TIDMRFX

RNS Number : 6891I

Ramsdens Holdings PLC

28 November 2018

Ramsdens Holdings PLC

("Ramsdens", the "Group", the "Company")

Interim Results for the six months ended 30 September 2018

Continued strategic progress and on track to meet full year

expectations

Ramsdens, the diversified financial services provider and

retailer, today announces its Interim Results for the six months

ended 30 September 2018 (the "Period" or the "first half").

Highlights:

-- Continued Group revenue growth reflecting diversification of

the Group's core income streams with:

o Foreign Currency Exchange income down 2% to GBP7.3m (H1 FY18:

GBP7.5m) impacted by exceptionally hot UK summer weather as well as

Easter trading falling outside of the Period;

o Pawnbroking income less impairment up 5% in the period,

following an increase in loan book of 6% from financial year end at

31 March 2018 to GBP6.8m;

o Jewellery Retail revenue grew by 27% to GBP4.5m (H1 FY18:

GBP3.5m) including online jewellery retail which itself increased

by 126% year on year;

o Gross profit from purchases of precious metals grew 6% to

GBP2.6m (H1 FY18: GBP2.5m).

-- A small and expected decline in EBITDA year on year,

reflecting the absence of peak Easter holiday FX trading, the

opening costs associated with new stores, and investment in the

infrastructure and team to support growth, in part compensated by

improved retail jewellery and pawnbroking trading.

-- Four stores opened during the Period and these, together with

the four stores opened in H2 FY18, are collectively trading ahead

of initial expectations. A further four stores have opened since

the Period end.

Financial Summary:

6 months 6 Months ended Increase

ended 30 30 September / (Decrease)

September 2017

2018

Group Revenue GBP23.9m GBP21.8m 10%

EBITDA GBP5.7m GBP5.9m (3%)

Underlying EBITDA* GBP5.8m GBP6.0m (3%)

Profit Before Tax GBP5.0m GBP5.2m (3%)

Underlying Profit Before

Tax* GBP5.1m GBP5.3m (3%)

Basic EPS 13.0p 13.4p (3%)

Interim Dividend 2.4p 2.2p 9%

*Underlying EBITDA / Profit Before Tax is after adding back LTIP

costs

-- Net assets up GBP2.7m from the financial year end of 31 March 2018 to GBP30.3m.

-- Net cash of GBP12.4m, down GBP0.3m from financial year end of

31 March 2018 reflecting investments in new stores, additional

stock and the payment of the FY18 final dividend.

Peter Kenyon, Chief Executive, commented:

"The Group has had a good first half, reflecting the strengths

of our diversified business model and outstanding value-for-money

customer offering. Whilst there have been headwinds for the foreign

currency exchange market in the UK driven by 'staycation' trends

over the summer, our investments in pawnbroking, jewellery retail

and the store estate have delivered positive results and helped to

underpin an overall first half performance in line with the Board's

expectations.

Reflecting the Group's continued growth, as well as the Board's

confidence in the outlook, we are pleased to announce a 0.2p

increase in the interim dividend to 2.4p.

The collective performance of the new stores opened from late

2017 onwards has been ahead of expectations and we have made a

solid start to the second half of the year across our business

segments. We have momentum to take us into the seasonally important

Christmas period for jewellery retail and, underpinned by the

strength of our business model and brand, the Board remains

confident of delivering further progress on its strategic

objectives and achieving its expectations for the year."

Enquiries:

Ramsdens Holdings PLC Tel: +44 (0) 1642 579957

Peter Kenyon, CEO

Martin Clyburn, CFO

Liberum Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3100 2000

Richard Crawley

Joshua Hughes

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Alex Brennan

Lucy Wollam

About Ramsdens

Ramsdens is a growing, diversified, financial services provider

and retailer, operating in the four core business segments of

foreign currency exchange, pawnbroking loans, precious metals

buying and selling and retailing of second hand and new

jewellery.

Headquartered in Middlesbrough, the Group operates from 139

stores within the UK (including 4 franchised stores) and has a

small but growing online presence.

In the last financial year, the Group served over 800,000

customers across its different services. Ramsdens is fully FCA

authorised for its pawnbroking and credit broking activities.

www.ramsdensplc.com

www.ramsdensforcash.co.uk

CHIEF EXECUTIVE'S REPORT

I am pleased to report on another period of good progress. The

Group's performance, which is in line with the Board's

expectations, again demonstrates the strength of our business model

which is underpinned by our four core diversified income streams

and we remain confident of achieving our underlying PBT

expectations for the year.

The Group delivered revenue growth of 10% in the first half. A

prolonged period of exceptionally hot weather in the UK contributed

to a decline in foreign currency exchange revenue when compared to

the prior year but this was more than offset by growth across the

Group's other business segments. Our ongoing investment in

Jewellery Retail has generated strong results, while further growth

continued in the Pawnbroking loan book income as well as in

Purchases of Precious Metals.

Underlying PBT for the Period was in line with the Board's

expectations at GBP5.1m (H1 FY18 GBP5.3m). The small year on year

decline for the first half of the year was anticipated and

reflected the investments in the eight new stores opened since the

comparable period of the prior year, the absence of Easter foreign

exchange trading during the Period, and investment in our support

structure and developing our team.

Our new store opening programme is gathering pace and the early

overall performance of the four stores opened in the second half of

the last financial year as well as the four stores opened in the

Period has been encouraging across all core business segments.

The Group's performance in the first half of the year, as well

as the investments made across the business to support long-term

growth, give the Board continued confidence in our future

prospects.

FINANCIAL REVIEW

Gross profit increased by 4% to GBP16.7m, up from GBP16.1m in

the first half of the prior year. Administration expenses increased

by 7% to GBP11.7m (H1 FY18: GBP10.9m) primarily as a result of

increased staff costs to support the Group's continued store

roll-out strategy.

The balance sheet remains strong with net assets of GBP30.3m,

which is a GBP2.7m increase from the year end on 31 March 2018

(FY18). The main assets are cash (including foreign currency),

pawnbroking loans secured on gold jewellery and watches, and retail

jewellery stock.

Net cash was GBP12.4m at the period end, down GBP0.3m from FY18.

The Group has the benefit of a GBP7m revolving credit facility,

which was used in the Summer to fund higher stocks of foreign

currency.

A final dividend of 4.4p per share (GBP1.4m) for FY18 was paid

during the Period. The Directors are pleased to announce that,

reflecting the Group's continued momentum and confidence in the

outlook, they have approved an interim dividend of 2.4p per share,

(up 0.2p per share or 9% against the prior year). This will be paid

on 21 February 2019 to those shareholders on the register on 18

January 2019.

IFRS 9

These statements have been prepared under IFRS 9 'Financial

instruments', with prior periods not restated. The Group has now

disclosed pawnbroking revenue gross of impairment with impairment

disclosed separately as a cost of sale. In prior periods

pawnbroking revenue was recorded net of impairment. This change has

no impact on profit or reserves in the current or prior periods. A

summary of income and impairment for each of the periods is shown

below:

6 months ended 6 Months ended 12 Months ended

30 September 30 September 31 March 2018

2018 2017 unaudited

unaudited unaudited

Pawnbroking income GBP4.0m GBP3.7m GBP7.4m

Impairment (GBP0.3m) (GBP0.2m) (GBP0.4m)

Income less impairment GBP3.7m GBP3.5m GBP7.0m

Segmental Review

Foreign Currency Exchange

The Foreign Currency Exchange (FX) segment primarily comprises

the sale and purchase of foreign currency notes to holiday-makers.

Ramsdens also offers prepaid travel cards and international bank to

bank payments.

The Group's FX business delivered a resilient result in

challenging market conditions over the summer as the exceptionally

hot UK weather reduced overseas travel volumes and, consequently,

the demand for travel money. Despite these conditions and no peak

Easter trading during the Period (which there was in the the prior

year), a similar number of customers exchanged currency with the

Group during the Period (507,000 vs. 511,000 in H1 FY18). This is

testament to the strong and growing reputation the Group has for

great service and value for money currency exchange.

GBP315m of currency was exchanged with the Group in the Period,

a 3% decline year on year (H1 FY18: GBP324m). The sales margin has

been closely managed and, as a result, FX income was down just 2%

to GBP7.3m (H1 FY18: GBP7.5m). We continue to drive growth online,

allowing the Group to access a broader customer base, and

improvements to the currency website (www.ramsdenscurrency.co.uk)

led to an increase in online FX transactions of 26% to GBP18.2m (H1

FY18: GBP14.5m).

The commission from international bank to bank payments

increased by 44%. Whilst this is from a very low base it remains an

opportunity for long-term growth.

Pawnbroking

Pawnbroking is a small subset of the consumer credit market in

the UK and a simple form of asset backed lending dating back to the

foundations of banking. In a Pawnbroking transaction an item of

value, known as a pledge, (in Ramsdens' case jewellery and

watches), is held by the pawnbroker as security against a six-month

loan. Customers pay interest on this loan, repay the capital sum

borrowed and recover their pledged item. If a customer defaults on

the loan, the pawnbroker sells the pledged item to repay the amount

owed and returns any surplus funds to the customer. Pawnbroking is

regulated by the FCA in the UK and Ramsdens is fully FCA

authorised.

A change to six-month terms from five was implemented in October

2017, to move to an industry norm. This has had little impact on

interest income, but increased the loan book by approximately

GBP200,000 over the comparable prior year period. Customer numbers

increased by 2.7% over H1 FY18.

GBP000s (6 months to 30 H1 FY18 H1 FY17 % change FY 18

September)

Within contractual term 6,043 5,418 11.5% 5,732

Past due 757 625 699

Total Loan Book 6,800 6,043 12.5% 6,431

Interest income net of impairment was 5% higher at GBP3.7m (H1

FY18: GBP3.5m) and represented a half year yield of 55% on the

average pledge book during the period. The yield has fallen

slightly from 58% due to the change to six-month pledges.

Jewellery Retail

The Group offers new and second-hand jewellery and the Board

believes there is significant growth potential in this segment by

leveraging the retail store estate and e-commerce operations by

both cross-selling its other services to existing customers and

attracting new customers.

Jewellery Retail revenue grew by 27% to GBP4.5m (H1 FY18:

GBP3.5m). This growth was achieved despite the much-publicised

difficulties on the UK high street and reflects increasing

recognition of the value and quality of our Jewellery Retail

proposition.

We enjoyed positive contributions from our newer stores and

drove improved sales from established stores by continued

investment in jewellery stock and enhanced window displays.

E-commerce jewellery sales increased by 126% year on year

resulting in gross profit generated online increasing by GBP48k

year on year. Pleasingly, 58% of online sales were generated from

outside our branch customer catchment area. The Board believes that

this demonstrates the growing reputation of the Group as a

jewellery retail destination.

The jewellery gross profit margin fell from 54% to 52% year on

year reflecting the mix of sales with new jewellery sales and

second hand premium watch sales (both lower margin than second hand

jewellery) increasing as a percentage of total sales.

Gross profit from total Jewellery Retail increased by 23% to

GBP2.3m (H1 FY18 GBP1.9m).

Purchases of Precious Metals

Through the precious metals buying and selling service, Ramsdens

buys unwanted jewellery, gold and other precious metals from

customers for cash. Typically, a customer brings unwanted jewellery

into a Ramsdens store and a price is agreed with the customer

depending upon the retail potential, weight or carat of the

jewellery. The Group has second-hand dealer licences and other

permissions and adheres to the Police approved "gold standard" for

buying precious metals.

Once jewellery has been bought from the customer, the Group's

dedicated jewellery department assesses whether to scrap or to

retail the item through the store network or online. Income derived

from the sale of jewellery which is purchased and then retailed is

reflected in Jewellery Retail income and profits. The residual

items are smelted and sold to a bullion dealer for their intrinsic

value and the proceeds are reflected in the accounts as Precious

Metals buying income. The Group has continued its strategy to

increase jewellery retail stock levels to assist jewellery retail

sales.

Group gross profit was up 6% to GBP2.6m (H1 FY18: GBP2.5m). The

increase in profitability is primarily a result of the new stores,

as the like-for-like weight of gold purchases was broadly flat. The

average sterling gold price during the Period fell by 3%.

Other Financial Services

In addition to the four core business segments, the Group also

provides additional services in cheque cashing, Western Union money

transfer, sale and buy back of electronics, franchise fees and

credit broking.

Gross profit from these income streams remained stable and in

line with expectations at GBP0.8m (H1 FY17: GBP0.8m).

OPERATIONAL REVIEW

We have invested in our regional and area support structure

including increasing our training team. This will help manage

growth and maximise the early returns of our new stores by

providing additional support. We have an ongoing programme to

continue to develop our team thereby helping to make the Group both

a great place to work and a great consumer experience.

We continue to actively manage our branch estate and 122 of our

123 established stores (defined as stores opened for more than two

years) are profitable on a standalone basis. The average term to

the end of the lease or a break option across the established store

estate is just 30 months, providing significant flexibility in

managing our retail estate. The Group has only one marginally loss

making established store and this was relocated during 2017. This

store has shown positive momentum in recent months and has the

benefit of a very flexible lease arrangement should its performance

not further improve to meet our criteria.

Two stores were relocated in the Period, in Glasgow and Halifax.

A further four stores are scheduled to relocate to better locations

in the second half of this financial year.

Four new stores were opened in the Period, in Whitehaven, Alloa,

Preston and Kendal. Subsequent to the Period end, four more stores

were opened, Castleford in October and Otley, Ripon and Bristol in

November. A further store is awaiting shop fit and there are two

additional stores currently progressing through the legal

process.

I would like to take this opportunity to thank each and every

staff member for their hard work and outstanding contribution

during the Period.

OUTLOOK

Despite a backdrop of Brexit uncertainty impacting consumer

confidence and struggling high streets, the Board believes that our

outstanding value proposition for customers will enable the Group

to continue to grow and prosper.

The Group is committed to its stated growth strategy of

improving what it does, opening more stores and developing its

online offering. The Group has a good pipeline of store

opportunities to achieve its objective of 12 new stores per annum

over the medium term.

The Group has made a solid start to the second half of the year

across all business segments and we have positive momentum to take

us into the seasonally important Christmas period for jewellery

retail. The Board remains confident of delivering further progress

on its strategic objectives and achieving its expectations for the

year.

Peter Kenyon

Chief Executive Officer

Interim Condensed Financial Statements

Unaudited condensed consolidated statement of comprehensive

income

For the six months ended 30 September 2018

6 months 6 months 12 months

ended Ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Revenue 3 23,934 21,758 39,942

Cost of sales (7,207) (5,642) (11,595)

------------- ----------------- ----------

Gross profit 3 16,727 16,116 28,347

Administrative expenses (11,655) (10,879) (21,937)

------------- ----------------- ----------

Operating profit 5,072 5,237 6,410

Finance Costs 5 (88) (105) (177)

Gain on fair value of derivative

financial liability 34 43 79

------------- ----------------- ----------

Profit before tax 5,018 5,175 6,312

Income tax expense (1,013) (1,034) (1,278)

Total comprehensive income

for the period 4,005 4,141 5,034

------------- ----------------- ----------

Basic earnings per share in

pence 7 13.0 13.4 16.3

Diluted earnings per share

in pence 7 12.7 13.2 15.9

Unaudited condensed consolidated statement of changes in

equity

For the six months ended 30 September 2018

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening total equity 27,568 23,395 23,395

Total comprehensive income

for the period 4,005 4,141 5,034

Dividends paid (1,357) (401) (1,079)

Share based payments 101 81 161

Deferred tax on share based

payments 12 28 57

------------- --------------- -------------

Closing total equity 30,329 27,244 27,568

------------- --------------- -------------

Unaudited condensed consolidated statement of financial

position

At 30 September 2018

As at As at As at

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 4,939 3,935 4,302

Intangible assets 402 446 429

Investments - - -

Deferred tax assets 111 - 84

5,452 4,381 4,815

Current Assets

Inventories 8,500 6,390 7,567

Trade and other receivables 11,507 10,465 10,613

Cash and short term deposits 14,398 16,519 14,619

------------- ------------- -------------

34,405 33,374 32,799

------------- ------------- -------------

Total assets 39,857 37,755 37,614

------------- ------------- -------------

Current liabilities

Trade and other payables 4,945 4,930 5,793

Interest bearing loans

and borrowings 4 2,013 3,101 1,883

Accruals and deferred

income 955 890 1,281

Income tax payable 1,182 1,124 633

------------- ------------- -------------

9,095 10,045 9,590

------------- ------------- -------------

Net current assets 25,310 23,329 23,209

------------- ------------- -------------

Non-current liabilities

Interest bearing loans

and borrowings 4 0 5 1

Accruals and deferred

income 319 326 300

Derivative financial liabilities 6 76 40

Deferred tax liabilities 108 59 115

------------- ------------- -------------

433 466 456

------------- ------------- -------------

Total liabilities 9,528 10,511 10,046

------------- ------------- -------------

Net assets 30,329 27,244 27,568

------------- ------------- -------------

Equity

Issued capital 8 308 308 308

Share premium 4,892 4,892 4,892

Retained earnings 25,129 22,044 22,368

------------- ------------- -------------

Total equity 30,329 27,244 27,568

------------- ------------- -------------

Unaudited condensed consolidated statement of cash flows

For the six months ended 30 September 2018

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating activities

Profit before tax 5,018 5,175 6,312

------------- ------------- ----------

Adjustments to reconcile profit

before tax to net cash flows:

Depreciation and impairment

of property, plant & equipment 568 525 1,079

Amortisation and impairment

of intangible assets 69 103 211

Change in derivative financial

instruments (34) (43) (79)

Loss on disposal of property,

plant and equipment 20 19 29

Share based payments 101 81 161

Finance costs 88 105 177

Working capital adjustments:

Movement in trade and other receivables

and prepayments (894) (1,103) (1,251)

Movement in inventories (933) (1,052) (2,229)

Movement in trade and other

payables (1,153) 1,119 2,350

------------- ------------- ----------

2,850 4,929 6,760

Interest paid (90) (98) (173)

Income tax paid (486) (265) (999)

------------- ------------- ----------

Net cash flows from operating

activities 2,274 4,566 5,588

------------- ------------- ----------

Investing activities

Proceeds from sales of property,

plant and equipment 3 - 1

Purchase of property, plant

and equipment (1,228) (269) (1,201)

Purchase of intangible assets (42) (20) (111)

------------- ------------- ----------

Net cash flows from investing

activities (1,267) (289) (1,311)

Financing Activities

Dividends paid (1,357) (401) (1,079)

Payment of finance lease liabilities (4) (4) (8)

Bank loans drawn down 133 783 1,875

Repayment of bank borrowings - - (2,310)

------------- ------------- ----------

Net cash flows from/(used

in) financing activities (1,228) 378 (1,522)

------------- ------------- ----------

Net increase in cash and cash

equivalents (221) 4,655 2,755

Cash and cash equivalents

at start of period 14,619 11,864 11,864

------------- ------------- ----------

Cash and cash equivalents

at end of period 14,398 16,519 14,619

------------- ------------- ----------

Unaudited notes to the interim condensed financial

statements

For the six months ended 30 September 2018

1. Basis of preparation

The interim condensed financial statements of the Group for the

six months ended 30 September 2018, which are unaudited, have been

prepared in accordance with the International Financial Reporting

Standards ('IFRS') accounting policies adopted by the Group and set

out in the annual report and accounts for the year ended 31 March

2018, except for the adoption of IFRS 9. The Group does not

anticipate any change in these accounting policies for the year

ending 31 March 2019. As permitted, this interim report has been

prepared in accordance with the AIM rules and not in accordance

with IAS 34 "Interim financial reporting". While the financial

figures included in this interim earnings announcement have been

computed in accordance with IFRS's applicable to interim periods,

this announcement does not contain sufficient information to

constitute an interim financial report as that term is defined in

the IFRS.

The financial information contained in the interim report also

does not constitute statutory accounts for the purpose of section

434 of the Companies Act 2006. The financial information for the

year ended 31 March 2018 is based on the statutory accounts for the

year ended 31 March 2018 which have been filed with the Registrar

of Companies and are available on the Group's website

www.ramsdensplc.com. The auditors reported on those accounts: their

report was unqualified, did not draw attention to any matters by

way of emphasis and did not contain a statement under section 498

(2) or (3) of the Companies Act 2006.

After conducting a further review of the group's forecasts of

earnings and cash over the next twelve months and after making

appropriate enquiries as considered necessary, the directors have a

reasonable expectation that the Company and Group have adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing the half yearly condensed financial statements.

2. IFRS 9 - Change in accounting policy

IFRS 9 'Financial instruments' has replaced IAS 39 'Financial

Instruments - Recognition and Measurement'. This change in

accounting standards has affected the way in which pawnbroking

income and impairment is reported through the financial statements.

The Group will continue to use amortised cost to measure financial

assets but interest income will now be reported gross of impairment

with an impairment cost shown separately as a cost of sale.

Interest income was previously shown net of impairment through

revenue. The Group has chosen not to restate the comparative

balances in line with the modified retrospective approach. The

change in accounting policy does not have an effect on opening

reserves. The Group notes that due to the short contract term of

pawnbroking loans the 12 month expected credit losses and the

lifetime expected credit losses are the same.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 30 September 2018

3. Segmental Reporting

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue

Pawnbroking 4,013 3,474 6,966

Purchases of precious metals 6,829 5,890 10,936

Retail Jewellery sales 4,503 3,547 7,960

Foreign currency margin 7,297 7,461 11,329

Income from other financial

services 1,292 1,386 2,751

------------- ------------- ----------

Total Revenue 23,934 21,758 39,942

------------- ------------- ----------

Gross profit

Pawnbroking 3,657 3,474 6,966

Purchases of precious metals 2,630 2,478 4,356

Retail Jewellery sales 2,343 1,907 4,130

Foreign currency margin 7,297 7,461 11,329

Income from other financial

services 800 796 1,566

------------- ------------- ----------

Total Gross profit 16,727 16,116 28,347

------------- ------------- ----------

Administrative expenses (11,655) (10,879) (21,937)

Finance costs (88) (105) (177)

Gain on fair value of derivative

financial liability 34 43 79

------------- ------------- ----------

Profit before tax 5,018 5,175 6,312

------------- ------------- ----------

Income from other financial services comprises of cheque cashing

fees, Electronics & buybacks, agency commissions on

miscellaneous financial products.

The Group is unable to meaningfully allocate administrative

expenses, or financing costs between the segments due to the fact

that these include staff costs who undertake all services in

branches. Accordingly, the Group is unable to disclose an

allocation of items included in the Consolidated Statement of

Comprehensive Income below Gross profit, which represents the

reported segmental results.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 30 September 2018

3. Segmental Reporting

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Other information GBP'000 GBP'000 GBP'000

Capital additions (*) 1,281 289 1,312

Depreciation and amortisation

(*) 637 628 1,290

Assets

Pawnbroking 10,026 8,793 9,421

Purchases of precious metals 1,459 1,160 1,323

Retail Jewellery sales 6,954 5,067 6,214

Foreign currency margin 6,644 7,303 7,162

Income from other financial

services 449 533 472

Unallocated (*) 14,325 14,899 13,022

------------- ------------- ----------

39,857 37,755 37,614

------------- ------------- ----------

Liabilities

Pawnbroking 261 208 254

Purchases of precious metals 5

Retail Jewellery sales 958 759 1,418

Foreign currency margin 2,361 2,478 2,814

Income from other financial

services 282 324 422

Unallocated (*) 5,666 6,742 5,133

------------- ------------- ----------

9,528 10,511 10,046

------------- ------------- ----------

(*) The Group is unable to meaningfully allocate this

information by segment due to the fact that all segments operate

from the same stores and the assets and liabilities are common to

all segments.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 30 September 2018

4. Borrowing

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Short term bank loans 2,008 3,093 1,875

Hire purchase agreements 5 8 8

------------- ------------- -----------

Amount due for settlement within

one year 2,013 3,101 1,883

------------- ------------- -----------

Hire purchase agreements - 5 1

------------- ------------- -----------

Amount due for settlement after

more than one year - 5 1

------------- ------------- -----------

5. Finance costs

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest on debts and borrowings 88 105 176

Finance charges payable under

hire purchase contracts - - 1

------------- ------------- -----------

Total finance costs 88 105 177

------------- ------------- -----------

6. Tax on profit

The taxation charge for the six months ended 30 September 2018

has been calculated by reference to the expected effective

corporation tax and deferred tax rates for the full financial

year to end on 31 March 2019. The underlying effective full

year tax charge is estimated to be 20%.

7. Earnings per share

6 months 6 months 12 months

ended ended ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Profit for the period (GBP'000) 4,005 4,141 5,034

Weighted average number of shares

in issue 30,837,653 30,837,653 30,837,653

Earnings per share (pence) 13.0 13.4 16.3

Fully diluted earnings per share

(pence) 12.7 13.2 15.9

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 30 September 2018

8. Issued capital and reserves

Ordinary shares issued and fully paid No. GBP'000

At 30 September 2017 30,837,653 308

At 30 September 2018 30,837,653 308

9. Dividends

On 26 November 2018, the directors approved a 2.4 pence interim

dividend (30 September 2017: 2.2p) which equates to a dividend

payment of GBP740,000 (30 September 2017: GBP678,000). The dividend

will be paid on 21 February 2019 to shareholders on the share

register at the close of business on 18 January 2019 and has

not been provided for in the September 2018 interim results.

The shares will be marked ex-dividend on 17 January 2019.

On 19 July 2018, the shareholders approved the payment of a

4.4 pence final dividend for the year ended 31 March 2018 which

equates to a dividend payment of GBP1,357,000 (31 March 2017:

GBP401,000). The dividend was paid on 20 September 2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FMMZMRNZGRZM

(END) Dow Jones Newswires

November 28, 2018 02:00 ET (07:00 GMT)

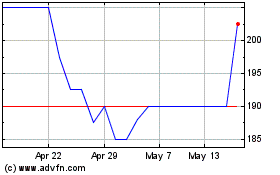

Ramsdens (LSE:RFX)

Historical Stock Chart

From Mar 2024 to May 2024

Ramsdens (LSE:RFX)

Historical Stock Chart

From May 2023 to May 2024