Regional REIT Limited Successful Refinancings of £121m (8235C)

20 June 2019 - 4:00PM

UK Regulatory

TIDMRGL

RNS Number : 8235C

Regional REIT Limited

20 June 2019

20 June 2019

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

Successful Refinancings of GBP121m

Regional REIT (LSE: RGL), the regional real estate investment

specialist focused on building a diverse portfolio of income

producing regional UK core and core plus office and industrial

property assets, today announces two refinancings amounting to

GBP121m.

A new GBP66m 10-year facility has been agreed with Santander

which refinances the existing GBP44m facility that was due to

mature in November 2022.

In addition, a new GBP55m 5-year facility has been agreed with

the Royal Bank of Scotland which refinances the existing GBP27m

facility with Royal Bank of Scotland and the GBP19m facility with

HSBC, both of which were due to mature in December 2021.

As a result of the above activity, the Group's cost of

borrowing, including hedging, will be 3.5%, with an unexpired debt

term extended from 6.7 years to 7.9 years. The facilities provide

the Group with headroom of c.GBP31m to pursue attractive

acquisitions that will provide additional value for the Company's

shareholders.

Stephen Inglis, CEO of London & Scottish Property Investment

Management, the Asset Manager, commented:

"These two considerable refinancings with major participating

institutions continue to demonstrate our steady and disciplined

approach to risk management. We have secured well priced debt for

the longer term whilst minimising the effect of any interest rate

increases.

"Regional REIT continues to be well supported by its key lenders

as it evolves through its next phase of growth capitalising on a

growing pipeline of attractive near-term acquisition opportunities.

We are delighted to continue to work with both the Royal Bank of

Scotland and Santander, and look forward to continuing to

strengthen our close working relationships over the coming

years."

- ENDS -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland / Victoria Hayns / Henry

Wilson

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly,

offices and industrial units located in the regional centres

outside of the M25 motorway. The portfolio is highly diversified,

with 150 properties, 1,192 units and 874 tenants as at 31 December

2018, with a valuation of GBP718.4m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com.

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): (549300D8G4NKLRIKBX73)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEANKNFFANEFF

(END) Dow Jones Newswires

June 20, 2019 02:00 ET (06:00 GMT)

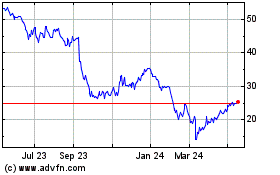

Regional Reit (LSE:RGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

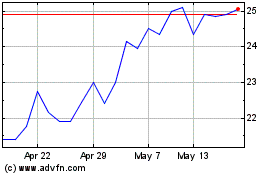

Regional Reit (LSE:RGL)

Historical Stock Chart

From Apr 2023 to Apr 2024