false000136929000013692902024-07-082024-07-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 8, 2024

Myomo, Inc.

(Exact Name of Company as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-38109 |

|

47-0944526 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

137 Portland St., 4th Floor Boston, MA |

|

02114 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Company’s telephone number, including area code: (617) 996-9058

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.0001 par value per share |

|

MYO |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 8, 2024, Myomo, Inc, (the "Company") announced preliminary revenues and operating metrics for the second quarter ended June 30, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Form 8-K (including Exhibit 99.1) is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

MYOMO, INC. |

|

|

|

|

Date: |

July 8, 2024 |

By: |

/s/ David A. Henry |

|

|

|

David A. Henry

Chief Financial Officer |

Myomo Reports Preliminary Second Quarter 2024 Revenues and Operating Metrics

Expects record quarterly revenues of $7.2 million to $7.4 million, an increase of 92% to 97% sequentially

Generates record pipeline additions, and authorizations and orders

BOSTON (July 8, 2024) – Myomo, Inc. (NYSE American: MYO) (“Myomo” or the “Company”), a wearable medical robotics company that offers increased functionality for those suffering from neurological disorders and upper-limb paralysis, reports preliminary revenues and operating metrics for the three months ended June 30, 2024.

Revenues for the second quarter of 2024 are expected to be $7.2 million to $7.4 million, the highest quarterly revenues in the Company’s history. This is up 92% to 97% over the first quarter of 2024, and compares with the Company’s previous expectation for second quarter revenues to be at least $5.0 million. Revenue units are expected to be between 155 and 160 in the second quarter of 2024, an increase of 70% to 76% compared with 91 revenue units in the first quarter of 2024. Payments during the second quarter from the Centers for Medicare & Medicaid Services (“CMS”) and certain Medicare Advantage plans reflected the fees published by CMS on April 1, 2024.

Pipeline additions, and authorizations and orders during the second quarter are expected to be approximately 550 and 210, respectively, each a record high.

“Payments from CMS were much faster than we had anticipated at the beginning of the quarter,” said Paul R. Gudonis, Myomo’s chairman and chief executive officer. “In addition, we expect to substantially meet our hiring objective for the first half of the year, as we exited the second quarter with nearly 150 employees. The added capacity in our clinical, reimbursement and manufacturing operations enabled us to evaluate a record number of patients and add them to our pipeline, generate a record number of authorizations and orders, and manufacture and deliver a record number of MyoPros.”

“With an established claims payment history from Medicare Part B beneficiaries, as of July 1, 2024, we began recording revenue for these patients upon product delivery,” added David Henry, Myomo’s chief financial officer.

Myomo expects to report full financial results and operating metrics for the three and six months ended June 30, 2024, as well as its expectations for third quarter and full year 2024 financial results, during the second week of August 2024.

About Myomo

Myomo, Inc. is a wearable medical robotics company that offers improved arm and hand function for those suffering from neurological disorders and upper-limb paralysis. Myomo develops and markets the MyoPro product line. MyoPro is a powered upper-limb orthosis designed to support the arm and restore function to the weakened or paralyzed arms of certain patients suffering from CVA stroke, brachial plexus injury, traumatic brain or spinal cord injury or other neuromuscular disease or injury. It is currently the only marketed device in the U.S. that, sensing a patient’s own EMG signals through non-invasive sensors on the arm, can restore an individual’s ability to perform activities of daily living, including feeding themselves, carrying objects and doing household tasks. Many are able to return to work, live independently and reduce their cost of care. Myomo is headquartered in Boston, Massachusetts, with sales and clinical professionals across the U.S. and representatives internationally. For more information, please visit www.myomo.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding the Company’s future business expectations, including expectations for second quarter 2024 revenue and revenue units, expectations for pipeline additions and authorizations and orders, expectations for headcount and its expectation to begin recording revenue for Medicare Part B patients at delivery effective July 1, 2024, which are subject to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors.

These factors include, among other things:

•our ability to obtain sufficient reimbursement from third-party payers for our products;

•our ability to navigate factors both within and outside our control to grow revenues sufficiently to achieve operating cash flow breakeven on a quarterly basis;

•our revenue concentration with a particular insurance payer as a result of focusing our efforts on patients with insurers who have previously reimbursed for the MyoPro;

•our ability to continue normal operations and patient interactions without supply chain disruption in order to deliver and fit our custom-fabricated devices;

•our marketing and commercialization efforts;

•our dependence upon external sources for the financing of our operations, to the extent that we do not achieve or maintain cash flow breakeven;

•our ability to obtain and maintain our strategic collaborations and to realize the intended results of such collaborations;

•our ability to effectively execute our business plan and scale up our operations;

•our expectations as to our product development programs, including improving our existing products and developing new products;

•our ability to maintain and grow our reputation and to achieve and maintain the market acceptance of our products;

•our expectations as to our clinical research program and clinical results;

•our ability to maintain adequate protection of our intellectual property and to avoid violation of the intellectual property rights of others;

•our ability to gain and maintain regulatory approvals;

•our ability to compete and succeed in a highly competitive and evolving industry; and

•general market, economic, environmental and social factors that may affect the evaluation, fitting, delivery and sale of our products to patients.

More information about these and other factors that potentially could affect our financial results is included in Myomo’s filings with the Securities and Exchange Commission, including those contained in the risk factors section of the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the Commission. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Although the forward-looking statements in this release of financial information are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material or adverse. The Company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Contacts:

For Myomo:

ir@myomo.com

Investor Relations:

Kim Sutton Golodetz

LHA Investor Relations

kgolodetz@lhai.com

212-838-3777

# # #

v3.24.2

Document And Entity Information

|

Jul. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 08, 2024

|

| Entity Registrant Name |

Myomo, Inc.

|

| Entity Central Index Key |

0001369290

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38109

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-0944526

|

| Entity Address, Address Line One |

137 Portland St.

|

| Entity Address, Address Line Two |

4th Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02114

|

| City Area Code |

617

|

| Local Phone Number |

996-9058

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

MYO

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

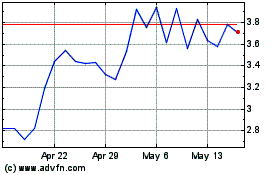

Myomo (AMEX:MYO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Myomo (AMEX:MYO)

Historical Stock Chart

From Jul 2023 to Jul 2024