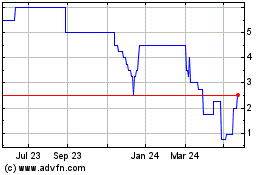

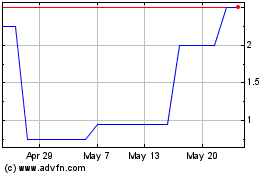

OTAQ Plc (OTAQ) OTAQ Plc: Final Results for 9 months to 31

December 2022 19-May-2023 / 07:00 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

19 May 2023

OTAQ plc

("OTAQ", or the "Company")

Final Results for 9 months to 31 December 2022

OTAQ plc (OTAQ.AQ), the innovative technology company targeting

the aquaculture, geotracking and offshore markets, announces its

audited results for the 9 month period to 31 December 2022.

Financial Highlights

2022 2021/22

Group (9 months) (12 months)

GBP'000 GBP'000

Revenue 2,561 4,292

Gross profit 794 2,027

Adjusted EBITDA* (258) (49)

Net cash / (debt) 758 (1,268)

Strategic and Operational Highlights

-- GBP2.3m of cash as at 31 December 2022 following the

successful equity fund raising in November 2022

-- New sales resource recruited in both the Aquaculture and

Offshore divisions

-- Commercialisation and near-commercialisation of key projects

in Aquaculture and Geotracking poised todeliver growth in 2023

*Adjusted EBITDA is earnings before income, tax, depreciation,

exceptional costs, impairment, share option charges and

amortisation

Commenting, Phil Newby, Chief Executive at OTAQ, said:

"OTAQ has ended the financial period with a strong balance sheet

following the November 2022 share issue and renewed optimism that

the Group will be successful. OTAQ is continuing to enhance its

portfolio of products in all divisions and is looking to penetrate

new markets through additional sales resource over the coming

year.

"Completing the commercialisation of our new products and

continuing the growth seen in the Offshore divisions gives the

directors confidence that the Group will return to profitable

growth."

Contacts:

OTAQ PLC 01524 748010

Adam Reynolds, Non-Executive Chairman

Phil Newby, Chief Executive Officer

Matt Enright, Chief Financial Officer

Dowgate Capital Limited (AQSE Corporate Advisor & Broker) 020 3903 7715

David Poutney / James Serjeant

Nicholas Chambers / Russell Cook

Walbrook PR Limited Tel: 020 7933 8780 or Otaq@walbrookpr.com

Tom Cooper / Nick Rome 0797 122 1972 or 07748 325 236

About OTAQ:

OTAQ is a highly innovative technology company targeting the

aquaculture, geotracking and offshore markets. It already has a

number of established products in its portfolio and is focused on

further developing its presence, customer base and cross selling

opportunities within core markets both organically and via

acquisition.

OTAQ's aquaculture products, which include a sonar device

(developed for Minnowtech LLC) to scan shrimp in ponds and water

quality monitoring, are focused on maximising welfare and

production yields. Additionally, the Company is developing a

potentially game changing live plankton analysis product for

finfish and shellfish farmers. It also continues to target

opportunities in the acoustic deterrent devices market via its

Sealfence product, which is used by salmon farmers, with global

opportunities in Chile, Australia, Canada and Norway.

The Company is also developing high accuracy location trackers

for specialist applications. Having already added clients within

safety and multiple participant sport/racing applications, the

Company is investigating wider market potential - including

opportunities in the seafood industry.

OTAQ's offshore product range includes OceanSense subsea leak

detection, Eagle IP camera systems, Lander seabed survey devices

and Subsea electrical connectors and penetrators. It is targeting a

number of growth opportunities in new territories and has a strong

client base including Expro, Amphenol and National Oilwell Varco.

The Company is also focused on the development of new products

through this division, with the aim of increased cross-deployment

of skills and technologies into the aquaculture arena.

CHAIRMAN'S STATEMENT FOR THE NINE-MONTH PERIODED 31 DECEMBER

2022

I'm pleased to present my first Chairman's Statement for the

nine-month period ended 31 December 2022.

The Group has spent the past nine-months working hard to develop

and expand its product portfolio in each of its core markets, being

Offshore, Aquaculture and Geotracking. Initial sales of some of

these new products have been made in this or the prior financial

period and the Group is now working hard to develop new markets and

commercial opportunities for these products. Where development of

key strategic products is not yet complete, efforts are being made

in the new year to complete this development where credible market

conditions prevail.

I am hopeful that 2023 will yield the benefit of our expanded

product portfolio and I will be able to present improved revenue

and profit performance for the year to 31 December 2023.

Strategy

The strategy of the business is to use the Group's customer base

in the Offshore and Aquaculture industries to allow it to sell our

new products developed by the Group's product development team.

Over time, the Group intends to have a full suite of complementary

and sophisticated products for use in the Aquaculture industry, be

that salmon or shrimp, as well as target niche markets in the

Offshore sector where the Group can continue to enjoy the success

historically seen. The Geotracking division will also make use of

the products developed for this division to target specific sectors

that the Group believe will benefit significantly from this

technology.

Offshore

The Offshore division, comprised of the previously separately

reported Connectors and Offshore divisions, has continued to

perform well and is expected to continue do so in 2023. The Group

now sees additional opportunities for this division in new

territories such as North America and other global markets. Sales

and marketing resource is being invested to help develop the

potential in this division and accelerate revenue growth.

Aquaculture

The Group has developed exciting new products for use in the

Aquaculture industry. As revenue from the company's historically

core product, Sealfence, has reduced, product development has been

pursued in collaboration with key strategic partners to permit

entry into the shrimp market, water quality monitoring sectors and

plankton analysis. Whilst not all of these products are yet fully

commercialised, the Group continues to believe in these

technologies and the huge market potential that is possible.

Geotracking

The Geotracking technology developed since 2020 has enjoyed some

commercial success. In the year to 31 March 2022, the Group

benefitted from a large contract award. Variants of the Geotracking

device remain in development consisting of tracking devices for use

in the railway industry and other similar sectors. Trials with

partners in the railway industry are ongoing with orders placed and

deliveries made. The potential for significant orders within this

division in 2023 exists and the Group is working hard to achieve

this.

Our Team

Despite the challenges the Group has faced over the past year, I

have been impressed since I joined with the passion and enthusiasm

that exists within the business. I am delighted to welcome Giles

Clifford to the Board and thank Malcolm Pye for his contribution

now he has left. I am confident the team will work diligently to

deliver the performance that the Board expects over the next twelve

months.

Adam Reynolds

Non-Executive Chairman

CHIEF EXECUTIVE'S REPORT FOR THE NINE-MONTH PERIODED 31 DECEMBER

2022

Review of the period

Despite the declining Revenue and increasing losses in the

period, the Group has taken steps to reposition itself during the

year to ensure the business can return to growth and profitability

without relying on its historically core product in the Aquaculture

division. The Offshore division has performed well in the

nine-month period with the Geotracking division not achieving

Revenue of significance but continuing to develop new markets and

products.

Development of the phytoplankton analysis product is continuing

with commercial launch being worked towards in 2023. Trial sites

with potential customers have been deployed and this has been

fruitful in enabling us to learn about this strategically important

market as well as allow Blue Lion Labs Ltd, in which we own 10% of

equity, to develop the software required as part of the

product.

Development of the shrimp sonar product in collaboration with

Minnowtech LLC, our 15% investment since February 2021, has

continued during the period. No sales of significance were made but

Minnowtech are continuing to finalise their end product and they

have now, post year-end, placed a one hundred unit quantity

order.

The Group achieved Revenue of GBP2.56m in the nine-month period

(2021/22: GBP4.29m) with this delivered by GBP1.62m in the Offshore

division (2021/22: GBP2.09m), GBP0.06m (2021/22: GBP0.76m) in the

Geotracking division and revenue of GBP0.88m (2021/ 22: GBP1.45m)

in the Aquaculture division. The Geotracking division in 2021/22

benefitted from the fulfilment of a significant sports tracking

contract as well as sonar sales to Minnowtech. Sonar sales in

future will be recorded as Aquaculture sales.

Sales to non-UK territories have increased from 46% of total

revenue in 2021/22 to 50% in 2022 as the Offshore division

continues to expand and become a more significant part of the

Group.

Revenue

Group revenue for the nine-month period ended 31 December 2022

was GBP2.56 million from GBP4.29 million in the twelve months to 31

March 2022. This revenue change is all organic.

With the changing mix of sales from Aquaculture to Offshore, the

Group sales mix is changing with UK revenue now representing only

50% of total revenue (2021/22: 54%). Chile represents 5% (2021/22:

8%) of total revenue with other European countries accounting for

14% (2021/22: 13%) of total revenue and the rest of the world for

31% (2021/22: 25%) of total revenue.

Profit

The statutory loss for the year of GBP2.30m (2021/22: GBP1.90m)

was impacted by the period being nine-months with Revenue being

GBP1.73m lower than the twelve-month prior period and Gross profit

being GBP1.23m lower accordingly. Gross profit of 31% (2021/22:

47%) was impacted by the high fixed costs in Cost of sales.

Administrative expenses changed to GBP3.10m (2021: GBP4.14) in line

with the nine-month period.

The GBP3.10m of administrative expenses was impacted by the

large exceptional charges and certain one-offs including a GBP0.06m

(2021/22: GBP0.31ml) impairment charge for the write-down of

Sealfence units returned from customers and a GBP0.33m (2021/22:

GBP0.57m) intangibles amortisation charge which included an

additional GBP0.15m impairment charge relating to development costs

not commercially viable.

The Group's exceptional charges in the year totalled GBP1.23m

(2021/22: GBP0.26m). These included costs regarding the end of the

Scottish Acoustic Deterrent Device market and costs that were

associated with legal fees for the new shares issued and listing on

the Aquis Stock Exchange in November 2022.

Dividends

The Board is not recommending a final dividend (2021/22:

GBPnil).

Trading environment

The North Sea and wider oil market in which the Offshore

division operates, and which impacts on demand for the Offshore

division, has remained buoyant during the period. Demand in this

division is expected to continue to be favourable in 2023 and will

be supported by additional sales resources and dedicated product

development support. The market for ADDs in Scotland is no longer

an area of focus although Scotland remains a key market for the

Group's new live plankton analysis system (LPAS) and water quality

monitoring product. The Chilean market has been subdued in the year

but progress is being made with the Chilean authorities around the

approval required to use ADDs and it is hoped when this is

concluded it will enable the Chilean market to grow.

Innovation

The Group has continued to invest in the development of new

products and improvement to existing products. Investment in

research and development, capitalised as development costs,

amounted to GBP0.36 million in the period to 31 December 2022

(2021/22: GBP0.59 million), equivalent to 14% of Group revenue

(2021/22: 14%). The aim of the Group's research and development

team is to deliver key projects such as LPAS, water quality

monitoring and Geotracking devices.

Current trading and prospects

There is cautious optimism that in the coming financial year the

Group can return to profitable growth due to the performance of the

Offshore division and the expected launch of the Group's strategic

new products such as LPAS. However, management and the Board will

continue to exercise firm controls on costs and cash whilst the

Group returns to profitability.

Phil Newby

Chief Executive

CHIEF FINANCIAL OFFICER'S REPORT FOR THE NINE-MONTH PERIODED 31

DECEMBER 2022

The strategy of the Group is to build a business of significance

within the aquaculture and offshore industries with the key

financing requirements being to ensure there is sufficient resource

to fund new product development and working capital as the Group

returns to growth.

The Group's Key Performance Indicators are aligned to revenue,

profits and ensuring sufficient cash flow to deliver future growth.

These three measures were below targets in the period to 31

December 2022 due to the withdrawal of Sealfence units from the

Scottish market. However, cash flow has been supplemented by the

issue of shares in November 2022 which aided cash balances by an

amount net of all relevant costs of GBP3.22m. In addition, the

Group carefully monitors loss time incidents and employee

absenteeism and turnover. Loss time incidents were zero (2021/22:

zero) for the year and employee absenteeism was in line with

historic levels although employee turnover increased.

Revenue

Group revenue changed to GBP2.56m from GBP4.29 million with

pro-rata growth in the Offshore division against decline in

Aquaculture and Geotracking.

Profits

The preferred measure of assessing profits for the Group is

explained below:

2022 2021/22

9 months 12 months

GBP'000 GBP'000

Operating loss (2,310) (2,114)

Share option charge - 20

Exceptional costs 1,230 257

Amortisation of intangible assets 326 572

Impairment of rental units 62 311

Right-of-use depreciation 130 164

Depreciation on property, plant and equipment 304 741

Adjusted EBITDA* (258) (49)

* Earnings before income, tax, depreciation, share option

charges, impairment, exceptional costs and amortisation.

Adjusted EBITDA declined to a loss of GBP0.26m from GBP0.05

million in 2021/22 with the corresponding EBITDA operating margin

declining from 1% EBITDA operating loss in the prior year to a 10%

EBITDA operating loss. This decline was driven by the decrease in

Gross profit in the period to GBP0.79m from GBP2.03m in the prior

year. The EBITDA decline also resulted from a decline in the gross

profit percentage from 47.2% to 31.0% due to the changing revenue

mix away from Sealfence rentals.

Operating losses increased to GBP2.31m from GBP2.11m with the

total comprehensive expense for the year increasing to

GBP2.30million (2021/22: GBP1.91 million). The statutory loss

before tax increased to GBP2.51 million compared to GBP2.16 million

in 2021/22.

Adjusted EBITDA

Adjusting items relate to expenditure which does not relate

directly to the core activities of the Group and is considered to

be one-off in nature or in relation to investing, restructuring or

financing activities. The total pre-tax adjusting items recorded in

the nine-month period to 31 December 2022 were GBP1.23m. These

relate to GBP0.23m of fees relating to the November 2022 issue of

equity, GBP0.12m relating to the write-off of amounts loaned to the

employee benefit trust due to the decline in the company's share

price, GBP0.34m of costs in association with Sealfence inventory

purchased in the period immediately written down, GBP0.49m

write-down of Aquaculture inventory associated with the Scottish

Sealfence rental market and GBP0.05m of sundry costs considered to

be one-off.

In addition to this, there were depreciation charges of GBP0.30

million (2021/22: GBP0.74m), intangible amortisation charges of

GBP0.33m (2021/22: GBP0.57m) and right-of-use depreciation charges

of GBP0.13m (2021/22: GBP0.16m). There was also an impairment

charge of GBP0.06m (2021/22: GBP0.31m) relating to Sealfence units

returned from customers following the end of rental agreements.

Other operating income

The grant income received in 2021/22 of GBP0.13m related to the

HMRC CBILs scheme.

.

Finance costs

Net finance costs totalled GBP0.20m (2021/22: GBP0.17m) and

related to the interest charge relating to deferred acquisition

payments made in the year associated with the terms of the

acquisition of Marine Sense Limited in 2018, Right of use asset

interest charges and predominantly interest costs relating to the

CBILs loan.

Taxation

As the Group remains in a statutory loss-making position, there

is no overall Group tax charge. The Group continues to benefit from

research and development tax credits which, along with a decrease

in deferred tax of GBP0.08m, accounts for the GBP0.22m (2021/22:

GBP0.25m) tax credit in the year.

Earnings and losses per share

Statutory basic losses per share were 5.0p (2021/22: loss 5.9p)

and statutory diluted losses per share totalled 5.0p (2021/22: loss

5.9p). These are calculated using the weighted average number of

shares in existence during the year.

Return on Capital

The Group intends to report on capital returns once sustained

profitability has been achieved. Whilst capital returns are

monitored currently, it is not a key performance or key results

measure given the Group's high revenue growth and current statutory

loss-making position.

Dividends

No dividends have been paid in the year (2021/22: GBPnil) and no

dividend is recommended. It is expected that all cash resources

will be retained by the Group.

Headcount

The Group's number of employees for 2022 stood at 43 (2021/22:

45). The change in staff numbers during the year was due to

efficiency measures undertaken.

Share capital and share options

The Group's issued share capital at 31 December 2022 totalled

127,824,881 Ordinary shares (2021/1: 37,716,250). During the year,

no share options were exercised with 108,631 (2021/22: 95,854)

shares issued as part of the employee Share Incentive Plan.

90,000,000 new shares were issued at a price of 4p as part of a

funding round held in November 2022. 6,272,729 new shares were

issued at a price of 22p as part of a funding round held in January

2022.

No share options were issued in the year (2021/22: 800,000) with

23,930,878 (2021/22: 2,130,900) share options and warrants in issue

at 31 December 2022. 700,000 (2021/22: 229,592) share options

lapsed in the year due to performance criteria not being met.

Warrants totalling 22,499,978 were issued in November 2022 with

22,819,978, included in the above figures, outstanding on 31

December 2022 (2021/22: 320,000).

Cashflow and net debt

This year's cash generated from operations totalled an outflow

of GBP0.88 million (2021/22: GBP1.77 million). Total capital

expenditure amounted to GBP0.61 million (2021/22: GBP1.23 million).

Year-end cash balances totalled GBP2.34 million compared to GBP1.01

million in 2021/22. The Group finished 2022 with net cash of

GBP0.76 million compared to GBP1.27 million of net debt at the end

of 2021/22 as reconciled below:

2022 2021/22

GBP'000 GBP'000

Cash and cash equivalents 2,337 1,008

Non-current lease liabilities (181) (255)

Current lease liabilities (172) (161)

Non-current financial liabilities (1,054) (1,392)

Current financial liabilities (447) (421)

Current deferred payment for acquisition - (213)

Income tax asset 275 166

Net cash / (debt) 758 (1,268)

The directors consider the income tax credit to be part of net

debt as the asset will be converted into cash and is not part of

normal working capital requirements as with other current

assets.

Assets and liabilities

Total current assets at 31 December 2022 were GBP4.24m compared

to total current assets of GBP4.11m at 31 March 2022. The key

change during the year relates to the increase in cash balances

following the November 2022 fund raising to GBP2.34m from GBP1.01m

and the decrease in trade and other receivables to GBP0.69m

(2021/22: GBP1.77m) due to the timing of prior year revenue being

weighted towards the last quarter of 2021/22. Inventories have

decreased to GBP0.94m from GBP1.18m with trade and other payables

decreasing to GBP0.50m from GBP1.24m with deferred income reducing

by GBP0.43m.

Total liabilities have decreased from GBP3.77m at 31 March 2022

to GBP2.36m at 31 December 2022 with this decrease driven by the

repayments due under the CBILs loan, reducing deferred income

balances and a reduction in deferred payments for acquisition.

Right-of-use lease liabilities at the end of the period amount to a

total liability of GBP0.35m (2021/22: GBP0.42m).

Despite the difficulties of the period, the Group's financial

position is improved over previous years due to the November 2022

fund raising. Nonetheless, the Group remains focussed on tight cost

control and cash management whilst revenue and EBITDA growth is

delivered to enable the Group to become cash flow positive.

Summary

The Group begins the new financial year with a strong balance

sheet, but where management and the Board will continue to exercise

firm controls on costs and cash. The Group's Offshore division is

trading well and there is optimism that this division and new

product launches can return the Group to an EBITDA-positive

position and improve the Group's cash performance.

Matt Enright

Chief Financial Officer consolidated Statement of comprehensive

income FOR the NINE-MONTH PERIOD ended 31 DECEMBER 2022

Note Nine-month period ended 31 December Year ended 31 March

2022 2022

GBP'000 GBP'000

Revenue 4 2,561 4,292

Cost of sales (1,767) (2,265)

Gross profit 794 2,027

Administrative expenses (3,104) (4,141)

Operating loss 5 (2,310) (2,114)

Other operating income 5 - 131

Finance income 7 1 -

Finance costs 7 (203) (172)

Loss before taxation (2,512) (2,155)

Taxation 8 217 251

Loss for the year (2,295) (1,904)

??????? ???????

Attributable to:

Equity shareholders of the Group (2,295) (1,904)

(2,295) (1,904)

??????? ???????

Other comprehensive income

Items that will be reclassified subsequently to profit

and loss:

Exchange differences on translation of foreign (-) (7)

operations

Total comprehensive expense for the year (2,295) (1,911)

??????? ???????

Attributable to:

Equity shareholders of the Group (2,295) (1,911)

(2,295) (1,911)

??????? ???????

As per note 9, the loss for the year arises from the Group's

continuing operations. Losses Per Share were 5.0p (2021 /22: loss

5.9p) and Diluted Losses Per Share were 5.0p (2021/22: loss

5.9p).

The accompanying notes on pages 36 to 66 form an integral part

of these consolidated financial statements. CONSOLIDATED Statement

of financial position as at 31 DECEMBER 2022

31 December 2022 31 March 2022

GBP'000 GBP'000

Note

ASSETS

Non-current assets

Property, plant and equipment 10 582 919

Right-of-use assets 11 364 434

Unlisted investments 13 511 511

Intangible assets 12 3,008 2,970

Total non-current assets 4,465 4,834

Current assets

Trade and other receivables 15 689 1,766

Income tax asset 16 275 155

Inventories 17 937 1,182

Cash and cash equivalents 18 2,337 1,008

Total current assets 4,238 4,111

Total assets 8,703 8,945

??????? ???????

EQUITY AND LIABILITIES

Equity

Share capital 19 1,278 5,657

Share premium 19 5,834 3,280

Deferred shares 19 5,286 -

Share option reserve 25 134 150

Merger relief reserve 20 9,154 9,154

Reverse acquisition reserve 20 (6,777) (6,777)

Other reserve 20 400 384

Revenue reserve 20 (8,963) (6,668)

Total equity 6,346 5,180

Non-current liabilities

Deferred tax 23 - 80

Financial liabilities 24 1,054 1,392

Lease liabilities 11 181 255

Total non-current liabilities 1,235 1,727

Current liabilities

Trade and other payables 22 503 1,243

Financial liabilities 24 447 421

Deferred payment for acquisition 21 - 213

Lease liabilities 11 172 161

Total current liabilities 1,122 2,038

Total liabilities 2,357 3,765

Total equity and liabilities 8,703 8,945

??????? ???????

The accompanying notes on pages 36 to 66 form an integral part

of these consolidated financial statements. The financial

statements were approved by the board of directors and authorised

for issue on 18th May 2023. The results of the parent company are

included on pages 67 to 71.

Signed on its behalf by M J Enright Company number: 11429299

............................. consolidated Statement of changes

in equity FOR THE NINE-MONTH PERIOD ended 31 DECEMBER 2022

Equity

Share Share Deferred Share Merger Reverse Other Revenue attributable to Total

capital premium shares option relief acquisition reserve reserve owners of the equity

reserve reserve reserve parent company

Note

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April 4,614 2,897 - 473 9,154 (6,777) 136 (4,764) 5,733 5,733

2021

Loss for the year - - - - - - - (1,904) (1,904) (1,904)

Exchange

differences on - - - - - - (7) - (7) (7)

translating foreign

operations

Total comprehensive

expense for the - - - - - - (7) (1,904) (1,911) (1,911)

year

Issues of shares 955 383 - - - - - - 1,338 1,338

Transfer on

exercised and 88 - - (343) - - 255 - - -

cancelled options

Charge for share 25 - - - 20 - - - - 20 20

options

Balance at 31 March 5,657 3,280 - 150 9,154 (6,777) 384 (6,668) 5,180 5,180

2022

???? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ??????

Balance at 1 April 5,657 3,280 - 150 9,154 (6,777) 384 (6,668) 5,180 5,180

2022

Loss for the year - - - - - - - (2,295) (2,295) (2,295)

Exchange

differences on - - - - - - - - - -

translating foreign

operations

Total comprehensive

expense for the - - - - - - - (2,295) (2,295) (2,295)

year

Sub-division and

conversion of 19 (5,286) - 5,286 - - - - - - -

shares

Issues of shares 19 907 2,554 - - - - - - 3,461 3,461

Transfer on

exercised and 25 - - - (16) - - 16 - - -

cancelled options

Balance at 31 1,278 5,834 5,286 134 9,154 (6,777) 400 (8,963) 6,346 6,346

December 2022

???? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ??????

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE NINE-MONTH PERIODED

31 DECEMBER 2022

31 December

Note 31 March 2022

2022

GBP'000 GBP'000

Cash flows from operating activities

Operating loss (2,310) (2,114)

Adjustments for non-cash/non-operating items:

Depreciation of property, plant and equipment 10 304 741

Impairment of property, plant and equipment 10 62 311

Loss on disposal of property, plant and equipment 10 6 -

Depreciation of right-of-use assets 11 130 164

Amortisation of intangible assets 12 181 277

Impairment of intangible assets 12 145 295

Gain on remeasurement of deferred consideration payable 21 - 40

Share option charge 25 - 20

(1,482) (266)

Changes in working capital:

Decrease / (increase) in inventories 245 (283)

Decrease / (increase) in trade and other receivables 1,077 (906)

Decrease in trade and other payables (740) (603)

Cash from operations (900) (2,058)

Taxation 17 289

Net cash from operating activities (883) (1,769)

Cash flows from investing activities

Purchases of tangible fixed assets 10 (35) (423)

Purchases of intangible assets 12 (364) (587)

Acquisition of unlisted equity securities 13 - (214)

Interest received 1 -

Deferred payment of acquisition 21 (213) -

Re-translation of foreign subsidiaries - (7)

Net cash used in investing activities (611) (1,231)

Cash flows from financing activities

Proceeds on issue of shares 3,611 1,408

Expenses of share issues (150) (70)

Repayment of loans (312) (187)

Principal element of lease payments (123) (181)

Interest paid (203) (82)

Net cash from financing activities 24 2,823 888

Net increase / (decrease) in cash and cash equivalents 1,329 (2,112)

Cash and cash equivalents at beginning of year 1,008 3,120

Cash and cash equivalents at end of year 2,337 1,008

??????? ???????

1. Reporting entity

OTAQ plc ("the Company") and its subsidiaries (together, "the

Group") develop, provide and support the technology for use in the

aquaculture industry and offshore oil & gas industries. The

principal activity of the Company is that of a holding company for

the Group as well as performing all administrative, corporate

finance, strategic and governance functions of the Group. The

Company is a public limited company, which is listed on the Aquis

Stock Exchange and domiciled in England and incorporated and

registered in England and Wales. The address of its registered

office is 8-3-4 Harpers Mill, South Road, White Cross, Lancaster,

England, LA1 4XF. The registered number of the Company is

11429299.

The principal accounting policies adopted by the Group and

Company are set out in note 2. 2. Accounting policies

The principal accounting policies applied in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied unless otherwise stated. a.

Basis of preparation

The consolidated financial statements of OTAQ plc have been

prepared in accordance with International Financial Reporting

Standards in conformity with the requirements UK-adopted

International Accounting Standards applicable to companies

reporting under IFRS and the Companies Act 2006. The consolidated

financial statements have been prepared under the historical cost

convention, as modified for any financial assets which are stated

at fair value through profit or loss. The consolidated financial

statements of OTAQ plc are presented in pounds sterling, which is

the presentation currency for the consolidated financial

statements. The functional currency of each of the group entities

is Sterling apart from OTAQ Chile SpA which is the Chilean Peso.

Figures have been rounded to the nearest thousand.

The preparation of financial statements requires the use of

certain critical accounting estimates. It also requires management

to exercise its judgement in the process of applying the Group's

accounting policies. The areas involving a higher degree of

judgement and complexity, or areas where assumptions and estimates

are significant to the consolidated financial statements are

disclosed in note 3.

The Group has taken advantage of the audit exemption for one of

its subsidiaries, OTAQ Aquaculture Limited (company number

SC498922) by virtue of s479A of the Companies Act 2006. The Group

has provided a parent guarantee to this subsidiary which has taken

advantage of the exemption from audit. The parent company has

applied FRS101 in its entity statements. b. Basis of

consolidation

The Group's financial statements consolidate the financial

information of OTAQ plc and the entities it controls (its

subsidiaries) drawn up to 31 December each year. In years prior to

31 December 2022, the financial statements were drawn up to 31

March each year. The year end date was amended on 16 December 2022

in order to algin with investor expectations. All business

combinations (except for the Hertsford Capital plc reverse takeover

on 31 March 2020 which used the merger accounting method) are

accounted for by applying the acquisition method as at the

acquisition date, which is the date on which control is transferred

to the Group.

The Group measures goodwill at the acquisition date as:

-- the fair value of the consideration transferred; plus

-- the recognised amount of any non-controlling interests in the

acquiree; plus

-- the fair value of the existing equity interest in the

acquiree; less

-- the net recognised amount (generally fair value) of the

identifiable assets acquired and liabilitiesassumed.

Transaction costs related to the acquisition, other than those

associated with the issue of debt or equity securities, that the

Group incurs in connection with a business combination are expensed

as incurred.

All subsidiaries are entities in which the Group owns sufficient

share capital and has sufficient voting rights in order to govern

the financial and operating policies. The percentage holdings of

the Company in its subsidiaries is set out in note 14. The

subsidiaries have been fully consolidated from the date control

passed. All intra-group transactions, balances and unrealised gains

on transactions between Group companies are eliminated on

consolidation. The accounting policies of subsidiaries are amended

where necessary to ensure consistency with the policies adopted by

the Group. c. Foreign currency transactions

Transactions in foreign currencies are initially recorded in the

functional currency by applying the spot rate ruling at the date of

the transaction. Monetary assets and liabilities denominated in

foreign currencies are retranslated at the functional currency rate

of exchange ruling at the reporting date. All differences are taken

to the Consolidated statement of comprehensive income. d. Going

Concern

The Group is developing new products for its core markets in

Offshore and Aquaculture as well as the new Geotracking division.

The Group has invested heavily in the development and procurement

of these products and has achieved this through use of its cash

reserves as well as the funds received following the share issue in

November 2022. As at 31 December 2022, the Group had cash and cash

equivalents of GBP2,337,000. The directors have prepared and

reviewed the Group's funding requirements over the next two years

and are confident the Group has sufficient financial resources to

meet its financial commitments and strategic objectives.

The forecasts generated by the Group, which cover the period to

June 2024 and have been modelled for reductions in anticipated

revenue, demonstrate sufficient ongoing demand to satisfy

liabilities as they fall due. For these reasons the directors

continue to adopt the going concern basis in preparing Group's

financial statements e. Functional and presentational currency

The financial statements are presented in pounds sterling, which

is the Group's functional and presentation currency. All financial

information presented has been rounded to the nearest thousand. f.

Segmental reporting

An operating segment is a component of an entity that engages in

business activities from which it may earn revenues and incur

expenses, whose operating results are regularly reviewed by the

entity's chief operating decision maker to make decisions about

resources to be allocated to the segment and assess its

performance, and for which discrete financial information is

available. Segmental information is set out in note 4. g. Revenue

recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

and services provided in the normal course of business, net of

sales related taxes.

Revenue related to sales of stock is recognised when goods are

dispatched and the title and control over a product have passed to

the customer, in accordance with agreed delivery terms.

Revenue under service contracts is recognised over the period in

which the performance obligation relating to the agreed contract

are satisfied. For rentals of the Group's assets, revenue is

recognised on a monthly basis based on the agreed rate and number

of days for which the asset is on hire to the customer. Some

contractual revenue is invoiced in advance and gives rise to a

contract liability which is recognised as deferred income. h.

Government grants

Government grants are recognised when it is reasonable to expect

that the grants will be received and that all related conditions

are met, usually on submission of a valid claim for payment.

Government grants of a revenue nature are deducted from

administrative expenses in the consolidated statement of

comprehensive income in line with the terms of the underlying grant

agreement. Government grants relating to capital expenditure are

deducted in arriving at the carrying amount of the asset.

Government grants relating specifically to Covid-19 support

measures have been disclosed as "other operating income". i.

Leases

The Group assesses whether a contract is or contains a lease, at

inception of the contract. The Group recognises a right-of-use

asset and a corresponding lease liability with respect to all lease

arrangements in which it is the lessee, except for short-term

leases (defined as leases with a lease term of 12 months or less)

and leases of low value assets (such as tablets and personal

computers, small items of office furniture and telephones). For

these leases, the Group recognises the lease payments as an

operating expense on a straight-line basis over the term of the

lease unless another systematic basis is more representative of the

time pattern in which economic benefits from the leased assets are

consumed. The lease liability is initially measured at the present

value of the lease payments that are not paid at the commencement

date, discounted by using the rate implicit in the lease. If this

rate cannot be readily determined, the lessee uses its incremental

borrowing rate.

Lease payments included in the measurement of the lease

liability comprise:

-- Fixed lease payments (including in-substance fixed payments),

less any lease incentives receivable;

-- Variable lease payments that depend on an index or rate,

initially measured using the index or rate atthe commencement

date;

-- The amount expected to be payable by the lessee under

residual value guarantees;

-- The exercise price of purchase options, if the lessee is

reasonably certain to exercise the options;

-- Payments of penalties for terminating the lease, if the lease

term reflects the exercise of an option toterminate the lease.

The lease liability is presented as a separate line in the

statement of financial position. The lease liability is

subsequently measured by increasing the carrying amount to reflect

interest on the lease liability (using the effective interest

method) and by reducing the carrying amount to reflect the lease

payments made.

The Group remeasures the lease liability (and makes a

corresponding adjustment to the related right-of-use asset)

whenever:

-- The lease term has changed or there is a significant event or

change in circumstances resulting in achange in the assessment of

exercise of a purchase option, in which case the lease liability is

remeasured bydiscounting the revised lease payments using a revised

discount rate;

-- The lease payments change due to changes in an index or rate

or a change in expected payment under aguaranteed residual value,

in which cases the lease liability is remeasured by discounting the

revised leasepayments using an unchanged discount rate (unless the

lease payments change is due to a change in a floatinginterest

rate, in which case a revised discount rate is used); and

-- A lease contract is modified and the lease modification is

not accounted for as a separate lease, inwhich case the lease

liability is remeasured based on the lease term of the modified

lease by discounting therevised lease payments using a revised

discount rate at the effective date of the modification.

The Group did not make any such adjustments during the periods

presented.

The right-of-use assets comprise the initial measurement of the

corresponding lease liability, lease payments made at or before the

commencement day, less any lease incentives received and any

initial direct costs. They are subsequently measured at cost less

accumulated depreciation and impairment losses.

Whenever the Group incurs an obligation for costs to dismantle

and remove a leased asset, restore the site on which it is located

or restore the underlying asset to the condition required by the

terms and conditions of the lease, a provision is recognised and

measured under IAS 37. To the extent that the costs relate to a

right-of-use asset, the costs are included in the related

right-of-use asset, unless those costs are incurred to produce

inventories.

Right-of-use assets are depreciated over the shorter period of

lease term and useful life of the underlying asset. If a lease

transfers ownership of the underlying asset or the cost of the

right-of-use asset reflects that the Group expects to exercise a

purchase option, the related right-of-use asset is depreciated over

the useful life of the underlying asset.

The depreciation starts at the commencement date of the lease.

The right-of-use assets are presented as a separate line in the

statement of financial position.

The Group applies IAS 36 to determine whether a right-of-use

asset is impaired and accounts for any identified impairment loss

as described in the 'Property, Plant and Equipment' policy.

Variable rents that do not depend on an index or rate are not

included in the measurement of the lease liability and the

right-of-use asset. The related payments are recognised as an

expense in the period in which the event or condition that triggers

those payments occurs and are included in 'Administrative expenses'

in profit or loss.

As a practical expedient, IFRS 16 permits a lessee not to

separate non-lease components, and instead account for any lease

and associated non-lease components as a single arrangement. The

Group has not used this practical expedient. j. Finance expense

Finance expense comprises interest expense on borrowings. All

borrowing costs are recognised using the effective interest method.

k. Income tax

Income tax expense comprises current and deferred tax. Income

tax expense is recognised in the consolidated statement of

comprehensive income except to the extent that it relates to items

recognised directly in equity or in other comprehensive income.

Current income tax assets and liabilities for the current and

prior periods are measured at the amount expected to be recovered

from or paid to, the tax authorities. The tax rates and tax laws

used to compute the amount are those that are enacted or

substantively enacted by the reporting date.

Deferred income tax is recognised on all temporary differences

arising between the tax bases of assets and liabilities and their

carrying amounts in the financial statements with the following

exceptions:

-- where the temporary difference arises from the initial

recognition of goodwill or of an asset orliability in a transaction

that is not a business combination, that at the time of the

transaction affects neitheraccounting nor taxable profit nor loss;

and

-- in respect of taxable temporary differences associated with

investments in subsidiaries where the timingof the reversal of the

temporary differences can be controlled and it is probable that the

temporary differenceswill not reverse in the foreseeable

future.

Deferred income tax assets and liabilities are measured on an

undiscounted basis using the tax rates and tax laws that have been

enacted or substantively enacted by the date and which are expected

to apply when the related deferred tax asset is realised, or the

deferred tax liability is settled.

Deferred income tax assets are recognised to the extent that it

is probable that future taxable profits will be available against

which differences can be utilised. An asset is not recognised to

the extent that the transfer or economic benefits in the future is

uncertain.

Amounts due under the HMRC Research and Development tax credit

scheme are accounted for based on the amount of qualifying

expenditure in the year and assuming 14.5% of the claim is paid in

cash once applicable losses and future profitability have been

reviewed. l. Property, plant and equipment

Property, plant and equipment assets are recognised initially at

cost. After initial recognition, these assets are carried at cost

less any accumulated depreciation and any accumulated impairment

losses. Cost comprises both the aggregate amount paid and the fair

value of any other consideration given to acquire the asset, and

includes costs directly attributable to making the asset capable of

operating as intended.

Depreciation is computed by allocating the depreciable amount of

an asset on a systematic basis over its useful life and is applied

separately to each identifiable component.

The following bases and rates are used to depreciate classes of

assets:

Systems for rental - straight line over 4 years

Plant and equipment - straight line over 2 to 5 years

Motor vehicles - straight line over 3 years

The carrying values of property, plant and equipment are

reviewed for impairment if events or changes in circumstances

indicate that the carrying value may not be recoverable and are

written down immediately to their recoverable amount. Useful lives

and residual values are reviewed annually and where adjustments are

required these are made prospectively.

All property, plant and equipment items are de-recognised on

disposal, or when no future economic benefits are expected to arise

from the continued use of the asset. Any gain or loss arising on

the de-recognition of the asset is included in the Consolidated

statement of comprehensive income in the period of de-recognition.

m. Intangible assets

Intangible assets acquired either as part of a business

combination or from contractual or other legal rights are

recognised separately from goodwill, provided they are separable

and their fair value can be measured reliably. This includes the

costs associated with acquiring and registering patents in respect

of intellectual property rights. Trademarks are assessed on

recognising fair value of assets acquired by calculating the future

net book value of expected cash flows.

Development costs are also charged to the statement of

comprehensive income in the year of expenditure, except when

individual projects satisfy the following criteria:

-- the project is clearly defined and related expenditure is

separately identifiable;

-- the project is technically feasible and commercially

viable;

-- current and future costs will be exceeded by future sales;

and

-- adequate resources exist for the project to be completed.

Where intangible assets recognised have finite lives, after

initial recognition their carrying value is amortised on a

straight-line basis over those lives. Development costs are

amortised once the project to which they relate is viewed to be

completed and capable of generating revenue. Once a project is

completed, any further costs are charged to the statement of

comprehensive income. The nature of those intangibles recognised

and their estimated useful lives are as follows:

Intellectual property licence - straight line over 4 years

Development costs - straight line over 6 years

Trademarks - straight line over 8 years

Goodwill is recognised when the purchase price of a business

exceeds the fair value of the assets acquired. Goodwill is subject

to annual impairment reviews. n. Impairment of assets

At each reporting date the Group reviews the carrying value of

its plant, equipment and intangible assets to determine whether

there is an indication that these assets have suffered an

impairment loss. If any such indication exists, or when annual

impairment testing for an asset is required, the Group makes an

assessment of the asset's recoverable amount.

An asset's recoverable amount is the higher of an asset's or

cash-generating unit's fair value less costs to sell and its value

in use and is determined for an individual asset, unless the asset

does not generate cash inflows that are largely independent of

those from other assets or groups of assets. Where the carrying

value of an asset exceeds its recoverable amount, the asset is

considered impaired and is written down to its recoverable amount.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset. In determining fair value less

costs of disposal, an appropriate valuation model is used, these

calculations corroborated by valuation multiples, or other

available fair value indicators. Impairment losses on continuing

operations are recognised in the Consolidated statement of

comprehensive income in those expense categories consistent with

the function of the impaired asset.

An assessment is made at each reporting date as to whether there

is any indication that previously recognised impairment losses may

no longer exist or may have decreased. If such indication exists,

the recoverable amount is estimated. A previously recognised

impairment loss is reversed only if there has been a change in the

assumptions used to determine the asset's recoverable amount since

the last impairment loss was recognised. If that is the case the

carrying amount of the asset is increased to its recoverable

amount. That increased amount cannot exceed the carrying amount

that would have been determined, net of depreciation, had no

impairment loss been recognised for the asset in prior years. Such

reversal is recognised in the Consolidated statement of

comprehensive income unless the asset is carried at re-valued

amount, in which case the reversal is treated as a valuation

increase.

After such a reversal the depreciation charge is adjusted in

future periods to allocate the asset's revised carrying amount,

less any residual value, on a systematic basis over its remaining

useful life. o. Inventories

Inventories are stated at the lower of cost and net realisable

value. Cost based on latest contractual prices includes all costs

incurred in bringing each product to its present location and

condition. Net realisable value is based on estimated selling price

less any further costs expected to be incurred to disposal.

Provision is made for slow-moving or obsolete items if they are

deemed to be no longer usable or sellable. p. Financial

instruments

A financial asset or financial liability is initially measured

at fair value. For an item not at fair value, adjustments to fair

value are made through profit and loss (FVTPL) including

transaction costs that are directly attributable to its acquisition

or issue. A trade receivable without a significant financing

component is initially measured at fair value and subsequently

measured at amortised cost.

Financial assets

On initial recognition, a financial asset is classified as

measured at: amortised cost; fair value through other comprehensive

income (FVOCI) - debt investment; FVOCI - equity investment; or

FVTPL. Financial assets are not reclassified subsequent to their

initial recognition unless the Group changes its business model for

managing financial assets, in which case all affected financial

assets are reclassified on the first day of the first reporting

period following the change in the business model.

The Group has only financial assets measured at amortised cost.

A financial asset is measured at amortised cost if it meets both of

the following conditions and is not designated as at FVTPL:

-- it is held within a business model whose objective is to hold

assets to collect contractual cash flows;

-- its contractual terms give rise on specified dates to cash

flows that are solely payments of principaland interest on the

principal amount outstanding.

Financial assets - Business model assessment

The Group makes an assessment of the objective of the business

model in which a financial asset is held at portfolio level because

this best reflects the way the business is managed and information

is provided to management. The information considered includes:

-- the stated policies and objectives for the portfolio and the

operation of those policies in practice.These include whether

management's strategy focuses on earning contractual interest

income, maintaining aparticular interest rate profile, matching the

duration of the financial assets to the duration of any

relatedliabilities or expected cash outflows or realising cash

flows through the sale of the assets;

-- how the performance of the portfolio is evaluated and

reported to the Company's management;

-- the risks that affect the performance of the business model

(and the financial assets held within thatbusiness model) and how

those risks are managed;

-- how managers of the business are compensated - e.g. whether

compensation is based on the fair value ofthe assets managed or the

contractual cash flows collected; and

-- the frequency, volume and timing of sales of financial assets

in prior periods, the reasons for suchsales and expectations about

future sales activity.

Financial assets: Assessment whether contractual cash flows are

solely payments of principal and interest

For the purposes of this assessment, 'principal' is defined as

the fair value of the financial asset on initial recognition.

'Interest' is defined as consideration for the time value of money

and for the credit risk associated with the principal amount

outstanding during a particular period of time and for other basic

lending risks and costs (e.g. liquidity risk and administrative

costs), as well as a profit margin.

In assessing whether the contractual cash flows are solely

payments of principal and interest, the Group considers the

contractual terms of the instrument. This includes assessing

whether the financial asset contains a contractual term that could

change the timing or amount of contractual cash flows such that it

would not meet this condition. In making this assessment, the Group

considers:

-- contingent events that would change the amount or timing of

cash flows;

-- terms that may adjust the contractual coupon rate, including

variable-rate features;

-- prepayment and extension features; and

-- terms that limit the Group's claim to cash flows from

specified assets (e.g. non-recourse features).

Financial assets at amortised cost are subsequently measured

fair value. The amortised cost is reduced by impairment losses.

Interest income, foreign exchange gains and losses and impairment

are recognised in the income statement. Any gain or loss on

derecognition is recognised in the income statement.

Financial liabilities

Financial liabilities are classified according to the substance

of the contractual arrangements entered into. Financial

liabilities, including trade and other payables and bank loans are

initially recognised at transaction price unless the arrangement

constitutes a financing transaction, where the debt instrument is

measured at the present value of the future payments discounted at

a market rate of interest. Debt instruments are subsequently

carried at amortised cost, using the effective interest rate

method.

Trade payables are obligations to pay for goods or services that

have been acquired in the ordinary course of business from

suppliers. Accounts payable are classified as current liabilities

if payment is due within one year or less. If not, they are

presented as non-current liabilities. Trade payables are recognised

initially at transaction price and subsequently measured at

amortised cost using the effective interest method.

Derecognition of financial liabilities

Financial liabilities are derecognised when, and only when, the

company's obligations are discharged, cancelled, or they expire. q.

Cash and cash equivalents

Cash and cash equivalents comprise cash at hand and deposits

with maturities of three months or less from the date of

acquisition. Foreign balances are revalued with any gain or loss

adjusted. r. Provisions

Provisions are recognised when the Group has a present

obligation (legal or constructive) as a result of a past event and

it is probable that an outflow of resources embodying economic

benefits will be required to settle the obligation and a reliable

estimate can be made of the amount of the obligation. The expense

relating to any provision is presented in the consolidated

statement of comprehensive income, net of any expected

reimbursement, but only where recoverability of such reimbursement

is virtually certain.

Provisions are discounted using a current pre-tax rate that

reflects, where appropriate, the risk specific to the liability.

Where discounting is used, the increase in the provision due to the

passage of time is recognised as a finance cost. s. Share capital

and premium

Proceeds on issue of shares are included in shareholders'

equity, net of transaction costs. The carrying amount is not

re-measured in subsequent years. The proceeds of the issue of

shares up to the nominal ordinary share value of 15p are included

in share capital with the balance of the proceeds, net of relevant

transaction costs, included in the share premium t. Share option

reserve

The cost of issuing share options is calculated using the

Black-Scholes method and are included in the share option reserve

until the share options are exercised, lapsed or cancelled. u.

Unlisted Investments

Unlisted investments are stated at fair value with adjustments

made following annualised fair value reviews through impairment

charges. v. Defined contribution pension scheme

The Group operates a defined contribution pension scheme. The

assets of the scheme are held separately from those of the Group in

an independently administered fund. The amounts charged against

profits represent the contributions payable to the scheme in

respect of the accounting period. w. New and amended standards

adopted by the Group

The following new accounting standards, interpretations and

amendments to existing standards have been published and are

mandatory for the accounting period beginning on 1 April 2022.

. Amendments to IAS 16: Property, Plant and Equipment: Proceeds

before intended use.

. Amendments to IFRS 3: Reference to the Conceptual

Framework.

. Amendments to IAS 37: Onerous Contracts - Cost of Fulfilling a

Contract.

. Annual Improvements to IFRS Standards 2018 - 2020: Including

amendments to IFRS 9 Financial Instruments and IFRS 16 Lease.

The new and amended standards adopted by the Group in the year

have not resulted in any impact in the current financial

statements.

Standards which are in issue but not yet effective

At the date of authorisation of these financial statements, the

following standards and interpretations, which have not yet been

applied in these financial statements, were in issue but not yet

effective:

. Amendments to IAS 1: Presentation of Financial Statements

(Effective 1 January 2024) and Disclosure of Accounting Policies

(Effective 1 January 2023).

. Amendments to IAS 8: Definition of Accounting Estimates

(Effective 1 January 2023).

. Amendments to IAS 12: Deferred Tax related to Assets and

Liabilities arising from a Single Transaction (Effective 1 January

2023).

. Amendments to IFRS 16: Lease Liability in a Sale and Leaseback

(Effective 1 January 2024).

The Group does not consider that any other standards, amendments

or interpretations issued by the IASB, but not yet applicable, will

have a significant impact on the financial statements. 3. Use of

estimates and judgements

The preparation of financial statements requires management to

make estimates and judgements that affect the amounts reported for

assets and liabilities as at the reporting date and the amounts

reported for revenues and expenses during the year. The nature of

estimation means that actual amounts could differ from those

estimates. Estimates and judgements used in the preparation of the

financial statements are continually reviewed and revised as

necessary. While every effort is made to ensure that such estimates

and judgements are reasonable, by their nature they are uncertain

and, as such, changes in estimates and judgements may have a

material impact on the financial statements. The key sources of

judgement and estimation uncertainty that have a significant risk

of causing material adjustment to the carrying amount of assets and

liabilities within the next financial year are discussed below.

Taxation

Management judgement is required to determine the amount of tax

assets that can be recognised, based upon the likely timing and

level of future taxable profits together with an assessment of the

effect of future tax planning strategies. The carrying value of the

unrecognised deferred tax asset for tax losses and other timing

differences at 31 December 2022 was GBP995,000 (2021/22:

GBP595,000). The value of the deferred tax liability at the

period-end is nil (2021/22: GBP105,000. Further information is

included in notes 8 and 23.

Useful Economic Life of assets and impairment

Judgements are required as to the useful economic life of

systems for rental assets. Further information on all useful

economic lives of assets is included in notes 2 and 10.

Development costs

Management judgement is required to determine the appropriate

value of an asset as well as when an asset should be recognised.

The value of the recognised asset is written off over the useful

economic life of the asset. These judgements are based upon the

likely timing and level of future revenues. Development costs are

periodically and at least annually assessed for impairment and

costs are written-off if the project to which they relate is no

longer considered to be commercially viable. The value of the

development costs capitalised at 31 December 2022 was GBP1,538,000

(2021/22: GBP1,411,000). Further information is included in note

12.

Goodwill impairment

Judgements are required as to the useful economic life of

goodwill. These judgements are based upon the likely future

benefits that will be derived from the recognised goodwill. Further

information on all useful economic lives of assets is included in

notes 2 and 12. 4. Segmental information

The directors review segmental information at a revenue, gross

margin, salary and operating cost level but do not review the

balance sheet by segments.

A segment is a distinguishable component of the Group's

activities from which it may earn revenue and incur expenses, whose

operating results are regularly reviewed by the Group's chief

operational decision makers to make decisions about the allocation

of resources and assessment of performance and about which discrete

financial information is available. In identifying its operating

segments, management generally follows the Group's service line

which represent the main products and services provided by the

Group.

The directors believe that the Group operates in three primary

segments being the sale and supply of rental systems to the

Aquaculture industry, the manufacture, rental and sale of

underwater measurement devices, leak detection devices and

underwater communication devices in the Offshore market and the

manufacture and sale of Geotracking devices (GeoTracking).

All of the Group's revenue have been generated from continuing

operations, are from external customers and relates to

point-in-time revenue recognised when the product or service is

delivered.

31 December 31 March

2022 2022

GBP'000 GBP'000

Analysis of revenue

Amounts earned from Aquaculture rentals and sales 882 1,450

Amounts earned from Offshore rentals and sales 1,620 2,085

Amounts earned from Geotracking 59 757

2,561 4,292

??????? ???????

There are no material customers included within revenue

(2021/22, one: GBP725,000).

31 December 31 March

2022 2022

GBP'000 GBP'000

Analysis of gross profit

Amounts earned from Aquaculture rentals and sales (114) 590

Amounts earned from Offshore rentals and sales 880 1,094

Amounts earned from Geotracking 28 343

794 2,027

??????? ???????

The Group operates in six main geographic areas, although all

are managed in the UK. The Group's revenue per geographical segment

based on the customer's location is as follows:

31 December 31 March

2022 2022

GBP'000 GBP'000

Revenue

UK 1,290 2,302

Chile 137 326

Asia 293 361

Europe (excluding UK) 354 548

North America 403 462

Rest of the World 84 293

2,561 4,292

??????? ???????

The Group's assets are located in the UK and Chile and although

some of its tangible assets, in the form of systems for rental, are

located in Chile, all are owned by the company or its subsidiaries.

5. Operating loss

Operating loss is stated after charging/(crediting):

31 December 2022 31 March 2022

GBP'000 GBP'000

Depreciation of property, plant and equipment (see note 10) 304 741

Depreciation of right-of-use assets (see note 11) 130 164

Impairment of property, plant and equipment (see note 11) 62 311

Amortisation and impairment of intangible assets (see note 12) 326 572

Research and development costs 1 227

Exceptional costs 1,230 257

Government grants relating to Covid-19 (Other Operating Income) - (131)

Share-based payment charge (see note 25) - 20

Loss on disposal of assets 6 -

Net foreign exchange (gains) / losses (37) 1

Auditor remuneration

31 December 2022 31 March 2022

GBP'000 GBP'000

Audit services:

Fees payable to the Group's auditor for the audit of the Group and 22 35

Company annual accounts

Fees payable to the Group's auditor for the audit of the Company's 26 45

subsidiaries

48 80

??????? ???????

6. Staff costs and numbers

The average monthly number of employees (including executive

directors) for the continuing operations was:

31 December 2022 31 March 2022

No. No.

Directors 3 2

Administration 14 17

Engineering 8 9

Manufacturing 18 17

43 45

??????? ???????

Staff costs for the Group during the year including executive

directors:

31 December 2022 31 March 2022

GBP'000 GBP'000

Wages and salaries 1,562 2,212

Social security costs 167 171

Other pension costs 42 56

1,771 2,439

??????? ???????

Directors' remuneration

Full details of the directors' remuneration, for current

directors, is provided in the Directors' Remuneration Report on

pages 21 to 23.

31 December 2022 31 March 2022

GBP'000 GBP'000

Directors' emoluments 329 624

Company contributions to defined contribution pension schemes 11 14

340 638

??????? ???????

The highest paid director received remuneration of GBP132,382

(2021/22: GBP390,219)

The Group operates a defined contribution pension scheme for all

qualifying employees. The assets of the scheme are held separately

from those of the Group in independently administered funds.

Retirement benefits are accruing to 3 directors (2021/22: 2).

The charge to the statement of comprehensive income in respect

of defined contribution schemes was GBP37,000 (2021/22: GBP56,000).

Contributions totalling GBP9,000 (2021/22: GBP8,000) were payable

to the fund at the year-end and are included in creditors. 7. Net

finance costs

31 December 2022 31 March 2022

GBP'000 GBP'000

Finance income

Bank interest received 1 -

Total finance income 1 -

Finance costs

Bank and loan interest payable (136) (156)

Unwinding of discount on deferred acquisition payment (62) (10)

Lease interest payable (5) (6)

Total finance costs (203) (172)

Net finance costs (202) (172)

??????? ??????? 8. Taxation

The tax credit is made up as follows:

31 December 2022 31 March 2022

GBP'000 GBP'000

Current income tax:

Adjustments in respect of prior year (18) (11)

Research and development income tax credit receivable (119) (144)

Total current income tax (137) (155)

Deferred tax expense:

Origination and reversal of temporary differences (80) (96)

Tax credit per statement of comprehensive income (217) (251)

??????? ???????

The tax charge differs from the standard rate of corporation tax

in the UK of 19% for the nine-month period ended 31 December 2022

(19% for the year ended 31 March 2022). The differences are

explained below:

31 December 2022 31 March 2022

GBP'000 GBP'000

Loss on ordinary activities before taxation (2,512) (2,155)

UK tax credit at standard rate of 19% (2021/22: 19%) (477) (409)

Effects of:

Fixed assets timing differences (80) (74)

Expenses not deductible for tax 77 95

Additional deduction for R&D expenditure (119) (144)

Adjustments in respect of prior year (18) (11)

Prior year losses utilised - 43

Deferred tax not recognised 400 249

Total taxation credit (217) (251)

??????? ???????

The Group has accumulated losses available to carry forward

against future trading profits. The estimated value of the deferred

tax asset measured at a standard rate of 19% (2021/22: 19%) is

GBP995,000 (2021: GBP595,000), of which GBPnil (2021: GBPnil) has

been recognised, as it is not certain that future taxable profits

will be available against which the unused tax losses can be

utilised.

The Group has not recognised a deferred tax liability in the

year as it is covered by accumulated losses (2021/22:

GBP80,000).

From 1 April 2023 the corporation tax rate will increase to 25%.

This was substantively enacted on 24 May 2021. The deferred tax

balance at 31 December 2022 has been calculated based on the rate

as at the balance sheet date of 25%. 9. Losses per share

Basic earnings or losses per share are calculated by dividing

the loss or profit after tax attributable to the equity holders of

the Group by the weighted average number of shares in issue during

the year.

Diluted earnings or losses per share are calculated by adjusting

the weighted average number of shares outstanding to assume

conversion of all potential dilutive shares, namely share options.

The calculation of earnings or losses per share is based on the

following losses and number of shares.

A reconciliation is set out below.

2022 2021/22

GBP'000 GBP'000

Loss for the year attributable to owners of the Group (2,459) (1,904)

Weighted average number of shares:

- Basic 49,659,304 32,535,945

- Diluted 94,036,802 34,024,147

Basic losses per share (pence) (5.0) (5.9)

Diluted losses per share (pence)* (5.0) (5.9)

Weighted average number of shares:

- Basic 49,659,304 32,535,945

- Diluted 94,036,802 34,024,147

Adjusted basic losses per share (pence) (5.0) (5.9)

Adjusted diluted losses per share (pence) (5.0) (5.9)

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has share options that are dilutive potential ordinary shares.

*These shares are not considered dilutive because they decrease

the loss per share. 10. Property, plant and equipment

Systems for rental Plant and equipment Motor vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000

COST

At 31 March 2021 2,588 361 86 3,035

Additions 370 52 1 423

At 31 March 2022 2,958 413 87 3,458

Additions 23 11 1 35

Disposals (348) (6) (9) (363)

At 31 December 2022 2,633 418 79 3,130

DEPRECIATION

At 31 March 2021 1,330 124 33 1,487

Depreciation charge for year 625 89 27 741

Impairment for year 311 - - 311

At 31 March 2022 2,266 213 60 2,539

Depreciation charge for year 218 71 15 304

Disposals (348) (3) (6) (357)

Impairment for year 62 - - 62

At 31 December 2022 2,198 281 69 2,548

NET BOOK VALUE

At 31 December 2022 435 137 10 582

??????? ??????? ??????? ???????

At 31 March 2022 692 200 27 919

??????? ??????? ??????? ???????

Depreciation charges in relation to Systems for rental are

included in Costs of sale. All other depreciation is included in

administrative expenses.

Impairment charges for the year relate to Sealfence rental

systems returned from customers. The impairment review performed

has been carried out on an individual asset basis, being the

smallest group of assets contributing to future economic benefits.

11. Leases

Right-of-use assets

Buildings and facilities Motor vehicles

Total