Third Point Investors Ltd - Third Point Releases Q2 2024 Investor Letter

23 August 2024 - 11:35PM

UK Regulatory

Third Point Investors Ltd - Third Point

Releases Q2 2024 Investor Letter

PR Newswire

LONDON, United Kingdom, August 23

23 August 2024

Third

Point Publishes Q2 2024 Investor Letter

Third

Point LLC, the Investment Manager of Third Point Investors Limited

(“TPIL”

or the “Company”)

announces that it has published its quarterly investor letter for

Q2 2024. The full letter can be accessed at the Company’s

website:

https://www.thirdpointlimited.com/resources/portfolio-updates

Highlights:

-

Third

Point’s flagship Offshore Fund (the “Master

Fund”)

generated a 1.8% gain in the Second Quarter, with strong

performance from positions connected to the AI thematic tempered by

consumer-oriented event-driven names.

-

During the

first half of 2024, the Master Fund generated profits across all

strategies, posting a 9.8% net return for the year-to-date.

-

Third

Point LLC (“Third

Point” or the

“Investment

Manager”)

provided updates on several positions, including Apple Inc., Corpay

Inc. and Intercontinental Exchange Inc., as well as updates on the

corporate credit and structured credit portfolios.

Performance

Key Points:

-

Third

Point returned

1.8% in the Master Fund during the second quarter of 2024, bringing

the year-to-date return to 9.8%.

-

The top

five positive contributors for the quarter were TSMC, Alphabet

Inc., Amazon.com Inc., Vistra Corp., and Apple Inc.

-

The top

five negative contributors for the quarter were Bath & Body

Works Inc., Advance Auto Parts Inc., Ferguson PLC, Airbus SE and

Corpay Inc.

Outlook

and Market Commentary:

-

While

indices have largely bounced back after the volatility experienced

in August, Third Point expects that volatility will persist for the

rest of the year with macroeconomic and geopolitical events

contributing to a choppy environment. However, the economic

backdrop looks relatively constructive, with decreasing inflation,

declining interest rates competing with a gradually slowing

economy.

-

Companies

continue to invest in AI infrastructure and look for applications

to their businesses, so the Investment Manager continues to hold

investments in cloud infrastructure providers, consumer AI

distribution platforms and semiconductors.

-

However,

Third Point is also finding many investments in the “physical

world” to be equally attractive, including those that are difficult

to disrupt due to competitive moats, consolidated industry

structures, unique products, or capital intensity that deter

competitive investment. Examples of these include aggregates,

nuclear power, life science tools, specialty alloy manufacturers,

and commercial aerospace.

-

The

Investment Manager also believes that the lower rate environment

should produce a wave of activity in credit transactions – both

public and private – as well as a burst of M&A transactions.

Such a period would be welcome for Third Point’s event-driven and

credit strategies.

Position

Updates

-

Apple

- In April,

the Investment Manager took a position in Apple, the world’s

leading consumer technology franchise.

- Despite

its dominance as a business, the stock had become increasingly

under-owned by institutional investors and its relative multiple

had compressed toward a multi-year low due to several years of

stagnant earnings growth, exacerbated by more recent fears that

Apple may turn out to be an AI loser.

- Third

Point’s research led it to a belief that AI-related demand could

drive a step change improvement in Apple’s revenue and earnings

over the next few years.

-

Corpay

- Third

Point added to its position in Corpay during the quarter after

having established a position in Q4 2023.

- Corpay is

a collection of network assets in the payments space, most notably

a fuel card business, where the company processes fuel purchases by

commercial vehicle operators, and a B2B payments business where

Corpay facilitates vendor payments for midmarket

clients.

- Over the

last five years, Corpay has seen its P/E multiple significantly

de-rate from the mid-20s to ~13x as market sentiment toward the

company's core fuel card business soured. Firstly, growth in the

segment has slowed as the market has matured. Secondly, the rise in

popularity of electric vehicles (EVs) as a theme has made investors

question the terminal value of a business whose main function is to

process gasoline and diesel payments.

- Third

Point believes Corpay has adequately planned for an EV transition,

which is also likely to take longer than expected. The Investment

Manager also sees rapid growth for the company’s payment business,

which should eventually overtake the fuel card

business.

-

Intercontinental

Exchange (ICE)

- Third

Point also added to its position in Intercontinental Exchange after

having established a position in April

2023, when the company’s proposed acquisition of Black

Knight impacted the share price.

- While the

deal overhang has lifted, the Investment Manager believes there is

a re-rating opportunity stemming from a structural and cyclical

acceleration of growth.

- The main

areas of opportunity, in Third Point’s view, are in ICE’s energy

and mortgage divisions. Energy is expected to continue its fast

growth by virtue of the increased demand for natural gas and the

globalization of the natural gas market. The mortgage business,

Third Point believes, now has the building blocks to automate the

highly analogue and parochial mortgage origination and servicing

ecosystem in the United

States.

-

London

Stock Exchange Group

- During the

first quarter, Third Point added to its position in LSEG a

mission-critical capital markets data provider that it believes

will be a beneficiary of Generative AI adoption in financial

services.

- LSEG is

now the only scale vendor working with Microsoft to democratise

access to financial data and embed it directly into Office365.

Third Point also expects that LSEG/MSFT will co-develop a powerful

Research Assistant application sitting on top of both LSEG’s and

clients’ data estates that will meaningfully reduce the time and

manpower needed to analyse data.

Credit

Updates

-

Corporate

Credit

- Corporate

Credit experienced relatively muted performance in the first half

of 2024, due to a slower-than-anticipated realization of the deal

events that Third Point expects to drive its positions

higher.

- Looking

ahead, Third Point believes the table is set for increasing

volatility and a broader opportunity set is already emerging.

Overall credit spreads are tight, however this belies the

underlying dispersion in the market. BB spreads are near their

tightest levels ever in comparison to BBBs, while the ratio of CCC

to B spreads is at its highest in history. Third Point believes

that this dispersion partly reflects a recognition that the long

and variable lags associated with changes in monetary policy are

beginning to manifest.

- The

Investment Manager believes that public credits will face

increasing stress as the impact of higher rates hits fixed rate

issuers that have to refinance at higher rates. Third Point expects

these pressures to provide a wealth of opportunity in secondary

markets for public credit.

-

Structured

Credit

- Third

Point anticipates increased opportunities in the corporate and real

estate structured finance markets as credit deteriorates. In the

firm’s US residential housing exposure, Third Point remains excited

about the current return profile and capital appreciation potential

as rates trend lower. The structured credit portfolio is long

duration in its mortgage exposure, and the rate rally provides a

promising tailwind to the projected return profile.

Press

Enquiries

|

Third

Point

Elissa

Doyle, Chief Communications Officer and Head of ESG

Engagement

edoyle@thirdpoint.com

Tel: +1

212-715-4907

|

Buchanan

Charles

Ryland

charlesr@buchanan.uk.com

Tel: +44

(0)20 7466 5107

Henry

Wilson

henryw@buchanan.uk.com

Tel: +44

(0)20 7466 5111

|

Notes

to Editors

About

Third Point Investors Limited

www.thirdpointlimited.com

Third

Point Investors Limited (LSE: TPOU) was listed on the London Stock

Exchange in 2007 and is a feeder fund that invests in the Third

Point Offshore Fund (the Master Fund), offering investors a unique

opportunity to gain direct exposure to founder Daniel S. Loeb’s

investment strategy. The Master Fund employs an event-driven,

opportunistic strategy to invest globally across the capital

structure and in diversified asset classes to optimize risk-reward

through a market cycle. TPIL’s portfolio is 100% aligned with the

Master Fund, which is Third Point’s largest investment strategy.

TPIL’s assets under management are currently $500 million.

About

Third Point LLC

Third

Point LLC is an institutional investment manager that actively

engages with companies across their lifecycle, using dynamic asset

allocation and an ethos of continuous learning to drive long-term

shareholder return. Led by Daniel S.

Loeb since its inception in 1995, the Firm has a 44-person

investment team, a robust quantitative data and analytics team, and

a deep, tenured business team. Third Point manages approximately

$11.2 billion in assets for sovereign

wealth funds, endowments, foundations, corporate & public

pensions, high-net-worth individuals, and employees.

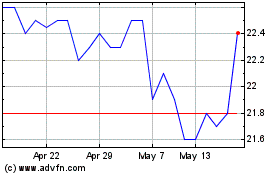

Third Point Investors (LSE:TPOU)

Historical Stock Chart

From Oct 2024 to Nov 2024

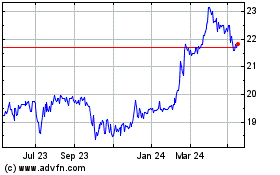

Third Point Investors (LSE:TPOU)

Historical Stock Chart

From Nov 2023 to Nov 2024