TIDMATC

RNS Number : 5038Y

All Things Considered Group PLC

05 May 2023

5 May 2023

All Things Considered Group Plc

("ATC", the "Company" or the "Group")

Final Results

Strong financial performance and operational progress

All Things Considered Group Plc (AQSE: ATC), the independent

music company housing talent management, live booking,

livestreaming and talent services, is pleased to announce audited

results for the year ended 31 December 2022.

Financial highlights

-- Record Group revenue of GBP12.1m, an increase of 33% (FY21:

GBP9.1m). Group revenue includes the nine-month contribution of

Driift, which is shown as Discontinued Operations, as required by

IFRS, due to Group ownership reducing to 32.5% following the

transaction announced on 30 September 2022

-- Profitability achieved, ahead of expectations and materially

ahead of prior year, with PBT of GBP0.01m (FY21: loss of GBP2.69m

before IPO and related costs)

-- Gain on disposal of controlling interest in Driift of

GBP2.5m, giving an overall post tax profit for the Group of

GBP2.44m (2021: loss of GBP3.31m)

-- Cash position, after short term debt, of GBP1.4m as at 31

December 2022 (FY21: GBP4.24m) - GBP1.34m of the reduction arising

from the removal of Driift as a subsidiary of the Group from 1

October 2022

Operational highlights

-- Growth underpinned by resilient business platform with

integrated and complementary services across artists' commercial

interests

-- Artist representation:

o ATC Management and ATC Live recorded best revenue numbers to

date, with over 70 management artists and over 500 live clients

respectively, representing roster growth of c.25%

o Strong traction in US artist management market following

opening of New York office in 2022, including attracting new

managers and doubling client roster with several high-profile

signings

o The return to full capacity touring in Q2 combined with strong

backlog of shows resulted in a good year for ATC Live, now the

6(th) largest touring agency worldwide

-- Highlights include The Lumineers performing the first post

pandemic show at the O2 Arena London by an international artist,

demonstrating the division's commitment to ensuring clients are at

the forefront of the return of touring

-- Nick Cave & The Bad Seeds summer festival tour was the

artists' biggest to date, with 34 festival headline shows

-- Services:

o Launch of ATC Experience to create and distribute artist-led

digital and in-person experiences for global audiences, with

project pipeline building

o The Group's synchronisation agency placed clients' work with

substantial brands including Apple, Sonos, Amazon, Netflix, and

games such as Fortnite and Valorant

-- Livestreaming:

o Driift's acquisition of technology and commerce platform

Dreamstage, concurrent with GBP4m of additional investment from

Deezer, resulting in ATC ownership of Driift reducing from 52% to

32.5% and Driift becoming an associate of the Group

Current trading and outlook

-- Trading in new year in line with expectations

-- ATC Live set to deliver c.6,000 live shows in 2023

-- First ATC Experience projects in development with strong

pipeline of commercial opportunities

-- More than 20 ATC Management clients have significant new

music releases scheduled for 2023 with corresponding touring and

promotional activities

-- Well positioned to capitalise on multiple revenue

opportunities within disrupted and growing global music industry,

forecast to grow to $153bn by 2030*

* Goldman Sachs: "Music in the Air" report, June 2022

Adam Driscoll, Chief Executive Officer of ATC Group plc,

commented:

"We are delighted with the progress we have made in our first

year as a PLC, delivering 33% top line growth and profitability

earlier than expected, whilst also investing in a number of

important strategic developments for the Group.

Our performance has been driven by strong growth across our core

artist representation businesses, supported by improved trading

conditions as live touring resumed, together with progress within

the Group's complementary services and livestreaming divisions.

During the year we expanded the Group's geographic footprint,

attracted new agents, managers, artist clients and key operational

management into the Group, and launched new innovative artist

service lines.

The new year has started with continued positive momentum and a

pipeline of exciting projects and opportunities. As the music

industry continues to undergo rapid change, we believe there is

substantial opportunity to co-create, co-produce and deliver new IP

via events and experiences, underpinned by our multi-service

approach across artists' commercial interests. We look ahead with

confidence in the Group's growth prospects ."

-S-

For more information, please contact:

ATC Group plc Via Alma PR

Adam Driscoll, CEO

Ram Villanueva, CFO

Canaccord Genuity +44(0)20 7523 8000

Aquis Corporate Adviser and Broker

Adam James / Patrick Dolaghan

Alma PR +44(0)20 3405 0205

Financial PR

Hilary Buchanan

Notes to Editors

ATC Group is an independent music company housing talent

management, live booking, livestreaming, and talent services within

the same group.

The Group is headquartered in London, with offices in Los

Angeles, New York, and Copenhagen. ATC Group Plc is led by an

experienced management team who have operated across multiple music

industry sectors.

The Group has an established, long-standing client base which,

together with innovative new offerings, gives the Directors

confidence that the company is well positioned to capitalise on the

opportunities emerging from a disrupted music industry.

The Group's key divisions, grouped under three segments,

are:

-- Artist representation

-- ATC Management (Europe and USA) - artist management and development

-- ATC Live - live event booking agency for artists

-- Services

-- ATC Media Inc - providing consultancy and development services

-- Your Army America - marketing and promotions agency

specialising in dance and electronic music

-- Familiar Music - synchronisation agency placing music in

films, TV, advertisements, and other media

-- ATC Experience - developing live events and digital experiences with artists

-- Livestreamed events

-- Driift - a global livestreaming business, and Flymachine, a livestreaming platform

For more information see: www.atcgroupplc.com

Co-Chairs' Statement

We are pleased to report on another year of strong double-digit

growth and significant strategic development for the Group, and a

close-to-full year of normalised trading post Covid lockdown.

The Group's growth and resilient business platform is

underpinned by an integrated, multi-service offering across a range

of artists' business interests. This model continued to generate

additional commercial opportunities for artists across service

lines during the year, contributing to top line growth of 33%.

Key to ATC's resilience is its well-established, long-standing

client base. This has come about as a result of patient years of

development, and we can now boast over 70 artists on our management

roster and over 500 acts on our live roster, representing roster

growth of c.25% in 2022. As a result, ATC Live and ATC Management

posted their best revenue numbers to date.

Contributing to this growth was pent up supply and demand

following the easing of lockdown restrictions together with a

return to near full-capacity touring in Q2. The Group saw a backlog

of postponed shows and tours from the previous two years return in

a short space of time, which was welcomed by fans. A consequence of

this was added pressure on touring operational costs across the

board as a huge number of artists required touring infrastructure

at the same time, in a global environment of challenging supply

chains. Despite this, the Group achieved profitability with profit

before tax of GBP0.01m, ahead of expectations.

ATC Live further deepened its trading arrangements with North

American agency, Arrival Artists, in order to offer artists the

option of global representation. This has strengthened its position

as one of the world's leading independent live agencies, now the

6th largest agency globally.

2022 saw the Group make a strategic expansion into NYC, opening

an office in Tribeca, bolstering our footprint in the most

important of geographical markets. This investment, together with

key personnel hires, provided the foundations for the North

American operation to post their best revenue numbers to date.

Within our Services division, we continued to expand our range

of services to both our own management clients and to third

parties. The Group established its ATC Experience business to take

advantage of the broadening IP rights opportunities that come with

working closely with artists contracted to the Group. The Group has

a building pipeline of projects.

The Livestream industry experienced considerable disruption

during the year with the live industry returning to traditional

business during 2022. Whilst many livestreaming providers exited

the market, the Group's livestreaming business, Driift, attracted

further capital from the streaming service, Deezer, bringing it

together with US based ticketing and technology operator

Dreamstage. As a result, Driift now has complete end-to-end

livestreaming capability - across show development, production,

ticketing, streaming and distribution. This transaction represents

a significant strategic development for the business, cementing

Driift's position as one of the leading brands in the field and

ideally positioned to benefit from the anticipated growth from this

segment, which we believe to be a permanent and complementary

feature to live touring. The transaction with Deezer resulted in

the Group's equity holding in Driift reducing to 32.5%.

People

It is important to recognise the immense effort put in by all

the ATC staff as we transitioned to the post Covid era. Despite the

unique challenges of re-opening for business and navigating the

evolving operating conditions, the team delivered across the board

with a special thank you to our senior management team who remain

fully committed to the Group and its vision for growth.

Shirin Foroutan resigned as an independent director on 30

November 2022 due to a potential conflict of interest in her role

resulting from her appointment to a new executive position with a

major music publishing group. We thank Shirin for her valuable

contribution; we are in the process of recruiting a replacement

independent director and our senior independent director, Andy

Glover, is acting Remuneration Committee chair until that

appointment is made.

Summary and Outlook

The Group took advantage of a near full year of post-lock down

trading to post its best revenue figures to date. In addition, the

Group posted a small profit before tax, ahead of expectations.

Importantly, the year saw the Group expand its capabilities through

the addition of headcount, the opening of an office in New York,

and the launch of complementary services. ATC continues to cement

its position as a leading independent music company at the

forefront of a rapidly changing industry.

2023 will still see the ramifications of lockdown strategies

unwind. We continue to assess any implications from wider

macroeconomic headwinds, including potential pressure on consumer

budgets or rising production costs. However, music and ticketing

have often outperformed the wider market in difficult economic

times and the livestream sector should improve for Driift as larger

players cut expenditure on productions, opening opportunities from

talent looking to expand revenue streams. We remain positive about

our prospects.

Brian Message and Craig Newman

Co-chairs

CEO Review

Overview

2022 marked the Group's first full year of trading since listing

on the Aquis Growth Market in London in late December 2021. The net

proceeds of the GBP4.15 million that we raised (before expenses)

have been used, in part, to invest across our businesses and

support the Directors' growth strategy for the Group. This has

resulted in expanding our geographic footprint, launching new

innovative services, and adding new agents, managers and

operational management to the team whilst delivering a record

financial performance.

Our underlying business model has proven to be resilient both

during the preceding Covid affected year and during 2022, when the

industry sought to return to 'business as usual'.

At the time of updating shareholders in relation to our interim

numbers in September 2022, we indicated that we were expecting the

Group to make a small loss for FY22. I'm pleased to report that we

improved upon that forecast position in the second half and our 33%

annual growth in revenue to GBP12.1m for 2022 has resulted in the

delivery of a nominal profit before tax, which represents a

material improvement upon the loss of GBP2.69m (excluding IPO

costs) for 2021. In addition, the investment that was made by

Deezer into Driift has given rise to a gain on the disposal of our

controlling interest in Driift of GBP2.51m, giving an overall post

tax profit for the Group of GBP2.44m for 2022. We retain a 32.5%

interest in Driift and remain confident about prospects for the

business and its long-term value to the Group.

There were a number of operational highlights in 2022 including

successfully opening our office in New York in February and seeing

the positive impact of that move on our US revenues during the

year; the delivery of Driift's first 'Full Circle' livestream

events for one of our managed clients 'The Smile' at the beginning

of the year; Driift's acquisition of technology and commerce

platform Dreamstage, concurrent with GBP4m of additional investment

from Deezer into Driift; the establishment of ATC Experience as a

new division to capitalise upon the changing commercial and

creative models developing globally in live entertainment; the

strengthening of our management team with the recruitment of Ram

Villaneuva as CFO and Despina Tsatsas as Managing Director of ATC

Experience; and the addition of a significant number of new

managers, agents and clients to our ever-expanding team and artist

roster.

The management team remains strongly aligned with shareholders,

with executive Board members and senior directors holding 42% of

the shares as at 31 December 2022.

Growth Strategy

The global music industry is a multi-billion dollar market

undergoing significant disruption brought about by technological

innovations, changing consumer demands and a rebalancing toward

'empowered-artists.' All industry income is ultimately derived from

the activities of the artist and the move to being in business

across all revenue categories with 'empowered creators' remains an

industry trend.

The Group's business units have been developed with the

strategic goal of ensuring that the Group can be at the forefront

of this evolution, with artists able to engage via specific

services or to take a more integrated approach. We continue to

focus on building out our offering with complementary services that

provide strategic and commercial cross-sell opportunities for other

Group businesses. We believe there is substantial opportunity to

co-create, co-produce and deliver new IP via events and

experiences, underpinned by our multi-service approach across key

revenue strands.

Current trading

We have seen positive momentum continue into the start of

FY2023, with our business model proving attractive to artists,

managers and agents. Additionally, the expansion of our Services

division has put us in a stronger position to be much more engaged

with artists and more involved in developing their wider business

aspirations. At the core of all revenues in the music industry is

the connection between an artist and a fan. Our businesses support

that connection and that will enable us to play a greater role in

'direct to consumer' offerings and in the development of IP across

emerging platforms in the future.

At ATC Management we have, over recent months, welcomed a number

of new managers to our team including Bertie Gibbon, Dan McEvoy and

Gwen Sanchez in the UK and Ben Rafson, Brandon Sanchez, Jordan

Alper and Emily Cameron in the USA. We are pleased that managers of

their calibre are choosing to make ATC their home.

Our management roster now stands at over 70 clients, with

substantial activity anticipated across 2023 for a large number of

those artists. In the coming months we will see new releases from

The Hives, Amaarae, Black Country, New Road, PJ Harvey, Katie

Melua, O, Max Winter, Izzi de Rosa, Jungleboi, Kabba, Christian

Balvig, Nick Cave & Warren Ellis , The Smile, Insincere, Nix

Northwest, Billie Marten, Alma, Keaton Henson, Nathan Nicholson,

Fink, and others. Touring and promotional activity will accompany

many of these releases.

Our composer roster within management continues to work with

highly regarded and commercially successful clients. Isobel Waller

Bridge scored The Boy, The Mole, The Fox and The Horse which

recently won the Oscar for best short film, and Volker Bertlman's

All Quiet On The Western Front score, winner of both the BAFTA and

Oscar best score was orchestrated and conducted by Robert Ames.

The ATC Live business continues to perform in line with

management expectations following a highly successful 2022 and we

now represent over 500 clients. New agents continue to join the

business, the most recent being Ed Thompson whose clients include

Jungle, a festival headlining act. Our relationship with North

American agency Arrival Artists continues to deepen and prosper and

we are excited about the opportunities to explore new markets

together in the coming months and years.

The strength of the ATC Live business and its clients continues

to be recognised by the industry at large with Alex Bruford, ATC

Live's Managing Director, recently being awarded Agent of the Year

at the prestigious ILMC conference. Additionally, for the second

year running, ATC Live clients were awarded 2 of the 3 key Grulke

Prizes awarded at the globally-recognised SXSW convention with

Blondshell winning the US Prize and Balming Tiger taking the

International Award.

Our Services businesses have got off to a good start this year.

Your Army America has seen impressive results for Q1 and confidence

remains high for this to continue. We are seeing good activity at

Familiar Music, our US sync agency, and Company X, our

recently-formed joint venture brand agency with Arrival Artists, is

making meaningful strides in its first months of operation.

Namethemachine Holdings, a US technology-focussed business for the

creative industry, in which we hold a 20% stake, has strong

development plans for the year which we are actively

supporting.

ATC Experience, a new business formed in 2022 to enable us to

create and distribute artist-led digital and in-person experiences

for global audiences, is successfully building a large development

slate of projects, a number of which are attracting exciting

international partners. We are positive about the commercial

outlook for this business.

The Group's livestreaming holding, Driift, has had a positive

start to 2023 as artists and managers look beyond traditional

touring and ticketing and seek promotional and revenue-generating

opportunities within the livestream market. Having weathered

tougher trading conditions in 2022, and with strong end-to-end

delivery capabilities and a solid balance sheet, Driift is now

poised to play a key role in the renewed growth of the

livestreaming sector, which is forecast to become a multi-billion

dollar segment over the next 3-5 years. Having recently signed a

number of deals for upcoming events alongside partnerships with the

likes of IMAX, the prospects for the business are looking very good

for the coming year.

During 2022 ATC Media, a Group business based in North America,

was engaged in consultancy work relating to the acquisition of

Napster by a newly formed US business which had raised around $90m

for the purposes of purchasing and investing in Napster. The aim of

the new group is to bring blockchain and Web3 to new artists and

fans via future developments in the Napster business. Our

consultancy arrangement also provided for us to be awarded deferred

revenue in the form of Napster crypto 'tokens'. Although not yet

commercially available, the owners of Napster set up a new token

structure in March 2023. At this point it is impossible to

determine what value these tokens may have in the future and so the

fair value of deferred revenue at the year end is nil and will be

revalued at such time as they are admitted to some form of public

trading.

In summary, 2023 is gearing up to be an exciting year of growth

and continued development for the Group. We expect our

comprehensive service offering to not only continue its organic

growth, but to engage in a period of more aggressive expansion.

Additionally, management believes that the Group is now well placed

to move into areas where it can create, capture and manage more IP

in partnership with its clients, which will enable us to build a

resilient business and a balance sheet that develops tangible and

intangible assets alongside the revenues generated from our client

service divisions. We have a unique set of assets and are convinced

that their combination gives us the right platform to grow a

substantial group which can take advantage of the near-term

evolution of music industry models.

Adam Driscoll

CEO

CFO Review

Overview

During the year, the Group's results saw a significant

improvement compared to 2021 with revenue posting a 33% increase to

GBP12.1 million (2021: GBP9.1 million) and a significant

improvement in profitability from a loss before tax (after IPO

related costs) of GBP3.3 million in 2021 to a profit before tax

(before the gain on the disposal of the controlling interest in

Driift) of GBP0.01 million in 2022.

Following the transaction with Deezer SA completed on 30

September 2022, the Group's ownership of Driift reduced from 52% to

32.5% and, from 1 October 2022, the enlarged Driift group is

treated as an associated undertaking in the group accounts. The

transaction resulted in the deconsolidation of Driift, and the

Group recorded a gain on the disposal of ATC's controlling interest

of GBP2.5 million.

After successfully implementing its business plan and objectives

for 2022 following the IPO listing in December 2021, ATC retains a

positive net cash position at 31 December 2022 (after current debt

but excluding long-term debt) of GBP1.4 million. GBP0.9m of the

long-term debt is owed to a related party and is payable over the

period to 2030. The Group is therefore well positioned to continue

its growth momentum in 2023.

Revenue

The Group's consolidated revenue was up 33% to GBP12.1 million

(2021: GBP9.1 million). The segmental analysis is shown below:

2022 2021

Continuing operations: GBP GBP

Artist representation 6,571,428 3,722,924

Services 2,874,603 778,502

9,446,031 4,501,426

Discontinued operations:

Livestreamed events* 2,608,079 4,642,212

------------------- ------------------

12,054,110 9,143,638

------------------- ------------------

* Revenue of Drift group for the nine-months ended

30 September 2022 (2021: twelve months to 31 December

2021)

2022 saw a return to revenue growth after a 2-year hiatus due to

the COVID pandemic and the associated lock downs in the following

areas:

Artist representation

The live music scene in 2022 has seen strong growth in live

music activities and this has created a huge demand for ATC Live's

roster as evidenced by the 400% growth in revenue from GBP0.56

million in 2021 to GBP2.22 million in 2022. In a similar vein, ATC

Management also achieved double digit revenue growth of 33% from

GBP2.89 million in 2021 to GBP3.85 million.

The Group expanded its Live and Management businesses during the

year (as explained in the net cash/(debt) section) and expects to

reap the long-term benefits from these investments.

Services

Revenue includes gross consultancy commission of $2.3m (net

commission of $1.15m) for the facilitation of the private

acquisition of streaming platform Napster. The Group is

continuously exploring big ticket consultancy deals, building

strategic partnerships with other players in the industry and

creating and offering new artist related services as part of its

growth strategy for this division.

Livestreamed events

As discussed above, Driift is now an associated undertaking as

of 1 October 2022. Following the transaction that was announced on

30 September, Driift is now engaged in a process of restructuring

its organisation, cost structure and business processes and with

the GBP4 million cash infusion from its major shareholder Deezer

S.A., it is now well capitalised and well-positioned to take

advantage of increasing interest in livestreaming.

Profit /(loss) before tax

The profit before tax in 2022 amounted to GBP0.01 million (2021:

loss before tax GBP3.3 million.) The segmental analysis is shown

below:

2022 2021

Continuing operations: GBP GBP

Artist representation 542,043 (503,085)

Services 488,185 53,762

Livestreamed events** (290,994) -

Central cost* (437,421) (713,948)

301,813 (1,163,273)

Discontinued operations:

Livestreamed events*** (291,802) (2,143,245)

---------------- --------------------

Profit /(loss) before tax 10,012 (3,306,518)

---------------- --------------------

* Includes IPO and related costs of GBP0.62 million

in FY21.

** Driift as an associate (32.5% of result)

*** Consolidated Driift (100% of results) up to 30

September 2022

Net cash /(debt) position

At the year end, the Group's net cash after short-term debt was

GBP1.4 million (2021: net cash of GBP4.24 million). It is important

to highlight that in 2021, the net cash included cash of the Driift

group of GBP1.6 million. The cash balances of the Driift group were

deconsolidated with effect from 1 October 2022.

The funds raised during the IPO provided the Group with the

necessary working capital to grow its various businesses in 2022.

The money was used in accordance with the Group's business plan and

objectives for 2022, which included, but were not limited to, the

following:

-- The office expansion in New York City in North America and

the hiring of new agents and managers to strengthen the roster of

artists of the Live and Management businesses with the main

objective of increasing revenue through market penetration and

market development strategies.

-- The establishment of a new ATC Services division, the

improvement of its service offerings and strategic partnerships

with certain third parties to allow the Group to offer a full suite

of artist related services.

-- Launch of ATC Experience to create and distribute artist-led

digital and in-person experiences for global audiences, with

project pipeline building

-- The recruitment of additional personnel in the areas of

operations, administration, and finance to improve the front-end

and back-end systems, procedures and processes to address the

regulatory and compliance requirements of a listed company and the

implementation of best practices across the Group.

-- The year has also seen an increase in the professional and

consultancy fees which is part of the growing compliance and

regulatory requirements as a listed company and travelling cost

owing to the increased business activities and rising cost of

inflation.

The funds raised in the IPO in December 2021 together with the

operational cash flow of the Group during the year has helped fuel

its expansion and mitigate the impacts of rising business costs

that were a feature of 2022 for many companies.

Overall, the Group's net cash position after long-term debt was

GBP0.073 million (2021: net cash of GBP2.31 million).

Financing costs of GBP0.128m (2021: GBP0.097m) was comprised

mainly of interest expenses on loans of GBP0.118 million (2021:

GBP0.083 million)

2022* 2021*

GBP GBP

Cash and cash equivalents 3,917,270 5,532,272

Funds held on behalf of

clients (2,172,873) (1,027,793)

------------------ ------------------

Own funds 1,744,397 4,504,479

Short-term:

Borrowings (209,188) (124,068)

Right of use lease liabilities (143,794) (140,287)

------------------ ------------------

Net cash after current

debt 1,391,415 4,240,124

------------------ ------------------

Long -term:

Borrowings ** (1,214,057) (1,676,986)

Right of use liabilities (104,444) (248,238)

------------------

(1,318,501) (1,925,224)

------------------ ------------------

Net cash after long term

debt 72,914 2,314,900

------------------ ------------------

* In 2021, net cash included the cash in Driift group

of GBP1.6 million. In 2022, Driift was deconsolidated

as the Group's ownership reduced from 52% to 32.5%.

** GBP0.9m of the long-term debt is owed to a related

party and is payable over the period to 2030

Earnings per share

Basic and diluted earnings per share from all activities was

27.10 pence per share (2021: loss of 24.56 pence per share).

Basic and diluted earnings per share from continuing activities

was 1.58 pence per share (2021: loss of 10.26 pence per share).

Going Concern

The accounts have been prepared on a going concern basis. Based

on the cash flow forecast for the period ended 30 June 2024, the

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future.

Ram Villanueva

CFO

Consolidated statement of comprehensive income

For the year ended 31 December 2022

2022 2021

----------------------------------------- ----------------------------------------------

Notes Continuing Discontinued Total Continuing Discontinued Total

activities operations activities operations

GBP GBP GBP GBP GBP GBP

Revenue 3,4 9,446,031 2,608,079 12,054,110 4,501,426 4,642,212 9,143,638

Cost of sales (3,084,378) (2,457,469) (5,541,847) (2,088,401) (6,209,493) (8,297,894)

------------ ------------- ------------ -------------- -------------- --------------

Gross profit 6,361,653 150,610 6,512,263 2,413,025 (1,567,281) 845,744

Other operating

income 192,937 240,830 433,767 617,517 545,979 1,163,496

Administrative

expenses (5,962,123) (683,111) (6,645,234) (4,268,933) (1,121,944) (5,390,877)

Operating

profit/(loss) 592,467 (291,671) 300,796 (1,238,390) (2,143,245) (3,381,637)

Share of results

of associates

and joint

ventures (165,729) - (165,729) 167,568 - 167,568

Finance income 3,000 - 3,000 4,852 - 4,852

Finance costs (127,924) (131) (128,055) (96,968) - (96,968)

Provisions for

owed by

participating

interest - - - (333) - (333)

Adjusted

profit/(loss)

before

tax 301,814 (291,802) 10,012 (546,538) (2,143,245) (2,689,783)

IPO and related

costs - - - (616,735) - (616,735)

----------------- ------ ------------ ------------- ------------ -------------- -------------- --------------

Profit/(loss)

before taxation 301,814 (291,802) 10,012 (1,163,273) (2,143,245) (3,306,518)

Income tax

expense 7 (77,931) - (77,931) (1,256) - (1,256)

------------ ------------- ------------ -------------- -------------- --------------

Profit/(loss)

for the year

before gain on

disposal of

controlling

interest 223,883 (291,802) (67,919) (1,164,529) (2,143,245) (3,307,774)

Discontinued

operations

Gain on disposal

of controlling

interest 5 - 2,511,979 2,511,979 - - -

------------ ------------- ------------ -------------- -------------- --------------

Profit/(loss)

for the year 223,883 2,220,177 2,444,060 (1,164,529) (2,143,245) (3,307,774)

Other

comprehensive

income:

Items that will

not be

reclassified

to profit and

loss:

Revaluation

gain/(loss) on

unlisted

investments (42,283) - (42,283) 139,061 - 139,061

Currency

translation

differences

and others (13,001) - (13,001) (4,949) (259) (5,208)

------------ ------------- ------------ -------------- -------------- --------------

Total items that

will not

be reclassified

to profit

and loss (55,284) - (55,284) 134,112 (259) 133,853

============ ============= ============ ============== ============== ==============

Total other

comprehensive

income for the

year (55,284) - (55,284) 134,112 (259) 133,853

============ ============= ============ ============== ============== ==============

Total

comprehensive

income

for the year 168,599 2,220,177 2,388,776 (851,495) (2,322,427) (3,173,921)

============ ============= ============ ============== ============== ==============

Profit/(loss)

for the year

attributable

to:

- Owners of the

parent company 151,146 2,445,775 2,596,921 (1,162,038) (1,191,430) (2,353,468)

-

Non-controlling

interests 72,737 (225,598) (152,861) (2,491) (951,815) (954,306)

------------ ------------- ------------ -------------- -------------- --------------

223,883 2,220,177 2,444,060 (1,164,529) (2,143,245) (3,307,774)

============ ============= ============ ============== ============== ==============

Total

comprehensive

income

for the year is

attributable

to:

- Owners of the

parent company 95,862 2,445,775 2,541,637 (849,003) (1,370,612) (2,219,615)

-

Non-controlling

interests 72,737 (225,598) (152,861) (2,491) (951,815) (954,306)

------------ ------------- ------------ -------------- -------------- --------------

168,599 2,220,177 2,388,776 (851,495) (2,322,427) (3,173,921)

============ ============= ============ ============== ============== ==============

Earnings/(loss) Total Total

per share

Pence Pence

Basic and

diluted (pence) 6 27.10 (24.56)

============ ==============

Consolidated statement of financial position

As at 31 December 2022

Notes 2022 2021

GBP GBP

Non-current assets

Goodwill 1,111,400 1,135,403

Property, plant and equipment 303,504 398,506

Investments 2,670,497 244,604

------------ ------------

4,085,401 1,778,513

Current assets

Trade and other receivables 2,669,395 2,647,834

Cash and cash equivalents 3,917,270 5,532,272

------------ ------------

6,586,665 8,180,106

Total assets 10,672,066 9,958,619

============ ============

EQUITY

Called up share capital 8 95,840 95,840

Share premium account 3,983,970 3,983,970

Merger reserve 2,883,611 2,883,611

Currency translation reserve 1,451 (9,750)

Retained earnings (2,727,652) (4,898,864)

------------ ------------

Equity attributable to the

shareholders of the parent

company 4,237,220 2,054,807

------------ ------------

Non-controlling interests 17,190 197,649

------------ ------------

Total equity 4,254,410 2,252,456

------------

LIABILITIES

Non-current liabilities

Borrowings 1,214,057 1,676,986

Other creditors 59,438 53,085

Right of use lease liabilities 104,444 248,238

------------ ------------

1,377,939 1,978,309

Current liabilities

Trade and other payables 4,686,735 5,463,499

Borrowings 209,188 124,068

Right of use lease liabilities 143,794 140,287

------------ ------------

5,039,717 5,727,854

Total liabilities 6,417,656 7,706,163

------------ ------------

Total equity and liabilities 10,672,066 9,958,619

============ ============

Consolidated statement of changes in equity

For the year ended 31 December 2022

Share Share Merger Currency Retained Total Non-controlling Total

capital premium reserve translation earnings interests

account reserve

GBP GBP GBP GBP GBP GBP GBP GBP

Year ended 1

January 2021 32,649 2,449,703 - (4,542) (3,442,423) (964,613) 10,395 (954,218)

--------- ------------ ------------ ------------ -------------- ------------ ---------------- ------------

Profit for the

year - - - (2,353,468) (2,353,468) (954,306) (3,307,774)

Other - - - - - - - -

comprehensive

income:

Revaluation gain

on unlisted

investments - - - 139,061 139,061 - 139,061

Currency

translation

differences

on overseas

subsidiaries - - (5,208) - (5,208) - (5,208)

Total

comprehensive

income

for the year - - (5,208) (2,214,407) (2,219,615) (954,306) (3,173,921)

Issue of share

capital of

previous parent 1,709 399,550 - - - 401,259 - 401,259

Issue of share

capital 95,840 3,983,970 - - - 4,079,810 - 4,079,810

Merger reserve (34,358) (2,849,253) 2,883,611 - - - -

Retained earnings

movements

due to increased

investment

by NCI - - - - 757,966 757,966 - 757,966

Acquisition of

non-controlling

interests - - - - - - (58,796) (58,796)

Other movements in

non-controlling

interests - - - - - 1,200,356 1,200,356

--------- ------------ ------------ ------------ -------------- ------------ ---------------- ------------

At 31 December

2021 95,840 3,983,970 2,883,611 (9,750) (4,898,864) 2,054,807 197,649 2,252,456

Profit for the

year - - - - 2,596,921 2,596,921 (152,861) 2,444,060

Other

comprehensive

income:

Revaluation loss

on unlisted

investments - - - - (42,283) (42,283) - (42,283)

Currency

translation

differences

on overseas

subsidiaries and

others - - - 10,941 (23,942) (13,001) - (13,001)

--------- ------------ ------------ ------------ -------------- ------------ ---------------- ------------

Total

comprehensive

income

for the year - - - 10,941 2,530,696 2,541,637 (152,861) 2,388,776

Disposal of

controlling

interest - - - 260 (361,098) (360,838) (21,687) (382,525)

Other movements - - - - 1,614 1,614 (5,911) (4,297)

At 31 December

2022 95,840 3,983,970 2,883,611 1,451 (2,727,652) 4,237,220 17,190 4,254,410

========= ============ ============ ============ ============== ============ ================ ============

Consolidated statement of cash flows

For the year ended 31 December 2022

2022 2021

GBP GBP

Cash flows from operating activities

Loss for the year after tax (67,919) (3,307,774)

Adjustments for:

Taxation charged 77,931 1,256

Finance costs 128,055 96,968

Finance income (3,000) (4,852)

Loss on disposal of property, 6,927

plant and equipment -

Depreciation of property, plant

and equipment 133,378 133,023

Share of results of associates

and joint ventures 165,729 (167,568)

Provision against investment

in associates and joint ventures - 333

Movements in working capital:

Increase in trade and other

receivables (444,986) (572,660)

Increase in trade and other

payables 582,008 1,136,345

------------ ------------

Cash generated/(absorbed by)

from operations 578,123 (2,684,929)

Interest paid (128,055) (96,968)

Tax paid - (1,256)

------------ ------------

Net cash inflow/ (outflow)

from operating activities 450,068 (2,783,153)

------------ ------------

Investing activities

Purchase of property, plant

and equipment (50,235) (20,983)

Purchase of subsidiaries (net

of cash acquired) - 274,700

Disposal of controlling interest (1,340,058)

in Driift - cash disposed of -

Investment in unlisted shares - (53,086)

Net amount (invested in)/withdrawn

from associates and joint ventures (158,825) -

Interest received 3,000 4,852

------------ ------------

Net cash generated from investing

activities (1,546,118) 205,483

------------ ------------

Financing activities

Proceeds from issue of shares - 4,311,119

Proceeds from borrowings - 500,000

Repayment of borrowings (377,809) (640,386)

Proceeds from non-controlling

interest additional investment

(Driift) - 2,000,000

Repayment of bank loans - (95,414)

Payment of lease liabilities (140,287) (136,865)

------------ ------------

Net cash (absorbed by)/ generated

from financing activities (518,096) 5,983,454

------------ ------------

Net (decrease)/increase in

cash and cash equivalents (1,614,146) 3,360,784

Cash and cash equivalents at

beginning of year 5,532,272 2,178,505

Effect of foreign exchange rates (856) (7,017)

------------ ------------

Cash and cash equivalents at

end of year 3,917,270 5,532,272

============ ============

1. General information

The Group financial statements have been prepared in accordance

with International Financial Reporting Standards in conformity with

the requirements of the Companies Act 2006 ("IFRS").

The financial information set out in this document does not

constitute the Group's statutory accounts for the year ended 31

December 2022 or 31 December 2021.

Statutory accounts for the year ended 31 December 2021 have been

filed with the Registrar of Companies and those for the year ended

31 December 2022 will be delivered to the Registrar in due course;

both have been reported on by independent auditors. The independent

auditor's report for the year ended 31 December 2022 is

unmodified.

Going concern

The accounts have been prepared on a going concern basis. Based

on the cash flow forecast for the period ended 30 June 2024, the

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future

2. Basis of consolidation

The consolidated Group financial statements comprise the

financial statements of ATC Group plc and its subsidiaries listed

in the Group financial statements. The financial statements of all

Group companies are adjusted, where necessary, to ensure the use of

consistent accounting policies.

3. Segmental analysis - 31 December 2022

Continuing activities Discontinued

operations

Artist Services* Livestreamed Central Total Livestreamed Total before Eliminations Total

representation events costs events eliminations

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Revenue 6,571,428 2,874,603 - - 9,446,031 2,608,079 12,054,110 - 12,054,110

Cost of sales - (2,053,180) (1,031,198) - - (3,084,378) (2,457,469) (5,541,847) - (5,541,847)

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Gross profit 4,518,248 1,843,405 - - 6,361,653 150,610 6,512,263 6,512,263

Other operating income 178,215 14,722 - 366,741 559,678 240,830 800,508 (366,741) 433,767

Administrative expenses (4,211,950) (1,354,434) - (762,481) (6,328,864) (683,111) (7,011,975) 366,741 (6,645,234)

------------- -------------

Operating profit/(loss) 484,513 503,694 - (395,740) 592,467 (291,671) 300,796 - 300,796

Share of results

of associates and

joint ventures 140,708 (15,443) (290,994) - (165,729) - (165,729) - (165,729)

Finance income 3,000 - 3,000 3,000 - 3,000

Finance costs (86,178) (66) - (41,681) (127,925) (131) (128,055) - (128,055)

Provisions for

amounts - - - - - - - - -

owed by participating

interest

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Profit/(Loss) before

taxation 542,043 488,185 (290,994) (437,421) 301,813 (291,802) 10,012 - 10,012

Income tax expense - (77,931) - (77,931) - (77,931) - (77,931)

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Profit/(loss) for

the year before gain

on disposal of controlling

interest 542,043 410,254 (290,994) (437,421) 223,882 (291,802) (67,919) - (67,919)

Discontinued

operations:

Gain on disposal

of controlling interest - - - - - 2,511,979 2,511,979 - 2,511,979

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Profit/(loss) for

the year 542,043 410,254 (290,994) (437,421) 223,882 2,220,177 2,444,060 - 2,444,060

=============== ============ ============= ============ ============ ============= ============= ============= ============

Assets and

liabilities

Total assets 6,173,734 960,920 2,184,533 3,047,786 12,366,973 - 12,366,973 (1,694,907) 10,672,066

Total liabilities (9,483,839) (331,239) - (115,674) (9,930,752) - (9,930,752) 3,513,096 (6,417,656)

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Net assets/(liabilities) (3,310,105) 629,681 2,184,533 2,932,112 2,436,221 - 2,436,221 1,818,189 4,254,410

=============== ============ ============= ============ ============ ============= ============= ============= ============

* Revenue of the Consultancy and Services segment in 2022 includes commission of $2,297,223 received

in March 20222 by ATC Media Inc for the facilitation of the acquisition of Napster Music Inc by Hivemind

and Algorand. ATC Media Inc is also entitled to deferred revenue in the form of a number of Napster crypto

tokens issued as part the merger between Napster Music Inc and Napster Holding Inc, a number that is currently

undetermined. The fair value of the deferred revenue receivable in Napster tokens has been determined

at the year end to be nil.

3. Segmental Analysis - 31 December 2021

Continuing activities Discontinued

operations

Artist Services Central Total Livestreamed Total before Eliminations Total

representation costs events eliminations

GBP GBP GBP GBP GBP GBP GBP GBP

Revenue 3,722,924 778,502 - 4,501,426 4,642,212 9,143,638 - 9,143,638

Cost of sales (2,060,725) (27,676) - (2,088,401) (6,209,493) (8,297,894) - (8,297,894)

--------------- ---------- ------------ -------------- -------------- -------------- ------------- --------------

Gross profit 1,662,199 750,826 - 2,413,025 (1,567,281) 845,744 845,744

Other operating

income 581,716 120,227 - 701,943 545,979 1,247,922 (84,426) 1,163,496

Administrative

expenses (2,822,245) (817,164) (713,948) (4,353,357) (1,121,944) (5,475,301) 84,426 (5,390,877)

-------------- -------------

Operating

profit/(loss) (578,331) 53,890 (713,948) (1,238,390) (2,143,245) (3,381,636) - (3,381,637)

Share of results

of associates

and joint

ventures 167,568 - - 167,568 - 167,568 - 167,568

Finance income 4,849 4 - 4,852 - 4,852 - 4,852

Finance costs (96,837) (132) - (96,968) - (96,968) - (96,968)

Provisions for

amounts owed

by

participating

interest (333) - - (333) - (333) - (333)

Adjusted

profit/(loss)

before

tax (503,085) 53,762 (97,213) (546,538) (2,143,245) (2,689,783) - (2,689,783)

IPO and related

costs - - (616,735) (616,735) (616,735) - (616,735)

------------------ --------------- ---------- ------------ -------------- -------------- -------------- ------------- --------------

Profit/(Loss)

before taxation (503,085) 53,762 (713,948) (1,163,273) (2,143,245) (3,306,518) - (3,306,518)

Income tax

expense - (1,256) - (1,256) - (1,256) - (1,256)

--------------- ---------- ------------ -------------- -------------- -------------- ------------- --------------

Profit/(loss) for

the year (503,085) 52,505 (713,948) (1,164,529) (2,143,245) (3,307,774) - (3,307,774)

=============== ========== ============ ============== ============== ============== ============= ==============

Assets and

liabilities

Total assets 6,749,386 505,566 3,512,328 10,767,280 3,395,862 14,163,141 (4,204,523) 9,958,619

Total liabilities (7,938,879) (279,363) (146,465) (8,364,707) (2,184,318) (10,549,025) 2,842,862 (7,706,163)

--------------- ---------- ------------ -------------- -------------- -------------- ------------- --------------

Net assets (1,189,493) 226,203 3,365,862 2,402,572 1,211,544 3,614,116 (1,361,661) 2,252,456

=============== ========== ============ ============== ============== ============== ============= ==============

4. Revenue analysed by geographical market

2022 2021

GBP GBP

United Kingdom 4,453,863 5,068,283

Europe 314,938 860,023

United States of America 7,268,132 2,631,178

Rest of the world 17,177 584,154

----------- ----------

12,054,110 9,143,638

=========== ==========

5. Discontinued operations

On 30 September 2022 the group entered into a transaction with

Deezer SA ('Deezer') involving Driift Holdings Limited ('Driift')

whereby Deezer introduced new equity funds of GBP4m and the company

Dreamstage, Inc. into the Driift group. As a result, ATCs interest

in Driift reduced from 52% to 32.5% and from 1 October 2022 Driift

has been accounted for as an associated undertaking.

In accordance with IFRS 5, the results of Driift to 30 September

2022 are shown as discontinued operations and the 2021 comparatives

adjusted accordingly. The share of Driift's results from 1 October

2022 are included in continuing activities.

The resulting gain on the disposal of the controlling interest

in Driift amounted to GBP2,511,979 (2021: GBPNil).

6. Earnings per share

2022 2021

GBP GBP

Profit (loss) attributable to owners of parent

company 2,596,921 (2,353,469)

Basic and diluted number of shares in issue 9,584,020 9,584,020

Earnings per share pence pence

Basic and diluted earnings/(loss) per share 27.10 (24.56)

Basic and diluted earnings/(loss) per share

(Continuing activities) 1.58 (10.26)

Basic and diluted earnings/(loss) per share

(Discontinued activities) 25.52 (14.30)

Basic earnings per share is calculated by dividing the

profit/loss after tax attributable to the equity holders of All

Things Considered Group Plc by the weighted numbers of shares in

issue during the year .

7. Income tax expense

2022 2021

GBP GBP

Current tax

UK corporation tax on losses for the current -

period -

Foreign taxes and reliefs 77,931 1,256

77,931 1,256

======= ======

The difference between the statutory income tax rate and the

effective tax rates are summarised as follows:

2022 2021

GBP GBP

Profit/(loss) before income taxes 10,012 (3,306,518)

---------- ------------

Expected tax at statutory UK corporation tax

rate of 19% 1,902 (628,238)

Increase/(decrease) in tax resulting from:

Effect of different tax rates in foreign jurisdictions 1,228 (27,081)

Tax losses utilised - 181,597

Capital allowances less depreciation (1,249) (1,894)

Losses carried forward - 471,027

Non-deductible expenditure 353,817 101,070

Income not taxable for tax purposes (171,957) -

Movement in deferred tax not recognised (116,191) -

Other adjustments 10,381 (95,225)

77,931 1,256

========== ============

At 31 December 2022, the Group has GBP2,882,169 (2021:

GBP5,496,781) of tax losses available to be carried forward against

future profits. A deferred tax asset on losses available to be

carried forward has not been provided due to uncertainty that

profits will arise against which the losses can offset.

From April 2023, the corporation tax rate increased from 19% to

25%.

8. Reserves

2022 2021 2022 2021

Ordinary share capital Number Number GBP GBP

Issued and fully paid

Ordinary shares of GBP0.01

(2020: GBP1) each 95,840,020 95,840,020 95,840 95,840

Number of

shares Share capital

No. GBP

Issued share capital in All Things

Considered Ltd at 31 December 2020 34,358 34,358

At 31 December 2020 34,358 34,358

========== =============

Exchanged for shares in All Things

Considered Group Plc 6,871,599 68,716

Share issued on incorporation 1 -

Shares issued 14 December 2021 2,712,420 27,124

---------- -------------

At 31 December 2021 and 2022 9,584,020 95,840

========== =============

The company has one class of Ordinary shares. The Ordinary

shares have full voting, dividend and capital distribution

(including on winding up) rights. They do not confer any rights of

redemption or carry any right to fixed income.

On 11 November 2021, All Things Considered plc issued 6,871,599

Ordinary shares of GBP0.01 each in exchange for the entire share

capital of All Things Considered Limited.

On 14 December 2021, 2,712,420 shares were issued leading to a

further GBP27,412 of share capital and share premium of

GBP3,983,970, net of share issue costs.

On 14 December 2021, 119,800 warrants were granted to Canaccord

Genuity Limited to subscribe for Ordinary Shares of GBP0.01 each in

All Things Considered Group Plc. The charge to the profit and loss

account in respect of these is immaterial for 2021 .

Merger reserve

The merger reserve was created as a separate component of

equity, representing the difference between the share capital of

the Company at the date of the Group reorganisation in 2021 and

that of the previous parent company of the Group.

Currency translation reserve

The currency translation reserve represents cumulative foreign

exchange differences arising from the translation of the financial

statements of foreign subsidiaries.

9. Related party transactions

Transactions with related parties for the year ended 31 December

2022

During the year, the Group paid rent of GBP150,000 (2021:

GBP150,000) to Pagham Investments Limited, a company in which close

family members of two of the directors, Craig Newman and Brian

Message, have a significant interest. The Group also paid rent of

GBP193,958 (2021: GBP178,240) to Craig Newman during the year.

During the year the Group recharged overheads totalling

GBP32,494 (2021: GBP20,554) to the following LLPs that the Group is

a member of and has a significant interest in:

-- ATC 9 LLP: GBP23,452 (2021: GBP20,554)

-- ATC Live LLP: GBP9,042 (2021: GBPnil)

In turn the group was recharged overheads totalling GBP305,300

(2021: GBP800,468) by the following LLPs that the Group is a member

of and has a significant interest in:

-- ATC 4 LLP: GBP284,674 (2021: GBP798,898)

-- ATC 9 LLP: GBP20,626 (2021: GBP1,570)

During the year, the Group paid interest of GBP23,790 (2021:

GBP10,778) to Pagham Investments Ltd.

Balances with related parties as at 31 December 2022

At 31 December 2022, the Group owed GBP900,000 (2020:

GBP1,015,027) to Pagham Investments Limited, a company in which

close family members of two of the directors, Craig Newman and

Brian Message, have a significant interest.

At 31 December 2022, the following represent the amount of

members capital in LLPs and LLCs attributable to the Group and

shown in 'investments in associates and joint ventures':

2022 2021

GBP GBP

ATC 4 LLP 206,412 -

ATC 7 LLP 15,932 398

ATC 9 LLP 88,070 52,060

-------- -------

310,414 52,458

======== =======

10. Events after the reporting date

There are no post balance sheet events that require disclosure

under IAS10.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSSSEELEDSEFI

(END) Dow Jones Newswires

May 05, 2023 02:00 ET (06:00 GMT)

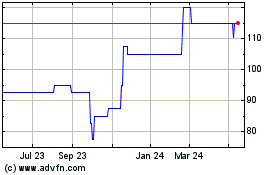

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Nov 2024 to Dec 2024

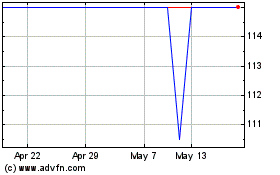

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Dec 2023 to Dec 2024