Trinity Exploration & Production Result of GM (3347U)

11 July 2018 - 9:42PM

UK Regulatory

TIDMTRIN

RNS Number : 3347U

Trinity Exploration & Production

11 July 2018

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION, OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, NEW ZEALAND, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

11 July 2018

Trinity Exploration & Production plc

Result of General Meeting and Conditional Placing and Offer for

Subscription to Qualifying Participants

and Total Voting Rights

Trinity Exploration & Production plc (AIM: TRIN) (the

"Company"), the independent exploration and production company

focused on Trinidad, announced on 25 June 2018 (the "Announcement")

that it had conditionally raised gross proceeds of US$18 million

(GBP13.7 million) by: (i) the conditional firm placing of

56,370,645 new Ordinary Shares (the "Firm Placing Shares"), which

was oversubscribed, at an issue price of 15 pence (the "Issue

Price") per Firm Placing Share to certain existing and new

institutional investors (the "Firm Placing"); and (ii) the

conditional subscription for 35,113,689 new Ordinary Shares (the

"Subscription Shares") at the Issue Price per Subscription Share by

certain Directors, members of the Company's senior management team

and certain holders of Loan Notes (the "Subscription"). The Company

proposed to raise up to a further US$2.0 million (GBP1.5 million)

by the issue of up to a further 10,164,926 new Ordinary Shares (the

"Offer Shares") at the Issue Price per Offer Share pursuant to an

offer for subscription to all Qualifying Participants (the

"Offer").

The Announcement also confirmed that Cenkos, as agent of the

Company, had entered into arrangements with the Conditional Placees

pursuant to which the Conditional Placees had agreed to subscribe

at the Issue Price for the New Ordinary Shares not taken up by

Qualifying Participants under the Offer (the "Conditional Placing"

and, together with the Firm Placing, the Subscription and the

Offer, the "Fundraising"), subject to clawback in respect of valid

applications by Qualifying Participants under the Offer. The

Fundraising was subject to, inter alia, the approval by

Shareholders of the Resolutions set out in the Notice of

Extraordinary General Meeting.

The Company is pleased to announce that all the Resolutions

proposed at the Extraordinary General Meeting, held earlier today,

were duly passed.

The Company is pleased to confirm that the Offer was

significantly oversubscribed. In accordance with the terms of the

Offer, the Directors have exercised their discretion with regard to

the allocation of the Offer Shares such that each Applicant who

applied for Offer Shares will receive the full amount of Offer

Shares applied for up to an application value of GBP10,000.

Thereafter, applications have been scaled back proportionately

according to the value of the application in excess of GBP10,000

and the balance of Offer Shares available. Accordingly, no New

Ordinary Shares will be allotted to the Conditional Placees

pursuant to the Conditional Placing.

Admission and Total Voting Rights

Accordingly, pursuant to the Fundraising announced on 25 June

2018, the Company is issuing 101,649,260 New Ordinary Shares at the

Issue Price. Application has been made for admission of the New

Ordinary Shares to trading on AIM which is expected to become

effective, and dealings are expected to commence, at 8.00 a.m. on

12 July 2018. Following Admission, the Company's issued share

capital will consist of 384,049,246 Ordinary Shares with voting

rights. The Company does not hold any Ordinary Shares in

treasury.

Following Admission, the abovementioned figure of 384,049,246

Ordinary Shares may be used by Shareholders as the denominator for

the calculations by which they will determine if they are required

to notify their interest in, or a change to their interest in, the

share capital of Trinity Exploration & Production plc under the

Financial Conduct Authority's Disclosure Guidance and Transparency

Rules.

Capitalised terms used but not defined in this notification

shall have the meanings given to such terms in the sections headed

'Definitions' and 'Glossary' in the Announcement.

Enquiries

For further information please visit www.trinityexploration.com

or contact:

Trinity Exploration & Production plc +44 (0)131 240 3860

Bruce Dingwall CBE, Executive Chairman

Jeremy Bridglalsingh, Chief Financial Officer

Tracy Mackenzie, Corporate Development

Manager

SPARK Advisory Partners Limited (Nominated

Adviser and Financial Adviser) +44 (0)20 3368 3550

Mark Brady

Miriam Greenwood

Andrew Emmott

Cenkos Securities PLC (Broker)

Joe Nally (Corporate Broking)

Neil McDonald

Beth McKiernan +44 (0)20 7397 8900

Derrick Lee +44 (0)131 220 6939

Whitman Howard Limited (Equity Adviser) +44 (0)20 7659 1234

Hugh Rich

Nick Lovering

Walbrook PR Limited +44 (0)20 7933 8780

Nick Rome trinityexploration@walbrookpr.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMUAOARWKABAAR

(END) Dow Jones Newswires

July 11, 2018 07:42 ET (11:42 GMT)

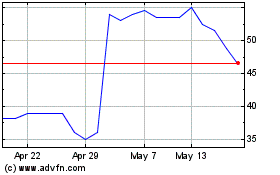

Trinity Exploration & Pr... (LSE:TRIN)

Historical Stock Chart

From Apr 2024 to May 2024

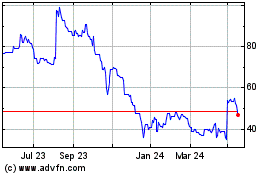

Trinity Exploration & Pr... (LSE:TRIN)

Historical Stock Chart

From May 2023 to May 2024