0000088121

false

0000088121

2023-10-09

2023-10-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

October 9, 2023

Seaboard

Corporation

(Exact name

of registrant as specified in its charter)

| Delaware |

|

1-3390 |

|

04-2260388 |

| (State or other jurisdiction of |

|

(Commission |

|

(I.R.S. Employer |

| incorporation) |

|

File Number) |

|

Identification No.) |

| 9000

West 67th Street, Merriam, Kansas |

|

66202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code (913) 676-8928

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock $1.00 Par Value |

SEB |

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive

Agreement

On October 9, 2023, Seaboard Corporation

(the “Company”) entered into three Stock Repurchase Agreements (the “Repurchase Agreements”), with

the following three separate counterparties: Seaboard Flour LLC, SFC Preferred, LLC, and REP23 LLC (collectively, the “Sellers”).

The Sellers are entities affiliated with Ellen S. Bresky, the Chairwoman of the Board of Directors of the Company, or other members of

the Bresky family (collectively, the “Bresky Group”). On October 10, 2023, the closings under the Repurchase Agreements

occurred pursuant to which the Company repurchased an aggregate of 189,724 shares (the “Shares”) of its common stock,

$1.00 par value per share (“Common Stock”), from the Sellers at a purchase price of $3,162.50 per share, representing

a 15.7% discount to the 180-day volume weighted average trading price of the Common Stock as of October 6, 2023, a 14.9% discount to the

30-day volume weighted average trading price of the Common Stock as of October 6, 2023 and a 13.5% discount to closing price of the Common

Stock as of October 6, 2023. In connection therewith, the Company paid an aggregate purchase price of $600,002,150 for the Shares, which

was funded by a combination of cash on hand, cash from the sale of marketable securities and a draw on the Company’s existing credit

facilities. The Shares repurchased were retired. The Repurchase Agreements contain customary representations, warranties and covenants

of the parties.

The Repurchase Agreements were negotiated

and approved by a special committee of the Board of Directors of the Company (the “Special

Committee”), comprised solely of disinterested, independent directors, including the Company’s lead independent director. The Special Committee was advised by Morris,

Nichols, Arsht & Tunnell LLP as its independent legal counsel and Kroll LLC and Kroll Securities, LLC (collectively,

“Kroll”) as its independent financial advisor. The Special Committee

received an opinion from Kroll as to the fairness of the consideration paid for the Shares from a financial point of view to the

Company and stockholders of the Company unaffiliated with the Bresky Group. The Special Committee’s grant of authority

provided that no repurchase or alternative proposed capital return transaction involving the Company and the Bresky Group could be

consummated without the prior favorable recommendation of the Special Committee.

The foregoing description of the Repurchase Agreements

does not purport to be complete and is qualified in its entirety by reference to the copies thereof, which are filed herewith as Exhibits

and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

Exhibits

|

104 | Cover

Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL

document. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Date: October

10, 2023 |

| |

|

|

| |

Seaboard Corporation |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/

David H. Rankin |

| |

|

David H. Rankin, Executive

Vice President |

| |

|

and Chief

Financial Officer |

Exhibit 10.1

Execution Version

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT

(this “Agreement”) is entered into as of October 9, 2023 by and between Seaboard Corporation, a Delaware corporation

(the “Company”), and Seaboard Flour LLC, a Delaware limited liability company (the “Seller”).

Background

A. The

Seller owns and has agreed to transfer, assign, sell, convey and deliver 6,901 shares (the “Repurchase Shares”) of

the Company’s common stock, $1.00 par value per share (“Common Stock”), to the Company on the terms and conditions

set forth in this Agreement;

B. The Company has agreed to purchase all of the Repurchase Shares at the price and upon the terms and conditions provided in this

Agreement (the “Repurchase”);

C. The

board of directors of the Company (the “Board”) formed a special committee of the Board (the “Special Committee”)

comprised solely of disinterested, independent directors to, among other things, review, evaluate, negotiate, approve or reject the Repurchase,

and the Board further resolved it would not approve any Repurchase without the prior favorable recommendation thereof by the Special

Committee;

D. The

Special Committee has received opinions (the “Opinions”) from Kroll, LLC (i) that the consideration to be paid by

the Company in exchange for the Repurchase Shares and shares of Common Stock to be acquired in simultaneous repurchases (x) pursuant

hereto and (y) from SFC Preferred, LLC and REP23 LLC, each a Delaware limited liability company, pursuant to other repurchase agreements

(together with the Repurchase, the “Aggregate Repurchases”) is fair, from a financial point of view, to the Company

and its stockholders (excluding the Bresky Group (for purposes of this Agreement, as defined in such opinion)) and (ii) regarding certain

determinations as to surplus and solvency of the Company in connection with the Aggregate Repurchases; and

E. The

Special Committee has, in reliance on the Opinions and taking into account such other factors as it deemed relevant, approved the Aggregate

Repurchases, the applicable repurchase agreements, and the transactions contemplated thereby.

THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

Agreement

(a) On

the terms and subject to the conditions set forth in this Agreement, at the Closing (as defined below), the Seller agrees to transfer,

assign, sell, convey and deliver to the Company the Repurchase Shares. The per share purchase price for each Repurchase Share shall be

$3,162.50 (the “Per Share Purchase Price”). The Company hereby agrees to purchase the Repurchase Shares from the Seller

at the Per Share Purchase Price and in an aggregate amount of $21,824,412.50 (the “Purchase Price”).

(b) The

closing of the sale of the Repurchase Shares (the “Closing”) shall take place by conference call at 9:00 a.m. eastern

time on October 10, 2023, or on such other date and time as the parties agree in writing. In accordance with the wire instructions set

forth on Exhibit A hereto and completed IRS Form W-9 previously provided by the Seller to the Company, payment for the Repurchase

Shares shall be made by wire transfer of immediately available funds to the account specified by the Seller on Exhibit A in an

amount equal to the Purchase Price. Transfer taxes payable in connection with the sale of such Repurchase Shares, if any, shall be paid

by the Seller.

(c) By executing this Agreement, the Seller hereby instructs and directs the Company, and the officers thereof, to, at the Closing,

reflect the transfer, assignment, sale, conveyance and delivery of the Repurchase Shares and the simultaneous retirement of the Repurchase

Shares by the Company in connection therewith, in all cases contemplated by, and in accordance with, this Agreement. At the Closing (i)

in accordance with the preceding sentence, Seller shall take any and all additional action necessary to cause the Repurchase Shares to

be transferred, assigned, sold, conveyed and delivered to the Company, (ii) the Company shall take any and all action necessary such that,

upon consummation of the Repurchase, the Repurchase Shares shall assume the status of authorized and unissued shares of Common Stock,

and (iii) the Company shall pay to Seller the Purchase Price.

2. Company

Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to the Seller as of

the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to an earlier date

(in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Assuming the

accuracy of the representation and warranty in Section 3(f) hereof, (i) the Company has the requisite power and authority to execute

and deliver this Agreement and to perform its obligations hereunder, and (ii) all action required to be taken for the due and proper

authorization, execution and delivery by it of this Agreement and the consummation by it of the transactions contemplated hereby has

been duly and validly taken.

(b) Assuming

the accuracy of the representation and warranty in Section 3(f) hereof, this Agreement has been duly authorized, executed and

delivered by the Company and constitutes a valid and binding agreement of the Company enforceable in accordance with its terms, except

to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement of

creditors’ rights or by general equitable principles.

3. Representations

of the Seller. In connection with the transactions contemplated hereby, the Seller represents and warrants to the Company as of the

date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to an earlier date (in

which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the State of

Delaware.

(b) All

consents, approvals, authorizations and orders necessary for the execution and delivery by the Seller of this Agreement, and for the

sale and delivery of the Repurchase Shares to be sold by the Seller hereunder, have been obtained; and the Seller has full right, power

and authority to enter into this Agreement, and to sell, assign, transfer and deliver the Repurchase Shares to be sold by the Seller

hereunder.

(c) This

Agreement has been duly authorized, executed and delivered by the Seller and constitutes a valid and binding agreement of the Seller,

enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization

or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d) As of immediately prior to the Closing, the Seller has valid title to the Repurchase Shares,

free and clear of all liens, encumbrances, equities or adverse claims, and, upon transfer of the Repurchase Shares and payment therefor

pursuant hereto, good and valid title to such Repurchase Shares, free and clear of all liens, encumbrances, equities or adverse claims,

will pass to the Company.

(e) The

Seller (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it is capable

of evaluating the merits and risks of the Repurchase. The Seller has had the opportunity to ask questions and receive answers concerning

the terms and conditions of the Repurchase and the Repurchase Shares and has had full access to such other information concerning the

Company as it has requested. The Seller has received all information that it believes is necessary or appropriate in connection with

the Repurchase. The Seller is an informed and sophisticated party and has engaged, to the extent the Seller deems appropriate, expert

advisors experienced in the evaluation of transactions of the type contemplated hereby. The Seller acknowledges that neither the Company

nor any person on behalf of the Company has made, and the Seller has not relied upon, any express or implied representations, warranties

or statements of any nature, whether or not in writing or orally, including as to the accuracy and completeness of any information provided

by or on behalf of the Company to the Seller or its representatives, except as expressly set forth for the benefit of the Seller in this

Agreement.

(f) The

Seller is, and has been at all times for at least three years prior to the date of this Agreement, and shall continue to be through Closing,

an “interested stockholder” (as such term is defined in Section 203 of the Delaware General Corporation Law) of the Company.

4. Information.

The Seller acknowledges that it knows that the Company and members of the Board and of the Company’s management may have

material, non-public information regarding the Company and its condition (financial and otherwise), results of operations,

businesses, properties, plans (including, without limitation, plans regarding other potential exchanges or purchases of Common

Stock, which may be for different amounts or types of consideration) and prospects (collectively, the “Information”).

The Seller acknowledges (a) that it has been offered, and does not wish to receive, any of the Information, (b) that the Company has

not disclosed, and has no obligation to disclose, the Information to the Seller, and (c) that the Information might be material to

the Seller’s decision to sell the Repurchase Shares or otherwise materially adverse to the Seller’s interests.

Accordingly, the Seller acknowledges and agrees that neither the Company nor any member of the Board or of the Company’s

management shall have any obligation to disclose to the Seller any of the Information. The Seller hereby waives and releases, to the

fullest extent permitted by law, any and all claims and causes of action (whether known or unknown) it has or may have against the

Company and its affiliates, controlling persons, officers, directors, employees, representatives and agents, based upon, relating to

or arising out of the nondisclosure of the Information in connection with the transactions contemplated by the Agreement. The Seller

is aware that the Company is relying on the foregoing acknowledgement and waiver in this Section 4 in connection with the

transactions contemplated by this Agreement.

5. Miscellaneous.

(a) Survival

of Representations and Warranties. All representations and warranties contained herein or made in writing by any party in connection

herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(b) Counterparts;

Execution of Agreement. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and all

of which taken together constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement

by facsimile or other electronic transmission, including by e-mail attachment or PDF document, shall be as effective as delivery of a

manually executed counterpart of this Agreement.

(c) No Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties hereto and their successors

and permitted assigns, and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights

or remedies to any person other than the parties to this Agreement and their successors and permitted assigns.

(d) Governing

Law; Arbitration; Jurisdiction. This Agreement and all disputes arising out of or related to this Agreement, whether in

contract, tort or otherwise (each, an “Agreement Dispute”), will be governed by and construed in accordance with,

the laws of the State of Delaware, without regard to any applicable principles of conflicts of law that might require the

application of the laws of any other jurisdiction. Any Agreement Dispute shall be resolved by binding arbitration in Chicago,

Illinois, before one arbitrator independent of the parties (each, an “Arbitration Proceeding”). Such arbitrator

shall be selected in accordance with, and the Arbitration Proceeding shall be administered by JAMS pursuant to, the JAMS

Comprehensive Arbitration Rules and Procedures excluding its optional Arbitration Appeal procedures. Any arbitrator designated

pursuant to this Section 5(d) shall be a lawyer experienced in commercial and business affairs. All Arbitration Proceedings will be

closed to the public and kept confidential, except to the extent necessary to (i) seek an injunction in aid of arbitration, (ii)

obtain court confirmation of the judgment of the arbitrator, or (iii) give effect to res judicata and collateral estoppel, in which

case, all filings with any court shall be sealed to the extent permissible by the court. Nothing in this Section 5(d) is intended

to, or shall, preclude a party to an Arbitration Proceeding from communicating with, or making disclosures to his, her or its

lawyers, tax advisors, auditors and insurers, or from making such other disclosures as may be required by any applicable law. To the

maximum extent permitted by applicable law, the decision of the arbitrator shall be final and binding and not be subject to appeal.

If any party to an Arbitration Proceeding fails to abide by a judgment rendered in such Arbitration Proceeding, the other party may

seek to enforce such judgment in any court of competent jurisdiction. EACH OF THE PARTIES TO THIS AGREEMENT IRREVOCABLY WAIVES ANY

AND ALL RIGHTS TO TRIAL BY JURY IN ANY AGREEMENT DISPUTE. Notwithstanding anything contained in this Agreement to the contrary, no

party shall have the right to institute any proceedings in any court against the other party or any person acting by, through or

under such other party to adjudicate an Agreement Dispute, except that any party shall be permitted to seek an injunction in aid of

arbitration with respect to an Agreement Proceeding, and any such injunction proceeding shall be sought and determined exclusively

in any Delaware state or federal court.

(e) Mutuality

of Drafting. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity

or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption

or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this Agreement.

(f) Amendment

and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of the Seller

and the Company; provided, in the case of the Company, such amendment, modification or waiver has been approved by the Special Committee

or, if the Special Committee is no longer in existence, by a majority of the members of the Board unaffiliated with the Bresky Group,

or a committee of such directors. No waiver of any of the provisions of this Agreement shall be deemed, or shall constitute, a waiver

of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. Moreover, no failure by any party to

insist upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach

thereof shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(g) Further Assurances. Each of the Company and the Seller shall execute and deliver such additional documents and instruments

and shall take such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(h) Expenses.

Each of the Company and the Seller shall bear their own respective expenses in connection with

the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(i) Entire

Agreement. This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes

all other prior or contemporaneous agreements and understandings, both written and oral, among or between any of the parties with respect

to the subject matter hereof.

[Signatures appear on following page.]

IN WITNESS WHEREOF, the parties

hereto have executed this Stock Repurchase Agreement as of the date first written above.

| |

SEABOARD CORPORATION |

| |

|

|

| |

By: |

/s/ Robert L. Steer |

| |

|

Name: Robert L. Steer |

| |

|

Title: President and Chief Executive Officer |

| |

SEABOARD FLOUR LLC |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

|

Name: Ellen S. Bresky |

| |

|

Title: Manager |

[Signature Page to Stock Repurchase Agreement]

Exhibit 10.2

Execution Version

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT

(this “Agreement”) is entered into as of October 9, 2023 by and between Seaboard Corporation, a Delaware corporation

(the “Company”), and SFC Preferred, LLC, a Delaware limited liability company (the “Seller”).

Background

A. The

Seller owns and has agreed to transfer, assign, sell, convey and deliver 6,671 shares (the “Repurchase Shares”) of

the Company’s common stock, $1.00 par value per share (“Common Stock”), to the Company on the terms and conditions

set forth in this Agreement;

B. The

Company has agreed to purchase all of the Repurchase Shares at the price and upon the terms and conditions provided in this Agreement

(the “Repurchase”);

C. The

board of directors of the Company (the “Board”) formed a special committee of the Board (the “Special Committee”)

comprised solely of disinterested, independent directors to, among other things, review, evaluate, negotiate, approve or reject the Repurchase,

and the Board further resolved it would not approve any Repurchase without the prior favorable recommendation thereof by the Special

Committee;

D. The

Special Committee has received opinions (the “Opinions”) from Kroll, LLC (i) that the consideration to be paid by

the Company in exchange for the Repurchase Shares and shares of Common Stock to be acquired in simultaneous repurchases (x) pursuant

hereto and (y) from Seaboard Flour LLC and REP23 LLC, each a Delaware limited liability company, pursuant to other repurchase agreements

(together with the Repurchase, the “Aggregate Repurchases”) is fair, from a financial point of view, to the Company

and its stockholders (excluding the Bresky Group (for purposes of this Agreement, as defined in such opinion)) and (ii) regarding certain

determinations as to surplus and solvency of the Company in connection with the Aggregate Repurchases; and

E. The

Special Committee has, in reliance on the Opinions and taking into account such other factors as it deemed relevant, approved the Aggregate

Repurchases, the applicable repurchase agreements, and the transactions contemplated thereby.

THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

Agreement

(a) On

the terms and subject to the conditions set forth in this Agreement, at the Closing (as defined below), the Seller agrees to

transfer, assign, sell, convey and deliver to the Company the Repurchase Shares. The per share purchase price for each Repurchase

Share shall be $3,162.50 (the “Per Share Purchase Price”). The Company hereby agrees to purchase the Repurchase

Shares from the Seller at the Per Share Purchase Price and in an aggregate amount of $21,097,037.50 (the “Purchase

Price”).

(b) The

closing of the sale of the Repurchase Shares (the “Closing”) shall take place by conference call at 9:00 a.m. eastern

time on October 10, 2023, or on such other date and time as the parties agree in writing. In accordance with the wire instructions set

forth on Exhibit A hereto and completed IRS Form W-9 previously provided by the Seller to the Company, payment for the Repurchase

Shares shall be made by wire transfer of immediately available funds to the account specified by the Seller on Exhibit A in an

amount equal to the Purchase Price. Transfer taxes payable in connection with the sale of such Repurchase Shares, if any, shall be paid

by the Seller.

(c) By executing this Agreement, the Seller hereby instructs and directs the Company, and the officers thereof, to, at the Closing,

reflect the transfer, assignment, sale, conveyance and delivery of the Repurchase Shares and the simultaneous retirement of the Repurchase

Shares by the Company in connection therewith, in all cases contemplated by, and in accordance with, this Agreement. At the Closing (i)

in accordance with the preceding sentence, Seller shall take any and all additional action necessary to cause the Repurchase Shares to

be transferred, assigned, sold, conveyed and delivered to the Company, (ii) the Company shall take any and all action necessary such that,

upon consummation of the Repurchase, the Repurchase Shares shall assume the status of authorized and unissued shares of Common Stock,

and (iii) the Company shall pay to Seller the Purchase Price.

2. Company Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to

the Seller as of the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to

an earlier date (in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The Company is a corporation duly organized, validly existing and in good standing under

the laws of the State of Delaware. Assuming the accuracy of the representation and warranty in Section 3(f) hereof, (i) the Company has

the requisite power and authority to execute and deliver this Agreement and to perform its obligations hereunder, and (ii) all action

required to be taken for the due and proper authorization, execution and delivery by it of this Agreement and the consummation by it of

the transactions contemplated hereby has been duly and validly taken.

(b) Assuming

the accuracy of the representation and warranty in Section 3(f) hereof, this Agreement has been duly authorized, executed and

delivered by the Company and constitutes a valid and binding agreement of the Company enforceable in accordance with its terms, except

to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement of

creditors’ rights or by general equitable principles.

3. Representations of the Seller. In connection with the transactions contemplated hereby, the Seller represents and warrants

to the Company as of the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates

to an earlier date (in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the State of

Delaware.

(b) All

consents, approvals, authorizations and orders necessary for the execution and delivery by the Seller of this Agreement, and for the

sale and delivery of the Repurchase Shares to be sold by the Seller hereunder, have been obtained; and the Seller has full right, power

and authority to enter into this Agreement, and to sell, assign, transfer and deliver the Repurchase Shares to be sold by the Seller

hereunder.

(c) This

Agreement has been duly authorized, executed and delivered by the Seller and constitutes a valid and binding agreement of the Seller,

enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization

or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d) As

of immediately prior to the Closing, the Seller has valid title to the Repurchase Shares, free and clear of all liens, encumbrances,

equities or adverse claims, and, upon transfer of the Repurchase Shares and payment therefor pursuant hereto, good and valid title to

such Repurchase Shares, free and clear of all liens, encumbrances, equities or adverse claims, will pass to the Company.

(e)

The Seller (either alone or together with its advisors) has such knowledge and experience in financial or business matters that

it is capable of evaluating the merits and risks of the Repurchase. The Seller has had the opportunity to ask questions and receive answers

concerning the terms and conditions of the Repurchase and the Repurchase Shares and has had full access to such other information concerning

the Company as it has requested. The Seller has received all information that it believes is necessary or appropriate in connection with

the Repurchase. The Seller is an informed and sophisticated party and has engaged, to the extent the Seller deems appropriate, expert

advisors experienced in the evaluation of transactions of the type contemplated hereby. The Seller acknowledges that neither the Company

nor any person on behalf of the Company has made, and the Seller has not relied upon, any express or implied representations, warranties

or statements of any nature, whether or not in writing or orally, including as to the accuracy and completeness of any information provided

by or on behalf of the Company to the Seller or its representatives, except as expressly set forth for the benefit of the Seller in this

Agreement.

(f) The

Seller is, and has been at all times for at least three years prior to the date of this Agreement, and shall continue to be through Closing,

an “interested stockholder” (as such term is defined in Section 203 of the Delaware General Corporation Law) of the Company.

4. Information.

The Seller acknowledges that it knows that the Company and members of the Board and of the Company’s management may have

material, non-public information regarding the Company and its condition (financial and otherwise), results of operations,

businesses, properties, plans (including, without limitation, plans regarding other potential exchanges or purchases of Common

Stock, which may be for different amounts or types of consideration) and prospects (collectively, the “Information”).

The Seller acknowledges (a) that it has been offered, and does not wish to receive, any of the Information, (b) that the Company has

not disclosed, and has no obligation to disclose, the Information to the Seller, and (c) that the Information might be material to

the Seller’s decision to sell the Repurchase Shares or otherwise materially adverse to the Seller’s interests.

Accordingly, the Seller acknowledges and agrees that neither the Company nor any member of the Board or of the Company’s

management shall have any obligation to disclose to the Seller any of the Information. The Seller hereby waives and releases, to the

fullest extent permitted by law, any and all claims and causes of action (whether known or unknown) it has or may have against the

Company and its affiliates, controlling persons, officers, directors, employees, representatives and agents, based upon, relating to

or arising out of the nondisclosure of the Information in connection with the transactions contemplated by the Agreement. The Seller

is aware that the Company is relying on the foregoing acknowledgement and waiver in this Section 4 in connection with the

transactions contemplated by this Agreement.

5. Miscellaneous.

(a) Survival of Representations and Warranties. All representations and warranties contained herein or made in writing by any

party in connection herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby.

(b) Counterparts; Execution of Agreement. This Agreement may be executed in separate counterparts, each of which is deemed to

be an original and all of which taken together constitute one and the same agreement. Delivery of an executed counterpart of a signature

page to this Agreement by facsimile or other electronic transmission, including by e-mail attachment or PDF document, shall be as effective

as delivery of a manually executed counterpart of this Agreement.

(c) No

Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties hereto and their successors and

permitted assigns, and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or

remedies to any person other than the parties to this Agreement and their successors and permitted assigns.

(d) Governing

Law; Arbitration; Jurisdiction. This Agreement and all disputes arising out of or related to this Agreement, whether in

contract, tort or otherwise (each, an “Agreement Dispute”), will be governed by and construed in accordance with,

the laws of the State of Delaware, without regard to any applicable principles of conflicts of law that might require the

application of the laws of any other jurisdiction. Any Agreement Dispute shall be resolved by binding arbitration in Chicago,

Illinois, before one arbitrator independent of the parties (each, an “Arbitration Proceeding”). Such arbitrator

shall be selected in accordance with, and the Arbitration Proceeding shall be administered by JAMS pursuant to, the JAMS

Comprehensive Arbitration Rules and Procedures excluding its optional Arbitration Appeal procedures. Any arbitrator designated

pursuant to this Section 5(d) shall be a lawyer experienced in commercial and business affairs. All Arbitration Proceedings will be

closed to the public and kept confidential, except to the extent necessary to (i) seek an injunction in aid of arbitration, (ii)

obtain court confirmation of the judgment of the arbitrator, or (iii) give effect to res judicata and collateral estoppel, in which

case, all filings with any court shall be sealed to the extent permissible by the court. Nothing in this Section 5(d) is intended

to, or shall, preclude a party to an Arbitration Proceeding from communicating with, or making disclosures to his, her or its

lawyers, tax advisors, auditors and insurers, or from making such other disclosures as may be required by any applicable law. To the

maximum extent permitted by applicable law, the decision of the arbitrator shall be final and binding and not be subject to appeal.

If any party to an Arbitration Proceeding fails to abide by a judgment rendered in such Arbitration Proceeding, the other party may

seek to enforce such judgment in any court of competent jurisdiction. EACH OF THE PARTIES TO THIS AGREEMENT IRREVOCABLY WAIVES ANY

AND ALL RIGHTS TO TRIAL BY JURY IN ANY AGREEMENT DISPUTE. Notwithstanding anything contained in this Agreement to the contrary, no

party shall have the right to institute any proceedings in any court against the other party or any person acting by, through or

under such other party to adjudicate an Agreement Dispute, except that any party shall be permitted to seek an injunction in aid of

arbitration with respect to an Agreement Proceeding, and any such injunction proceeding shall be sought and determined exclusively

in any Delaware state or federal court.

(e) Mutuality of Drafting. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In

the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties,

and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this

Agreement.

(f) Amendment

and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of the Seller

and the Company; provided, in the case of the Company, such amendment, modification or waiver has been approved by the Special Committee

or, if the Special Committee is no longer in existence, by a majority of the members of the Board unaffiliated with the Bresky Group,

or a committee of such directors. No waiver of any of the provisions of this Agreement shall be deemed, or shall constitute, a waiver

of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. Moreover, no failure by any party to

insist upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach

thereof shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(g) Further Assurances. Each of the Company and the Seller shall execute and deliver such additional documents and instruments

and shall take such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(h) Expenses. Each of the Company and the Seller shall bear their own respective expenses

in connection with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby.

(i) Entire

Agreement. This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes

all other prior or contemporaneous agreements and understandings, both written and oral, among or between any of the parties with respect

to the subject matter hereof.

[Signatures appear on following page.]

IN WITNESS WHEREOF, the parties

hereto have executed this Stock Repurchase Agreement as of the date first written above.

| |

SEABOARD CORPORATION |

| |

|

|

| |

By: |

/s/ Robert L. Steer |

| |

|

Name: Robert L. Steer |

| |

|

Title: President and Chief Executive Officer |

| |

SFC PREFERRED, LLC |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

|

Name: Ellen S. Bresky |

| |

|

Title: Manager |

[Signature Page to Stock Repurchase Agreement]

Exhibit 10.3

Execution Version

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT

(this “Agreement”) is entered into as of October 9, 2023 by and between Seaboard Corporation, a Delaware corporation

(the “Company”), and REP23 LLC, a Delaware limited liability company (the “Seller”).

Background

A. The

Seller owns and has agreed to transfer, assign, sell, convey and deliver 176,152 shares (the “Repurchase Shares”)

of the Company’s common stock, $1.00 par value per share (“Common Stock”), to the Company on the terms and conditions

set forth in this Agreement;

B. The

Company has agreed to purchase all of the Repurchase Shares at the price and upon the terms and conditions provided in this Agreement

(the “Repurchase”);

C. The

board of directors of the Company (the “Board”) formed a special committee of the Board (the “Special Committee”)

comprised solely of disinterested, independent directors to, among other things, review, evaluate, negotiate, approve or reject the Repurchase,

and the Board further resolved it would not approve any Repurchase without the prior favorable recommendation thereof by the Special

Committee;

D. The

Special Committee has received opinions (the “Opinions”) from Kroll, LLC (i) that the consideration to be paid by

the Company in exchange for the Repurchase Shares and shares of Common Stock to be acquired in simultaneous repurchases (x) pursuant

hereto and (y) from Seaboard Flour LLC and SFC Preferred, LLC, each a Delaware limited liability company, pursuant to other repurchase

agreements (together with the Repurchase, the “Aggregate Repurchases”) is fair, from a financial point of view, to

the Company and its stockholders (excluding the Bresky Group (for purposes of this Agreement, as defined in such opinion)) and (ii) regarding

certain determinations as to surplus and solvency of the Company in connection with the Aggregate Repurchases; and

E. The

Special Committee has, in reliance on the Opinions and taking into account such other factors as it deemed relevant, approved the Aggregate

Repurchases, the applicable repurchase agreements, and the transactions contemplated thereby.

THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

Agreement

(a) On

the terms and subject to the conditions set forth in this Agreement, at the Closing (as defined below), the Seller agrees to

transfer, assign, sell, convey and deliver to the Company the Repurchase Shares. The per share purchase price for each Repurchase

Share shall be $3,162.50 (the “Per Share Purchase Price”). The Company hereby agrees to purchase the Repurchase

Shares from the Seller at the Per Share Purchase Price and in an aggregate amount of $557,080,700.00 (the “Purchase

Price”).

(b) The closing of the sale of the Repurchase Shares (the “Closing”) shall take place by conference call at 9:00

a.m. eastern time on October 10, 2023, or on such other date and time as the parties agree in writing. In accordance with the wire instructions

set forth on Exhibit A hereto and completed IRS Form W-9 previously provided by the Seller to the Company, payment for the Repurchase

Shares shall be made by wire transfer of immediately available funds to the account specified by the Seller on Exhibit A in an

amount equal to the Purchase Price. Transfer taxes payable in connection with the sale of such Repurchase Shares, if any, shall be paid

by the Seller.

(c) By executing this Agreement, the Seller hereby instructs and directs the Company, and the officers thereof, to, at the Closing,

reflect the transfer, assignment, sale, conveyance and delivery of the Repurchase Shares and the simultaneous retirement of the Repurchase

Shares by the Company in connection therewith, in all cases contemplated by, and in accordance with, this Agreement. At the Closing (i)

in accordance with the preceding sentence, Seller shall take any and all additional action necessary to cause the Repurchase Shares to

be transferred, assigned, sold, conveyed and delivered to the Company, (ii) the Company shall take any and all action necessary such that,

upon consummation of the Repurchase, the Repurchase Shares shall assume the status of authorized and unissued shares of Common Stock,

and (iii) the Company shall pay to Seller the Purchase Price.

2. Company Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to

the Seller as of the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to

an earlier date (in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Assuming the

accuracy of the representation and warranty in Section 3(f) hereof, (i) the Company has the requisite power and authority to execute

and deliver this Agreement and to perform its obligations hereunder, and (ii) all action required to be taken for the due and proper

authorization, execution and delivery by it of this Agreement and the consummation by it of the transactions contemplated hereby has

been duly and validly taken.

(b) Assuming

the accuracy of the representation and warranty in Section 3(f) hereof, this Agreement has been duly authorized, executed and

delivered by the Company and constitutes a valid and binding agreement of the Company enforceable in accordance with its terms, except

to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement of

creditors’ rights or by general equitable principles.

(c) Subject

to the execution hereof by the Seller, the Special Committee has taken all corporate action necessary to approve the transfer of Common

Stock from Seaboard Flour LLC and SFC Preferred, LLC to REP23 LLC immediately prior to Closing (the “Pre-Closing Transfer”).

3. Representations of the Seller. In connection with the transactions contemplated hereby, the Seller represents and warrants

to the Company as of the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates

to an earlier date (in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware.

(b) All

consents, approvals, authorizations and orders necessary for the execution and delivery by the Seller of this Agreement, and for the

sale and delivery of the Repurchase Shares to be sold by the Seller hereunder, have been obtained; and the Seller has full right, power

and authority to enter into this Agreement, and to sell, assign, transfer and deliver the Repurchase Shares to be sold by the Seller

hereunder.

(c) This

Agreement has been duly authorized, executed and delivered by the Seller and constitutes a valid and binding agreement of the Seller,

enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization

or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d) As

of immediately prior to the Closing, the Seller has valid title to the Repurchase Shares, free and clear of all liens, encumbrances,

equities or adverse claims, and, upon transfer of the Repurchase Shares and payment therefor pursuant hereto, good and valid title to

such Repurchase Shares, free and clear of all liens, encumbrances, equities or adverse claims, will pass to the Company.

(e) The

Seller (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it is capable

of evaluating the merits and risks of the Repurchase. The Seller has had the opportunity to ask questions and receive answers concerning

the terms and conditions of the Repurchase and the Repurchase Shares and has had full access to such other information concerning the

Company as it has requested. The Seller has received all information that it believes is necessary or appropriate in connection with

the Repurchase. The Seller is an informed and sophisticated party and has engaged, to the extent the Seller deems appropriate, expert

advisors experienced in the evaluation of transactions of the type contemplated hereby. The Seller acknowledges that neither the Company

nor any person on behalf of the Company has made, and the Seller has not relied upon, any express or implied representations, warranties

or statements of any nature, whether or not in writing or orally, including as to the accuracy and completeness of any information provided

by or on behalf of the Company to the Seller or its representatives, except as expressly set forth for the benefit of the Seller in this

Agreement.

(f) From

the date hereof through the Pre-Closing Transfer, the Seller is and will be owned and controlled by “persons” (as such

term is defined in Section 203 of the Delaware General Corporation Law (“DGCL”)) who are, and have been at all

times for at least three years prior to the date of this Agreement, and will be through the Pre-Closing Transfer, an

“affiliate” (as such term is defined in Section 203 of the DGCL) of either Seaboard Flour LLC or SFC Preferred, LLC,

each of which is, and has been at all times for at least three years prior to the date of this Agreement, and will be through the

Pre-Closing Transfer, an “interested stockholder” (as such term is defined in Section 203 of the DGCL) of the Company,

such that Seller is, and has been at all times for at least three years prior to the date of this Agreement, and will be through the

Pre-Closing Transfer, an “interested stockholder” (as such term is defined in Section 203 of the DGCL) of the Company.

From the Pre-Closing Transfer through Closing, Seller shall continue to be an “interested stockholder” (as such term is

defined in Section 203 of the DGCL) of the Company by virtue of its ownership (as such term is defined in Section 203 of the DGCL)

of the Repurchase Shares.

4. Information.

The Seller acknowledges that it knows that the Company and members of the Board and of the Company’s management may have

material, non-public information regarding the Company and its condition (financial and otherwise), results of operations,

businesses, properties, plans (including, without limitation, plans regarding other potential exchanges or purchases of Common

Stock, which may be for different amounts or types of consideration) and prospects (collectively, the “Information”).

The Seller acknowledges (a) that it has been offered, and does not wish to receive, any of the Information, (b) that the Company has

not disclosed, and has no obligation to disclose, the Information to the Seller, and (c) that the Information might be material to

the Seller’s decision to sell the Repurchase Shares or otherwise materially adverse to the Seller’s interests.

Accordingly, the Seller acknowledges and agrees that neither the Company nor any member of the Board or of the Company’s

management shall have any obligation to disclose to the Seller any of the Information. The Seller hereby waives and releases, to the

fullest extent permitted by law, any and all claims and causes of action (whether known or unknown) it has or may have against the

Company and its affiliates, controlling persons, officers, directors, employees, representatives and agents, based upon, relating to

or arising out of the nondisclosure of the Information in connection with the transactions contemplated by the Agreement. The Seller

is aware that the Company is relying on the foregoing acknowledgement and waiver in this Section 4 in connection with the

transactions contemplated by this Agreement.

5. Miscellaneous.

(a) Survival

of Representations and Warranties. All representations and warranties contained herein or made in writing by any party in connection

herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(b) Counterparts; Execution of Agreement. This Agreement may be executed in separate counterparts, each of which is deemed to

be an original and all of which taken together constitute one and the same agreement. Delivery of an executed counterpart of a signature

page to this Agreement by facsimile or other electronic transmission, including by e-mail attachment or PDF document, shall be as effective

as delivery of a manually executed counterpart of this Agreement.

(c) No

Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties hereto and their successors and

permitted assigns, and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or

remedies to any person other than the parties to this Agreement and their successors and permitted assigns.

(d) Governing

Law; Arbitration; Jurisdiction. This Agreement and all disputes arising out of or related to this Agreement, whether in contract,

tort or otherwise (each, an “Agreement Dispute”), will be governed by and construed in accordance with, the laws

of the State of Delaware, without regard to any applicable principles of conflicts of law that might require the application of the laws

of any other jurisdiction. Any Agreement Dispute shall be resolved by binding arbitration in Chicago, Illinois, before one arbitrator

independent of the parties (each, an “Arbitration Proceeding”). Such arbitrator shall be selected in accordance with,

and the Arbitration Proceeding shall be administered by JAMS pursuant to, the JAMS Comprehensive Arbitration Rules and Procedures excluding

its optional Arbitration Appeal procedures. Any arbitrator designated pursuant to this Section 5(d) shall be a lawyer experienced in

commercial and business affairs. All Arbitration Proceedings will be closed to the public and kept confidential, except to the extent

necessary to (i) seek an injunction in aid of arbitration, (ii) obtain court confirmation of the judgment of the arbitrator, or (iii)

give effect to res judicata and collateral estoppel, in which case, all filings with any court shall be sealed to the extent permissible

by the court. Nothing in this Section 5(d) is intended to, or shall, preclude a party to an Arbitration Proceeding from communicating

with, or making disclosures to his, her or its lawyers, tax advisors, auditors and insurers, or from making such other disclosures as

may be required by any applicable law. To the maximum extent permitted by applicable law, the decision of the arbitrator shall be final

and binding and not be subject to appeal. If any party to an Arbitration Proceeding fails to abide by a judgment rendered in such Arbitration

Proceeding, the other party may seek to enforce such judgment in any court of competent jurisdiction. EACH OF THE PARTIES TO THIS AGREEMENT

IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY AGREEMENT DISPUTE. Notwithstanding anything contained in this Agreement

to the contrary, no party shall have the right to institute any proceedings in any court against the other party or any person acting

by, through or under such other party to adjudicate an Agreement Dispute, except that any party shall be permitted to seek an injunction

in aid of arbitration with respect to an Agreement Proceeding, and any such injunction proceeding shall be sought and determined exclusively

in any Delaware state or federal court.

(e) Mutuality

of Drafting. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity

or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption

or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this Agreement.

(f) Amendment

and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of the Seller

and the Company; provided, in the case of the Company, such amendment, modification or waiver has been approved by the Special Committee

or, if the Special Committee is no longer in existence, by a majority of the members of the Board unaffiliated with the Bresky Group,

or a committee of such directors. No waiver of any of the provisions of this Agreement shall be deemed, or shall constitute, a waiver

of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. Moreover, no failure by any party to

insist upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach

thereof shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(g) Further Assurances. Each of the Company and the Seller shall execute and deliver such additional documents and instruments

and shall take such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(h) Expenses. Each of the Company and the Seller shall bear their own respective expenses

in connection with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby.

(i) Entire Agreement. This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof

and supersedes all other prior or contemporaneous agreements and understandings, both written and oral, among or between any of the parties

with respect to the subject matter hereof.

[Signatures appear on following page.]

IN WITNESS WHEREOF, the parties

hereto have executed this Stock Repurchase Agreement as of the date first written above.

| |

SEABOARD CORPORATION |

| |

|

|

| |

By: |

/s/ Robert L. Steer |

| |

|

Name: Robert L. Steer |

| |

|

Title: President and Chief Executive Officer |

| |

REP23 LLC |

| |

|

| |

By: |

/s/ Jonathan Graber |

| |

|

Name: Jonathan Graber |

| |

|

Title: Manager |

[Signature Page to Stock Repurchase Agreement]

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

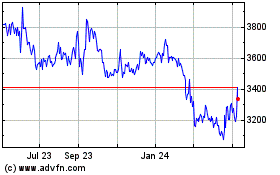

Seaboard (AMEX:SEB)

Historical Stock Chart

From Feb 2025 to Mar 2025

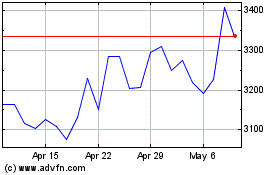

Seaboard (AMEX:SEB)

Historical Stock Chart

From Mar 2024 to Mar 2025