Shareholders’ Equity Increases to $7.58 Per

Share From $7.22 Per Share

Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the second quarter and first six months of

fiscal 2024.

Fiscal 2024 Second Quarter Results

For the three months ended December 31, 2023, revenue decreased

2% to $12,202,000 compared to $12,390,000 for the same quarter last

year, primarily related to a decline in revenue in the Company’s

testing services segment.

The overall gross margin was $2,854,000, or 23% of revenue,

compared to $3,335,000, or 27% of revenue, for the same quarter

last year. Operating income was $677,000, or 6% of revenue,

compared to $1,069,000, or 9% of revenue, for the same quarter last

year.

Total other expenses were $100,000, compared to $253,000 in the

same quarter last year, due principally to an increase in interest

income to $96,000 from $37,000, and a strengthening of the US

dollar against the Singapore dollar, which reduced currency

exchange losses to $236,000, compared to $349,000 in the same

quarter last year.

Net income for the second quarter of fiscal 2024 was unchanged

at $507,000, or $0.12 per diluted share from the second quarter of

fiscal 2023. Net income for this year’s second quarter benefited

from non-controlling interests’ after-tax loss of $21,000, versus

an after-tax income of $58,000 in the same quarter last year.

Cash and cash equivalents at December 31, 2023, increased to

$10,966,000, compared to $7,583,000 at June 30, 2023, and

shareholders' equity increased to $31,528,000, or $7.58 per

outstanding share, compared to $29,571,000, or $7.22 per

outstanding share at June 30, 2023. There were approximately

4,160,555 and 4,096,680 common shares outstanding at December 31,

2023 and June 30, 2023, respectively.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, “Distribution revenue

increased 63% in the quarter and distribution margins improved to

18% from 15% compared to the second quarter last year. In addition,

we received customer acceptance for the initial dynamic test system

delivered in the recent first quarter and anticipate delivering the

remaining five units in the second half of fiscal 2024.

“Semiconductor industry capital spending improved last fall,

boosting second quarter manufacturing segment revenue and

contributing to backlog, which is expected to be delivered during

the remainder of fiscal 2024.

“We remain optimistic and encouraged by improvements in our

manufacturing and distribution segments. Our strong cash position,

improving operating efficiency and tight expense controls will

enable the Company to quickly evaluate and react proactively when

the semiconductor industry gradually recovers from the current

downturn.”

Fiscal 2024 First Half Results

For the first six months of fiscal 2024, revenue decreased 9% to

$22,168,000 compared to $24,329,000 for the same period last

year.

Gross margin for the first six months of fiscal 2024 was

$5,374,000, or 24% of revenue, compared to $6,957,000, or 29% of

revenue for the same period last year.

Income from operations was $676,000, or 3% of revenue, compared

to $2,136,000, or 9% of revenue for the same period last year.

Total other income was $145,000, compared to expenses of

$118,000 in the same quarter last year, due to an increase in

interest income to $174,000, compared to $55,000, and reduced

currency exchange losses of $177,000, compared to $279,000 in the

same period last year.

Net income for the first half of fiscal 2024 was $737,000, or

$0.17 per diluted share, compared to $1,389,000, or $0.33 per

diluted share for the same period last year.

About Trio‑Tech

Established in 1958, Trio-Tech International is located in Van

Nuys, California, with its Principal Executive Office and regional

headquarter in Singapore. Trio-Tech International is a diversified

business group with interests in semiconductor testing services,

manufacturing and distribution of semiconductor testing equipment,

and real estate. Our subsidiary locations include Tianjin, Suzhou,

Chongqing and Jiangsu in China, as well as Kuala Lumpur Malaysia

and Bangkok Thailand. Further information about Trio-Tech's

semiconductor products and services can be obtained from the

Company's Web site at www.triotech.com and

www.universalfareast.com.

Forward Looking Statements

This press release contains statements that are forward looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; the divestiture of one or more

business segments in response to, among other factors, changing

business conditions or technologies and volatility in the

semiconductor industry, which could affect demand for the Company's

products and services; the impact of competition; problems with

technology; product development schedules; delivery schedules;

changes in military or commercial testing specifications which

could affect the market for the Company's products and services;

difficulties in profitably integrating acquired businesses, if any,

into the Company; risks associated with conducting business

internationally and especially in Asia, including currency

fluctuations and devaluation, currency restrictions, local laws and

restrictions and possible social, political and economic

instability; changes in U.S. and global financial and equity

markets, including market disruptions and significant interest rate

fluctuations; public health issues related to the COVID-19

pandemic; trade tension between U.S. and China; inflation; the war

in Ukraine and Russia, the war between Israel and Hamas; and other

economic, financial and regulatory factors beyond the Company's

control. Other than statements of historical fact, all statements

made in this release are forward looking, including, but not

limited to, statements regarding industry prospects, future results

of operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward looking statements by the use of

terminology such as "may," "will," "expects," "plans,"

"anticipates," "estimates," "potential," "believes," "can impact,"

"continue," or the negative thereof or other comparable

terminology. Forward looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions. Many of these risks and

uncertainties are beyond the Company's control. Reference is made

to the discussion of risk factors detailed in the Company's filings

with the Securities and Exchange Commission including its reports

on Form 10-K and 10-Q. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the dates on which they are made.

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

Six Months Ended

December 31,

December 31,

Revenue

2023

2022

2023

2022

Manufacturing

$

4,790

$

5,044

$

7,675

$

8,629

Testing services

4,646

5,648

9,810

12,012

Distribution

2,760

1,694

4,670

3,676

Real estate

6

4

13

12

12,202

12,390

22,168

24,329

Cost of Sales

Cost of manufactured products sold

3,609

3,849

5,658

6,374

Cost of testing services rendered

3,464

3,747

7,248

7,873

Cost of distribution

2,256

1,441

3,852

3,089

Cost of real estate

19

18

36

36

9,348

9,055

16,794

17,372

Gross Margin

2,854

3,335

5,374

6,957

Operating Expenses:

General and administrative

1,817

1,919

3,975

4,224

Selling

248

193

435

366

Research and development

131

151

216

224

(Gain) Loss on disposal of property, plant

and equipment

(19

)

3

72

7

Total operating expenses

2,177

2,266

4,698

4,821

Income from Operations

677

1,069

676

2,136

Other (Expenses) Income

Interest expenses

(22

)

(10

)

(46

)

(54

)

Other (expenses) income, net

(82

)

(264

)

114

(106

)

Government grant

4

21

77

42

Total other (expenses) income

(100

)

(253

)

145

(118

)

Income from Continuing Operations before

Income Taxes

577

816

821

2,018

Income Tax Expenses

(95

)

(241

)

(132

)

(466

)

Income from Continuing Operations

before

Non-controlling Interest, Net of Tax

482

575

689

1,552

Income (Loss) from Discontinued

Operations, Net of Tax

4

(10

)

4

(9

)

NET INCOME

486

565

693

1,543

Less: Net (Loss) Income Attributable to

Non-controlling Interest

(21

)

58

(44

)

154

Net Income Attributable to Trio-Tech

International

507

507

737

1,389

Net Income Attributable to Trio-Tech

International:

Income from Continuing Operations, Net of

Tax

503

512

730

1,394

Income (Loss) from Discontinued

Operations, Net of Tax

4

(5

)

7

(5

)

Net Income attributable to Trio-Tech

International

$

507

$

507

$

737

$

1,389

Basic Earnings per Share

$

0.12

$

0.12

$

0.18

$

0.34

Diluted Earnings per share

$

0.12

$

0.12

$

0.17

$

0.33

Weighted Average Shares Outstanding -

Basic

4,120

4,074

4,109

4,074

Weighted Average Shares Outstanding -

Diluted

4,259

4,162

4,270

4,160

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

Six Months Ended

December 31,

December 31,

2023

2022

2023

2022

Comprehensive Income Attributable to

Trio-Tech International Common

Shareholders:

Net income

$

486

$

565

$

693

$

1,543

Foreign Currency Translation, Net of

Tax

1,158

1,568

975

355

Comprehensive Income

1,644

2,133

1,668

1,898

Less: Comprehensive (loss) income

Attributable to Non-controlling

Interest

(72

)

133

(74

)

212

Comprehensive Income Attributable to

Trio-Tech International Common

Shareholders

$

1,716

$

2,000

$

1,742

$

1,686

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(IN THOUSANDS, EXCEPT NUMBER OF

SHARES)

Dec. 31,

Jun. 30,

2023

2023

ASSETS

(Unaudited)

(Audited)

CURRENT ASSETS:

Cash and cash equivalents

$

10,966

$

7,583

Short-term deposits

5,791

6,627

Trade account receivables, net

12,388

9,804

Other receivables

1,029

939

Inventories, net

3,546

2,151

Prepaid expenses and other current

assets

589

694

Assets held for sale

--

274

Financed sales receivable

6

16

Restricted term deposit

762

739

Total current assets

35,077

28,827

NON-CURRENT ASSETS:

Deferred tax assets

153

100

Investment properties, net

461

474

Property, plant and equipment, net

6,601

8,344

Operating lease right-of-use assets

2,359

2,609

Other assets

169

116

Restricted term deposits

1,778

1,716

Total non-current assets

11,521

13,359

TOTAL ASSETS

$

46,598

$

42,186

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Lines of credit

$

384

$

--

Accounts payable

2,345

1,660

Accrued expense

4,506

4,291

Contract liabilities

3,808

1,277

Income taxes payable

257

418

Current portion of bank loans payable

375

475

Current portion of finance leases

81

107

Current portion of operating leases

1,119

1,098

Total current liabilities

12,875

9,326

NON-CURRENT LIABILITIES:

Bank loans payable, net of current

portion

762

877

Finance leases, net of current portion

15

42

Operating leases, net of current

portion

1,240

1,511

Income taxes payable, net of current

portion

141

255

Deferred tax liabilities

7

10

Other non-current liabilities

30

594

Total non-current liabilities

2,195

3,289

TOTAL LIABILITIES

$

15,070

$

12,615

EQUITY

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS'

EQUITY:

Common stock, no par value, 15,000,000

shares authorized; 4,160,555 and 4,096,680 shares issued and

outstanding at December 31 and June 30, 2023, respectively

13,018

12,819

Paid-in capital

5,156

5,066

Accumulated retained earnings

11,500

10,763

Accumulated other comprehensive

income-translation adjustments

1,763

758

Total Trio-Tech International

shareholders' equity

31,437

29,406

Non-controlling interest

91

165

TOTAL EQUITY

31,528

29,571

TOTAL LIABILITIES AND EQUITY

$

46,598

$

42,186

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240212111431/en/

Company Contact: Siew Wai Yong Chairman & CEO (818)

787-7000

Investor Contact: Berkman Associates (310) 927-3108

robert.jacobs@jacobscon.com

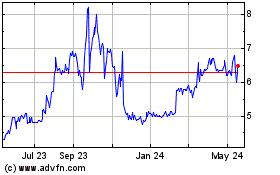

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

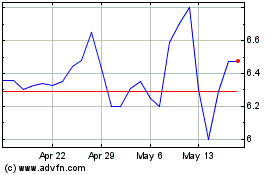

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Jan 2024 to Jan 2025