false

0001065078

0001065078

2024-10-01

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): October

1, 2024

NETWORK-1

TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-15288 |

11-3027591 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

65

Locust Avenue, Third Floor, New

Canaan, Connecticut 06840

(Address of Principal

Executive Offices) (Zip Code)

(203)

920-1055

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

Common

Stock, par value $0.01 per share

|

NTIP

|

NYSE

American |

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October

1, 2024, Network-1 Technologies, Inc. (“Network-1”) announced that the U. S. Patent and Trademark Office issued U.S.

Patent No.12,107,587 (Field Programmable Gate Array with Internal Phase-Locked Loop) to its wholly-owned subsidiary (HFT Solutions,

LLC). The newly issued patent is part of Network-1’s HFT patent portfolio that relates to, among other things, technologies

used by firms engaged in high frequency trading activities that utilize custom field- programmable gate array (FPGA) hardware,

including clock domain management technology that provides critical transaction latency gains in trading systems where the

difference between success and failure may be measured in nanoseconds.

A copy of the

press release is attached as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

NETWORK-1 TECHNOLOGIES, INC. |

| |

|

|

| |

|

|

| Dated:

October 2, 2024 |

By: |

/s/ Corey M.

Horowitz |

| |

|

Name: Corey

M. Horowitz

Title: Chairman

and Chief Executive Officer

|

| |

|

|

-3-

Exhibit

99.1

FOR

IMMEDIATE RELEASE

Network-1

Subsidiary Receives New Patent from U.S. Patent Office

Expanding Its HFT Patent Portfolio To Include 10 Issued U.S. Patents

NEW

CANAAN, CT / ACCESSWIRE / October 1, 2024 / Network-1 Technologies, Inc. (NYSE American:NTIP), a company engaged

in the acquisition, development, licensing, and monetization of intellectual property, announced today that the U.S. Patent and Trademark

Office issued U.S. Patent No. 12,107,587 (Field Programmable Gate Array with Internal Phase-Locked Loop) to its wholly-owned subsidiary

(HFT Solutions, LLC). The claims in the newly issued patent are generally directed toward certain advanced technologies relating to high

frequency trading.

The newly issued

patent arises from a patent application contained in the HFT patent portfolio acquired by HFT Solutions, LLC in March 2022 (the “HFT

Patent Portfolio”). The HFT Patent Portfolio relates to, among other things, technologies used by firms engaged in high frequency

trading activities that utilize custom field-programmable gate array (FPGA) hardware, including clock domain management technology that

provides critical transaction latency gains in trading systems where the difference between success and failure may be measured in nanoseconds.

With this latest issuance, the HFT

Patent Portfolio now includes ten (10) issued U.S. patents and three (3) pending U.S. patent applications. The patent terms of the

HFT Patent Portfolio are currently expected to extend until 2040. HFT Solutions anticipates further issuances of additional claims

for the HFT Patent Portfolio.

ABOUT

NETWORK-1 TECHNOLOGIES, INC.

Network-1

Technologies, Inc. is engaged in the acquisition, development, licensing and protection of its intellectual property and proprietary

technologies. Network-1 works with inventors and patent owners to assist in the development and monetization of their patented technologies.

Network-1 currently owns one-hundred three (103) U.S. patents and sixteen (16) international patents covering various telecommunications

and data networking technologies as well as technologies relating to document stream operating systems and the identification of media

content. Network-1’s current strategy includes efforts to monetize five patent portfolios (the Cox, M2M/IoT, HFT, Mirror Worlds

and Remote Power Patent portfolios). Network-1’s strategy is to focus on acquiring and investing in high quality patents which

management believes have the potential to generate significant licensing opportunities as Network-1 has achieved with respect to its

Remote Power Patent and Mirror Worlds Patent Portfolio. Network-1’s Remote Power Patent has generated licensing revenue in excess

of $188,000,000 from May 2007 through June 30, 2024. Network-1 has achieved licensing and other revenue of $47,150,000 through June 30,

2024 with respect to its Mirror Worlds Patent Portfolio.

This

release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. These statements address future events and conditions concerning Network-1’s business plans. Such

statements are subject to a number of risk factors and uncertainties as disclosed in the Network-1’s Annual Report on Form 10-K

for the year ended December 31, 2023 and its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024 filed with the

Securities and Exchange Commission including, among others, Network-1’s uncertain revenue from licensing its intellectual property,

uncertainty as to the outcome of pending litigation involving Network-1’s Remote Power Patent, whether Network-1 in its Cox patent

litigation against Google and YouTube will be successful in its appeal of the judgment of the U.S. District Court for the Southern District

of New York dismissing all of Network-1’s claims in the case, whether Network-1 will be successful in its appeal to the Federal

Circuit of the District Court judgment of non-infringement dismissing Network-1’s litigation against Facebook (now Meta Platforms,

Inc.), the ability of Network-1 to successfully execute its strategy to acquire or make investments in high quality patents with significant

licensing opportunities, Network-1’s ability to achieve revenue and profits from its Cox Patent Portfolio, M2M/IoT Patent Portfolio,

HFT Patent Portfolio and additional revenue and profit from its Mirror Worlds Patent Portfolio and Remote Power Patent as well as a return

on its investment in ILiAD Biotechnologies, LLC or other intellectual property it may acquire or finance in the future, the ability of

Network-1 to enter into additional license agreements, uncertainty as to whether cash dividends will continue be paid, Network-1’s

ability to enter into strategic relationships with third parties to license or otherwise monetize their intellectual property, the risk

in the future of Network-1 being classified as a Personal Holding Company which may result in Network-1 issuing a special cash dividend

to its stockholders, the increasing development of artificial intelligence could materially impact Network-1’s business, and future

economic conditions and technology changes and legislative, regulatory and competitive developments. Except as otherwise required to

be disclosed in periodic reports, Network-1 expressly disclaims any future obligation or undertaking to update or revise any forward-looking

statement contained herein.

| Corey

M. Horowitz, Chairman and CEO |

| Network-1

Technologies, Inc. |

| 917-692-0000 |

v3.24.3

Cover

|

Oct. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 01, 2024

|

| Entity File Number |

001-15288

|

| Entity Registrant Name |

NETWORK-1

TECHNOLOGIES, INC.

|

| Entity Central Index Key |

0001065078

|

| Entity Tax Identification Number |

11-3027591

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

65

Locust Avenue, Third Floor,

|

| Entity Address, City or Town |

New

Canaan

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06840

|

| City Area Code |

(203)

|

| Local Phone Number |

920-1055

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

NTIP

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

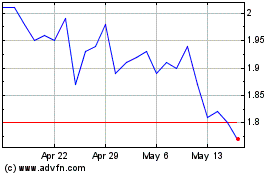

Network 1 Technologies (AMEX:NTIP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Network 1 Technologies (AMEX:NTIP)

Historical Stock Chart

From Nov 2023 to Nov 2024