TIDMPOW

RNS Number : 1574R

Power Metal Resources PLC

25 October 2023

25 October 2023

Power Metal Resources PLC

("Power Metal" or the "Company")

Business Update

Power Metal Resources PLC (AIM:POW), the AIM listed metals

exploration and development company, provides a Business Update for

shareholders following completion of the Company's financial year

on 30 September 2023.

Sean Wade, Chief Executive Officer of Power Metal Resources plc,

commented:

"I am pleased to provide this update for shareholders

summarising the status of Power Metal's extensive business

interests and our key business objectives for the near term.

The team are working intensively and concurrently on significant

exploration and corporate initiatives, details of which are

outlined below.

We expect various news updates in the near term, informing

shareholders of the outcomes of current exploration programmes, the

launch of new exploration activities and the results of our

corporate activities seeking value crystallisation and streamlining

of the Company.

I am well aware that our long-term shareholders have been

extremely patient in what are close to unprecedented market

conditions. I am very confident that the actions we are taking,

coupled with the positive macro backdrop for commodity prices, will

translate into significant returns for shareholders over time."

KEY BUSINESS OBJECTIVES

Power Metal's key business objectives in the short term are as

follows:

- Complete transactions with third parties looking to acquire

business interests, enter into project joint ventures, or otherwise

engage in our various ongoing activities;

- Focus on major metal discoveries from our retained in-house

portfolio through cost-effective exploration including drilling,

utilising our strong financial position and cash generated from

future project disposals;

- Expand the ownership of Power Metal shares into new investor

groups, a process that started with the May 2023 GBP2.7m financing

corner-stoned by Term Oil Inc, a Company controlled by

internationally recognised resources specialist Rick Rule;

- Identify new territories for future business opportunities and

incoming project level investment, including notably Saudi Arabia

and Oman, where we recently conducted in-country meetings and site

visits;

- Focus on demonstrable value growth in the Power Metal

portfolio through exploration and value crystallisation, to

materially increase the Company's market valuation.

KEY OPERATIONAL ACTIVITIES

Note: the information below covers the certain areas of internal

operational activities within Power Metal, where the Company is

targeting near term value generative outcomes. It does not cover

all the activities within the Company or the Company's investment

holdings, where we also note extensive operational activity

continues.

EXPLORATION ACTIVITIES

Key Exploration Activities Table:

PROJECT LOCATION NEXT STEPS

Athabasca Uranium Canada Completion of ongoing 2023 exploration

programme and publication of findings

targeting significant uranium discoveries.

---------- --------------------------------------------

North Wind Project Canada Receipt of assay results from

2023 field exploration targeting

a significant lithium discovery.

---------- --------------------------------------------

Molopo Farms Botswana Drilling of major conductor targeting

Complex nickel/platinum group element discovery.

---------- --------------------------------------------

Tati Gold Project Botswana Completion of ongoing 2023 exploration

programme and publication of findings.

---------- --------------------------------------------

Wallal Project Australia Drilling of major magnetic bullseye

target in Paterson Region with

geophysical signature similar to

Greatland Gold's Havieron Project.

---------- --------------------------------------------

ATHABASCA URANIUM EXPLORATION

Power Metal currently has a 100% interest in 17 uranium

properties covering over 1000km(2) in the Athabasca Region of

Saskatchewan, Canada. This is the largest ground footprint in the

Athabasca Region held by a UK listed company.

Power Metal's technical team selected the Athabasca footprint by

painstaking review of historical exploration data from work

conducted and paid for by others, applying modern geological

knowledge and techniques to identify the best available ground. The

ground was available because other explorers had relinquished their

interests during the long-term uranium bear market or because the

geological opportunities the Company identified had, at that stage,

been noted by others.

2023 has seen the largest Athabasca uranium exploration

programme ever undertaken by the Company with some very significant

early findings announced recently.

Once completed our 2023 exploration programme will cover

approximately 10 properties and to date we have announced major

exploration results from across the portfolio, with further updates

expected in the near term as our field teams remain active and a

range of exploration results are awaited.

AFRICA EXPLORATION

Tati Project (POW 100%)

Exploration work at Tati has continued to validate the gold

mineralisation within the previously identified 8km long gold

trend. This work continues with further infill sampling focused on

newly discovered target areas of gold mineralisation within the

trend which pending analysis of final results, may be followed by

reverse circulation and/or diamond drilling which will be targeted

towards the highest profile areas.

In the Company's view there is considerable evidence building

for a potentially significant, economic gold deposit at Tati.

Moreover, that there is potential for rapid project development

with a recommencement of historic mining activities, subject to

applicable local regulatory approvals. This is made more feasible

if the Company can rapidly demonstrate the extent of gold

mineralisation within the project boundaries. The latter is Power

Metal's present focus.

Molopo Farms Complex Project (POW 87.71%)

Extensive exploration to date has confirmed the feeder zone

geological model, confirmed the presence of nickel sulphides and

platinum group elements ("PGEs") through drilling as announced on

27 April 2023 which includes 2.3m @ 0.56g/t Pt+Pd+Au & 0.17% Ni

from DDH1-6B, and by aggregating and analysing the extensive

database of historical work has now identified the highest profile

conductor drill target to date.

Power Metal sees the potential for a district-scale nickel and

PGE discovery at Molopo and is planning the next diamond drill

programme with this objective in focus.

NORTH AMERICA EXPLORATION

North Wind (POW 100%)

North Wind is held by ION Battery Resources Limited a 100% owned

POW subsidiary. A lithium focused ground exploration programme

conducted earlier this summer led to the identification of several

pegmatites.

The results from assay testing of outcrop rock samples from the

identified pegmatites, together with those from extensive soil

geochemical sampling at North Wind, are expected in the near

term.

CORPORATE DEVELOPMENT ACTIVITIES

The Power Metal model is to advance robust internal exploration

programmes to seek major metal discoveries and build underlying

project value, whilst also looking in parallel for significant

value crystallisation through corporate activity to build the value

of the Company.

In some cases, exploration programmes continue across certain

projects where there has been incoming third-party interest. Power

Metal's policy is to continue planned exploration notwithstanding

discussions that may be occurring in parallel.

Athabasca Uranium Corporate Activity

Given the resurgence in the uranium sector, Power Metal has seen

a considerable increase in the level of interest in our strategic

Athabasca holdings.

Power Metal has previously announced the disposal of Reitenbach

and E-12 properties into Uranium Energy Exploration ("UEE"). Plans

for an IPO of UEE have are advancing and a further market update is

expected shortly.

The Company has also received third party interest across our

uranium portfolio and further commercial transactions are

anticipated however shareholders should note that there can be no

certainty of any such transactions being concluded.

Africa Corporate Activity

Both Tati and Molopo Farms Complex projects have received third

party interest and the Company continues in discussions to explore

complementary, joint venture and other project level

partnerships.

Power Metal continues to liaise with our partner to seek a new

pathway for advancement of the Haneti Project in Tanzania where the

Company holds a 35% interest.

North America Corporate Activity

Power Metal's 100% owned ION Battery Resources Limited ("ION")

holds the North Wind project where lithium focused exploration is

currently underway, together with the Authier North lithium project

and Doerksen Bay graphite project.

The next corporate steps for ION are to be determined following

receipt of assay results from the North Wind summer exploration

programme and a further announcement will be made in due

course.

The Company's 30% interest in the Silver Peak project remains as

previously stated and we are working with our partners on the next

commercial steps for this important asset.

Australia Corporate Activity

New Ballarat Gold PLC (49.9% POW) has secured an enviable ground

footprint in the Victoria Goldfields of Australia, including two

high grade former working gold mines. Power Metal is working with

its joint venture partner to create a pathway to expedite the

commercial success of this strategic Australian opportunity and

hopes to announce an update with progress in the near future.

First Development Resources PLC ("FDR")(58.59% POW) holds

strategic exploration projects in Western Australia and the

Northern Territory and has been fully prepared for an IPO listing

which subject to a return to normalised market conditions and final

regulatory approvals can be undertaken at short notice. In Western

Australia FDR holds the Wallal Project which includes the company's

primary target - the Eastern Anomaly, a magnetic bullseye target

with a geophysical signature similar to Greatland Gold's Havieron

discovery in the Paterson Region.

FDR has secured a c. GBP110,000 Co-funding grant from the

Western Australian government as part of the Exploration Incentive

Scheme to be set against the costs of Wallal drilling and has

received all the necessary local approvals for the drill to be

undertaken. FDR has also agreed a contract with DDH1 Drilling Ltd

to undertake the Phase I diamond drilling drill programme and has

prepared the access and the drill pad location in readiness for

drilling. Recognising this progress the early commencement of

drilling is being considered alongside the work being undertaken to

finalise the IPO listing.

Finally, Power Metal holds a 20% interest in New Horizon Metals

Pty Ltd, which holds projects in Queensland and South Australia,

and is working towards the completion of a listing in the

Australian capital markets.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please visit

https://www.powermetalresources.com/ or contact:

Power Metal Resources plc

Sean Wade (Chief Executive Officer) +44 (0) 20 3778 1396

SP Angel Corporate Finance (Nomad and Joint Broker)

Ewan Leggat/Charlie Bouverat +44 (0) 20 3470 0470

SI Capital Limited (Joint Broker)

Nick Emerson +44 (0) 1483 413 500

First Equity Limited (Joint Broker)

David Cockbill/Jason Robertson +44 (0) 20 7330 1883

BlytheRay (PR Advisors) +44 (0) 20 7138 3204

Tim Blythe

Megan Ray

NOTES TO EDITORS

Power Metal Resources plc - Background

Power Metal Resources plc (LON:POW) is an AIM listed metals

exploration company which finances and manages global resource

projects.

The Company has a principal focus on opportunities offering

district scale potential across a global portfolio including

precious, base and strategic metal exploration in North America,

Africa and Australia.

Project interests range from early-stage greenfield exploration

to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through

strategic joint ventures until a project becomes ready for disposal

through outright sale or separate listing on a recognised stock

exchange, thereby crystallising the value generated from our

internal exploration and development work.

Value generated through disposals will be deployed internally to

grow the Company, or may be returned to shareholders through share

buy backs, dividends or in-specie distributions of assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUSVVROKURUAA

(END) Dow Jones Newswires

October 25, 2023 02:00 ET (06:00 GMT)

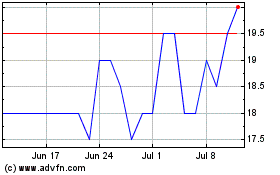

Power Metal Resources (AQSE:POW.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Power Metal Resources (AQSE:POW.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024