Trio Reports Notable Increases in Estimated Oil and Gas Reserves

03 September 2024 - 10:30PM

Trio Petroleum Corp (NYSE American: TPET) (“Trio” or the

“Company”), a California-based oil and gas company, today provided

an update on estimates of oil and gas reserves and future net cash

flows at its South Salinas Project in Monterey County, California.

The Company recently filed with the Securities and Exchange

Commission (“SEC”) a Registration Statement on Form S-1 (“S-1”)

that included an updated reserve report, effective April 30, 2024

(“Reserve Report”), for the Company’s assets at the South Salinas

Project. The Reserve Report was prepared by an independent

third-party engineering firm, KLS Petroleum Consulting LLC.

The updated Reserve Report calculated

approximately $475 million in estimated discounted (at 10%) net

cash flow to the Company from its Probable (P2) Undeveloped

Reserves of combined Phases 1-3 in the South Salinas Project, which

is an increase of approximately $67 million from the Company’s

earlier reserve report as filed with the SEC. The Reserve Report

recognizes Probable (P2) Undeveloped Reserves and Possible (P3)

Undeveloped Reserves for three project development phases, namely

existing wells and permitted drilling locations, an additional

12-well drilling program, and the full development of the field

over a four year period.

“I am pleased to report the results of our

updated independent reserves report. This improved value is a

strong validation of the operational investments we have

successfully completed on these assets in 2024,” commented Robin

Ross, CEO of Trio Petroleum. “We have been extremely focused on

improving the current value of our California oil and gas assets,

bringing wells online, carefully investing to optimize current

production, increasing lease and working interest acquisitions with

the goal of quickly generating sustained cash flows. Additionally

we have been making notable progress in the permitting process as

well as holding ongoing discussions with third-parties that may

wish to join us in expanding our oil and gas development project to

include a carbon capture and storage project. Increasing our

reserves and increasing our discounted net cash flow by $67 million

are healthy reflections of our continued effort to unlock the value

of our assets.”

The Reserve Report indicates that the Probable

(P2) Undeveloped Reserves of combined Phases 1-3, net to TPET, are

approximately 40 million stock tank barrels of oil and 42 billion

cubic feet of gas, or 47 million barrels of oil equivalent, that

the associated Undiscounted Net Cash Flow to TPET is approximately

$2.1 billion, and that the associated Discounted Net Cash Flow

(discounted at 10%) to TPET is approximately $475 million.

For additional information, the updated Reserve

Report is available online at the following link:

http://pdf.secdatabase.com/272/0001493152-24-030816.pdf.

About Trio Petroleum Corp

Trio Petroleum Corp is an oil and gas

exploration and development company headquartered in Bakersfield,

California, with operations in Monterey County, California, and

Uintah County, Utah. In Monterey County, Trio owns a 85.75% working

interest in 9,245 acres at the Presidents and Humpback oilfields in

the South Salinas Project, and a 21.92% working interest in 800

acres in the McCool Ranch Field. In Uintah County, Trio owns a

2.25% working interest in 960 acres and options to acquire up to an

additional 17.75% working interest in the 960 acres, and also an

option to acquire 20% working interest in an adjacent 1,920 acres,

and a right of first refusal to participate in an additional

approximate 30,000 acres of the Asphalt Ridge Project at terms

offered to other third parties.

Cautionary Statement Regarding

Forward-Looking Statements

All statements in this press release of Trio

Petroleum Corp (“Trio”) and its representatives and partners that

are not based on historical fact are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 and the provisions of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended (the “Acts”). In particular, when used in the

preceding discussion, the words "estimates," "believes," "hopes,"

"expects," "intends," “on-track”, "plans," "anticipates," or "may,"

and similar conditional expressions are intended to identify

forward-looking statements within the meaning of the Acts and are

subject to the safe harbor created by the Acts. Any statements made

in this news release other than those of historical fact, about an

action, event or development, are forward-looking statements. While

management has based any forward-looking statements contained

herein on its current expectations, the information on which such

expectations were based may change. These forward-looking

statements rely on a number of assumptions concerning future events

and are subject to a number of risks, uncertainties, and other

factors, many of which are outside of the Trio's control, that

could cause actual results to materially and adversely differ from

such statements. Such risks, uncertainties, and other factors

include, but are not necessarily limited to, those set forth in the

Risk Factors section of the Trio’s reports filed with the

Securities and Exchange Commission (SEC), including its 2024 Annual

Report on Form 10-K filed on January 29, 2024. Copies are of such

documents are available on the SEC's website, www.sec.gov.

Trio undertakes no obligation to update these statements for

revisions or changes after the date of this release, except as

required by law.

Investor Relations Contact:Redwood

Empire Financial CommunicationsMichael Bayes(404) 809

4172michael@redwoodefc.com

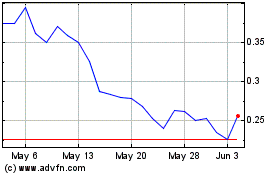

Trio Petroleum (AMEX:TPET)

Historical Stock Chart

From Oct 2024 to Nov 2024

Trio Petroleum (AMEX:TPET)

Historical Stock Chart

From Nov 2023 to Nov 2024