Tompkins Financial Corporation (NYSEMKT:TMP)

Tompkins Financial Corporation reported net income of $12.6

million for the first quarter of 2014, an increase of 9.2% from the

$11.5 million reported for the same period in 2013. Diluted

earnings per share were $0.84 for the first quarter of 2014, a 6.3%

increase from $0.79 reported for the first quarter of 2013. Prior

period results included in this press release were impacted by

certain non-recurring items, which are more fully described in the

non-GAAP disclosure tables included with this press release.

President and CEO Stephen S. Romaine said, "We are pleased to

start 2014 with the strongest first quarter in our history. In

addition to earnings per share growth over the first quarter of

2013, loan and deposit levels increased from the same period last

year, and from the most recent prior quarter. At the same time we

saw continued improvement in nearly all credit quality

indicators.”

FIRST QUARTER SELECTED HIGHLIGHTS:

- Net interest income of $40.0 million

was up 4.8% from the same period last year.

- Annualized return on average equity was

10.88% for the quarter ended March 31, 2014, compared to 10.53% for

the same period in 2013.

- Tangible book value per share has

increased for the third consecutive quarter, and is up 5.8% from

the first quarter of 2013. Refer to Non-GAAP disclosure for

additional details on tangible book value per share.

- Credit quality improved with

non-performing assets representing 0.81% of total assets, which is

the lowest this percentage has been over the past 20 quarters, and

remains well below the most recent peer average of 1.69% by the

Federal Reserve1.

- Total loans of $3.2 billion were up

7.0% over the same period in 2013, and were up an annualized 1.3%

over year-end 2013.

- The average cost of deposits declined

from 0.34% in the first quarter of 2013, to 0.28% in 2014. Average

total deposits for the first quarter of 2014 were $4.0 billion,

which is comparable to the same period in 2013.

NET INTEREST INCOME

Net interest income of $40.0 million for the first quarter of

2014 increased 4.8% compared to $38.2 million reported for the same

period in 2013. Net interest income was down $2.6 million or 6.1%

from the fourth quarter of 2013. The fourth quarter included higher

interest income related to interest collected on the payoff of a

nonaccrual loan and a higher level of purchase accounting accretion

related to loans paid off during the fourth quarter of 2013. The

net interest margin for the first quarter of 2014 was 3.60%

compared to 3.57% for the first quarter of 2013 and 3.78% for the

fourth quarter of 2013.

NONINTEREST INCOME

Noninterest income was $17.4 million for the first quarter of

2014, which was in line with both the same period prior year and

the fourth quarter of 2013. Noninterest income represented 30.3% of

total revenue for the first quarter of 2014, compared to 31.3% for

the same period in 2013. Fee based services related to wealth

management, deposit fees, and card services fees, were all up from

the same period in 2013, while insurance revenues were in line with

the prior year period. Other noninterest income was down from the

first quarter of 2013, in part due to certain nonrecurring items in

the first quarter of 2013. The first quarter of 2014 also saw a

decline in realized gains on the sale of securities, when compared

to the first quarter of 2013.

NONINTEREST EXPENSE

Noninterest expense was $38.2 million for the first quarter of

2014, up 1.8% compared to March 31, 2013, and down 5.1% from the

fourth quarter of 2013. The increase in noninterest expense

compared to the same period prior year is mainly a result of higher

salary and wages expense. The decline in noninterest expense when

compared to the fourth quarter of 2013 was driven by higher salary

and wages in the fourth quarter, which included increased variable

compensation accruals, reflecting the Company’s strong performance

in 2013.

ASSET QUALITY

Asset quality trends improved in nearly all categories during

the quarter. Substandard and Special Mention loans declined by

$39.5 million from the same period last year, and by $1.6 million

from the most recent previous quarter. The percentage of

nonperforming loans and leases to total loans and leases improved

to 1.11% at March 31, 2014, compared to 1.24% reported at March 31,

2013.

Provision for loan and lease losses was $743,000 for the first

quarter of 2014, which was an improvement of 28.4% compared to the

first quarter of 2013. Net loan and lease charge-offs totaled

$699,000 in the first quarter of 2014, down from $1.0 million in

the first quarter of 2013.

The Company’s allowance for originated loan and lease losses

totaled $26.7 million at March 31, 2014, which represented 1.04% of

total originated loans, compared to 1.11% at March 31, 2013 and

1.06% at year-end 2013. The allowance for loan and lease losses

covered 78.88% of nonperforming loans and leases as of March 31,

2014, compared to 66.16% at March 31, 2013 and 71.65% at year-end

2013.

CAPITAL POSITION

Capital ratios remain well above the regulatory well capitalized

minimums. Tier 1 capital to average assets improved for the fifth

consecutive quarter, to 8.68% at March 31, 2014, and the ratio of

total capital to risk-weighted assets was 13.68%.

ABOUT TOMPKINS FINANCIAL CORPORATION

Tompkins Financial Corporation is a financial services company

serving the Central, Western, and Hudson Valley regions of New York

and the Southeastern region of Pennsylvania. Headquartered in

Ithaca, NY, Tompkins Financial is parent to Tompkins Trust Company,

The Bank of Castile, Mahopac Bank, VIST Bank, Tompkins Insurance

Agencies, Inc., and offers wealth management services through

Tompkins Financial Advisors. For more information on Tompkins

Financial, visit www.tompkinsfinancial.com.

NON-GAAP MEASURES

This press release contains financial information determined by

methods other than in accordance with accounting principles

generally accepted in the United States of America (GAAP). Where

non-GAAP disclosures are used in this press release, the comparable

GAAP measure, as well as reconciliation to the comparable GAAP

measure, is provided in the accompanying tables. Management

believes that these non-GAAP measures provide useful information.

Non-GAAP measures should not be considered a substitute for

financial measures determined in accordance with GAAP and investors

should consider the Company’s performance and financial condition

as reported under GAAP and all other relevant information when

assessing the performance or financial condition of the Company.

See “Tompkins Financial Corporation - Summary Financial Data

(Unaudited)” tables for Non-GAAP related calculations.

"Safe Harbor" Statement under the Private Securities

Litigation Reform of 1995:

This press release may include forward-looking statements with

respect to revenue sources, growth, market risk, and corporate

objectives. The Company assumes no duty, and specifically disclaims

any obligation, to update forward-looking statements, and cautions

that these statements are subject to numerous assumptions, risks,

and uncertainties, all of which could change over time. Actual

results could differ materially from forward-looking

statements.

TOMPKINS FINANCIAL CORPORATION CONDENSED CONSOLIDATED

STATEMENTS OF CONDITION (In thousands, except share and

per share data) (Unaudited)

As of As of

ASSETS 03/31/2014 12/31/2013 Cash and

noninterest bearing balances due from banks $ 97,283 $ 82,163

Interest bearing balances due from banks 1,016

721

Cash and Cash Equivalents

98,299 82,884 Trading securities, at fair

value 10,498 10,991

Available-for-sale securities, at fair

value (amortized cost of $1,384,804 at March 31, 2014 and

$1,368,736 at December 31, 2013)

1,379,600 1,354,811

Held-to-maturity securities, fair value of

$19,434 at March 31, 2014, and $19,625 at December 31, 2013

18,820 18,980 Originated loans and leases, net of unearned income

and deferred costs and fees 2,555,522 2,527,244 Acquired loans and

leases, covered 24,106 25,868 Acquired loans and leases,

non-covered 624,584 641,172 Less: Allowance for loan and lease

losses 28,014 27,970

Net Loans and Leases 3,176,198 3,166,314

FDIC Indemnification Asset 3,999 4,790 Federal Home Loan

Bank stock 18,240 25,041 Bank premises and equipment, net 56,776

55,932 Corporate owned life insurance 72,339 69,335 Goodwill 92,246

92,140 Other intangible assets, net 16,004 16,298 Accrued interest

and other assets 98,781 105,523

Total Assets $ 5,041,800

$ 5,003,039 LIABILITIES

Deposits: Interest bearing: Checking, savings and money market

2,338,780 2,190,616 Time 898,884 865,702 Noninterest bearing

867,506 890,898

Total

Deposits 4,105,170 3,947,216 Federal funds

purchased and securities sold under agreements to repurchase

158,794 167,724

Other borrowings, including certain

amounts at fair value of $11,228 at March 31, 2014 and $11,292 at

December 31, 2013

214,616 331,531 Trust preferred debentures 37,211 37,169 Other

liabilities 52,187 61,460

Total Liabilities $ 4,567,978

$ 4,545,100 EQUITY

Tompkins Financial Corporation shareholders' equity:

Common Stock - par value $.10 per share:

Authorized 25,000,000 shares; Issued: 14,864,917 at March 31, 2014;

and 14,785,007 at December 31, 2013

1,486 1,479 Additional paid-in capital 349,812 346,096 Retained

earnings 143,766 137,102 Accumulated other comprehensive loss

(19,685 ) (25,119 )

Treasury stock, at cost – 103,921 shares

at March 31, 2014, and 105,449 shares at December 31, 2013

(3,042 ) (3,071 )

Total Tompkins Financial Corporation

Shareholders’ Equity 472,337 456,487

Noncontrolling interests 1,485

1,452

Total Equity $ 473,822

$ 457,939 Total Liabilities

and Equity $ 5,041,800

$ 5,003,039 TOMPKINS FINANCIAL

CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Three Months Ended (In thousands, except per

share data) (Unaudited)

03/31/2014 03/31/2013

INTEREST AND DIVIDEND INCOME Loans $ 36,954 $ 36,429 Due

from banks 1 7 Trading securities 112 165 Available-for-sale

securities 7,936 7,480 Held-to-maturity securities 152 191 Federal

Home Loan Bank stock and Federal Reserve Bank stock

210 185

Total Interest and Dividend

Income 45,365

44,457 INTEREST EXPENSE Time certificates of

deposits of $100,000 or more 952 1,204 Other deposits 1,790 2,182

Federal funds purchased and securities

sold under agreements to repurchase

817 1,010 Trust preferred debentures 570 687 Other borrowings

1,209 1,168

Total

Interest Expense 5,338

6,251 Net Interest Income

40,027 38,206 Less:

Provision for loan and lease losses 743

1,038

Net Interest Income After Provision for Loan

and Lease Losses 39,284

37,168 NONINTEREST INCOME Insurance

commissions and fees 7,257 7,261 Investment services income 4,010

3,788 Service charges on deposit accounts 2,116 1,908 Card services

income 2,112 1,738 Mark-to-market loss on trading securities (59 )

(115 ) Mark-to-market gain on liabilities held at fair value 65 77

Other income 1,839 2,366 Gain on sale of available-for-sale

securities 94 367

Total Noninterest Income 17,434

17,390 NONINTEREST EXPENSES

Salaries and wages 16,646 15,572 Pension and other employee

benefits 6,045 6,070 Net occupancy expense of premises 3,260 3,061

Furniture and fixture expense 1,337 1,457 FDIC insurance 811 772

Amortization of intangible assets 527 557 Merger related expenses 0

196 Other operating expense 9,584

9,835

Total Noninterest Expenses

38,210 37,520 Income

Before Income Tax Expense 18,508

17,038 Income Tax Expense

5,906 5,495

Net Income

attributable to Noncontrolling Interests and Tompkins Financial

Corporation 12,602

11,543 Less: Net income attributable to

noncontrolling interests 33 33

Net Income Attributable to Tompkins Financial

Corporation $ 12,569

$ 11,510 Basic Earnings Per Share

$ 0.85 $ 0.80 Diluted Earnings Per

Share $ 0.84 $

0.79 Average Consolidated Statements of

Condition and Net Interest Analysis (Unaudited)

Year to Date Period Ended Year to Date Period

Ended March 31, 2014

March 31, 2013 Average Average

Balance Average Balance Average (Dollar amounts in thousands)

(YTD) Interest Yield/Rate

(YTD) Interest Yield/Rate

ASSETS

Interest-earning assets Interest-bearing balances due from banks $

1,026

$ 1 0.40 % $

3,908

$ 7 0.73 % Securities (4) U.S. Government securities 1,284,771

7,373 2.33 % 1,297,578 6,794 2.12 % Trading securities 10,832 112

4.19 % 16,126 165 4.15 % State and municipal (5) 88,037 1,109 5.11

% 100,089 1,299 5.26 % Other securities (5) 5,194

44 3.44 % 9,158

90 3.99 % Total securities 1,388,834

8,638 2.52 % 1,422,951 8,348 2.38 % FHLBNY and FRB stock 20,137 210

4.23 % 18,859 185 3.98 % Total loans and leases, net of

unearned income (5)(6) 3,192,520 37,399

4.75 % 2,963,737

36,567 5.00 %

Total interest-earning assets

4,602,517 46,248

4.08 % 4,409,455

45,107 4.15 %

Other assets 379,516 490,272

Total assets

4,982,033 4,899,727

LIABILITIES &

EQUITY Deposits Interest-bearing deposits Interest bearing

checking, savings, & money market 2,287,871 1,097 0.19 %

2,269,900 1,418 0.25 % Time deposits 888,474

1,645 0.75 % 979,860

1,968 1.02 % Total interest-bearing

deposits 3,176,345 2,742 0.35 % 3,249,760 3,386 0.42 %

Federal funds purchased & securities

sold under agreements to repurchase

162,348 817 2.04 % 198,707 1,010 2.06 % Other borrowings 248,678

1,209 1.97 % 119,606 1,168 3.96 % Trust preferred debentures

37,184 570 6.22 %

43,675 687 6.38 %

Total

interest-bearing liabilities 3,624,555 5,338

0.60 % 3,611,748 6,251 0.70

% Noninterest bearing deposits 834,864 771,761

Accrued expenses and other liabilities 54,099 72,941

Total liabilities 4,513,518 4,456,450 Tompkins

Financial Corporation Shareholders’ equity 467,048 441,810

Noncontrolling interest 1,467 1,467

Total

equity 468,515 443,277 Total

liabilities and equity $ 4,982,033

$ 4,899,727 Interest rate spread

3.48 % 3.45 % Net

interest income/margin on earning assets

40,910 3.60

% 38,856 3.57 % Tax Equivalent

Adjustment

(883 ) (650 ) Net

interest income per consolidated financial statements

$ 40,027

$ 38,206

Tompkins Financial Corporation - Summary Financial Data

(Unaudited) (In thousands, except per share data)

Quarter-Ended Year-Ended Mar-14

Dec-13 Sep-13 Jun-13

Mar-13 Dec-13

Period End Balance Sheet

Securities $

1,408,918 $ 1,384,782 $ 1,390,233 $ 1,469,315

$ 1,566,510 $ 1,384,782 Originated loans and leases,

net of unearned income and deferred costs and fees (2)

2,555,522 2,527,244 2,420,695

2,309,232 2,208,346

2,527,244 Acquired loans and leases (3) 648,690

667,040 698,617 745,951

785,449 667,040 Allowance for loan and

lease losses 28,014 27,970

26,408 25,458 24,661

27,970 Total assets 5,041,800

5,003,039 4,932,428 4,931,883

4,987,280 5,003,039 Total deposits

4,105,170 3,947,216 3,972,756

3,912,910 4,072,352

3,947,216 Federal funds purchased and securities sold under

agreements to repurchase 158,794

167,724 162,117 171,498

194,091 167,724 Other borrowings

214,616 331,531 242,177

299,098 156,649 331,531 Trust preferred

debentures 37,211 37,169

37,127 43,703 43,687

37,169 Shareholders' equity 473,822

457,939 444,276 431,894

446,812 457,939

Average Balance Sheet

Average earning assets $ 4,602,517 $ 4,571,099

$ 4,533,603 $ 4,571,428 $ 4,409,455 $

4,521,873 Average assets 4,982,033

4,950,476 4,897,678 4,965,895

4,899,727 4,928,499 Average interest-bearing

liabilities 3,624,555 3,574,803

3,572,708 3,663,230 3,611,748

3,605,430 Average equity 468,515

449,445 434,482 447,088

443,277 443,565

Share data

Weighted average shares outstanding (basic)

14,644,548 14,589,120 14,515,053

14,427,838 14,374,265 14,477,617

Weighted average shares outstanding (diluted)

14,775,386 14,731,786 14,622,512

14,496,859 14,436,757 14,573,919

Period-end shares outstanding 14,829,007

14,749,097 14,692,671 14,599,558

14,447,017 14,749,097 Book value per

share 31.95 31.05 30.24

29.58 30.93 31.05

Tangible book value per share (Non-GAAP) 24.65

23.70 22.82 22.08

23.29 23.70

Income Statement

Net

interest income $ 40,027 $ 42,624 $ 40,473

$ 39,826 $ 38,206 $ 161,129 Provision for

loan/lease losses 743 585

2,049 2,489 1,038 6,161

Noninterest income 17,434 17,439

18,528 16,541 17,390

69,898 Noninterest expense 38,210

40,251 37,554 37,777

37,520 153,102 Income tax expense

5,906 4,905 5,316

5,061 5,495 20,777 Net income

attributable to Tompkins Financial Corporation 12,602

14,290 14,049 11,007

11,510 50,856 Noncontrolling interests

33 32 33 33

33 131 Basic earnings per share (9)

$ 0.85 $ 0.97 $ 0.96 $ 0.76 $

0.80 $ 3.48 Diluted earnings per share (9) $ 0.84

$ 0.96 $ 0.95 $ 0.75 $ 0.79 $

3.46

Nonperforming Assets

Originated nonaccrual loans and

leases $ 26,974 $ 29,875 $ 33,881 $

32,100 $ 32,554 $ 29,875 Acquired nonaccrual loans

and leases 6,936 8,508

8,008 6,916 4,561 8,508

Originated loans and leases 90 days past due and accruing

339 607 1,217 156

157 607 Troubled debt restructurings

not included above 1,266 45

46 0 - 45 Total

nonperforming loans and leases 35,515

39,035 43,152 39,172

37,272 39,035 OREO (8) 5,351

4,253 6,264 4,918

3,950 4,253 Total nonperforming assets

40,866 43,288 49,416

44,090 41,222 43,288

Tompkins

Financial Corporation - Summary Financial Data (Unaudited) -

continued Quarter-Ended

Year-Ended Delinquency - Originated loan and lease

portfolio Mar-14 Dec-13

Sep-13 Jun-13 Mar-13

Dec-13

Loans and leases 30-89 days past due and

accruing (2)

$ 5,660 $ 5,762 $ 12,193 $ 9,597

$ 10,888 $ 5,762 Loans and leases 90

days past due and accruing (2) 339 607

1,217 156

157 607 Total originated loans and leases past

due and accruing (2) 5,999 6,369

13,410 9,753

11,045 6,369

Delinquency - Acquired loan and lease portfolio

Covered loans and leases 30-89 days past due and accruing (3)(7)

635 0 1,132

1,613 3,503 0

Covered loans and leases 90 days or more

past due and accruing (3)(7)

1,135 2,416 2,980

3,091 3,809 2,416

Non-covered loans and leases 30-89 days

past due and accruing (3)(7)

2,293 1,532 6,887

5,591 5,738 1,532

Non-Covered loans and leases 90 days past

due and accruing (3)(7)

3,746 4,557 10,521

13,324 14,026

4,557 Total acquired loans and leases past due and accruing

7,809 8,505 21,520

23,619 27,076

8,505

Total loans and leases past due and accruing

$ 13,808 $ 14,874 $ 34,930 $

33,372 $ 38,121 $ 14,874

Allowance for Loan Losses - Originated loan and lease

portfolio Balance at beginning of period $ 26,700

$ 25,722 $ 24,853 $ 24,598 $

24,643 $ 24,643 Provision for loan and lease losses

511 (325 ) 1,499

(994 ) 820 1,000 Net loan

and lease (recoveries) charge-offs 550

(1,303 ) 630 (1,249 ) 865

(1,057 )

26,661 26,700 25,722 24,853 24,598 26,700

Allowance for loan and lease losses

(originated loan portfolio) - balance at end of period

Allowance for Loan Losses - Acquired

loan and lease portfolio Balance at beginning of period

$ 1,270 $ 686 $ 605 $ 63

$ 0 $ 0 Provision for loan and lease losses

232 910 549

3,483 218 5,160 Net loan

and lease charge-offs 149 326

468 2,941 155

3,890

Allowance for loan and lease losses

(acquired loan portfolio) - balance at end of period

1,353 1,270 686

605 63 1,270

Total allowance for loan and lease losses

28,014 27,970 26,408

25,458 24,661

27,970

Loan Classification - Originated

Portfolio

Special Mention $ 44,725 $ 42,365

$ 42,975 $ 43,099 $ 48,468

$ 42,365 Substandard 32,917

35,022 37,004 41,969

43,449 35,022

Loan

Classification - Acquired Portfolio

Special Mention

14,936 17,322 23,939

29,300 26,568 17,322

Substandard 34,137 33,561

42,433 55,079

47,698 33,561

Loan Classifications - Total

Portfolio

Special Mention 59,661

59,687 66,914 72,399

75,036 59,687 Substandard

67,054 68,583 79,437

97,048 91,147

68,583

Tompkins Financial Corporation - Summary

Financial Data (Unaudited) - continued

RATIO ANALYSIS Quarter-Ended

Year-Ended Credit Quality Mar-14

Dec-13 Sep-13 Jun-13

Mar-13 Dec-13 Nonperforming loans and

leases/total loans and leases (7) 1.11 %

1.22 % 1.38 % 1.28 %

1.24 % 1.22 % Nonperforming assets/total

assets 0.81 % 0.87 % 1.00

% 0.89 % 0.83 % 0.87 %

Allowance for originated loan and lease losses/total originated

loans and leases 1.04 % 1.06 %

1.06 % 1.08 % 1.11 %

1.06 % Allowance/nonperforming loans and leases

78.88 % 71.65 % 61.20 %

64.99 % 66.16 % 71.65 % Net loan

and lease losses (recoveries) annualized/total average loans and

leases 0.09 % (0.12 %)

0.14 % 0.22 % 0.14 % 0.09

%

Capital Adequacy

(period-end)

Tier 1 capital / average assets 8.68 %

8.52 % 8.37 % 8.16 %

8.11 % 8.52 % Total capital /

risk-weighted assets 13.68 % 13.42 %

13.32 % 13.34 % 12.93 %

13.42 % Tangible common equity / tangible assets

7.38 % 7.11 % 6.92 %

6.65 % 6.87 % 7.11 %

Profitability

Return on average assets *

1.02 % 1.15 % 1.10 %

0.89 % 0.95 % 1.03 % Return on

average equity * 10.88 % 12.62 %

12.83 % 9.87 % 10.53 %

11.47 % Net interest margin (TE) * 3.60 %

3.78 % 3.63 % 3.58 %

3.57 % 3.65 % * Quarterly ratios have

been annualized

Non-GAAP Disclosure

Reported

noninterest income (GAAP) $ 17,434 $ 17,439

$ 18,528 $ 16,541 $

17,390 $ 69,898 Adjustments (pre-tax):

Gain on

redemption of trust preferred 0

0 (1,410 ) 0

0 (1,410 ) Gain on deposit conversion

0 (1,285 ) 0

0 0

(1,285 ) Noninterest income (Non-GAAP) $ 17,434

$ 16,154 $ 17,118 $ 16,541

$ 17,390 $ 67,203

Non-GAAP Disclosure

Reported net income (GAAP) $

12,569 $ 14,290 $ 14,049

$ 11,007 $ 11,510 $ 50,856

Adjustments (net of tax):

Merger related expenses 0

0 0 22

118 140 Gain on

redemption of trust preferred 0

0 (846 ) 0

0 (846 ) Gain on deposit conversion

0 (771 ) 0

0 0 (771 )

Subtotal adjustments 0 (771 )

(846 ) 22 118

(1,477 ) Net operating income (Non-GAAP)

12,569 13,519

13,203 11,029

11,628 49,379 Adjusted diluted earnings

per share (Non-GAAP) (9) $ 0.84 $ 0.91

$ 0.89 $ 0.75 $ 0.80

$ 3.36

Tompkins Financial Corporation -

Summary Financial Data (Unaudited) - continued

Non-GAAP Disclosure

Quarter-Ended Year-Ended

Mar-14 Dec-13 Sep-13

Jun-13 Mar-13 Dec-13 Reported net

income (GAAP) $ 12,569 $ 14,290

$ 14,049 $ 11,007 $ 11,510

$ 50,856 Merger related expenses (net of tax)

0 0 0

22 118 140

Gain on redemption of trust preferred (net of tax)

0 0 (846 )

0 0 (846 ) Gain on

deposit conversion 0 (771 )

0 0 0

(771 ) Net operating income (Non-GAAP)

$ 12,569 $ 13,519 $ 13,203

$ 11,029 $ 11,628 $ 49,379

Amortization of intangibles (net of tax) 316

329 327

328 334 1,318

Adjusted net operating income (Non-GAAP)

12,885 13,848 13,530

11,357 11,962

50,697

Average total shareholders'

equity 468,515 449,445

434,482 447,088

443,277 443,565 Less: Average

goodwill and intangibles 108,437

108,729 109,277 110,037

110,687 109,676

Average tangible shareholders' equity (Non-GAAP)

360,078 340,716 325,205

337,051 332,590

333,889

Adjusted operating return on

shareholders' tangible equity (annualized) (Non-GAAP)

14.51 % 16.13 % 16.51 %

13.52 % 14.59 % 15.18 %

Non-GAAP Disclosure

Total shareholders' equity (GAAP)

$ 473,822 $ 457,939 $ 444,276

$ 431,894 $ 446,812 $

457,939 Less: goodwill and intangibles 108,250

108,438 108,981

109,540 110,314

108,438 Tangible shareholders' equity

365,572 349,501 335,295

322,354 336,498

349,501

Ending shares outstanding

14,829,007 14,749,097

14,692,671 14,599,558

14,447,017 14,749,097 Tangible

book value per share (Non-GAAP) 24.65

23.70 22.82 22.08

23.29 23.70

_________________________________________________________(1)

Federal Reserve peer ratio as of December 31, 2013, includes banks

and bank holding companies with consolidated assets between $3

billion and $10 billion.(2) "Originated" equals loans and leases

not included by definition in "acquired loans"(3) "Acquired Loans

and Leases" equals loans and leases acquired at fair value,

accounted for in accordance with FASB ASC Topic 805. "Covered

Loans" are loans for which the Company will share losses with the

FDIC and consist of loans VIST Bank acquired as part of an

FDIC-assisted transaction during the fourth quarter of 2010.(4)

Average balances and yields on available-for-sale securities are

based on historical amortized cost.(5) Interest income includes the

tax effects of taxable-equivalent basis.(6) Nonaccrual loans are

included in the average asset totals presented above. Payments

received on nonaccrual loans have been recognized as disclosed in

Note 1 of the Company's consolidated financial statements included

in Part I of the Company's annual report on Form 10-K for the

fiscal year ended December 31, 2013.(7) Certain acquired loans and

leases that are past due are not on nonaccrual and are not included

in nonperforming loans. The risk of credit loss on these loans has

been considered by virtue of the Corporation's estimate of

acquisition-date fair value and these loans are considered accruing

as the Corporation primarily recognizes interest income through

accretion of the difference between the carrying value of these

loans and their expected cash flows.(8) Includes all other real

estate owned, including those balances acquired through business

combinations.(9) Earnings per share year-to-date may not equal the

sum of the quarterly earnings per share as a result of rounding of

average shares.

Tompkins Financial CorporationStephen S. Romaine,

888-503-5753President & CEOorFrancis M. Fetsko, 888-503-5753CFO

& COO

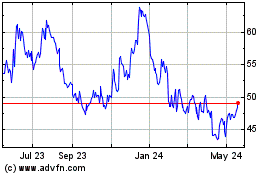

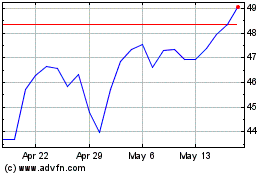

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Jul 2023 to Jul 2024