TIDMNANO

RNS Number : 2944G

Nanoco Group PLC

18 July 2023

18 July 2023

NANOCO GROUP PLC

("Nanoco", the "Company" or the "Group")

Posting of Circular and Notice of General Meeting in relation to

Requisitioned General Meeting

Board Recommendation to VOTE AGAINST ALL Resolutions

Nanoco Group plc (LSE: NANO), a world leader in the development

and manufacture of cadmium-free quantum dots and other specific

nanomaterials emanating from its technology platform, announces

that it will today post a Circular setting out details of Nanoco's

response to the shareholder Requisition of a General Meeting and

why the Board believes Shareholders should VOTE AGAINST ALL

Resolutions. The Circular will also contain the Notice of General

Meeting to be held on 14 August 2023.

The Proposals are not in the best interests of Shareholders; the

Board recommends VOTING AGAINST ALL Resolutions to PROTECT YOUR

CASH and PROTECT YOUR COMPANY

-- Nanoco is at an exciting inflection point, with the

litigation proceeds fully underpinning our transition from an

R&D first mover to a leading producer of next-generation QD

materials in the short term

-- The Board changes proposed by the Requisitionists would, in

effect, represent a total change of control of Nanoco with no

takeover premium being paid

-- The Board changes proposed by the Requisitionists would

result in the new Board gaining complete control of YOUR CASH - the

net Samsung litigation proceeds of US$90m - having spent only a

fraction of that to acquire control of the business

-- The Requisitionists' proposals would be damaging and

disruptive to Nanoco's future prospects and, if successful, will

result in an exodus of key talent from the business including Dr

Nigel Pickett, the Group's co-founder and Chief Technology

Officer

-- Mr Hamoodi's unfounded allegations create a false narrative that misleads Nanoco shareholders

Shareholder support for the Board

The Board is pleased to have received the following message of

support from Christopher Mills, Founder, Director, Chief Executive

Officer and Chief Investment Officer of Harwood Capital, a c.3%

shareholder:

"I fully support the board of Nanoco as they have a clear

strategy to build value for all shareholders. I believe it would be

highly irresponsible to support the resolutions in the

requisitioned meeting in so far as the proposed new directors are

not of the experience or calibre I would expect to see on the board

of a UK public company in which I am invested."

Randolph Baron, Lead Portfolio Manager, International of

Pinnacle Associates, a c.1% shareholder, had the following to

say:

"We have been Nanoco shareholders for over half a decade. While

the successful Samsung settlement has consumed much investor

attention of late, especially since the company could return to

shareholders over 60 percent of its current share price within

seven months, as long-term investors we are more focused on

Nanoco's underlying business. Its current prospects give us more

enthusiasm than we have had at any point in the last three

years.

"We are neither for nor against any individual management: We

are for shareholders. Towards that end, we lament the current

distraction and bemoan that shareholder cash will be used to defend

against Mr. Hamoodi's efforts. We believe bringing in a new

management team (including replacing the founder who is also a

named patent holder on much of the company's technology) could

potentially derail the operational progress that has been building

momentum even during the recent Samsung lawsuit. We plan to vote

against the resolutions."

Shareholder presentation

The Company will host a presentation for shareholders via

Investor Meet Company during which the Board will set out the

reasons why they recommend that you VOTE AGAINST ALL the

resolutions. Shareholders will also have the opportunity to submit

questions in advance to nanocoGM@mhpgroup.com. Details of the

Investor Meet Company call will be circulated in due course.

Christopher Richards, Non-Executive Chairman of Nanoco,

said:

"The Resolutions proposed by the Requisitionists are not in the

best interest of shareholders and would give undue influence and

control to one small, disgruntled group of Shareholders, who only

own 5.02% of the Company. Indeed, the proposed Board changes will

result in the new Board gaining complete control of Shareholder's

cash - the net Samsung litigation proceeds of US$90m - having spent

only a fraction of that to acquire control.

"The Requisitionists' proposals would also be damaging and

disruptive to Nanoco's future prospects and, if successful, would

result in an exodus of key talent from the business, including Dr

Pickett who is a named inventor on the majority of the Group's

retained patents. In stark contrast, the proposed nominees lack the

requisite experience, having no track record of serving on the

board of any UK listed companies, and are not the right choice to

lead Nanoco at this crucial point in its development."

Brian Tenner, Chief Executive Officer of Nanoco Group plc,

said:

"The Group is closer to commercial production than at any time

in its 20-year history, strengthened by its newly validated IP and

proceeds from the successful conclusion of the Samsung litigation,

providing a firm financial footing to unlock Nanoco's potential and

return significant cash to shareholders. The Requisitionists'

proposals would destroy the significant potential value within

Nanoco's organic business and risk turning Nanoco into a highly

speculative litigation shell company, whilst also risking the

majority of future value being lost to third parties."

- Ends -

A copy of the Circular will be published on the Company's

website later today at www.nanocotechnologies.com .

This summary should be read in conjunction with the full text of

the Circular. Capitalised terms used but not defined in this

announcement will have the same meaning given to them in the

Circular.

FORWARD LOOKING STATEMENTS

This announcement (including information incorporated by

reference in this announcement) and other information published by

Nanoco may contain statements about Nanoco that are or may be

deemed to be forward looking statements. Such statements are

prospective in nature. All statements other than historical

statements of facts may be forward looking statements. Without

limitation, statements containing the words "targets", "plans",

"believes", "expects", "aims", "intends", "will", "may",

"anticipates", "estimates", "projects" or "considers" or other

similar words may be forward looking statements.

Forward looking statements inherently contain risks and

uncertainties as they relate to events or circumstances in the

future. Important factors such as business or economic cycles, the

terms and conditions of Nanoco's financing arrangements, tax rates,

or increased competition may cause Nanoco's actual financial

results, performance or achievements to differ materially from any

forward looking statements. Due to such uncertainties and risks,

readers are cautioned not to place undue reliance on such forward

looking statements, which speak only as of the date hereof. Nanoco

disclaims any obligation to update any forward looking or other

statements contained herein, except as required by applicable

law.

Expected Timetable of Principal Events

Date of receipt of Requisition 27 June 2023

Date of the Notice of General Meeting 18 July 2023

Time and date of Company presentation To be announced in due

to shareholders via the Investor Meet course

Company platform

Latest time and date for receipt of Forms 11:00 am on 10 August

of Proxy from Shareholders 2023

Latest time and date by which a request 11:00 am on 10 August

to participate in the General Meeting 2023

via the conference facility must be made

Deadline for ownership of shares to be 6:00 pm on 10 August

registered in order to be entitled to 2023

attend and vote at the General Meeting

General Meeting 11:00am on 14 August

2023

For further information, please contact:

Nanoco Group PLC :

Dr Christopher Richards, Non-Executive

Chairman

Brian Tenner, CEO

Liam Gray, CFO & Company Secretary +44(0)1928 761 404

Peel Hunt (Joint Corporate Broker):

Paul Gillam

James Smith +44 (0) 20 7418 890

Turner Pope Investments (Joint

Corporate Broker):

Andrew Thacker

James Pope +44 (0) 20 3657 0050

MHP :

Reg Hoare

nanoco@mhpgroup.com +44 (0) 203 128 8570

Notes for editors:

About Nanoco Group plc

Nanoco (LSE: NANO) harnesses the power of nano-materials.

Nano-materials are materials with dimensions typically in the range

1 - 100 nm. Nano-materials have a range of useful properties,

including optical and electronic. Quantum dots are a subclass of

nano-material that have size-dependent optical and electronic

properties. The Group produces quantum dots and other

nano-materials. Within the sphere of quantum dots, the Group

exploits different characteristics of the quantum dots to target

different performance criteria that are attractive to specific

markets or end-user applications such as the Display, Sensor and

Electronics markets. An interesting property of quantum dots is

size-tunable absorption spectrum. Nanoco's HEATWAVE(TM) quantum

dots can be tuned to absorb light at different wavelengths across

the near-infrared spectrum, rendering them useful for applications

including image sensors. Another interesting property of quantum

dots is photoluminescence: the emission of longer wavelength light

upon excitation by light of a shorter wavelength. The colour of

light emitted depends on the particle size. Nanoco's CFQD(R)

quantum dots are free of cadmium and other toxic

heavy metals, and can be tuned to emit light at different

wavelengths across the visible and infrared spectrum, rendering

them useful for a wide range of applications including displays,

lighting and biological imaging.

Nanoco was founded in 2001 and is headquartered in Runcorn, UK,

with a US subsidiary, Nanoco Inc., in Concord, MA. Nanoco continues

to build out a world-class, patent-protected IP portfolio generated

both by its own innovation engine, as well as through

acquisition.

Nanoco is listed on the Main Market of the London Stock Exchange

and trades under the ticker symbol NANO. For

further information, please visit: www.nanocotechnologies.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGGDRDDBDGXR

(END) Dow Jones Newswires

July 18, 2023 02:00 ET (06:00 GMT)

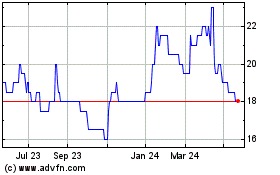

Nanoco (AQSE:NANO.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

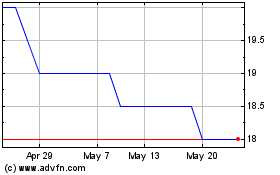

Nanoco (AQSE:NANO.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024