NextEnergy Solar Fund Limited Refinancing of Short Term Debt Facility (6132D)

08 July 2016 - 4:00PM

UK Regulatory

TIDMNESF

RNS Number : 6132D

NextEnergy Solar Fund Limited

08 July 2016

NextEnergy Solar Fund Limited (the "Company" or "NESF")

Refinancing of Short Term Debt Facility

Highlights

-- Refinancing of existing debt facility with NIBC Bank N.V.

("NIBC") for GBP21.7 million ("NIBC Facility")

-- Term of new NIBC Facility to June 2019

-- Arranged debt facilities totalling GBP242.1 million, of which

GBP228.6 million currently drawn

NESF is pleased to announce the closing of a debt facility of

GBP21.7 million with NIBC. The NIBC Facility has been drawn down to

refinance the existing debt of GBP22.7 million with NIBC which was

used to finance the acquisition of NESF's Cock Hill (20.0MW) and

Llwyndu (8.0MW) projects in July 2015.

The NIBC Facility extends the tenure of the existing debt for an

additional three years and matures in July 2019.

NESF current gearing is 46% in terms of debt outstanding vs.

Gross Asset Value (which is equal to NAV as of 31 March 2016 plus

current debt outstanding of GBP228.6 million).

For further information:

NextEnergy Capital

Limited 020 3239 9054

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Sue Inglis

Shore Capital 020 7408 4090

Bidhi Bhoma

Anita Ghanekar

Macquarie Capital (Europe)

Limited 020 3037 2000

Ken Fleming

Nick Stamp

MHP Communications 020 3128 8100

Andrew Leach

Jamie Ricketts

Gina Bell

Notes to Editors:

NextEnergy Solar Fund (NESF)

NESF is a specialist investment company that invests in

operating solar power plants in the UK. Its objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

NESF has raised equity proceeds of GBP285.4m since its initial

public offering on the main market of the London Stock Exchange in

April 2014. It also has credit facilities of GBP242.1m in place

(Macquarie and Santander: GBP120m, MIDIS: GBP55.0m, Bayersiche

Landesbank: GBP45.4m and NIBC: GBP21.7m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division, providing solar asset management, monitoring and other

services to over 1,250 utility-scale solar power plants with an

installed capacity in excess of 1.7 GW. NextPower II is NEC Group's

private equity fund with initial commitments of EUR150m, investing

in operating solar power plants and focused on consolidating the

substantial, highly fragmented Italian solar market.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAXXXEDLKEFF

(END) Dow Jones Newswires

July 08, 2016 02:00 ET (06:00 GMT)

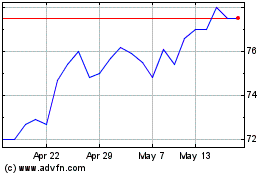

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jul 2023 to Jul 2024