TIDMNESF

RNS Number : 2055C

NextEnergy Solar Fund Limited

15 January 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, JAPAN,

SOUTH AFRICA OR ANY JURISDICTION IN WHICH THE SAME WOULD BE

UNLAWFUL OR RESTRICTED BY LAW OR TO US PERSONS (WITHIN THE MEANING

OF REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS

AMENDED).

15 January 2015

NextEnergy Solar Fund Limited (the "Company")

Quarterly Trading Statement

Highlights

Three Months Ended 31 December 2014

-- Placing programme established in November 2014 to issue up to

250,000,000 shares; 95,000,000 ordinary shares subsequently issued

raising gross proceeds of GBP99.6m.

-- Net assets increased from GBP88.3m to GBP181.2m as at 31

December 2014, resulting in NAV per ordinary share of 100.3p (30

September 2014: 103.1p, or 100.5p excluding interim dividend).

-- Interim dividend of 2.625p per ordinary share for period

ended 30 September 2014 declared in November 2014 and paid on 17

December 2014.

-- Conditional agreements entered into to acquire four solar

power plants with aggregate energy capacity of 57 Megawatts Peak

("MWp") and total acquisition value of up to GBP65.0m, with all

plants expected to be accredited under 1.4 Renewable Obligation

Certificate ("ROC") regime.

-- At 31 December 2014, portfolio comprised eleven assets with

aggregate capacity of c.124MWp and total investment value of

c.GBP145m (c.79% of equity proceeds raised since IPO).

Post 31 December 2014

-- Completed acquisition of Gover Farm and acquisitions of

Bilsham and Brickyard expected to complete during January 2015.

These assets have, in aggregate, capacity of 25.7MWp and

acquisition value of GBP29.9m (as these assets are operational at

completion, they will be valued based on discounted cash flows,

rather than cost, which is expected to be incremental to NAV per

ordinary share as at 31 January 2015).

-- Board is pursuing a further issue of new ordinary shares

under the previously announced Placing Programme to take advantage

of its large pipeline of attractive investment opportunities, with

share issue expected to take place in February 2015 and issue price

based on the NAV per ordinary share as at 31 January 2015.

Outlook

-- On course to deliver target dividend of 5.25p per ordinary

share in respect of its first financial year ending 31 March 2015

and, thereafter, annual dividends of, in aggregate, 6.25p per

ordinary share (adjusted subsequently on an annual basis in direct

proportion to variations in RPI).

-- Strong pipeline of assets available for acquisition: total

capacity of c.174MWp with investment value of c.GBP237m secured

(through letters of intent giving Company exclusivity for defined

period), the majority of which are expected to be accredited under

1.4 ROC regime.

Financial Information (As at 31 December 2014)

Net assets GBP181.2m

NAV per ordinary share 100.3p

Market capitalisation GBP187.4m

Share price 103.75p

Share price premium to

NAV 3.4%

----------------------- ---------

At 31 December 2014, including cash on hand and the Revolving

Credit Facility, NESF had available liquidity of GBP128.0m, of

which GBP79.4m was allocated to announced investments. The Company

had no financial debt outstanding as at 31 December 2014.

Investment Activity and Performance

During the quarter ended 31 December 2014, the Company entered

into agreements to purchase four solar power plants (Condover, Cock

Hill, Llwyndu and Boxted Airfield) with an aggregate capacity of

57.6MWp and an aggregate consideration of up to GBP65.0m.

Construction of each of these plants is underway and they are all

expected to become operational by 31 March 2015. Accordingly, these

plants are expected to be accredited under the 1.4 ROC regime. The

Company has the right to withdraw, without incurring any financial

penalties, from acquiring any plant in the event that it is not

eligible for the contracted ROC regime.

In addition, during the period share purchase agreements

covering two projects amounting to a total of 32.9MWp and GBP37.1m

were signed by NextPower Development Limited (the "Developer"). The

Company has the right to acquire the two plants at unchanged terms

and conditions, with no consideration payable to the Developer.

The Company's operational portfolio performed satisfactorily

over the course of 2014. Irradiation was significantly lower than

expected during the months of October and November. However,

overall, recorded solar irradiation was 2.1% above predicted levels

and recorded electricity generation was 3.4% above expectations.

Revenues were also above expectations.

The Investment Manager continues to carefully monitor

developments in the UK power market, in particular as it pertains

to the market price of electricity. Recent factors influencing the

electricity market prices include, inter alia, the

warmer-than-usual weather conditions, declining hydrocarbon (oil

and gas) prices in the UK and beyond, regulatory developments as

well as changes to the country-wide portfolio of

electricity-generating power plants. The Investment Manager has

noted the recent weakening in the spot and forward electricity

prices, and continues to design the Company's electricity sales

strategy to secure the highest prices achievable while maintaining

adequate flexibility.

Portfolio at 31 December 2014

Operating Assets

Valuation

Capacity Cost(1) at 31-Dec-14

Power Plant Acquired ROC Regime (MWp) (GBPm) (GBPm)

Ellough

(Suffolk) 27-Jul-14 1.6 14.9 18.0 19.0

Shacks Barn

(Silverstone,

Northants) 8-May-14 2.0 6.3 8.2 9.5

Higher Hatherleigh

(Wincanton,

Somerset) 30-Apr-14 1.6 6.1 7.3 8.5

-------- -------- --------------

Total 27.3 33.5 37.0

------------------------------- ---------- -------- -------- --------------

(1) Including acquisition price paid to 31 December 2014,

expenses and working capital requirements.

Assets in Construction for, or Secured by, the Company(1)

Acquisition

Price

Capacity (Max.)

(GBPm) Completion

Power Plant Operational ROC Regime (MWp) (3) of Acquisition

Cock Hill

(Wiltshire) Mar-15(2) 1.4 20.0 23.3 Apr-15(2)

Boxted Airfield

(Essex) Feb-15(2) 1.4 18.8 20.6 Mar-15(2)

Poulshot

(Trowbridge,

Wiltshire) Mar-15(2) 1.4 14.5 15.6 Mar-15(2)

Bilsham

(Bognor Regis,

Sussex) Nov-14 1.4 12.5 15.2 Jan-15(2)

Condover

(Shropshire) Mar-15(2) 1.4 10.2 11.7 Apr-15(2)

Gover Farm

(Truro, Cornwall) Oct-14 1.4 9.4 10.7 Jan-15

Llwyndu

(Mid-Wales) Mar-15(2) 1.4 8.0 9.4 Apr-15(2)

Brickyard

(Leamington

Spa, Warwick) Nov-14 1.4 3.8 4.0 Jan-15(2)

Total 97.2 110.5

--------------------------------- ---------- -------- ----------- ---------------

(1) Projects secured by the Company through executed share

purchase agreements. Completion of acquisitions is subject to

contractual conditions, including, inter alia, on-time completion

of construction.

(2) Target.

(3) Including expenses and working capital requirements

Since 31 December 2014, the Company has completed the

acquisition of Gover Farm and expects to complete the acquisitions

of Bilsham and Brickyard during January 2015 with, in aggregate,

capacity of 25.7MWp and acquisition value of GBP29.9m. NESF has

contractual rights to all revenues generated by the three plants

from their operational date. As these assets are operational at

completion, they will be valued based on discounted cash flows

(rather than cost), which is expected to be incremental to the NAV

per ordinary share as at 31 January 2015.

Assets Secured by the Developer and Available to the

Company(1)

Acquisition

Price Completion

Capacity (Max.) of

Power Plant Operational ROC Regime (MWp) (GBPm) Acquisition

Lagenhoe

(Essex) Feb-15(2) 1.4 21.2 22.9 Mar-15(2)

Hawkers Farm

(Somerset) Mar-15(2) 1.4 11.7 14.2 Jun-15(2)

-------- -----------

32.9 37.1

-------------------------- ---------- -------- ----------- -------------

(1) Projects secured by the Developer through executed share

purchase agreements. Completion of acquisitions is subject to

contractual conditions, including, inter alia, on-time completion

of construction. The Company has the right to acquire these plants

at unchanged terms and conditions, with no consideration payable to

the Developer.

(2) Target.

Investment Pipeline

The Company's investment pipeline of opportunities secured by

letters of intent amounts to ten projects, for a total capacity of

c.174MWp (including the two transactions already signed by the

Developer referred to above). The estimated investment value of the

entire secured pipeline totals c.GBP237m.

This pipeline comprises assets secured from a variety of

counterparts and located across southern England. The majority of

assets is expected to be accredited under the 1.4 ROC regime, with

one asset expected to be accredited under the 1.6 ROC regime. The

secured assets also include a portfolio of operating commercial and

residential rooftop sites accredited under the Feed-in-Tariff

("FiT") regime. Two other projects in the pipeline are operational.

Construction activities are underway on most of the remaining

projects in the pipeline.

Outlook

The Investment Adviser, NextEnergy Capital Ltd, continues to

evaluate a broad set of incremental investment opportunities for

the Company. These investment opportunities mainly comprise assets

accredited or expected to be accredited under regimes including ROC

(1.6, 1.4 and 1.3 ROCs), FiT and Contracts for Difference

("CfD").

These new-build opportunities include ground-based projects

below 5MWp which can qualify for ROC or FiT accreditation, as well

as rooftop portfolios qualifying for FiT treatment. The Company is

also in discussions with partners seeking to accredit and construct

large-scale projects under the new CfD regime.

The Company is also pursuing utility-scale operating projects

constructed previously under the ROC and FiT regimes as well as

presently being constructed under current regulation.

Considering the number and overall size of projects pursued and

on-going developments in the market, the Board believes the Company

will continue to expand its portfolio of assets acquired after

March 2015.

Placing Programme

Shareholders approved the establishment of a placing programme

to issue up to 250,000,000 shares at a general meeting of the

Company held on 4 November 2014. 95,000,000 ordinary shares have

been issued under the placing programme, raising gross proceeds of

GBP99.6m.

The Board is pursuing a further issue of new ordinary shares to

allow the Company to take advantage of its large pipeline of

attractive investment opportunities. It is expected that this issue

will take place in February 2015 and that the issue price will be

based on the unaudited NAV per ordinary share as at 31 January

2015. A further announcement will be made in due course.

Enquiries:

NextEnergy Capital Limited 020 3239 9054

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe (Financial Adviser and Joint Lead Bookrunner) 020 7894 7667

Sue Inglis (Corporate Finance)

Andrew Worne / Andrew Davey / Tom Dixon (Sales)

Shore Capital (Sponsor and Joint Bookrunner) 020 7408 4090

Bidhi Bhoma

Anita Ghanekar

Patrick Castle

Macquarie Capital (Europe) Limited (Joint Lead Bookrunner) 020 3037 2000

Ken Fleming

Nick Stamp

MHP Communications 020 3128 8100

Andrew Leach

Jamie Ricketts

Gina Bell

Notes

This announcement does not constitute or form part of any offer

to issue or sell, or any solicitation of any offer to subscribe or

purchase, any securities in the Company in any jurisdiction, nor

shall it (or any part of it or the fact of its distribution) form

the basis of, or be relied on in connection with, any contract

therefor or investment decision is respect of any such securities.

Without prejudice to the foregoing generality, this announcement

does not constitute a recommendation regarding any securities. Any

decision to purchase or subscribe for shares in the Company must be

made exclusively on the basis of the prospectus published by the

Company on 10 November 2014 (and any supplement thereto) in

connection with its placing programme.

Unless otherwise noted, the financial information contained in

this announcement is unaudited. The information contained in this

announcement is subject to updating and amendment, and does not

purport to be full or complete. No reliance may be placed for any

purpose on the information contained in this announcement in

connection with the Company or the purchase of any securities in

the Company.

The potential acquisition by the Company of any of the

investments referred to in this announcement is subject, among

other things, to those projects reaching legal completion and to

the Company having conducted satisfactory due diligence in relation

to such investments. There is therefore no guarantee that any of

the investments will be acquired and, if they are, on what

terms.

This IMS contains forward-looking statements that are based on

current expectations or beliefs, as well as assumptions about

future events. Forward-looking statements are not guarantees of

future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, distribution

policy and the development of its financing strategies may differ

materially from the impression created by the forward-looking

statements contained in this document. Subject to their legal and

regulatory obligations, the Company and its Investment Manager

expressly disclaim any obligations to update or revise any

forward-looking statement contained in this announcement to reflect

any change in expectations with regard thereto or any change in

events, conditions or circumstances on which any statement is

based.

Notes to Editors:

NextEnergy Solar Fund

NextEnergy Solar Fund (www.nextenergysolarfund.com) is a

specialist investment fund focused on operational solar

photovoltaic assets located in the UK. The Company intends to

provide investors with a sustainable and attractive dividend that

increases in line with RPI over the long term and an element of

capital growth through the re-investment of net cash generated in

excess of the target dividend.

Further information on NextEnergy Capital and WiseEnergy is

available at www.nextenergycapital.com and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBIMBTMBTBTFA

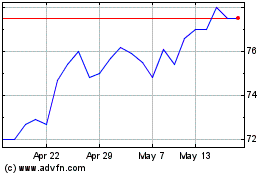

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jun 2024 to Jul 2024

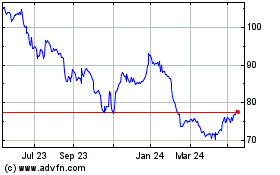

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jul 2023 to Jul 2024