Moneysupermarket.com Group PLC Trading Statement (5576W)

18 April 2019 - 4:00PM

UK Regulatory

TIDMMONY

RNS Number : 5576W

Moneysupermarket.com Group PLC

18 April 2019

18 April 2019

Q1 2019 Update: Strong trading performance supported by

increased energy switching

Moneysupermarket.com Group PLC reports trading results for the

quarter ending 31 March 2019

Q1 2019 Q1 2018 Growth

GBPm GBPm %

Insurance 48.3 47.1 3

Money 25.3 23.1 9

Home Services 19.6 11.5 70

Other revenue 11.7 6.5 80

------- ------- ---------------

Total revenue 104.9 88.3 19*

------- ------- ---------------

* Revenue growth 12% excluding Decision Technologies

-- Motor insurance benefitted from improved conversion,

partially offset by subdued trading in life insurance as

competitors spent more on their customer incentives

-- Positive momentum in Money continued albeit lapping a weak

quarter in 2018

-- The combination of attractive offers and the announcement of

the price cap increase meant energy switching was exceptionally

strong in the quarter

-- Other revenue includes GBP6.2m attributable to Decision

Technologies

Mark Lewis, CEO of Moneysupermarket.com Group, said:

"The reinvent strategy continues with a strong first quarter of

trading, notably helping a record number of customers beat the

rising energy price cap. MoneySuperMarket innovation continues, we

have new branding and advertising to remind everyone how we can

help them with their finances and 'get money calm' and new products

like Credit Monitor are on the site."

Outlook

Performance of Home Services was exceptional in the first

quarter and we expect this to moderate through the year. Our

outlook for the year remains unchanged. The Board remains confident

of meeting current market expectations.

Enhanced distribution

Following our announcement on 14 February of a proposed GBP40m

enhanced distribution and the related shareholder consultation, the

Board confirms today that this will be made by way of special

dividend. The special dividend of 7.46 pence per share will be paid

on 21 May 2019 to shareholders on the register on 3 May 2019.

Shares will trade ex-dividend from 2 May 2019.

For further information, contact

Scilla Grimble, Chief Financial Officer - Scilla.Grimble@moneysupermarket.com / 0207 379 5151

Jo Britten, Investor Relations Director - Jo.Britten@moneysupermarket.com / 07896 469 380

William Clutterbuck, Maitland AMO - wclutterbuck@maitland.co.uk / 0207 379 5151

Notes

Adjusted EBITDA is operating profit adjusted for depreciation,

amortisation and other non-underlying costs including strategy

related costs.

Market expectations for the 12 months to 31 December 2019 (from

the analyst consensus on our investor website) are in a range of

GBP135.0m to GBP145.0m, with an average of GBP140.7m. Consensus

includes 3 estimates adjusted for IFRS16, the remaining 8 estimates

are unadjusted. As disclosed in the preliminary results the impact

from the transition to IFRS 16 on 2019 is estimated at GBP3.0m

reduction in rental costs, GBP2.6m increase to depreciation costs

and GBP1.0m increase in finance costs.

Cautionary note regarding forward looking statements

This announcement includes statements that are forward looking

in nature. Forward looking statements involve known and unknown

risks, assumptions, uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements expressed or implied by such forward looking

statements. Except as required by the Listing Rules, Disclosure and

Transparency Rules and applicable law, the company undertakes no

obligation to update, revise or change any forward-looking

statements to reflect events or developments occurring on or after

the date such statements are published.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFMGMDLNVGLZM

(END) Dow Jones Newswires

April 18, 2019 02:00 ET (06:00 GMT)

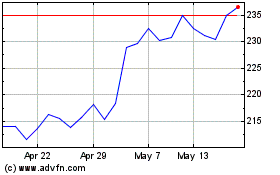

Moneysupermarket.com (LSE:MONY)

Historical Stock Chart

From Apr 2024 to May 2024

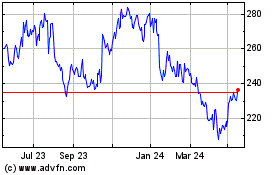

Moneysupermarket.com (LSE:MONY)

Historical Stock Chart

From May 2023 to May 2024