By Angus Loten

Cisco Systems Inc. is turning to smart software in a bid to ward

off a number of fast-growing rivals challenging its lead in the

enterprise-collaboration market, which helps employees within an

organization communicate with chat, videoconferencing and other

tools.

Amy Chang, senior vice president of Cisco's collaboration

technology group, said a new generation of digital capabilities is

transforming enterprise collaboration, citing the impact of cloud

computing and machine learning, among other emerging tools.

That is forcing the more than 30-year-old tech company to think

like "a giant startup," Ms. Chang said: "We have to behave that way

or we will not be in the market a decade from now," she told CIO

Journal.

A former global head of product at Google Analytics, Ms. Chang

was tapped to lead Cisco's collaboration business last May, when it

acquired her relationship-intelligence venture, Accompany, for $270

million.

At Accompany, Ms. Chang and a small team of former Google

engineers and developers built algorithms with machine-learning

capabilities to automate the process of creating information-rich

personal profiles by scouring countless public online sources.

She is now putting those capabilities to work at Cisco, in a bid

to upgrade its enterprise collaboration tool, known as Webex. That

includes an initiative in the past year to couple

facial-recognition technology with auto-generated personal

profiles, enabling users to identify meeting participants -- from

present job titles, to past work experience, expertise or off-duty

hobbies, like golfing, bowling or line dancing.

"I think of this as an enterprise LinkedIn," she said, "It lets

me know who I am talking to and what is their expertise."

Webex currently boasts 130 million meeting attendees every

month, and more than 360 million meetings hosted each year,

including 95% of Fortune 500 firms, the company said.

The global market for enterprise collaboration is estimated to

have grown 11.8% last year to $2.4 billion, and is on pace to reach

$3.2 billion by 2021, according to International Data Corp.

Wayne Kurtzman, an IDC research director for social and

collaboration, said market growth is now being fueled by office

workers and other professionals expecting the same capabilities in

the workplace that they get on social media when sharing photos,

buying products or videoconferencing with friends and family on

personal mobile devices.

The focus on boosting Webex with new artificial

intelligence-powered services is part of a broader strategy at

Cisco to build revenue on recurring software sales, and move away

from one-time hardware sales.

There are signs the strategy is working. Cisco in February

reported a fiscal second-quarter profit of $2.82 billion, with

revenue rising 4.7% to $12.45 billion. While revenue from its core

business of selling switches, routers and other networking

equipment to companies rose 6% to $7.13 billion, its applications

business, which includes videoconferencing and other products, grew

24% to $1.47 billion.

Chuck Robbins, the company's chairman and chief executive, said

the gains were the result of a strategy to "aggressively

transitioning to a software model and accelerating our pace of

innovation."

Some analysts are less convinced, calling Cisco's software push

a case of too little, too late: "One of Cisco's challenges is that

Slack and Microsoft (with Teams) are redefining enterprise

messaging faster than Cisco has been able to respond with Webex,"

said Larry Cannell, research director at Gartner Inc. for technical

professionals, collaboration and content strategies service.

Teams, Microsoft Corp.'s two-year-old collaboration tool, has

benefited from the tech giant's strength in both the cloud and

desktop software markets, according to tech industry analysts.

Microsoft last month said more than 500,000 organizations are

using the tool for workplace chat, messaging and meetings,

including 91 Fortune 100 companies. It recently rolled out added

features, including customized backgrounds for videoconferencing,

live captions for meetings and a broadcast feature for up to 10,000

viewers.

Cisco's other fast-growing rivals in the collaboration market

include Slack Technologies Inc., which launched in 2013. In the

past year, Slack has grown 50% to 10 million daily active users,

including 65 Fortune 100 firms and 85,000 paying customers,

offering meetings and messaging tools, while position itself as a

central hub with a directory of more than 1,500 apps, the company

says.

Facebook Inc.'s Workplace, another competitor that entered the

collaboration market in late 2016, currently has some two million

paid users, including more than 150 companies with over 10,000

users each, the company said.

As for adding facial recognition to Cisco's Webex, Gartner's Mr.

Cannell sees limited value.

"Using facial recognition is a video-centric approach that

hardly applies to collaborative scenarios where participants

already know each other," Mr. Cannell said. "So, no, I don't think

facial recognition will necessarily help Cisco compete with Slack

and Microsoft Teams."

Ms. Chang said Webex may not have impressive growth rates, but

only because its total number of users is so large. As a result,

she said, adding a few million new users appears only as a small

percentage growth.

"Last year we grew an entire Slack in 10 months," Ms. Chang

said.

Write to Angus Loten at angus.loten@wsj.com

(END) Dow Jones Newswires

April 15, 2019 20:03 ET (00:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

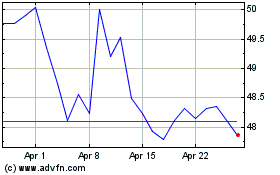

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024