TIDMTSCO

RNS Number : 6219B

Tesco PLC

08 January 2015

8 January 2015

TRADING STATEMENT for 19 weeks ended 3 January

2015

===============================================

-- Investing in a better offer for Tesco customers is driving a

step up in underlying business performance

-- Broad-based improvement in the UK business resulting in

like-for-like sales performance of (2.9)% in last 19 weeks versus

(5.4)% in Q2. This includes like-for-like sales performance of

(0.3)% for the six-week Christmas period

-- All UK formats and categories improved like-for-like

performance. In the six week Christmas period, this included:

o Grocery home shopping +12.9%, general merchandise online

+22.2% and clothing online +52.4%

o Express format +4.9%, overall general merchandise +4.8% and

fresh food volume growth for first time in five years

-- Europe returned to positive like-for-like sales growth of +1.0% in last six weeks

-- Announcing progress on our immediate priorities, including a

significant cost-efficiency programme and a reduction in capital

expenditure to GBP1bn in 2015/16

-- Decision not to pay a final dividend for 2014/15

Dave Lewis - Chief Executive

=============================

"We are seeing the benefits of listening to our customers. The

investments we are making in service, availability and selectively

in price are already resulting in a better shopping experience. A

broad-based improvement has built gradually through the third

quarter, leading to a strong Christmas trading performance.

I would like to thank all of my colleagues in Tesco. The unique

combination of retail expertise and real passion for the customer

has been an inspiration to be a part of. In difficult circumstances

the team has begun the challenging task of reinvigorating our

business. There is more to do but we have taken the first important

steps in the right direction.

We have some very difficult changes to make. I am very conscious

that the consequences of these changes are significant for all

stakeholders in our business but we are facing the reality of the

situation. Our recent performance gives us confidence that when we

pull together and put the customer first we can deliver the right

results."

Like-for-Like Sales Growth (Inc. VAT, Exc.

Fuel)

=======================================================================================

Q1 2014/15 Q2 2014/15 Q3 2014/15 Christmas 19 Week

Period(*) Period

2014/15 2014/15

----------- ----------- ----------- ----------- ---------

(A) + (B) = (C)

---------------- ----------- ----------- ----------- ----------- ---------

UK (3.7)% (5.4)% (4.2)% (0.3)% (2.9)%

---------------- ----------- ----------- ----------- ----------- ---------

Asia (3.2)% (4.9)% (5.0)% (3.9)% (4.6)%

---------------- ----------- ----------- ----------- ----------- ---------

Europe (1.0)% (2.5)% (1.2)% 1.0% (0.4)%

---------------- ----------- ----------- ----------- ----------- ---------

International (2.2)% (3.7)% (3.1)% (1.3)% (2.5)%

---------------- ----------- ----------- ----------- ----------- ---------

Group (3.2)% (4.8)% (3.8)% (0.6)% (2.7)%

---------------- ----------- ----------- ----------- ----------- ---------

(*) For the six weeks ended 3 January 2015

UPDATE ON OUR PRIORITIES

=========================

Following a briefing of Tesco colleagues Dave Lewis and Alan

Stewart will be updating investors and analysts at 11.30am this

morning with further detail on our Christmas trading performance.

In addition they will share more details on progress against our

three immediate priorities:

1. Regaining competitiveness in core UK business, including:

-- the appointment of Matt Davies, Group Chief Executive of

Halfords Group plc, as the new CEO for the UK and Ireland business,

effective 1(st) June

-- a restructuring of central overheads, simplification of store

management structures and increased working-hour flexibility,

delivering savings of c.GBP250m per year at a one-off cost of

GBP(300)m

-- flat investment in payroll, the introduction of a flexible

benefits package for store colleagues and a turnaround-based bonus

for all colleagues

-- a decision to consolidate head office locations, closing

Cheshunt in 2016 and making Welwyn Garden City the UK and Group

centre

-- the closure of 43 unprofitable stores

-- our latest initiative to set lower prices on some of the nation's favourite brands

2. Protecting and strengthening the balance sheet,

including:

-- a significant revision to our store building programme

-- the initiation of consultation to close the company defined

benefit pension scheme to all colleagues

-- a significantly reduced capital expenditure budget in 2015/16 of GBP1bn

-- the disposal of Tesco Broadband and Blinkbox to TalkTalk

-- the appointment of advisors to explore strategic options for the dunnhumby business

-- the decision not to pay a final dividend for 2014/15

-- these actions are the first steps in strengthening the

balance sheet. Further initiatives which maximise shareholder value

are under consideration

3. Rebuilding trust and transparency, including:

-- the next step in re-establishing trust in our pricing policy

-- the progress made against our three major social responsibility initiatives

-- regenerating relations with suppliers with new commercial

income guidelines and associated year end cash management

Group trading profit guidance of no more than GBP1.4bn for

2014/15 is maintained. The immediate priority for proceeds from the

new level of financial discipline and cost control will be

reinvestment in our core customer proposition.

The full presentation will be webcast live and available to

download on our website from 11.30am at

www.tescoplc.com/investors.

Trading Update

===============

Group sales

Group sales for the 19 weeks to 3 January 2015 declined by

(0.6)% at constant rates, including fuel and (1.0)% excluding fuel.

At actual rates, sales declined by (1.9)% including fuel and by

(2.3)% excluding fuel.

UK performance

We delivered a marked improvement in our performance across the

period. Total UK sales including VAT and fuel for the full 19 weeks

to 3 January declined by (0.7)% compared to a decline of (3.2)% in

the second quarter, and decreased by (1.3)% excluding fuel.

Like-for-like sales (excluding fuel) decreased by (2.9)% for the 19

week period, compared to a decline of (5.4)% in the second quarter.

This included a gradual improvement through the third quarter and

resulted in a like-for-like sales performance of (0.3)% for the

six-week Christmas trading period.

The encouraging response from customers follows the investments

we have made across the store offer. We have seen strong

improvements in satisfaction with prices, availability, queues and

store standards following the introduction of more than 6,000 new

colleagues in customer-facing roles in store.

Our new commercial approach includes a comprehensive review of

product ranges to simplify them, reset prices and improve

availability. We are increasing shelf capacity for our 1,000

bestselling lines resulting in significant improvements in product

availability, particularly in the evenings.

Like-for-like volume growth in fresh food was positive over the

Christmas period, for the first time in five years. Within this,

performance was particularly pleasing in produce where we have

already made significant progress in the quality, freshness and

competitiveness of our offer. Our market-leading 'Festive Five'

deal where five key produce items were reduced to 49p, helped

millions of customers enjoy feeding their families and friends for

less.

Our overall general merchandise performance stepped up to

positive like-for-like sales growth over Christmas helped by the

success of our seasonal and gifting ranges. Black Friday promotions

resulted in the highest week of sales on record for Tesco Direct,

contributing to 22.2% like-for-like sales growth in online

merchandise for the Christmas period.

Customers also benefited from a strong offer in our convenience

and online grocery businesses over the seasonal period, resulting

in like-for-like sales growth of 4.9% and 12.9% respectively. Our

share of the online grocery market improved as customer numbers

rose strongly including a significant increase in the proportion of

customers taking advantage of our Click & Collect

locations.

International performance

In Asia, total sales for the 19 week period declined by (1.5)%

at constant rates, with like-for-like sales declining by (4.6)%.

Market conditions across the region remain challenging. In

Thailand, sales trends improved over the period as we annualised

the impact of the external pressures linked to political disruption

last year. In Korea, a higher number of enforced Sunday closures

under the DIDA opening regulations affected the performance of all

large retailers.

In Europe, total sales increased by 0.4% at constant rates for

the 19 week period, excluding fuel. The like-for-like sales

performance for the region, though still held back by our

performance in Ireland, improved from (2.5)% in the second quarter

to (1.2)% in the third quarter. Further improvement in all markets

resulted in positive like-for-like sales growth of 1.0% for the

Christmas period.

Tesco Bank

Sales at Tesco Bank increased by 3.0%, due to a broader product

range in mortgages and loans, although this was partly offset by a

more competitive insurance market.

Contacts

Investor Relations: Chris Griffith 01992 644 800

Media: Tom Hoskin 01992 644 645

Brunswick 0207 404 5959

Appendix 1 - Like-for-Like Sales Growth (Inc.

VAT, Exc. Fuel)

========================================================================================

Q1 2014/15 Q2 2014/15 Q3 2014/15 Christmas 19 Week

Period Period

2014/15 2014/15

----------- ----------- ----------- ---------- ---------

(A) + (B) = (C)

------------------ ----------- ----------- ----------- ---------- ---------

UK (3.7)% (5.4)% (4.2)% (0.3)% (2.9)%

------------------ ----------- ----------- ----------- ---------- ---------

inc. VAT,

inc. fuel (3.8)% (5.0)% (3.2)% 0.1% (2.1)%

------------------ ----------- ----------- ----------- ---------- ---------

exc. VAT,

exc. fuel (3.8)% (5.5)% (4.4)% (0.5)% (3.1)%

------------------ ----------- ----------- ----------- ---------- ---------

exc. VAT,

exc. fuel,

IFRIC 13

compliant (4.0)% (5.5)% (5.1)% (1.2)% (3.7)%

------------------ ----------- ----------- ----------- ---------- ---------

Asia (3.2)% (4.9)% (5.0)% (3.9)% (4.6)%

------------------ ----------- ----------- ----------- ---------- ---------

Malaysia (2.3)% (6.8)% (8.7)% (6.0)% (7.8)%

------------------ ----------- ----------- ----------- ---------- ---------

South Korea (2.8)% (4.7)% (4.0)% (4.0)% (4.0)%

------------------ ----------- ----------- ----------- ---------- ---------

Thailand (5.3)% (4.7)% (4.5)% (1.8)% (3.5)%

------------------ ----------- ----------- ----------- ---------- ---------

Europe (1.0)% (2.5)% (1.2)% 1.0% (0.4)%

------------------ ----------- ----------- ----------- ---------- ---------

Czech Republic 1.6% 1.3% 2.9% 5.7% 3.9%

------------------ ----------- ----------- ----------- ---------- ---------

Hungary^ 2.7% (0.6)% 1.4% 4.2% 2.5%

------------------ ----------- ----------- ----------- ---------- ---------

Poland 0.5% (2.4)% (2.5)% (1.2)% (2.0)%

------------------ ----------- ----------- ----------- ---------- ---------

Slovakia (5.8)% (4.6)% (2.1)% 0.8% (1.0)%

------------------ ----------- ----------- ----------- ---------- ---------

Turkey 3.4% 3.6% 6.7% 13.7% 8.9%

------------------ ----------- ----------- ----------- ---------- ---------

Republic

of Ireland (5.5)% (7.3)% (6.2)% (5.5)% (6.0)%

------------------ ----------- ----------- ----------- ---------- ---------

International (2.2)% (3.7)% (3.1)% (1.3)% (2.5)%

------------------ ----------- ----------- ----------- ---------- ---------

Group (3.2)% (4.8)% (3.8)% (0.6)% (2.7)%

------------------ ----------- ----------- ----------- ---------- ---------

(^) Following the introduction of legislation preventing large

retailers from selling tobacco in mid-July 2013, Hungary

like-for-like growth is shown on an exc. tobacco basis. Including

tobacco sales, in 2014/15, Q1 was 0.0%, Q2 was (2.0)%.

Appendix 2 - Total Sales Growth at Constant

Rates

======================================================================================

Q1 2014/15 Q2 2014/15 Q3 2014/15 Christmas 19 Week

Period Period

2014/15 2014/15

----------- ----------- ----------- ---------- ---------

(A) + (B) = (C)

----------------

Including

Fuel:

---------------- ----------- ----------- ----------- ---------- ---------

UK (2.0)% (3.2)% (1.7)% 1.5% (0.7)%

---------------- ----------- ----------- ----------- ---------- ---------

Asia 1.5% (0.9)% (1.7)% (1.0)% (1.5)%

---------------- ----------- ----------- ----------- ---------- ---------

Europe (0.7)% (1.9)% (0.6)% 0.8% (0.1)%

---------------- ----------- ----------- ----------- ---------- ---------

International 0.5% (1.4)% (1.1)% (0.1)% (0.7)%

---------------- ----------- ----------- ----------- ---------- ---------

Tesco Bank 3.6% 5.8% 2.7% 3.8% 3.0%

---------------- ----------- ----------- ----------- ---------- ---------

Group (1.2)% (2.5)% (1.5)% 1.0% (0.6)%

---------------- ----------- ----------- ----------- ---------- ---------

Excluding

Fuel:

---------------- ----------- ----------- ----------- ---------- ---------

UK (1.7)% (3.3)% (2.6)% 1.2% (1.3)%

---------------- ----------- ----------- ----------- ---------- ---------

Asia 1.5% (0.9)% (1.7)% (1.0)% (1.5)%

---------------- ----------- ----------- ----------- ---------- ---------

Europe (0.6)% (1.6)% (0.3)% 1.6% 0.4%

---------------- ----------- ----------- ----------- ---------- ---------

International 0.5% (1.2)% (1.0)% 0.3% (0.5)%

---------------- ----------- ----------- ----------- ---------- ---------

Tesco Bank 3.6% 5.8% 2.7% 3.8% 3.0%

---------------- ----------- ----------- ----------- ---------- ---------

Group (0.9)% (2.5)% (2.0)% 0.9% (1.0)%

---------------- ----------- ----------- ----------- ---------- ---------

Appendix 3 - Total Sales Growth at Actual Rates

======================================================================================

Q1 2014/15 Q2 2014/15 Q3 2014/15 Christmas 19 Week

Period Period

2014/15 2014/15

----------- ----------- ----------- ---------- ---------

(A) + (B) = (C)

----------------

Including

Fuel:

---------------- ----------- ----------- ----------- ---------- ---------

UK (2.0)% (3.2)% (1.7)% 1.5% (0.7)%

---------------- ----------- ----------- ----------- ---------- ---------

Asia (8.9)% (6.4)% (2.5)% (0.5)% (1.9)%

---------------- ----------- ----------- ----------- ---------- ---------

Europe (7.1)% (10.5)% (8.7)% (5.7)% (7.6)%

---------------- ----------- ----------- ----------- ---------- ---------

International (8.0)% (8.4)% (5.6)% (3.3)% (4.8)%

---------------- ----------- ----------- ----------- ---------- ---------

Tesco Bank 3.6% 5.8% 2.7% 3.8% 3.0%

---------------- ----------- ----------- ----------- ---------- ---------

Group (3.7)% (4.7)% (2.8)% 0.0% (1.9)%

---------------- ----------- ----------- ----------- ---------- ---------

Excluding

Fuel:

---------------- ----------- ----------- ----------- ---------- ---------

UK (1.7)% (3.3)% (2.6)% 1.2% (1.3)%

---------------- ----------- ----------- ----------- ---------- ---------

Asia (8.9)% (6.4)% (2.5)% (0.5)% (1.9)%

---------------- ----------- ----------- ----------- ---------- ---------

Europe (6.9)% (10.3)% (8.6)% (5.0)% (7.2)%

---------------- ----------- ----------- ----------- ---------- ---------

International (8.0)% (8.3)% (5.5)% (2.9)% (4.6)%

---------------- ----------- ----------- ----------- ---------- ---------

Tesco Bank 3.6% 5.8% 2.7% 3.8% 3.0%

---------------- ----------- ----------- ----------- ---------- ---------

Group (3.8)% (4.9)% (3.5)% (0.2)% (2.3)%

---------------- ----------- ----------- ----------- ---------- ---------

Notes:

These results have been reported on a continuing operations

basis and exclude the results from our operations in China.

Like-for-like sales growth is reported at constant exchange

rates. All other figures quoted are at actual exchange rates,

including VAT and excluding fuel unless otherwise stated.

For UK and ROI, these results are for the 19 weeks for both the

current year and the previous year comparison, for the period ended

3 January 2015 and 4 January 2014 respectively; the 3rd Quarter

results are for 91 days for both the current year and the previous

year comparison, for the periods ended 22 November 2014 and 23

November 2013 respectively. The Christmas period results are for

six weeks for both the current and the previous year comparison,

for the periods ended 3 January 2015 and 4 January 2014

respectively.

For Tesco Bank and India, these results are for the 19 weeks for

both the current year and the previous year comparison, for the

period ended 7 January 2015 and 7 January 2014 respectively; the

3rd Quarter results are for 91 days for both the current year and

the previous year comparison, for the periods ended 30 November

2014 and 30 November 2013 respectively. The Christmas period

results are for the month of December and one additional week for

both the current year and the previous year comparison, for the

period ended 7 January 2015 and 7 January 2014 respectively.

For all other countries, these results are for both the current

year and the previous year comparison, for the period ended 4

January 2015 and 5 January 2014 respectively; the 3rd Quarter

results are for 91 days for both the current year and the previous

year comparison, for the periods ended 23 November 2014 and 24

November 2013 respectively. The Christmas period results are for

six weeks for both the current year and the previous year

comparison, for the period ended 4 January 2015 and 5 January 2014

respectively.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTGLGDBGDGBGUI

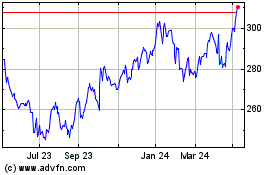

Tesco (LSE:TSCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

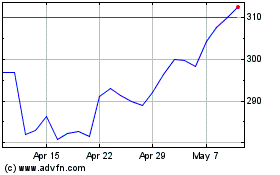

Tesco (LSE:TSCO)

Historical Stock Chart

From Jan 2024 to Jan 2025