VietNam Holding Limited Monthly Investor Report (0363U)

12 January 2017 - 11:46PM

UK Regulatory

TIDMVNH TIDMVNHW

RNS Number : 0363U

VietNam Holding Limited

12 January 2017

VietNam Holding Limited ("VNH" or the "Company")

Monthly Investor Report

A report detailing the activities of the Company for the month

of December 2016 has been issued by VietNam Holding Asset

Management Limited, the investment manager of the Company.

Electronic copies of the report have been made available to

shareholders on the Company's website at

http://www.vietnamholding.com/publications/investor-reports and a

summary of the report is included below.

Investor Report Summary

The Vietnam All Share Index declined 1.6% in December to 623.2,

thus making the stock market's 2016 full calendar year performance

+7.5% in local currency terms and +6.2% in US dollar terms. Amid

this somewhat tepid year for the market, VNH continued its

multiyear string of annual market outperformances, rising 19.1% in

the year to an NAV per share of USD 2.650. For December alone, the

fund was down 1.5%.

It was a year, broadly speaking, of two parts, with market

performance through September being very positive: the year's VNAS

index peak of 674 occurred in late September, marking at that time

a year-to-date rise of over 16%. But things were tougher towards

the year end, with the hitherto solid dong cracking under the

weight of a rising US dollar.

Of course, 2016 was a year of dramatic global political events

that few predicted, and therefore the outlook as we look forward to

2017 and 2018 is more uncertain than usual.

What we can say, however, is that Vietnamese policy makers, for

the most part, control their own fate. Firstly, although Vietnam is

a very open economy, with exports plus imports equalling some 175%

of GDP, most of Vietnam's exports are likely to see solid progress

based on global market share growth amid long term structural

advantages for the country.

Secondly, Vietnam - compared to most major southeast Asian

economies - remains a place with only a partially opened capital

account, so this stands it in good stead in what could be a fairly

turbulent year for global capital flows.

Thirdly and finally, Vietnamese policy makers have the power to

effect very noticeable improvement in government finances and the

overall business environment. There are still some 700+ state-owned

enterprises in Vietnam, with a historically-accounted total asset

value of some USD 220bn. Privatisation is accelerating.

For more information please contact:

VietNam Holding Asset Management Tel: +41 43 500

Limited 28 10

Investor Relations

Gyentsen Zatul

investorrelations@vnham.com

www.vietnamholding.com

Smith & Williamson Corporate Tel: +44 20 7131

Finance Limited Nominated 4000

Adviser

Azhic Basirov / Ben Jeynes

Winterflood Investment Trusts Tel: +44 20 3100

Broker 0000

Joe Winkley / Neil Langford

Buchanan Communications Tel: +44 20 7466

Financial Public Relations 5000

Charles Ryland / Vicky Hayns

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCOKBDQBBKDPDD

(END) Dow Jones Newswires

January 12, 2017 07:46 ET (12:46 GMT)

Vietnam (LSE:VNH)

Historical Stock Chart

From Apr 2024 to May 2024

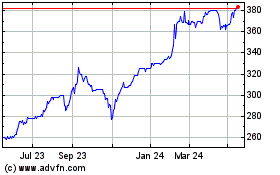

Vietnam (LSE:VNH)

Historical Stock Chart

From May 2023 to May 2024