U.S. Dollar Lower Amid Drop In U.S. Treasury Yields

17 May 2021 - 6:53PM

RTTF2

The U.S. dollar weakened against its most major counterparts in

the European session on Monday, as U.S. treasury yields fell before

the release of minutes from the U.S. Federal Reserve's latest

meeting that may shed more cues on the central bank's monetary

policy.

The benchmark yield on 10-year note dropped 1.63 percent. Yields

move inversely to bond prices.

The minutes, due on Wednesday, will be scrutinized for more

details on policymakers' view on price pressures and any hints on

when it might consider tapering of QE program.

Fed officials downplayed inflation fears last week, emphasizing

that the central bank is in no rush to scale back its easy

policy.

Today's U.S. economic calendar includes New York Fed's empire

manufacturing survey and U.S. NAHB housing market index for May,

due at 8:30 am ET and 10 am ET, respectively.

Mixed Chinese data and a resurgence of COVID-19 cases in much of

Asia lifted the safe-haven currency in the previous session.

The greenback hit 6-day lows of 1.2169 against the euro and

0.9002 against the franc, off its early highs of 1.2126 and 0.9029,

respectively. Next key support for the greenback is seen around

1.24 against the euro and 0.88 against the franc.

The greenback slipped to a 5-day low of 109.07 against the yen

from its last week's close of 109.34. If the greenback slides

further, 106.00 is possibly seen as its next support level.

Data from the Bank of Japan showed that Japan producer prices

rose 0.7 percent on month in April.

That exceeded expectations for a gain of 0.5 percent and up from

the downwardly revised 0.6 percent increase in March (originally

0.8 percent).

In contrast, the greenback appreciated to 0.7731 against the

aussie and 0.7182 against the kiwi, from Friday's closing values of

0.7780 and 0.7246, respectively. The greenback is likely to face

resistance around 0.75 against the aussie and 0.70 against the

kiwi.

The greenback recovered to 1.2131 against the loonie, from an

Asian session's low of 1.2104. On the upside, 1.25 is likely seen

as the next resistance level for the greenback.

The greenback reversed from an early 5-day low of 1.4119 against

the pound, with the pair trading at 1.4092. The greenback is seen

finding resistance around the 1.37 level.

U.S. NAHB housing market index for May will be published in the

New York session.

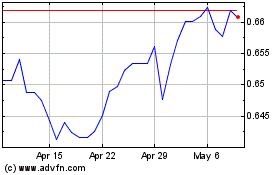

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024