BiomX Inc. (NYSE American: PHGE, the “Company” or “BiomX”), a

clinical-stage company advancing novel natural and engineered phage

therapies that target specific pathogenic bacteria, today announced

that it has entered into a securities purchase agreement with

investors in connection with a registered direct offering,

concurrent private placement of the Company’s securities, and

simultaneous exercise of certain existing common stock purchase

warrants (collectively, the “Offerings”) for expected aggregate

gross proceeds of approximately $12 million to the Company, before

deducting placement agent fees and other offering expenses. The

Company intends to use the net proceeds from the Offerings to

support the completion of the Phase 2b clinical study of BX004,

BiomX’s fixed phage cocktail, for the treatment of people with CF

with chronic pulmonary infections caused by Pseudomonas aeruginosa

(P. aeruginosa), and analysis of real-world evidence. The Company

expects to report topline results from the Phase 2b study in Q1

2026. The Offerings were led by Deerfield Management Company and

included significant participation from the Cystic Fibrosis

Foundation, with additional participation from Nantahala Capital

and other investors. The Offerings are expected to close on or

about February 27, 2025, subject to the satisfaction of customary

closing conditions.

“Following these offerings, we expect to have sufficient funding

to reach substantial inflection points including topline results of

our Phase 2b study of BX004 in Q1 2026 and our Phase 2 readout for

BX211 in Diabetic Foot Osteomyelitis later this quarter,” said

Jonathan Solomon, BiomX’s Chief Executive Officer. “Peer-reviewed

publications report findings supporting the link between P.

aeruginosa reduction and improved clinical outcomes in people with

CF. Following communication with the FDA we intend to present our

plans to analyze real-world evidence and attain endorsement that

supports potential future regulatory filings. We anticipate further

discussion with the FDA and European Committee for Medicinal

Products for Human Use (CHMP) later this year to discuss our

proposed plan. To date, the FDA has granted BX004 Fast Track

designation and Orphan Drug Designation.”

Laidlaw & Company (UK) Ltd. acted as sole placement agent

for the Offerings. Haynes and Boone, LLP served as legal counsel to

BiomX. Sullivan & Worcester LLP served as legal counsel to

Laidlaw.

Terms of the Offerings

Under the securities purchase agreement, the investors have

agreed to purchase an aggregate of 3,633,514 shares of the

Company’s common stock (or registered pre-funded warrants in lieu

thereof) in a registered direct offering at an effective purchase

price of $0.9306 per share of common stock (or registered

pre-funded warrants in lieu thereof). In a concurrent private

placement, the investors have agreed to purchase unregistered

pre-funded warrants to purchase up to an aggregate of 2,305,871

shares of the Company’s common stock at the same effective purchase

price. Each share of common stock (or registered pre-funded warrant

in lieu thereof) and each unregistered pre-funded warrant will be

accompanied by one unregistered warrant to purchase one share of

the Company’s common stock (or 5,939,385 shares in the

aggregate).

Exercise of the unregistered pre-funded warrants are subject to

stockholder approval and such warrants will be exercisable until

exercised in full. Exercise of the unregistered warrants are

subject to stockholder approval and such warrants will be

exercisable for a period of five years following the stockholder

approval date.

The Company also has agreed with holders of certain existing

warrants to purchase up to an aggregate of 6,955,527 shares of the

Company’s common stock, which warrants were issued on March 15,

2024 with an exercise price of $2.311 per share and expiration date

of July 6, 2026, to amend such warrants effective upon the closing

of the Offerings so that the amended warrants will have a reduced

exercise price of $0.9306 per share. Such holders have agreed to

exercise such warrants for common stock (or pre-funded warrants in

lieu thereof) as part of the Offerings. As consideration for

exercising the existing warrants at the reduced exercise price, the

Company agreed to issue to the holders of the existing warrants new

warrants exercisable for up to a number of shares of the Company’s

common stock equal to 100% of the number of shares of common stock

issued upon the exercise of the existing warrants. Exercise of the

new warrants are subject to stockholder approval and such warrants

will not be exercisable until the stockholder approval date and

will expire five years following the stockholder approval date.

The offer and sale in the registered direct offering of the

shares of the Company’s common stock, registered pre-funded

warrants and shares of common stock underlying the registered

pre-funded warrants are being made by the Company pursuant to a

“shelf” registration statement on Form S-3 (333-275935), including

a base prospectus, initially filed with the Securities and Exchange

Commission (the “SEC”) on December 7, 2023 and declared effective

by the SEC on January 2, 2024 and a prospectus supplement that

forms a part of the registration statement. The prospectus

supplement relating to the registered direct offering will be filed

with the SEC and will be available at the SEC’s website located at

http://www.sec.gov.

The unregistered pre-funded warrants, unregistered warrants and

the new warrants described above were offered in a private

placement under Section 4(a)(2) of the Securities Act of 1933, as

amended (the “Act”) and/or Regulation D promulgated thereunder. The

Company has agreed to file one or more registration statements with

the SEC covering the resale of the shares of common stock issuable

upon exercise of the unregistered pre-funded warrants, unregistered

warrants and new warrants. This press release shall not constitute

an offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of securities of BiomX in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

About BX004BiomX is developing BX004, a fixed

multi-phage cocktail, for the treatment of people with CF with

chronic pulmonary infections caused by P. aeruginosa, a main

contributor to morbidity and mortality in people with CF. In

November 2023, BiomX announced positive topline results from Part 2

of the Phase 1b/2a trial where BX004 demonstrated improvement in

pulmonary function associated with a reduction in P. aeruginosa

burden compared to placebo in a predefined subgroup of patients

with reduced lung function (baseline FEV1<70%). BiomX expects to

initiate a randomized, double blind, placebo-controlled,

multi-center Phase 2b trial in CF patients with chronic P.

aeruginosa pulmonary infections. The trial is designed to enroll

approximately 60 patients randomized at a 2:1 ratio to BX004 or

placebo. Treatment is expected to be administered via inhalation

twice daily for a duration of 8 weeks. The trial is designed to

monitor the safety and tolerability of BX004 and is designed to

demonstrate improvement in microbiological reduction of P.

aeruginosa burden and evaluation of effects on clinical parameters

such as lung function measured by FEV1 and patient reported

outcomes. Pending progress of the trial, topline results are

expected in the first quarter of 2026. The U.S. Food and Drug

Administration (“FDA”) has granted BX004 Fast Track designation and

Orphan Drug Designation.

About BX211BX211 is a personalized phage

treatment for the treatment of DFO associated with S. aureus.

The personalized phage treatment tailors a specific phage selected

from a proprietary phage-bank according to the specific strain

of S. aureus biopsied and isolated from each patient. DFO

is a bacterial infection of the bone that usually develops from an

infected foot ulcer and is a leading cause of amputation in

patients with diabetes.

The ongoing randomized, double-blind, placebo-controlled,

multi-center Phase 2 trial investigating the safety, tolerability,

and efficacy of BX211 for subjects with DFO associated with S.

aureus has finished enrollment for a randomized at a 2:1 ratio

to BX211 or placebo. BX211 or placebo is designed to be

administered weekly, by topical and IV route at Week 1 and by the

topical route only at each of Weeks 2-12. Over the 12-week

treatment period, all subjects are expected to continue to be

treated in accordance with standard of care which will include

antibiotic treatment as appropriate. A first readout of study

topline results is expected at Week 13 evaluating healing of the

wound associated with osteomyelitis, followed by a second readout

at Week 52 evaluating amputation rates and resolution of

osteomyelitis based on X-ray, clinical assessments, and established

biomarkers (ESR and CRP). These readouts are expected in the first

quarter of 2025 and the first quarter of 2026, respectively.

About BiomX BiomX is a clinical-stage company

leading the development of natural and engineered phage cocktails

and personalized phage treatments designed to target and destroy

harmful bacteria for the treatment of chronic diseases with

substantial unmet needs. BiomX discovers and validates proprietary

bacterial targets and applies its BOLT (“BacteriOphage Lead to

Treatment”) platform to customize phage compositions against these

targets. For more information, please visit www.biomx.com, the

content of which does not form a part of this press release.

Safe Harbor This press release contains express

or implied “forward-looking statements” within the meaning of the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

words such as: “target,” “believe,” “expect,” “will,” “may,”

“anticipate,” “estimate,” “would,” “positioned,” “future,” and

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. For

example, when BiomX refers to the closing of the Offerings, the use

of the net proceeds of the Offerings, the filing of the

registration statement with the SEC covering the resale of the

shares of common stock issuable upon exercise of the unregistered

pre-funded warrants, unregistered warrants and new warrants, its

anticipated timing for reporting results for its clinical assets as

well as the design thereof, the potential of its candidates to

address the substantial unmet needs of patients with intractable

infections, and the estimates of the sufficiency of its cash, cash

equivalents and short-term deposits, it is using forward-looking

statements. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based only

on BiomX management’s current beliefs, expectations and

assumptions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of BiomX’s control. These risks and uncertainties

include, but are not limited to, BiomX’s ability to obtain all

necessary regulatory approvals on a timely basis, or at all;

BiomX’s ability to obtain stockholder approval on a timely basis,

or at all; the closing of the Offerings on a timely basis on the

terms described herein, or at all; changes in applicable laws or

regulations; the possibility that BiomX may be adversely affected

by other economic, business, and/or competitive factors, including

risks inherent in pharmaceutical research and development, such as:

adverse results in BiomX’s drug discovery, preclinical and clinical

development activities, the risk that the results of preclinical

studies and early clinical trials may not be replicated in later

clinical trials, BiomX’s ability to enroll patients in its clinical

trials, and the risk that any of its clinical trials may not

commence, continue or be completed on time, or at all; decisions

made by the FDA and other regulatory authorities; investigational

review boards at clinical trial sites and publication review bodies

with respect to our development candidates; BiomX’s ability to

obtain, maintain and enforce intellectual property rights for its

platform and development candidates; its potential dependence on

collaboration partners; competition; uncertainties as to the

sufficiency of BiomX’s cash resources to fund its planned

activities for the periods anticipated and BiomX’s ability to

manage unplanned cash requirements; and general economic and market

conditions. Therefore, investors should not rely on any of these

forward-looking statements and should review the risks and

uncertainties described under the caption “Risk Factors” in BiomX’s

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on April 4, 2024, and additional disclosures

BiomX makes in its other filings with the SEC, which are available

on the SEC’s website at www.sec.gov. Forward-looking statements are

made as of the date of this press release, and except as provided

by law BiomX expressly disclaims any obligation or undertaking to

update forward-looking statements.

Contacts:

BiomX Inc.Ben Cohen

benc@biomx.com

CORE IR

Mike Masonir-biomx@biomx.com

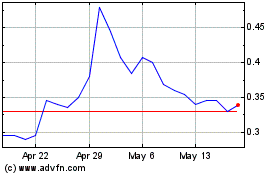

BiomX (AMEX:PHGE)

Historical Stock Chart

From Feb 2025 to Mar 2025

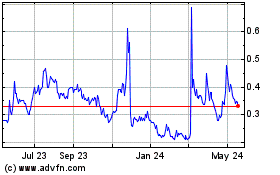

BiomX (AMEX:PHGE)

Historical Stock Chart

From Mar 2024 to Mar 2025