false000150237700015023772024-07-102024-07-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 10, 2024 |

Contango Ore, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35770 |

27-3431051 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

516 2nd Avenue Suite 401 |

|

Fairbanks, Alaska |

|

99701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (907) 888-4273 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

CTGO |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On July 10, 2024, Contango ORE, Inc. (“Contango” or the “Company”) completed its acquisition of HighGold Mining Inc., a corporation existing under the laws of the Province of British Columbia (“HighGold”), pursuant to the previously announced Arrangement Agreement and the Plan of Arrangement attached thereto (the “Arrangement Agreement”), dated May 1, 2024, by and among the Company, Contango Mining Canada Inc., a corporation organized under the laws of British Columbia and a wholly owned subsidiary of the Company, and HighGold (the “HighGold Acquisition”). The HighGold Acquisition, which was approved by HighGold shareholders at HighGold’s special meeting held on June 27, 2024, was subsequently approved by the Supreme Court of British Columbia on July 2, 2024.

As contemplated by the Arrangement Agreement, each HighGold share of common stock was exchanged for 0.019 shares of Contango common stock (the “Exchange Ratio”). HighGold options were also exchanged, directly or indirectly, for Contango shares, based on the fair market value of the HighGold options prior to the closing date. Upon completion of the HighGold Acquisition, existing Contango shareholders own approximately 85.9% and HighGold shareholders own approximately 14.1% of the combined company.

The foregoing summary description of the completion of the HighGold Acquisition does not purport to be complete and is qualified in its entirety by reference to the terms of the Arrangement Agreement, which was attached as Exhibit 10.1 to Contango’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 6, 2024 and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth under Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

Upon consummation of the transactions contemplated by the Arrangement Agreement, the Company issued an aggregate of 1,698,887 shares of Contango common stock to HighGold shareholders in reliance upon an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 3(a)(10) of the Securities Act. Such exemption was based on the final order of the Supreme Court of British Columbia issued on July 2, 2024, approving the HighGold Acquisition following a hearing by the court which considered, among other things, the fairness of the HighGold Acquisition to the persons affected.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors

In connection with the HighGold Acquisition, Contango granted HighGold the right to appoint one director to its board of directors (the “Board”). As of the effective time of the HighGold Acquisition, the Board increased its number of directors from five to six, and, on July 10, 2024, Darwin Green was appointed to the Board.

Mr. Green served as Director, President and Chief Executive Officer of HighGold from August 2019 until its acquisition by Contango ORE in July 2024, and has served as Executive Chairman for Onyx Gold Corp from July 2023 to present. Mr. Green was a founder of HighGold and Onyx Gold, both publicly traded companies focused on mineral exploration and mine development in North America. Between November 2008 and December 31, 2019, he served as the Vice President Exploration for Constantine Metal Resources Ltd. and prior to that, Mr. Green oversaw exploration and underground development programs at the Niblack deposit, for which he received the Commissioner’s Award for Project Excellence by the State of Alaska. Mr. Green holds a B.Sc. from the University of British Columbia and an M.Sc. in economic geology from Carleton University. Mr. Green has thirty years of experience in the minerals mining industry and brings significant industry, corporate and technical knowledge to the Company.

Mr. Green will stand for re-election at the next annual meeting of stockholders. Mr. Green will serve on the Audit and Compensation Committees of the Board. Mr. Green has not had any related person transactions with the Company as of the date of his appointment, and therefore is independent in accordance with NYSE American rules.

Mr. Green will be eligible for compensation in accordance with the Company’s standard compensation policies for non-employee directors as described in the section entitled “Corporate Governance” in the Company’s proxy statement on Schedule 14A filed with the SEC on October 4, 2023.

Item 7.01 Regulation FD Disclosure.

First Pour at Manh Choh

On July 8, 2024, the Company issued a press release announcing that the first gold pour for the Manh Choh mine took place at the Fort Knox mill facility on July 8, 2024. The Company is a 30% owner of Peak Gold, LLC, which operates the Manh Choh mine near Tok, Alaska. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Closing of HighGold Acquisition

On July 10, 2024, the Company issued a press release announcing the closing of the HighGold Acquisition. A copy of the press release is attached as Exhibit 99.2 hereto and is incorporated herein by reference.

The information included herein and in Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act.

Cautionary Note Regarding Forward-Looking Statements

Many of the statements included or incorporated in this Current Report on Form 8-K and the furnished exhibits constitutes “forward-looking statements.” In particular, they include statements relating to future actions and strategies, future operating and financial performance, and the Company’s future financial results. These forward-looking statements are based on current expectations and projections about future events. Readers are cautioned that forward-looking statements are not guarantees of future operating and financial performance or results and involve substantial risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual performance of the Company may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, factors described from time to time in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC (including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CONTANGO ORE, INC. |

|

|

|

|

Date: |

July 10, 2024 |

By: |

/s/ Mike Clark |

|

|

|

Chief Financial Officer and Secretary |

NEWS RELEASE

CONTANGO ORE, INC.

Manh Choh Mine Pours First Gold

FAIRBANKS, AK -- (July 8, 2024) -- Contango ORE, Inc. (“Contango” or the “Company”) (NYSE American: CTGO) is pleased to announce that today the first gold from the Manh Choh mine, a joint venture between Kinross and the Company, was poured at the Kinross Fort Knox mill facility.

Rick Van Nieuwenhuyse, CEO and President for Contango commented: “Today was a monumental day for Contango shareholders. From the first discovery hole to pouring the first bar of gold emblazed with the special Manh Choh branding (as shown in the video link below), it has certainly been a journey, but one that sets us up for future success. With the Peak Gold JV’s Manh Choh project now producing gold, we have a solid foundation to build Contango by employing a different, more disciplined model. The Lucky Shot and Johnson Tract projects represent high quality resources that are ideally suited for our unique direct ship ore (“DSO”) model. Our five year plan is to grow production from our existing portfolio to 200,000 of annual gold equivalent production. By developing high-grade, high-quality mines that can utilize the DSO model by transporting our ore to existing and permitted operating processing facilities, we will reduce our environmental footprint and thereby lower our permitting risk, as well as lower the overall capital requirements to achieve commercial production. We believe this is a unique model and a right-fit for these continuing challenging capital markets for miners.”

Link to gold pour video: https://youtu.be/2_73S0E13cs

ABOUT CONTANGO

Contango is a NYSE American listed company that engages in exploration for gold and associated minerals in Alaska. Contango holds a 30% interest in the Peak Gold JV, which leases approximately 675,000 acres of land for exploration and development on the Manh Choh project, with the remaining 70% owned by KG Mining (Alaska), Inc., an indirect subsidiary of Kinross, operator of the Peak Gold JV. The Company also has a lease on the Lucky Shot project from the underlying owner, Alaska Hardrock Inc. and through its subsidiary has 100% ownership of approximately 8,600 acres of peripheral State of Alaska mining claims. Contango also owns a 100% interest in an additional approximately 145,000 acres of State of Alaska mining claims

through its wholly owned subsidiary, which gives Contango the exclusive right to explore and develop minerals on these lands. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding Contango that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for, developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

CONTACTS:

Contango ORE, Inc.

Rick Van Nieuwenhuyse

(907) 888-4273

www.contangoore.com

NEWS RELEASE

Contango Completes Acquisition of HighGold

FAIRBANKS, AK – July 10, 2024 – Contango ORE, Inc. (NYSE American: CTGO) (“Contango” or the “Company”) and HighGold Mining Inc. (TSX-V:HIGH, OTCQX:HGMIF) (“HighGold”) are pleased to announce that Contango has completed its acquisition of HighGold (the “Acquisition”) by way of a court approved plan of arrangement under the Business Corporations Act (British Columbia) (the “BCBCA”). The Acquisition was overwhelmingly approved by HighGold securityholders in accordance with the requirements of the BCBCA at a special meeting of HighGold securityholders held on June 27, 2024, and was subsequently approved by the Supreme Court of British Columbia on July 2, 2024.

Rick Van Nieuwenhuyse, CEO and President for Contango commented: “With the Manh Choh project now in production, the Lucky Shot and Johnson Tract projects provide a solid portfolio for growing gold production using our unique Direct Ship Ore (“DSO”) model. Our five year plan is to grow production from our existing projects to 200,000 ounces of annual gold equivalent production. By developing high-grade, high-quality mines that can utilize the DSO model by transporting our ore to existing and permitted operating processing facilities, we will reduce our environmental footprint and thereby lower our permitting risk, as well as lower the overall capital requirements to achieve commercial production. We believe this is a unique model and a right-fit for these continuing challenging capital markets for miners.”

As part of the Acquisition, Contango issued 1,698,887 shares of its common stock (“Contango Shares”) to HighGold shareholders based on a share exchange ratio of 0.019 of a Contango Share for each common share of HighGold (“HighGold Share”).

Concurrent with the Acquisition, Contango has appointed Darwin Green, HighGold’s President and Chief Executive Officer, to its board of directors.

The HighGold Shares are expected to be delisted from the TSX Venture Exchange at the close of trading on July 11, 2024 and HighGold intends to submit an application to the applicable securities regulators to cease to be a reporting issuer and to terminate its public reporting obligations.

Non-registered HighGold shareholders, or those that hold their HighGold Shares through an intermediary (i.e., broker), will receive the consideration payable to them pursuant to the Acquisition through their broker or other intermediary. Consideration for HighGold Shares that are held through an intermediary has been issued to Computershare Investor Services Inc. (“Computershare”), as depositary, and will be distributed to intermediaries in due course. Such

non-registered HighGold shareholders should contact their intermediary for instructions and assistance in receiving the Acquisition consideration.

Registered HighGold shareholders, or those that hold their HighGold Shares directly with HighGold, will be required to file a Letter of Transmittal with Computershare in order to receive the consideration to which they are entitled. Registered HighGold Shareholders of record on May 21, 2024 should have received a Letter of Transmittal by mail. Registered HighGold shareholders requiring assistance to exchange their HighGold Shares may contact Computershare for assistance at 1-800-564-6253.

In connection with financial advisory services rendered by Agentis Capital Mining Partners (“Agentis”) to HighGold with respect to the Acquisition, a cash success fee of Cdn$693,900 is now payable by HighGold to Agentis. The cash success fee was calculated as 1.35% of the value of consideration received by HighGold Shareholders under the Acquisition.

ABOUT CONTANGO

Contango is a NYSE American listed company that engages in exploration for gold and associated minerals in Alaska. Contango holds a 30% interest in the Peak Gold JV, which leases approximately 675,000 acres of land for exploration and development on the Manh Choh project, with the remaining 70% owned by KG Mining (Alaska), Inc., an indirect subsidiary of Kinross Gold Corporation, operator of the Peak Gold JV. The Company also has a lease on the Lucky Shot project from the underlying owner, Alaska Hardrock Inc. and through its subsidiary has 100% ownership of approximately 8,600 acres of peripheral State of Alaska mining claims. Contango also owns a 100% interest in an additional approximately 145,000 acres of State of Alaska mining claims through its wholly owned subsidiary, which gives Contango the exclusive right to explore and develop minerals on these lands. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements and certain "forward-looking information" (within the meaning of Canadian securities legislation) regarding Contango and HighGold that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango’s and HighGold’s current expectations and includes statements regarding the expected delisting of HighGold Shares from the TSX Venture Exchange, the distribution of Contango Shares by Computershare, plans of Contango to grow gold production, including an anticipated reduced environmental footprint and lower permitting risks, future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: HighGold not receiving requisite approvals for the delisting

of the HighGold Shares and for HighGold to cease to be a reporting issuer in Canada; the risks of the exploration and the mining industry (for example, operational risks in exploring for and developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango and HighGold do not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

CONTACTS:

Contango ORE, Inc.

Rick Van Nieuwenhuyse

(907) 888-4273

www.contangoore.com

v3.24.2

Document And Entity Information

|

Jul. 10, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 10, 2024

|

| Entity Registrant Name |

Contango Ore, Inc.

|

| Entity Central Index Key |

0001502377

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35770

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

27-3431051

|

| Entity Address, Address Line One |

516 2nd Avenue

|

| Entity Address, Address Line Two |

Suite 401

|

| Entity Address, City or Town |

Fairbanks

|

| Entity Address, State or Province |

AK

|

| Entity Address, Postal Zip Code |

99701

|

| City Area Code |

(907)

|

| Local Phone Number |

888-4273

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 per share

|

| Trading Symbol |

CTGO

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

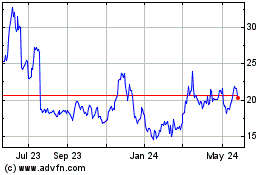

Contango Ore (AMEX:CTGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

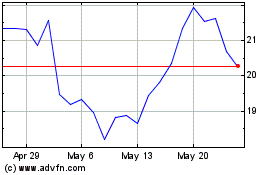

Contango Ore (AMEX:CTGO)

Historical Stock Chart

From Jul 2023 to Jul 2024