Riverstone Credit Opps. Inc PLC Portfolio Update (4045B)

10 June 2021 - 4:00PM

UK Regulatory

TIDMRCOI

RNS Number : 4045B

Riverstone Credit Opps. Inc PLC

10 June 2021

Riverstone Credit Opportunities Income Plc

Portfolio Update

London, UK 10 June 2021: Riverstone Credit Opportunities Income

Plc ("RCOI" or the "Company") has announced it has the below update

and has additionally realised one investment:

Riverstone-related Shareholdings' Update

Riverstone Credit Opportunities Income Plc ("RCOI" or the

"Company") has been notified that Pierre F. Lapeyre, Jr. sold

2,597,680 ordinary shares, David M. Leuschen sold 2,576,669

ordinary shares, and Riverstone Holdings LLC sold 1,711,132

ordinary shares in the Company. These shares are part of the

significant investment made by Riverstone at the time of the IPO

and the sales were made in response to increased investor demand,

facilitating the company's planned strategy to increase shares

available to third party investors . Christopher Abbate and Jamie

Brodsky, the key principals at Riverstone Credit Partners, still

own all of their ordinary shares and collectively the credit team

owns 2,353,900 ordinary shares or 2.6% of the shares

outstanding.

Realisation

-- Project Alp Realisation - In June 2019, RCOI committed $13.3

million to a sponsor-backed E&P company with operations focused

in the Northern Delaware Basin of New Mexico. In December 2020,

RCOI sold 40% of the loan to a third-party, and subsequently, RCOI

entered a contract with a trade date of 19 May 2021 to sell the

remainder of the loan to a separate third-party. The sale is

expected to close the middle of June, resulting in approximately a

19.7% realised IRR and approximately a 1.21x realised MOIC.

About Riverstone Credit Opportunities Income Plc :

RCOI seeks to generate consistent Shareholder returns

predominantly in the form of income distributions, principally by

making senior secured loans to small and middle-market energy

companies, which span conventional energy as well as low carbon and

renewable sources. The investment strategy is predicated on

asset-based lending, with conservative loan-to-value ratios and

structural protective features to mitigate risk. The Company will

invest broadly across energy subsectors globally, with a primary

focus on infrastructure businesses and going forward those with

de-carbonization strategies in North America. RCOI intends to

create a diversified portfolio across various energy subsectors,

commodity exposures, technologies and end-markets to provide

natural synergies that aim to enhance the overall stability of the

portfolio.

For further details, see https://www.riverstonecoi.com/ .

Neither the contents of RCOI's website nor the contents of any

website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part of, this announcement.

Media Contacts

For Riverstone Credit Opportunities Income Plc:

Jingcai Zhu

+1 212 271 6261

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUSSAESUEFSEEM

(END) Dow Jones Newswires

June 10, 2021 02:00 ET (06:00 GMT)

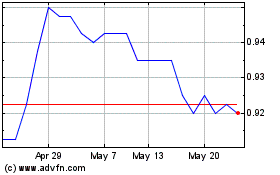

Riverstone Credit Opport... (LSE:RCOI)

Historical Stock Chart

From Apr 2024 to May 2024

Riverstone Credit Opport... (LSE:RCOI)

Historical Stock Chart

From May 2023 to May 2024