TIDMSOU

RNS Number : 1346N

Sound Energy PLC

21 September 2023

21 September 2023

SOUND ENERGY PLC

("Sound Energy", "Sound" or the "Company" and together with

subsidiaries the "Group")

HALF YEARLY REPORT FOR THE SIX MONTHSED 30 JUNE 2023

Sound Energy, the transition energy company, announces its

unaudited half-year report for the six months ended 30 June

2023.

HIGHLIGHTS

Development of the Moroccan Tendrara Production Concession

-- Phase 1 Micro LNG ("mLNG") project ("Phase 1")

o Site preparation activities completed by March 2023

o Completed mLNG tank foundations by May 2023

o Currently, extensive activity taking place offsite with our

contractor and its sub-contractors designing and constructing plant

equipment for delivery to site late 2023, early 2024

o Design, planning and procurement of equipment of workover of

the wells TE-6 and TE-7 progressing with rigless activities planned

for later 2023and rig activities scheduled for early 2024.

o Phase 1 LNG delivery scheduled to commence in 2024

-- Phase 2 Gas (pipeline) development ("Phase 2")

o Receipt of binding conditioned term sheet in June 2023, for

project financing from exclusive lead arranger, Attijariwafa Bank,

Morocco's largest bank

Corporate

-- In June 2023 entered into an exclusivity period and

non-binding term sheet with Calvalley Petroleum (Cyprus) Limited

for a partial divestment of a net 40% working interest in the

Tendrara Production Concession and the Grand Tendrara exploration

permit

-- In May 2023 the Company entered into a full and final

settlement of its tax disputes with the Moroccan tax authorities

and received court papers in June 2023 confirming the withdrawal of

the cases between the Company and Moroccan tax authority

-- We have expressed our condolences to all those affected by

the Morocco Earthquake of 8th September, and we have offered and

given our support in country and continue to do so. As previously

announced to the market at the time, our Sidi Moktar well assets

are located some 100 kilometres to the northwest of the earthquake

epicentre within our Sidi Moktar Onshore exploration permits, these

have not been impacted by the earthquake in any way. Our operations

and site development work at Tendrara Concession, Anoual and Grand

Tendrara exploration permits some 600 kilometres away are

unaffected.

Financial

-- Drawdown of GBP2.5 million of up to GBP4.0 million senior

unsecured convertible bond instrument in June 2023

-- Full and final settlement of its tax disputes with the

Moroccan tax authorities - phased payment schedule of approximately

US$2.5 million as a full and final settlement against a claim of

approximately US$24.0 million

-- As at 31 August 2023, the Group had unaudited cash and

short-term deposits of approximately GBP4.0 million (GBP1.4 million

held as collateral for a bank guarantee against licence

commitments)

-- Post period end receipt of Tendrara Concession receivable of approximately GBP2.3 million

Graham Lyon, Executive Chairman said:

"I am grateful for continued support of all our shareholders and

can say that the first half of 2023 saw significant advances

preparing the Company for revenue generation. Significantly, we

have laid out a funding plan for Phase 2; have made steady progress

on Phase 1 with mLNG tank construction and tank site preparation,

well preparation and design engineering; have identified a

potential partner to enter the Tendrara area to work alongside us;

removed the tax claim overhang; brought in new bridge funding and

collected the receivables. All in all, a busy first half of the

year.

There is much to do in closing and completing on these various

initiatives and in positioning the Company for production and for

further growth. As our key project in Morocco is considered of

strategic importance in the country all efforts must be placed in

ensuring a safe and efficient execution of our business plan within

the resources available.

I would like to thank the Ministries in Morocco and ONHYM our

state partner for their continued co-operation and increased

support."

For further information, visit www.soundenergyplc.com or follow

us on twitter @soundenergyplc

Enquiries:

Flagstaff Strategic and Investor Communications Tel: 44 (0)20 129 1474

Tim Thompson soundenergy@flagstaffcomms.com

Mark Edwards

Alison Allfrey

Sound Energy Chairman@soundenergyplc.com

Graham Lyon, Executive Chairman

Cavendish Securities - Nominated Adviser Tel: 44 (0)20 7397

Ben Jeynes 8900

Peter Lynch

SP Angel Corporate Finance LLP- Broker Tel:44 (0) 7789 865

Richard Hail 095

Gneiss Energy Limited- Financial Adviser Tel:44 (0)20 3983 9263

Jon Fitzpatrick

Paul Weidman

Doug Rycroft

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended. Upon

the publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

STATEMENT FROM THE EXECUTIVE CHAIRMAN

Continuing to execute on our strategy to deliver revenue

generation

Our strategy of the phased development of the Tendrara gas

discovery is well defined and whilst the economic and geo-political

environment continued to present challenges, the Company continues

to make progress towards revenue generation.

Phase 1 Tendrara Micro LNG Project (mLNG)

Post the completion of site preparation in March 2023, the

Company finalised the main civil works including the mLNG tank

foundations by May 2023. Additionally, activities such as well head

inspection and servicing tool fabrication, flowlines concept

selection, engineering and owners engineering support have been

ongoing and are well advanced.

Currently, there is extensive activity taking place offsite with

our contractor Italfluid Geoenergy S.r.l and its sub-contractors

designing and constructing key plant equipment for delivery to site

in early 2024. In addition to Italfluid's project scope of work,

Sound Energy is to undertake well head and flow line preparation,

including workovers of TE-6 and TE-7. Afriquia Gaz S.A is to

procure and put in place the LNG transportation trucking, local

storage and regasification facilities. Once on site, the processing

and liquefaction equipment will be commissioned and integrated with

the wells and trucking systems. Whilst the mLNG storage tank fabric

has been manufactured, there has been some supply chain disruption

leading to later than planned delivery to site which remains on the

critical path. Despite this, the Company remains committed to

commencing production in 2024.

Phase 2 Tendrara Processing and Pipeline Project

Progress continued to be made with the Phase 2 development

project in 2023.

Crucially, significant progress has been made regarding Project

funding with Attijariwafa Bank, Morocco's largest bank, as

exclusive lead arranger of a senior debt financing issuing a

binding conditioned term sheet. The bank completed legal and

technical due diligence in respect of the proposed financing in

March, and in June made a conditioned offer for a maximum financing

of MAD 2.365 billion (approximately US$237 million), proposed to be

100% underwritten by the bank, and subject to certain conditions

being met such as Governmental approvals, Gas Sales agreement

amendments, further engineering and Contractor contracts being in

place.

Corporate

Following the commencement in 2022 of a process to secure

participation of a strategic partner, in June the Company entered

into a period of exclusivity and non-binding term sheet with

Calvalley Petroleum (Cyprus) Limited ("Calvalley") for a partial

divestment of a net 40% working interest in the Tendrara

Exploitation Concession and the Grand Tendrara Exploration Permit

which result in, subject to agreement of definitive transaction

documentation:

-- Funding of the first US$48 million of Sound Energy and

Calvalley's Phase 2 equity funded development costs by Calvalley,

subject to final investment decision

-- Funding of 100% of the TE-4 Horst well costs by Calvalley up to a cap of US$7 million

-- Funding of 40% share of Phase 1 costs, including back costs

net to Calvalley of approximately US$8 million (through to July

2023)

-- Advancement to Sound Energy of additional Phase 1 and Phase 2

costs, if necessary, and at the Company's election, repayable out

of future revenue.

Post the period, definitive documents are being negotiated with

the aim to conclude the transaction in 2023.

The combination of closing the transactions with Calvalley and

Attijariwafa Bank will allow the Company to take the Final

Investment decision and begin activities to construct the

much-needed pipeline infrastructure at Tendrara.

In June the Company received court papers confirming the

withdrawal of cases between the Company and the Moroccan Tax

authority for matters with respect to claims against Sound Energy

Morocco East and Sound Energy Morocco SARL AU.

In June the Company raised up to GBP4.0 million by way of a

senior unsecured convertible bond instrument. The proceeds will, if

fully drawn, provide funds for the Company to continue to execute

its Phase 1 development of the Tendrara Production Concession and

bridge group working capital liquidity ahead of receipt of a

receivable as disclosed in the year end results and/or receipt of

Phase 1 back costs from Calvalley if a partial divestment is

ultimately completed. The term of the Convertible Notes is five

years from draw down date, with interest of 15% per annum, payable

bi-annually in cash or capitalised to the principal, at the

Company's election. Post the period the Company announced a partial

conversion of the Convertible Loan Note.

Subject to the draw down in full of the Convertible Notes, the

Company is now funded for its near-term working capital

requirements until year end 2023.

Board Changes

In May, Mr Marco Fumagalli announced that he would be stepping

down in June as a Non-Executive Director and former Acting Chairman

of the company in order to pursue other business opportunities.

In June, Sound appointed Mr Simon Ashby-Rudd to the Board as

Independent Non-Executive Director. Mr Ashby-Rudd is an

international energy banking specialist with more than 35 years of

experience.

I thank Marco for his contribution over the years and look

forward to working with Mr Ashby-Rudd going forward.

Graham Lyon

Chairman (Executive)

OPERATIONS REVIEW

Tendrara Development: Micro LNG

Sound Energy is pursuing the Field Development Plan underpinning

the Concession centred around the TE-5 Horst gas discovery. The

development is progressing in two phases. Phase 1, targeting

industrial consumers, is intended to prioritise early first cash

flows from the Concession via a mLNG production scheme. The planned

Phase 2 development provides gas to power via state energy power

stations. It is centred around the installation of a 120km gas

export pipeline to help fully unlock the gas potential of this

region and lower the cost of development for future discoveries.

Both phases address different markets in Morocco; the industrial

energy user and the state power producer, both of which have strong

and growing demand, with Tendrara gas playing an important role in

supporting Morocco's strategy to lower carbon emissions.

Progress of the Phase 1 Development Project

This first phase focuses on the existing TE-6 and TE-7 wells of

the TE-5 Horst. First gas will be achieved by tying the currently

suspended TE-6 and TE-7 gas wells with flowlines connected to the

inlet of a skid mounted, combined gas processing and mLNG

plant.

In 2021, the Company entered into a contract with Italfluid

Geoenergy S.r.l. ("Italfluid") for the design, construction,

commissioning, operation, and maintenance of the mLNG facilities

under a 10-year lease arrangement. The mLNG facilities, which will

also treat, and process raw gas produced from the wells prior to

liquefaction, is the principal part of the surface facilities

required to be built and operated as part of this first phase of

development. LNG will be delivered to on-site storage from the

outlet of the mLNG facilities whereupon Afriquia Gaz will lift and

take title for LNG for transportation, distribution and sale to the

Moroccan industrial market.

Groundworks for the construction of the mLNG facility commenced

March 2022 following completion of surveying and remediation works

to the access road for the facility. The raised foundation platform

for the LNG storage tank, and pads for the skid mounted units,

including the compressor package, have been completed. The

necessary piping and cabling for the firefighting system have been

installed along with fencing and lighting towers. Facilities

engineering will continue to progress throughout the year with

major vendors and Italfluid has placed purchase orders for the gas

processing and liquefaction package which I ready for factor

testing now Whilst the mLNG storage tank fabric has been

manufactured, there has been some supply chain disruption leading

to later than planned delivery. Despite this, the Company remains

committed to commencing production in 2024. The Company has also

completed preliminary engineering of the wellhead facilities,

flowlines and manifold system required to bring the raw gas form

the TE-6 and TE-7 wellheads. This work was completed by Kellogg

Brown and Root Ltd alongside the flow assurance work. Inspection

and routine maintenance of the wellhead Christmas tree assemblies

on TE-6 and TE-7, was successfully completed by Petroleum Equipment

Supply Engineering Company Ltd.

The Company engaged Bedrock Drilling Ltd to design, plan and

execute the necessary work overs of the TE-6 and TE-7 wells in

preparation for turning these appraisal gas wells into long term

gas producers. These works are planned to be undertaken during Q4

2023 and Q1 2024 in preparation for first gas.

The next key steps to progress the project include final design,

engineering, procurement and installation of the flowline system

and associated well head facility equipment for the gas gathering

system to transport the gas from the well heads to the mLNG plant.

Additionally, Italfluid continues to progress detailed design,

place its remaining purchase orders for equipment packages and

bulks, now the site preparation and commence civils foundation

works have been completed.

Italfluid, Sound Energy and Afriquia Gaz are working together,

to supply LNG to the local industry in 2024 in a safe and efficient

manner.

Throughout 2023 and early 2024 the equipment packages are to be

completed and tested in the workshops and later be brought from

workshops located around the world, delivered to site via the main

ports in Morocco and assembled on site.

Progress of the Phase 2 Development Project

On 13 June the Company announced that it has now entered into

exclusivity for a period of 45 days on the basis of an otherwise

non-binding term sheet with Calvalley, an associated company of

Octavia Energy Corporation Limited. Whilst the exclusivity has

expired the Company continues to support the ongoing due diligence

by Calvalley. The terms of the term sheet would provide Sound

Energy, together with the envisaged project debt financing and

under current cost estimates, with the required funds to achieve

first gas under its Phase 2 development plan whilst also funding

the costs of drilling the TE-4 Horst appraisal well, with an

estimated unrisked exploration potential of 273 Bcf gross Pmean Gas

Initially in Place ('GIIP').

In June 2023, following a period of due diligence and further

discussions between the bank, the Company announced that, on behalf

of the Tendrara Production Concession partners, it had received a

conditioned offer from Attijariwafa Bank for a maximum financing of

MAD 2.365 billion (c.US$237 million), proposed to be 100%

underwritten by the bank, subject to the conditions precedent to

the conditioned offer being satisfied prior to 30 September

2023.

Eastern Morocco

GREATER TRARA

- 8 years from September 2018

75% interest Operated Exploration permit 14,411 km(2) acreage

------------------- --------------------

ANOUAL

- 10 years from September 2017

75% interest Operated Exploration permit 8,873 km(2)

------------------- --------------------

Eastern Morocco licences

TRARA CONCESSION

- 25 years from September 2018

75% interest Operated Production permit 133.5 km(2) acreage

----------------- -------------------

Exploration

Our Eastern Morocco Licences comprising the Concession together

with the Anoual and Greater Tendrara exploration permits are

positioned in a region containing a potential extension of the

established petroleum plays of Algerian Triassic Province and

Saharan Hercynian Platform. The presence of the key geological

elements of the Algerian Trias Argilo-Gréseux Inférieur or 'TAGI'

gas play are already proven within the licence areas with the

underlying Palaeozoic, representing a significant upside

opportunity to be explored.

These licences cover a surface area of over 23,000 square

kilometres, but so far only thirteen wells have been drilled, of

which six are either located within or local to the Concession.

Exploration drilling beyond the region of the Concession has been

limited and the Group maintains a portfolio of features identified

from previous operators' studies, plus new targets identified by

Sound Energy from the recent geophysical data acquisition,

subsequent processing and ongoing interpretation studies. These

features are internally classified as either prospects, leads or

concepts based upon their level of technical maturity and represent

potential future exploration drilling targets.

Whilst the Company has strategically prioritised its gas

monetisation strategy through the phased development of the TE-5

Horst (Tendrara Production Concession), the Company has also

re-evaluated its extensive exploration portfolio within the Greater

Tendrara and Anoual exploration permits surrounding the Concession.

By integrating the acquired data and learnings from previous

drilling campaigns with acquired and reprocessed seismic datasets,

the Company has high graded several potential near term subsalt

drilling opportunities within the TAGI gas reservoir, the proven

reservoir of the TE-5 Horst gas accumulation.

In August 2022, the Company launched a farm-out process in the

underexplored but highly prospective Tendrara Basin in Eastern

Morocco. This opportunity provides access to high impact, short

term exploration opportunities, in a stable country with very

attractive fiscal terms. The Company has high graded three

potential near term sub-salt drilling opportunities where,

importantly, future discoveries have the potential to be

commercialised through the planned infrastructure of Phase 2. The

Company's intention is to seek to secure an ambitious strategic

partner for both the ongoing and planned development of the

Concession together with exploration and appraisal of the Eastern

Morocco exploration permits.

Near term drillable targets include the exploration prospect

'M5' located on the Anoual permits, together with the potential of

the structures previously drilled on the Greater Tendrara permits,

SBK-1 and TE-4. Both SBK-1 and TE-4, drilled in 2000 and 2006

respectively, encountered gas shows in the TAGI reservoir. SBK-1

flowed gas to surface during testing in 2000 at a peak rate of 4.41

mmscf/d post acidification but was not tested with mechanical

stimulation. TE-4 was tested in 2006 but did not flow gas to the

surface. Mechanical stimulation has proven to be a key technology

to commercially unlock the potential of the TAGI gas reservoir in

the TE-5 Horst gas accumulation and accordingly the Company

believes this offers potential to unlock commerciality elsewhere in

the basin.

Southern Morocco

Southern Morocco licence

SIDI MOKTAR ONSHORE

- 8 years remaining

- Effective date 9/04/2018

75% interest Operated Exploration permit 4,712 km(2)

------------------- -----------

Southern Morocco Exploration

The Sidi Moktar licence is located in the Essaouira Basin, in

Southern Morocco. The licence covers a combined area of 4,712 km2.

The Group views the Sidi Moktar licences as an exciting opportunity

to explore high impact prospectivity within the sub-salt Triassic

and Palaeozoic plays in the underexplored Essaouira Basin in the

West of Morocco.

The Sidi Moktar permit hosts a variety of proven plays. The

licence host 44 vintage wells drilled between the 1950s and the

present. Previous exploration has been predominantly focused on the

shallower post-salt plays. The licence is adjacent to the ONHYM

operated Meskala gas and condensate field. The main reservoirs in

the field are Triassic aged sands, directly analogous to the deeper

exploration plays in the Sidi Moktar licence. The Meskala field and

its associated gas processing facility is linked via a pipeline to

a state-owned phosphate plant, which produces fertiliser both for

domestic and export markets. This pipeline passes across the Sidi

Moktar licence. The discovery of the Meskala field proved the

existence of a deeper petroleum system in the basin. Specifically,

Meskala provides evidence that Triassic clastic reservoirs are

effective, proves the existence of the overlying salt seal and

provides support for evidence of charge from deep Palaeozoic source

rocks. Based on work undertaken by Sound Energy, the main focus of

future exploration activity in the licence is expected to be within

this deeper play fairway. The Company believes that the deeper,

sub-salt Triassic and Palaeozoic plays may contain significant

prospective resources, in excess of any discovered volumes in the

shallower stratigraphy.

The Company's evaluation of the exploration potential of Sidi

Moktar, following an independent technical review, includes a

mapped portfolio of sub-salt, Triassic and Palaeozoic leads in a

variety of hydrocarbon trap types. Sound Energy is developing a

work programme to mature the licence with specific focus on the

deeper, sub-salt plays. The Company believes additional seismic

acquisition and processing is required to mature these leads into

drillable exploration prospects.

Preparations for this seismic acquisition campaign have

commenced with the completion and approval of an EIA in late

2019.

The Company continues to seek to progress a farm out process for

this permit, offering an opportunity to a technically competent

partner to acquire a material position in this large tract of

prospective acreage. In parallel, the Company has engaged in

dialogue with a number of seismic acquisition and processing

contractors for potential services to undertake the survey.

Condensed Interim Consolidated Income Statement

Six months ended Year ended

Six months ended 30 June 2022 31 Dec 2022

30 June 2023 Unaudited Audited

Notes Unaudited GBP'000s GBP'000s GBP'000s

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Other income 4 41 43

(Impairment loss)/reversal of impairment on development

assets and exploration costs 4 (4,213) 5,407 5,678

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Gross (loss)/profit (4,209) 5,448 5,721

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Administrative expenses (1,247) (2,018) (3,175)

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Group operating (loss)/profit from continuing operations (5,456) 3,430 2,546

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Finance revenue 29 2 13

Foreign exchange (loss)/gain (2,380) 5,896 5,462

Finance expense (822) (720) (1,446)

---------------------------------------------------------- ----- ------------------- ---------------- ------------

(Loss)/profit for period before taxation (8,629) 8,608 6,575

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Tax expense (1) (7) (1,602)

---------------------------------------------------------- ----- ------------------- ---------------- ------------

(Loss)/profit for period after taxation (8,630) 8,601 4,973

Other comprehensive (loss)/income

Items that may subsequently be reclassified

to profit and loss account:

Foreign currency translation (loss)/income (5,735) 13,136 13,373

---------------------------------------------------------- ----- =================== ================ ============

Total comprehensive (loss)/income for

the period attributable to equity holders

of the parent (14,365) 21,737 18,346

---------------------------------------------------------- ----- =================== ================ ============

Pence Pence Pence

---------------------------------------------------------- ----- ------------------- ================ ============

Basic and diluted (loss)/profit per share for the period

attributable to equity holders of

the parent 3 (0.47) 0.52 0.28

---------------------------------------------------------- ----- ------------------- ---------------- ------------

Condensed Interim Consolidated Balance Sheet

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

Notes GBP'000s GBP'000s GBP'000s

-------------------------------- ----- ---------- ----------- ----------

Non-current assets

Property, plant and equipment 4 152,964 161,631 163,362

Intangible assets 5 34,834 35,434 36,007

Interest in Badile land - 619 637

Prepayments 6 4,082 3,087 4,272

-------------------------------- ----- ---------- ----------- ----------

191,880 200,771 204,278

-------------------------------- ----- ---------- ----------- ----------

Current assets

Inventories 920 969 963

Other receivables 3,042 2,345 2,815

Prepayments 165 233 139

Cash and short term deposits 3,733 10,513 3,861

-------------------------------- ----- ---------- ----------- ----------

7,860 14,060 7,778

-------------------------------- ----- ---------- ----------- ----------

Total assets 199,740 214,831 212,056

-------------------------------- ----- ---------- ----------- ----------

Current liabilities

Trade and other payables 1,899 6,184 1,868

Tax liabilities 7 - - 126

Lease liabilities 174 - 162

Loans and borrowings 8 2,122 - 1,121

4,195 6,184 3,277

-------------------------------- ----- ---------- ----------- ----------

Non-current liabilities

Lease liabilities 31 - 121

Tax liabilities 7 1,534 - 1,505

Loans and borrowings 8 29,088 27,271 29,068

-------------------------------- ----- ---------- ----------- ----------

30,653 27,271 30,694

-------------------------------- ----- ---------- ----------- ----------

Total liabilities 34,848 33,455 33,971

-------------------------------- ----- ---------- ----------- ----------

Net assets 164,892 181,376 178,085

-------------------------------- ----- ---------- ----------- ----------

Capital and reserves

Share capital and share premium 38,822 38,621 38,621

Shares to be issued 404 404 404

Warrant reserve 2,071 1,607 1,607

Convertible bond reserve 388 - -

Foreign currency reserve 2,714 8,212 8,449

Accumulated surplus 120,493 132,532 129,004

-------------------------------- ----- ---------- ----------- ----------

Total equity 164,892 181,376 178,085

-------------------------------- ----- ---------- ----------- ----------

Condensed Interim Consolidated Statement of Changes in

Equity

Convertible Foreign

Share Share Shares to be Accumulated Warrant bond currency Total

capital premium issued surplus reserve reserve reserves equity

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

At 1 January 2023 18,487 20,134 404 129,004 1,607 - 8,449 178,085

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

Total loss for the period - - - (8,630) - - - (8,630)

Other comprehensive loss - - - - - - (5,735) (5,735)

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

Total comprehensive loss for

the period - - - (8,630) - - (5,735) (14,365)

Issue of share capital 114 87 - - - - - 201

Fair value of warrants issued

during the period - - - - 464 - - 464

Equity component of

convertible bond - - - - - 388 - 388

Share based payments - - - 119 - - - 119

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

At 30 June 2023 (unaudited) 18,601 20,221 404 120,493 2,071 388 2,714 164,892

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

Convertible Foreign

Share Share Shares to be Accumulated Warrant bond currency Total

capital premium issued surplus reserve reserve reserves equity

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

At 1 January 2022 16,292 18,281 - 123,872 1,534 - (4,924) 155,055

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

Total profit for the year - - - 4,973 - - - 4,973

Other comprehensive income - - - - - - 13,373 13,373

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

Total comprehensive income for

the year - - - 4,973 - - 13,373 18,346

Issue of share capital 2,195 2,246 - - - - - 4,441

Share issue costs - (393) - - - - - (393)

Fair value of warrants issued

during the period - - - - 73 - - 73

Vested nil options bonus

awards - - 404 - - - - 404

Share based payments - - - 159 - - - 159

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

At 31 December 2022 (audited) 18,487 20,134 404 129,004 1,607 - 8,449 178,085

------------------------------ -------- ----------- ------------------- -------------- ------------ --------------- ------------ ------------

Convertible Foreign

Share Share Shares to be Accumulated Warrant bond currency Total

capital premium issued surplus reserve reserve reserves equity

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

------------------------------ -------------- --------------- -------------- ------------- ------------ --------------- ------------ ----------

At 1 January 2022 16,292 18,281 - 123,872 1,534 - (4,924) 155,055

------------------------------ -------------- --------------- -------------- ------------- ------------ --------------- ------------ ----------

Total profit for the period - - - 8,601 - - - 8,601

Other comprehensive income - - - - - - 13,136 13,136

------------------------------ -------------- --------------- -------------- ------------- ------------ --------------- ------------ ----------

Total comprehensive loss for

the period - - - 8,601 - - 13,136 21,737

Issue of share capital 2,195 2,246 - - - - - 4,441

Share issue costs - (393) - - - - - (393)

Fair value of warrants issued

during the period - - - - 73 - - 73

Vested nil options bonus

awards - - 404 - - - - 404

Share based payments - - - 59 - - - 59

------------------------------ -------------- --------------- -------------- ------------- ------------ --------------- ------------ ----------

At 30 June 2022 (unaudited) 18,487 20,134 404 132,532 1,607 - 8,212 181,376

------------------------------ -------------- --------------- -------------- ------------- ------------ --------------- ------------ ----------

Condensed Interim Consolidated Statement of Cash Flows

Year

Six months Six months ended

ended ended 31 Dec

30 June 30 June 2022

2023 Unaudited 2022 Unaudited Audited

GBP'000s GBP'000s GBP'000s

------------------------------------------- --------------- --------------- ---------

Cash flow from operating activities

Cash flow from operations (1,207) (1,080) (3,928)

Interest received 29 2 13

Tax paid (125) (7) (7)

-------------------------------------------- --------------- --------------- ---------

Net cash flow from operating activities (1,303) (1,085) (3,922)

-------------------------------------------- --------------- --------------- ---------

Cash flow from investing activities

Capital expenditure (751) (770) (1,519)

Exploration expenditure (359) (311) (399)

Prepayment for Phase 1, mLNG Project - - (4,272)

Receipt from interest in Badile land 134 - -

-------------------------------------------- --------------- --------------- ---------

Net cash flow from investing activities (976) (1,081) (6,190)

-------------------------------------------- --------------- --------------- ---------

Cash flow from financing activities

Net proceeds from equity issue - 3,680 3,680

Net proceeds from borrowings 2,425 5,532 7,233

Interest payments (222) (214) (431)

Lease payments (89) - (58)

-------------------------------------------- --------------- --------------- ---------

Net cash flow from financing activities 2,114 8,998 10,424

-------------------------------------------- --------------- --------------- ---------

Net (decrease)/increase in cash and cash

equivalents (165) 6,832 312

Net foreign exchange difference 37 768 636

Cash and cash equivalents at the beginning

of the period 3,861 2,913 2,913

-------------------------------------------- --------------- --------------- ---------

Cash and cash equivalents at the end of

the period 3,733 10,513 3,861

-------------------------------------------- --------------- --------------- ---------

Notes to Statement of Cash Flows

Year

Six months Six months ended

ended ended 31 Dec

30 June 30 June 2022

2023 Unaudited 2022 Unaudited Audited

GBP'000s GBP'000s GBP'000s

--------------------------------------------------- --------------- --------------- ---------

Cash flow from operations reconciliation

(Loss)/profit for the period before tax (8,629) 8,608 6,575

Finance revenue (29) (2) (13)

Decrease/(increase) in drilling inventories 43 (98) (92)

Increase in short term receivables and prepayments (253) (666) (2,071)

(Decrease)/Increase in accruals and short

term payables (108) 702 190

Impairment loss/(reversal of Impairment)

on development assets and exploration costs 4,213 (5,407) (5,678)

Impairment of interest in Badile land 125 60 107

Depreciation and amortisation 110 30 101

Share based payments charge and remuneration

paid in shares 119 869 969

Finance costs and exchange adjustments 3,202 (5,176) (4,016)

Cash flow from operations (1,207) (1,080) (3,928)

---------------------------------------------------- --------------- --------------- ---------

Non-cash transactions during the period included the issue of

11,404,211 ordinary shares to third parties in settlement of fees

for services provided amounting to approximately GBP0.2 million

(note 9).

The Group has provided collateral of $1.75 million (December

2022: $1.75 million) to the Moroccan Ministry of Petroleum to

guarantee the Group's minimum work programme obligations on the

Anoual and Sidi Moktar licences. The cash is held in a bank account

under the control of the Company and as the Group expects the funds

to be released as soon as the commitment is fulfilled on this basis

the amount remains included within cash and cash equivalents.

Notes to the Condensed interim Consolidated Financial Statements

for the six months ended 30 June 2023

1. Basis of preparation

The condensed interim consolidated financial statements do not

represent statutory accounts within the meaning of section 435 of

the Companies Act 2006. The financial information for the year

ended 31 December 2022 is based on the statutory accounts for the

year ended 31 December 2022. Those accounts, upon which the

auditors issued an unqualified opinion, have been delivered to the

Registrar of Companies and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The condensed interim financial information is unaudited and has

been prepared on the basis of the accounting policies set out in

the Group's 2022 statutory accounts and in accordance with IAS 34

Interim Financial Reporting as adopted by the United Kingdom.

The seasonality or cyclicality of operations does not impact on

the interim financial statements.

Going concern

As at 31 August 2023, the Group's unaudited cash balance was

approximately GBP4.0 million (including approximately GBP1.4

million held as collateral for a bank guarantee against licence

commitments). The Directors have reviewed the Company's cash flow

forecasts for the next 12-month period to September 2024. The

Company's forecasts and projections indicate that, to fulfil its

other obligations, primarily the Company's exploration licences

commitments, the Company will require additional funding. The

Company commenced its Phase 1 of the Concession upon taking FID on

the mLNG project, and has continued to actively monitor the project

schedule, costs, and financing. The Company is progressing towards

a final investment decision for the Phase 2, pipeline led

development of the Concession and has received a conditional offer

for partial financing of the Phase 2 development and is working to

satisfy the conditions precedents and other elements necessary for

the taking of Phase 2 FID.

The need for additional financing indicates the existence of a

material uncertainty, which may cast significant doubt about the

Company's ability to continue as a going concern. These Interim

condensed consolidated financial statements do not include

adjustments that would be required if the Company was unable to

continue as a going concern. The Company continues to exercise

rigorous cost control to conserve cash resources, and the Directors

believe that there are several corporate funding options available

to the Company, including signing of a term sheet with Calvalley

for a potential farm-down on some of the Company's Eastern Morocco

licences and various debt funding options. Furthermore, based upon

the Company's proven track record in raising capital in the London

equity market and based on feedback from ongoing financing

discussions, the Directors have a reasonable expectation that the

Company and the Group will be able to secure the funding required

to continue in operational existence for the foreseeable future,

and have made a judgement that the Group will continue to realise

its assets and discharge its liabilities in the normal course of

business. Accordingly, the Directors have adopted the going concern

basis in preparing the Interim condensed consolidated financial

statements.

2. Segment information

The Group categorises its operations into three business

segments based on Corporate, Exploration and Appraisal and

Development and Production. The Group's Exploration and Appraisal

activities are carried out in Morocco. The Group's reportable

segments are based on internal reports about the components of the

Group which are regularly reviewed by the Board of Directors, being

the Chief Operating Decision Maker ("CODM"), for strategic decision

making and resources allocation to the segment and to assess its

performance. The segment results for the period ended 30 June 2023

are as follows:

Segment results for the period ended 30 June 2023

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

------------------------------------------ --------- ------------- ------------ ---------

Other income - - 4 4

Impairment loss on development assets and

exploration costs - (4,213) - (4,213)

Administration expenses (1,247) - - (1,247)

------------------------------------------ --------- ------------- ------------ ---------

Operating profit segment result (1,247) (4,213) 4 (5,456)

------------------------------------------ --------- ------------- ------------ ---------

Interest revenue 29 - - 29

Finance costs and exchange adjustments (3,202) - - (3,202)

------------------------------------------ --------- ------------- ------------ ---------

Profit for the period before taxation (4,420) (4,213) 4 (8,629)

------------------------------------------ --------- ------------- ------------ ---------

The segments assets and liabilities at 30 June 2023 are as

follows:

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------- --------- ------------- ------------ ---------

Non-current assets 201 156,854 34,825 191,880

Current assets 2,758 2,385 2,717 7,860

Liabilities attributable to continuing

operations (23,628) (8,276) (2,944) (34,848)

--------------------------------------- --------- ------------- ------------ ---------

The geographical split of non-current assets at 30 June 2023 is

as follows:

UK Morocco

GBP'000s GBP'000s

---------------------------------------- --------- ---------

Development and production assets - 152,772

Right of use assets 188 -

Fixtures, fittings and office equipment 4 -

Software - 9

Prepayment - 4,082

Exploration and evaluation assets - 34,825

Total 192 191,688

---------------------------------------- --------- ---------

Segment results for the period ended 30 June 2022

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------------- --------- ------------- ------------ ---------

Other income - - 41 41

Reversal of impairment of development assets

and exploration costs - 5,407 - 5,407

Administration expenses (2,018) - - (2,018)

--------------------------------------------- --------- ------------- ------------ ---------

Operating profit segment result (2,018) 5,407 41 3,430

--------------------------------------------- --------- ------------- ------------ ---------

Interest revenue 2 - - 2

Finance costs and exchange adjustments 5,176 - - 5,176

--------------------------------------------- --------- ------------- ------------ ---------

Profit for the period before taxation 3,160 5,407 41 8,608

--------------------------------------------- --------- ------------- ------------ ---------

The segments assets and liabilities at 30 June 2022 were as

follows:

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------- --------- ------------- ------------ ---------

Non-current assets 632 164,705 35,434 200,771

Current assets 4,383 6,625 3,052 14,060

Liabilities attributable to continuing

operations (17,629) (10,446) (5,380) (33,455)

--------------------------------------- --------- ------------- ------------ ---------

The geographical split of non-current assets at 30 June 2022 was

as follows:

Europe Morocco

GBP'000s GBP'000s

---------------------------------------- --------- ---------

Development and production assets - 161,618

Interest in Badile land 619 -

Fixtures, fittings and office equipment 5 8

Prepayment - 3,087

Exploration and evaluation assets - 35,434

Total 624 200,147

---------------------------------------- --------- ---------

Segment results for the year ended 31 December 2022

Development Exploration

Corporate and production and appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------------- --------- --------------- -------------- ---------

Other income - - 43 43

--------------------------------------------- --------- --------------- -------------- ---------

Reversal of impairment of development

assets and exploration costs - 5,678 - 5,678

--------------------------------------------- --------- --------------- -------------- ---------

Administration expenses (3,175) - - (3,175)

--------------------------------------------- --------- --------------- -------------- ---------

Operating profit/(loss) segment result (3,175) 5,678 43 2,546

--------------------------------------------- --------- --------------- -------------- ---------

Interest revenue 13 - - 13

Finance costs and exchange adjustments 4,016 - - 4,016

--------------------------------------------- --------- --------------- -------------- ---------

Profit/(loss) for the period before taxation

from continuing operations 854 5,678 43 6,575

--------------------------------------------- --------- --------------- -------------- ---------

The segments assets and liabilities at 31 December 2022 were as

follows:

Development Exploration

Corporate and production and appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------- --------- --------------- -------------- ---------

Non-current assets 944 163,346 35,988 204,278

Current assets 4,224 2,141 1,413 7,778

Liabilities attributable to continuing

operations (23,024) (8,301) (2,646) (33,971)

--------------------------------------- --------- --------------- -------------- ---------

The geographical split of non-current assets at 31 December 2022

was as follows:

Europe Morocco

GBP'000s GBP'000s

---------------------------------------- --------- ---------

Development and production assets - 163,074

Interest in Badile land 637 -

Fixtures, fittings and office equipment 5 9

Right of use assets 274 -

Software - 19

Prepayments - 4,272

Exploration and evaluation assets - 35,988

---------------------------------------- --------- ---------

Total 916 203,362

---------------------------------------- --------- ---------

3. Profit/(loss) per share

The calculation of basic profit/(loss) per Ordinary Share is

based on the profit/(loss) after tax and on the weighted average

number of Ordinary Shares in issue during the period. The

calculation of diluted profit/(loss) per share is based on the

profit/(loss) after tax on the weighted average number of ordinary

shares in issue plus weighted average number of shares that would

be issued if dilutive options, restricted stock units and warrants

were converted into shares. Basic and diluted profit/(loss) per

share is calculated as follows:

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------------------------- -------- -------- -----------

Profit/(loss) after tax from continuing operations (8,630) 8,601 4,973

--------------------------------------------------- -------- -------- -----------

million million million

------------------------------------------ ------- ------- -------

Weighted average shares in issue 1,849 1,650 1,752

Dilutive potential ordinary shares - 9 7

------------------------------------------ ------- ------- -------

Diluted weighted average number of shares 1,849 1,659 1,759

------------------------------------------ ------- ------- -------

Pence Pence Pence

----------------------------------------------------------- ------ ----- -----

Basic profit/(loss) per share from continuing operations (0.47) 0.52 0.28

----------------------------------------------------------- ------ ----- -----

Diluted profit/(loss) per share from continuing operations (0.47) 0.52 0.28

----------------------------------------------------------- ------ ----- -----

4. Property, plant and equipment

30 June 30 June 31 December

2023 2022 2022

GBP'000s GBP'000s GBP'000s

----------------------------- ---------- ---------- ------------

Cost

At start of period 164,061 145,361 145,361

Additions 969 795 1,932

Disposal - (3) (3)

Exchange adjustments (7,179) 16,119 16,771

At end of period 157,851 162,272 164,061

----------------------------- ---------- ---------- ------------

Impairment and depreciation

At start of period 699 5,695 5,695

Charge/(reversal) for period 4,309 (5,377) (5,591)

Disposal - (2) (2)

Exchange adjustments (121) 325 597

----------------------------- ---------- ---------- ------------

At end of period 4,887 641 699

----------------------------- ---------- ---------- ------------

Net book amount 152,964 161,631 163,362

----------------------------- ---------- ---------- ------------

Change in estimation

The discount rate and forecast gas price are significant

estimates used by the Company to determine the recoverable amount

when undertaking impairment testing of the Company's TE-5 Horst

concession. The Company has taken account of changes in market

conditions and certain corporate parameters during the period and

accordingly revised the discount rate to 11.6% as at 30 June 2023

from 12.5% at 31 December 2022. The Company at 31 December 2022

used an average of forecast gas price referenced to the Title

Transfer Facility ("TTF") in the Netherlands and the UK National

Balancing Point ("NBP") for pricing the forecasted uncontracted gas

sales volumes for impairment testing. At 30 June 2023 the Company

has used average TTF prices only since future gas sales contracts

the Company is likely to enter into are expected to be priced in

reference to TTF and in addition, the Company received an

indicative non-binding gas pricing term sheet referenced to TTF.

For the impairment testing, the average TTF gas price projections,

from leading independent industry consultants, used for the period

to 2032 (and increasing at 2% inflationary rate thereafter) was

15.03 US$/MMBtu. The average TTF and NBP gas price projections for

the period to 2032 was 14.45 US$/MMBtu.

After taking account of the changes to the discount rate and

referenced forecast gas price, an impairment charge of

approximately GBP4.2 million (net of foreign exchange movements)

has been recognised.

5. Intangibles

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

---------------------------- ----------- ----------- ------------

Cost

At start of period 46,969 42,556 42,556

Additions 400 401 836

Exchange adjustments (1,573) 3,466 3,577

---------------------------- ----------- ----------- ------------

At end of period 45,796 46,423 46,969

---------------------------- ----------- ----------- ------------

Impairment and Depreciation

At start of period 10,962 10,958 10,958

Charge for period 14 - 14

Exchange adjustments (14) 31 (10)

---------------------------- ----------- ----------- ------------

At end of period 10,962 10,989 10,962

---------------------------- ----------- ----------- ------------

Net book amount 34,834 35,434 36,007

---------------------------- ----------- ----------- ------------

6. Prepayments

Non-current prepayment of GBP4.1 million relates to activities

of the Company's Phase 1 mLNG Project in the Concession.

7. Tax liabilities

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

------------------------ ----------- ----------- -------------

Current liability

Taxes payable - - 126

------------------------ ----------- ----------- -------------

- - 126

------------------------ ----------- ----------- -------------

Non-current liability

Taxes payable 1,534 - 1,505

------------------------ ----------- ----------- -------------

1,534 - 1,505

------------------------ ----------- ----------- -------------

The Group had tax cases where Morocco Tax Authority had claimed

taxes relating to the Group historical licences transfers and

intragroup transactions. In May 2023, the Company entered into a

settlement agreement with Morocco Tax Authority on a phased payment

schedule back ended over 6 years. The amount paid on entry into the

settlement agreement was approximately GBP124k (after taking

account of exchange rate movements). The discounted non-current

liability amounted to approximately GBP1.5 million as at 30 June

2023.

8. Loans and borrowings

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

---------------------- ----------- ----------- -------------

Current liability

Secured bonds 2,122 - 1,121

---------------------- ----------- ----------- -------------

2,122 - 1,121

---------------------- ----------- ----------- -------------

Non-current liability

Secured bonds 19,652 20,941 20,855

Loan note- Afriquia 8,083 6,330 8,213

Convertible bonds 1,353 - -

---------------------- ----------- ----------- -------------

29,088 27,271 29,068

---------------------- ----------- ----------- -------------

The Company has EUR25.32 million secured bonds (the "Bonds").

The Bonds mature on 21 December 2027. The outstanding principal

amount of the Bonds will be partially settled, at a rate of 5%

every six months, commencing on 21 December 2023. The Bonds bear

until maturity 2% cash interest paid per annum and 3% deferred

interest per annum to be paid at redemption. The Company has the

right, at any time until 21 December 2024, to redeem the Bonds in

full for 70% of the principal value then outstanding together with

any unpaid interest at the date of redemption. The Company issued

to the Bondholders 99,999,936 warrants to subscribe for new

ordinary shares in the Company at an exercise price of 2.75 pence

per share. The warrants expire on 21 December 2027. The Bonds are

secured on the issued share capital of Sound Energy Morocco South

Limited. After taking account of the terms of the Bonds, the

effective interest is approximately 6.2%.

The Company has drawn down $9.5 million from the Company's $18.0

million 6% secured loan note facility with Afriquia Gaz maturing in

December 2033 (the "Loan"). The drawn down principal bears 6%

interest per annum payable quarterly but deferred and capitalised

semi-annually until the second anniversary of the issue of Notice

to Proceed. Thereafter, principal and deferred interest will be

repayable annually in equal instalments commencing December 2028.

The loan is secured on the issued share capital of Sound Energy

Meridja Limited. The effective interest on the drawdown amount is

approximately 6.2%.

In June 2023, the Company issued GBP2.5 million convertible

bonds from a senior unsecured convertible bond facility of up to

GBP4.0 million. The GBP2.5 million Convertible bonds have a fixed

conversion price of 2.25 pence per ordinary share. The term of the

Convertible bonds is 5 years from drawdown date, with interest of

15% per annum payable bi-annually in cash or capitalised to the

principal, at the Company's election.

Other key terms of the Convertible bonds ("Bonds") are:

1) Issue price and redemption price on maturity is 100% of par value;

2) Early redemption/change of control: callable in cash by the

Company at any time after drawdown or in the event of a change of

control of the Company at 110% of par value together with all

unpaid interest. If the Bonds are redeemed by the Company, the

maximum amount of future interest payable by the Company in respect

of any early redemption occurring on or prior to the second

anniversary will be 15% of the Bonds and after second anniversary,

10% of the Bonds;

3) Convertible into the Company's ordinary shares at the fixed

conversion price. Upon conversion, interest shall be rolled up and

paid as if the Bonds were held to the redemption date, with such

interest convertible at the lower of the applicable fixed

conversion price and the average of the 5 daily value weighted

average price calculations selected by the holder out of the 15

trading days prior to the conversion date;

4) The Company issued to Bonds holders 33,333,333 warrants to

subscribe for new ordinary shares in the Company at an exercise

price of 2.25 pence per ordinary share with a term of 3 years.

.

9. Shares in issue and share based payments

As at 30 June 2023, the Company had 1,860,106,895 ordinary

shares in issue.

Share issues during the period

In June 2023, the Company issued 11,404,211 shares to third

party advisers being settlement for services provided relating to

the Company's convertible bonds issue.

Warrants

In June 2023 as part of the Convertible bonds issue, the Company

issued warrants to Convertible bonds holders and advisors over a

total of 40,476,190 ordinary shares exercisable at 2.25 pence per

share for a period of 3 years.

10. Post Balance Sheet events

In July 2023, the Company announced that it has received

conversion notices to issue 22,222,222 Ordinary Shares ("Shares")

at a conversion price of 2.25 pence per Share under its Convertible

bonds agreement ("Partial Conversion"). The Partial Conversion

reduced the amount owing on the Convertible bonds by GBP500,000,

with GBP2,000,000 remaining.

In September 2023, the Company announced that it has received

conversion notices to issue 22,222,221 Shares at a conversion price

of 2.25 pence per Share as a Partial Conversion. The Partial

Conversion reduced the amount owing on the Convertible bonds by

GBP500,000, with GBP1,500,000 remaining.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKKBKKBKBOCB

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

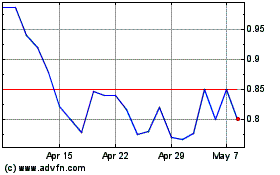

Sound Energy (LSE:SOU)

Historical Stock Chart

From Apr 2024 to May 2024

Sound Energy (LSE:SOU)

Historical Stock Chart

From May 2023 to May 2024