TIDMWSG

RNS Number : 8116E

Westminster Group PLC

01 November 2022

01 November 2022

Westminster Group Plc

('Westminster', the 'Group' or the 'Company')

Trading Update

Westminster Group Plc (AIM: WSG), a leading supplier of managed

services and technology-based security solutions worldwide,

provides a trading update for the year ending 31 December 2022 and

an update on business prospects.

2022 Trading Update

In our interim results announcement in August 2022, we stated we

expected the current year to be H2 weighted, which remains the

case, and that we remained optimistic we could meet 2022 market

expectations, whilst being mindful that the global situation and

growing economic crisis around the world may yet impact

forecasts.

The Board's current expectation is that 2022 revenue outturn

will be approximately a third below market expectations, which is

expected to deliver a loss before tax equivalent to approximately

half of that reported in 2021. This is predominantly because of the

slippage of the multimillion pound Technology project mentioned

below.

We have made important progress this year. Highlights in the

period include:

-- Our West African Airport operations have not only recovered

to pre-pandemic levels, but 2022 looks set to be the highest

revenue levels ever achieved since we started operation in 2012.

This is most encouraging and bodes well for the future,

particularly with a new terminal due to open in the next 12

months.

-- Active preparation for the opportunities we believe will

arise in UK from the forthcoming Protect Duty legislation, as we

outlined in our Interim Report in August. This has already led to

two important new contract wins, one for an iconic UK building and

another for a theatre and exhibition complex in Northern England.

We are already in discussions with and developing similar

opportunities around the country.

-- Delivered outstanding security services at Her Majesty the

Queen's funeral having been contracted to be on standby and having

rehearsed to provide specific equipment and services during recent

years.

We have previously advised that we anticipated the ratification

process for the contract covering 5 airports in the DRC, originally

announced in June 2021, would be concluded in Q4 2022 allowing for

the project to commence at last. Whilst this has been a slow

process, the Board believes this timing remains the case and recent

events and activity add to our confidence that progress is being

made. Should ratification occur pre the 2022 year end, we expect

revenue will start to be recognised in early 2023.

In our interim results announcement, we also stated we expected

to secure at least one more long-term, large-scale managed services

contract this year and we continue to believe that to be the case.

Whilst there is never certainty of timing or outcome of

negotiations for such projects, which are complex and can involve

various bodies, we have reached an advanced stage of negotiation

with at least one such project. However, if signed, there would be

little, if any, revenue recognised in the current year.

Further, a key part of achieving 2022 market expectations was

the timely award of a multi-million-pound Technology project for

the MENA region, which, whilst we still expect to be awarded the

contract this year, we are now running short on time to deliver and

recognise revenues in 2022, and accordingly, depending on when the

order arrives, some of this revenue is now likely to slip into

2023.

Future Prospects and Financial Position

Despite global economic and political pressures, we continue to

have healthy levels of enquiries, a large bank of opportunities and

over the course of the year have provided goods and services to

numerous countries around the world.

Westminster Arabia has recently been certified by the Saudi

Arabian High Commission for Industrial Security (HCIS) - this is

something we have been pursuing for some time and an important

achievement being a requirement for government regulated and/or

funded projects (such as Giga Projects, critical infrastructure,

transport etc.) and to supply products & services to government

affiliated companies.

There has been no change with our other West Africa port

project. We continue to wait for our client to finalise the land

allocation issues with the government but remain ready to start

once access is granted.

Our guarding business continues to perform to expectations and

has been winning new business whilst our training business is

performing ahead of expectations. However, given the global

situation, whilst we expect to maintain current activity levels in

these areas, but we are not expecting significant growth in

2023.

It is likely that the economic crisis in the UK and around the

world will impact business sentiment and spending. We are mindful

that this may affect decisions on some of the larger Technology

project opportunities which underpins the importance of building

our recurring revenue streams, in particular our pursuit of

long-term, large-scale managed services projects.

Regarding our Ghana port operations, whilst we remain on site

and continue to operate as normal, the relationship with our local

partners, Scanport, has become increasingly strained in recent

months. We are looking at potential mediation to resolve matters,

but we may look to terminate the arrangement early, in 2023, rather

than 2024 and receive accelerated receipt in recompense

accordingly. This would allow us to free up resources for the new

and larger managed services projects we expect to have in place by

2023 which will mitigate any impact on our 2023 expectations.

In response to cost inflation, we are taking measures to reduce

our energy consumption and have also commenced a cost cutting

programme across the business. Currency volatility is also

something we are monitoring carefully and where possible provide

natural hedging by selling goods in the same currency we are

purchasing them, but this is not always possible and so we are

looking at hedging where appropriate. One positive for our business

at present is that the majority of our international revenues, such

as our West African airport, are in USD and so showing healthy

gains.

The Company's executive continues to carefully monitor the cash

needs of the business on a regular basis and are of the opinion

that, with the abovementioned cost saving measures and prudent cash

management in the near term, and assuming no further new

large-scale projects are signed, there are sufficient cash

resources available to the group to undertake current operations at

least the end of 2023. In anticipation of new large-scale projects

that would require financing, we have held discussions with a

number of funding sources and have various non-dilutive options we

can pursue including potential support from UK Export Finance.

For further information please contact:

Westminster Group Plc Media enquiries via Walbrook

PR

Rt. Hon. Sir Tony Baldry - Chairman

Peter Fowler - Chief Executive Officer

Mark Hughes - Chief Financial Officer

Strand Hanson Limited (Financial & Nominated

Adviser)

James Harris 020 7409 3494

Ritchie Balmer

Richard Johnson

Arden Partners plc (Broker)

Ruari McGirr (Corporate)

Tim Dainton/Simon Johnson (Broking) 020 7614 5900

Walbrook (Investor Relations)

Tom Cooper 020 7933 8780

Paul Vann

Nick Rome Westminster@walbrookpr.com

Notes:

Westminster Group plc is a specialist security and services

group operating worldwide via an extensive international network of

agents and offices in over 50 countries.

Westminster's principal activity is the design, supply and

ongoing support of advanced technology security solutions,

encompassing a wide range of surveillance, detection, tracking and

interception technologies and the provision of long-term managed

services contracts such as the management and running of complete

security services and solutions in airports, ports and other such

facilities together with the provision of manpower, consultancy and

training services. The majority of its customer base, by value,

comprises governments and government agencies, non-governmental

organisations (NGO's) and blue-chip commercial organisations.

The Westminster Group Foundation is part of the Group's

Corporate Social Responsibility activities.

www.wg-foundation.org

The Foundation's goal is to support the communities in which the

Group operates by working with local partners and other established

charities to provide goods or services for the relief of poverty

and the advancement of education and healthcare particularly in the

developing world.

The Westminster Group Foundation is a Charitable Incorporated

Organisation, CIO, registered with the Charities Commission number

1158653.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR") WHICH

IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUAAWRUKUROAA

(END) Dow Jones Newswires

November 01, 2022 03:00 ET (07:00 GMT)

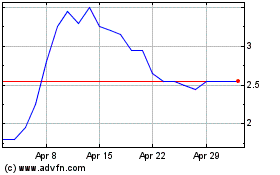

Westminster (LSE:WSG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Westminster (LSE:WSG)

Historical Stock Chart

From Dec 2023 to Dec 2024