SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment

No. __)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to § 240.14a-12 |

BARNWELL INDUSTRIES, INC.

(Name of Registrant as Specified in Its Charter)

Ned L. Sherwood

MRMP-Managers LLC

Ned L. Sherwood Revocable Trust

151 Terrapin Point

Vero Beach, Florida 32963

(772) 257-6658

(Name of Person(s) Filing Proxy Solicitation, if

other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table below per Exchange Act Rule 14a-6(i)(4)

and 0-11. |

On January 21, 2025, Ned L. Sherwood and his affiliates issued a statement

regarding Barnwell Industries, Inc., a copy of which is filed herewith as Exhibit 1.

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY

STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES, BY NED L. SHERWOOD AND HIS AFFILIATES, FROM THE STOCKHOLDERS OF

BARNWELL INDUSTRIES, INC. (“BRN”) FOR USE AT ITS 2025 ANNUAL MEETING OF STOCKHOLDERS WHEN SUCH DOCUMENTS BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED,

A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF BRN AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE

SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY

SOLICITATION IS CONTAINED IN THE SCHEDULE 13D, ORIGINALLY FILED ON JUNE 11, 2013, AS AMENDED, INCLUDING BY THE AMENDMENT THERETO FILED

ON JANUARY 21, 2025.

Exhibit 1

MRMP-Managers LLC

151 Terrapin Point

Vero Beach, Florida 32963

(772) 448-3877

January 21, 2025

Dear Barnwell Industries, Inc. Shareholders:

On May 14th, 2012, more than 12 ½ years ago, I purchased my

first shares in Barnwell Industries, Inc. (BRN) at $2.95 per share, when BRN had an approximate total market cap of $24 million. This

purchase gave me the dubious privilege of becoming what I believe to be a long suffering “non-Kinzler family” BRN shareholder.

In 2012, BRN held valuable land on the Big Island in Hawaii and attractive oil and gas assets in Canada. I hoped that profits and cash

flow from these assets would lead to significant share price appreciation. The following table excerpts certain key statistics from BRN’s

financial history since my initial purchase in 2012.

| Date1 | |

BRN

Share

Price2 | |

Mort

Kinzler Annual

Total Compensation

($000)3 | |

Alex

Kinzler Annual Total

Compensation ($000)3 | |

Ken

Grossman Annual Total

Compensation

($000)3 |

| 1/17/25 | |

$1.65 | |

- | |

NA | |

NA |

| 1/23/24 | |

$2.48 | |

- | |

$300(NR)4 | |

$100(NR)4 |

| 1/23/23 | |

$2.74 | |

- | |

$328 | |

$183 |

| 1/27/22 | |

$2.58 | |

- | |

$409 | |

$80 |

| 1/27/21 | |

$1.83 | |

- | |

$489 | |

$229 |

| 1/27/20 | |

$1.12 | |

- | |

$239 | |

$245 |

| 1/25/19 | |

$1.43 | |

- | |

$358 | |

|

| 1/26/18 | |

$2.45 | |

-6 | |

$481 | |

|

| 1/27/17 | |

$1.67 | |

$147 | |

$481 | |

|

| 1/27/16 | |

$1.58 | |

$252 | |

$363 | |

|

| 1/27/15 | |

$2.86 | |

$617 | |

$563 | |

|

| 1/27/14 | |

$2.92 | |

$890 | |

$728 | |

|

| 1/25/13 | |

$3.31 | |

$806 | |

$603 | |

|

| 5/14/128 | |

$2.92 | |

$829 | |

$930 | |

|

| | |

| |

| |

| |

|

| TOTALS | |

| |

$3,408 | |

$6,272 | |

$616 |

Total to Kinzlers & Grossman (Non-Kinzler

Family Ally): $10,296,000

Footnotes to Table:

| 1. | Other than indicated, the dates noted in the table reflect approximate

anniversaries of when I had previously entered into cooperation and support agreements with BRN (January 27, 2021 and January 23, 2023). |

| 2. | The share price is the closing price on the date noted as reported

by Yahoo! Finance. |

| 3. | The annual compensation is the reported total compensation amount

reported in the BRN proxy statements for the year reflected by the date. For example, the amount of total annual compensation for the

line item beginning with 1/23/23 reflects the amount of 2023 total annual compensation received by the individuals noted in the chart. |

| 4. | Since BRN has not yet filed their proxy statement disclosing

the amount of total annual compensation earned by Mr. Alex Kinzler and Mr. Grossman in 2024, the amounts noted are not reported (NR)

and are estimated based on compensation earned in the prior year of 2023. |

| 5. | 2020 was a partial year for Mr. Grossman. |

| 6. | Mr. Mort Kinzler passed away in 2018. |

| 7. | 2017 was a partial year for Mr. Mort Kinzler. |

| 8. | This date reflects the date that I first purchased BRN shares. |

As of Friday, January 17,

2025, BRN’s share price was $1.65, giving the Company an approximate total market cap of $16 million (i.e., $8 million less than

12 ½ years ago). As outlined in the table, BRN’s share price has actually declined by approximately 44% since my initial purchase

12 ½ years ago – notwithstanding BRN’s realization of significant cash flow from its Hawaiian land assets and oil and

gas properties. As a “non-Kinzler family” shareholder, we have seen the value of our investments in BRN decline sharply. However,

if you were Mort Kinzler until his death at age 92 or Alex Kinzler, his son, your results were remarkably different - reaping an aggregate

of approximately $9.68 million in total compensation since 2012. Although Mort and Alex owned approximately 25 - 30% of BRN shares, they

managed to garner 100% of the company’s profits for their benefit by paying themselves annual compensation which we believe was excessive.

In Mort’s case these salaries continued in retirement until his death (although in his final years he resided in Palm Beach FL and

seldom if ever ventured to Hawaii). Alex followed in his father’s footsteps and continued to channel most of BRN’s cash flow into his

pocket. I believe the cash flows to Alex have only moderated recently due to my activist efforts over the past few years.

Although my activist efforts

during the past five years have moderated Alex Kinzler’s largess from BRN, he has not welcomed my efforts. During the past five

years BRN has spent $2.0 million in shareholder expenses and more than $4.0 million in legal fees (to firms including Skadden Arps and

other top tier lawyers) in order to craft poison pills and counter my proxy efforts on behalf of the “non-Kinzler family”

shareholders. Additionally, Alex Kinzler’s “attack dog” Director, Ken Grossman, has reaped $616,000 in aggregate compensation.

Ken’s brother, Richard Grossman happens to work at Skadden Arps and has benefited via legal fees – adding the Grossman family

to the Kinzler family as recipients of BRN’s cash flow. I believe Alex and Ken are not happy that I want to redirect future BRN

cash flows to the “non-Kinzler/Grossman” shareholders who like me want to build BRN’s businesses to better enable us

to experience share price appreciation in the future.

Alex’s unhappiness with my

actions on behalf of BRN shareholders has been effective in slowing my efforts during the past several years. My fear of Alex and Ken

causing the company to spend millions on lawyers and defense experts that would severely drain BRN of its cash led me to attempt to staunch

the outflows by entering into a Shareholder Support and Cooperation Agreement on January 27, 2021, followed by an additional two-year

extension entered on January 21, 2023. These agreements have moderated BRN’s use of funds, which we believe was unwise and for wasteful

corporate spending, but in my opinion (and I believe obviously in the market’s opinion as evidenced by the share price depreciation)

are moving much too slowly in my view. Although Directors Doug Woodrum and Laurance Narbut are aligned with me on my efforts to cut excessive

expenses and grow BRN’s cash flow, the three other Directors have stymied our efforts. Kinzler and Grossman obviously are only focused

on excessive remuneration to themselves and Josh Horowitz apparently is loyal to Ken because Josh’s investment fund has benefited

from some of Ken’s other investment ideas and ventures.

Therefore, I do not plan to

extend the Cooperation and Support Agreement, but instead will propose a slate of five directors at the 2025 annual meeting that I believe

will finally work solely on behalf of all BRN shareholders to build value.

By having a group of all five

Directors focused on building value for all BRN shareholders, we hope that for the first time in decades, the “non-Kinzler/Grossman”

shareholders will accrue their fair share of BRN’s cash flow and earnings. If we don’t act decisively now and remove the company from

Kinzler’s control, we believe BRN will just languish with very little positive changes. After all why would Kinzler and Grossman

and their associates want to upset the “gravy train” that provides them with renumeration while the “non-Kinzler”

shareholders receive little or nothing? As the 30% owner of BRN shares I have asked myself why would any shareholder want to retain a

management team that delivered the 12-year track record shown in the above chart? Furthermore, as a BRN shareholder, I wonder how BRN

directors could vote to spend legal and shareholder funds to fight to defend a management with this woeful record?

If I am successful in installing

my slate of directors for 2025 and beyond, I assure all “non-Kinzler/Grossman” shareholders that you will be treated fairly

in the future. Our team has concrete plans to improve and grow BRN which we will reveal in the near future. However, for now our first

key task will be to terminate Alex Kinzler, Ken Grossman and their associates from their lucrative lifetime employment or directorships

at BRN. If you are a shareholder that supports our efforts, please e-mail us at dumpkinzler@gmail.com listing the number of shares you

hold. If we happen to receive support of 20% of the shares of “non-Kinzler” shareholders, in addition to my 30% holding, maybe

we can dissuade BRN’s directors from wasting shareholder money in order to defend this horrible management group via a costly proxy

contest.

As a long suffering “non-Kinzler/Grossman”

shareholder (with 30% ownership), I’m mad as hell and don’t plan to take it anymore! Email dumpkinzler@gmail.com to show Kinzler,

Grossman and Horowitz that the silent majority has awakened. I look forward to hearing from like-minded shareholders.

| Sincerely, |

|

| |

|

| /s/ Ned L. Sherwood |

|

| Ned L. Sherwood |

|

Additional Information and Where to Find It;

Notice to Investors

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY

STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES, BY NED L. SHERWOOD AND HIS AFFILIATES, FROM THE STOCKHOLDERS OF

BARNWELL INDUSTRIES, INC. (“BRN”) FOR USE AT ITS 2025 ANNUAL MEETING OF STOCKHOLDERS WHEN SUCH DOCUMENTS BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED,

A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF BRN AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE

SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY

SOLICITATION IS CONTAINED IN THE SCHEDULE 13D, ORIGINALLY FILED ON JUNE 11, 2013, AS AMENDED, INCLUDING BY THE AMENDMENT THERETO FILED

ON JANUARY 21, 2025.

Other Important Disclosure Information

SPECIAL NOTE REGARDING THIS COMMUNICATION:

THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES

ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES.

THIS COMMUNICATION CONTAINS OUR CURRENT VIEWS

ON CERTAIN ACTIONS THAT BRN’S BOARD MAY TAKE, INCLUDING ACTIONS IT MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE

BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN BE NO ASSURANCE THAT

THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT.

THE PERFORMANCE, RESULTS AND OTHER EFFECTS ON BRN MAY DIFFER MATERIALLY FROM OUR ASSUMPTIONS AND ANALYSIS.

WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION

FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS COMMUNICATION. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT

OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY

TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR

OTHER ACTIONS REGARDING BRN WITHOUT UPDATING THIS COMMUNICATION OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE

REQUIRED BY LAW).

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this communication

are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans

or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown

risks and uncertainties. Forward-looking statements are not guarantees of future performance, events or activities and are subject to

many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially

from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the

future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,”

“plan,” “estimate,” “should,” “may,” “will,” “objective,” “projection,”

“forecast,” “management believes,” “continue,” “strategy,” “position” or the

negative of those terms or other variations of them or by comparable terminology.

Important factors that could cause actual results

to differ materially from the expectations set forth in this communication include, among other things, the factors identified in BRN’s

public filings. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation,

and expressly disclaim any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

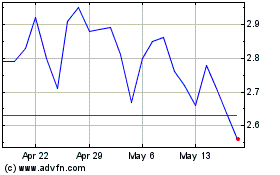

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Dec 2024 to Jan 2025

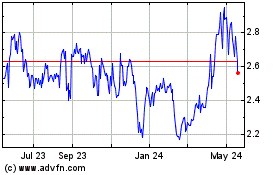

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Jan 2024 to Jan 2025