January was a month to forget for equity investors, as broad

markets took a step back to start the year. Concerns over job

growth, emerging markets, and the continuation of the taper weighed

heavily on stocks in the month, and led some to believe that

the bull run is finally nearing an end.

This sluggishness was further confirmed by the performance of

volatility-linked (usually VIX-linked) investments as these have

done pretty well over the past two weeks. This is a bit of a

surprise as volatility Exchange Traded Products usually see

terrible performances, though in rare times like the past 10 days

they can really prove their worth for short-term oriented

traders.

Volatility and the VIX in Focus

The VIX is often referred to as the ‘fear index’ and is thought of

as a gauge of investor perception of the market’s risk. It is

constructed using implied volatilities of S&P 500 index

options, taking both calls and puts into account.

Generally speaking, this benchmark increases when fear levels are

rising, and it slumps when markets are doing well and there is

little prospect of risk events on the horizon (read Why I Hate

Volatility ETFs).

While investors can’t directly buy up this index, there is a

popular ETN option at our disposal that can give us some exposure

to volatility, the

iPath S&P 500 VIX Short-Term Futures

ETN (VXX). This product has nearly $1 billion in assets

under management and it sees an average daily volume of over 18

million shares so trading in and out of VXX shouldn’t be too much

of a problem.

The product has been a pretty poor performer over the past year

though, as the solid market has curtailed the need for

volatility-linked investments. Additionally, due to the nature of

volatility, the underlying index’s futures contracts—which are the

basis of this ETN—are generally in contango and thus it can be an

uphill battle for long term investors in this type of product (see

all the Volatility ETFs here).

Still, during short time periods, products like VXX can prove to be

winners, and that has certainly been the case during this recent

sell-off.

Selling Pressure Leads to VXX Gains

Over the past ten trading sessions, SPY has declined by about 3.4%

in a steady downward move. Emerging market worries and the Fed’s

escalation of the taper really hit the market hard, and have left

many feeling bearish (and fearful) about the market’s near term

outlook.

Thanks to this, VXX has been doing quite well on extreme amounts of

volume. The product has actually added more than 21% in the past

ten days, including a nearly 10% burst higher in Friday trading on

volume that was over 69 million shares (see Volatility ETFs: Three

Factors Investors Must Know).

And for the truly bold traders out there, two leveraged volatility

products exist; the

VelocityShares Daily 2x VIX Short Term

ETN (TVIX) and the

ProShares Ultra VIX Short-Term

Futures ETF (UVXY). These both added more than 16% in

Friday trading, capping off a 10 day run of more than 40% each.

So clearly, it has been a very good time to be in the volatility

market, though the ‘volatility of volatility’ is pretty high. The

leveraged volatility products saw more than half of the gains

disappear in one session, while Friday trading saw these losses

erased as the S&P 500 tumbled again. Positions in this corner

of the market need to be monitored closely, as after such a run in

volatility we are probably due for a pullback soon.

Bottom Line

When markets are sliding and investors are starting to become

fearful, there are few investments that are better than volatility.

As we have seen with the trio of VXX, TVIX, and UVXY, huge gains

are possible in a very short time frame, and they can help to

balance out weakness in other parts of a long-focused

portfolio.

However, gains can evaporate as quickly as they come in the

volatility market, so make sure to be nimble. The futures curve

generally works against investors here, and long-term charts aren’t

pretty for products like VXX, so make sure to only use these for

short-term purposes.

If you are looking to apply a volatility-hedged strategy as part of

a broader equity play, consider either the

PowerShares

S&P 500 Downside Hedged Portfolio (PHDG) or the

Barclays ETN+ S&P VEQTOR ETN (VQT). Both of

these follow a dynamic index which includes both equity and

volatility components, shifting towards volatility as volatility

levels rise (see Two Hedged ETFs Built for Rocky Markets).

This technique costs a lot more than a simple investment in the

S&P 500, and it can often underperform broad markets. However,

during times when volatility is rising, this approach can earn its

keep in a big way, suggesting that some who are fearful—but aren’t

willing to tolerate the big moves in VXX and the like—might want to

look to these products instead for a ‘safer’ way to play volatility

in today’s uncertain market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

PWRSH-SP5 DHP (PHDG): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VEL-2X VIX ST (TVIX): ETF Research Reports

PRO-ULT VIX STF (UVXY): ETF Research Reports

BARCLY-SP VEQTR (VQT): ETF Research Reports

IPATH-SP5 VX ST (VXX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

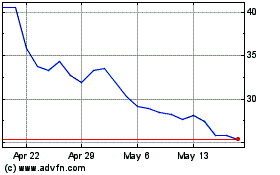

ProShares Ultra VIX Shor... (AMEX:UVXY)

Historical Stock Chart

From Feb 2025 to Mar 2025

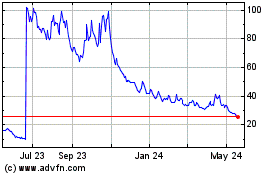

ProShares Ultra VIX Shor... (AMEX:UVXY)

Historical Stock Chart

From Mar 2024 to Mar 2025