By Kristin Broughton

Investors have become choosier about their portfolios,

increasingly flocking to companies that align with their values

related to the environment or social issues.

But that raises a difficult question: How can investors identify

those companies?

Fortunately, they have more tools than ever to judge companies

based on their values. Unfortunately, there are so many tools that

they may be obscuring, instead of illuminating, the path to

righteous investing.

ESG ratings firms, such as MSCI Inc. and Sustainalytics, have

long scored companies on emissions, labor policies and other

nonfinancial factors. Equity analysts and, in recent months,

credit-rating firms have also ramped up efforts to flag potentially

material environmental, social and governance risks for investors

-- aspects of products or operations that could leave companies

open to regulatory fines or damage to their reputations.

The flurry of firms attempting to grade companies on ESG

factors, and the dizzying array of techniques and methodologies

used to arrive at those scores, has led to mixed signals in the

marketplace.

"Imagine if the major ratings agencies for a corporate bond

disagreed, and one said a bond was investment grade and another

said it was high yield," says Will Kinlaw, head of State Street

Associates, the research and advisory unit of State Street Corp.

"That's where we are with ESG today. It is very hard to

navigate."

A multitude of recipes

ESG-scoring firms often rely heavily on information that

companies voluntarily disclose in annual sustainability reports,

which can be inconsistent across sectors or even within a single

company year to year. Scoring firms try to find uniformity across

industries by supplementing company reports with information

gleaned from analysts' own surveys, interviews or online sources.

From there analysts apply varying weight to factors they think are

most relevant to a given industry. Each firm has its own formula,

its own process.

The result: a lot of different results.

There are at least 200 providers of ESG ratings, ranging from

large data providers to smaller nonprofits that focus on niche

topics, such as gender pay equity, according to experts who track

ESG data.

The biggest players in the market have gained influence through

consolidation. MSCI has scooped up smaller competitors over the

past decade, including RiskMetrics and GMI Ratings. In April,

Moody's Corp. acquired a majority stake in French ESG data company

Vigeo Eiris.

S&P Global Inc., meanwhile, launched an ESG evaluation tool

in April, and State Street announced a partnership with Harvard

Business School professor George Serafeim to help clients measure

and integrate ESG performance metrics into their portfolios.

Company efforts

The increasing focus on ESG ratings, and investors' interest in

sustainable finance, also has caused companies themselves to become

more rigorous in how they track and report progress on ESG metrics.

But here, too, the wide diversity of methods for measuring ESG

performance has in some cases led to confusion -- a disconnect

between the way companies view their own behavior and the scores

they are given by others.

Take L'Oréal SA, which has invested in its corporate-ethics

division since the appointment of its first chief ethics officer in

2007. The Paris-based cosmetics company tracks its ESG scores from

several major providers, and often agrees when analysts say the

company comes up short at times, says Emmanuel Lulin, the company's

chief ethics officer.

But, Mr. Lulin says, the assessments overlook important elements

of a company's workplace environment that can be difficult to

ascertain from the outside, such as whether employees are

encouraged to speak up about harassment or other potential

misbehavior.

"It's really a work in progress. I think there is not enough

focus on the culture," he says, discussing the ESG-scoring

business. "It's more difficult to do, because it means more

investment in getting to know the company and getting to know the

people."

Investors have looked to regulators and standard-setters to

address inconsistencies in how companies disclose ESG data. A

requirement that large companies in the European Union disclose

information on social and environmental issues took effect with

their 2018 annual reports. And academics and investors last year

asked the U.S. Securities and Exchange Commission to develop a

framework for ESG disclosures.

Industry groups such as the Sustainability Accounting Standards

Board, meanwhile, have established accounting methods for companies

to follow in crafting their sustainability reports.

"There are so many players working on so many different levers

to try to get some sort of mandatory disclosure in this space,"

says Louis Coppola, co-founder and executive vice president of the

Governance and Accountability Institute, a sustainability

consulting firm. "It is something that is needed if we want real

standardized information across the board from every company, and

not just cherry-picking."

Making it work

In the end, though, despite the discord in measuring ESG

factors, reports on companies' ESG performance still provide useful

information, which is why experts recommend looking at multiple

ratings for a given company and understanding the underlying

methodologies. Following a ratings firm's analysis of a single

company over time also can provide useful insight.

Consider MSCI's ESG rating of Equifax Inc. MSCI lowered

Equifax's rating in August 2016, citing a data breach at the

company that resulted in the exposure of the personal data of

employees at Kroger Co., the supermarket chain. The following year,

in September 2017, Equifax disclosed that the personal information

of as many as 143 million consumers had been exposed.

"We can't forecast the events themselves, but there are usually

a series of indicators," says Remy Briand, MSCI's head of ESG.

Equifax declined to comment for this article.

Vladimir Demine is a portfolio manager for the international

equity team at Morgan Stanley Investment Management and head of ESG

research for the team. He views ESG scores as the first step in a

broader analysis of the nonfinancial risks that could have a big

impact on a company's bottom line. "You look at various sources of

data," he says, "and then you try to solve the puzzle."

Ms. Broughton is a Wall Street Journal reporter in New York. She

can be reached at kristin.broughton@wsj.com.

(END) Dow Jones Newswires

June 24, 2019 08:47 ET (12:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

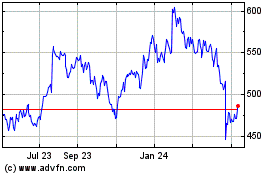

MSCI (NYSE:MSCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

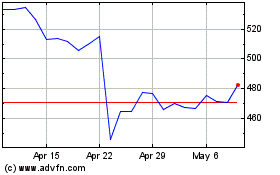

MSCI (NYSE:MSCI)

Historical Stock Chart

From Apr 2023 to Apr 2024