Know Labs, Inc. (NYSE American: KNW), an emerging developer of

non-invasive medical diagnostic technology, today reported

financial results for the fourth quarter and fiscal year ended

September 30, 2023.

Financial Highlights:

- Know Labs reported a net loss of $15.29 million dollars in

FY2023, compared to a net loss of $20.07 million dollars in FY2022,

a reduction in net loss of 23.8%. This translates to Earnings Per

Share of a loss of $0.41, better than FY2022 Earnings Per Share

Loss of $0.50, an improvement of 18%, before preferred stock

dividends.

- In FY2023, recorded a non-cash charge to earnings of $4.77

million principally related to the fair market value of dividends

on our Series C and D preferred stock in the amount of $2.96

million, that were either paid or accrued in shares of common

stock, and the remaining $1.81 million non-cash charge comprised of

$310,000 in depreciation & amortization, $550,000 loss on the

sale of assets, $507,000 loss on debt extinguishment, $350,000 from

the modification of notes and warrants and $142,000 from the

amortization of operating lease right of use during FY 2023.

- Research and development expense for FY2023 was $7.73 million

dollars as compared to $5.39 million dollars in FY2022, an increase

of 43.5% year over year. The increase in R&D expense was

related to increases in engineering, third-party technical

services, and expenditures related to the development of our

Generation 1 device, which we completed and announced on June 7th,

as we continue to execute our path to FDA clinical trials and

commercialization.

- Selling, general and administrative expenses for FY2023 was

$6.57 million, which was lower by $1.55 million than the $8.12

million dollars in FY 2022, an improvement of 19.1%, as we continue

our initiatives to reduce our cash burn.

- As of September 30, 2023, we had cash and cash equivalents of

$8.02 million dollars, as compared to $12.59 million at the end of

September 30, 2022. Net cash used in operations for FY2023 was

$10.35 million dollars compared with $6.92 million in the prior

year.

- During the year ended September 30, 2023, the Company made

adjustments to its fixed expenses and the impact of those

adjustments has significantly reduced our monthly burn rate. Given

the significant reduction in fixed expenses, the Company believes

that it has enough available cash and flexibility with its

operating expenses to operate until at least June 30, 2024. As we

have stated in our FY 2023 10-K, we expect to raise additional

funds through the issuance of equity, preferred stock and

convertible debentures.

- Shareholder equity for the fiscal year 2023 was $3.74 million

versus $9.86 million in fiscal year 2022.

Income Statement:

KNOW LABS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

Years Ended, September 30, 2023 September 30, 2022

REVENUE- DIGITAL ASSET SALES $

-

$

4,360,087

OPERATING EXPENSES- RESEARCH AND DEVELOPMENT EXPENSES

7,727,467

5,385,586

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

6,570,597

8,118,137

SELLING AND TRANSACTIONAL COSTS FOR DIGITAL ASSETS

(274,019

)

3,430,438

Total operating expenses

14,024,045

16,934,161

OPERATING LOSS

(14,024,045

)

(12,574,074

)

OTHER INCOME (EXPENSE), NET Interest income

127,145

15,283

Interest expense

(389,626

)

(8,034,081

)

Loss on debt extinguishment

(506,865

)

-

Other (expense) income, net

(495,776

)

521,628

Total other (expense), net

(1,265,122

)

(7,497,170

)

LOSS BEFORE INCOME TAXES

(15,289,167

)

(20,071,244

)

Income tax expense

-

-

NET LOSS

(15,289,167

)

(20,071,244

)

Common stock dividends on Series D Preferred Stock

(1,627,230

)

-

Deemed dividends on Series C and D Preferred Stock

(3,526,653

)

-

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS $

(20,443,050

)

$

(20,071,244

)

Basic and diluted loss per share $

(0.41

)

$

(0.50

)

Weighted average shares of common stock outstanding- basic

and diluted

49,581,467

40,370,473

Balance Sheet:

KNOW LABS, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

September 30, 2023 September 30, 2022

ASSETS

CURRENT ASSETS: Cash and cash equivalents $

8,023,716

$

12,593,692

Total current assets

8,023,716

12,593,692

PROPERTY AND EQUIPMENT, NET

81,325

862,977

OTHER ASSETS Other assets

15,766

13,767

Operating lease right-of-use asset

145,090

287,930

TOTAL ASSETS $

8,265,897

$

13,758,366

LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT

LIABILITIES: Accounts payable - trade $

1,292,861

$

526,968

Accrued expenses

94,062

462,940

Accrued expenses - related parties

218,334

348,264

Convertible notes payable, net

2,761,931

2,255,066

Current portion of operating lease right-of-use liability

154,797

215,397

Total current liabilities

4,521,985

3,808,635

NON-CURRENT LIABILITIES: Operating lease right-of-use

liability, net of current portion

-

87,118

Total non-current liabilities

-

87,118

COMMITMENTS AND CONTINGENCIES (Note 11)

-

-

STOCKHOLDERS' EQUITY Preferred stock - $0.001 par value,

5,000,000 shares authorized, Series C and D shares issued and

outstanding as follows: Series C Convertible Preferred stock $0.001

par value, 30,000 shares authorized, 17,858 shares issued and

outstanding at 9/30/2023 and 9/30/2022, respectively

1,790

1,790

Series D Convertible Preferred stock $0.001 par value, 20,000

shares authorized, 10,161 shares issued and outstanding at

9/30/2023 and 9/30/2022, respectively

1,015

1,015

Common stock - $0.001 par value, 200,000,000 shares authorized,

80,358,463 and 48,156,062 shares issued and outstanding at

9/30/2023 and 9/30/2022, respectively

80,358

48,158

Additional paid in capital

125,501,537

111,209,388

Accumulated deficit

(121,840,788

)

(101,397,738

)

Total stockholders' equity

3,743,912

9,862,613

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $

8,265,897

$

13,758,366

Cash Flow:

KNOWLABS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

Years Ended, September 30, 2023 September 30, 2022 CASH

FLOWS FROM OPERATING ACTIVITIES: Net loss $

(15,289,167

)

$

(20,071,244

)

Adjustments to reconcile net loss to net cash (used in) operating

activities Depreciation and amortization

313,019

320,995

Issuance of common stock for services

-

183,000

Issuance of common stock warrants for services

-

451,487

Gain on debt settlement

(50,000

)

(268,872

)

Loss on disposal of property and equipment

549,431

-

Loss on debt extinguishment

506,865

-

Modification of notes and warrants - interest expense

349,721

-

Stock based compensation- stock option grants

2,955,933

4,421,634

Gain on forgiveness of notes payable-PPP Loans

-

(252,700

)

Amortization of operating lease right-of-use asset

142,840

35,963

Amortization of debt discount to interest expense

-

7,272,911

Changes in operating assets and liabilities: Other long-term assets

(1,999

)

-

Operating lease right-of-use liability

(147,719

)

(22,917

)

Accounts payable - trade and accrued expenses

317,085

1,009,935

NET CASH (USED IN) OPERATING ACTIVITIES

(10,353,991

)

(6,919,808

)

CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of property

and equipment

(80,797

)

(855,468

)

NET CASH (USED IN) INVESTING ACTIVITIES:

(80,797

)

(855,468

)

CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from

isssuance of common stock for NYSE uplisting

-

8,280,000

Proceeds from issuance of common stock offering, net

5,472,791

-

Payments for stock for NYSE uplisting

-

(855,321

)

Settlement of notes payable-PPP loans

-

(179,103

)

Proceeds from issuance of common stock for stock options exercise

4,687

26,687

Proceeds from issuance of common stock for warrant exercise

387,334

838,487

NET CASH PROVIDED BY FINANCING ACTIVITIES

5,864,812

8,110,750

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS

(4,569,976

)

335,474

CASH AND CASH EQUIVALENTS, beginning of period

12,593,692

12,258,218

CASH AND CASH EQUIVALENTS, end of period $

8,023,716

$

12,593,692

Supplemental disclosures of cash flow information: Interest

paid $

-

$

-

Taxes paid $

-

$

-

Supplemental disclosure of non-cash financing activity:

Conversion of debt $

-

$

14,209,000

Conversion of accrued interest $

-

$

1,136,720

Common stock dividends on Series D Preferred Stock $

1,627,230

$

-

Deemed dividends on Series C and D Preferred Stock $

3,526,653

$

-

Issuance costs from common stock offering $

1,527,209

$

-

Conference Call:

Know Labs will host an audio webcast to discuss its results and

provide a business update today, December 19, 2023, at 4:30pm ET

(1:30 pm PT). The live webcast will be available on the Investors

page of the Company’s website, www.knowlabs.co/investors, and a

replay will be available for six months.

Participant Dial-In: 877-514-3621 / +1 215-268-9856 Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=MtMDMZ5d

A copy of the form 10-K filed with the SEC can also be

downloaded from the Company’s website. All holders, including

stockholders and bondholders, can request and receive a hard copy

of the complete audited financial statements free of charge.

Requests must be submitted to ask@knowlabs.co.

About Know Labs, Inc.

Know Labs, Inc. is a public company whose shares trade on the

NYSE American Exchange under the stock symbol “KNW.” The Company’s

platform technology uses spectroscopy to direct electromagnetic

energy through a substance or material to capture a unique

molecular signature. The technology can be integrated into a

variety of wearable, mobile or bench-top form factors. This

patented and patent-pending technology makes it possible to

effectively identify and monitor analytes that could only

previously be performed by invasive and/or expensive and

time-consuming lab-based tests. The first application of the

technology will be in a product marketed as a non-invasive glucose

monitor. The device will provide the user with accessible and

affordable real-time information on blood glucose levels. This

product will require U.S. Food and Drug Administration clearance

prior to its introduction to the market.

Safe Harbor Statement

This release contains statements that constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. These statements appear in a number of places in this

release and include all statements that are not statements of

historical fact regarding the intent, belief or current

expectations of Know Labs, Inc., its directors or its officers with

respect to, among other things: (i) financing plans; (ii) trends

affecting its financial condition or results of operations; (iii)

growth strategy and operating strategy; and (iv) performance of

products. You can identify these statements by the use of the words

“may,” “will,” “could,” “should,” “would,” “plans,” “expects,”

“anticipates,” “continue,” “estimate,” “project,” “intend,”

“likely,” “forecast,” “probable,” “potential,” and similar

expressions and variations thereof are intended to identify

forward-looking statements. Investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, many of which are beyond Know

Labs, Inc.’s ability to control, and actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors. These risks and uncertainties also

include such additional risk factors as are discussed in the

Company’s filings with the U.S. Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

September 30, 2023, Forms 10-Q and 8-K, and in other filings we

make with the Securities and Exchange Commission from time to time.

These documents are available on the SEC Filings section of the

Investor Relations section of our website at www.knowlabs.co. The

Company cautions readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date made.

The Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231219236136/en/

For Know Labs Media Inquiries: Matter Health Abby Mayo

Knowlabs@matternow.com Ph. (617) 272-0592

Know Labs, Inc.: Jordyn Hujar jordyn@knowlabs.co Ph.

(206) 629-6414

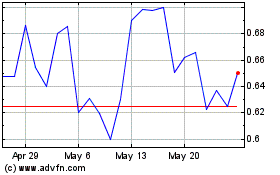

Know Labs (AMEX:KNW)

Historical Stock Chart

From Apr 2024 to May 2024

Know Labs (AMEX:KNW)

Historical Stock Chart

From May 2023 to May 2024