Ad Giant WPP Resists Breakup Talk

20 April 2018 - 2:37AM

Dow Jones News

By Nick Kostov

WPP PLC's interim management is pouring cold water on analyst

demands for a breakup of the world's largest advertising group in

the wake of founder Martin Sorrell's departure.

The 73-year-old's exit as WPP chief executive, following an

investigation into an allegation of personal misconduct, has

financial analysts performing sum-of-parts valuations for WPP's

sprawling ad empire.

"We don't believe this makes sense," Mark Read, WPP's freshly

appointed co-chief operating officer, wrote in a memo to staff on

Thursday.

Earlier this month, WPP said an independent counsel has been

appointed to look into "an allegation of personal misconduct" after

The Wall Street Journal reported on the probe. The Journal reported

that the board was also looking into whether Mr. Sorrell misused

company assets. WPP said any possible misconduct did not involve

sums that were material to the company. Mr. Sorrell denied any

financial impropriety.

WPP said it is treating the departure as a retirement, and the

investigation's findings are confidential.

"WPP is a great business with outstanding people, world-class

agencies and most of the world's leading companies as its clients

and partners," Mr. Read wrote Thursday. "Nothing that's happened in

the last week has changed that."

Mr. Sorrell's departure has stoked investor anxieties about how

the business will fare without the person who built it from the

ground up. In his 33-year career at WPP, Mr. Sorrell transformed a

manufacturer of shopping baskets into a holding company

encompassing more than 400 agencies that provide marketing

campaigns for clients such as Unilever PLC and Coca-Cola Co.

That business model was designed to insulate the company from

downturns in ad spending in different countries.

But digital disruption is leading advertisers that once splurged

on ad agency-led campaigns to redirect their spending. The company

last month posted its worst sales performance since the financial

crisis and projected no revenue growth for the year. Its stock

price has dipped almost 35% over the past year, including a 6.5%

drop on Monday after Mr. Sorrell stepped down.

Analysts at London brokerage Liberum described Mr. Sorrell as

"the glue that bound much of WPP together."

Kantar, the company's market research unit, is "the most obvious

candidate for disposal," Liberum wrote in a research note, adding a

sale could raise 3.5 billion pounds to reduce debt or return cash

to shareholders.

Alex DeGroote of Cenkos, the London brokerage, said separating

the company's digital, advertising, market research and other

assets could lead to a 40% rise in the share price.

"The problem isn't replacing Martin. The problem is that the

model doesn't work," he said.

Mr. Read is serving as chief operating officer alongside Andrew

Scott, previously WPP's corporate development director and chief

operating officer for Europe, until a new CEO is found.

WPP's board has tapped New York-based recruitment firm Russell

Reynolds to conduct a global search to replace Mr. Sorrell,

according to a person familiar with the matter.

The next CEO will need to review WPP's strategy at a time when

the company faces a quickly changing digital advertising landscape

and pressure from clients that are moving their marketing spend

away from traditional agencies.

On Omnicom Group Inc.'s earnings call Tuesday, Mr. Wren said

Kantar was "not a key focus for our acquisition dollars," adding:

"There will be any one of a number of other buyers, including

probably private equity."

Publicis Chief Executive Arthur Sadoun declined "to speculate on

the future of WPP" when he was asked on an earnings call Thursday

about the possibility of acquiring WPP assets.

Under Mr. Sorrell, WPP moved to align its different agencies,

cut costs and allow clients to work with advertising staff that

previously had been siloed. WPP executives often refer to this

approach as "horizontality."

"There's universal admiration for Martin's achievements, and

sadness about his departure," Mr. Read said. "At the same time,

there's a huge amount of support and goodwill for the company, and

no shortage of confidence about the future."

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

April 19, 2018 12:22 ET (16:22 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

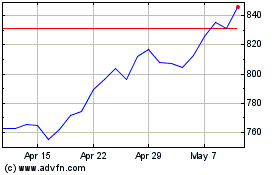

Wpp (LSE:WPP)

Historical Stock Chart

From Apr 2024 to May 2024

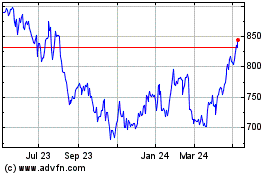

Wpp (LSE:WPP)

Historical Stock Chart

From May 2023 to May 2024