TIDMONC

RNS Number : 1067G

Oncimmune Holdings PLC

14 July 2023

14 July 2023

Oncimmune Holdings plc

("Oncimmune" or the "Company" or the "Group")

Corrected unaudited interim results for the 12 months to 31 May

2022

Oncimmune Holdings plc (AIM: ONC.L), the leading autoantibody

profiling company to the pharmaceutical and biotechnology industry,

today announces its corrected unaudited interim results for the 12

months to 31 May 2022, which were originally announced on 21

September 2022.

These results were unaudited as the Company had previously

announced its intention to change the date of its year end, from 31

May to 31 August, and were required to maintain continuity of

financial reporting as the Company was not due to report its

subsequent audited results for the 15 months ended 31 August 2022

until early 2023.

As stated in the announcement on 15 June 2023, the financial

results of one of the Company's subsidiaries had been incorrectly

consolidated into those of the Group, resulting in an overstatement

of approximately GBP0.7 million for both revenue and cost of sales

at the consolidated Group level. This error had no effect on the

gross profit, or the operating loss as previously reported, nor has

it had any effect on the reported cash position. Furthermore, this

one-off error had no effect on the audited final results for the

15-month period to 31 August 2022, which were announced on 27

February 2023. The unaudited interim results for the six months

ended 28 February 2023, as announced on 31 May 2023, were similarly

unaffected save for the comparative data for the 12 months to May

2022 in the consolidated income statement.

The corrected unaudited interim results for the 12 months to 31

May 2022 are included in this announcement.

For further information:

Oncimmune Holdings plc

Ron Kirschner, Chief Executive Officer

contact@oncimmune.co.uk

Singer Capital Markets (Nominated Adviser and Broker)

Phil Davies, Harry Gooden, George Tzimas, James Fischer

+44 (0)20 7496 3000

Zeus (Joint Broker)

Dominic King, Victoria Ayton, Dan Bate

+44 (0)20 3829 5000

+44 (0)20 3727 1000

About Oncimmune

Oncimmune is a specialist pharmaceutical services company,

primarily focused on the growing fields of immuno-oncology,

autoimmune disease and infectious diseases. Oncimmune has a

contract discovery and development service business whose

ImmunoINSIGHTS platform delivers actionable insights into therapies

to the Company ' s pharmaceutical and biotech partners.

Our understanding of the immune system enables us to harness its

sophisticated response to disease to detect cancer earlier and to

support the development of better therapies. The key to improving

cancer survival is early detection and better selection for

therapy. As a company, we are driven by our passion to improve

cancer survival and to give people extra time.

Oncimmune ' s ImmunoINSIGHTS platform enables life science

organisations to optimise drug development and delivery, leading to

more effectively targeted and safer treatments for patients.

Oncimmune ' s ImmunoINSIGHTS service business at its discovery

research centre in Dortmund, Germany. The ImmunoINSIGHTS business

development team are based in the US and Europe.

For more information, visit www.oncimmune.com

Consolidated statement of comprehensive income

Unaudited Audited

12 months Year to

to 31 May

31 May

2022 2021

GBP'000 GBP'000

Total Total

Revenue 3,206 3,722

Cost of sales (1,749) (865)

----------- -----------

Gross profit/(loss) 1,457 2,857

Research and development expenses (1,517) (1,615)

Administrative expenses (7,052) (5,652)

Share-based payment (1,800) (1,046)

(10,369) (8,313)

Other income 326 311

----------- -----------

Operating loss (8,586) (5,145)

Finance income - 403

Finance costs (943) (954)

Finance costs - net (943) (551)

Loss before taxation (9,529) (5,696)

Taxation 17 1,068

----------- -----------

Loss after tax from continuing

operations the financial year (9,512) (4,628)

Other comprehensive income

Exchange translation differences (384) (91)

Loss after tax and total comprehensive

income for the year attributable

to equity holders (9,896) (4,719)

Basic and diluted loss per share (13.7)p (7.17)p

=========== ===========

Consolidated statement of financial position

Unaudited Audited

31 May 31 May

2022 2021

GBP'000 GBP'000

Assets

Non-current assets

Goodwill 1,578 1,578

Intangible assets 3,237 4,116

Property, plant and equipment 918 664

Right-of-use assets 627 930

Deferred tax asset 927 937

----------- ---------

7,287 8,225

----------- ---------

Current assets

Inventories 413 143

Trade and other receivables 6,219 7,079

Contract assets 808 200

Cash and cash equivalents 2,530 8,631

----------- ---------

9,970 16,063

----------- ---------

Total assets 17,257 24,278

=========== =========

Equity

Capital and reserves attributable

to the equity holders

Share capital 695 691

Share premium 40,635 40,497

Other reserves 5,894 4,094

Merger reserve 31,882 31,882

Foreign currency translation

reserve (296) 88

Own shares (1,926) (1,926)

Retained earnings (79,611) (70,099)

----------- ---------

Total equity (2,727) 5227

Liabilities

Non-current liabilities

Deferred tax 115 374

Lease liability 352 671

Other liabilities 2,000 2000

Borrowings 2,420 6,239

----------- ---------

4,887 9,284

----------- ---------

Current liabilities

Trade and other payables 1,963 1,979

Contract liabilities 5,180 5,175

Other statutory liabilities 40 55

Lease liability 443 310

Other liabilities - -

Borrowings 7,471 2,248

----------- ---------

15,097 9,767

----------- ---------

Total liabilities 19,984 19,051

=========== =========

Total equity and liabilities 17,257 24,278

=========== =========

Consolidated statement of changes in equity

Share Share Other Merger Foreign Own Retained Total

capital premium reserves reserve currency shares earnings

translation

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 June 2020 635 31,459 3,048 31,882 179 (1,926) (65,471) (194)

Loss for the year - - - - - - (4,628) (4,628)

Other comprehensive income:

Currency translation

differences - - - - (91) - - (91)

-------- -------- --------- -------- ------------ -------- --------- --------

Total comprehensive expense

for the period - - - - (91) - (4,628) (4,719)

Transactions with owners:

Shares issued in year 50 8,331 - - - - - 8,381

Options exercised 2 106 - - - - - 108

Shares issued in relation to

prior year acquisition 4 601 - - - - - 605

Share-based option charge - - 1,046 - - - - 1,046

As at 31 May 2021 691 40,497 4,094 31,882 88 (1,926) (70,099) 5,227

======== ======== ========= ======== ============ ======== ========= ========

Loss for the year - - - - - - (9,512) (9,512)

Other comprehensive income:

Currency translation

differences - - - - (384) - - (384)

-------- -------- --------- -------- ------------ -------- --------- --------

Total comprehensive income - - - - (384) - (9,512) (9,896)

Transactions with owners:

Shares issued in year - - - - - - -

Exercise of options and

warrants 4 138 - - - - - 142

Shares issued in relation to - - - - - - - -

prior year acquisition

Share option charge - - 1,800 - - - - 1,800

As at 31 May 2022 695 40,635 5,894 31,882 (296) (1,926) (79,611) (2,727)

======== ======== ========= ======== ============ ======== ========= ========

Consolidated statement of cash flows

Unaudited Audited

12 months Year to

to 31 May

31 May

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Loss before income tax (9,529) (5,696)

Adjusted by:

Depreciation and amortisation 1429 740

Share-based payment charge 1,800 1,046

Interest received - (403)

Interest expense 943 954

Gain on disposal of assets - -

Fair value gain - 176

Exchange rate movement 3 -

Changes in working capital:

(Increase)/decrease in inventories (270) 31

Increase in trade and other receivables 253 (5,837)

Increase / (decrease) in trade

and other payables (428) 4,841

Cash used in operating activities (5,799) (4,148)

Interest paid (169) (885)

Interest received - 3

Income tax received (243) 503

----------- ---------

Net cash used by operating activities (6,211) (4,527)

----------- ---------

Cash flows from investing activities

Purchase of property, plant and

equipment (504) (446)

Purchase of intangible assets - (625)

Proceeds from sale of assets - 215

Net cash (used in)/ generated

from investing activities (504) (856)

----------- ---------

Cash flows from financing activities

Net funds raised through share

issue 142 8,489

Loan advances 3,345 2,728

Loan repayments (2,347) (1,135)

Principal elements of lease repayments (153) (303)

Net cash generated from financing

activities 987 9,779

----------- ---------

Movement in cash attributable

to foreign exchange (375) (5)

Net change in cash and cash

equivalents (6,103) 4,391

Cash and cash equivalents at

the beginning of the year 8,631 4,240

Cash and cash equivalents at

the end of the year 2,528 8,631

=========== =========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FUREAAXLFEKDEFA

(END) Dow Jones Newswires

July 14, 2023 09:00 ET (13:00 GMT)

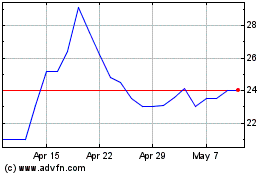

Oncimmune (LSE:ONC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oncimmune (LSE:ONC)

Historical Stock Chart

From Apr 2023 to Apr 2024