BiomX Inc. Announces 1-for-10 Reverse Stock Split

15 August 2024 - 8:30PM

BiomX Inc. (NYSE American: PHGE) (“BiomX” or the “Company”), a

clinical-stage company advancing novel natural and engineered phage

therapies that target specific pathogenic bacteria, today announced

that it intends to effect a one-for-ten reverse split (the "Reverse

Stock Split") of the Company’s common stock (the "Common Stock").

The Common Stock will continue to trade on the NYSE American under

the existing symbol “PHGE” and will begin trading on a

split-adjusted basis when the market opens on August 26,

2024. The new CUSIP number for the Common Stock following the

Reverse Stock Split will be 09090D 301.

The Reverse Stock Split was previously approved by the Company’s

stockholders at a special meeting held on July 9, 2024, with the

final ratio determined by the Company’s Board of Directors on

August 8, 2024. The Company plans to file a Certificate of

Amendment to the Company’s Certificate of Incorporation with the

Secretary of State of the State of Delaware to effect the Reverse

Stock Split.

The 1-for-10 Reverse Stock Split will automatically combine and

convert ten current shares of the Common Stock into one issued and

outstanding new share of Common Stock. Proportional adjustments

also will be made to shares underlying outstanding equity awards,

warrants and convertible preferred stock, and to the number of

shares issued and issuable under the Company’s stock incentive

plans and certain existing agreements. The Company’s units will

also be proportionally adjusted, and each unit will continue to

represent one share and one warrant exercisable for half a share.

The Company will provide the CUSIP number for the units later

today. The Reverse Stock Split will not change the par value of the

Common Stock nor the authorized number of shares of Common Stock,

preferred stock or any series of preferred stock.

The Reverse Stock Split will affect all stockholders uniformly

and will not alter any stockholder’s percentage ownership interest

in the Company’s equity, except for minor changes to the treatment

of fractional shares as described below. After the effectiveness of

the Reverse Stock Split, the number of outstanding shares of Common

Stock will be reduced from approximately 178,958,447 to

approximately 17,895,845, subject to adjustment to give effect to

the treatment of any fractional shares that stockholders would have

received in the Reverse Stock Split. No fractional shares of Common

Stock will be issued in connection with the Reverse Stock Split.

Stockholders of the Company who otherwise would be entitled to

receive fractional shares because they hold a number of shares not

evenly divisible by the Reverse Stock Split ratio will be

automatically entitled to receive an additional fraction of a share

of the Common Stock to round up to the next whole share.

Continental Stock Transfer & Trust Company, the Company

transfer agent, will send instructions to stockholders of record

who hold stock certificates regarding the exchange of certificates

for Common Stock. Stockholders who hold their shares of Common

Stock in book-entry form or in brokerage accounts or “street name”

are not required to take any action to effect the exchange of their

shares of Common Stock following the Reverse Stock Split.

Continental Stock Transfer & Trust Company may be reached for

questions at (800) 509-5586.

About BiomXBiomX is a clinical-stage company

leading the development of natural and engineered phage cocktails

and personalized phage treatments designed to target and destroy

harmful bacteria for the treatment of chronic diseases with

substantial unmet needs. BiomX discovers and validates proprietary

bacterial targets and applies its BOLT (“BacteriOphage Lead to

Treatment”) platform to customize phage compositions against these

targets. For more information, please visit www.biomx.com, the

content of which does not form a part of this press release.

Safe HarborThis press release contains express

or implied “forward-looking statements” within the meaning of the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

words such as: “target,” “believe,” “expect,” “will,” “may,”

“anticipate,” “estimate,” “would,” “positioned,” “future,” and

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. For

example, when BiomX discusses the effective date for the Reverse

Stock Split and the date that trading of the New Common Stock will

begin on a split-adjusted basis, it is using forward-looking

statements. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based only

on BiomX management’s current beliefs, expectations and

assumptions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of BiomX’s control. Therefore, investors should

not rely on any of these forward-looking statements and should

review the risks and uncertainties described under the caption

“Risk Factors” in BiomX’s Annual Report on Form 10-K filed with the

Securities and Exchange Commission (the “SEC”) on April 4, 2024,

and additional disclosures BiomX makes in its other filings with

the SEC, which are available on the SEC’s website at www.sec.gov.

Forward-looking statements are made as of the date of this press

release, and except as provided by law BiomX expressly disclaims

any obligation or undertaking to update forward-looking

statements.

BiomX, Inc.Assaf Oron+97254-2228901assafo@biomx.com

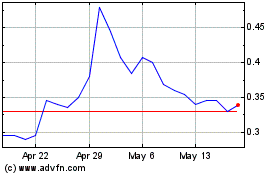

BiomX (AMEX:PHGE)

Historical Stock Chart

From Feb 2025 to Mar 2025

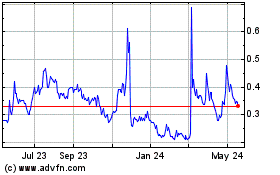

BiomX (AMEX:PHGE)

Historical Stock Chart

From Mar 2024 to Mar 2025