1,020,000

Goldridge 47,738

MNRG Eco Ltd / EQTEC 605,280

Total 1,673,018

=======================

Corporate

Legal fees 85,000

Legal fees 192,000

Audit fees 61,200

PR fees 12,600

Listing fees 15,750

Website 8,100

Website 2,400

Broker fees 9,000

IT Support / Bank

charges 236

Other (Postage) 32

Salaries, Dir fees,

bonuses 89,564

Total 475,882

=======================

The majority of funds, some GBP1,020,000, were paid, in May

2021, to BritENERGY Holdings LLP, a limited liability partnership

in which Mr Pierpaolo Rocco had, at the time, an indirect

beneficial interest of not less than 70% (which is now admitted by

Mr Rocco as being held through a company owned by his wife and of

which he was also a director), which information was not properly

disclosed to the Company at the time of the transactions giving

rise to the payment obligation (and was not apparent from public

records at Companies House which did not reflect the actual

interests held at the relevant time).

It is the undisclosed nature of this interest which has led

directly to the litigation between the Company, BritENERGY Holdings

LLP, BritNRG Limited and Mr Rocco, with the Company seeking the

return of the payment, which in the view of the Company was of the

nature of a secret profit being made by a then director at the

expense of the Company and is, in any event, recoverable pursuant

to section 195 of the Companies Act, inter alia, as a direct result

of the failure by Mr Rocco to adequately disclose his interest in

those transactions.

The Company has applied to the High Court for an order that the

GBP1,020,000 be returned together with interest and costs by way of

summary judgement (on grounds that no substantive defence has been

filed and the relevant facts have largely admitted by the

defendants). The Company is currently awaiting a date for a hearing

of the summary judgment application and is confident that summary

judgement will be granted in its favour, together with costs.

In the meantime, the Company continues to receive ancillary

legal challenges from Mr Rocco (some of which have been

successfully defended by the Company, for example Mr Rocco's claims

brought in the Sheriff Court in Scotland, which were dismissed with

costs awarded to the Company against Mr Rocco in an amount to be

assessed) and others subsequently threatened but seemingly

abandoned by Mr Rocco (many of which shareholders will have seen

reference to in websites maintained by and posts on social media

made by Mr Rocco and/or his associated entities) including cases of

alleged actions for defamation and a petition for unfair

prejudice). As with the defective requisition notice, these actions

are, in the opinion of the Company, ill-conceived and generally

fail to comply with (or are made without a proper understanding of)

the applicable laws and regulations, being designed, in the view of

the Company, as attempts to deflect shareholder attention from the

true matter affecting shareholder assets, being the recovery of

funds unlawfully received by BritENERGY Holdings LLP from the

Company in May 2021.

END

Contact details:

MetalNRG plc

Rolf Gerritsen

Christopher Latilla-Campbell +44 (0) 20 7796 9060

Corporate Broker

PETERHOUSE CAPITAL LIMITED

Lucy Williams/Duncan Vasey +44 (0) 20 7469 0930

----------------------

Corporate Broker

SI CAPITAL LIMITED

Nick Emerson +44 (0) 1483 413500

----------------------

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAUKURRUVUNUAR

(END) Dow Jones Newswires

June 29, 2022 06:45 ET (10:45 GMT)

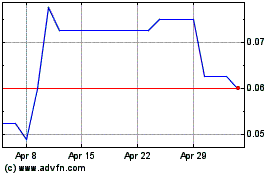

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024