3 Emerging Market ETFs Surviving the Slump - ETF News And Commentary

26 August 2013 - 10:02PM

Zacks

Taper talk is having a huge impact on markets, not just in the

U.S., but around the world as well. In fact, several Asian emerging

markets have plunged in the past few weeks losing more than 10% in

the time frame.

The losses were led by extremely rough trading in the huge

markets of India and Indonesia. These two giants have both faced

uncertain trading conditions and thanks to sluggish currencies,

current account deficits and inflationary worries, they could

remain under pressure in the weeks ahead too (see Indonesia ETFs in

Crash Territory on Currency Woes).

This trend has made many very bearish on broad emerging markets,

and particularly on ETFs targeting nations like India

(EPI) or Indonesia (EIDO). However, the

terrible stretch hasn’t hit every emerging market, as a few have

managed to soar higher and outperform despite the gloom surrounding

the space.

Below, we briefly highlight a few of these top performing

emerging markets and some reasons behind their surge:

China

While many Asian markets have faced weakness, China has

rebounded from its lows in recent weeks. Many of the top performers

came from those that focused on technology stocks, including

PGJ, QQQC, and

CQQQ, a group which averaged out 10% gains for the

past month (see Focus on These China ETFs for Outperformance).

Others in the space also saw strength too, including a number of

sectors that have seen severe weakness like financials

(CHIX), infrastructure (CHXX) and

materials (CHIM). These gained about 8% in the

time frame, and suggested to many that broad China strength was at

hand in the market.

Latin America

Latin American ETFs also saw a rebound lately, led by two very

different markets, Peru (EPU) and

Argentina (ARGT). These two also have performed

well after slumping earlier in the year, as EPU has added about

8.5% in the past month, while ARGT has moved higher by more than

10% in the time frame.

Peru is seeing strength thanks to some solid trading in silver,

one of its key exports. Meanwhile, Argentina has moved higher

despite some inflation concerns due to higher growth forecasts, and

commodity strength of its own (see all the Latin American Equity

ETFs here).

More Information

For more about the sluggish trading in India and Indonesia, as

well as ways to play emerging market weakness in the weeks ahead,

watch our short video on the subject below:

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

GLBL-X F ARG20 (ARGT): ETF Research Reports

GUGG-CHINA TEC (CQQQ): ETF Research Reports

ISHARS-MS INDON (EIDO): ETF Research Reports

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-MSCI PER (EPU): ETF Research Reports

PWRSH-GL DR HA (PGJ): ETF Research Reports

GLBL-X NDQ CHIN (QQQC): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

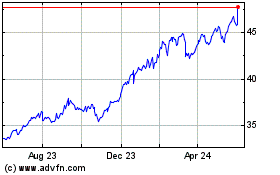

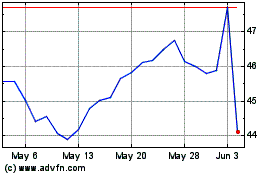

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Feb 2025 to Mar 2025

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Mar 2024 to Mar 2025