Terrace Hill Group PLC Acquisition of Remaining Residential Assets (2957F)

22 May 2013 - 4:55PM

UK Regulatory

TIDMTHG

RNS Number : 2957F

Terrace Hill Group PLC

22 May 2013

22 May 2013

TERRACE HILL GROUP PLC

("Terrace Hill" or the "Group" or the "Company")

TERRACE HILL ACQUIRES REMAINING RESIDENTIAL ASSETS OF TERRACE

HILL RESIDENTIAL PLC

Terrace Hill Group PLC (AIM: THG), a leading UK property

development and investment group, announces that it has acquired

all the remaining residential assets of Terrace Hill Residential

PLC (THR), its residential investment joint venture in which it

owns a 49% interest, for the sum of GBP5.3 million (the

"Transaction"). The balance of the interest in THR is beneficially

owned by the Chairman of the Group. The purchase was funded by a

bank loan of GBP4.6 million and cash from the Group's own

resources.

The assets consist of 47 units in Scotland, Manchester, Bristol

and Minehead and currently generate an annual income of

approximately GBP0.3 million. The Group intends to dispose of these

units on a piecemeal basis to owner occupiers, continuing the

process adopted by THR prior to the Group's purchase. The purchase

price of GBP5.3 million represents the current open market value of

the assets as determined by independent third party valuers.

Following this transaction, the Group's net gearing (including on a

look through basis) is expected to be approximately 35%.

The Group agreed to acquire these assets in order that it could

reach a negotiated settlement with the lender to THR as regards its

guarantee exposure to that lender. At 30 September 2012, the Group

had provided GBP6.0 million in respect of its guarantee exposure

and as a consequence of the terms agreed with the lender to THR,

this guarantee exposure is now fixed at the reduced amount of

GBP4.2 million leading to a release of GBP1.8 million in the

Group's accounts. The GBP4.2 million liability payment in respect

of the guarantee has been funded by way of a 13 month term bank

loan.

Arrangements with the Chairman

The Group has agreed with the Chairman that any net profit or

loss arising on the disposal of these properties will be shared

equally with him, continuing the same profit or loss sharing that

would have arisen if the properties had not been acquired by the

Group.

In addition, as agreed in 2010 and as previously disclosed, the

Group agreed to pay to the Chairman a fee of 4.41% on the amount by

which his guarantee to THR's lender had exceeded the amount of the

Group's guarantee. The amount accrued in the Group's accounts under

this agreement was GBP0.6 million and the Group and the Chairman

have agreed that the accrued amount will be used to part fund

payments by the Chairman in respect of his liability to THR's

lender under the guarantee arrangements.

The Transaction is deemed to be a Related Party Transaction

under Rule 13 of the AIM Rules for Companies. The Directors of the

Company, with the exception of Robert Adair who is party to the

Transaction, consider that, having consulted with Oriel Securities

Limited, the Company's Nominated Adviser, the terms of the

transaction are fair and reasonable insofar as the Company's

shareholders are concerned. In providing advice to the Directors,

Oriel Securities Limited has taken into account the commercial

assessment of the Directors.

Philip Leech, Chief Executive at Terrace Hill, commented:

"Following the sale of the majority of our residential assets to

Places for People in February 2013 we are very pleased to have

purchased the remaining assets of THR which facilitates a

favourable negotiated settlement with the lender to THR on the

guarantee. The remaining properties are continuing to be sold on a

piecemeal basis to owner occupiers which we expect to complete

within 15 months."

-Ends-

For further information, please visit www.terracehill.co.uk or

contact:

Terrace Hill Tel: 020 7631 1666

Philip Leech/Jon Austen

FTI Consulting Tel: 020 7831 3113

Richard Sunderland/Will Henderson /Faye Walters

terracehill@fticonsulting.com

Oriel Securities (Nominated Adviser) Tel: 020 7710 7600

Gareth Price

Mark Young

Notes to editors:

Terrace Hill Group

Terrace Hill Group PLC is a regionally based UK property

development and investment group quoted on AIM.

Formed in 1986, the Company has five offices located in London,

Glasgow, Teesside, Bristol and Manchester.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUUSNROKAVURR

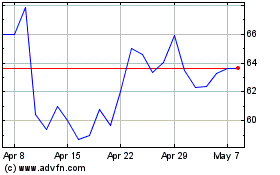

Thg (LSE:THG)

Historical Stock Chart

From Oct 2024 to Nov 2024

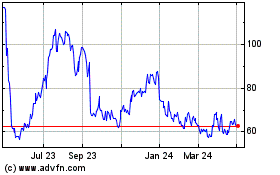

Thg (LSE:THG)

Historical Stock Chart

From Nov 2023 to Nov 2024