TIDMOPTI

RNS Number : 0559F

OptiBiotix Health PLC

17 March 2022

OptiBiotix Health plc

("OptiBiotix" or the "Company" or "Group")

Intention to list ProBiotix Health on the AQSE Growth Market and

dividend in specie timetable

OptiBiotix Health p lc (AI M: OPTI), a life sciences busi ness d

eveloping compou n ds to tackle obesity, high cholesterol, diabetes

and skin care, a nnounces that it intends to seek admission (the

"Proposed Admission") of its wholly owned subsidiary, ProBiotix

Health Limited ("ProBiotix Health"), onto the AQSE Growth Market

with an associated fund raise and distribution in specie

("Distribution").

Key points

-- Proposed GBP2.5m fundraise by ProBiotix Health by way of placing and subscription.

-- EIS/VCT qualifying.

-- A distribution in specie of ProBiotix Health shares to

OptiBiotix Health plc shareholders on its register at the record

date.

ProBiotix Health

ProBiotix was established by OptiBiotix to develop probiotics to

tackle cardiovascular disease and other lifestyle conditions which

are affecting growing numbers of people across the world. Since its

creation, ProBiotix has become a leader in microbiome modulating

compounds for use in functional foods and supplements.

Human volunteer studies have shown that ProBiotix's principal

product, LP-LDL(R), can reduce key cardiovascular risk markers,

such as total cholesterol, LDL (bad) cholesterol, and Apolipo

protein B, by up to 34.2 per cent, 28.4 per cent and 28.6 per cent

respectively (RNS 18:1:22). Structured consumer studies have

confirmed these findings in real-world use of products with 95% of

users stating that the product was effective, and 90% reporting

they would recommend the product to family and friends (RNS:

1:2:22). Since launching LP-LDL(R) in May 2017 ProBiotix has signed

over 38 agreements including a number of large pharmaceutical

companies such as AlfaSigma and Actial Pharma as a product line

extension of its VSL(#) 3(R) brand, one of the world's best known

probiotic brands.

LP-LDL(R) was designated Generally Recognized As Safe ("GRAS")

by an independent Expert GRAS Panel in the United States in

February 2019, which extends its applications from use as a

supplement to use as a functional ingredient in a wide range of

food, dairy, and beverage products in the USA.

The global probiotics market is estimated to be valued at USD

61.1 billion in 2021 (Research and Markets, 2021) and is projected

to reach USD 91.1 billion by 2026, at a CAGR of 8.3% during the

forecast period. Factors affecting the growth of the probiotics

market are health benefits associated with probiotic-fortified

foods, technological advancements in probiotic products, and

technological advancements in probiotic products driving consumer

demand for science-based products.

In OptiBiotix's most recent trading statement to 31 December

2021 (notified 28 February 2022), ProBiotix Health Ltd reported

unaudited EBITDA of GBP195k, (2020: GBP88k) with total sales of

GBP1.1m (2020: GBP821k).

Reason for the listing

OptiBiotix believes that the best way to exploit the multiple

opportunities offered by the microbiome is to structure the

business across prebiotic and probiotic technology platforms as

wholly owned subsidiaries, each containing its own technology, IP

portfolio and partner agreements, with potential for a separate

exit. OptiBiotix's Probiotic subsidiary containing its cholesterol

and blood pressure reducing strain LP(LDL) (R) has made strong

scientific and commercial progress. The business uses its high

throughput OptiScreen(R) technology for the identification of

probiotics with specific health benefits as supplements or

therapeutic products creating the potential for a pipeline of

future products.

Whilst this strategy creates multiple opportunities it can lead

to group funding being shared across a number of platforms which

may limit the opportunities which could be better exploited if

separately funded.

The Company believes that ProBiotix has established a strong

position with its products nominated for multiple awards, excellent

results from clinical studies, five-star customer reviews and

growing sales delivering early profit. The Board believe the scale

of the opportunities offered by its LPLDL are beyond those

currently being exploited and may be best realised by a separate

listing and fundraise.

The planned Admission of ProBiotix Health allows the business to

extend territories, grow direct to consumer product sales, expand

into the dairy market, and further explore the potential of LPLDL

as a live biotherapeutic or OTC product with consumer health pharma

companies. These developments have the potential for substantial

future value enhancement.

Fundraise and listing

As part of the Proposed Admission, ProBiotix Health is seeking

to raise approximately GBP2.5m through a placing and subscription

at an indicative premoney valuation of GBP22.5m. Peterhouse Capital

Limited ("Peterhouse") is acting as AQSE Corporate Adviser and

broker to ProBiotix Health.

ProBiotix Health has received advanced assurance from HMRC that

the shares to be issued pursuant to the Fundraise will rank as

"eligible shares" for the purposes of the Enterprise Investment

Scheme.

In order to provide OptiBiotix shareholders with the opportunity

to invest directly in ProBiotix Health, the Company has agreed with

Peterhouse that applications may be made on behalf of existing

OptiBiotix shareholders to acquire Shares in ProBiotix Health by

subscription ("Subscription").

Peterhouse cannot take direct orders from individual private

investors. Accordingly, independent financial advisers,

stockbrokers, or other firms authorised by the Financial Conduct

Authority, should communicate their clients' interest in the

Subscription by contacting Peterhouse on 020 7220 9797 or 020 7469

0936. Each application should state the number of Shares that the

interested party wishes to acquire and should be submitted to

Peterhouse no later than 4.30 pm on 23 March 2022.

As far as is practical, participation in the Subscription will

be prioritised for shareholders in OptiBiotix. Peterhouse may

choose not to accept applications and/or to accept applications,

either in whole or in part, on the basis of allocations determined

at their sole discretion (after consultation with the Company) and

may scale down any applications for this purpose on such basis as

Peterhouse may determine.

Distribution

In connection with the Fundraise and Proposed Admission, the

Company is proposing to declare a 'dividend in specie' of ordinary

shares of ProBiotix Health ("Dividend Shares") to shareholders who

are on the Company's register of members at the close of business

on Friday 25 March 2022 ("Record Date"), such shareholders being

referred to as "Qualifying Shareholders". The Dividend Shares will

be allocated on a pro rata basis. The final number of Dividend

Shares to be distributed will be determined by the amount of funds

raised through the placing and subscription and the need for

OptiBiotix's shareholding in ProBiotix Health to be reduced below

50% to meet the HMRC EIS requirements.

The Dividend Shares are expected to represent between 35% and

37% of the issued share capital of ProBiotix Health admitted to

trading on the AQSE Growth market. Following the Distribution, the

Company will hold between 46-48%, with the remaining 13- 18% held

by new shareholders.

The legal title to the Dividend Shares will be held by Global

Prime Partners Ltd acting as nominee on behalf of each of the

Qualifying Shareholders ("Nominee") and an 'omnibus' share

certificate in respect of the Dividend Shares will be issued and

held by the Nominee. The Nominee will hold the Dividend Shares on

trust for each of the Qualifying Shareholders for a minimum period

of 9 months following admission to trading on AQSE of the issued

share capital of ProBiotix Health ("Lock-up Period"). The Lock-up

Period is intended to contribute to the creation of an orderly

market in ProBiotix Health's shares for a period after admission to

trading.

The legal title to the Dividend Shares will be held by the

Nominee under a declaration of trust on terms that, in relation to

any shareholder resolution of ProBiotix Health, the Nominee will

request that ProBiotix Health's registrar seeks the voting

instructions of each Qualifying Shareholder in relation to the

Dividend Shares it is holding on that Qualifying Shareholder's

behalf. The Nominee will vote those Dividend Shares in accordance

with such instructions as it receives. At the end of the Lock-up

Period, the Nominee will be entitled to execute stock transfer

forms to transfer the legal title to the Dividend Shares to each

Qualifying Shareholder (as appropriate).

Qualifying Shareholders will receive a letter informing them of

their beneficial holdings of Dividend Shares shortly after the

transfer of the Dividend Shares to the Nominee.

Following the Lock-up Period, and upon transfer of the legal

title in the Dividend Shares by the Nominee, Qualifying

Shareholders will receive individual share certificates in respect

of their Dividend Shares. The Company's articles of association

permit such a Distribution without specific consent of the

Company's shareholders.

CREST shareholders should note that pursuant to the Dividend the

ProBiotix shares will be transferred to the Nominee to be held on

trust for the benefit of the OptiBiotix shareholders.

CREST will not therefore be raising market claims in respect of

the entitlements to ProBiotix shares and as a result this event

will deviate from the normal dividend in specie procedures. Any

market claims will therefore need to be agreed bi-laterally between

affected participants following the transfer of the ProBiotix

shares from the Nominee to the entitled OptiBiotix shareholders in

January 2023.

The anticipated timetable is:

OptiBiotix announces ProBiotix Health (PBX) Thursday 17 March 2022

IPO and intended dividend in specie

Ex-dividend date for the distribution in Thursday 24 March 2022

specie

-----------------------

Record date for the distribution in specie Friday 25 March 2022

-----------------------

PBX shares admitted to AQSE Friday 31 March 2022

PBX Shares allotted to Nominee

-----------------------

Each of the dates set out above may be subject to change at the

absolute discretion of the Company.

Stephen O'Hara, CEO of OptiBiotix, commented : "OptiBiotix has

followed a strategy of developing multiple technology platforms in

the microbiome space which can be developed as separate legal

entities with the potential for exit by trade sale or IPO.

OptiBiotix shareholders benefit by having a position in multiple

companies, and with it the prospect of multiple returns, as a mix

of dividends and asset value enhancement using non-dilutive

funding.

"ProBiotix has now reached a stage of scientific and commercial

maturity with strong IP, growing sales, and a profitable business.

It now wants to accelerate commercial progress by securing funding

to extend territories, grow direct to consumer product sales, and

expand into key markets like dairy and pharma. The planned

Admission to AQSE and fundraise creates the opportunity for

ProBiotix to focus its activities on driving the development and

commercialisation of LP-LDL(R) into key markets, like dairy and

pharma, and create the potential for substantial future value

enhancement."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information, please contact:

OptiBiotix Health plc www.optibiotix.com

Stephen O'Hara, Chief Executive Contact via Walbrook

below

Cairn Financial Advisers LLP (NOMAD) Tel: 020 7213 0880

Liam Murray / Jo Turner / Ludovico Lazzaretti

Cenkos Securities plc (Broker) Tel: 020 7397 8900

Callum Davidson / Neil McDonald

Michael Johnson / Russell Kerr (Sales)

Walbrook PR Ltd Mob: 07876 741 001

Anna Dunphy

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCJFMMTMTMBTLT

(END) Dow Jones Newswires

March 17, 2022 03:00 ET (07:00 GMT)

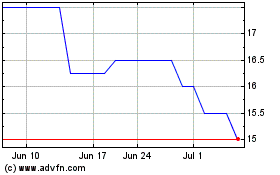

OptiBiotix Health (AQSE:OPTI.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

OptiBiotix Health (AQSE:OPTI.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024