Evolution Petroleum Corporation (NYSE American: EPM) ("Evolution"

or the "Company") today announced its financial and operating

results for its fiscal second quarter ended December 31, 2024. The

Company’s diversified portfolio continues to deliver production

growth, with fiscal Q2 volumes increasing 10% year-over-year to

6,935 BOEPD. Further reinforcing its commitment to shareholder

returns, Evolution declared its 46th consecutive quarterly cash

dividend of $0.12 per common share for the fiscal 2025 third

quarter.

Financial & Operational Highlights

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

Q2 2025 |

|

Q2 2024 |

|

Q1 2025 |

|

% Change vs Q2/Q2 |

|

% Change vs Q2/Q1 |

|

2025 YTD |

|

2024 YTD |

|

% Change vs YTD'24 |

|

Average BOEPD |

|

6,935 |

|

|

|

6,304 |

|

|

7,478 |

|

10 |

% |

|

(7 |

)% |

|

|

7,212 |

|

|

|

6,380 |

|

13 |

% |

| Revenues |

$ |

20,275 |

|

|

$ |

21,024 |

|

$ |

21,896 |

|

(4 |

)% |

|

(7 |

)% |

|

$ |

42,171 |

|

|

$ |

41,625 |

|

1 |

% |

| Net Income(1) |

$ |

(1,825 |

) |

|

$ |

1,082 |

|

$ |

2,065 |

|

NM |

|

|

NM |

|

|

$ |

240 |

|

|

$ |

2,556 |

|

(91 |

)% |

| Adjusted Net Income(1)(2) |

$ |

(841 |

) |

|

$ |

1,082 |

|

$ |

728 |

|

NM |

|

|

NM |

|

|

$ |

(103 |

) |

|

$ |

2,556 |

|

NM |

|

| Adjusted EBITDA(3) |

$ |

5,688 |

|

|

$ |

6,832 |

|

$ |

8,125 |

|

(17 |

)% |

|

(30 |

)% |

|

$ |

13,813 |

|

|

$ |

13,535 |

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) "NM" means "Not Meaningful." |

|

(2) Adjusted Net Income is a non-GAAP financial measure;

see the non-GAAP reconciliation schedules to the most comparable

GAAP measures at the end of this release for more information. |

|

(3) Adjusted EBITDA is Adjusted Earnings Before

Interest, Taxes, Depreciation, and Amortization and is a non-GAAP

financial measure; see the non-GAAP reconciliation schedules to the

most comparable GAAP measures at the end of this release for more

information. |

| |

- Fiscal Q2 production increased 10% year-over-year to 6,935

average barrels of oil equivalent per day ("BOEPD"), with oil

increasing 13%, natural gas increasing 9%, and natural gas liquids

("NGLs") increasing 9%.

- $4.1 million returned to shareholders in the form of cash

dividends during the fiscal second quarter of 2025.

- Three gross SCOOP/STACK wells brought online during the quarter

— currently, 8 wells in progress or permitted.

- Subsequent to quarter end, completed drilling two of four gross

wells in the 2nd Chaveroo Field development block and expect to

finish drilling the remaining 2 wells in the block by early

March.

Kelly Loyd, President and Chief Executive

Officer, commented: “Driven by our favorable near and long-term

outlook for sustainable cash flow generation from our diversified

asset base, we are pleased to announce our 11th straight dividend

at the rate of $0.12 per share for the upcoming quarter, payable

March 31, 2025. Despite operational issues and downtime at Chaveroo

and Williston, which resulted in approximately 90 BOEPD lower

production for the quarter, our balanced portfolio delivered strong

year-over-year production growth of 10%. These issues have been

resolved, and rates were restored before the end of January. Lower

commodity pricing, particularly for natural gas, was the main

contributor to a modest revenue decline and net adjusted loss.

However, towards the end of the quarter and beyond, we have seen a

strong recovery throughout the natural gas futures curve and

substantially improved natural gas price realizations to date,

while oil and natural gas liquids pricing has remained relatively

stable to slightly improved.

We continue to see above-average results from

new wells in the SCOOP/STACK area and are excited about new well

proposals from several operators within our acreage. We remain very

excited about the upcoming four gross wells (two net) in the second

development block at Chaveroo. As of today, two of these new wells

have been drilled, the third is underway and the fourth will follow

immediately thereafter. We expect all four wells to be completed

and turned in line during our fiscal fourth quarter.”

Mr. Loyd concluded, “Looking ahead, we remain

committed to driving long-term shareholder value with pursuing

high-quality, low-decline assets at attractive valuations,

expanding our drilling inventory, and maintaining our strong

financial foundation. We are evaluating multiple acquisition

opportunities that have the potential to enhance our long-term

growth strategy and further improve our cash flow generation — all

at very compelling valuations that would be materially accretive to

earnings. Given our track record of executing disciplined

investments, we are confident in our ability to deliver sustainable

growth, create value through accretive M&A, and continue

supporting our dividend program for years to come.”

Fiscal Second Quarter 2025 Financial

Results

Total revenues decreased 4% to $20.3 million

compared to $21.0 million in the year-ago quarter. The decline was

driven primarily by a 12% decrease in average realized commodity

prices which offset an increase in production volumes. The increase

in production volumes was largely due to the Company's SCOOP/STACK

acquisitions in February 2024 and subsequent drilling and

completion activities, as well as new wells at Chaveroo that came

online at the same time.

Lease operating costs ("LOE") increased to $12.8

million compared to $12.4 million in the year-ago quarter. The

overall increase was driven by the addition of the Company's

SCOOP/STACK properties and Chaveroo wells since the prior year

period, collectively adding $1.2 million in lease operating costs

this quarter. The overall increase was partially offset by the

reduction in CO2 purchases at Delhi Field due to maintenance on the

pipeline that began in February 2024. CO2 purchases restarted in

late October 2024. The increase in production from the Company’s

SCOOP/STACK properties and Chaveroo wells, which incur lower

relative operating costs compared to other areas, has also driven

down LOE on a per-unit basis. On a per unit basis, total LOE

decreased 6% to $20.05 per BOE compared to $21.30 per BOE in the

year-ago quarter.

Depletion, depreciation, and accretion expense

was $5.4 million compared to $4.6 million in the year-ago period.

On a per BOE basis, the Company's current quarter depletion rate

increased to $7.87 per BOE compared to $7.31 per BOE in the

year-ago period due to an increase in depletable base related to

the Company's SCOOP/STACK acquisitions and capital development

expenditures added since the prior fiscal year.

General and administrative ("G&A") expenses,

excluding stock-based compensation, increased slightly to $2.0

million compared to $1.9 million in the year-ago period. On a per

BOE basis, G&A expenses decreased to $3.13 compared to $3.34 in

the year-ago period. The decrease on a per unit basis is the result

of increased production.

The Company reported a net loss of $1.8 million

or $(0.06) per share, compared to net income of $1.1 million or

$0.03 per share in the year-ago period. Excluding the impact of

unrealized losses, adjusted net loss was $0.8 million or $(0.03)

per diluted share, compared to adjusted net income of $1.1 million

or $0.03 per diluted share in the prior quarter.

Adjusted EBITDA was $5.7 million compared to

$6.8 million in the year-ago period. The decrease was primarily due

to decreased revenue as a result of lower commodity prices and

higher total operating costs due to the SCOOP/STACK

acquisitions.

Production & Pricing

|

|

|

|

|

|

|

|

|

|

| Average price per

unit: |

Q2 2025 |

|

Q2 2024 |

|

% Change vs Q2/Q2 |

|

Crude oil (BBL) |

$ |

65.72 |

|

$ |

73.96 |

|

(11)% |

| Natural gas (MCF) |

|

2.73 |

|

|

3.35 |

|

(19)% |

| Natural Gas Liquids (BBL) |

|

25.90 |

|

|

28.48 |

|

(9)% |

| Equivalent (BOE) |

|

31.78 |

|

|

36.25 |

|

(12)% |

|

|

|

|

|

|

|

|

|

|

Total production for the second quarter of

fiscal 2025 increased 10% to 6,935 net BOEPD compared to 6,304 net

BOEPD in the year-ago period. Total production for the second

quarter of fiscal 2025 included 1,946 barrels per day ("BOPD") of

crude oil, 3,848 BOEPD of natural gas, and 1,141 BOEPD of NGLs. The

increase in total production was driven by the closing of the

Company's SCOOP/STACK acquisitions in February 2024 and production

from the initial three wells in the Chaveroo oilfield coming online

at the same time. Total oil and natural gas liquids production

generated 71% of revenue for the quarter compared to 69% in the

year-ago period.

The Company's average realized commodity price

(excluding the impact of derivative contracts) decreased 12% to

$31.78 per BOE, compared to $36.25 per BOE in the year-ago period.

These decreases were primarily driven by a decrease of

approximately 19% in realized natural gas prices year over

year.

Operations Update

At SCOOP/STACK, the Company's operators brought

three gross wells online during fiscal Q2 2025, which is in

addition to the seven gross wells brought online during fiscal Q1

2025. Additionally, Evolution has agreed to participate in eight

gross new horizontal wells across the acreage. Since the effective

date of the acquisitions, a total of 32 gross wells (or 0.5 net

wells) have commenced first production.

Chaveroo production for fiscal Q2 was down due

to gas interference in the downhole pumps. However, these issues

have since been resolved, and production rebounded back to expected

rates in January 2025. The Company has preliminarily agreed to six

additional horizontal wells in Drilling Block Three, which are

anticipated to begin operations in early fiscal 2026. Drilling

activities began in January 2025 on the four new gross wells in the

Company's second development block. As of today, Evolution has

finished drilling two of the four gross wells and expects to finish

drilling the remaining wells by early March.

In the Williston Basin, a compressor failure on

a third-party-operated gathering system caused temporary downtime

for 30 days at the beginning of fiscal Q2, resulting in reduced

natural gas sales for the period. Correspondingly, NGL production

saw a decline during this period as well. Oil sales volumes were

also negatively impacted during the quarter due to delays in sales

of oil at the end of December. Those volumes were subsequently sold

in January.

At Delhi, CO2 injections resumed during fiscal

Q2 2025, which has positively impacted production. Following the

quarter end, one new well has been drilled at Test Site V and the

Company is awaiting results.

Balance Sheet, Liquidity, and Capital

Spending

On December 31, 2024, cash and cash equivalents

totaled $11.7 million, and working capital was $10.5 million.

Evolution had $39.5 million of borrowings outstanding under its

revolving credit facility, and total liquidity of $22.2 million,

including cash and cash equivalents. In fiscal Q2, Evolution paid

$4.1 million in common stock dividends and $0.8 million in capital

expenditures. During the period ended December 31, 2024, the

Company sold a total of approximately 0.4 million shares of its

common stock under its At-the-Market Sales Agreement for net

proceeds of approximately $2.0 million, after deducting an initial

$0.2 million in fees for due diligence incurred with the

offering.

Cash Dividend on Common

Stock

On February 10, 2025, Evolution's Board of

Directors declared a cash dividend of $0.12 per share of common

stock, which will be paid on March 31, 2025, to common stockholders

of record on March 14, 2025. This will be the 46th consecutive

quarterly cash dividend on the Company's common stock since

December 31, 2013. To date, Evolution has returned approximately

$126.6 million, or $3.81 per share, back to stockholders in common

stock dividends.

Conference Call

As previously announced, Evolution Petroleum

will host a conference call on Wednesday, February 12, 2025, at

10:00 a.m. CT to review its fiscal second quarter 2025 financial

and operating results. Participants can join online at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=HS7VesBT

or by dialing (844) 481-2813. Dial-in participants should ask to

join the Evolution Petroleum Corporation call. A replay will be

available through February 12, 2026, via the provided webcast link

and on Evolution's Investor Relations website at

www.ir.evolutionpetroleum.com.

About Evolution Petroleum

Evolution Petroleum Corporation is an

independent energy company focused on maximizing total shareholder

returns through the ownership of and investment in onshore oil and

natural gas properties in the U.S. The Company aims to build and

maintain a diversified portfolio of long-life oil and natural gas

properties through acquisitions, selective development

opportunities, production enhancements, and other exploitation

efforts. Properties include non-operated interests in the following

areas: the SCOOP/STACK plays of the Anadarko Basin in Oklahoma; the

Chaveroo Oilfield located in Chaves and Roosevelt Counties, New

Mexico; the Jonah Field in Sublette County, Wyoming; the Williston

Basin in North Dakota; the Barnett Shale located in North Texas;

the Hamilton Dome Field located in Hot Springs County, Wyoming; the

Delhi Holt-Bryant Unit in the Delhi Field in Northeast Louisiana;

as well as small overriding royalty interests in four onshore Texas

wells. Visit www.evolutionpetroleum.com for more information.

Cautionary Statement

All forward-looking statements contained in this

press release regarding the Company's current and future

expectations, potential results, and plans and objectives involve a

wide range of risks and uncertainties. Statements herein using

words such as "believe," "expect," "may," "plans," "outlook,"

"should," "will," and words of similar meaning are forward-looking

statements. Although the Company's expectations are based on

business, engineering, geological, financial, and operating

assumptions that it believes to be reasonable, many factors could

cause actual results to differ materially from its expectations.

The Company gives no assurance that its goals will be achieved.

These factors and others are detailed under the heading "Risk

Factors" and elsewhere in our periodic reports filed with the

Securities and Exchange Commission ("SEC"). The Company undertakes

no obligation to update any forward-looking statement.

ContactInvestor Relations(713)

935-0122ir@evolutionpetroleum.com

|

Evolution Petroleum Corporation |

|

Condensed Consolidated Statements of Operations

(Unaudited) |

|

(In thousands, except per share amounts) |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2024 |

|

2023 |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil |

$ |

11,763 |

|

|

$ |

11,759 |

|

|

$ |

14,737 |

|

|

$ |

26,500 |

|

|

$ |

24,375 |

|

|

Natural gas |

|

5,793 |

|

|

|

6,531 |

|

|

|

4,285 |

|

|

|

10,078 |

|

|

|

12,083 |

|

|

Natural gas liquids |

|

2,719 |

|

|

|

2,734 |

|

|

|

2,874 |

|

|

|

5,593 |

|

|

|

5,167 |

|

|

Total revenues |

|

20,275 |

|

|

|

21,024 |

|

|

|

21,896 |

|

|

|

42,171 |

|

|

|

41,625 |

|

| Operating costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating costs |

|

12,793 |

|

|

|

12,358 |

|

|

|

11,790 |

|

|

|

24,583 |

|

|

|

24,241 |

|

|

Depletion, depreciation, and accretion |

|

5,433 |

|

|

|

4,598 |

|

|

|

5,725 |

|

|

|

11,158 |

|

|

|

8,860 |

|

|

General and administrative expenses |

|

2,654 |

|

|

|

2,502 |

|

|

|

2,527 |

|

|

|

5,181 |

|

|

|

5,105 |

|

|

Total operating costs |

|

20,880 |

|

|

|

19,458 |

|

|

|

20,042 |

|

|

|

40,922 |

|

|

|

38,206 |

|

| Income (loss) from

operations |

|

(605 |

) |

|

|

1,566 |

|

|

|

1,854 |

|

|

|

1,249 |

|

|

|

3,419 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net gain (loss) on derivative contracts |

|

(1,219 |

) |

|

|

— |

|

|

|

1,798 |

|

|

|

579 |

|

|

|

— |

|

|

Interest and other income |

|

52 |

|

|

|

104 |

|

|

|

57 |

|

|

|

109 |

|

|

|

220 |

|

|

Interest expense |

|

(764 |

) |

|

|

(34 |

) |

|

|

(823 |

) |

|

|

(1,587 |

) |

|

|

(66 |

) |

| Income (loss) before income

taxes |

|

(2,536 |

) |

|

|

1,636 |

|

|

|

2,886 |

|

|

|

350 |

|

|

|

3,573 |

|

| Income tax (expense)

benefit |

|

711 |

|

|

|

(554 |

) |

|

|

(821 |

) |

|

|

(110 |

) |

|

|

(1,017 |

) |

| Net income (loss) |

$ |

(1,825 |

) |

|

$ |

1,082 |

|

|

$ |

2,065 |

|

|

$ |

240 |

|

|

$ |

2,556 |

|

| Net income (loss) per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.06 |

) |

|

$ |

0.03 |

|

|

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

0.08 |

|

|

Diluted |

$ |

(0.06 |

) |

|

$ |

0.03 |

|

|

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

0.08 |

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

32,934 |

|

|

|

32,693 |

|

|

|

32,722 |

|

|

|

32,828 |

|

|

|

32,676 |

|

|

Diluted |

|

32,934 |

|

|

|

32,900 |

|

|

|

32,868 |

|

|

|

32,994 |

|

|

|

32,940 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evolution Petroleum Corporation |

|

Condensed Consolidated Balance Sheets

(Unaudited) |

|

(In thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

| |

December 31, 2024 |

|

June 30, 2024 |

|

Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

11,667 |

|

$ |

6,446 |

|

Receivables from crude oil, natural gas, and natural gas liquids

revenues |

|

10,675 |

|

|

10,826 |

|

Derivative contract assets |

|

1,073 |

|

|

596 |

|

Prepaid expenses and other current assets |

|

3,572 |

|

|

3,855 |

|

Total current assets |

|

26,987 |

|

|

21,723 |

| Property and equipment, net of

depletion, depreciation, and impairment |

|

|

|

|

|

|

Oil and natural gas properties, net—full-cost method of accounting,

of which none were excluded from amortization |

|

131,722 |

|

|

139,685 |

|

|

|

|

|

|

|

| Other noncurrent assets |

|

|

|

|

|

|

Derivative contract assets |

|

250 |

|

|

171 |

|

Other assets |

|

1,258 |

|

|

1,298 |

| Total assets |

$ |

160,217 |

|

$ |

162,877 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

10,771 |

|

$ |

8,308 |

|

Accrued liabilities and other |

|

5,249 |

|

|

6,239 |

|

Derivative contract liabilities |

|

439 |

|

|

1,192 |

|

State and federal taxes payable |

|

— |

|

|

74 |

|

Total current liabilities |

|

16,459 |

|

|

15,813 |

| Long term liabilities |

|

|

|

|

|

|

Senior secured credit facility |

|

39,500 |

|

|

39,500 |

|

Deferred income taxes |

|

6,673 |

|

|

6,702 |

|

Asset retirement obligations |

|

19,993 |

|

|

19,209 |

|

Derivative contract liabilities |

|

1,277 |

|

|

468 |

|

Operating lease liability |

|

13 |

|

|

58 |

|

Total liabilities |

|

83,915 |

|

|

81,750 |

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

|

Common stock; par value $0.001; 100,000,000 shares authorized:

issued and |

|

|

|

|

|

|

outstanding 34,076,846 and 33,339,535 shares as of

December 31, 2024 |

|

|

|

|

|

|

and June 30, 2024, respectively |

|

34 |

|

|

33 |

|

Additional paid-in capital |

|

44,140 |

|

|

41,091 |

|

Retained earnings |

|

32,128 |

|

|

40,003 |

|

Total stockholders' equity |

|

76,302 |

|

|

81,127 |

|

Total liabilities and stockholders' equity |

$ |

160,217 |

|

$ |

162,877 |

| |

|

|

|

|

|

|

Evolution Petroleum Corporation |

|

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

|

(In thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2024 |

|

2023 |

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(1,825 |

) |

|

$ |

1,082 |

|

|

$ |

2,065 |

|

|

$ |

240 |

|

|

$ |

2,556 |

|

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depletion, depreciation, and accretion |

|

5,433 |

|

|

|

4,598 |

|

|

|

5,725 |

|

|

|

11,158 |

|

|

|

8,860 |

|

|

Stock-based compensation |

|

659 |

|

|

|

564 |

|

|

|

559 |

|

|

|

1,218 |

|

|

|

1,036 |

|

|

Settlement of asset retirement obligations |

|

(182 |

) |

|

|

— |

|

|

|

(98 |

) |

|

|

(280 |

) |

|

|

— |

|

|

Deferred income taxes |

|

252 |

|

|

|

(567 |

) |

|

|

(281 |

) |

|

|

(29 |

) |

|

|

(642 |

) |

|

Unrealized (gain) loss on derivative contracts |

|

1,368 |

|

|

|

— |

|

|

|

(1,868 |

) |

|

|

(500 |

) |

|

|

— |

|

|

Accrued settlements on derivative contracts |

|

9 |

|

|

|

— |

|

|

|

(66 |

) |

|

|

(57 |

) |

|

|

— |

|

|

Other |

|

(1 |

) |

|

|

3 |

|

|

|

(2 |

) |

|

|

(3 |

) |

|

|

3 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables from crude oil, natural gas, and natural gas liquids

revenues |

|

29 |

|

|

|

447 |

|

|

|

(37 |

) |

|

|

(8 |

) |

|

|

(2,239 |

) |

|

Prepaid expenses and other current assets |

|

(1,494 |

) |

|

|

(443 |

) |

|

|

1,929 |

|

|

|

435 |

|

|

|

(274 |

) |

|

Accounts payable, accrued liabilities and other |

|

3,471 |

|

|

|

2,123 |

|

|

|

(238 |

) |

|

|

3,233 |

|

|

|

2,443 |

|

|

State and federal taxes payable |

|

— |

|

|

|

(753 |

) |

|

|

(74 |

) |

|

|

(74 |

) |

|

|

(365 |

) |

|

Net cash provided by operating activities |

|

7,719 |

|

|

|

7,054 |

|

|

|

7,614 |

|

|

|

15,333 |

|

|

|

11,378 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of oil and natural gas properties |

|

(69 |

) |

|

|

— |

|

|

|

(262 |

) |

|

|

(331 |

) |

|

|

— |

|

|

Capital expenditures for oil and natural gas properties |

|

(758 |

) |

|

|

(3,878 |

) |

|

|

(2,740 |

) |

|

|

(3,498 |

) |

|

|

(5,705 |

) |

|

Net cash used in investing activities |

|

(827 |

) |

|

|

(3,878 |

) |

|

|

(3,002 |

) |

|

|

(3,829 |

) |

|

|

(5,705 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock dividends paid |

|

(4,082 |

) |

|

|

(4,021 |

) |

|

|

(4,033 |

) |

|

|

(8,115 |

) |

|

|

(8,034 |

) |

|

Common stock repurchases, including stock surrendered for tax

withholding |

|

(103 |

) |

|

|

(108 |

) |

|

|

(88 |

) |

|

|

(191 |

) |

|

|

(213 |

) |

|

Issuance of common stock |

|

2,259 |

|

|

|

— |

|

|

|

— |

|

|

|

2,259 |

|

|

|

— |

|

|

Offering costs |

|

(236 |

) |

|

|

— |

|

|

|

— |

|

|

|

(236 |

) |

|

|

— |

|

|

Net cash used in financing activities |

|

(2,162 |

) |

|

|

(4,129 |

) |

|

|

(4,121 |

) |

|

|

(6,283 |

) |

|

|

(8,247 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

4,730 |

|

|

|

(953 |

) |

|

|

491 |

|

|

|

5,221 |

|

|

|

(2,574 |

) |

|

Cash and cash equivalents, beginning of period |

|

6,937 |

|

|

|

9,413 |

|

|

|

6,446 |

|

|

|

6,446 |

|

|

|

11,034 |

|

|

Cash and cash equivalents, end of period |

$ |

11,667 |

|

|

$ |

8,460 |

|

|

$ |

6,937 |

|

|

$ |

11,667 |

|

|

$ |

8,460 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evolution Petroleum

CorporationNon-GAAP Reconciliation – Adjusted

EBITDA (Unaudited)(In thousands)

Adjusted EBITDA and Net income (loss) and

earnings per share excluding selected items are non-GAAP financial

measures that are used as supplemental financial measures by our

management and by external users of our financial statements, such

as investors, commercial banks, and others, to assess our operating

performance as compared to that of other companies in our industry,

without regard to financing methods, capital structure, or

historical costs basis. We use these measures to assess our ability

to incur and service debt and fund capital expenditures. Our

Adjusted EBITDA and Net income (loss) and earnings per share,

excluding selected items, should not be considered alternatives to

net income (loss), operating income (loss), cash flows provided by

(used in) operating activities, or any other measure of financial

performance or liquidity presented in accordance with U.S. GAAP.

Our Adjusted EBITDA and Net income (loss) and earnings per share

excluding selected items may not be comparable to similarly titled

measures of another company because all companies may not calculate

Adjusted EBITDA and Net income (loss) and earnings per share

excluding selected items in the same manner.

We define Adjusted EBITDA as net income (loss)

plus interest expense, income tax expense (benefit), depreciation,

depletion, and accretion (DD&A), stock-based compensation,

ceiling test impairment, and other impairments, unrealized loss

(gain) on change in fair value of derivatives, and other

non-recurring or non-cash expense (income) items.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

Net income (loss) |

$ |

(1,825 |

) |

|

$ |

1,082 |

|

$ |

2,065 |

|

|

$ |

240 |

|

|

$ |

2,556 |

| Adjusted by: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

764 |

|

|

|

34 |

|

|

823 |

|

|

|

1,587 |

|

|

|

66 |

| Income tax expense

(benefit) |

|

(711 |

) |

|

|

554 |

|

|

821 |

|

|

|

110 |

|

|

|

1,017 |

| Depletion, depreciation, and

accretion |

|

5,433 |

|

|

|

4,598 |

|

|

5,725 |

|

|

|

11,158 |

|

|

|

8,860 |

| Stock-based compensation |

|

659 |

|

|

|

564 |

|

|

559 |

|

|

|

1,218 |

|

|

|

1,036 |

| Unrealized loss (gain) on

derivative contracts |

|

1,368 |

|

|

|

— |

|

|

(1,868 |

) |

|

|

(500 |

) |

|

|

— |

| Adjusted

EBITDA |

$ |

5,688 |

|

|

$ |

6,832 |

|

$ |

8,125 |

|

|

$ |

13,813 |

|

|

$ |

13,535 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evolution Petroleum Corporation |

|

Non-GAAP Reconciliation – Adjusted Net Income

(Unaudited) |

|

(In thousands, except per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2024 |

|

2023 |

| As

Reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss), as reported |

$ |

(1,825 |

) |

|

$ |

1,082 |

|

|

$ |

2,065 |

|

|

$ |

240 |

|

|

$ |

2,556 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impact of Selected

Items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized loss (gain) on

commodity contracts |

|

1,368 |

|

|

|

— |

|

|

|

(1,868 |

) |

|

|

(500 |

) |

|

|

— |

|

| Selected items, before income

taxes |

$ |

1,368 |

|

|

$ |

— |

|

|

$ |

(1,868 |

) |

|

$ |

(500 |

) |

|

$ |

— |

|

| Income tax effect of selected

items(1) |

|

384 |

|

|

|

— |

|

|

|

(531 |

) |

|

|

(157 |

) |

|

|

— |

|

| Selected items, net of

tax |

$ |

984 |

|

|

$ |

— |

|

|

$ |

(1,337 |

) |

|

$ |

(343 |

) |

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As Adjusted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss), excluding

selected items(2) |

$ |

(841 |

) |

|

$ |

1,082 |

|

|

$ |

728 |

|

|

$ |

(103 |

) |

|

$ |

2,556 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Undistributed earnings

allocated to unvested restricted stock |

|

(100 |

) |

|

|

(24 |

) |

|

|

(14 |

) |

|

|

(178 |

) |

|

|

(51 |

) |

| Net income (loss), excluding

selected items for earnings per share calculation |

$ |

(941 |

) |

|

$ |

1,058 |

|

|

$ |

714 |

|

|

$ |

(281 |

) |

|

$ |

2,505 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common

share — Basic, as reported |

$ |

(0.06 |

) |

|

$ |

0.03 |

|

|

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

0.08 |

|

| Impact of selected items |

|

0.03 |

|

|

|

— |

|

|

|

(0.04 |

) |

|

|

(0.01 |

) |

|

|

— |

|

| Net income (loss) per common

share — Basic, excluding selected items(2) |

$ |

(0.03 |

) |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common

share — Diluted, as reported |

$ |

(0.06 |

) |

|

$ |

0.03 |

|

|

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

0.08 |

|

| Impact of selected items |

|

0.03 |

|

|

|

— |

|

|

|

(0.04 |

) |

|

|

(0.01 |

) |

|

|

— |

|

| Net income (loss) per common

share — Diluted, excluding selected items(2)(3) |

$ |

(0.03 |

) |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ________________________________ |

| (1) The tax impact for the three months

ended December 31, 2024 and September 30, 2024, is represented

using estimated tax rates of 28.0% and 28.4%, respectively. The tax

impact for the six months ended December 31, 2024 is represented

using estimated tax rates of 31.4%. |

| (2) Net income (loss) and earnings per

share excluding selected items are non-GAAP financial measures

presented as supplemental financial measures to enable a user of

the financial information to understand the impact of these items

on reported results. These financial measures should not be

considered an alternative to net income (loss), operating income

(loss), cash flows provided by (used in) operating activities, or

any other measure of financial performance or liquidity presented

in accordance with U.S. GAAP. Our Adjusted Net Income (Loss) and

earnings per share may not be comparable to similarly titled

measures of another company because all companies may not calculate

Adjusted Net Income (Loss) and earnings per share in the same

manner. |

| (3) The impact of selected items for

the three months ended December 31, 2024, and 2023, were each

calculated based upon weighted average diluted shares of 32.9

million, due to the net income (loss), excluding selected items.

The impact of selected items for the three months ended September

30, 2024, was calculated based upon weighted average diluted shares

of 32.9 million due to the net income (loss), excluding selected

items. The impact of selected items for the six months ended

December 31, 2024, and 2023, was each calculated based upon

weighted average diluted shares of 32.8 million and 32.9 million,

respectively, due to the net income (loss), excluding selected

items. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evolution Petroleum Corporation |

|

Supplemental Information on Oil and Natural Gas Operations

(Unaudited) |

|

(In thousands, except per unit and per BOE

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, |

|

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil |

$ |

11,763 |

|

$ |

11,759 |

|

$ |

14,737 |

|

$ |

26,500 |

|

$ |

24,375 |

| Natural gas |

|

5,793 |

|

|

6,531 |

|

|

4,285 |

|

|

10,078 |

|

|

12,083 |

| Natural gas liquids |

|

2,719 |

|

|

2,734 |

|

|

2,874 |

|

|

5,593 |

|

|

5,167 |

| Total revenues |

$ |

20,275 |

|

$ |

21,024 |

|

$ |

21,896 |

|

$ |

42,171 |

|

$ |

41,625 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease operating

costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ad valorem and production

taxes |

$ |

1,441 |

|

$ |

1,272 |

|

$ |

1,414 |

|

$ |

2,855 |

|

$ |

2,550 |

| Gathering, transportation, and

other costs |

|

2,889 |

|

|

2,496 |

|

|

2,790 |

|

|

5,679 |

|

|

4,399 |

| Other lease operating

costs |

|

8,463 |

|

|

8,590 |

|

|

7,586 |

|

|

16,049 |

|

|

17,292 |

| Total lease operating

costs |

$ |

12,793 |

|

$ |

12,358 |

|

$ |

11,790 |

|

$ |

24,583 |

|

$ |

24,241 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depletion of full cost proved

oil and natural gas properties |

$ |

5,024 |

|

$ |

4,238 |

|

$ |

5,325 |

|

$ |

10,349 |

|

$ |

8,148 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil (MBBL) |

|

179 |

|

|

159 |

|

|

204 |

|

|

383 |

|

|

320 |

| Natural gas (MMCF) |

|

2,125 |

|

|

1,951 |

|

|

2,228 |

|

|

4,353 |

|

|

3,976 |

| Natural gas liquids

(MBBL) |

|

105 |

|

|

96 |

|

|

113 |

|

|

218 |

|

|

191 |

| Equivalent (MBOE)(1) |

|

638 |

|

|

580 |

|

|

688 |

|

|

1,327 |

|

|

1,174 |

| Average daily production

(BOEPD)(1) |

|

6,935 |

|

|

6,304 |

|

|

7,478 |

|

|

7,212 |

|

|

6,380 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average price per

unit:(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil (BBL) |

$ |

65.72 |

|

$ |

73.96 |

|

$ |

72.24 |

|

$ |

69.19 |

|

$ |

76.17 |

| Natural gas (MCF) |

|

2.73 |

|

|

3.35 |

|

|

1.92 |

|

|

2.32 |

|

|

3.04 |

| Natural Gas Liquids (BBL) |

|

25.90 |

|

|

28.48 |

|

|

25.43 |

|

|

25.66 |

|

|

27.05 |

| Equivalent (BOE)(1) |

$ |

31.78 |

|

$ |

36.25 |

|

$ |

31.83 |

|

$ |

31.78 |

|

$ |

35.46 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average cost per

unit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ad valorem and production

taxes |

$ |

2.26 |

|

$ |

2.19 |

|

$ |

2.06 |

|

$ |

2.15 |

|

$ |

2.17 |

| Gathering, transportation, and

other costs |

|

4.53 |

|

|

4.30 |

|

|

4.06 |

|

|

4.28 |

|

|

3.75 |

| Other lease operating

costs |

|

13.26 |

|

|

14.81 |

|

|

11.03 |

|

|

12.09 |

|

|

14.73 |

| Total lease operating

costs |

$ |

20.05 |

|

$ |

21.30 |

|

$ |

17.15 |

|

$ |

18.52 |

|

$ |

20.65 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depletion of full cost proved

oil and natural gas properties |

$ |

7.87 |

|

$ |

7.31 |

|

$ |

7.74 |

|

$ |

7.80 |

|

$ |

6.94 |

|

_______________________________ |

|

(1) Equivalent oil reserves are defined as six MCF of

natural gas and 42 gallons of NGLs to one barrel of oil conversion

ratio, which reflects energy equivalence and not price equivalence.

Natural gas prices per MCF and NGL prices per barrel often differ

significantly from the equivalent amount of oil. |

|

(2) Amounts exclude the impact of cash paid or received

on the settlement of derivative contracts since we did not elect to

apply hedge accounting. |

| |

|

Evolution Petroleum Corporation |

|

Summary of Production Volumes and Average Sales Price

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

December 31, |

|

September 30, |

| |

2024 |

|

2023 |

|

2024 |

| |

Volume |

|

Price |

|

Volume |

|

Price |

|

Volume |

|

Price |

| Production: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (MBBL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCOOP/STACK |

|

35 |

|

$ |

70.52 |

|

|

— |

|

$ |

— |

|

|

49 |

|

$ |

75.38 |

|

Chaveroo Field |

|

9 |

|

|

67.55 |

|

|

— |

|

|

— |

|

|

16 |

|

|

73.69 |

|

Jonah Field |

|

7 |

|

|

64.54 |

|

|

8 |

|

|

80.25 |

|

|

7 |

|

|

65.77 |

|

Williston Basin |

|

30 |

|

|

64.64 |

|

|

35 |

|

|

71.71 |

|

|

33 |

|

|

68.87 |

|

Barnett Shale |

|

2 |

|

|

65.99 |

|

|

2 |

|

|

76.77 |

|

|

2 |

|

|

70.30 |

|

Hamilton Dome Field |

|

35 |

|

|

57.53 |

|

|

36 |

|

|

62.03 |

|

|

35 |

|

|

62.37 |

|

Delhi Field |

|

60 |

|

|

68.66 |

|

|

78 |

|

|

79.02 |

|

|

61 |

|

|

77.22 |

|

Other |

|

1 |

|

|

71.61 |

|

|

— |

|

|

— |

|

|

1 |

|

|

78.32 |

|

Total |

|

179 |

|

$ |

65.72 |

|

|

159 |

|

$ |

73.96 |

|

|

204 |

|

$ |

72.24 |

| Natural gas (MMCF) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCOOP/STACK |

|

314 |

|

$ |

2.89 |

|

|

— |

|

$ |

— |

|

|

354 |

|

$ |

2.48 |

|

Chaveroo Field |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Jonah Field |

|

803 |

|

|

3.21 |

|

|

883 |

|

|

4.87 |

|

|

830 |

|

|

2.08 |

|

Williston Basin |

|

18 |

|

|

1.41 |

|

|

14 |

|

|

1.91 |

|

|

27 |

|

|

1.43 |

|

Barnett Shale |

|

990 |

|

|

2.31 |

|

|

1,054 |

|

|

2.10 |

|

|

1,017 |

|

|

1.62 |

|

Total |

|

2,125 |

|

$ |

2.73 |

|

|

1,951 |

|

$ |

3.35 |

|

|

2,228 |

|

$ |

1.92 |

| Natural gas liquids (MBBL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCOOP/STACK |

|

18 |

|

$ |

21.34 |

|

|

— |

|

$ |

— |

|

|

19 |

|

$ |

21.67 |

|

Chaveroo Field |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Jonah Field |

|

9 |

|

|

30.08 |

|

|

10 |

|

|

25.88 |

|

|

9 |

|

|

28.15 |

|

Williston Basin |

|

2 |

|

|

17.86 |

|

|

4 |

|

|

20.41 |

|

|

7 |

|

|

17.93 |

|

Barnett Shale |

|

57 |

|

|

25.86 |

|

|

60 |

|

|

30.07 |

|

|

56 |

|

|

26.03 |

|

Delhi Field |

|

19 |

|

|

29.13 |

|

|

22 |

|

|

26.90 |

|

|

20 |

|

|

29.48 |

|

Other |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2 |

|

|

13.06 |

|

Total |

|

105 |

|

$ |

25.90 |

|

|

96 |

|

$ |

28.48 |

|

|

113 |

|

$ |

25.43 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent (MBOE)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCOOP/STACK |

|

105 |

|

$ |

35.48 |

|

|

— |

|

$ |

— |

|

|

127 |

|

$ |

39.20 |

|

Chaveroo Field |

|

9 |

|

|

67.55 |

|

|

— |

|

|

— |

|

|

16 |

|

|

73.69 |

|

Jonah Field |

|

150 |

|

|

22.14 |

|

|

165 |

|

|

31.60 |

|

|

154 |

|

|

15.85 |

|

Williston Basin |

|

35 |

|

|

57.00 |

|

|

41 |

|

|

63.22 |

|

|

45 |

|

|

54.62 |

|

Barnett Shale |

|

224 |

|

|

17.29 |

|

|

238 |

|

|

17.61 |

|

|

227 |

|

|

14.21 |

|

Hamilton Dome Field |

|

35 |

|

|

57.53 |

|

|

36 |

|

|

62.03 |

|

|

35 |

|

|

62.37 |

|

Delhi Field |

|

79 |

|

|

59.37 |

|

|

100 |

|

|

67.63 |

|

|

81 |

|

|

65.28 |

|

Other |

|

1 |

|

|

71.61 |

|

|

— |

|

|

— |

|

|

3 |

|

|

61.15 |

|

Total |

|

638 |

|

$ |

31.78 |

|

|

580 |

|

$ |

36.25 |

|

|

688 |

|

$ |

31.83 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average daily production

(BOEPD)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCOOP/STACK |

|

1,141 |

|

|

|

|

|

— |

|

|

|

|

|

1,380 |

|

|

|

|

Chaveroo Field |

|

98 |

|

|

|

|

|

— |

|

|

|

|

|

174 |

|

|

|

|

Jonah Field |

|

1,630 |

|

|

|

|

|

1,793 |

|

|

|

|

|

1,674 |

|

|

|

|

Williston Basin |

|

380 |

|

|

|

|

|

446 |

|

|

|

|

|

489 |

|

|

|

|

Barnett Shale |

|

2,435 |

|

|

|

|

|

2,587 |

|

|

|

|

|

2,467 |

|

|

|

|

Hamilton Dome Field |

|

380 |

|

|

|

|

|

391 |

|

|

|

|

|

380 |

|

|

|

|

Delhi Field |

|

859 |

|

|

|

|

|

1,087 |

|

|

|

|

|

880 |

|

|

|

|

Other |

|

12 |

|

|

|

|

|

— |

|

|

|

|

|

34 |

|

|

|

|

Total |

|

6,935 |

|

|

|

|

|

6,304 |

|

|

|

|

|

7,478 |

|

|

|

|

_____________________________ |

|

(1) Equivalent oil reserves are defined as six MCF

of natural gas and 42 gallons of NGLs to one barrel of oil

conversion ratio, which reflects energy equivalence and not price

equivalence. Natural gas prices per MCF and NGL prices per barrel

often differ significantly from the equivalent amount of oil. |

| |

|

Evolution Petroleum Corporation |

|

Summary of Average Production Costs

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

December 31, |

|

September 30, |

| |

2024 |

|

2023 |

|

2024 |

| |

Amount |

|

Price |

|

Amount |

|

Price |

|

Amount |

|

Price |

| Production costs (in

thousands, except per BOE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease operating costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCOOP/STACK |

$ |

1,050 |

|

$ |

9.97 |

|

$ |

— |

|

$ |

— |

|

$ |

1,156 |

|

$ |

9.10 |

|

Chaveroo Field |

|

122 |

|

|

12.92 |

|

|

— |

|

|

— |

|

|

118 |

|

|

7.38 |

|

Jonah Field |

|

2,196 |

|

|

14.62 |

|

|

2,392 |

|

|

14.45 |

|

|

2,162 |

|

|

13.95 |

|

Williston Basin |

|

1,190 |

|

|

34.12 |

|

|

1,205 |

|

|

28.74 |

|

|

1,238 |

|

|

27.51 |

|

Barnett Shale |

|

4,030 |

|

|

18.03 |

|

|

3,883 |

|

|

16.31 |

|

|

3,598 |

|

|

15.83 |

|

Hamilton Dome Field |

|

1,188 |

|

|

34.18 |

|

|

1,404 |

|

|

39.43 |

|

|

1,531 |

|

|

43.48 |

|

Delhi Field |

|

3,017 |

|

|

38.15 |

|

|

3,474 |

|

|

35.00 |

|

|

1,987 |

|

|

24.30 |

|

Total |

$ |

12,793 |

|

$ |

20.05 |

|

$ |

12,358 |

|

$ |

21.30 |

|

$ |

11,790 |

|

$ |

17.15 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evolution Petroleum

CorporationSummary of Open Derivative Contracts

(Unaudited)

For more information on the Company's hedging

practices, see Note 7 to its financial statements included on Form

10-Q filed with the SEC for the quarter ended December 31,

2024.

The Company had the following open crude oil and

natural gas derivative contracts as of February 11, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Volumes in |

|

Swap Price per |

|

Floor Price per |

|

Ceiling Price per |

|

Period |

|

Commodity |

|

Instrument |

|

MMBTU/BBL |

|

MMBTU/BBL |

|

MMBTU/BBL |

|

MMBTU/BBL |

|

January 2025 - March 2025 |

|

Crude Oil |

|

Collar |

|

42,566 |

|

|

|

|

$ |

68.00 |

|

$ |

73.77 |

|

January 2025 - June 2025 |

|

Crude Oil |

|

Fixed-Price Swap |

|

51,992 |

|

$ |

73.49 |

|

|

|

|

|

|

|

February 2025 - March 2025 |

|

Crude Oil |

|

Put |

|

3,277 |

|

|

|

|

|

75.00 |

|

|

|

|

February 2025 - March 2025 |

|

Crude Oil |

|

Fixed-Price Swap |

|

3,278 |

|

|

71.02 |

|

|

|

|

|

|

|

April 2025 - June 2025 |

|

Crude Oil |

|

Collar |

|

41,601 |

|

|

|

|

|

65.00 |

|

|

84.00 |

|

April 2025 - December 2025 |

|

Crude Oil |

|

Fixed-Price Swap |

|

32,229 |

|

|

72.00 |

|

|

|

|

|

|

|

July 2025 - December 2025 |

|

Crude Oil |

|

Fixed-Price Swap |

|

81,335 |

|

|

71.40 |

|

|

|

|

|

|

|

January 2026 - March 2026 |

|

Crude Oil |

|

Collar |

|

43,493 |

|

|

|

|

|

60.00 |

|

|

75.80 |

|

January 2025 - February 2025 |

|

Natural Gas |

|

Fixed-Price Swap |

|

312,286 |

|

|

3.56 |

|

|

|

|

|

|

|

January 2025 - March 2025 |

|

Natural Gas |

|

Basis Swap |

|

305,607 |

|

|

0.66 |

|

|

|

|

|

|

|

March 2025 - December 2026 |

|

Natural Gas |

|

Fixed-Price Swap |

|

3,170,705 |

|

|

3.60 |

|

|

|

|

|

|

|

January 2026 - March 2026 |

|

Natural Gas |

|

Collar |

|

375,481 |

|

|

|

|

|

3.60 |

|

|

5.00 |

|

April 2025 - December 2027 |

|

Natural Gas |

|

Fixed-Price Swap |

|

3,729,540 |

|

|

3.57 |

|

|

|

|

|

|

This press release was published by a CLEAR® Verified

individual.

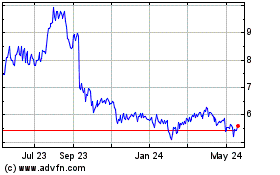

Evolution Petroleum (AMEX:EPM)

Historical Stock Chart

From Feb 2025 to Mar 2025

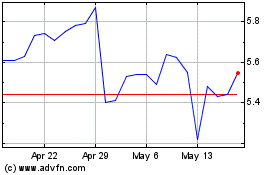

Evolution Petroleum (AMEX:EPM)

Historical Stock Chart

From Mar 2024 to Mar 2025