TIDMWATR

RNS Number : 3642D

Water Intelligence PLC

21 June 2023

Audited Results for Year Ended 31 December 2022

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence" or

the "Group"), a leading multinational provider of precision,

minimally-invasive leak detection and remediation solutions for

both potable and non-potable water, is pleased to present its full,

audited results for the year ended 31 December 2022.

2022 and YTD Overview

Water Intelligence continues to perform strongly despite current

macroeconomic volatility. Market demand for the Group's water leak

detection and repair solutions remains strong reinforced by

increased public sector spending forecast in US and EU for aging

water and wastewater infrastructure.

2022

-- Adjusted 2022 FY Results (Not including one-time gain in

2021) in line with February Trading Update

o Revenues +31% to $71.3 million

o Adjusted EBITDA +20% to $12.4 million

o Adjusted PBT +12% to $7.8 million

-- In terms of market capture, 2022 Network Sales (direct

corporate sales and indirect gross sales to third parties from

which franchise royalty is derived) grew 11%, reaching

approximately $165 million (FY 2021: $148.5 million)

YTD

-- The Group recorded a strong start to 2023 as communicated in the 1Q Trading Update

-- Balance Sheet strong as at 31 May with Cash of $19.4 million

and Cash Net of Bank Debt and Deferred Acquisition Payments of

$(8.4) million, with deferred payments spread through 2027

-- Group has available cash resources for further Corporate

Development in 2023 to accelerate growth

2022 Highlights

Financial Performance

v Group Revenue increased by 31% to $71.3 million (2021: $54.5

million)

American Leak Detection subsidiary

-- Franchise royalty declined 1% to $6.7 million (2021: $6.8

million) (due to number of franchise acquisitions in 2021 reducing

the pool of franchise royalty for 2022; without acquisitions

franchise royalty would have grown 8%)

-- Franchise Related Activities (Insurance Channel) grew 9% to

$10.6 million (2021: $9.8 million)

-- US Corporate locations grew 48% to $47.3 million (2021: $31.9

million)

-- Same store sales grew 26% to $35 million (2021: $27.8 million)

Water Intelligence International subsidiary

-- International corporate locations grew 9% to $6.7 million

(2021: $6.1 million)

v EBITDA Adjusted** grew 20% to $12.4 million (2021: $10.3

million)

EBITDA* grew 16% to $11.1 million (2021: $9.5 million)

v PBT Adjusted** grew 12% to $7.8 million (2021: $6.9

million)

PBT* declined 3% to $5.5 million (2021: $5.7 million) (due to

non-cash expenses including amortization of Salesforce

implementation)

v Basic EPS Adjusted** of 29.5 cents (2021: 30.2 cents)

Fully diluted EPS Adjusted** of 27.6 cents (2021: 27.7

cents)

* EBITDA, PBT and EPS are adjusted to exclude the 2021 one-time

gain of $1.9 million to allow for like-for-like comparisons with

2021.

** EBITDA Adjusted, PBT Adjusted and EPS Adjusted all adjusted

for non-core costs and non-cash expense of share-based payments;

PBT Adjusted and EPS Adjusted also adjusted for non-cash expense of

amortization.

v Balance Sheet at 31 December 2022

-- Cash at $23 million

-- Cash net of bank debt at $6.2 million

-- Cash net of bank debt and deferred franchise acquisition

payments $(6.4) million

-- Debt and acquisition payments all spread through 2027 at a

blended fixed rate of approximately 4.9%

2022 Corporate Development:

-- Expansion of Acquisition Credit Facilities ($17 million at a

blended fixed rate of approximately 5.5% through 2027)

-- Franchise Acquisitions: Fort Worth, Texas; Midland, Texas

-- Plumbing Acquisition: Fairfield, Connecticut

-- Sale of Franchise Territory: Central North Carolina

-- Salesforce and related web applications being developed and

implemented across all US locations (automates all aspects of

workflow: scheduling and delivery; marketing followup; e-commerce;

highest level of data security in Salesforce Cloud)

-- New Service Offerings developed and commercial in 2023:

Municipal Pulse (sewer diagnostic tool) and Municipal LS1 (snapshot

survey tool)

2023 Corporate Development

-- Franchise Acquisition: Nashville, Tennessee

-- Productizing of Residential Pulse (sewer diagnostic tool)

Commenting on the Group's performance, Executive Chairman, Dr.

Patrick DeSouza remarked:

"We are pleased to deliver on our growth plan for our

stakeholders. During 2022 our team successfully navigated various

execution challenges posed by short-run inflationary shocks and

subsequent spikes in interest rates now raising concerns over a

coming recession. Despite it all, our core business remains strong

and market demand for water infrastructure solutions is only

growing as both private and public sectors recognize the adverse

effects of aging water and waste water infrastructure.

We remain confident in our strategic growth plan and competitive

strategy, especially as we realize the benefits of prior

investments in new technology solutions for our customers and

automation for our operations. Our entire team has a sense of

mission. Given increasingly adverse climate conditions - whether

droughts, freezes or flooding - our customers need us more than

ever.

We appreciate the continued support of our shareholders as we

deliver results and build a market leader."

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014

Enquiries :

Water Intelligence plc

Patrick DeSouza, Executive Chairman Tel: +1 203 654 5426

Maria McDonald, Director, Communications Tel: +1 415 272 2459

RBC Capital Markets - Joint Broker Tel: +44 (0)207 653 4000

Rupert Walford

Elizabeth Evans

Daniel Saveski

WH Ireland Limited - NOMAD & Joint Broker Tel: +44 (0)207 220 1666

Hugh Morgan

James Bavister

Dowgate Capital Ltd - Joint Broker Tel: +44 (0)20 3903 7721

Stephen Norcross

Chairman's Statement

Overview

Over the next decade, the water and wastewater industries will

be transformed globally as a result of stresses produced by climate

change and growing populations. Both the US and EU are committed to

spending tens of billions annually to address problems of aging

water and wastewater infrastructure. In the US, the Infrastructure

Investment and Jobs Act signed in November 2022 authorizes USD$55

billion in spending on water initiatives over the next five years.

The OECD estimates that the EU over the next decade will need

additional spending of approximately EUR290 billion to meet water

and sanitation needs under Directives covering Drinking Water and

Urban Waste Water Treatment.

Water Intelligence is well-positioned to accelerate its growth

trajectory to meet such market demand. Over the last decade, the

Group has grown quickly by attacking two critical infrastructure

problems occurring across the range of residential, commercial and

municipal pipes: water loss from leakage and wastewater overflow.

Our compounded annual growth from 2017 to 2022 has been 32% in

terms of revenue and 37% in terms of statutory profit before taxes.

And we have been able to achieve this record despite various

challenges brought on by Covid and now macroeconomic volatility in

a post-Covid world.

The opportunity ahead for Water Intelligence is particularly

exciting for two reasons: First, our Group attacks these water

infrastructure problems in a differentiated way by using

proprietary technologies to provide solutions that are

minimally-invasive - akin to precision medicine but for pipes as

opposed to arteries. Second, the competitive landscape is largely

fragmented, particularly on the residential side where we are

strong and have the leading national brand in the US through our

subsidiary American Leak Detection.

Our 2022 performance reaffirms our strong foundation and our

growth plan. During 2022 Water Intelligence grew each of its

operating businesses: American Leak Detection (ALD) and Water

Intelligence International (WII). Broadly, we use the concept of

network sales ("Network Sales") to illuminate our market capture.

Network Sales measures total gross sales from all corporate

operations and franchisees. For the end-user/ customer, there is no

distinction between our franchise-delivered and corporate-delivered

services because both operate under the same ALD brand with the

same training and uniformed service and provide the same menu of

solutions. However, as an accounting matter, while corporate gross

sales are recorded directly by Water Intelligence, franchise gross

sales are only reflected indirectly on Water Intelligence IFRS

accounts as franchisee royalty income, understating the Group's

actual market presence. For 2022, Network Sales grew by 11% to $165

million (2021: $149 million).

2022 Financial Performance and KPIs .

Our IFRS Accounts follow. Water Intelligence revenue increased

31% to $71.3 million (2021: $54.5 million). We then evaluate such

progress on our growth plan through key performance indicators

(KPIs) more fully reported in our Strategic Report as part of these

Accounts. Four KPIs, identified below, reflect our execution

through franchise-operated and corporate-operated locations.

Our franchise System sales continue to grow despite the number

of reacquisitions of franchise locations during 2021. KPI #1 - ALD

royalty income - is a proxy for System-wide franchise sales.

Franchise royalty decreased 1% to $6.7 million (2021: $6.8

million). Had those same locations remained as franchises instead

of being converted to corporate stores, royalty income would have

grown by 8%. KPI #2 - Franchise-related Activity - measures Group

support of franchise growth through the sale of equipment and

additional territory and the development of channel sales such as

insurance. Franchise-related Activity grew 9% to $10.6 million

(2021: $9.8 million).

Our corporate operations also grew both in the US and

internationally even after one adjusts for franchise

reacquisitions. KPI #3 - US Corporate sales - grew 48% to $47.3

million (2021: $31.9 million). As noted above, some of the US

corporate store growth resulted from franchise reacquisitions

converting royalty income into direct revenue and profits from

corporate operations. But even if we exclude those acquired

locations in 2021 and 2022 and just consider "same store" corporate

sales, same store locations grew 26% to $35 million (2021: $27.8

million). Same store numbers, underscore a key driver of our

reacquisition strategy: corporate reacquisition provides the

location with additional working capital from the Group's more

substantial balance sheet, further accelerating growth. KPI #4 -

International Corporate sales - grew by 9% to $6.7 million (2021:

$6.1 million). It should be noted that the Group is supporting

international growth not only organically but also through

acquisitions such as UK-based Wat-er-Save Limited in Q4 2021.

Wat-er-Save enhances WII's ability in the UK to execute not only

its current municipal work but also more residential and commercial

work. It also prepares the way for an introduction into the UK

market during 2024 of our ALD brand which is more focused on

minimally-invasive residential solutions. WII, though smaller today

than ALD in terms of sales, is leading the way in commercializing

our waste water solutions technology which segment is expected to

grow strongly.

The above component lines of Group sales growth have increased

Group profits. To make a like for like comparison between 2022 and

2021 operating results, we must hold aside a one-time gain of $1.9

million during 2021. Holding that aside, earnings before interest,

taxes and depreciation (EBITDA) grew 16% to $11.1 million (2021:

$9.5 million). When EBITDA is also adjusted for non-cash expenses

of share-based payments and non-core or one-time costs, EBITDA

Adjusted increased by 20% to $12.4 million (2021: $10.3 million).

Moreover, when profit before taxes (PBT) is adjusted for

amortization, non-cash share-based payments and non-core costs,

PBTA grew 12.3% to $7.8 million (2021: $6.9 million).

As noted above, our business plan reflects not only current

market capture but also seeks to better position the Group for

future market capture through targeted investment, especially given

the forecasted growth in the addressable market for the Group's

solutions over the next decade. First, we have invested over $3

million in automating operations via Salesforce and associated

applications. This set of applications, when fully implemented,

will ensure that both franchise and corporate locations are able to

schedule and dispatch trucks more efficiently both to provide the

needed solution and then to also sell more follow-up solutions for

other homeowner needs, thus enabling Water Intelligence to scale

operations more quickly and capture more sales.

Second, to increase capture of market demand, we need to invest

in hiring and training more technicians on our proprietary

technologies. Our trained technicians are our most important

assets. Each new technician requires training of up to eighteen

months before that technician can reliably and comfortably deploy

our proprietary leak detection solutions by himself. During the

training period, the compensation expense for "technicians in

training" is largely a drag. Though an expense today, like any

asset, a fully trained technician will return significant

incremental revenue and profits each year over a career life cycle.

For 2022, we increased our investment in training headcount by

approximately $1 million.

Our strong balance sheet with available cash and a comfortable

debt repayment schedule supports our reinvestment to sustain our

growth trajectory and to increase market share. At year-end 2022,

cash stood at $23 million. Bank debt was approximately $17 million.

Deferred payments from franchise reacquisitions were approximately

$12 million. Notably, total bank debt and deferred payments from

reacquisitions (approximately $29 million) are spread through 2027

with a blended fixed interest rate of approximately 4.9%. The

amount of bank debt and deferred payments coming due in 2023 is

approximately $9.2 million and well-covered by 2023 EBITDA which is

anticipated to be above the $11.1 million generated in 2022 and the

$23 million in cash on the balance sheet at year-end 2022. Hence we

have cash resources available for further corporate

development.

Direction

We believe that market demand for our services and products will

continue to be strong despite various macroeconomic scenarios

ranging from stagflation to recession driven by higher interest

rates. Simply put, water and wastewater infrastructure continue to

age, producing leaks and blockages that cannot be ignored. We have

the asset base to deliver on our vision of a "one stop shop" for

minimally invasive solutions to aging water and waste water

infrastructure: a critical mass of approximately $165 million in

Network Sales; more than 150 operating locations from which to

scale; national business channels in the US, such as insurance,

that leverage our sales footprint; and prior investments in new

technology products for customers and business automation for

enhanced scheduling and delivery that now can be realized in

meeting increased market demand over the next decade. Onward with

confidence.

Dr. Patrick DeSouza

Executive Chairman

Strategic Report

Business Review and Key Performance Indicators

The Chairman's Statement provides an overview of the year and an

outlook for Water Intelligence plc and its subsidiaries, together

referred to as the "Group". The business indicators offered below

are meant to capture for the Board not only the state of

performance but also the evolution of our business model as a

platform company with multiple sales channels. As a "One-stop Shop"

for our growing base of customers, we offer a matrix of clean water

and waste-water solutions for residential, commercial and municipal

infrastructure problems. With such offerings, we can both

cross-sell services from different business units or up-sell

technology products from partners.

The Water Intelligence platform has two wholly-owned

subsidiaries: American Leak Detection (ALD) and Water Intelligence

International (WII). These business units generated approximately

$165 million of gross sales to third-parties during 2022. The two

subsidiaries are distinguished by the degree of franchise-operated

and corporate-operated locations and their respective priorities

with respect to residential, business-to-business and municipal

customers.

ALD, our core business, is largely a franchise business with

strategic corporate-operated locations. ALD is a leader in using

technology to pinpoint and repair water leaks without destruction.

Solutions target both residential and business-to-business

customers, such as insurance companies, which value our "minimally

invasive" value proposition. During 2022 ALD generated

approximately $158 million of gross sales to end-users. That

critical mass of gross sales is derived from direct sales via

corporate-operated locations and indirect sales measured by royalty

income from franchisees, which, in turn, is based on franchisee

gross sales to end-users.

WII, our international based operation, focuses on municipal

solutions to the world-wide problem of failing water

infrastructure. During 2022 WII generated approximately $7 million

of sales to customers. Like ALD, WII's solutions are also

technology-based. WII is exclusively a corporate-run unit that

leads the Group's international expansion. WII does have the

capability to execute ALD service offerings and is currently doing

so at our corporate-operated locations in Australia. WII also

cross-sells complementary municipal offerings and residential

wastewater solutions to ALD customers in the US.

The Group's business model and growth strategy is evaluated

through key performance indicators (KPIs). The KPIs capture both

corporate-operated and franchise-operated organic growth from ALD

and WII solutions. They also capture acquisition-led growth,

especially by selectively converting ALD franchises into

corporate-operated locations. Such re-acquisitions of franchisee

operations enable some amount of the approximately $100 million in

highly profitable franchisee gross sales to end-users, currently

recorded as royalty income, to be converted to the Group's direct

Statement of Income. In evaluating such acquisition-led growth, it

is also important to separate continuing operating costs from

non-recurring costs or transaction costs. Finally, we have a KPI

that provides guidance as to the availability of capital to execute

our growth plan. Because of the monthly recurring royalty income

from the franchise business, the Group is able to be efficient in

its capital formation by mixing in non-dilutive bank debt. As a

result, the Group manages to the right balance in capital formation

between debt and equity by monitoring the level of bank

borrowings.

Six key performance indicators (KPIs) are used by the Board to

monitor the above described business model: (i) growth in ALD

franchise royalty income, (ii) growth in ALD franchise-related

activities that include both business to business sales and sales

of parts and equipment, (iii) growth in ALD corporate-operated

locations in the United States, (iv) growth in WII corporate

activities located outside the United States, (v) non-core costs

and (vi) net borrowings from banks which are subject to financial

covenants. These six indicators are reported to the Board and used

to assist the Board in the management of the business.

Evaluation of Strategic Plan Drawn From 6 KPIs:

i. Royalty income is a measure of the health of the ALD

franchise System which represents the majority of gross sales under

the ALD brand. The change in royalty income must be evaluated

against the number of franchise reacquisitions in any given year

which reduces the pool of available royalty income for the

subsequent year.

ii. Franchise-related Activities are a measure of the services

and products sold by Corporate to its franchises to fuel growth in

the franchise System. ALD's Business-to-Business Channel leverages

for customers our national execution presence under one brand and

is led by insurance companies.

iii. ALD Corporate-operated locations add to critical mass of

Group revenue and profits. Selective reacquisitions from our

franchise System further unlock equity value for the Group in two

ways. First, reacquisitions set up corporate regional hubs from

which corporate may help grow both franchise and corporate units.

Second, reacquisitions add growing revenue and profits directly

onto the accounts of the Group.

iv. WII complements our ALD brand which is focused largely on

residential and commercial customers, by contributing municipal

sales to the Group's overall sales presence in the US and

international geographies.

v. Non-core costs (transactions costs and non-recurring costs)

should be taken into account in evaluating on-going operating

performance.

vi. Credit facilities enable the Group to fuel expansion and

preserve shareholder equity. Because of the quality of monthly

recurring royalty income, the Group is attractive to banks enabling

the Group to optimize capital formation.

(i) Franchise Royalty Income.

ALD is the Group's core business generating approximately $158

million of corporate and franchisee gross sales. During 2022

approximately $100 million of such gross sales may be attributed to

the franchise System. The Group derives royalty income from such

gross sales. There are currently 82 franchises operating in over

100 locations across 46 states of the US, with additional locations

in Australia and Canada. Some franchisees operate multiple

locations in their territory.

Part of the Group's growth strategy to unlock shareholder value

by selectively reacquiring franchises and operating the business as

a corporate location. By executing such conversions, the Group is

trading-off a portion of the pool of available royalty income to

directly aggregate and grow the underlying revenue and profits from

those locations. Royalty income in 2022 decreased in absolute terms

by 1% compared with 2021. It is important to note that this small

decline is attributable to a significant number of reacquisitions

during 2021 which had the effect of reducing the eligible pool of

royalty income for 2022. Without such reacquisitions in 2021,

royalty income would have grown 8% indicating that on a

like-for-like basis the franchise System is still growing, driven

especially by the growth of the insurance channel noted in KPI

#2.

Performance from royalty income is as follows:

Year ended Year ended

31 December 31 December

2022 2021 Change

$'000 $'000 %

----------------------------- --------------------------- -------------- --------

Total USA 6,637 6,699 (1)%

International 110 105 5%

----------------------------- --------------------------- -------------- --------

Total Group Royalty Income 6,747 6,803 (1)%

----------------------------- --------------------------- -------------- --------

Profit before tax (see note

4) 1,957 1,809 8%

----------------------------- --------------------------- -------------- --------

(ii) Franchise-related Activities.

US franchise-related activities capture what Corporate

Administration ("Corporate") does to grow the franchise System. It

is also one indication of the reinvestment of franchisees in the

Group's growth plan.

Parts and equipment sold to franchisees by Corporate enables

franchisees to further grow their respective operations. For 2022,

not captured within this subcategory are amounts paid by

franchisees for licenses to Salesforce and associated applications

($0.16 million) which is also part of their reinvestment in the

Group's growth plan. If added to the parts and equipment sales

subcategory, franchisee reinvestment in their operations grew 3% to

$0.83 million.

Business-to-Business channels, such as insurance, capture the

market demands of national customers. These customers place

significant value on ALD's nationwide brand, service

standardization and delivery footprint - an important aspect of

competitive strategy when one considers that the market for service

providers is fragmented. Jobs for franchisees are sourced by

Corporate from insurance companies using a centralized processing

system. Important to note is that national channel jobs executed by

Corporate locations are not counted in the Group's

Business-to-Business sales. Hence the 11% growth of

Business-to-Business sales understates the contribution of

insurance relationships for Network Sales.

Finally, Sales of Franchise Units represent the decision to

develop a new territory through a franchisee as opposed to

corporate operations. It should be noted that the Group's current

priority is to add corporate-operated locations as opposed to

franchisee-operated locations. Given the rising value of franchise

territory given franchise reacquisitions, demand for additional

territory is rising among franchisees. The Group reviews annually

its priority on new corporate locations as opposed to franchise

locations.

Revenue from franchise-related activities in 2022 grew by 9%

compared to 2021 largely because of the growth of the Group's

business-to-business channel. Profits before tax grew 20% in 2022

compared with 2021 largely driven by the high margin surrounding

the sale of franchise territory. Performance from franchise-related

activities are as follows:

Year ended Year ended

31 December 31 December

2022 2021 Change

$'000 $'000 %

------------------------------------ -------------- -------------- --------

Parts and equipment sales 668 806 (17)%

Business-to-Business sales 9,893 8,941 11%

Sales of Franchise Units 63 23 175%

------------------------------------ -------------- -------------- --------

Total Revenue Franchise Activities 10,624 9,770 9%

------------------------------------ -------------- -------------- --------

Profit before tax (see note

4) 965 805 20%

------------------------------------ -------------- -------------- --------

(iii) US Corporate Operated Locations (ALD).

Corporate-run locations, both greenfield and initiated after

reacquisition of franchise locations, contribute revenue and

profits to the Group. In addition, such operations also support the

franchise System with strategy, marketing and execution support in

further developing territories. Performance of US corporate-run

locations after reacquisition is also an indication of the success

of the Group's strategy to capture more market demand for our

minimally invasive leak detection and repair solutions. The Group

directly operates 41 locations, an increase of 3 locations (2021:

38).

As set forth below, ALD Corporate-operated revenue grew 48% to

$47.3 million (2021: $31.9 million). Meanwhile profits before tax

grew strongly by 37% to a $8.2 million (2021: $6.0 million). Such

growth is a result of both organic growth and the contribution of

revenue and profits from franchisees reacquired during the period.

Much like the pro forma adjustment for royalty income in KPI #1

based on the number of franchisees reacquired in the prior year, so

also we can separate out corporate locations owned prior to January

2021 so that a comparison may be made for "same store sales" as a

measure of organic growth post franchise reacquisition.

Corporate-operated "same store" revenue grew 26% to $34.9 million

(2021: $27.8 million) and profit before tax grew 13% to $5.9

million (2021: $5.2 million).

Table (iii) also enables us to illustrate the trade-off between

franchise royalty growth and corporate-operated growth by examining

yield in terms of Group profit before tax. For 2022 US corporate

locations profit before tax amounted to $8.2 million. If the Group

was a "franchise-only" business and the same $47.3 million of sales

to the same customers under the same ALD brand were executed by

franchisees, the Group would only receive approximately $0.93

million of the profit before taxes. ($47.3 million of sales

multiplied by 6.75% average royalty fee equals approximately $3.19

million of royalty income; and $3.19 million is then multiplied by

29% profit margin of royalty income - see KPI #1 - to yield $0.93

million of profit before tax to the Group). Even at a much higher

margin of managing the franchise System, corporate profits on

direct sales is higher; to be sure, depending on the location, such

yield may require additional management costs.

Performance from corporate-operated locations is as follows:

Year ended Year ended

31 December 31 December

2022 2021 Change

$'000 $'000 %

----------------------------- -------------- --- -------------- --------

Revenue 47,297 31,861 48%

Locations owned prior to

1 January 2021 34,979 27,815 26%

Profit before tax (see note

4) 8,253 6,007 37%

Locations owned prior to

1 January 2021 5,985 5,287 13%

----------------------------- -------------- --- -------------- --------

(iv) International Corporate Operated Locations (WII)

The Group continues to strengthen its multinational presence

through its UK-based WII subsidiary. WII focuses largely on

municipal solutions while maintaining core residential and

commercial offerings. In the UK, WII executes municipal work for

all major utilities and residential and commercial projects through

its Wat-er-Save subsidiary. In this way, WII has multinational

operating scope by managing corporate locations established in

Australia and Ontario, Canada after ALD franchisee

reacquisitions.

WII sales grew 9% during 2022 to $6.7 million. (2021: $6.1

million) and profits decreased by 73% to $0.09 million (2021: $0.32

million). Much of the decline in profits is attributable to

extraordinary conditions in Australia during Q1 2022 identified

below in non-core costs and initial investments in the UK

Wat-er-Save Services Limited during 1H 2022 after its acquisition

in Q4 2021.

Performance from Water Intelligence International is as

follows:

Year ended Year ended

31 December 31 December

2022 2021 Change

$'000 $'000 %

---------------------------------- -------------- -------------- --------

UK 3,437 2,384 44%

Australia 2,038 2,614 (22)%

Canada 1,191 1,111 7%

Total Revenue from International

Corporate Activities 6,666 6,109 9%

---------------------------------- -------------- -------------- --------

Profit before tax (see note

4) 86 316 (73)%

---------------------------------- -------------- -------------- --------

(v) Non-Core Costs.

During 2022, the Group incurred non-core costs relating to

transactions or non-recurring expenses. As discussed herein,

understanding non-core costs, as distinct from continuing operating

costs, helps the Board evaluate capital allocation choices made to

accelerate operations organically and to scale through acquisition.

In 2022, there were $840,000 of non-core costs (2021:

$323,000).

Please see table below for details:

Year ended Year ended

31 December 2022 31 December

2021

$'000 $'000

------------------------------------ ----------------- ------------

ADP software upgrade - 30

Technology upgrades 450 193

Transaction-related legal and other

costs 243 100

Australian flood conditions 147 -

Total 840 323

------------------------------------ ----------------- ------------

(vi) Net Bank Borrowings.

Management of financial resources is important for making

various decisions regarding the reinvestment rate for the growth of

operations. As noted herein, the monthly recurring income from

franchise royalty provides the Group with attractive attributes for

using bank debt to complement equity sources of capital. The

Group's objective for risk management purposes is to be prudent

with respect to bank financial covenants. Net cash after Bank

Borrowings is positive and amortisation of such debt extends

through 2027.

Group

Year ended Year ended

31 December 31 December

2022 2021

$'000 $'000

----------------------------------- --- --- -------------- --------------

Lines of credit: acquisition and

working capital - 227

Bank borrowings 16,425 7,780

----------------------------------- ------- -------------- --------------

16,425 8,007

Less: Cash

Held in US Dollars 20,514 20,403

Held in GBP Sterling 1,779 2,570

Held in CDN Dollars 359 270

Held in AU Dollars 362 559

---------------------------------------- --- -------------- --------------

23,014 23,802

--------------------------------------- --- -------------- --------------

Total Net Bank Borrowings/(Cash) (6,589) (15,795)

---------------------------------------- --- -------------- --------------

Principal Risks and Uncertainties

The Group's objectives, policies and processes for measuring and

managing risk are described in note 23. The principal risks and

uncertainties to which the Group is exposed include:

Market Risk

The Group's activities expose it to the financial risk of

changes in foreign currency exchange rates as it undertakes certain

transactions denominated in foreign currencies. There has been no

change to the Group's exposure to market risks. The Group monitors

exposure to foreign exchange rate changes on a daily basis by a

daily review of the Group's cash balances in the US, UK, Canada and

Australia.

Interest Rate Risk

The Group's interest rate risk arises from its working capital

and term loan borrowings.

Whilst borrowing issued at variable rates would expose the Group

to cash flow risks, as at year-end, the Company is only subject to

a variable rate on its working capital line of credit. As of the

report date, all credit facilities in use are at fixed interest

rates.

Credit Risk

The Group's credit risk is primarily attributable to its cash

and cash equivalents and trade receivables. The credit risk on

other classes of financial assets is considered insignificant.

Liquidity Risk

The Group manages its liquidity risk primarily through the

monitoring of forecasts and actual cash flows.

Covid-19 Risk

2022 represented the third year of the global pandemic. Some

regulations eased while others remained. The Group delivers water

and wastewater solutions and is considered a supplier of "essential

services" under governmental policies covering shelter-in-place.

The Group continually evaluates health and safety protocols for our

technicians. The Group has sufficient cash to execute its plan and

balance work protocols for the health and safety of all our

stakeholders, especially our technicians and our customers.

Other Risks

There is a risk that existing and new customer relationships and

R&D will not lead to sales growth and increased profits. The

Group is reliant on a small number of skilled managers. The Group

is reliant on effective relationships with its franchisees,

especially in the US. Finally, while not fully apparent during

2022, there are emerging risks given the sharp rise in interest

rates during 2022 in the aftermath of inflationary pressures, The

Group is monitoring risks associated with stagflation or recession

during 2023.

Corporate Governance statement S172 of the UK's Companies

Act

Each director must act in a way that, in good faith, would most

likely promote the success of the Group for the benefit of its

stakeholders. The Board of Directors consider, both individually

and together, that they have acted in the way they consider, in

good faith, would be most likely to promote the success of the

company for the benefit of its members as a whole (having regard to

the stakeholders and matters indicated in S172) in the decisions

taken during the year ended 31 December 2022. Following is an

overview of how the Board performed its duties during 2022.

Shareholders and Banking Relationships

The Executive Chairman, Chief Financial Officer, members of the

Board and senior executives on the management team have regular

contact with major shareholders and banking relationships. The

Board receives regular updates on the views of shareholders which

are taken into account when the Board makes its decisions. During

February 2021 and March 2022, the Group expanded its credit

facilities. During July and November 2021, the Company raised

capital largely from its current shareholders. The Group received

feedback during each process.

Employees

The Board recognizes the importance of skilled human capital for

a technology and services-led business. The Board works through its

human resources director to provide on-going training and benefits.

It also provides advancement opportunities in its various

corporate-operated locations. As noted herein, the Group has taken

a variety of steps to address the COVID-19 pandemic in terms of its

employees and stakeholders.

Franchisees

The Group holds an annual convention for its franchisees which

includes education and training sessions. During 2021, as a result

of the pandemic, the Group did not hold its Convention but rather

relied on video conference meetings. During October 2022, the Group

held its annual convention in Nashville, Tennessee. Franchisees

have an Advisory Committee that provides input to the Board with

quarterly meetings. Moreover, one of our Board members, Bobby

Knell, successfully developed the Dallas franchise and retired as

one of our leading franchisees. He provides an additional channel

for input from the franchise System. Throughout the year, the Group

continues to share best practices guidance with franchisees in

responding to various business topics including Covid-19

circumstances and now a Salesforce.com implementation.

Customers

ALD has a reputation for high quality service delivery across

the United States for over forty years. Given the importance of our

reputation with customers, especially insurance companies, the

Board pays significant levels of attention to the quality of our

service delivery. Management gathers data that it shares with the

Board on customer satisfaction.

Community and Environment

The Group's brand stands for the conservation of water and the

importance of providing solutions to potable and non-potable water

leaks. Through our advertising and marketing the Group seeks to

communicate to the public both the importance of sustainability,

particularly with respect to water loss through leakage, and the

importance for public health of remediating sewer blockages as

consumers dispose of sanitary wipes in toilets during Covid-19. The

Group took an active role not only in providing leak detection

services to local government in Flint, Michigan - a community known

for its lead in the water crisis - but also in working to educate

community members on the importance of on-going water monitoring.

The Board has sought to be active with respect to education and

water. During 2019 and 2020, members of the Board have worked with

Columbia University to contribute to its "Year of Water" education

campaign.

By order of the Board

Patrick DeSouza

Executive Chairman

Director's Report

The Directors present their report on the affairs of Water

Intelligence plc and its subsidiaries, referred to as the Group,

together with the audited Financial Statements and Independent

Auditors' report for the year ended 31 December 2022.

Principal Activities

The Group is a leading provider of minimally invasive leak

detection and remediation services for potable and non-potable

water. The Group's strategy is to be a "One-stop Shop" for services

and product solutions for residential, commercial and municipal

customers.

Results

The financial performance for the year, including the Group's

Statement of Comprehensive Income and the Group's financial

position at the end of the year, is shown in the Financial

Statements.

2022 was marked by sustained and balanced multinational growth

for both ALD and WII. Total revenue for Water Intelligence grew 31%

to $71.3 million (2021: $54.5 million). ALD revenue grew 34% to

$64.6 million (2021: $48.3 million). WII revenue grew 9% to $6.8

million (2021: $6.2 million). The splits between ALD and WI revenue

remained consistent during 2022 when compared with 2021 with

approximately 91% of total revenue attributable to ALD and 9% of

total revenue attributable to WII.

Profit-based comparisons between 2022 and 2021 need to take into

account a one-time profit before tax gain of $1.9 million in 2021.

Holding that one-time gain aside, statutory earnings before

interest, taxes and depreciation (EBITDA) grew 16% to $11.1 million

(2021: $9.5 million). When EBITDA is adjusted for non-cash expenses

of share-based payments and non-core or non-recurring costs, EBITDA

Adjusted increased by 20% to $12.4 million (2021: $10.3 million).

Statutory profit before taxes (PBT) decreased by 3% to $5.5 million

(2021: $5.7 million). When profit before taxes is adjusted for

amortization, non-cash share-based payments and non-core costs,

PBTA grew 12.3% to $7.8 million (2021: $6.9 million).

Going Concern

The Directors have prepared a business plan and cash flow

forecast for the period to December 2024. The forecast contains

certain assumptions about the level of future sales and the level

of margins achievable. These assumptions are the Directors' best

estimate of the future development of the business. The Group

generates increasing levels of cash driven by its profitable and

growing US-based business, ALD. The Directors also note that the

Group has diversified its operations with growth in WII. Moreover,

after oversubscribed capital raises in July and November 2021 and

expansion of its credit facilities in February 2021 and March 2022,

the Directors believe that funding will be available on a

case-by-case basis for additional initiatives.

Cash at 31 December 2022 was $23 million (2021: $23.8 million).

At 31 December 2022, total debt (borrowings and deferred

consideration from franchise acquisitions) was $29 million with

amortisation of such amount spread through 2027. Meanwhile,

operating cash flows (EBITDA) in 2022 increased by 16% to $11.1

million (2021: $9.5 million). Cash on the balance sheet plus an

ability to generate significant cash relative to the amount of debt

that comes due in any one year between 2023 and 2027 are important

variables for Director considerations. Moreover, the Directors

consider various scenarios that may influence cash availability

such as inflationary pressures, the threat of recession from rising

interest rates and the use of cash for investments, such as

Salesforce.com and related software applications, geared to create

operational efficiencies that enhance future organic cash

generation.

The Directors conclude that the Group will have adequate cash

resources both to pursue its growth plan and to accelerate

execution if it so chooses. The Directors are satisfied that the

Group has adequate resources to continue in operational existence

for the foreseeable future and accordingly, continue to adopt the

going concern basis in preparing the financial statements.

Research & Development; Commercialization

The Group's focus is currently on reinvestment for

commercialization of technology and technology-based products not

pure R&D. Expenditure on pure research, all of which is

undertaken by third parties not related to the Group, was $0 (2021:

$0). The Group remains committed to anticipate market demands and

has spent money on product development during the year which has

been capitalised.

Dividends

The Directors do not recommend the payment of a dividend (2021:

$nil).

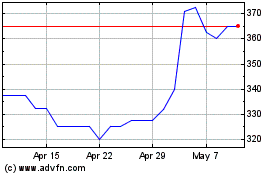

Share Price

On 31 December 2022, the closing market price of Water

Intelligence plc ordinary shares was 660.0 pence. The highest and

lowest prices of these shares during the year to 31 December 2022

were 1140.0 pence and 560.0 pence respectively.

Capital Structure

Details of the authorised and issued share capital are shown in

Note 21. No person has any special rights of control over the

Company's share capital and all issued shares are fully paid.

Future Developments

Future developments are outlined throughout the Chairman's

Statement.

Financial Risk Management

Financial risk management is outlined in the principal risks and

uncertainties section of the Strategic Report.

Subsequent Events

On 7 February 2023, the Group announced the reacquisition of its

Nashville, Tennessee franchise territory within the Group's ALD

franchise business. The acquisition is pursuant to the Group's

growth strategy of creating regional hubs and adds further

corporate scale to operations in the Midwest, United States. The

cash consideration for the acquisition is $3.25 million based on a

2022 Adjusted Income Statement of $2.4 million in revenue and

$550,000 in profit before tax and includes the transfer of all

operating assets to the Group.

Directors

The Directors who served the Company during the year and up to

the date of this report were as follows:

Executive Directors

Patrick DeSouza - Executive Chairman

Non-Executive Directors

Laura Hills

Bobby Knell

Michael Reisman

C. Daniel Ewell

The biographical details of the Directors of the Company are set

out on the Corporate Governance section of the report and on the

Company's website www.waterintelligence.co.uk

Directors' emoluments

2022 Salary,

Fees & Bonus Benefits Redundancy Total

-------------------------

$ $ $ $

------------------------- -------------- --------- ----------- --------

Executive Directors

P DeSouza 591,473 - - 591,473

Non-Executive Directors

------------------------- -------------- --------- ----------- --------

L Hills 49,231 - - 49,231

D Ewell - - - -

B Knell - - - -

M Reisman - - - -

640,704 - - 640,704

------------------------- -------------- --------- ----------- --------

* In lieu of cash compensation, all of the directors were awarded

stock options with an exercise price of $8.18 as announced on

7, February 2023. (See Note 7) The value of the options is as

follows: P DeSouza $80k, L Hills $40k, D Ewell $40k, B Knell

$80k, M Reisman $40k, for a total of $280k. Options granted plus

cash compensation above totals $920,704 which is to be compared

to $889,385 in 2021

2021 Salary,

Fees & Bonus Benefits Redundancy Total

-------------------------

$ $ $ $

------------------------- -------------- --------- ----------- --------

Executive Directors

P DeSouza 639,381 15,004 - 654,385

L Hills 125,000 - - 125,000

Non-Executive Directors

------------------------- -------------- --------- ----------- --------

D Ewell 30,000 - - 30,000

B Knell 40,000 - - 40,000

M Reisman 40,000 - - 40,000

------------------------- -------------- --------- ----------- --------

874,381 15,004 - 889,385

------------------------- -------------- --------- ----------- --------

Directors' interests

The Directors who held office at 31 December 2022 and subsequent

to year end had the following direct interest in the voting rights

of the Company at 31 December 2022 and at the date of this report,

excluding the shares held by Plain Sight Systems, Inc.

Number of shares % held at

at 31 December 31 December Number of shares % held at

2022 2022 at 20 June 2023 20 June 2023

Patrick DeSouza*/** 4,867,110 27.83 4,867,110 27.83

Michael Reisman* 184,126 1.05 184,126 1.05

Laura Hills 122,723 0.70 122,723 0.70

Bobby Knell 27,000 0.15 27,000 0.15

Dan Ewell 33,670 0.18 33,670 0.18

---------------------- ---------- ------------- ----------------- --------------

*Included in the total above, Patrick DeSouza has (i) 180,000

Partly Paid Shares (2016), (ii) 750,000 (March 2018) (iii) 850,000

(May 2019) and (iv) 300,000 Partly Paid Shares (October 2020).

These will not be admitted to trading or carry any economic rights

until fully paid.

*Patrick DeSouza and Michael Reisman are directors and

shareholders in Plain Sight Systems, Inc.

**Patrick DeSouza's interests include 1,965,000 shares held by

The Patrick J. DeSouza 2020 Irrevocable Trust U/A Dtd 11/23/2020

and 605,936 shares held in The Patrick J. DeSouza GRAT #1 U/T/A Dtd

11/23/2020

Share option schemes

To provide incentive for the management and key employees of the

Group, the Directors award stock options. Details of the current

scheme are set out in Note 7.

Substantial Shareholders

As well as the Directors' interests reported above, the

following interests of 3.0% and above as at the date of this report

were as follows:

Number of shares % held

----------------------------- ---------------- ------

Plain Sight Systems, Inc. 2,430,410 13.90

Canaccord Genuity Group Inc. 2,134,432 12.21

Berenberg Asset Management 1,259,992 7.21

George D. Yancopoulos 880,920 5.04

Amati AIM VCT 814,660 4.66

Herald Investment Trust 642,526 3.67

----------------------------- ---------------- ------

Corporate Responsibility

The Board recognises its employment, environmental and health

and safety responsibilities. It devotes appropriate resources

towards monitoring and improving compliance with existing

standards. An Executive Director has responsibility for these areas

at Board level, ensuring that the Group's policies are upheld and

providing the necessary resources.

Employees

The Board recognises that the Group's employees are its most

important asset.

The Group is committed to achieving equal opportunities and to

complying with relevant anti-discrimination legislation. It is

established Group policy to offer employees and job applicants the

opportunity to benefit from fair employment, without regard to

their sex, sexual orientation, marital status, race, religion or

belief, age or disability. Employees are encouraged to train and

develop their careers.

The Group has continued its policy of informing all employees of

matters of concern to them as employees, both in their immediate

work situation and in the wider context of the Group's well-being.

Communication with employees is effected through the Board, the

Group's management briefings structure, formal and informal

meetings and through the Group's information systems.

Independent Auditors

Crowe UK LLP has expressed their willingness to continue in

office. In accordance with section 489 of the Companies Act 2006,

resolutions for their re-appointment and to authorise the Directors

to determine the Independent Auditors' remuneration will be

proposed at the forthcoming Annual General Meeting.

Statement of disclosure to the Independent Auditor

Each of the persons who are directors at the time when this

Directors' report is approved has confirmed that:

-- so far as that Director is aware, there is no relevant audit

information of which the Company and the Group's auditor is

unaware; and

-- that Director has taken all the steps that ought to have been

taken as a director in order to be aware of any relevant audit

information and to establish that the Company and the Group's

auditor is aware of that information.

By order of the Board

Patrick DeSouza

Executive Chairman

Corporate Governance Statement

As a Board, we believe that practicing good Corporate Governance

is essential for building a successful and sustainable business in

the long-term interests of all stakeholders. Water Intelligence's

shares are listed on AIM, a market operated by the London Stock

Exchange.

With effect from September 2018, Water Intelligence has adopted

the QCA Corporate Governance Code. The Company has adopted a share

dealing code for the Board and employees of the Company which is in

conformity with the requirements of Rule 21 of the AIM Rules for

Companies. The Company takes steps to ensure compliance by the

Board and applicable employees with the terms of such code.

The following sections outline the structures, processes and

procedures by which the Board ensures that high standards of

corporate governance are maintained throughout the Group.

Further details can be found on our website at

www.waterintelligence.co.uk/corporate-Board-and-governance.

Takeovers and Mergers

The Company is subject to The City Code on Takeovers and

Mergers.

Board

The Board, chaired by Patrick DeSouza, comprises one executive

and four non-executive directors and it oversees and implements the

Company's corporate governance program. As Chairman, Dr. DeSouza is

responsible for the Company's approach to corporate governance and

the application of the principles of the QCA Code. Michael Reisman

and Dan Ewell are the Company's independent directors. The Board is

supported by two committees: audit and remuneration. The Board does

not consider that it is of a size at present to require a separate

nominations committee, and all members of the Board are involved in

the appointment of new directors.

Each Board member commits sufficient time to fulfil their duties

and obligations to the Board and the Company. They are required to

attend at least 4 Board meetings annually and join regular Board

calls that take place between formal meetings and offer

availability for consultation when needed.

Board papers are sent out to all directors in advance of each

Board meeting including management accounts and accompanying

reports from those responsible.

Meetings held during the period between 1 January 2022 and 31

December 2022 and the attendance of directors is summarized

below:

Board meetings Audit committee Remuneration committee

Possible (attended) Possible (attended) Possible (attended)

----------------- -------------------- -------------------- -----------------------

Patrick DeSouza 6/6

Bobby Knell 5/6 2/2

Michael Reisman 5/6 2/2 2/2

Dan Ewell 5/6 2/2

Laura Hills 6/6

Board Committees

The Board has established an Audit Committee and a Remuneration

Committee with delegated duties and responsibilities.

(a) Audit Committee

Dan Ewell, Non-Executive Director, is Chairman of the Audit

Committee. The other member of the Committee is Michael Reisman.

The Audit Committee is responsible for ensuring that the financial

performance, position and prospects for the Company are properly

monitored, controlled and reported on and for meeting the auditors

and reviewing their reports relating to accounts and internal

controls.

(b) Remuneration Committee

Michael Reisman, Non-Executive Director, is Chairman of the

Remuneration Committee. The other member of the Committee is Bobby

Knell. The Remuneration Committee is responsible for reviewing

performance of Executive Directors and determining the remuneration

and basis of service agreement with due regard for the Combined

Code. The Remuneration Committee also determines the payment of any

bonuses to Executive Directors and the grant of options.

The Company has adopted and operates a share dealing code for

directors and senior employees on the same terms as the Model Code

appended to the Listing Rules of the UKLA.

Board Experience

All five members of the Board bring complementary skill sets to

the Board. One director is female and four are male. The Board

believes that its blend of relevant experience, skills and personal

qualities and capabilities is sufficient to enable it to

successfully execute its strategy. In addition, the Board receives

regular updates from, amongst others, its nominated adviser, legal

counsel and company secretary in relation to key rule changes and

corporate governance requirements, as well as regular liaison with

audit firms both in the UK and the US in respect of key disclosure

and accounting requirements for the Group, especially as accounting

standards evolve. In addition, each new director appointment is

required to receive AIM rule training from the Company's nominated

adviser at the time of their appointment.

Patrick J. DeSouza, Executive Chairman

Term of office: Appointed as Executive Chairman in July

2010.

Background and suitability for the role: Dr. DeSouza has been

Chairman of American Leak Detection since 2006 and Executive

Chairman since its reverse merger to create Water Intelligence plc

in 2010. He has 25 years of operating and advisory leadership

experience with both public and private companies in the defence,

software/Internet and asset management industries. Over the course

of his career, Dr. DeSouza has had significant experience in

corporate finance and cross-border mergers and acquisition

transactions. He has practised corporate and securities law as a

member of the New York and California bars. Dr. DeSouza has also

worked at the White House as Director for Inter-American Affairs on

the National Security Council. He is the author of Economic

Strategy and National Security (2000). He is a graduate of Columbia

College, the Yale Law School and Stanford Graduate School.

Laura Hills, Non-Executive Director

Term of office: Appointed 7 June 2021 as Executive Director but

returned to non-executive director which she originally was

appointed since 6 February 2018.

Background and suitability for the role: Laura has more than 30

years' experience as a legal professional, having spent 10 years

working for Overseas Private Investment Corporation (OPIC), where

she served as Associate General for the agency's finance program,

supervising a team of lawyers on all finance transactions ranging

from micro-lending and small business to multi-creditor

infrastructure project financing in emerging market countries. In

2002, Ms. Hills founded Hills, Stern & Morley LLP, an emerging

markets legal firm based in Washington D.C. Laura sits on the Board

of the Gerald Ford Presidential Foundation. Laura brings

considerable expertise in negotiating on infrastructure and

renewables related transactions globally. Moreover, Ms. Hills

experience with non-profits assists the Board in fulfilling its

responsibility to advance the mission of Water Intelligence to

support underserved communities globally. Laura holds

undergraduate, graduate and law degrees from Stanford

University.

Bobby Knell, Non-Executive Director

Term of office: Appointed 7 June 2021, having previously been an

executive director, non-executive director since 17 January

2019.

Background and suitability for the role: The ALD franchise

business is central to the operations and value proposition of

Water Intelligence. Bobby has served as a managing director at

Water Intelligence responsible for franchise relations for the last

four years. Prior to this role, Bobby founded and grew the Dallas

franchise of American Leak Detection into a multi-million dollar

operation, an operation now run by his son. His appointment

furthers the alignment of strategy and interests between corporate

operations and the core American Leak Detection franchise

business.

Michael Reisman, Independent Non-executive Director

Term of office: Appointed as a non-executive director on 30 July

2010.

Background and suitability for the role: Professor Reisman

currently serves as Myres S. McDougal Professor of International

Law at the Yale Law School, where he has been on the faculty since

1965 and has previously been a visiting professor in Tokyo, Berlin,

Basel, Paris, Geneva and Hong Kong Professor Reisman is the

President of the Arbitration Tribunal of the Bank for International

Settlements and a member of the Advisory Committee on International

Law of the Department of State. He has served as arbitrator and

counsel in many international cases. He was also President of the

Inter-American Commission on Human Rights of the Organization of

American States. Because of his international legal experience and

the growing multinational character of the Company, Professor

Reisman leads matters of governance, corporate responsibility and

remuneration. He is a graduate of Yale Law School.

C. Daniel Ewell, Independent Non-executive Director

Term of office: Appointed as a non-executive director on 8 April

2021

Background and suitability for the role: Dan Ewell is currently

a Senior Advisor at Morgan Stanley, where he has worked as an

investment banker for over 33 years. Prior to assuming his current

role, Mr. Ewell served as Vice Chairman and Head of Western Region

Investment Banking for Morgan Stanley. Dan has extensive experience

in advising companies and helping them grow through capital raising

and strategic transactions. His experience spans a range of sectors

including consumer/retails, industrial, healthcare and

media/technology, and included companies with franchised business

models. As the Group continues to scale its operations

internationally, it has a need to broaden its institutional and

strategic activity in capital markets. Mr. Ewell brings

considerable expertise in this area. He is a graduate of University

of California, Berkeley, Yale Law School and Yale School of

Management.

The Group has a non-Board Chief Financial Officer, Pat Lamarco

Jr., who attends all Board meetings and reports regularly to the

Board and assists in the preparation of Board materials and in

reviewing the budget and ongoing performance.

The Company Secretary is responsible for ensuring that Board

procedures are followed and that all applicable rules and

regulations are complied with. Adrian Hargrave currently performs

the role of Company Secretary, providing an advisory role to the

Board. The Company Secretary is supported and guided in this role

by the Company's legal advisors.

The Directors have access to the Company's CFO, NOMAD, Company

Secretary, lawyers and auditors as and when required and are able

to obtain advice from other external bodies when necessary.

Board Performance and Effectiveness

The performance and effectiveness of the Board, its committees

and individual Directors is reviewed by the Chairman and the Board

an ongoing basis. Training is available should a Director request

it, or if the Chairman feels it is necessary. The performance of

the Board is measured by the Chairman and Michael Reisman, one of

the non-executive directors, with reference to the Company's

achievement of its strategic goals.

Risk Management

The Directors recognise their responsibility for the Group's

system of internal control and have established systems to ensure

that an appropriate and reasonable level of oversight and control

is provided. The Group's systems of internal control are designed

to help the Group meet its business objectives by appropriately

managing, rather than eliminating, the risks to those objectives.

The controls can only provide reasonable, not absolute, assurance

against material misstatement or loss.

The Executive Chairman with the assistance of the Company

Secretary and the Chief Financial Officer manages a risk register

for the Group that identifies key risks in the areas of corporate

strategy, financial, clients, staff, environmental and the

investment community. The Board is provided with a copy of the

register. The register is reviewed periodically and is updated as

and when necessary.

Within the scope of the annual audit, specific financial risks

are also evaluated in detail, including in relation to foreign

currency, interest rates, debt covenants, taxation and

liquidity.

The annual budget is reviewed and approved by the Board.

Financial results, with comparisons to budget and latest forecasts

are reported on a monthly basis to the Board together with a report

on operational achievements, objectives and issues encountered.

Significant variances from plan are discussed at Board meetings and

actions set in place to address them.

Approval levels for authorisation of expenditure are at set

levels throughout the management structure with any expenditure in

excess of pre-defined levels requiring approval from the Executive

Chairman and the Chief Financial Officer.

Measures continue to be taken to review and embed internal

controls and risk management procedures into the business processes

of the organisation and to deal with areas of improvement which

come to the management's and the Board's attention. We expect the

internal controls for the business to change as the business

expands both geographically and in terms of product

development.

The Company's auditors are encouraged to raise comments on

internal control in their management letter following their audit,

and the points raised and actions arising are monitored through to

completion by the Audit Committee.

Corporate Culture

Corporate Responsibility

The Board recognises its employment, environmental and health

and safety responsibilities. It devotes appropriate resources

towards monitoring and improving compliance with existing

standards. There is a professional Human Resources Director. Laura

Hills is responsible for oversight at the Board level. Ms. Hills

ensures that the Group's policies are upheld and providing the

necessary resources. All members of the Board have significant

experience in matters of public policy.

Employees

The Board recognises that the Group's employees are its most

important asset.

The Group is committed to achieving equal opportunities and to

complying with relevant anti-discrimination legislation. It is

established Group policy to offer employees and job applicants the

opportunity to benefit from fair employment, without regard to

their sex, sexual orientation, marital status, race, religion or

belief, age or disability. Employees are encouraged to train and

develop their careers. The Group has an employee handbook that is

provided to all employees upon starting their employment within the

Group.

The Group has continued its policy of informing all employees of

matters of concern to them as employees, both in their immediate

work situation and in the wider context of the Group's

well-being.

In addition, all directors and senior employees are required to

abide by the Group's share dealing code, which was updated in 2016

to reflect changes made to legislation following the introduction

of the Market Abuse Regulation.

Audit Committee Annual Review

The role of the Audit Committee is to monitor the quality of

internal controls and check that the financial performance of the

Group is properly assessed and reported on. It receives and reviews

reports from the Chief Financial Officer, other members of

management and external auditors relating to the interim and annual

accounts and the accounting and internal control systems in use

throughout the Group. The members of the Audit Committee are Dan

Ewell (Chairman) and Michael Reisman.

The Executive Chairman and Chief Financial Officer are invited

to attend parts of meetings, with other senior financial managers

required to attend when necessary. The external auditors attend

meetings to discuss the planning and conclusions of their work and

meet with the members of the Committee. The Committee is able to

call for information from management and consults with the external

auditors directly as required.

The objectivity and independence of the external auditors is

safeguarded by reviewing the auditors' formal declarations,

monitoring relationships between key audit staff and the Company

and tracking the level of non-audit fees payable to the

auditors.

The Committee met twice during the year, to review the 2021

annual accounts and the interim accounts to 30 June 2022. The

Committee reviewed with the independent auditor its judgements as

to the acceptability of the Company's accounting principles.

Remuneration Committee Annual Review

The Remuneration Committee convenes not less than once a year

and during the year it met on two occasions. The Committee

comprises Michael Reisman and Bobby Knell, with Michael Reisman as

Chairman. The Remuneration Committee is responsible for reviewing

the performance of Executive Directors and determining the

remuneration and basis of service agreement. The Remuneration

Committee also determines the payment of any bonuses to Executive

Directors and the grant of options. Where appropriate the Committee

consults the Executive Chairman regarding its proposals. No

Director plays a part in any discussion regarding his or her own

remuneration.

Relations with Shareholders

The Company is available to hold meetings with its shareholders

to discuss objectives and to keep them updated on the Company's

strategy, Board membership and management.

The Board also welcome shareholders' enquiries, which may be

sent via the Company's website www.waterintelligence.co.uk .

Statement of Directors' Responsibilities

Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and the Financial Statements in accordance with the Companies Act

2006 and for being satisfied that the Financial Statements give a

true and fair view. The Directors are also responsible for

preparing the Financial Statements in accordance with UK adopted

International Accounting Standards.

Company law requires the Directors to prepare Financial

Statements for each financial period which give a true and fair

view of the state of affairs of the Company and the Group and of

the profit or loss of the Company and the Group for that period. In

preparing those Financial Statements, the Directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- make judgments and estimates that are reasonable and prudent;

-- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the Financial Statements; and

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company and the

Group will continue in business.

The Directors confirm that they have complied with the above

requirements in preparing the Financial Statements. The Directors

are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions, disclose

with reasonable accuracy at any time the financial position of the

Company and the Group, and to enable them to ensure that the

Financial Statements comply with the Companies Act 2006.

They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Website publication

The Directors are responsible for ensuring the Annual Report and

Financial Statements are made available on a website. Financial

Statements are published on the Group's website (

www.waterintelligence.co.uk ) in accordance with legislation in the

United Kingdom governing the preparation and dissemination of

Financial Statements, which may vary from legislation in other

jurisdictions. The maintenance and integrity of the Group's website

is the responsibility of the Directors. The Directors'

responsibility also extends to the ongoing integrity of the

Financial Statements contained there.

Independent Auditors' report to the members of Water

Intelligence plc

Opinion

We have audited the financial statements of Water Intelligence

plc (the "Parent Company") and its subsidiaries (the "Group") for

the year ended 31 December 2022, which comprise:

-- the Group statement of comprehensive income for the year ended 31 December 2022 ;

-- the Group and parent company statements of financial position as at 31 December 2022 ;

-- the Group and parent company statements of changes in equity for the year then ended;

-- the Group and parent company statements of cash flows for the year then ended ; and

-- the notes to the financial statements, including significant accounting policies.

The financial reporting framework that has been applied in the

preparation of the Group and parent company financial statements is

applicable law and UK-adopted international accounting

standards.

In our opinion the financial statements:

-- give a true and fair view of the state of the Group's and of

the Parent Company's affairs as at 31 December 2022 and of the

Group's profit for the period then ended;

-- have been properly prepared in accordance with UK-adopted

international accounting standards; and

-- have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial