Prospectus Filed Pursuant to Rule 424(b)(2) (424b2)

12 September 2019 - 6:50AM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(2)

Registration No. 333-223355

PRICING SUPPLEMENT NO. 4, DATED SEPTEMBER 10, 2019

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Offered

|

|

Maximum

Aggregate Offering

Price (1)

|

|

Amount of

Registration Fee (2)

|

|

3.700% Medium-Term Notes, Series E

Due March 13,

2051

|

|

$1,489,770,000

|

|

$180,560

|

|

|

|

|

|

(1)

|

Excludes accrued interest, if any.

|

|

(2)

|

Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. This “Calculation

of Registration Fee” table shall be deemed to update the “Calculation of Registration Fee” table in Prudential Financial, Inc.’s Registration Statement on Form S-3 (No. 333-223355).

|

Pricing Supplement No. 4, dated September 10, 2019,

to the Prospectus, dated March 1, 2018, and

the Prospectus

Supplement, dated March 1, 2018.

$1,500,000,000

PRUDENTIAL FINANCIAL, INC.

3.700% MEDIUM-TERM NOTES, SERIES E

DUE MARCH 13, 2051

|

|

|

|

|

|

|

UNDERWRITER AND PRINCIPAL AMOUNT:

|

|

|

|

|

|

Goldman Sachs & Co. LLC

|

|

$

|

212,500,000

|

|

|

Barclays Capital Inc.

|

|

$

|

212,500,000

|

|

|

Citigroup Global Markets Inc.

|

|

$

|

212,500,000

|

|

|

Credit Suisse Securities (USA) LLC

|

|

$

|

212,500,000

|

|

|

Mizuho Securities USA LLC

|

|

$

|

212,500,000

|

|

|

Wells Fargo Securities, LLC

|

|

$

|

212,500,000

|

|

|

Natixis Securities Americas LLC

|

|

$

|

37,500,000

|

|

|

Scotia Capital (USA) Inc.

|

|

$

|

37,500,000

|

|

|

SG Americas Securities, LLC

|

|

$

|

37,500,000

|

|

|

The Williams Capital Group, L.P.

|

|

$

|

37,500,000

|

|

|

Academy Securities, Inc.

|

|

$

|

15,000,000

|

|

|

CastleOak Securities, L.P.

|

|

$

|

15,000,000

|

|

|

Drexel Hamilton, LLC

|

|

$

|

15,000,000

|

|

|

R. Seelaus & Co., LLC

|

|

$

|

15,000,000

|

|

|

Samuel A. Ramirez & Company, Inc.

|

|

$

|

15,000,000

|

|

|

TOTAL

|

|

$

|

1,500,000,000

|

|

The note being purchased has the following terms:

STATED MATURITY: March 13, 2051

SPECIFIED CURRENCY: U.S.

dollars

principal: U.S. dollars

interest: U.S. dollars

exchange rate agent: Not applicable

2

TRADE DATE: September 10, 2019

ORIGINAL ISSUE DATE: September 13, 2019

ORIGINAL ISSUE

PRICE: 99.318%

UNDERWRITERS COMMISSION: 0.875%

NET

PROCEEDS TO PRUDENTIAL FINANCIAL, INC. (before expenses): 98.443% or $1,476,645,000

AMORTIZING NOTE: Not applicable

ORIGINAL ISSUE DISCOUNT NOTE: Not applicable

EXTENDIBLE NOTE:

Not applicable

FORM OF NOTE:

master global

form only: Yes

non-global form available:

CUSIP/ISIN: 74432QCF0/US74432QCF00

REDEMPTION AND REPAYMENT

Prior to September 13, 2050, redeemable at a redemption price equal to the greater of (a) 100% of the principal amount of the notes and (b) the discounted value at CMT rate plus 25 basis points as described in the Prospectus Supplement dated

March 1, 2018, plus accrued and unpaid interest to but excluding the redemption date. On or after September 13, 2050, redeemable at a redemption price equal to 100% of the principal amount of the notes, plus accrued and unpaid interest to

the redemption date.

INTEREST RATE IS FIXED: Yes

INTEREST

RATE IS FLOATING: No

Base Rate:

Base Rate Source:

Initial

Interest Rate:

Spread, if any:

Spread Multiplier, if any:

Interest Determination Dates:

Interest Reset Dates:

Interest

Payment Dates:

Record Dates:

Index Maturity:

Maximum Interest

Rate, if any:

Minimum Interest Rate, if any:

INTEREST PAYMENT DATES: Semi-annually on the 13th day of each March and September, starting March 13, 2020.

DAY COUNT FRACTION: The amount of interest payable for any interest period will be computed on the basis of a 360-day

year of twelve 30-day months.

3

REPORTS AND EVENTS OF DEFAULT:

The indenture, to the extent relating to the notes offered hereunder, certain notes previously issued under the indenture and all future series

of securities under the indenture, provides that any documents or reports that Prudential Financial, Inc. may be required to file with the Securities and Exchange Commission, or SEC, pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934, as amended, will be filed with the trustee within 15 days after Prudential Financial, Inc. has filed those documents or reports with the SEC. Under the Trust Indenture Act of 1939, as amended, Prudential Financial, Inc. may have a

separate obligation to file with the trustee documents or reports it is required to file with the SEC. Prudential Financial, Inc.’s failure to comply with either filing obligation is not an event that will result in an event of default under

the indenture. Accordingly, acceleration of Prudential Financial, Inc.’s obligations under the notes offered hereunder will not be a remedy for its failure to file those documents or reports with the trustee, and you may have no remedy for the

failure other than an action in damages. For certain other outstanding series of notes of Prudential Financial, Inc., acceleration is a remedy, upon appropriate notice and passage of time, for the holders of those securities for Prudential

Financial, Inc.’s failure to file documents or reports with the trustee.

DEFEASANCE APPLIES AS FOLLOWS:

full defeasance—i.e., our right to be relieved of all our obligations on the note by placing funds in trust for the investor: Yes

covenant defeasance—i.e., our right to be relieved of specified provisions of the note by placing funds in trust for the

investor: Yes

Certain Federal Income Tax Considerations

Book/Tax Conformity

United States persons that use an accrual method of accounting for tax purposes (“accrual method holders”) generally are required to

include certain amounts in income no later than the time such amounts are reflected on certain financial statements (the “book/tax conformity rule”). The application of the book/tax conformity rule thus may require the accrual of income

earlier than would be the case under the general tax rules described below. It is not entirely clear to what types of income the book/tax conformity rule applies, or, in some cases, how the rule is to be applied if it is applicable. However,

recently released proposed regulations generally would exclude, among other items, original issue discount and market discount (in either case, whether or not de minimis) from the applicability of the book/tax conformity rule. Although the

proposed regulations generally will not be effective until taxable years beginning after the date on which they are issued in final form, taxpayers generally are permitted to elect to rely on their provisions currently. Accrual method holders should

consult with their tax advisors regarding the potential applicability of the book/tax conformity rule to their particular situation.

FATCA Withholding

On

December 13, 2018, the Internal Revenue Service proposed regulations, upon which taxpayers can rely, that eliminate FATCA withholding (as defined in the Prospectus Supplement, dated March 1, 2018) on gross proceeds. For a discussion of

FATCA withholding, see “Certain Federal Income Tax Considerations—FATCA Withholding” in the Prospectus Supplement, dated March 1, 2018.

4

Supplemental Plan of Distribution

Prudential Financial, Inc. estimates that the total offering expenses, excluding the underwriting discount and commission paid to the

underwriters, will be approximately $300,000.

Singapore Securities and Futures Act Product Classifications—Solely for the

purposes of its obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”), we have determined, and hereby notify all persons, that the notes are “prescribed

capital markets products” (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018 of Singapore) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice

on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

The selling restrictions for the following jurisdictions are amended in their entirety as follows:

European Economic Area

The notes

are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”). For these purposes, a retail investor means a

person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning of Directive 2016/97/EU (the

“Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129

(the “Prospectus Regulation”). Consequently no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail

investors in the EEA has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. This pricing supplement and the accompanying

prospectus and prospectus supplement have been prepared on the basis that any offer of notes in any Member State of the EEA will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers

of notes. This pricing supplement and the accompanying prospectus and prospectus supplement are not a prospectus for the purposes of the Prospectus Regulation.

United Kingdom

In the United

Kingdom, this pricing supplement and the accompanying prospectus and prospectus supplement are being distributed only to, and is directed only at, persons who are “qualified investors” (as defined in the Prospectus Regulation) who are

(i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), or (ii) high net worth entities falling within Article 49(2)(a) to

(d) of the Order, or (iii) persons to whom it may lawfully be communicated, all such persons together being referred to as “Relevant Persons”. The notes are only available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire such notes will be engaged in only with, Relevant Persons. This pricing supplement and the accompanying prospectus and prospectus supplement and their contents are confidential and should not be distributed, published

or reproduced (in whole or in part) or disclosed by any recipients to any other person in the United Kingdom. Any person in the United Kingdom that is not a Relevant Person should not act or rely on this pricing supplement and the accompanying

prospectus and prospectus supplement, or their contents. The notes are not being offered to the public in the United Kingdom. In addition, in the United Kingdom, the notes may not be offered other than by an agent that:

5

|

|

(a)

|

has only communicated or caused to be communicated and will only communicate or cause to be communicated an

invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) received by it in connection with the issue or sale of the notes in circumstances

in which Section 21(1) of the FSMA would not apply to the issuer; and

|

|

|

(b)

|

has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in

relation to the notes in, from or otherwise involving the United Kingdom.

|

Use of Proceeds

We intend to use the net proceeds from the sale of the notes to pay a portion of the consideration for our previously announced acquisition of

Assurance IQ, Inc. and for general corporate purposes, which may include refinancing portions of our medium-term notes maturing through 2020.

|

|

|

|

|

|

|

|

|

|

|

|

Goldman

Sachs & Co.

LLC

|

|

Barclays

|

|

Citigroup

|

|

Credit Suisse

|

|

Mizuho Securities

|

|

Wells Fargo

Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natixis

|

|

Scotiabank

|

|

SOCIETE

GENERALE

|

|

The Williams Capital

Group, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Academy

Securities

|

|

CastleOak

Securities, L.P.

|

|

Drexel Hamilton

|

|

R. Seelaus & Co.,

LLC

|

|

Ramirez & Co.,

Inc.

|

6

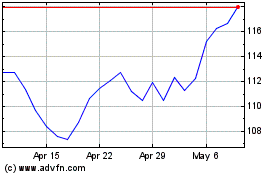

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

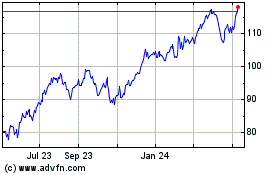

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024