PLW: The Only Treasury ETF You Need - ETF News And Commentary

07 December 2012 - 9:51PM

Zacks

Although the American fiscal position isn’t exactly great, there

is still substantial demand for U.S. Treasury bonds. This is

despite low rates on these securities, and is due at least in part

to the lack of other options in the space.

Japan’s bonds are yielding even less while their government is

in a worse fiscal position than America, while Europe is probably

too volatile for most investors. Emerging market securities are

coming on strong, but as of now, none of have the deep liquidity

and size of the American bond market, making U.S. Treasury

securities a staple of many portfolios (see Three Bond ETFs for a

Fixed Income Bear Market).

For investors uninterested in holding just one or two U.S.

treasury bonds, a number of ETFs have appeared to give investors

broader exposure to the space. Most of these securities focus on a

particular maturity level, either offering investors holdings in

short-term, mid-term, or long-term government bonds.

There is, however, an exception to this with the

PowerShares 1-30 Year Treasury Laddered ETF (PLW).

This fund looks to take an entirely different approach to Treasury

bond investing, giving a more holistic view of the market (read

HYEM: The Best Choice in Junk Bond ETFs?).

This ETF tracks the Ryan/Mergent 1-30 Year Treasury Laddered

Index, which is a broad benchmark of American Treasury securities

not including STRIPS, TIPS, or ultra-short term T-bills. Instead,

the fund holds approximately 30 equally weighted U.S. Treasury

issued with fixed coupons, scheduled to mature in a proportional,

annual sequential—read ‘laddered’—structure.

In other words, PLW holds roughly one U.S. Treasury bond issue

for each of the next 30 years in roughly equal quantities, although

it should be noted that mid term debt maturing in roughly 20 years

time does receive a bit of an outsized portion of the total assets

(see Forget Interest Rate Risk with These Bond ETFs).

This approach gives the fund a very spread out profile in terms

of maturity dates with roughly 15% of the portfolio maturing in

five years or less with 17% maturing in 25 years or more on the

flipside. This leaves the bulk for mid-term securities—suggesting a

tilt for this asset level—although even this is well spread out

among the various maturity levels.

The fund could be appropriate for those seeking a mid-term

duration play on the Treasury market with a more balanced approach.

Although, it should be noted that the 30-Day SEC yield is just 1.6%

so it won’t be much of a yield destination, but it could be a more

even way to tackle the Treasury market.

This is especially true given that the fund sees decent volume

on a modest size asset base, so bid ask spreads should be modest.

Additionally, the expense ratio comes in at 0.25% so it will be a

relatively low cost pick as well.

While some might be wondering why they should take this approach

when compared to other mid range Treasury ETFs, a look to yield and

price performance could demonstrate why PLW is a potentially better

pick (read Three Great Bond ETFs Investors Have Overlooked).

The ETF has a better yield than PIMCO’s mid-range product TENZ,

although it slips in comparison to TLH, iShares’ 10-20 year

Treasury bond ETF. While both are a little less expensive than PLW,

the PowerShares product has proven itself to be a good middle

ground between the two in terms of volatility—but also performance

as well, at least over the past one year period.

So for investors seeking a potentially more balanced approach in

the U.S. Treasury market, PLW could be an interesting choice. While

the fund is a little pricier than its counterparts, the ETF does

offer up a nice mix of holdings that is unmatched by others in the

space, suggesting it could be well positioned no matter what

happens in the next few months in the U.S. Treasury market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

PWRSH-1-30 LAD (PLW): ETF Research Reports

PIMCO-7-15Y UST (TENZ): ETF Research Reports

ISHARS-BR 10-20 (TLH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

iShares 10 to 20 Year Tr... (AMEX:TLH)

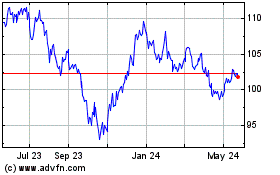

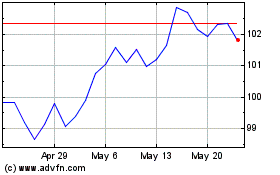

Historical Stock Chart

From Dec 2024 to Jan 2025

iShares 10 to 20 Year Tr... (AMEX:TLH)

Historical Stock Chart

From Jan 2024 to Jan 2025