UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024.

Commission File Number 001-31722

New Gold Inc.

Suite 3320 - 181 Bay Street

Toronto, Ontario M5J 2T3

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

NEW GOLD INC. |

| |

|

|

| |

By: |

/s/ Sean Keating |

|

| Date: February 8, 2024 |

|

Sean Keating |

| |

|

Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

NEW GOLD OUTLINES SIGNIFICANT FREE CASH FLOW

GENERATION PROFILE SUPPORTED BY IMPROVING PRODUCTION AND DECREASING COSTS OVER THE NEXT THREE YEARS

Provides Inaugural Three-Year Operational Outlook

and Updated Mineral Reserves and Resources

(All amounts are in U.S. dollars unless otherwise

indicated)

TORONTO, Feb. 8, 2024 /CNW/ - New Gold Inc. ("New

Gold" or the "Company") (TSX: NGD) (NYSE American: NGD) is pleased to provide its inaugural three-year operational

outlook and updated Mineral Reserve and Mineral Resources statement for the Company as of December 31, 2023. The Company will host a webcast

today at 12:30 pm Eastern Time to discuss these items (details are provided at the end of this news release). The Company uses certain

non-GAAP financial performance measures throughout this release. Please refer to the "Non-GAAP Financial Performance Measures"

section of this news release for more information. Numbered note references throughout this news release are to endnotes which can be

found at the end of this news release.

Increasing Production and Decreasing Costs Highlight

Strong Free Cash Flow Generation Over the Next Three Years

"With our inaugural presentation of three-year

guidance, the Company has clearly defined the path forward to significant free cash flow generation," stated Patrick Godin, President

and CEO. "This is underpinned by the work completed in recent years to prepare our operations for meaningful production and cash

flow increases, as costs and capital spend decrease."

- Consolidated gold production is expected to increase by approximately

35% from 2023 to 410,000 to 460,000 ounces in 2026 driven by increasing production profiles at both Rainy River and New Afton as growth

projects are completed in the near-term.

- Copper production is expected to increase by approximately 60%

from 2023 to 71 to 81 million pounds in 2026 driven by the steady ramp-up of C-Zone.

- All-in sustaining costs (on a by-product basis)1 are

expected to decrease by over 50% compared to the 2023 midpoint of guidance to between $650 and $750 per ounce in 2026, driven by higher

production at both operations, significant reduction in total capital, and lower operating costs as the C-Zone crusher and conveyor comes

online, and Rainy River completes Phase 4 waste removal and commences mining from the underground Main Zone.

- The higher production, lower costs, and lower capital spend over

the next three years are expected to drive significant free cash flow2 for the Company.

2024 to See Realization of Growth Projects, With

the Second Half to Highlight Free Cash Flow Generation Potential

"The Company is set to successfully complete

a number of key catalysts in 2024, including reaching commercial production at New Afton's C-Zone, and first ore from Rainy River's underground

Main Zone. Capital deployed in 2024, weighted to the first half of the year, will allow the Company to enter a sustained free cash flow

generation period. In fact, at current commodity prices New Gold is expected to generate approximately $75 million in free cash flow in

the second half of the year," added Mr. Godin.

- 2024 consolidated gold production is expected to be 310,000 to

350,000 ounces compared to 321,178 in 2023. Production is expected to strengthen in the second half of the year, with the second half

of 2024 expected to represent approximately 60% of annual production as waste stripping at Rainy River is sequenced in the first half

of the year.

- 2024 copper production is expected to be between 50 to 60 million

pounds, approximately 16% higher than 2023 driven by increased contribution from C-Zone at New Afton.

- 2024 total cash costs (on a by-product basis)1 are

expected to decrease by approximately 7% compared to the 2023 midpoint of guidance to between $725 and $825 per ounce driven by increased

production from both operations.

- 2024 all-in sustaining costs (on a by-product basis)1

are expected to decrease by approximately 10% compared to the 2023 midpoint of guidance to between $1,240 and $1,340 per ounce driven

by lower total cash costs, higher production from both operations and lower sustaining capital primarily related to waste stripping activities

at Rainy River.

- 2024 total capital is expected to be in-line with the 2023 guidance

range, as growth projects at both operations are brought online during the year.

Strategic Outlook Beyond 2026 Highlights Operational

Sustainability and Longevity, with Minimal Capital Investment

"Looking beyond our three-year guidance, the

Company has a strategic objective of targeting a sustainable production platform of approximately 600,000 gold equivalent ounces per year

with a line of sight until at least 2030. Following the successful execution of operational stabilization initiatives and growth projects

over the past two years, we are increasingly looking to unlock the long-term value of our operations. Based on Mineral Reserves alone,

Rainy River and New Afton have mine lives to 2031 and 2030, respectively, and modest conversion of Mineral Resources to Mineral Reserves

would not only extend mine lives but also improve the production profiles from 2027 to 2031 with minimal capital investment. The strategic

outlook demonstrates our confidence in the sustainability of our operations" added Mr. Godin.

- Rainy River successfully added 201,000 ounces of open pit and

underground gold Mineral Reserves, replacing 2023 depletion by 74%. Extension of open pit mining, with the inclusion of Phase 5, is expected

to maintain mill throughput near full capacity until at least 2030.

- Following a detailed optimization of the Rainy River underground

mining method, design and schedule, lateral development metres were reduced despite an increase in underground Mineral Reserves. As a

result, the underground ramp-up period is

de-risked and the steady-state underground production rate is expected to increase to 5,500 tpd beginning in 2027.

- Several high-quality open pit and underground exploration targets

were identified in 2023, including the extension of existing zones and potential new zones. From 2017 to 2022, minimal exploration drilling

was carried out at Rainy River, as the mine focused on ramping up production and stabilizing the operation. As such, several promising

targets remain untested. In 2024, exploration at Rainy River will focus on drilling several of these targets from both surface and underground.

- On October 10, 2023, the Company presented a strategic pipeline

for increasing the production profile and extending mine life at New Afton, including the evaluation of three promising opportunities

for conversion of Mineral Resources to Mineral Reserves: C-Zone Extension, East Extension, and D-Zone. As a result of infill drilling,

a portion of Inferred Mineral Resources were converted to Measured and Indicated Resources at year-end.

- Additionally, the Company reported encouraging drill results from

two potential new mining zones: K-Zone and AI-Southeast. Development of an exploration drift is now underway which is anticipated to provide

better access to drill these zones, speeding up exploration efforts. The first drill bay is expected to be operational by the second quarter

of 2024, with full completion of the drift scheduled in the third quarter.

- Following commissioning of the thickened and amended tailings

plant and in-pit tailings storage project in late 2022, New Afton has sufficient tailings capacity to double the remaining mine life with

minimal capital.

Three-Year Consolidated Operational Outlook

In 2024, the Company will report production on a gold

and copper basis. Operating expense will be reported on a co-product basis. Consolidated total cash costs1,4 and all-in sustaining

costs1,4 will be reported on a by product basis, net of by-product silver and copper sales. Given New Afton's significant copper

contribution, the mine will also report cash costs and all-in sustaining costs on a co-product basis, which removes the impact of copper

sales revenue and apportions cash costs and all-in sustaining costs to gold and copper activities, and subsequently divides the amount

by the total gold ounces or pounds of copper sold, as the case may be, to arrive at per ounce or per pound figures. The Company has assumed

$22.00 per silver ounce and $3.75 per copper pound, and a foreign exchange rate of $1.32 Canadian dollars to $1.00 US dollar in its three-year

outlook.

| Operational Estimates |

2024 Guidance |

2025 Guidance |

2026 Guidance |

| Gold production (ounces)2 |

310,000 – 350,000 |

360,000 – 410,000 |

410,000 – 460,000 |

| Copper production (M lbs) |

50 - 60 |

51 – 61 |

71– 81 |

| Operating expenses ($/oz gold, co-product) |

$965 - $1,065 |

$850 - $950 |

$750 - $850 |

| Operating expenses ($/lb copper, co-product) |

$1.90 – $2.40 |

$1.85 – $2.35 |

$1.50 – $2.00 |

| Cash costs per gold ounce sold (by-product)1 |

$725 - $825 |

$650 - $750 |

$400 - $500 |

All-in sustaining costs per gold ounce sold

(by-product)1 |

$1,240 - $1,340 |

$975 - $1,075 |

$650 - $750 |

| Capital Investment & Exploration Estimates |

2024 Guidance |

2025 Guidance |

2026 Guidance |

| Total capital ($M) |

$290 - $330 |

$190 - $220 |

$85 - $105 |

| Sustaining capital ($M)1 |

$115 - $130 |

$75 - $90 |

$55 - $70 |

| Growth capital ($M)1 |

$175 - $200 |

$115 - $130 |

$30 - $35 |

2024 Consolidated Outlook

Gold production2 is expected to be 310,000

to 350,000 ounces, approximately 3% higher than 2023 driven by increased underground production at Rainy River and the ongoing ramp-up

of C-Zone at New Afton. Production is expected to strengthen in the second half of the year, with the second half of 2024 expected to

represent approximately 60% of annual production as waste stripping at Rainy River is sequenced in the first half of the year. Copper

production is expected to be between 50 to 60 million pounds, approximately 16% higher than 2023 driven by increased contribution from

C-Zone at New Afton.

2024 total cash costs (on a by-product basis)1

are expected to decrease by approximately 7% compared to the 2023 midpoint of guidance to between $725 and $825 per ounce driven by increased

production from both operations. 2024 all-in sustaining costs (on a by-product basis)1 are expected to decrease by approximately

11% compared to the 2023 midpoint of guidance to between $1,240 and $1,340 per ounce driven by lower total cash costs and higher production

from both operations. Total cash costs (on a by-product basis)1 and all-in sustaining costs (on a by-product basis)1

are expected to decrease quarter-over-quarter throughout 2024 due to increasing production and a lower strip ratio at Rainy River in the

second half of 2024.

Total capital is expected to be $290 to $330 million,

of which, sustaining capital1 is expected to be $115 to $130 million, and growth capital1 is expected to be $175

to $200 million.

Sustaining capital1 is expected to be generally

in-line with the prior year, as 2023 sustaining capital spend was tracking to the low end of the guidance range through the first nine

months, as previously stated. The sustaining capital1 spend primarily relates to capital stripping activities at Rainy River

and tailings dam raises and maintenance. Sustaining capital1 is expected to trend lower through the second half of the year,

as stripping activities at Rainy River are prioritized in the first half of the year. The second half of 2024 expected to represent approximately

40% of the sustaining capital spend. Growth capital1 at New Afton relates to C-Zone development and commissioning of the crusher

and conveyor and at Rainy River relates to advancing underground development at the Intrepid and underground Main Zones. Growth capital1

is expected to be higher in the second half of the year as major projects near completion. The second half of 2024 is expected to represent

approximately 55% of the growth capital spend.

Exploration expenditures are expected to be $17 to

$22 million, an increase over the prior year, and are expected to focus on expanding the current Mineral Resources and Mineral Reserves

and defining new mining zones within the existing footprint of the Company's operations. A portion of the exploration expenditures is

also attributed to a regional program that targets the discovery of the next generation of porphyry copper-gold deposits in South-Central

British Columbia.

Rainy River Operational Outlook

| Operational Estimates |

2024 Guidance |

2025 Guidance |

2026 Guidance |

| Gold production (ounces)2 |

250,000 – 280,000 |

295,000 – 335,000 |

315,000 – 355,000 |

| Cash costs per gold ounce sold (by-product)1 |

$980 - $1,080 |

$875 - $975 |

$850 - $950 |

All-in sustaining costs per gold ounce sold

(by-product)1 |

$1,425 - $1,525 |

$1,150 - $1,250 |

$1,000 - $1,100 |

| Capital Investment & Exploration Estimates |

2024 Guidance |

2025 Guidance |

2026 Guidance |

| Total capital ($M) |

$145 - $165 |

$105 - $120 |

$75 - $90 |

| Sustaining capital ($M)1 |

$100 - $110 |

$70 - $80 |

$45 - $55 |

| Growth capital ($M)1 |

$45 - $55 |

$35 - $40 |

$30 - $35 |

2024 Rainy River Outlook

Gold production2 is expected to be 250,000

to 280,000 ounces, an increase of 4% over the prior year due to a modest increase in gold grade as the underground mining rate is expected

to increase. Production is expected to significantly strengthen in the second half of the year as waste stripping activities are sequenced

in the first half. The second half of 2024 is expected to represent approximately 60% of the annual production, with the fourth quarter

expected to represent approximately 35%. Initial production from the underground Main Zone remains on-track for the fourth quarter of

2024.

2024 total cash costs (on a by-product basis)1

are expected to be in-line with 2023. All-in sustaining costs (on a by-product basis)1 are expected to decrease by approximately

4% compared to the 2023 midpoint of guidance to $1,425 and $1,525 per ounce due higher production. Total cash costs (on a by-product basis)1

and all-in sustaining costs (on a by-product basis)1 are expected to decrease significantly on a quarterly basis throughout

2024 due to the processing of lower grades in the first half of the year while stripping activities are sequenced.

Total capital is expected to be $145 to $165 million.

Sustaining capital1 is expected to be $100 to $110 million, including approximately $50 million in capitalized waste ($25 million

of which was deferred from 2023), $25 million towards the annual tailings dam raise, $10 million in capital parts and components replacement

programs and $20 million related to equipment and other general sustaining capital. Growth capital1 is expected to be $45 to

$55 million, related to the continued development of the Intrepid and underground Main Zones. Sustaining capital1 is expected

to be heavily first half weighted and will trend lower in the second half of the year, with the second half of 2024 expected to represent

approximately 40% of the sustaining capital spend. Growth capital1 is expected to be second half weighted, as underground mine

development is increasing in the second half of the year. The second half of 2024 is expected to represent approximately 70% of the

growth capital spend.

Waste stripping activities are expected to significantly

decrease after the first half of 2024, priming Rainy River to enter a sustained free cash flow generating period.

2024 Rainy River Exploration Outlook

2024 exploration expenditures at Rainy River are expected

to be approximately $5 million. The program is expected to focus on converting Mineral Resources to Mineral Reserves, expanding current

ore zones and exploring for new mining zones within the Rainy River footprint.

Following the successful conversion of Phase 5 and

its addition to the open pit Mineral Reserves in 2023, the Company intends to continue testing other near-surface opportunities for open

pit extraction, including high-quality targets that were previously

de-prioritized during the construction and production ramp-up period. These targets include the Western Zone, North Target, 280 Zone,

and ODM East. Further extension of open pit mining could sustain operating the processing plant at full capacity beyond 2030.

The Company also intends to grow the underground Mineral

Resources and Mineral Reserves by targeting the down-plunge extension of current ore zones which remain open at depth, including ODM Main

and 17 East. Exploration is expected to be accelerated once underground development is operational and drilling from underground can commence.

Concurrently, the Company intends to utilize the new, underground connection drift to continue to explore for potential new zones, such

as the Gap zone located between the Intrepid and underground Main Zones.

Looking beyond the existing operational footprint,

the Company intends to follow up on the compilation of geochemical and geophysical data that was completed in 2023 to generate exploration

targets over the extensive Rainy River property. In 2024, soil and till geochemistry work will be carried out to generate targets, a proven

method that led to the discovery of the Rainy River deposit.

New Afton Operational Outlook

| Operational Estimates |

2024 Guidance |

2025 Guidance |

2026 Guidance |

| Gold production (ounces)2,3 |

60,000 – 70,000 |

65,000 – 75,000 |

95,000 – 105,000 |

| Copper production (Mlbs) |

50 – 60 |

51 – 61 |

71 – 81 |

| Cash costs per gold ounce sold (by-product)1 |

($300) – ($200) |

($400) – ($300) |

($1,050) – ($950) |

| Cash costs per gold ounce sold (co-product) 1 |

$800 - $900 |

$725 - $825 |

$500 - $600 |

| Cash costs per copper pound sold (co-product) 1 |

$2.15 - $2.65 |

$2.00 - $2.50 |

$1.35 - $1.85 |

All-in sustaining costs per gold ounce sold

(by-product) 1 |

$25 - $125 |

($275) – ($175) |

($900) – ($800) |

All-in sustaining costs per gold ounce sold

(co-product) 1 |

$895 - $995 |

$775 - $875 |

$550 - $650 |

All-in sustaining costs per copper pound sold

(co-product) 1 |

$2.40 - $2.90 |

$2.10 - $2.60 |

$1.65 - $2.15 |

| Capital Investment & Exploration Estimates |

2024 Guidance |

2025 Guidance |

2026 Guidance |

| Total capital ($M) |

$145 - $165 |

$85 - $100 |

$10 - $15 |

| Sustaining capital ($M) 1 |

$15 - $20 |

$5 - $10 |

$10 - $15 |

| Growth capital ($M) 1 |

$130 - $145 |

$80 - $90 |

$0 |

2024 New Afton Outlook

Gold production2,3 is expected to be 60,000

to 70,000 ounces, approximately 3% higher than 2023 (excluding gold produced from ore purchase agreements). Copper production is expected

to be 50 to 60 million pounds, approximately 16% higher than 2023. The increase in gold and copper production are a result of ongoing

steady-state production above design at B3, and the ramp-up of mining at C-Zone through the year. B3 is expected to average approximately

8,300 tpd in 2024. C-Zone commercial production remains on-track for the second half of 2024, and with a modest ramp-up through 2024 mill

throughput is expected to average 12,000 tpd by year-end. Gold and copper production is expected to be relatively constant on a quarterly

basis as a reduction in grade through the year is offset by increasing throughput as C-Zone ramps up.

Total cash costs (on a by-product basis)1

are expected to decrease compared to the 2023 midpoint of guidance to between ($300) and ($200) per ounce due to higher production. All-in

sustaining costs (on a by-product basis)1 are expected to decrease compared to the 2023 midpoint of guidance to between $25

and $125 per ounce due to lower total cash costs and higher production. Total cash costs1 and all-in sustaining costs1

are expected to decrease on a quarterly basis throughout 2024 as throughput increases as C-Zone ramps up.

Total capital is expected to be $145 to $165 million.

Sustaining capital1 is expected to be $15 to $20 million, including approximately $5 million related to tailings management

and $5 million related to equipment and the remainder related to other general sustaining capital. Growth capital1 is expected

to be $130 to $145 million related to the continued advancement of the C-Zone project, primarily focused on mine development, commissioning

of the crusher and conveyor and other infrastructure installation, and continued progress on stabilization. Growth capital1

is expected to be generally consistent throughout the year.

The ramp-up of mining at C-Zone through the year and

the completion of key development and infrastructure activities position New Afton to begin sustained free cash glow generation in the

second half of 2024.

2024 New Afton Exploration Outlook

2024 exploration expenditures at New Afton are expected

to be $12 to $17 million. New Afton continues to execute on its exploration strategy to extend the mine life beyond 2030. The Company

is currently evaluating three promising opportunities for potential Mineral Reserves conversion: C-Zone Extension, East Extension and

D-Zone. The opportunities at C-Zone and East Extension are well positioned to benefit from the C-Zone materials handling, ventilation

and dewatering infrastructure, thus reducing additional capital investment.

Exploration efforts in 2024 are expected to also focus

on potential new mine zones located above the C-Zone extraction level, which would provide opportunities to minimize capital investment

and maximize free cash flow generation. The Company has commenced development of a 370-metre exploration drift to accelerate underground

exploration drilling and provide ideal drill platforms for Mineral Resources and Mineral Reserves growth over the coming years. The first

drill bay of the exploration drift is expected to be operational in the second quarter of 2024, with full completion scheduled in the

third quarter, and is expected to prioritize the AI-Southeast and K-Zone targets.

The Company continues to advance a number of strategic

opportunities for mine life extension, both within the New Afton land package and regionally within South-Central British Columbia, leveraging

on New Afton's processing plant, infrastructure and tailings storage facility, which have sufficient capacity to process significantly

more ore beyond the current New Afton mine life.

2024 Sensitivities

A summary of key assumption sensitivities to all-in

sustaining costs1 can be found below:

| Sensitivities |

Copper Price |

CDN/USD |

Silver |

| Base Assumption |

$3.75 |

$1.32 |

$22.00 |

| Sensitivity |

+/- $0.25 |

+/- $0.05 |

+/- $1.00 |

| All-In Sustaining Cost Per Ounce Impact |

| Rainy River |

- |

+/- $50 |

+/- $5 |

| New Afton |

+/- $200 |

+/- $90 |

+/- $5 |

| Consolidated |

+/- $40 |

+/- $60 |

+/- $5 |

| |

|

|

|

|

|

Mineral Reserves and Mineral Resources (as at December

31, 2023)

As at December 31, 2023, New Gold is reporting Mineral

Reserves and Mineral Resources as summarized in the table below. Detailed Mineral Reserve and Mineral Resource tables follow at the end

of this press release.

| Mineral Reserves and Mineral Resources Summarya |

As at December 31, 2023b |

As at December 31, 2022 |

| Gold koz |

Silver koz |

Copper Mlbs |

Gold koz |

Silver koz |

Copper Mlbs |

| Proven and Probable Mineral Reserves |

| Rainy River |

2,421 |

6,343 |

- |

2,493 |

6,176 |

- |

| Open Pit |

867 |

1,947 |

- |

1,081 |

2,212 |

- |

| Underground |

1,322 |

3,161 |

- |

1,228 |

2,966 |

- |

| Low grade and stockpile |

233 |

1,235 |

- |

185 |

999 |

- |

| New Afton |

735 |

1,856 |

551 |

804 |

1,999 |

607 |

| Total Proven and Probable Mineral Reservesc |

3,156 |

8,199 |

551 |

3,297 |

8,176 |

607 |

| Measured and Indicated Mineral Resources (exclusive of Mineral Reserves)1 |

| Rainy River |

837 |

2,218 |

- |

1,501 |

3,627 |

- |

| Open Pit |

128 |

159 |

- |

127 |

161 |

- |

| Underground |

709 |

2,060 |

- |

1,374 |

3,466 |

- |

| New Afton |

1,350 |

5,093 |

1,147 |

1,222 |

4,495 |

1,035 |

| Total Measured and Indicated Mineral Resourcesc |

2,187 |

7,312 |

1,147 |

2,722 |

8,122 |

1,035 |

| Total Inferred Mineral Resourcesc |

230 |

563 |

101 |

375 |

782 |

135 |

|

a. Refer to the detailed Mineral

Reserve and Mineral Resource tables that follow at the end of this press release for the estimates as at December 31, 2023 and

the Company's Annual Information Form dated March 31, 2022 for estimates as at December 31, 2022.

b. The Mineral Reserves and Mineral

Resources stated above are as at December 31, 2023 and do not reflect any events subsequent to that date.

c. Numbers may not add due to rounding |

As of December 31, 2023, New Gold reported total Mineral

Reserves of 3,156,000 ounces of gold, 8.2 million ounces of silver, and 551 million pounds of copper. Measured and Indicated Mineral Resources,

exclusive of Mineral Reserves, totals 2,187,000 ounces of gold, 7.3 million ounces of silver and 1,147 million pounds of copper and Inferred

Mineral Resources of 230,000 ounces of gold, 563,000 ounces of silver and 101 million pounds of copper.

Rainy River successfully added new open pit and underground

Mineral Reserves in 2023, reporting a total of 2,421,000 ounces of gold, 74% replacement of mining depletion. In the open pit mine, Phase

5 is included in Mineral Reserves following an infill drilling campaign in 2023. Phase 5 is expected to add approximately one year to

the open pit mine life. Underground Mineral Reserves increased from 1,228,000 ounces of gold at the end of 2022 to 1,322,000 ounces of

gold at the end of 2023, more than offsetting depletion from underground mining.

New Afton reported Mineral Reserves of 735,000 ounces

of gold and 551 million pounds of copper in the B3 and C-Zone block caves, forming the basis for a reserves mine life to 2030. Mineral

Reserves reduced by 69,000 ounces of gold and 56 million pounds of copper in 2023 due to mining depletion. The Company is targeting to

replace a portion of mining depletion over the next few years, starting at the end of 2024, through extension of existing zones and inclusion

of new mining zones.

Operational Outlook Technical Session Webcast Details

The Company will host a Technical Session via webcast

today at 12:30 pm Eastern Time to discuss the operational outlook.

- Participants may listen to the webcast by registering on our website

at www.newgold.com or via the following link https://app.webinar.net/r8RX4Pl4PYA

- Participants may also listen to the conference call by calling

North American toll free 1-888-664-6383, or 1-416-764-8650 outside of the U.S. and Canada, passcode 41369885

- A recorded playback of the conference call will be available until

March 9, 2024 by calling North American toll free 1-888-390-0541, or 1-416-764-8677 outside of the U.S. and Canada, passcode 369885. An

archived webcast will also be available at www.newgold.com.

About New Gold

New Gold is a Canadian-focused

intermediate mining Company with a portfolio of two core producing assets in Canada, the Rainy River gold mine and the New Afton copper-gold

mine. The Company also holds Canadian-focused investments. New Gold's vision is to build a leading diversified intermediate gold company

based in Canada that is committed to the environment and social responsibility. For further information on the Company, visit www.newgold.com.

| Endnotes |

| 1. |

"Total cash costs", "all-in sustaining costs" (or "AISC"), "sustaining capital and sustaining leases", "growth capital", and "free cash flow" are all non-GAAP financial performance measures that are used in this news release. These measures do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For more information about these measures and, why they are used by the Company, see the "Non-GAAP Financial Performance Measures" section of this news release. |

| 2. |

Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 3. |

New Afton operational estimates are exclusive of any material from the ore purchase agreement. |

| 4. |

New Gold produces copper and silver as by-products of its gold production. The calculation of consolidated total cash costs and all-in sustaining costs per gold ounce is net of by-product silver and copper sales revenue. As a Company focused on gold production, New Gold aims to assess the economic results of its operations in relation to gold, which is the primary driver of New Gold's business. New Gold believes this metric is of interest to its investors, who invest in the Company primarily as a gold mining Company. To determine the relevant costs associated with gold only, New Gold believes it is appropriate to reflect all operating costs, as well as any revenue related to metals other than gold that are extracted in its operations. |

Non-GAAP Financial Performance Measures

Total Cash Costs per Gold ounce

"Total cash costs per gold ounce" is a non-GAAP

financial performance measure that is a common financial performance measure in the gold mining industry but does not have any standardized

meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. New Gold reports total cash costs

on a sales basis and not on a production basis. The Company believes that, in addition to conventional measures prepared in accordance

with IFRS, this measure, along with sales, is a key indicator of the Company's ability to generate operating earnings and cash flow from

its mining operations. This measure allows investors to better evaluate corporate performance and the Company's ability to generate liquidity

through operating cash flow to fund future capital exploration and working capital needs.

This measure is intended to provide additional information

only and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. This measure

is not necessarily indicative of cash generated from operations under IFRS or operating costs presented under IFRS.

Total cash cost figures are calculated in accordance

with a standard developed by The Gold Institute, a worldwide association of suppliers of gold and gold products that ceased operations

in 2002. Adoption of the standard is voluntary and the cost measures presented may not be comparable to other similarly titled measures

of other companies. Total cash costs include mine site operating costs such as mining, processing and administration costs, royalties,

and production taxes, but are exclusive of amortization, reclamation, capital and exploration costs.

In 2024, New Gold will start reporting total cash

costs on a by-product basis. The Company produces copper and silver as by-products of its gold production. Upon adoption of

the change in 2024, the calculation of total cash costs per gold ounce sold for Rainy River will be net of by-product silver sales revenue,

and the calculation of total cash costs per gold ounce sold for New Afton will be net of by-product silver and copper sales revenue.

New Gold notes that in connection with New Afton, the copper by-product revenue is sufficiently large to result in a negative total cash

cost on a single mine basis. Additionally, for New Afton, the Company will also report total cash costs on a co-product basis beginning

in 2024, which removes the impact of other metal sales that are produced as a by-product of gold production and apportions the cash costs

to each metal produced on a percentage of revenue basis, and subsequently divides the amount by the total gold ounces, or pounds of copper

sold, as the case may be, to arrive at per ounce or per pound figures. In 2024, New Gold will no longer report gold equivalent metrics.

New Gold will cease providing gold equivalent cash cost after 2023.

Notwithstanding the impact of copper and silver sales,

as the Company is focused on gold production, New Gold aims to assess the economic results of its operations in relation to gold, which

is the primary driver of New Gold's business. New Gold believes this metric is of interest to its investors, who invest in the Company

primarily as a gold mining business. To determine the relevant costs associated with gold ounces, New Gold believes it is appropriate

to reflect all operating costs incurred in its operations.

All-In Sustaining Costs per Gold ounce

"All-in sustaining costs per gold ounce"

is a non-GAAP financial performance measure that does not have any standardized meaning under IFRS and therefore may not be comparable

to similar measures presented by other issuers. New Gold calculates "all-in sustaining costs per gold ounce" based on guidance

announced by the World Gold Council ("WGC") in September 2013. The WGC is a non-profit association of the world's leading gold

mining companies established in 1987 to promote the use of gold to industry, consumers and investors. The WGC is not a regulatory body

and does not have the authority to develop accounting standards or disclosure requirements. The WGC has worked with its member companies

to develop a measure that expands on IFRS measures to provide visibility into the economics of a gold mining company. Current IFRS measures

used in the gold industry, such as operating expenses, do not capture all of the expenditures incurred to discover, develop and sustain

gold production. New Gold believes that "all-in sustaining costs per gold ounce" provides further transparency into costs associated

with producing gold and will assist analysts, investors, and other stakeholders of the Company in assessing its operating performance,

its ability to generate free cash flow from current operations and its overall value. In addition, the Human Resources and Compensation

Committee of the Board of Directors uses "all-in sustaining costs", together with other measures, in its Company scorecard to

set incentive compensation goals and assess performance.

"All-in sustaining costs per gold ounce"

is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to

similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance

prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs

presented under IFRS.

New Gold defines "all-in sustaining costs per

gold ounce" as the sum of total cash costs, capital expenditures that are sustaining in nature, corporate general and administrative

costs, capitalized and expensed exploration that is sustaining in nature, lease payments that are sustaining in nature, and environmental

reclamation costs, all divided by the total gold ounces sold to arrive at a per ounce figure. The definition of sustaining versus

non-sustaining is similarly applied to capitalized and expensed exploration costs and lease payments. Exploration costs and lease payments

to develop new operations or that relate to major projects at existing operations where these projects are expected to materially increase

production are classified as non-sustaining and are excluded.

In 2024 New Gold will start reporting all-in sustaining

costs on a by-product basis. The Company produces copper and silver as by-products of its gold production. Upon adoption of

the change in 2024, the calculation of all-in sustaining costs per gold ounce sold for Rainy River will be net of by-product silver sales

revenue, and the calculation of all-in sustaining costs per gold ounce sold for New Afton will be net of by-product silver and copper

sales revenue. New Gold notes that in connection with New Afton, the copper by-product revenue is sufficiently large to result in

a negative all-in sustaining cost on a single mine basis. Additionally, for New Afton, the Company will also report all-in sustaining

costs on a co-product basis, which removes the impact of other metal sales that are produced as a by-product of gold production and apportions

the cash costs to each metal produced on a percentage of revenue basis, and subsequently divides the amount by the total gold ounces,

or pounds of copper sold, as the case may be, to arrive at per ounce or per pound figures. New Gold will cease providing gold equivalent

all-in sustaining cost after 2023.

Costs excluded from all-in sustaining costs are non-sustaining

capital expenditures, non-sustaining lease payments and exploration costs, financing costs, tax expense, and transaction costs associated

with mergers, acquisitions and divestitures, and any items that are deducted for the purposes of adjusted earnings.

Sustaining Capital and Sustaining Leases

"Sustaining capital" and "sustaining

lease" are non-GAAP financial performance measures that do not have any standardized meaning under IFRS and therefore may not be

comparable to similar measures presented by other issuers. New Gold defines "sustaining capital" as net capital expenditures

that are intended to maintain operation of its gold producing assets. Similarly, a "sustaining lease" is a lease payment that

is sustaining in nature. To determine "sustaining capital" expenditures, New Gold uses cash flow related to mining interests

from its consolidated statement of cash flows and deducts any expenditures that are capital expenditures to develop new operations or

capital expenditures related to major projects at existing operations where these projects will materially increase production. Management

uses "sustaining capital" and "sustaining lease" to understand the aggregate net result of the drivers of all-in sustaining

costs other than total cash costs. These measures are intended to provide additional information only and should not be considered in

isolation or as substitutes for measures of performance prepared in accordance with IFRS.

Growth Capital

"Growth capital" is a non-GAAP financial

performance measure that does not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented

by other issuers. New Gold considers non-sustaining capital costs to be "growth capital", which are capital expenditures to

develop new operations or capital expenditures related to major projects at existing operations where these projects will materially increase

production. To determine "growth capital" expenditures, New Gold uses cash flow related to mining interests from its consolidated

statement of cash flows and deducts any expenditures that are capital expenditures that are intended to maintain operation of its gold

producing assets. Management uses "growth capital" to understand the cost to develop new operations or related to major projects

at existing operations where these projects will materially increase production. This measure is intended to provide additional information

only and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Free Cash Flow

"Free cash flow" is a non-GAAP financial

performance measure that does not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented

by other issuers. New Gold defines "free cash flow" as cash generated from operations and proceeds of sale of other assets less

capital expenditures on mining interests, lease payments, settlement of non-current derivative financial liabilities which include the

gold stream obligation and the Ontario Teachers' Pension Plan free cash flow interest. New Gold believes this non-GAAP financial performance

measure provides further transparency and assists analysts, investors and other stakeholders of the Company in assessing the Company's

ability to generate cash flow from current operations. "Free cash flow" is intended to provide additional information only and

should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. This measure is

not necessarily indicative of operating profit or cash flows from operations as determined under IFRS.

For additional information with respect to the non-GAAP

measures used by the Company, including a reconciliation to the most directly comparable measure under IFRS, refer to the detailed "Non-GAAP

Financial Performance Measure" section disclosure in the MD&A for the three months and nine-months ended September 30, 2023 filed

on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

MINERAL RESERVES AND MINERAL RESOURCES

New Gold's Mineral Reserve estimates as at December

31, 2023, are presented in the following table.

Mineral Reserves

| |

Tonnes

000s |

Grade |

Contained Metal |

Gold

g/t |

Silver

g/t |

Copper

% |

Gold

koz |

Silver

koz |

Copper

Mlb |

| RAINY RIVER |

| Open Pit |

|

|

|

|

|

|

|

| Proven |

5,100 |

1.11 |

2.06 |

- |

182 |

337 |

- |

| Probable |

22,937 |

0.93 |

2.18 |

- |

685 |

1,610 |

- |

| Proven & Probable |

28,037 |

0.96 |

2.16 |

- |

867 |

1,947 |

- |

| Underground |

|

|

|

|

|

|

|

| Proven |

- |

- |

- |

- |

- |

- |

- |

| Probable |

14,322 |

2.87 |

6.86 |

- |

1,322 |

3,161 |

- |

| Proven & Probable |

14,322 |

2.87 |

6.86 |

- |

1,322 |

3,161 |

- |

| Stockpile |

|

|

|

|

|

|

|

| Proven |

17,478 |

0.41 |

2.20 |

- |

233 |

1,235 |

- |

| Probable |

- |

- |

- |

- |

- |

- |

- |

| Proven & Probable |

17,478 |

0.41 |

2.20 |

- |

233 |

1,235 |

- |

| Total Rainy River |

|

|

|

|

|

|

|

| Proven |

22,578 |

0.57 |

2.17 |

- |

414 |

1,573 |

- |

| Probable |

37,259 |

1.67 |

3.98 |

- |

2,006 |

4,771 |

- |

| Proven & Probable |

59,837 |

1.26 |

3.30 |

- |

2,421 |

6,343 |

- |

| NEW AFTON |

| B3 |

|

|

|

|

|

|

|

| Proven |

- |

- |

- |

- |

- |

- |

- |

| Probable |

4,452 |

0.59 |

1.34 |

0.70 |

85 |

192 |

69 |

| Proven & Probable |

4,452 |

0.59 |

1.34 |

0.70 |

85 |

192 |

69 |

| C-Zone |

|

|

|

|

|

|

|

| Proven |

- |

- |

- |

- |

- |

- |

- |

| Probable |

29,635 |

0.68 |

1.75 |

0.74 |

650 |

1,664 |

482 |

| Proven & Probable |

29,635 |

0.68 |

1.75 |

0.74 |

650 |

1,664 |

482 |

| Total New Afton |

|

|

|

|

|

|

|

| Proven |

- |

- |

- |

- |

- |

- |

- |

| Probable |

34,087 |

0.67 |

1.69 |

0.73 |

735 |

1,856 |

551 |

| Proven & Probable |

34,087 |

0.67 |

1.69 |

0.73 |

735 |

1,856 |

551 |

| TOTAL NEW GOLD |

| Proven & Probable |

|

|

|

|

3,156 |

8,199 |

551 |

Notes to the Mineral Reserve and Mineral Resource

estimates are provided below.

MINERAL RESOURCES

New Gold's Mineral Resource estimates as at December

31, 2023, are presented in the following tables:

Mineral Resources (Exclusive of Mineral Reserves)

| |

Tonnes

000s |

Grade |

Contained Metal |

Gold

g/t |

Silver

g/t |

Copper

% |

Gold

koz |

Silver

koz |

Copper

Mlb |

| RAINY RIVER |

| Open Pit |

|

|

|

|

|

|

|

| Measured |

457 |

1.50 |

1.83 |

- |

22 |

27 |

- |

| Indicated |

2,276 |

1.45 |

1.80 |

- |

106 |

132 |

- |

| Measured & Indicated |

2,734 |

1.46 |

1.81 |

- |

128 |

159 |

- |

| Inferred |

- |

- |

- |

- |

- |

- |

- |

| Underground |

|

|

|

|

|

|

|

| Measured |

- |

- |

- |

- |

- |

- |

- |

| Indicated |

9,043 |

2.44 |

7.08 |

- |

709 |

2,060 |

- |

| Measured & Indicated |

9,043 |

2.44 |

7.08 |

- |

709 |

2,060 |

- |

| Inferred |

1,388 |

2.76 |

2.58 |

- |

123 |

115 |

- |

| Total Rainy River |

|

|

|

|

|

|

|

| Measured |

457 |

1.50 |

1.83 |

- |

22 |

27 |

- |

| Indicated |

11,319 |

2.24 |

6.02 |

- |

815 |

2,192 |

- |

| Measured & Indicated |

11,776 |

2.21 |

5.86 |

- |

837 |

2,218 |

- |

| Inferred |

1,388 |

2.76 |

2.58 |

- |

123 |

115 |

- |

| NEW AFTON |

| Total New Afton |

|

|

|

|

|

|

|

| Measured |

37,399 |

0.64 |

2.29 |

0.80 |

768 |

2,759 |

663 |

| Indicated |

36,578 |

0.49 |

1.99 |

0.60 |

582 |

2,335 |

484 |

| Measured & Indicated |

73,976 |

0.57 |

2.14 |

0.70 |

1,350 |

5,093 |

1,147 |

| Inferred |

10,219 |

0.33 |

1.36 |

0.45 |

107 |

448 |

101 |

| TOTAL NEW GOLD |

| Measured & Indicated |

|

|

|

|

2,187 |

7,312 |

1,147 |

| Inferred |

|

|

|

|

230 |

563 |

101 |

Notes to the Mineral Reserve and Mineral Resource

estimates are provided below.

Notes to Mineral Reserve and Resource Estimates

| 1. |

New Gold's Mineral Reserves and Mineral Resources have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014). |

| 2. |

Mineral Reserves and Mineral Resources have been estimated based on the following metal price assumptions and foreign exchange rate criteria: |

| |

Gold Price

$/ounce |

Silver Price

$/ounce |

Copper Price

$/pound |

Exchange Rate

CAD:USD |

| Mineral Reserves |

1,400 |

19.00 |

3.25 |

1.25 |

| Mineral Resources |

1,500 |

21.00 |

3.50 |

1.25 |

| 3.

Cut-offs for Mineral Reserves and Mineral Resources are outlined in the table below: |

| Mineral Property |

Mineral Reserves |

Mineral Resources |

| Rainy River |

Open Pit |

0.30 g/t AuEq |

0.3 g/t AuEq |

| |

Underground |

1.74 g/t AuEq |

1.70 g/t AuEq |

| New Afton |

|

24.00 $/t |

0.40% CuEq |

| 4. |

New Gold reports its Measured and Indicated Mineral Resources exclusive of Mineral Reserves. Resources are not Mineral Reserves and do not have demonstrated economic viability. Numbers may not add due to rounding. |

| 5. |

Additional details regarding Mineral Reserve and Mineral Resource estimation, classification, reporting parameters, key assumptions and associated risks for each of New Gold's material properties are provided in the respective NI 43-101 Standard of Disclosure for Mineral Projects ("NI 43-101") Technical Reports. The most recent technical report on the Rainy River Mine that is filed on SEDAR+ at www.sedarplus.ca is titled "NI 43-101 Technical Report for the Rainy River Mine, Ontario, Canada" with an effective date of March 28, 2022. The most recent technical report on the New Afton Mine that is filed on SEDAR+ at www.sedarplus.ca is titled "Technical Report on the New Afton Mine, British Columbia, Canada" dated February 28, 2020. The Company's Technical Reports are available on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov). |

| 6. |

The preparation of New Gold's Mineral Reserves and Mineral Resources has been completed under the review and oversight of the following New Gold employees, all of whom are "Qualified Persons" as defined by NI 43-101.

|

| Mineral Reserves |

Mineral Resources |

| Rainy River |

|

Open Pit

Mr. Jason Chiasson, P.Eng

Chief Open Pit Engineer, Rainy River

Underground

Mr. Alexander Alousis, P.Eng

Chief Underground Engineer, Rainy River |

Mr. Vincent Nadeau-Benoit, P.Geo

Senior Manager, Resource Geology, New Gold |

| New Afton |

|

Mr. Joshua Parsons, P.Eng

Principal Mine Engineer, New Afton |

Mr. Vincent Nadeau-Benoit, P.Geo

Senior Manager, Resource Geology, New Gold

Mr. Joshua Parsons, P.Eng

Principal Mine Engineer, New Afton |

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this presentation,

including any information relating to New Gold's future financial or operating performance are "forward-looking". All statements

in this presentation, other than statements of historical fact, which address events, results, outcomes or developments that New Gold

expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical facts and

are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects", "is

expected", "budget", "scheduled", "targeted", "estimates", "forecasts", "intends",

"anticipates", "projects", "potential", "believes" or variations of such words and phrases or

statements that certain actions, events or results "may", "could", "would", "should", "might"

or "will be taken", "occur" or "be achieved" or the negative connotation of such terms. Forward-looking

statements in this presentation include, among others, statements with respect to: the Company's guidance and expectations regarding production,

costs, capital investments and expenses on a mine-by-mine and consolidated basis, associated timing and accomplishing the factors contributing

to those expected results; successfully completing Rainy River and New Afton growth projects and the accomplishing the anticipated benefits

thereof; successfully increasing gold and copper production, decreasing costs and capital spend as well as generating free cash flow as

a result thereof; successfully generating approximately $75 million in free cash flow in the second half of 2024; planned activities and

timing for 2024 and future years at the Rainy River Mine and New Afton Mine, including planned development and exploration activities

and related expenses; successfully achieving commercial production from the C-Zone in the second half of 2024, with a modest ramp-up through

2024; successfully achieving first production from the underground Main Zone in the second half of 2024 with production ramp-up throughout

2025; successfully reducing operating costs and lowering capital expenditures over the next three year and the consistent free cash flow

anticipated to be generated as a result thereof commencing in the second half of 2024; expectations regarding strengthened production

in the second half of 2024 and the projected allocation of production percentages between the first and second half of the year; the intended

drilling of several exploration targets at Rainy River in 2024; successfully commencing drilling of the K-Zone and AI-Southeast by the

second quarter of 2024; expectations regarding exploration expenditures and the intended focus areas thereof; the potential to successfully

extend the New Afton mine life beyond 2030; successfully reducing the strip ratio in the second half of 2024 and significantly after 2024

at Rainy River and achieving the benefits associated therewith; projected opportunities resulting from the open pit and underground mine

strategy at Rainy River and the Company's ability to successfully accomplish such strategy; the potential for the Company to successfully

improve the production profiles from 2027 to 2031 with minimal capital investment; expectations regarding significantly decreasing waste

stripping activities after the first half of 2024 at Rainy River; opportunities to extend both the open pit and underground mine at Rainy

River; successfully achieving a steady-state underground production rate of 5,500 tpd beginning in 2027; achievement of the Company's

proposed strategic pipeline for mine life extension and the anticipated factors and opportunities contributing thereto; the accuracy of

the Company's estimates and expectations regarding Mineral Reserves and Mineral Resources and the grades thereof; advancement of the underground

plan at Rainy River and the higher grade mill feed anticipated to result therefrom; successfully consistently improving operating margins

over the next three years; expected increase in Phase 4 ore release in the second half of 2024; expectations regarding mining Phase 5

in 2027 and successfully adding approximately one year of open pit mill feed and keeping the mill at full capacity until at least 2030;

successfully completing Rainy River underground priorities and the timing associated therewith; successfully generating strong free cash

flow and strong results in the second half of 2024 at Rainy River; expectations regarding the B3 mining rate in 2024 and mill throughput

rates by the end of 2024 at New Afton; successful commissioning of the underground crusher and conveyor in the second half of 2024; anticipated

availability of opportunities for resources to reserve conversion as well as resource growth, and the Company's ability to successfully

undertake such opportunities over the coming years; successful execution of New Afton's proposed underground and regional exploration

strategy and on the anticipated timeline; expectations regarding the first drill bay of the exploration drift being operational in the

second quarter of 2024 at New Afton, with full completion of the drift in Q3 2024; anticipated exploration opportunities within Rainy

River's current land package and successfully accomplishing the 2024 exploration strategy; successfully accomplishing the targeted sustainable

production platform of 600,000 gold eq. ounces per year until at least 2030; accomplishing the Company's 2024 strategic goals; and expectations

that 2024 will be the final year of significant capital spending.

All forward-looking statements in this presentation

are based on the opinions and estimates of management that, while considered reasonable as at the date of this presentation in light of

management's experience and perception of current conditions and expected developments, are inherently subject to important risk factors

and uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking

statements are discussed in this presentation, New Gold's latest annual management's discussion and analysis ("MD&A"), its

most recent annual information form and technical reports on the Rainy River Mine and New Afton Mine filed on SEDAR+ at www.sedarplus.ca

and on EDGAR at www.sec.gov. In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking

statements in this presentation are also subject to the following assumptions: (1) there being no significant disruptions affecting New

Gold's operations, including material disruptions to the Company's supply chain, workforce or otherwise; (2) political and legal developments

in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold's current expectations; (3) the

accuracy of New Gold's current Mineral Reserve and Mineral Resource estimates and the grade of gold, copper and silver expected to be

mined; (4) the exchange rate between the Canadian dollar and U.S. dollar, and to a lesser extent the Mexican peso, and commodity prices

being approximately consistent with current levels and expectations for the purposes of guidance and otherwise; (5) prices for diesel,

natural gas, fuel oil, electricity and other key supplies being approximately consistent with current levels; (6) equipment, labour and

material costs increasing on a basis consistent with New Gold's current expectations; (7) arrangements with First Nations and other Indigenous

groups in respect of the New Afton Mine and Rainy River Mine being consistent with New Gold's current expectations; (8) all required permits,

licenses and authorizations being obtained from the relevant governments and other relevant stakeholders within the expected timelines

and the absence of material negative comments or obstacles during any applicable regulatory processes; and (9) the results of the life

of mine plans for the New Afton Mine and Rainy River Mine described herein being realized.

Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual

results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

statements. Such factors include, without limitation: price volatility in the spot and forward markets for metals and other commodities;

discrepancies between actual and estimated production, between actual and estimated costs, between actual and estimated Mineral Reserves

and Mineral Resources and between actual and estimated metallurgical recoveries; equipment malfunction, failure or unavailability; accidents;

risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes

to perform as designed or intended; the speculative nature of mineral exploration and development, including the risks of obtaining and

maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each

jurisdiction in which New Gold operates, including, but not limited to: uncertainties and unanticipated delays associated with obtaining

and maintaining necessary licenses, permits and authorizations and complying with permitting requirements; changes in project parameters

as plans continue to be refined; changing costs, timelines and development schedules as it relates to construction; the Company not being

able to complete its construction projects at the Rainy River Mine or the New Afton Mine on the anticipated timeline or at all; volatility

in the market price of the Company's securities; changes in national and local government legislation in the countries in which New Gold

does or may in the future carry on business; compliance with public company disclosure obligations; controls, regulations and political

or economic developments in the countries in which New Gold does or may in the future carry on business; the Company's dependence on the

Rainy River Mine and New Afton Mine; the Company not being able to complete its exploration drilling programs on the anticipated timeline

or at all; inadequate water management and stewardship; tailings storage facilities and structure failures; failing to complete stabilization

projects according to plan; geotechnical instability and conditions; disruptions to the Company's workforce at either the Rainy River

Mine or the New Afton Mine, or both; significant capital requirements and the availability and management of capital resources; additional

funding requirements; diminishing quantities or grades of Mineral Reserves and Mineral Resources; actual results of current exploration

or reclamation activities; uncertainties inherent to mining economic studies including the Technical Reports for the Rainy River Mine

and New Afton Mine; impairment; unexpected delays and costs inherent to consulting and accommodating rights of First Nations and other

Indigenous groups; climate change, environmental risks and hazards and the Company's response thereto; ability to obtain and maintain

sufficient insurance; actual results of current exploration or reclamation activities; fluctuations in the international currency markets

and in the rates of exchange of the currencies of Canada, the United States and, to a lesser extent, Mexico; global economic and financial

conditions and any global or local natural events that may impede the economy or New Gold's ability to carry on business in the normal

course; inflation; compliance with debt obligations and maintaining sufficient liquidity; the responses of the relevant governments to

any disease, epidemic or pandemic outbreak not being sufficient to contain the impact of such outbreak; disruptions to the Company's supply

chain and workforce due to any disease, epidemic or pandemic outbreak; an economic recession or downturn as a result of any disease, epidemic

or pandemic outbreak that materially adversely affects the Company's operations or liquidity position; taxation; fluctuation in treatment

and refining charges; transportation and processing of unrefined products; rising costs or availability of labour, supplies, fuel and

equipment; adequate infrastructure; relationships with communities, governments and other stakeholders; labour disputes; effectiveness

of supply chain due diligence; the uncertainties inherent in current and future legal challenges to which New Gold is or may become a

party; defective title to mineral claims or property or contests over claims to mineral properties; competition; loss of, or inability

to attract, key employees; use of derivative products and hedging transactions; reliance on third-party contractors; counterparty risk

and the performance of third party service providers; investment risks and uncertainty relating to the value of equity investments in

public companies held by the Company from time to time; the adequacy of internal and disclosure controls; conflicts of interest; the lack

of certainty with respect to foreign operations and legal systems, which may not be immune from the influence of political pressure, corruption

or other factors that are inconsistent with the rule of law; the successful acquisitions and integration of business arrangements and

realizing the intended benefits therefrom; and information systems security threats. In addition, there are risks and hazards associated

with the business of mineral exploration, development, construction, operation and mining, including environmental events and hazards,

industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate

insurance or inability to obtain insurance to cover these risks) as well as "Risk Factors" included in New Gold's Annual Information

Form and other disclosure documents filed on and available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Forward-looking

statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated

in such statements. All of the forward-looking statements contained in this news release are qualified by these cautionary statements.

New Gold expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new

information, events or otherwise, except in accordance with applicable securities laws.

Technical Information

The scientific and technical information relating

to the Mineral Reserves and Mineral Resources contained herein has been reviewed and approved by the following New Gold employees, all

of whom are "Qualified Persons" for the purposes of NI 43-101.

| Mineral Reserves |

Mineral Resources |

| Rainy River |

|

Open Pit

Mr. Jason Chiasson, P.Eng

Chief Open Pit Engineer, Rainy River Mine

Underground

Mr. Alexander Alousis, P.Eng

Chief Underground Engineer, Rainy River Mine |

Mr. Vincent Nadeau-Benoit, P.Geo

Senior Manager, Resource Geology, New Gold |

| New Afton |

|

Mr. Joshua Parsons, P.Eng

Principal Mine Engineer, New Afton Mine |

Mr. Vincent Nadeau-Benoit, P.Geo

Senior Manager, Resource Geology, New Gold

Mr. Joshua Parsons, P.Eng

Principal Mine Engineer, New Afton Mine |

All other scientific and technical information in

this news release has been reviewed and approved by Yohann Bouchard, Executive Vice President and Chief Operating Officer of New Gold.

Mr. Bouchard is a Professional Engineer and a member of the Professional Engineers of Ontario. Mr. Bouchard is a "Qualified Person"

for the purposes of NI 43-101. To the Company's knowledge, each of the aforementioned persons holds less than 1% of the outstanding securities

of the Company.

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-gold-outlines-significant-free-cash-flow-generation-profile-supported-by-improving-production-and-decreasing-costs-over-the-next-three-years-302056761.html

SOURCE New Gold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2024/08/c6260.html

%CIK: 0000800166

For further information: Ankit Shah, Executive Vice President, Strategy

& Business Development, Direct: +1 (416) 324-6027; Email: ankit.shah@newgold.com; Brandon Throop, Director, Investor Relations, Direct:

+1 (647) 264-5027, Email: brandon.throop@newgold.com

CO: New Gold Inc.

CNW 06:30e 08-FEB-24

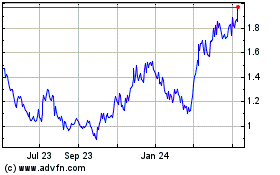

New Gold (AMEX:NGD)

Historical Stock Chart

From Mar 2024 to Apr 2024

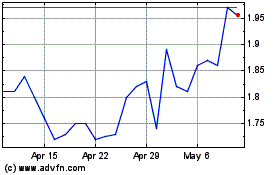

New Gold (AMEX:NGD)

Historical Stock Chart

From Apr 2023 to Apr 2024